Академический Документы

Профессиональный Документы

Культура Документы

Case 6

Загружено:

Mohammad OthmanИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Case 6

Загружено:

Mohammad OthmanАвторское право:

Доступные форматы

Question No.

1

Calculate the Iirm's 1996 ratios listed in Exhibit 3.

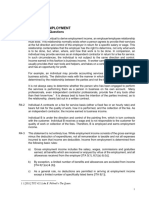

Financial Ratios for the Holly Fashions Company: 1993 -1996

ndustry Average (1993 - 1996)

1993 1994 1995 Present

1996

Average

of

HF(1993-

1996)

Top 25%

companies

Average

50%

companies

Lowest

25%

companies

Liquidity Ratios

Current 3.8 3.7 3.4 3.6 3.6 2.6 1.7 1.3

Quick 2.4 2.4 1.8 2 2.2 1.6 0.8 0.6

Leverage Ratios

Debt (%) 41.1 37.7 35.3 31.3 36.4 41 57 71

Time interest earned 8 8.5 11.6 15.7 11.0

ursrx

r

r.'

3 9

v

:?i;3 u

Activity Ratios

nventory Turnover

(CGS)

6.4 6.4 4.8 5.1 5.7 8.1 6 3.5

Fixed Asset Turnover 30 29.3 30.1 29 29.6 40 25 12

Total Asset Turnover 2.8 2.8 2.7 2.7 2.8 3.5 2.8 2

Average collection

Period

56 55 51 62 56.0 41 50 68

Days Purchases

Outstanding

25 22 31 31 27.3 18 25 32

Profitability Ratios

Gross Margin {%) . 24 25.5 24.9 25 24.9 28 26 24

Net Profit Margin (%)j 3 2.6 2.6 2.7 2.7 4.2 3.1 1.2

Return on Equity (%Jf 14.3 11.6 10.8 10.7 11.9 27.3 19.5 7.8

Return on Total Asset

8.4"

7 7.3 7.5 11.8 8.7

3.4

Operating Margin (%) 6.8 6 6.1 59. 6.2 9.9 7.2 3.1

Question No. 2

!art oI Hamilton's evaluation will consist oI comparing the Iirm's ratios to the

industry numbers shown in Exhibit 3.

(a) Discuss the limitations oI such a comparative Iinancial analysis.

Tne limitations include that these ratios cover a long period Ior the industry while it more

speciIic Ior HF, so in order to be accurate and Iair the comparison should be made Ior

speciIic equal periods. Moreover Ratios can indicate that there is a problem but it doesn't tell

what is the type oI the existing problem and what is the Iactor that was responsible Ior it in

terms oI the industry ratios. Another limitation is that all the Iinancial data oI all companies

in the industry should be developed in the same way in order to be able to compare them.

(b)In view oI these limitations, why are such industry comparisons so Irequently

made?

They are so Irequently made because it helps the company to indicate how well in general it

is doing by cross sectional comparison with the whole industry and with speciIic

competitors..

Question o. 3

Hamilton thinks that the proIitability oI the Iirm to the owners has been hurt by

White's reluctance to use much mterest-bearing debt. Is this a reasonable position?

Explain.

Yes it is a reasonable position, since it was clear in the case that Mr. White has retired lots oI

long term debts and he preIerred to use the capital as a source oI Iinancing and so as a result

each partner had to contribute $15'000 in order to meet companies cash needs. Moreover over

the long period, the return oI equity has been decreasing sharply and it is lower than the

median oI companies. Tnis means that using the capital instead oI debt was not the correct

decision and so iI debt was used instead the partners would have had the opportunity to invest

the capital in more eIIicient long term investment rather than to be used to cover operating

activities.

Question No. 4

The case mentions that White rarely takes trade discounts, which are typically ,

1/10, net 30. Does this seem like a wise Iinancial move? Explain.

It doesn't seem a wise Iinancial move especially since their liquidity ratios are higher than the

top 25 oI the companies and so it means that it can easily pay their short term debts and

beneIit Irom the discount.

Question No. 5

Calculate the company's market-to-book (MV/BV) ratio. (There are 5'000 ...

shares oI common stock).

Book Value oI the company ? Common StQck-`Retained earnings

...;-u ../ iso'ooa`i49

!

8po~.$329

,

sod ":.:.:u.:u:,. *(..

