Академический Документы

Профессиональный Документы

Культура Документы

BAV Model v4.7

Загружено:

Missouri SoufianeАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

BAV Model v4.7

Загружено:

Missouri SoufianeАвторское право:

Доступные форматы

Courseware: #103-701

Contents Overview and Instructions Imported Financial Statements Standardized Financial Statements Accounting Adjustments Ratio Analysis Performance Charts Assumptions Pro Formas and Valuation

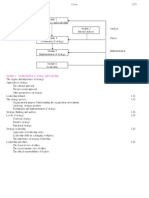

Overview The purpose of the Business Analysis and Valuation Model (BAV Model) is to aid users in analyzing and valuing any company with at least two years of historical financial statement data. This program may be used in conjunction with the Business Analysis & Valuation Using Financial Statements text, written by Professors Krishna Palepu, Paul Healy, and Victor Bernard (Cincinnatti, OH: South-Western College Publishing, 2004). Instructions links within this model require the Internet Explorer browser. Download a PDF version of Instructions with screenshots: http://www.hbs.edu/it/pdf/bav_help.pdf

Technical Note This workbook makes extensive use of macros. For these macros to be operational, your security level must be set to 'medium', and you must select the 'enable macros' button when the workbook is first opened. To check/adjust your security level, select Tools| Macro| Security| Medium (level). If your security level is set to 'high', the workbook will not operate correctly. To open multiple copies of the model at the same time, each copy should be opened in a new instance of Microsoft Excel (i.e. start Excel from the Start menu, then use File|Open to open the model). Excel allocates a fixed amount of memory for each launch, and multiple copies of the model can easily require more memory than allocated by a single Excel instance, resulting in 'Out of System Resources' errors. The Business Analysis and Valuation Model was developed by Professor Paul Healy and Professor Krishna Palepu with the assistance of Research Associate Jonathan Barnett. Development assistance was provided by Village Software, Inc. See BAV Navigator menu --> About BAV Model for software version number. Please do not use without the authors' permission.

Copyright 2002-2008 President and Fellows of Harvard College

Imported Income Statement Initial Setup Step 1: If you have a Compustat WRDS account If you do not have a Compustat account, fill in the yellow cells and proceed to Step 2. Company Name Ordering of Years on Financial Statements Latest Income Statement Year Earliest Income Statement Year Fiscal Year-End (Month, Day) Units

Download Company Financials from Compustat WRDS

Step 2: Select Valuation Type

Classifications

Change Sign?

Year Ended , () PASTE FINANCIAL STATEMENT LABELS IN THIS COLUMN PASTE IMPORTED FINANCIAL STATEMENT DATA HERE

Page 2 of 27

Imported Income Statement Change Sign?

Classifications

Year Ended , ()

Page 3 of 27

Imported Income Statement Change Sign?

Classifications

Year Ended , ()

Page 4 of 27

Imported Balance Sheet Change Sign?

Classifications

#N/A 0 -1 PASTE FINANCIAL STATEMENT LABELS IN THIS COLUMN PASTE IMPORTED FINANCIAL STATEMENT DATA HERE *

*Please import the BEGINNING balance sheet values for the years shown above. The beginning balance sheet values for a given year are equivalent to the prior year's ENDING balance sheet values.

Page 5 of 27

Imported Balance Sheet Change Sign?

Classifications

#N/A

-1

Page 6 of 27

Imported Balance Sheet Change Sign?

Classifications

#N/A

-1

Page 7 of 27

Imported Statement of Cash Flows Change Sign?

Classifications

Year Ended , () PASTE FINANCIAL STATEMENT LABELS IN THIS COLUMN

PASTE IMPORTED FINANCIAL STATEMENT DATA HERE

Page 8 of 27

Imported Statement of Cash Flows Change Sign?

Classifications

Year Ended , ()

Page 9 of 27

Imported Statement of Cash Flows Change Sign?

Classifications

Year Ended , ()

Page 10 of 27

Classification Lookup

Directions: 1. Select the financial statement (Income Statement, Balance Sheet, or Statement of Cash Flows) from the white drop-down menu below. 2. Select the desired line-item classification heading(s) from the yellow shaded drop-down menu for examples of financial statement line-items typically classified under that heading.

