Академический Документы

Профессиональный Документы

Культура Документы

Idrf Faq 2011

Загружено:

Veeru popuriОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Idrf Faq 2011

Загружено:

Veeru popuriАвторское право:

Доступные форматы

Frequently Asked Questions

What is IDRF? IDRF is a tax-exempt organization under the U.S. Internal Revenue Code, Section 501 (C)(3). It aims to support grassroots, voluntary NGOs committed to serving the most disadvantaged and needy people in India. How does IDRF operate? IDRF is administered by volunteers from their homes and thus has very low overheads (about 5%). Prudent management of all resources helps us to minimize the admin cost. We also generate income by organizing events such as cultural programs and sporting activities. We are thus able to disburse 100% of your donations and that too directly to the beneficiary NGOs. Our compliance standards are very high and all our financial statements are prepared by independent auditors and annually submitted to the IRS. How does IDRF select grassroots NGOs? IDRFs founder and president has been visiting India over the past three decades and identifying NGOs managed by dedicated, selfless people, who are imbibed with a spirit of selfless, humanitarian service. IDRFs volunteers also remain in direct contact with such NGOs throughout the tribal, rural and urban India from Jammu to Kanyakumari and from Arunachal to Gujarat. What specific traits does IDRF seek in NGOs? IDRFs NGOs focus on integrated human development, self-empowerment, inculcation of responsible citizenry and better governance, ecological awareness, family planning and public health, and overall promotion of social and economic harmony to bring the marginalized segments of the society (including those with

Share our joys and progress at www.idrf.org

disabilities) into the mainstream. Our NGOs operate under a minuscule budget and serve people without consideration of caste, religion or sect. What are the accomplishments of IDRF? Thanks to the selfless, unstinting support of our volunteers and the growing donors confidence in IDRFs services and impacts, we have raised and given grants totaling ~$24 million to grassroots NGOs across India over the past two decades. Inspired by IDRF, 15 young couples mostly born/brought up in the USA have showed unprecedented generosity and love for India by donating their (cash) wedding gifts for social service projects. Many NRIs have fulfilled their dreams of establishing schools and dorms in their villages, and others have contributed funds that have enabled IDRF to finance as many as 30 mobile medical clinics. Many have also sponsored one-teacher schools and provided homes for children and widows tormented by poverty, illiteracy, natural disasters, terrorism, or insurgency. Many of you have saved children from blindness, supported family planning programs, and much more. Visits to IDRF-supported NGOs have been an exhilarating experience, seeing the best possible use of your donations. We are invariably moved to tears of joy and inspired to double our efforts each successive year. We strongly encourage you to visit the NGOs you are supporting. Can I be assured that my hard-earned money will be properly used? Yes. This is precisely the inherent core strength of IDRF. We attach utmost importance to the NGOs accountability and integrity. We select NGOs with proven track records only. Dr. Vinod

November 2011

Prakash, the moving spirit behind IDRF, visits seva projects in India almost every year. Since his early retirement from the World Bank in 1988, he has virtually volunteered full-time for IDRF. Mr. Mohandas Gupta, another retiree, spends 3-4 months a year in India and visits IDRF-supported projects. Our other volunteers also keep visiting seva projects. Can my employer/corporation match my donations to IDRF? Yes, as a 501(C)(3) tax-exempt organization, IDRF receives the matching corporate gifts and we promptly take care of the paperwork. Can I choose an NGO for my donation? Yes, you have the privilege of recommending an organization in India. IDRF may accept your choice only if the designated organization is taxexempt, FCRA approved, internet-connected and gets its accounts audited. The total of your donoradvised contributions should be at least $5,000. IDRF may retain a small portion; as your aggregated donation goes up, the percentage retained is lowered from 6% (at minimum donation amount of $5,000) to 2% (at donation amount of $50,000). When can I donate to IDRF? You may respond to IDRFs annual November campaign and also to its special appeals at times of natural disaster. However, we welcome donations year round. You may think of donating on special occasions, such as a birthday, wedding, pooja or havan or death anniversary of a close one. How can I support IDRFs ongoing projects? You may leave it to our discretion or allocate to a project of your choice. See map inset on the back or visit www.idrf.org for more program choices.

