Академический Документы

Профессиональный Документы

Культура Документы

James P Jones Financial Disclosure Report For 2010

Загружено:

Judicial Watch, Inc.Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

James P Jones Financial Disclosure Report For 2010

Загружено:

Judicial Watch, Inc.Авторское право:

Доступные форматы

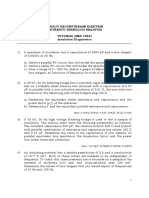

AO 10 R~.

I/~011

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization Western District of Virginia

5a. Report Type (check appropriate type) ] Nomination, [] Initial Date [] Annual [] Final

Report Required by the Ethics in Government Act of 1978 (5 U.S.C. app. 101-111)

1. Person Reporting (last name, first, middle initial) Jones, James P.

4. Title (Article II I judges indicate active or senior status; magistrate judges indicate full- or pan-time)

3. Date of Report 5/14/2011

6. Reporting Period I/I/2010 to 12/31/2010

U.S. District Judge - active

5b. [] Amended Report 7. Chambers or Office Address 8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Revie~ving Officer Date

180 West Main Street Rm. 104 Abingdon, VA 24210

IMPORTANT NOTES: The instructions accompanying this form must be followecL Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I. POSITIONS. (Reporting individual only; see pp. 9-13 of filing instructions.)

~] NONE (No reportable positions.)

POSITION

NAME OF ORGANIZATION/ENTITY

2. 3. 4. 5.

II. AGREEMENTS. mopo.i.g i.aivia.ot o.ly; s~o pp. 14-16 oI~li.g instructions.)

NONE (No reportable agreements.)

DATE

I. 2. 3.

PARTIES AND TERMS

Jones, James P.

FINANCIAL DISCLOSURE REPORT Page 2 of 13

Name of Person Reporting Jones, James P.

Date of Report 5/14/201 I

1II. NON-INVESTMENT INCOME. (Reporting individual andspouse; seepp. 17-24 of filing instructions.) A. Filers Non-Investment Income

[-~ NONE (No reportable non-investment income.)

DATE

SOURCE AND TYPE

INCOME (yours, not spouses)

2. 3. 4.

H. Spouses Non-Investment Income - tf j.ou were married during anyportion of the reporting ycar, complete this sectio~

(Dollar amount not required except for honoraria.)

NONE (No reportable non-investment income.) DATE SOURCE AND TYPE

1.2010 2. 3. 4.

IV. REIMBURSEMENTS - transportation, Iodglng, food, entertainmen~

(Includes those to spouse and dependent children," see pp. 25-27 of filing instructions.)

D

I. 2. 3. 4. 5.

NONE (No reportable reimbursements.)

SOURCE

Virginia CLE

DATES May 19-20, 2010

LOCATION Charlottesville, VA

PURPOSE

lecture at lawyers seminar

ITEMS PAID OR PROVIDED

transportation, room & meals

FINANCIAL DISCLOSURE REPORT Page 3 of 13

Name of Person Reporting Jones, James P.

Date of Report 5/14/2011

V. GIFTS. ancludes ,ho~o ,o spouse ond d,~enden, children; see pp. 28-31 of filing instructiong)

NONE (No reportable gifts.)

SOURCE

I. 2. 3. 4.

DESCRIPTION

VALUE

5.

VI. L IAB ILITIES. (Includes those of spouse and dependent children; see pp. 32-33 of 3qllng instructio.g)

NONE (No reportable liabilities.)

CREDITOR

I. 2. 3. 4. 5.

DESCRIPTION

VALUECODE

FINANCIAL DISCLOSURE REPORT Page 4 of 13 VII. INVESTMENTS and TRUSTS - i ....

Name of Person Reporting Jones, James P.

Date of Report 5/14/2011

e, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructionx.)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Place "IX)" after each asset exempt from prior disclosure Income during repotaing period (J) (2) Amount Typ~ (e.g., Code I div., rent,

(A-H) or int.)