Income Statement

Please select Classification category here

Page 11 of 27

Classification Lookup Income Statement

Please select Classification category here

Page 12 of 27

Standardized Financial Statements As Reported ### Beginning Balance Sheet Assets Cash and Marketable Securities Accounts Receivable Inventory Other Current Assets Total Current Assets Long-Term Tangible Assets Long-Term Intangible Assets Other Long-Term Assets Total Long-Term Assets Total Assets Liabilities Accounts Payable Short-Term Debt Other Current Liabilities Total Current Liabilities Long-Term Debt Deferred Taxes Other Long-Term Liabilities (non-interest bearing) Total Long-Term Liabilities Total Liabilities Minority Interest Shareholders' Equity Preferred Stock Common Shareholders' Equity Total Shareholders' Equity Total Liabilities and Shareholders' Equity Common Shares Outstanding at Fiscal Year End

Page 13 of 27

Standardized Financial Statements

As Reported Year Ended , () Income Statement Sales Cost of Sales Gross Profit SG&A Other Operating Expense Operating Income Investment Income Other Income, net of Other Expense Other Income Other Expense Net Interest Expense (Income) Interest Income Interest Expense Minority Interest Pre-Tax Income Tax Expense Unusual Gains, Net of Unusual Losses (after tax) Net Income Preferred Dividends Net Income to Common Common Shares for Primary EPS Calculation

As Reported Year Ended , () Statement of Cash Flows Net Income

Page 14 of 27

Standardized Financial Statements After-tax net interest expense (income) Non-operating losses (gains) Long-term operating accruals Depreciation and amortization Other Operating cash flow before working capital investments Net (investments in) or liquidation of operating working capital Operating cash flow before investment in long-term assets Net (investment in) or liquidation of operating long-term assets Free cash flow available to debt and equity After-tax net interest expense (income) Net debt (repayment) or issuance Free cash flow available to equity Dividend (payments) Net stock (repurchase), issuance, or other equity changes Net increase (decrease) in cash balance

Page 15 of 27

BAV Identities

Beginning Balance Sheet & Identities #N/A I. Net Working Capital Accounts Receivable + Inventory + Other Current Assets - Accounts Payable - Other Current Liabilities = Beginning Net Working Capital II. Net Long-Term Assets Long-term Tangible Assets Long-term Intangible Assets Other Long-Term Assets Minority Interest Deferred Taxes Other Long-Term Liabilities (non-interest bearing) Beginning Net Long-Term Assets

+ + =

III. Total Assets Beginning Net Working Capital + Beginning Net Long-Term Assets = Beginning Net Assets IV. Total Net Capital Short-term Debt Long-term Debt Cash Beginning Net Debt Beginning Preferred Stock Beginning Common Shareholders' Equity Beginning Total Net Capital

+ = + + =

Page 16 of 27

BAV Identities

Income Statement & Identities Year Ended , () Sales Net Operating Profit after Tax (NOPAT): Net Interest Expense after Tax Net Income Preferred Dividends Net Income to Common

= =

I. Net Interest Expense after Tax Interest Expense Interest Income Net Interest Expense (Income) (1- Tax/Pre-Tax Income) Net Interest Expense after Tax

= x =

II. Net Operating Profit after Tax (NOPAT) Net Income Net Interest Expense after Tax Net Operating Profit after Tax Unusual Gains, Net of Unusual Losses (after tax) Net Operating Profit excluding Unusual Gains, Net of Unusual Losses (after tax)

+ = =

Page 17 of 27

Condensed Financial Statements

#N/A

Beginning Balance Sheet Beginning Net Working Capital + Beginning Net Long-Term Assets = Total Assets Beginning Net Debt + Beginning Preferred Stock + Beginning Shareholders' Equity = Total Net Capital

Year Ended , ()

Income Statement Sales Net Operating Profit after Tax Net Interest Expense after Tax Net Income Preferred Stock Dividends Net Income to Common Operating ROA ROE BV of Assets Growth Rate BV of Equity Growth Rate Net Operating Asset Turnover ratio

= =

Page 18 of 27

Ratio Analysis

Please choose calculation method:

