Академический Документы

Профессиональный Документы

Культура Документы

History

Загружено:

Jin TaoИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

History

Загружено:

Jin TaoАвторское право:

Доступные форматы

History of Royal Bank

Fredrick T. Walker was a young banker with a vision and a motive from the west coast of Canada. Like his fellow peers, they were people of the Maritimes. In 1980, at age fifteen he had joined forces with the Merchants' Bank of Halifax, an upstart of Maritime Bank. The bank primarily took discounted promissory notes and acceptances, made advances on approved securities, purchased and sold bills of exchange, received money on deposits, and transacted all other business matters connected with a banking establishment. In 1882 the Merchants Bank opened an agency specializing in a franchise operation in Bermuda and captured some of the booming trading activity between the Caribbean and Halifax. The Bank of Bermuda Ltd eventually bought out the rights from the agency in 1889, which ended attempts to expand operations rather than branching out. In 1901, the Maritime bank had adopted a new name to The Royal Bank of Canada, but it was shortened to Royal Bank of Canada in the early 1990's. In 1907 Royal Bank moved their head offices from Halifax to Montreal's energetic St. James Street, Canada's financial capital. Starting in 1910, the bank set out a major drive to seek and to expand more rapidly. Domestically, the bank acquired the operations of the Union Bank of Halifax, Traders Bank of Canada, Qubec Bank, the Union Bank of Canada, and the Northern Crown Bank. Truly becoming a national bank after acquiring 113 branches located primarily in Western Canada, through the acquisition of the Northern Crown Bank alone. Based on assets, RBC had become Canada's largest bank by 1920, which was recorded to be worth $594.7 million at the time. By 1925, the bank's international network was over 120 branches, expanding from the Caribbeans down to South America During 1920s and 1930s, Royal Bank had a downturn due to worldwide economic depression and started stricter lending and branch closures. Total assets took a 10% decline during 1930 to 1935,

the number of branches were at a low of 652 worldwide until 1944. The bank would never start new operations to increase profits until 1970s. Following the end of World War II, the bank returned to sustained profitability and growth. In 1961 the Royal Bank became the first Canadian bank to install a computer, proclaiming a new way to progress the business of banking. By June 1967 the bank had introduced Magnetic Ink Character Recognition for encoding and processing cheques. They opened a computer centre in Montral and were the first to make a transaction using a computer. In the 1970s, the bank returned to a strategy of expanding its operations by obtainment, forming joint ventures across the globe. Between 1969 and 1979, the bank's total, worldwide assets increased to $50.7 billion and its staff grew from 23 181 to 38 895 employees, an increase of almost 68 %. Starting in 1986, several changes to Canadian financial markets deleting the outline between Canadian financial services landscape - banks, trust companies, insurance companies, and investment dealers. It permitted cross-ownership in a less regulated environment. The Royal Bank acquired companies such as: Dominion Securities, Voyageur Insurance Company, and Royal Trust in the years between 1988 and 1993. Now Royal Bank of Canada is still the largest financial institution in Canada. The bank serves over 17 million clients and has over 80,000 employees worldwide. The company Headquarters are now located in Toronto, Ontario. Royal Bank is the largest Canadian company by revenue and market capitalization listed by The Globe and Mail, currently ranked 68 on the Forbes Financial list and has operations in Canada, the United States, and 51 other countries.

