Академический Документы

Профессиональный Документы

Культура Документы

Anderson On Risk Governance - ICSA Chartered Secretary

Загружено:

David W. AndersonОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Anderson On Risk Governance - ICSA Chartered Secretary

Загружено:

David W. AndersonАвторское право:

Доступные форматы

Across the pond

with David Anderson

David Anderson is President of the Anderson Governance Group

Unique position

This serves to align the perspectives of the board and the management team on core risk judgements. A board governing risk thus works with management to align their judgements on an acceptable appetite for risk and, given the corporate strategy, adopt a set of trade-offs that are most likely to yield an appropriate return. So where do boards typically go wrong? While directors know that governing and managing risk imposes a cost, they may behave as if the costs are marginal. As such they put the onus on management to deliver relatively high returns, yet only accept relatively low margins of risk. This encourages management to restrict communication to the board, under-reporting risks. In an effort to understand risk and reduce their liability, directors blur the governance/ management line in board meetings, spending too much time on the details of risk management. In an area as nebulous and complex as risk, some directors focus valuable time on areas of personal interest or concern. Boards are more likely to provide their unique governance value and help management reach a risk-optimised outcome when directors: focus on risk governance; consider strategy and risk simultaneously; set the risk appetite for the organisation from an owner perspective; encourage a culture of innovation, which praises creative failure within certain financial bounds; reward strategic and executional excellence and associated risk awareness. The mathematics and procedures of risk management are well-understood. The culture and behaviours that support good risk governance are not so well-understood, nor so readily articulated. Improving the quality of human judgement and decision-making within boards is our best bet for governing risk intelligently and profitably.

Boards need to get much better at risk governance.

ntense pressure for tighter controls and a sharper focus on risk from investors and regulators continues to build on both sides of the Atlantic. Consequently, boards are spending more time on risk management. Is this response producing more effective boards? Should boards be managing or governing risk? The UK Corporate Governance Code emphasises the boards responsibility for determining the nature and extent of the significant risks it is willing to take in achieving its strategic objectives. Wisely, provisions for proper risk oversight are shared across the principles of leadership, accountability and remuneration, acknowledging the multi-faceted nature of risk management. Boards have been inclined to interpret existing codes and guidance on risk management to mean that they themselves ought to engage in the finer details of risk management. Certainly, correcting the wildly lax risk management that characterised much of the last decade and preventing massive loss are necessary goals. To aid boards in achieving those goals, some nuance may help: it is management who needs to improve risk

management; boards need to get much better at risk governance. This distinction may be harder to draw when half the board is made up of executive directors, but it is that factor which makes the distinction vital. The unique value of a board is realised when it serves a governance function distinct from managements function. To govern means to oversee managements efforts. By delving into risk management without a clear understanding of this distinction, boards are prone to diving deeply into managements territory and forfeiting their unique ability to add value. Boards that can carve out a unique role for themselves tend to govern risk more effectively. They are in a better position to help management optimise the costs and benefits of risk (including the costs of mitigation efforts), which are associated with corporate strategy. These boards also oversee risk management efforts, engaging in robust dialogue on testing risk assumptions and scenarios and the correlation between the two (a major blind spot exacerbating the recent financial crisis), and the variance assigned to risk outcomes.

About the author

David Anderson MBA PhD ICD.D is the President of the Anderson Governance Group based in Toronto. He can be reached at david.anderson@taggra.com and +1 (416) 815 1212.

w w w . c h a r t e r e d s e c r e t a r y. n e t

19

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Introduction To HACCP Plan For MayonnaiseДокумент8 страницIntroduction To HACCP Plan For Mayonnaiseshaimamoh225279Оценок пока нет

- Abraham Harold Maslow Motivation and PersonalityДокумент399 страницAbraham Harold Maslow Motivation and PersonalityAspect01100% (20)

- 786015756Документ6 страниц786015756Novia Kristanti100% (1)

- Anderson On Shareholder VoiceДокумент1 страницаAnderson On Shareholder VoiceDavid W. AndersonОценок пока нет

- Anderson On Audit and Regulation - ICSA Chartered Secretary (Jun 2012)Документ1 страницаAnderson On Audit and Regulation - ICSA Chartered Secretary (Jun 2012)David W. AndersonОценок пока нет

- A Leadership Self-Efficacy Taxonomy and Its Relation To Effective Leadership (Anderson, Krajewski Et Al)Документ15 страницA Leadership Self-Efficacy Taxonomy and Its Relation To Effective Leadership (Anderson, Krajewski Et Al)David W. AndersonОценок пока нет

- Anderson Puts Charles Sirois in The Directors Chair: The Ownsership ImperativeДокумент4 страницыAnderson Puts Charles Sirois in The Directors Chair: The Ownsership ImperativeDavid W. AndersonОценок пока нет

- Anderson On Regulatory Regime Fit - ICSA Chartered SecretaryДокумент1 страницаAnderson On Regulatory Regime Fit - ICSA Chartered SecretaryDavid W. AndersonОценок пока нет