Beginning Balance Sheet values

DECOMPOSING PROFITABILITY: DUPONT ALTERNATIVE x = x = NOPAT / Sales Sales / Net Assets Operating ROA Spread Net Financial Leverage Financial Leverage Gain ROE (Operating ROA + Spread * Net Financial Leverage) EVALUATING OPERATING MANAGEMENT Key Growth Rates: Annual Sales Growth Annual Net Income Growth Key Profitability Ratios: Sales / Sales Cost of Sales / Sales Gross Margin SG&A / Sales Other Operating Expense / Sales Investment Income / Sales Other Income, net of Other Expense / Sales Minority Interest / Sales EBIT Margin Net Interest Expense (Income) / Sales Pre-Tax Income Margin Taxes / Sales Unusual Gains, Net of Unusual Losses (after tax) / Sales Net Income Margin EBITDA Margin NOPAT Margin Recurring NOPAT Margin Page 19 of 27 NA* NA

Ratio Analysis

Please choose calculation method:

Beginning Balance Sheet values

EVALUATING INVESTMENT MANAGEMENT Working Capital Management: Operating Working Capital / Sales Operating Working Capital Turnover Accounts Receivable Turnover Inventory Turnover Accounts Payable Turnover Days' Receivables Days' Inventory Days' Payables Long-Term Asset Management: Net Long-Term Assets Turnover Net Long-Term Assets / Sales PP&E Turnover Depreciation & Amortization / Sales

EVALUATING FINANCIAL MANAGEMENT Short-Term Liquidity: Current Ratio Quick Ratio Cash Ratio Operating Cash Flow Ratio Debt and Long-Term Solvency: Liabilities-to-Equity Debt-to-Equity Net-Debt-to-Equity Debt-to-Capital Net-Debt-to-Net Capital Interest Coverage Ratio: Interest Coverage Page 20 of 27

Ratio Analysis

Please choose calculation method: Payout Ratio: Dividend Payout Ratio Sustainable Growth Rate:

Beginning Balance Sheet values

* NA - not available, n/a - not applicable

Page 21 of 27

Key Assumptions

Note: All yellow-shaded cells require input (including those preset to zero). If the appropriate value for a blank input cell is zero, enter 0. Inputs are optional for gray-shaded cells. Historical Ratios Year Ended , () Assumptions for years 1-15: Sales growth rate Net operating profits after tax / sales Beginning net operating working capital / sales Beginning net operating long-term assets / sales Assumptions for year 16 and beyond: Sales growth rate Net operating profit after tax / sales Beginning net operating working capital / sales Beginning net operating long-term assets / sales Book Value Leverage (beginning of year) Net debt / book value of net capital Preferred equity / book value of net capital Shareholders' equity / book value of net capital 0.0% Market Value Leverage (beginning of year) Net debt / market value of net capital Preferred equity / market value of net capital Shareholders' equity / market value of net capital 0.0% Cost of Capital parameters: Market risk premium Risk free rate Tax rate Cost of debt Cost of preferred equity (if applicable) Implied debt beta Implied preferred equity beta Common equity beta Implied asset beta After tax cost of debt Cost of common equity Number of Common shares outstanding 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0 Forecast Horizon 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Terminal Years 16 17

Note: Only the most recent historical years reflect accounting adjustments that have been made. 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

Page 22 of 27

Performance Charts

HISTORIC and FORECAST CHARTS for Overview and Instructions Return to BAV Dashboard

10-Year Historic Performance of Comparable U.S. Firms(1)

Sales Growth

70% 60% 50% 40% 30% 20% 10% 0% -10% -20% -30%

0 1

10-Year Historic Sales Growth for Comparable U.S. Firms

50% -80% -210% -340% -470% View Company's Historic Performance -600% View Company's Pro Forma Performance -730% View Historic Performance of US Companies -860% -990% -1120% -1250% -1380% -1510% 1 2 3 4 5 Year

Annual Sales Growth

Annual Sales Growth

10

Year

Net Operating Profit after Tax (NOPAT) Margin Net Operating Profit after Tax/ Sales

25% 20% 15% 10% 5% 0% -5% -10% -15% -20% -25% -30% -35%

0 1

10-Year Historic NOPAT Margin for Comparable U.S. Firms

10% -145% -300% -455% -610% -765% -920% -1075% -1230% -1385% -1540% -1695% -1850% -2005% 1 2 3 4 5 Year 6 7 8 9 10