15 7% 4360 224739

16 7% 4360 245136

17 7% 4360 266961

18 7% 4360 290313

19 7% 4360 315300

20 7% 4360 337371

The amount aIter tax 70 * 337371 $236160

(d) Redo your answer to part (c) assuming 8 percent is earned during years 1 to

10, 5 percent during years 11 to 15, and 7 percent in years 16 to 20.

Year nterest Rate Annuity Ace. Amount BT

o

1

2

3

4

5

6

7

8

9

10

11

12

14.

15

16

17

18

19

20

4360

8% 12000 12960

8% 12000 26957

8% 12000 42073

8% 12000 58399

8% 12000 76031

8% 12000 95074

8% 12000 107388

8% 4360 120688

8% 4360 135052

xr

4360 150565

5% 4360 162671

5% 4360 175383

5% 4360 188730

5% 4360 202744

.,5%, 4360 217460

7% 4360 237347

7% 4360 258627

7% 4360 281396

7% 4360 305759

7% 4360

The amount aIter tax 70 * 327162 $229'013

Market Value oI the company 55 -I 65 $60 per share.

2

ThereIore the company's market-to-book ratio (60 * 5000) - $0.91

329'800

Question No. 6

Hamilton's position is that White has not competently managed the Iirm. DeIend this

position using your previous answers and other inIormation in the case.

White was not eIIicient in managing the Operation Cycle oI the business, where he has

produced lots oI inventory and kept it until customers would come and so this has hold up the

capital invested in it. Also the average Collection period has also increased which has held

the capital two. Moreover the Average payment period was increasing without any need and

also it led to the lost oI trade discounts. Also he wanted to use the capital to Iinance the

company rather the debt which is not a right decision. In addition, the MV/BV is still $0.91

despite the Iact White didn't distribute dividend oyer the past Iew years.

Question No. 7

White's position is that he has eIIectively managed the Iirm. DeIend this

position using your previous answers and other inIormation in the case.

The company leverage ratios are higher even the top 25 oI the companies and this means it

doesn't suIIer any debts which reduces the risk oI not going bankrupted.

Question No. 8 j

4

!lay the role oI an arbitrator. Is it possible based on an examination oI the Iirm's ratios and

other inIormation in the case to assess White's managerial competence. DeIend your

position.

According to the inIormation provided in Ihe case, Wliite's management was unsuccessIul Ior

example:` ..

:

./ ... ..,....,......... ...,:..*,...'..- .................. .-..... .. -... .......... .:' .... ........... ~..:.......

(1) He didn't improving the Average collection period and he kept selling to retailers who were

owing the company lot oI money and so by doing so he increased the A/R and increased the risk

oI making these A/R uncollectible.

(2) Companies like HF should maintain a stable bank relationship. Debt avoidance has signiIicantly -

reduced HF's Iinancial Ilexibility since all projects are equity Iinanced. This cost the company even

more than the debt interest.

(3) More evidence were already mentioned in previous answers. :.

W Question No. 9

(a) Are the ratios you calculated based on market or book values? Explain.

The ratios are calculated on Book values since the inIormation were taken Irom the Iinancial

statements.

(b) Would you preIer ratios based on market or book values? Explain.

I preIer market values since they reIlect the current situation and thereIore they are more

accurate and very close to the reality.

Question o. 5

Based on your previous calculations and other inIormation in the case, what do you

recommend? JustiIy your answer.

%e first scenario

Invest both the $30'000 and the excess $3052 in the monthly market at 4 interest

rate.

The accumulated aIter-tax investment in 20 years is $156*612. The

Tax is deducted on the spot.

%e second scenario

Invest the $30'000 in a S!A and the excess $3052 in TDA.

The accumulated aIter-tax investment in 20 years is $186*095 (60*270 125*825).

The Tax is deIerred until year 20.

%e %ird scenario

Invest both the $30'000 and the excess $3052 in the TDA

The accumulated aIter-tax investment in 20 years is $236*160 iI invested in orthern

Annuities.

The. accumulated aIter-tax investment in 20 years is $229*013 iI invested in Modern

Investment Ior 15 years and then in orthern Annuities Ior the last 5 years.

The Tax is deIerred until year 20.