Contact us at idrfhq@yahoo.com

Beneficiaries of Your Donations Reflected Below

FUNDS RAISED OVER THE LAST 5 YEARS (IN THOUSAND $S)

2006 Donor Contributions 963 2007 981 2008 592 2009 492 2010 705 2011 Goal 1000

INDIA DEVELOPMENT & RELIEF FUND

[Tax-Exempt under IRS Code 501(C)(3)]

IDRF

Some of the donation choices you could make:

$200: One-teacher school in Jharkhand (1 year) $365: Ekal Vidyalayas in Uttarakhand (1 year) $600: Preventing blindness among 400 people $1,000: Microcredit for 5 women self-help groups $3,000: Provide complete schooling for 1 tribal girl

IDRF raises funds for helping the most disadvantaged and/or impoverished people by supporting carefully selected dedicated grassroots non-governmental organizations (NGOs) that have a proven track record.

IDRFs beneficiary NGOs are engaged in:

States with IDRF programs Large Medium

One-teacher schools like these are empowering tribal children with education and life skills

Combating corruption and improving governance Empowering rural women through microcredit

loans and training

Supporting quality children education in villages Providing healthcare Enabling self-reliance and eco-friendly rural

development

What are the means through which I can contribute to IDRF? Donate online at www.idrf.org through PayPal (accepts VISA, MasterCard, AMEX, or Discover, and direct debit from bank account) Donate stocks/shares. You may email to inform us and instruct your stock broker to electronically transfer stocks to IDRF (details at www.idrf.org). This will save you capital gains tax and also deduct the market value from your taxable income. You may also secure employers matching gift for your donation. Designate your donation to IDRF under the United Ways donor-choice program. If IDRF is not already registered under this program at your initiative, we will be happy to get the registration done. Please let us know. Donate you old car. IDRF is registered for used car program. Please contact us for details at idrfhq@yahoo.com.

Share our joys and progress at www.idrf.org

Volunteers and Friends at Your Service Mohan (AZ) Malati (CA) Dharmesh (DC) Pooja (MD) Jaipal (NJ) mohandasgupta@gmail.com malatig@sbcglobal.net idrfhq@gmail.com pvarmaidrf@gmail.com jaipal.rathi@wgint.com

Promoting awareness on family planning and

gender parity

Mainstreaming children with developmental

challenges/disabilities

Rehabilitating and post-disaster development

Thanks to its volunteers and strict oversight, IDRF spends about 5% as overheads and is able to disburse almost all the donated amount received. We accept all amounts big or small with gratitude. Please make checks payable to IDRF and mail to: IDRF, 5821 Mossrock Dr., North Bethesda, MD 20852. Informing us by email regarding your donation will expedite the issuance of our official receipt to you. OR Donate online at www.idrf.org

The poor, the illiterate, the ignorant, the afflicted let these be your God. Know that service to these alone is the highest religion. Vivekananda

November 2011

Contact us at idrfhq@yahoo.com

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Sevabharathi Telangana Annual Report 2021-2022Документ14 страницSevabharathi Telangana Annual Report 2021-2022Veeru popuriОценок пока нет

- Sevabharathi Telangana Annual Report 2020-21Документ10 страницSevabharathi Telangana Annual Report 2020-21Veeru popuriОценок пока нет

- Seva Bharathi Suposhan Report - A PATH FOR HOLISTIC NUTRITIONДокумент11 страницSeva Bharathi Suposhan Report - A PATH FOR HOLISTIC NUTRITIONVeeru popuriОценок пока нет

- Sevabharathi Telangana Annual Report 2021-22Документ14 страницSevabharathi Telangana Annual Report 2021-22Veeru popuriОценок пока нет

- E-Vanavani 2022 June IssueДокумент24 страницыE-Vanavani 2022 June IssueVeeru popuriОценок пока нет

- Vaidehi Kishori Vikas Project Sevabharathi Annual Report 2021 - 2022Документ6 страницVaidehi Kishori Vikas Project Sevabharathi Annual Report 2021 - 2022Veeru popuriОценок пока нет