Net Operating Profit after Tax / Sales

Year

Historic Net Operating Asset Turnover

7.0 6.5 7.0 6.5 6.0

10-Year Historic Net Operating Asset Turnover for Comparable U.S. Firms

Sales / Net Operating Assets

Sales / Net Operating Assets

0 1

6.0 5.5 5.0 4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 Year

5.5 5.0 4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 Year

Operating Return-on-Assets (ROA)

40%

10-Year Historic Operating ROA for Comparable U.S. Firms

500% Net Operating Profit after Tax / Net Assets 0% -500% -1000% -1500% -2000% -2500% -3000% -3500% 1 2 3 4 5 Year 6 7 8 9 10

Net Operating Profit after Tax / Net Assets

30% 20% 10% 0% -10% -20% -30% -40% -50%

0 1

Year

Return-on-Equity (ROE)

40% 500% 30% 20% 10% 0% -10% -20% -30% -40% -50% -60%

0 1

10-Year Historic ROE for Comparable U.S. Firms

0% -500% -1000% -1500% -2000% -2500% -3000% -3500% -4000% 1 2 3 4 5 Year 6 7 8 9 10

Net Income / Beginning Shareholders' Equity

Year

(1) Herein, comparable firms are defined as all publicly traded U.S. firms between the years 1984 and 2001, whose measure of interest (e.g., sales growth, NOPAT margin, ROE, etc.) resides within the same quintile as (for which the measure was taken in the latest income statement year).

Page 23 of 27

Net Income / Beginning Shareholders' Equity

Pro Formas & Valuation

PRO FORMA FINANCIAL STATEMENTS

Overview and Instructions Return to BAV Dashboard

Historical Year Ended , () -1 0 Forecast Horizon 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Terminal Years 16 17

Beginning Balance Sheet Beg. Net Working Capital + Beg. Net Long-Term Assets = Net Operating Assets Net Debt + Preferred Stock + Shareholders' Equity = Net Capital

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

Income Statement Sales Net operating profits after tax - Net interest expense after tax = Net income - Preferred dividends = Net income to common Operating Return on Assets Return on Common Equity Book Value of Assets Growth Rate Book Value of Common Equity Growth Rate Net Operating Asset Turnover Free Cash Flow to Equity Discount Factor - Common Equity Book Value of Equity Growth Factor (cumulative) Cost of Common Equity

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0.0%

0.0% 0.0%

0.0% 0.0% 0.0

0.0% 0.0% 0.0

0.0% 0.0% 0.0

0.0% 0.0% 0.0

0.0% 0.0% 0.0

0.0% 0.0% 0.0

0.0% 0.0% 0.0

0.0% 0.0% 0.0

0.0% 0.0% 0.0

0.0% 0.0% 0.0

0.0% 0.0% 0.0

0.0% 0.0% 0.0

0.0

0.0

1.00 1.00 0.0% Forecast Horizon

1.00 0.0%

1.00 0.0%

1.00 0.0%

1.00 0.0%

1.00 0.0%

1.00 0.0%

1.00 0.0%

1.00 0.0%

1.00 0.0%

1.00 0.0%

1.00 0.0%

1.00 0.0%

1.00 0.0%

1.00 0.0%

1.00 0.0% Terminal Years

1.00 0.0%

Year Ended , () DCF Valuation of the Equity Net Income to Common - Investment in Net Working Capital - Investment in Net Long-Term Assets + Increase in debt obligations + Increase in preferred equity = Free Cash Flow to Equity * Discount factor - Common Equity (CAPM) = Present value of Free Cash Flow to Equity PV of FCF to Equity (years 1-15) +PV of FCF to Equity beyond Year 15 = Value of the Equity Number of shares outstanding (MM) Estimated value per share

10

11

12

13

14

15

16

17

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

0 0.0

Forecast Horizon Year Ended , () Abnormal Earnings Valuation of the Equity Net Income to Common - Charge for Common Equity Capital = Residual Operating Income * Discount factor - Common Equity = Present Value of Residual Operating Income PV of Residual Operating Income (years 1-15) + PV of Residual Operating Income beyond Year 15 + Beg. Book Value of Equity = Value of the Equity Number of shares outstanding (MM) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