It was clear that he wanted a long-term, tax-sheltered investment and also he made it clear

that he won't need the money beIore the age oI 60. So according to the above Scenarios, the

third scenario is the best one and it seems that the highest earnings come Irom investing in

orthern Annuities, but also investing in Modem Investment and then in orthern Annuities

would be also an advisable and recommended option since the lowest interest oI 5 may not

be reachable and thereIore the amount oI $229*013 would represent the lowest earnings and

so the earning might exceed it. So Irom my point oI view, I would recommend investing in

Modern Investment Ior 15 years and then in orthern Annuities Ior the last 5 years.

Question No. 1

(a) The $30'000 oI excess liquidity is earning 5 percent compounded monthly in

a money market Iund. This is a 5.12 percent annualized return. How was this

determined?

Year o Accumulated

0 \ 30'000

1 30'125

2 30'251

3 30'377

4 30'504

5 30'631

6 30'759

7 30'887

8 31'016

9 31'145

10 31'275

11 31'405

12 31'536

ThereIore the return on investment aIter year is 31*536 -30'000 5.12

30'000

(b) This annualized return oI 5.12 percent results in an aIter-tax return oI 3.58

percent since taxes on any interest must be paid each year. How was this

determined?

AIter Tax annualized return Return beIore Tax - Tax expenses

5.12-(0.3* 5.12)

3.58

Question No. 2

Assume a 4 percent aIter-tax annual return will be earned in a money market

Iund. How much will be accumulated in 20 years iI the $30'000 remains in the -

money market and $3'052 per year is placed in the same investment? -;

FV oI all the investments | !V (FVIF) n-20, M A (FVIFA) n20, i4 |

........................ - |30'000 (2.191) -3'052 (29.778) | ---- .. .,- uu-.---.uuu..-u- ...

.

:

-|65730 90'882| .u-.u.'.- -.`i.- .u-..u.-:..u..-

$156'612

Вам также может понравиться

- Operating Model in A Digital WorldДокумент6 страницOperating Model in A Digital WorldMohammad OthmanОценок пока нет

- Annex 1 (A) Target Operating Model: The Compelling AlternativeДокумент8 страницAnnex 1 (A) Target Operating Model: The Compelling AlternativeMohammad OthmanОценок пока нет

- Mmis Brochure ArabicДокумент10 страницMmis Brochure ArabicMohammad OthmanОценок пока нет

- Role Profile: Role Title: Director Strategy Execution & Communication Reporting To: Chief StrategyДокумент3 страницыRole Profile: Role Title: Director Strategy Execution & Communication Reporting To: Chief StrategyMohammad OthmanОценок пока нет

- MofindexДокумент23 страницыMofindexMohammad OthmanОценок пока нет

- Societies: Homeownership: What Does Houston Habitat For Humanity Homeowners Have To Say?Документ21 страницаSocieties: Homeownership: What Does Houston Habitat For Humanity Homeowners Have To Say?Mohammad OthmanОценок пока нет

- ITIL Role DescriptionsДокумент32 страницыITIL Role DescriptionsMohammad OthmanОценок пока нет

- A Starter Set of ITSM Guiding PrinciplesДокумент96 страницA Starter Set of ITSM Guiding PrinciplesalawawdsОценок пока нет

- Nokia SQM Brochure 2015final PDFДокумент8 страницNokia SQM Brochure 2015final PDFMohammad OthmanОценок пока нет

- Issues To Consider When Starting Gis Project Gis DayДокумент59 страницIssues To Consider When Starting Gis Project Gis DayMohammad OthmanОценок пока нет

- Cos TeaДокумент7 страницCos TeachouhanbhupendraОценок пока нет

- CV Abdelhadi IMCNE08Документ2 страницыCV Abdelhadi IMCNE08Mohammad OthmanОценок пока нет

- CV Abdelhadi IMCNE08Документ2 страницыCV Abdelhadi IMCNE08Mohammad OthmanОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Chapter 4-FinanceДокумент14 страницChapter 4-Financesjenkins66Оценок пока нет

- Buckwold 21e - CH 4 Selected SolutionsДокумент18 страницBuckwold 21e - CH 4 Selected SolutionsLucy50% (2)

- Capital Budgeting BasicsДокумент90 страницCapital Budgeting BasicsshalooОценок пока нет

- Strategic ManagementДокумент36 страницStrategic ManagementSoundari Nadar100% (1)