- Anderson Puts Carol Stephenson in The Director's Chair: Risk, Reward, RepeatДокумент4 страницыAnderson Puts Carol Stephenson in The Director's Chair: Risk, Reward, RepeatDavid W. AndersonОценок пока нет

- Housekeeping Manpower PlanДокумент2 страницыHousekeeping Manpower PlanaajakirОценок пока нет

- Submitted To:-Dr. A.P. Singh: Compiled By: - Nisha SharmaДокумент8 страницSubmitted To:-Dr. A.P. Singh: Compiled By: - Nisha SharmaKamal K SharmaОценок пока нет

- JSA For Cleaning Exchanger Channel Head by High Pressure Water JettingДокумент17 страницJSA For Cleaning Exchanger Channel Head by High Pressure Water JettingThái Đạo Phạm LêОценок пока нет

- Drug Use During Pregnancy and LactationДокумент50 страницDrug Use During Pregnancy and LactationchintyamontangОценок пока нет

- Ouvrages de Captage Deau Et Perimetres de Protection: Cas Des Nouveaux Champs Captants de Djibi Et de Niangon Nord Ii A Abidjan (Cote Divoire)Документ19 страницOuvrages de Captage Deau Et Perimetres de Protection: Cas Des Nouveaux Champs Captants de Djibi Et de Niangon Nord Ii A Abidjan (Cote Divoire)IJAR JOURNALОценок пока нет

- Doctors AreДокумент2 страницыDoctors Areanon_703664359Оценок пока нет

- 5 Modules Basic Security TrainingДокумент72 страницы5 Modules Basic Security TrainingVela SinnappanОценок пока нет

- 个人陈述:作为护理工作者的我Документ13 страниц个人陈述:作为护理工作者的我cjcnpvseОценок пока нет

- Costco202111us DLДокумент169 страницCostco202111us DLhoomar70Оценок пока нет

- Led Lighting in HospitalsДокумент7 страницLed Lighting in HospitalsNgọc Nguyễn ThảoОценок пока нет

- Gingipain Periodontitis DogДокумент5 страницGingipain Periodontitis Dogvioleta.enachescu-1Оценок пока нет

- A Non Beta Cell Tumor Located in The Abdomen of A Patient With Hypoglycaemia Secreting High Levels of "Big" Insulin-Like Growth Factor (IGF) - II and IGF-binding Protein-6.Документ8 страницA Non Beta Cell Tumor Located in The Abdomen of A Patient With Hypoglycaemia Secreting High Levels of "Big" Insulin-Like Growth Factor (IGF) - II and IGF-binding Protein-6.Wouter van de HoefОценок пока нет

- Resu ME: Patel Nitesh BharatbhaiДокумент4 страницыResu ME: Patel Nitesh BharatbhaiAnonymous MeZhswОценок пока нет

- Maggi FinalДокумент10 страницMaggi FinalDeepak Singh NegiОценок пока нет

- Activity Design For Orientation.Документ4 страницыActivity Design For Orientation.Ricky Canico Arot50% (2)

- Emergency Care For MO - Medico-Legal Issues and DocumentationДокумент21 страницаEmergency Care For MO - Medico-Legal Issues and DocumentationSharon B JosephОценок пока нет

- Student Nurses' Community Nursing Care PlanДокумент3 страницыStudent Nurses' Community Nursing Care PlanMussaib MushtaqОценок пока нет

- 021218drug Study CetirizineДокумент2 страницы021218drug Study Cetirizineliza sian100% (1)

- Logo of Indian Institutes and Corporations PDFДокумент20 страницLogo of Indian Institutes and Corporations PDFHarithaHarryОценок пока нет

- NA NME TerminologyДокумент3 страницыNA NME TerminologyVha AmalaОценок пока нет

- Root Cause Analysis FallsДокумент8 страницRoot Cause Analysis Fallsapi-355495007100% (1)

- Jmkes 49-1Документ7 страницJmkes 49-1Faiza OktavianiОценок пока нет

- Dental Fear in Patients Pursuing Orthodontic Treatment: Original ArticleДокумент6 страницDental Fear in Patients Pursuing Orthodontic Treatment: Original Articlemudassir rehmanОценок пока нет

- Ely Effervescent Powders PDFДокумент8 страницEly Effervescent Powders PDFAjinОценок пока нет

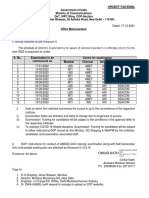

- GMDSS Exam Schedule For Year 2022Документ7 страницGMDSS Exam Schedule For Year 2022Mani ThapaОценок пока нет

- The Art of Critical ThinkingДокумент2 страницыThe Art of Critical ThinkingAmeer Youseff MarotoОценок пока нет

- Bronchial AsthmaДокумент46 страницBronchial AsthmaKhor Kee GuanОценок пока нет