Terminal Years 16 17

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

0.0

Page 24 of 27

Pro Formas & Valuation Estimated value per share

Forecast Horizon Year Ended , () Abnormal Returns Valuation of the Equity Return on Common Equity - Cost of Common Equity = Abnormal Returns * Discount Factor - Common Equity * Book Value of Equity Growth Factor = Present Value of Abnormal Return on Common Equity Beg. Book Value of Common Equity * PV of Abnormal ROE (years 1-15) + Beg. Book Value of Common Equity * PV of Abnormal ROE beyond year 15 + Beg. Book Value of Common Shareholders' Equity = Value of the Equity Implied Market to Book Value Ratio Number of shares outstanding (MM) Estimated value per share 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

Terminal Years 16 17

0.0% 1.00 1.00

0.0% 1.00

0.0% 1.00

0.0% 1.00

0.0% 1.00

0.0% 1.00

0.0% 1.00

0.0% 1.00

0.0% 1.00

0.0% 1.00

0.0% 1.00

0.0% 1.00

0.0% 1.00

0.0% 1.00

0.0% 1.00

0.0% 1.00

0.0% 1.00

0.0

Page 25 of 27

Valuation Summary Reminders:

Table 1. Valuation SummaryValuation Summary:

() Discounted Cash Flows Abnormal Earnings Abnormal Returns

Equity Value $0.0 $0.0 $0.0

Equity Value per share

No reminders to report.

Table 2. Accounting Adjustments and Summary of Effects on 's Financial Statements:

Accounting Adjustments Effect on: () Net Income to Common Beginning Book Value of Common Shareholders' Equity Return on Common Equity (ROE) NO ADJUSTMENTS RECORDED As Reported Adjusted Difference

Table 3. Key Assumptions (Note: Assumptions cannot be modified in this worksheet. To further revise assumptions, please return to the Key Assumptions sheet.)

Historical Ratios Forecast Horizon Terminal Years

Year Ended , () Assumptions for years 1-15: Sales growth rate Net operating profits after tax / sales Beginning net operating working capital / sales Beginning net operating long-term assets / sales Assumptions for year 16 and beyond: Sales growth rate Net operating profit after tax / sales Beginning net operating working capital / sales Beginning net operating long-term assets / sales Book Value Leverage (beginning of year) Net debt / book value of net capital Preferred equity / book value of net capital Shareholders' equity / book value of net capital

10

11

12

13

14

15

16

17

0.0% Market Value Leverage (beginning of year) Net debt / market value of net capital Preferred equity / market value of net capital Shareholders' equity / market value of net capital 0.0% Cost of Capital parameters: Market risk premium Risk free rate Tax rate Cost of debt Cost of Preferred equity (if applicable) Implied Debt Beta Implied Preferred Equity Beta Common Equity Beta Implied asset beta After tax cost of debt Cost of common equity Pro Forma ROE 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

Number of Common shares outstanding

Table 4. Valuation Summary, all stored scenarios for :

() Equity Value Equity Value per share

Page 26 of 27

Valuation Summary Scenario 1 Discounted Cash Flows Abnormal Earnings Abnormal Returns Scenario 2 Discounted Cash Flows Abnormal Earnings Abnormal Returns Scenario 3 Discounted Cash Flows Abnormal Earnings Abnormal Returns Scenario 4 Discounted Cash Flows Abnormal Earnings Abnormal Returns Scenario 5 Discounted Cash Flows Abnormal Earnings Abnormal Returns $0.0 $0.0 $0.0 $0.00 $0.00 $0.00 $0.0 $0.0 $0.0 $0.00 $0.00 $0.00 $0.0 $0.0 $0.0 $0.00 $0.00 $0.00 $0.0 $0.0 $0.0 $0.00 $0.00 $0.00 $0.0 $0.0 $0.0 $0.00 $0.00 $0.00

Page 27 of 27

Вам также может понравиться

- Financial Statements SampleДокумент41 страницаFinancial Statements SampleMohamedОценок пока нет

- Merger Model - Blank Template: Control Panel Outputs Sensitivities Model Comps Data Diluted Shares CalculationДокумент49 страницMerger Model - Blank Template: Control Panel Outputs Sensitivities Model Comps Data Diluted Shares CalculationGugaОценок пока нет

- Management Accounting SampleДокумент25 страницManagement Accounting SampleEdward Baffoe100% (1)

- BiiiimplmoniwbДокумент34 страницыBiiiimplmoniwbShruti DubeyОценок пока нет

- Excel SampleДокумент8 страницExcel SampleVõ Văn PhúcОценок пока нет

- Untitled SpreadsheetДокумент816 страницUntitled SpreadsheetrakhalbanglaОценок пока нет