- Grama Bharathi Telugu Broucher - 2022Документ2 страницыGrama Bharathi Telugu Broucher - 2022Veeru popuriОценок пока нет

- Sewa Vibhag Telugu States Affection Homes ListДокумент14 страницSewa Vibhag Telugu States Affection Homes ListVeeru popuriОценок пока нет

- Vanavasi Kalyan Parishad Telanaga ChatrawasДокумент2 страницыVanavasi Kalyan Parishad Telanaga ChatrawasVeeru popuriОценок пока нет

- Kishori Vikas Annual Report 2020 - 21Документ14 страницKishori Vikas Annual Report 2020 - 21Suyodhan TalakantiОценок пока нет

- Janahitha Seva Trust BroucherДокумент2 страницыJanahitha Seva Trust BroucherVeeru popuri0% (1)

- E-Vanavani 2021 June IssueДокумент24 страницыE-Vanavani 2021 June IssueVeeru popuri100% (1)

- Seva Bharathi Telangana Leaflet A4Документ2 страницыSeva Bharathi Telangana Leaflet A4Veeru popuriОценок пока нет

- Seva Sangam SouvenirДокумент12 страницSeva Sangam SouvenirVeeru popuriОценок пока нет

- Yanadi Social & Economic Conditions & Developmental Challenges BookДокумент77 страницYanadi Social & Economic Conditions & Developmental Challenges BookVeeru popuri100% (1)

- Report of ZPHS School Activities 2017-2018 - AmarДокумент11 страницReport of ZPHS School Activities 2017-2018 - AmarVeeru popuriОценок пока нет

- Sevanavartha Sevabharathi Kerala Magazine June 2018Документ27 страницSevanavartha Sevabharathi Kerala Magazine June 2018Veeru popuriОценок пока нет

- Chatrawas or Hostels Run by Vanvasi Kalyan Parishad in APДокумент3 страницыChatrawas or Hostels Run by Vanvasi Kalyan Parishad in APVeeru popuriОценок пока нет

- Sevanavartha 2018 May - A Monthly Magazine From Seva Bharathi KeralaДокумент24 страницыSevanavartha 2018 May - A Monthly Magazine From Seva Bharathi KeralaVeeru popuriОценок пока нет

- Right Way To Leverage Corporate VolunteeringДокумент28 страницRight Way To Leverage Corporate VolunteeringVeeru popuriОценок пока нет

- Chatrawas or Hostels Run by Vanvasi Kalyan Parishad in Telangana LeafletДокумент3 страницыChatrawas or Hostels Run by Vanvasi Kalyan Parishad in Telangana LeafletVeeru popuriОценок пока нет

- Sevabharathi Vaidehi Kishori Vikas Results 2018 UpdatedДокумент6 страницSevabharathi Vaidehi Kishori Vikas Results 2018 UpdatedVeeru popuriОценок пока нет

- Amar A Grassroots Volunteers' Report of ZPHS School Activities 2016 - 2017Документ10 страницAmar A Grassroots Volunteers' Report of ZPHS School Activities 2016 - 2017Veeru popuriОценок пока нет

- Sevabharathi Madikonda Skill DevelopmentДокумент4 страницыSevabharathi Madikonda Skill DevelopmentVeeru popuriОценок пока нет

- E - Vanavaani Freedom Fighters Jan 2018Документ64 страницыE - Vanavaani Freedom Fighters Jan 2018Veeru popuriОценок пока нет

- Sevabharathi Gandhi Hospital Shelter Home Secunderabad PamphletДокумент1 страницаSevabharathi Gandhi Hospital Shelter Home Secunderabad PamphletVeeru popuriОценок пока нет

- Sevabharathi Secunderabad Activities PamphletДокумент4 страницыSevabharathi Secunderabad Activities PamphletVeeru popuriОценок пока нет

- Sevanavartha Feb 2018Документ28 страницSevanavartha Feb 2018Veeru popuriОценок пока нет

- Experiences of A RSS Pracharak - Hindu Seva PratishtanaДокумент22 страницыExperiences of A RSS Pracharak - Hindu Seva PratishtanaVeeru popuriОценок пока нет