- Aviva Pension Deposit S6Документ2 страницыAviva Pension Deposit S6Ramesh behlОценок пока нет

- Chap 11 & 12Документ4 страницыChap 11 & 12ElizabethОценок пока нет

- AC 1103 OBEdized Syllabi FINALДокумент19 страницAC 1103 OBEdized Syllabi FINALEdgar L. AlbiaОценок пока нет

- Lecture 5 - Bond Portfolio Management - IRRM - Immunization and ALMДокумент31 страницаLecture 5 - Bond Portfolio Management - IRRM - Immunization and ALMNguyễn Việt LêОценок пока нет

- Security Analysis and Port Folio Management: Question Bank (5years) 2 MarksДокумент7 страницSecurity Analysis and Port Folio Management: Question Bank (5years) 2 MarksVignesh Narayanan100% (1)

- MGT411 Online Quizzes No.2Документ17 страницMGT411 Online Quizzes No.2Kanwar M. AbidОценок пока нет

- Summative Exam Bus. Finance 2nd QuarterДокумент6 страницSummative Exam Bus. Finance 2nd QuarterEmelyn GalamayОценок пока нет

- Portfolio Management 1Документ139 страницPortfolio Management 1thuyvuОценок пока нет

- A Study On Financial Performance of Axis Bank in Comparison of HDFC Bank and Icici BankДокумент99 страницA Study On Financial Performance of Axis Bank in Comparison of HDFC Bank and Icici Bankjenish modiОценок пока нет

- Guideline Answers To The Concept Check Questions Chapter 8: Capital BudgetingДокумент8 страницGuideline Answers To The Concept Check Questions Chapter 8: Capital BudgetingDawn CaldeiraОценок пока нет

- Accounting Textbook Solutions - 63Документ19 страницAccounting Textbook Solutions - 63acc-expertОценок пока нет

- Foundations of Engineering EconomyДокумент29 страницFoundations of Engineering EconomyZESTYОценок пока нет

- Universiti Teknologi Malaysia Test 2 1 Hour Engineering EconomyДокумент5 страницUniversiti Teknologi Malaysia Test 2 1 Hour Engineering EconomySheensky V. SalasaОценок пока нет

- Financial ManagementДокумент28 страницFinancial ManagementAkash ArvikarОценок пока нет

- Chapter 9 - The Capital Asset Pricing Model (CAPM)Документ126 страницChapter 9 - The Capital Asset Pricing Model (CAPM)Joydeep AdakОценок пока нет

- Managing Finance in Health and Social CareДокумент26 страницManaging Finance in Health and Social CareShaji Viswanathan. Mcom, MBA (U.K)Оценок пока нет

- 305Документ34 страницы305Kahfi Revi AlfatahОценок пока нет

- ch4 5 Exercise 11thДокумент10 страницch4 5 Exercise 11thkc103038Оценок пока нет

- Applying Financial Engineering To Wealth Management Zvi Bodie Professor of Finance and Economics School of Management, Boston University BostonДокумент72 страницыApplying Financial Engineering To Wealth Management Zvi Bodie Professor of Finance and Economics School of Management, Boston University BostoniddrisskОценок пока нет

- Why Is Gold Different From Other Assets? An Empirical InvestigationДокумент45 страницWhy Is Gold Different From Other Assets? An Empirical InvestigationAnonymous XR7iq7Оценок пока нет

- Business Plan Zambia - Individual InvestorsДокумент11 страницBusiness Plan Zambia - Individual InvestorsMelvin D'SouzaОценок пока нет

- 3 8 12 Prof. Kalpesh GeldaДокумент5 страниц3 8 12 Prof. Kalpesh GeldaSaurabh UpadhyayОценок пока нет

- Time Value of Money (Part I) - Notes 3.30Документ55 страницTime Value of Money (Part I) - Notes 3.30E OzanОценок пока нет

- Fof Im Chapter 08 - 7thДокумент20 страницFof Im Chapter 08 - 7thAnonymous 7CxwuBUJz3Оценок пока нет

- CH09SДокумент34 страницыCH09SIntelaCrosoftОценок пока нет

- To Finance: Financial Statements in Financial AnalysisДокумент86 страницTo Finance: Financial Statements in Financial AnalysisMoktar Tall ManОценок пока нет