- FULLIFRS Vs IFRSforSMES BAGSITДокумент220 страницFULLIFRS Vs IFRSforSMES BAGSITVidgezxc LoriaОценок пока нет

- Payback Period TemplateДокумент3 страницыPayback Period TemplateSobanah ChandranОценок пока нет

- 3 Statement Model: Strictly ConfidentialДокумент13 страниц3 Statement Model: Strictly ConfidentialLalit mohan PradhanОценок пока нет

- Blank Financial ModelДокумент109 страницBlank Financial Modelrising_aboveОценок пока нет

- Projected Financial Statements SummaryДокумент43 страницыProjected Financial Statements SummaryKumar SinghОценок пока нет

- ACCT212 WorkingPapers E3-31AДокумент2 страницыACCT212 WorkingPapers E3-31Alowluder0% (1)

- Assumption Sheet Financial ModelДокумент5 страницAssumption Sheet Financial ModelVishal SachdevОценок пока нет

- Consolidation ModelДокумент19 страницConsolidation ModelTran Anh VanОценок пока нет

- FCFF Valuation Model: Before You Start What The Model Doe Inputs Master Inputs Page Earnings NormalizerДокумент34 страницыFCFF Valuation Model: Before You Start What The Model Doe Inputs Master Inputs Page Earnings Normalizernikhil1684Оценок пока нет

- FCFF ValuationДокумент123 страницыFCFF ValuationeamonnsmithОценок пока нет

- Best Answer 3Документ14 страницBest Answer 3Chelsi Christine TenorioОценок пока нет

- Weekly Cash Flow TemplateДокумент20 страницWeekly Cash Flow Templatew_fibОценок пока нет

- Type Answers On This Side of The Page OnlyДокумент40 страницType Answers On This Side of The Page Only嘉慧Оценок пока нет

- Small Bank Pro Forma Model: Balance Sheets Thousand $Документ5 страницSmall Bank Pro Forma Model: Balance Sheets Thousand $jam7ak3275Оценок пока нет

- Control Questionnaire - Insurers and ReinsurersДокумент115 страницControl Questionnaire - Insurers and ReinsurersmsrchandОценок пока нет

- Forecasting ModelДокумент92 страницыForecasting ModelDoan Kieu MyОценок пока нет

- Income Statement: Khybey Tobacco Company LTDДокумент15 страницIncome Statement: Khybey Tobacco Company LTDMuzamil Ur rehmanОценок пока нет

- Alibaba IPO Financial Model WallstreetMojoДокумент52 страницыAlibaba IPO Financial Model WallstreetMojoJulian HutabaratОценок пока нет

- Company ValuationДокумент68 страницCompany ValuationXinyi SunОценок пока нет

- SBDC Valuation Analysis ProgramДокумент8 страницSBDC Valuation Analysis ProgramshanОценок пока нет

- Vertical Analysis Exercise: Strictly ConfidentialДокумент2 страницыVertical Analysis Exercise: Strictly ConfidentialSueetYeingОценок пока нет

- Equity Beta and Asset Beta Conversion Template: Strictly ConfidentialДокумент3 страницыEquity Beta and Asset Beta Conversion Template: Strictly ConfidentialLalit KheskwaniОценок пока нет

- AuditSampleForms Master Sept 27 2011Документ92 страницыAuditSampleForms Master Sept 27 2011Marta OsorioОценок пока нет

- Bit - Financial StatementsДокумент10 страницBit - Financial StatementsAldrin ZolinaОценок пока нет

- Starboard Darden Sept 2014 294 Slide Deck PPT PDF PresentationДокумент294 страницыStarboard Darden Sept 2014 294 Slide Deck PPT PDF PresentationAla BasterОценок пока нет

- CPA113 (Author: Laikwan)Документ73 страницыCPA113 (Author: Laikwan)api-371730683% (6)

- Valuation Cash Flow A Teaching NoteДокумент5 страницValuation Cash Flow A Teaching NotesarahmohanОценок пока нет

- Internal Audit Manager in San Jose CA Resume Andrew KatcherДокумент4 страницыInternal Audit Manager in San Jose CA Resume Andrew KatcherAndrewKatcherОценок пока нет