- Sewa International Bharat Annual Report 2016 17Документ36 страницSewa International Bharat Annual Report 2016 17Veeru popuriОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Aml Case StdyДокумент5 страницAml Case Stdyammi25100% (2)

- Deductions On Gross Estate Part 1Документ19 страницDeductions On Gross Estate Part 1Angel Clarisse JariolОценок пока нет

- Amaecombrochure - V0.1Документ25 страницAmaecombrochure - V0.1Afolayan ToluwalopeОценок пока нет

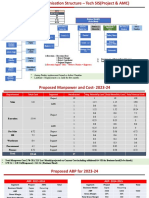

- Proposed Org Chart - Tech SIS.Документ5 страницProposed Org Chart - Tech SIS.Santosh KumarОценок пока нет

- 10 Administrative DecentralisationДокумент16 страниц10 Administrative DecentralisationAlia Al ZghoulОценок пока нет

- Money (Part II) Please Go Over The Following Terms and Their DefinitionsДокумент4 страницыMoney (Part II) Please Go Over The Following Terms and Their DefinitionsDelia LupascuОценок пока нет

- Case - A Survey of Capital Budgeting Techniques by US FirmsДокумент8 страницCase - A Survey of Capital Budgeting Techniques by US FirmsYatin PushkarnaОценок пока нет

- The Red-Bearded BaronДокумент6 страницThe Red-Bearded BaronSarith Sagar100% (2)

- Bangkok Residential MarketView Q3 2017Документ4 страницыBangkok Residential MarketView Q3 2017AnthonОценок пока нет

- Chapter 11 Quiz - SolutionsДокумент15 страницChapter 11 Quiz - Solutionszak robertsОценок пока нет

- Franchise PackageДокумент3 страницыFranchise PackageJayson Nonan100% (1)

- The Sumerian SwindleДокумент447 страницThe Sumerian SwindleqwzrtzОценок пока нет

- Pakistan Stock Exchange: (1994-2019 OVERVIEW)Документ31 страницаPakistan Stock Exchange: (1994-2019 OVERVIEW)danixh HameedОценок пока нет

- FbvarДокумент4 страницыFbvarSRGVPОценок пока нет

- S 11 - Capital Budgeting For The Levered FirmДокумент13 страницS 11 - Capital Budgeting For The Levered FirmAninda DuttaОценок пока нет

- Lia Lafico Laico ZawyaДокумент4 страницыLia Lafico Laico Zawyaapi-13892656Оценок пока нет

- Project ReportДокумент86 страницProject ReportavnishОценок пока нет

- Paper 19 Revised PDFДокумент520 страницPaper 19 Revised PDFAmey Mehta100% (1)

- Demat Account OpeningДокумент8 страницDemat Account OpeningNivas NowellОценок пока нет

- Service Tax NotesДокумент24 страницыService Tax Notesfaraznaqvi100% (1)

- Rural Auto FinanceДокумент78 страницRural Auto FinanceLande AshutoshОценок пока нет

- Maritime CommerceДокумент7 страницMaritime CommerceAyeDingoasen-CabalbalОценок пока нет

- Diskusi 3. D1-Anissa Asyahra-20.05.51.0253-Manajemen Keuangan 2Документ8 страницDiskusi 3. D1-Anissa Asyahra-20.05.51.0253-Manajemen Keuangan 2Anissa AsyahraОценок пока нет

- CH 02Документ23 страницыCH 02Nurhidayati HanafiОценок пока нет

- BAFS SAMPLE - SMEs Mangement (Partial)Документ11 страницBAFS SAMPLE - SMEs Mangement (Partial)Phoebe WangОценок пока нет

- Option Nifty - BankДокумент41 страницаOption Nifty - Banksawsac9Оценок пока нет

- AdvancedДокумент3 страницыAdvancedprabhav2050Оценок пока нет

- Chapter 4 Branch AccountingДокумент17 страницChapter 4 Branch Accountingkefyalew TОценок пока нет

- Pitchbook: The Private Equity 2Q 2012 BreakdownДокумент14 страницPitchbook: The Private Equity 2Q 2012 BreakdownpedguerraОценок пока нет

- Ppe 2016Документ40 страницPpe 2016Benny Wee0% (1)