Вам также может понравиться

- Subqueries-and-JOINs-ExercisesДокумент7 страницSubqueries-and-JOINs-ExerciseserlanОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Fake PDFДокумент2 страницыFake PDFJessicaОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Bajaj Allianz InsuranceДокумент93 страницыBajaj Allianz InsuranceswatiОценок пока нет

- Rebar Coupler: Barlock S/CA-Series CouplersДокумент1 страницаRebar Coupler: Barlock S/CA-Series CouplersHamza AldaeefОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

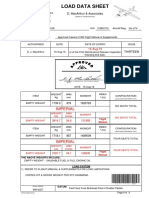

- Load Data Sheet: ImperialДокумент3 страницыLoad Data Sheet: ImperialLaurean Cub BlankОценок пока нет

- Abu Hamza Al Masri Wolf Notice of Compliance With SAMs AffirmationДокумент27 страницAbu Hamza Al Masri Wolf Notice of Compliance With SAMs AffirmationPaulWolfОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Maths PDFДокумент3 страницыMaths PDFChristina HemsworthОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- 2016 066 RC - LuelcoДокумент11 страниц2016 066 RC - LuelcoJoshua GatumbatoОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- 18 - PPAG-100-HD-C-001 - s018 (VBA03C013) - 0 PDFДокумент1 страница18 - PPAG-100-HD-C-001 - s018 (VBA03C013) - 0 PDFSantiago GarciaОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Familiarization With Apparatus and Equipment Used in Testing of MaterialsДокумент5 страницFamiliarization With Apparatus and Equipment Used in Testing of MaterialsEmanoAce33% (6)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Embedded Systems DesignДокумент576 страницEmbedded Systems Designnad_chadi8816100% (4)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- LOG-2-8-FLEETWAREHOUSE-TEMPLATE-Waybill-Delivery Note-IFRCДокумент1 страницаLOG-2-8-FLEETWAREHOUSE-TEMPLATE-Waybill-Delivery Note-IFRCMОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Tinplate CompanyДокумент32 страницыTinplate CompanysnbtccaОценок пока нет

- Aisladores 34.5 KV Marca Gamma PDFДокумент8 страницAisladores 34.5 KV Marca Gamma PDFRicardo MotiñoОценок пока нет

- Using Boss Tone Studio For Me-25Документ4 страницыUsing Boss Tone Studio For Me-25Oskar WojciechowskiОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- 1SXP210003C0201Документ122 страницы1SXP210003C0201Ferenc SzabóОценок пока нет

- Government of West Bengal Finance (Audit) Department: NABANNA', HOWRAH-711102 No. Dated, The 13 May, 2020Документ2 страницыGovernment of West Bengal Finance (Audit) Department: NABANNA', HOWRAH-711102 No. Dated, The 13 May, 2020Satyaki Prasad MaitiОценок пока нет

- Microsoft Word - Claimants Referral (Correct Dates)Документ15 страницMicrosoft Word - Claimants Referral (Correct Dates)Michael FourieОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Vinera Ewc1201Документ16 страницVinera Ewc1201josue1965Оценок пока нет

- Aluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyДокумент2 страницыAluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyJoachim MausolfОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- QUIZ Group 1 Answer KeyДокумент3 страницыQUIZ Group 1 Answer KeyJames MercadoОценок пока нет

- Financial Derivatives: Prof. Scott JoslinДокумент44 страницыFinancial Derivatives: Prof. Scott JoslinarnavОценок пока нет

- 199437-Unit 4Документ36 страниц199437-Unit 4Yeswanth rajaОценок пока нет

- BS 8541-1-2012Документ70 страницBS 8541-1-2012Johnny MongesОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Fernando Salgado-Hernandez, A206 263 000 (BIA June 7, 2016)Документ7 страницFernando Salgado-Hernandez, A206 263 000 (BIA June 7, 2016)Immigrant & Refugee Appellate Center, LLCОценок пока нет

- Unit 2Документ97 страницUnit 2MOHAN RuttalaОценок пока нет

- Ajp Project (1) MergedДокумент22 страницыAjp Project (1) MergedRohit GhoshtekarОценок пока нет

- Mid Term Exam 1Документ2 страницыMid Term Exam 1Anh0% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- IdM11gR2 Sizing WP LatestДокумент31 страницаIdM11gR2 Sizing WP Latesttranhieu5959Оценок пока нет

- 30 Creative Activities For KidsДокумент4 страницы30 Creative Activities For KidsLaloGomezОценок пока нет