- Balanced ScorecardДокумент13 страницBalanced Scorecardatulmir0% (1)

- Model #14 M - A Model (Mergers and Acquisitions)Документ11 страницModel #14 M - A Model (Mergers and Acquisitions)Rahul GopanОценок пока нет

- 7 Consolidation Package - TemplateДокумент369 страниц7 Consolidation Package - TemplateOUSMAN SEIDОценок пока нет

- Mapping New Expert-KEUДокумент37 страницMapping New Expert-KEUApdev OptionОценок пока нет

- Football Field Chart Template: Strictly ConfidentialДокумент3 страницыFootball Field Chart Template: Strictly ConfidentialDebanjan MukherjeeОценок пока нет

- DP Delivering Sustainable Development Public Private 100415 enДокумент8 страницDP Delivering Sustainable Development Public Private 100415 enHossein DavaniОценок пока нет

- Work Sample 1Документ79 страницWork Sample 1api-337384142Оценок пока нет

- Management Reporting MC ProductsДокумент2 страницыManagement Reporting MC Productsharish_inОценок пока нет

- Merger Model PP Allocation BeforeДокумент100 страницMerger Model PP Allocation BeforePaulo NascimentoОценок пока нет

- Mixed Use JK PDFДокумент9 страницMixed Use JK PDFAnkit ChaudhariОценок пока нет

- Kellogg: Balance SheetДокумент14 страницKellogg: Balance SheetSubhajit KarmakarОценок пока нет

- KTML Annual 2011Документ364 страницыKTML Annual 2011Mian Asif BashirОценок пока нет

- DCF Model - Power Generation: Strictly ConfidentialДокумент5 страницDCF Model - Power Generation: Strictly ConfidentialAbhishekОценок пока нет

- Journal Entries Template: Strictly ConfidentialДокумент7 страницJournal Entries Template: Strictly ConfidentialSheikh Abdullah AnnoorОценок пока нет

- Accounting Policies and Procedures For Early Stage CompaniesДокумент49 страницAccounting Policies and Procedures For Early Stage CompaniesJoud H Abu HashishОценок пока нет

- CFI Interview QuestionsДокумент5 страницCFI Interview QuestionsSagar KansalОценок пока нет

- LBO Model Cash Flow AnalysisДокумент38 страницLBO Model Cash Flow AnalysisBobbyNicholsОценок пока нет

- Walmart Inc. - Operating Model and Valuation - Cover Page and NavigationДокумент24 страницыWalmart Inc. - Operating Model and Valuation - Cover Page and Navigationmerag76668Оценок пока нет

- DCF ModellДокумент7 страницDCF ModellziuziОценок пока нет

- CH 6 Model 14 Free Cash Flow CalculationДокумент12 страницCH 6 Model 14 Free Cash Flow CalculationrealitОценок пока нет

- Synopsis of Many LandsДокумент6 страницSynopsis of Many Landsraj shekarОценок пока нет

- FINA, CIVE, ENMG Courses in Business, Civil Engineering & ManagementДокумент5 страницFINA, CIVE, ENMG Courses in Business, Civil Engineering & Managementnassif75Оценок пока нет

- Critical Financial Review: Understanding Corporate Financial InformationОт EverandCritical Financial Review: Understanding Corporate Financial InformationОценок пока нет

- Guide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesОт EverandGuide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesОценок пока нет

- Krispy Kreme DoughnutsДокумент2 страницыKrispy Kreme DoughnutsMissouri Soufiane100% (1)

- Team Member Guide 2011: Capsim Management Simulations, IncДокумент40 страницTeam Member Guide 2011: Capsim Management Simulations, IncMissouri SoufianeОценок пока нет

- Final Exam View AttemptДокумент10 страницFinal Exam View AttemptMissouri SoufianeОценок пока нет

- Af495 Case3 Soufiane M. ErrahhalyДокумент4 страницыAf495 Case3 Soufiane M. ErrahhalyMissouri SoufianeОценок пока нет

- Effects On Unsecured Loans On The Performance On BanksДокумент45 страницEffects On Unsecured Loans On The Performance On BanksBenjamin Agyeman-Duah OtiОценок пока нет

- Test 01 Chapters 2 & 3 September 25Документ8 страницTest 01 Chapters 2 & 3 September 25barbara tamminenОценок пока нет

- PT Cowell Development Interim Consolidated Financial StatementsДокумент79 страницPT Cowell Development Interim Consolidated Financial StatementsTamara EkaОценок пока нет

- FHA Loans GuideДокумент5 страницFHA Loans GuideHollanderFinancialОценок пока нет

- 37.) Ian Gaskell Admits To Unreported CDO Losses, Per ABX-based NAVДокумент1 страница37.) Ian Gaskell Admits To Unreported CDO Losses, Per ABX-based NAVFailure of Royal Bank of Scotland (RBS) Risk ManagementОценок пока нет

- Amortization Grade 11Документ1 страницаAmortization Grade 11PAULET AURALYN GUBALLAОценок пока нет

- David 02 eLMS Quiz 1 ARGДокумент3 страницыDavid 02 eLMS Quiz 1 ARGRang CalaguianОценок пока нет

- How To Evaluate Private Real Estate InvestmentsДокумент22 страницыHow To Evaluate Private Real Estate InvestmentsVeronica Nanco100% (4)

- 11 Acc ch1 AnsДокумент7 страниц11 Acc ch1 AnsAbhijit BharadeОценок пока нет

- PHEI Yield Curve: Daily Fair Price & Yield Indonesia Government Securities March 22, 2021Документ3 страницыPHEI Yield Curve: Daily Fair Price & Yield Indonesia Government Securities March 22, 2021Trisno SuryowinarkoОценок пока нет

- Managing A Consumer Lending Business - David Lawrence - Z Lib - OrgДокумент386 страницManaging A Consumer Lending Business - David Lawrence - Z Lib - OrgSebas 24Оценок пока нет

- Free Credit Score & Free Credit Reports With Monitoring - Credit KarmaДокумент18 страницFree Credit Score & Free Credit Reports With Monitoring - Credit KarmaERVIN CATALANОценок пока нет

- C013 ProblemsДокумент3 страницыC013 ProblemsTushar KumarОценок пока нет

- Credit Appraisal Means An InvestigationДокумент3 страницыCredit Appraisal Means An InvestigationSoumava Paul100% (1)

- CH 10. Govt. Budget QBДокумент8 страницCH 10. Govt. Budget QBAdrian D'souzaОценок пока нет

- Asset Backed SecuritiesДокумент22 страницыAsset Backed Securitieskah53100% (1)

- Qa Percentages AdwbДокумент6 страницQa Percentages AdwbDeepika NeelapalaОценок пока нет

- How Federal Regulators Lenders and Wall Street Caused The Housing CrisisДокумент66 страницHow Federal Regulators Lenders and Wall Street Caused The Housing CrisisDeontosОценок пока нет

- Basic Points: Homeicide: The Crime of The CenturyДокумент40 страницBasic Points: Homeicide: The Crime of The Centuryvb12wxОценок пока нет

- Oladipo 3Документ26 страницOladipo 3PandorerОценок пока нет

- Question Bank Test 1 With AnswersДокумент9 страницQuestion Bank Test 1 With AnswersUlugbek BayboboevОценок пока нет

- Corporate Debt RestructuringДокумент3 страницыCorporate Debt RestructuringSourav JainОценок пока нет

- California Budget Summary 2018-19Документ272 страницыCalifornia Budget Summary 2018-19Capital Public Radio100% (1)

- SecuritisationДокумент78 страницSecuritisationAshita DoshiОценок пока нет

- Monthly Billing Statement: Account InformationДокумент2 страницыMonthly Billing Statement: Account Informationarianne Dela cruz100% (1)

- Gallagher & Mohan - DCF - Modeling - Example - DealДокумент12 страницGallagher & Mohan - DCF - Modeling - Example - Dealbrin dizelleОценок пока нет

- Lesson 1 What Is The Globalization?: Globalization: A Working DefinitionДокумент24 страницыLesson 1 What Is The Globalization?: Globalization: A Working DefinitionCherry BanadaОценок пока нет

- Little Blue Book, 2016 EditionДокумент146 страницLittle Blue Book, 2016 EditiongiovanniОценок пока нет

- HARTALEGAДокумент7 страницHARTALEGATeo Zhen TingОценок пока нет

- Intermediate - Accounts (19.07.2019)Документ10 страницIntermediate - Accounts (19.07.2019)Åådil MirОценок пока нет