Gross value at end of reporting period (]) (2)

Value Code 2 (J-P) Value Method Code 3 (Q-W)

Transactions during r~porfing period O) Type (e.g.,

buy, sell,

(2) Date mm/dd/yy

redemption)

(3) Value Code2 (J-P)

(4) Gain Code I (A-H)

(5) Identity of buyer/seller (if private transaction)

I. 2. 3. 4. 5. 6. 7. 8. 9. 10.

~! ~!/~: ~::-~ Trust, income beneficiary FBR Gas Utility Index Fund Berkshire Hathaway B common stock Chevron Corp common stock Duke Energy common stock Spectra Energy common stock Exxon Mobil common stock IBM common stock AT&T Inc. common stock T. Rowe Price Va Bond Fund

D A

Dividend Dividend None

P3 J J M N M M M K J J N M M M M N

T T T T T T T T T T T T T T T T T

C E D D B B A A A C B B B E

Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend

1 I. T. Rowe Price Summit Muncipal Intermediate Fund 12. 13.

14.

T. Rowe Price Growth Stock Fund T. Rowe Price New Horizons Fund

T. Rowe Price New Asia Fund

15. 16. 17.

T. Rowe Price lntl Stock Fund T. Rowe Price Intl Stock Fund T. Rowe Price New Income Fund

I, Income Gain Codes: (See Colunms BI and D4) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes ISce Column C2)

A =$ 1,000 or less F =$50.001 - $100.000 J =$15.000 or less N =$250.001 - $500.000 P3 =$25,000,001 - $50.000.000 Q =Appraisal U =Book Value

B =$1,001 - $2,500 G =$10~.001 - $1.00~.009 K =$15,001 - $50.0~ O =$500.001 - $1.0~0.0~ R =Cost (Real Estalc Only) V =Olhcr

C =$2.501 - $5.000 H I -$1.000.001 - $5.000.000 L =$50.001 - $100.000 Pl =$1.000.001 - $5.000.000 P4 -More than $50,000.000 S =As~:ssmcnt W =Estimated

D = $ 5.001 - $15,000 H2 =/.lore than $5.000.000 M =$ 100.001 - $250.000 P2 =$5.000,001 - $25.000.000 T Cash Market

E =$15,001 -

FINANCIAL DISCLOSURE REPORT Page 5 of 13

Name of Person Reporting Jones, James P.

Date of Report 5/14/2011

VII. INVESTMENTS and TRUSTS -inc~me~va~ue~transacti~ns(~ndudesth~se~fsp~useanddependentchi~dren;seepp~34-6~f~inginstructi~ns)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure Income during reporting period Gross value at end Transactions during reporting period

of reporting period

(I) (2)

(I)

Amount Code I (A-H)

(2)

Type (e.g., div., rent, or int.)

Value Code 2

(J-P)

Value Method

Code 3

Type (e.g.,

buy, sell,

redemption)

(2) (3) (4) Date Value Gain mm/dd/yy Code2 Code I (J-P) (A-H)

Identity of buyer/seller (if private

(Q-W) 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. T. Rowe Price Prime Reserve Fund T. Rowe Price Science & Tech. Fund T. Rowe Price Blue Chip Growth Fund T. Rowe Price Equity Index 500 Fund T. Rowe Price Value Fund T. Rowe Price Equity Income T. Rowe Price High Yield Fund T. Rowe Price Summit Cash Reserves Wachovia Bank account TS&W Intl Equity Portfolio 3M Co common stock Abbott Laboratories common stock Ameriprise Financial Inc common stock Amgen Inc. common stock Anadarko Petroleum Corp common stock AT&Tlnc common stock Annaly Capitol MGMT REIT A A A

A E B A Dividend N T

transaction)

None

Dividend Dividend Dividend

M

N O M

T

T T T

Sold (part)

11/23/10 M

B A A A C A A A

Dividend Dividend Dividend Interest Dividend Dividend Dividend Dividend None Dividend Dividend Dividend

L K K J M

T T T T T Buy (addl) Sold 12/30/10 03/05/10 J K D Buy Buy 04115/10 04/15/10 K K

K J J

T T T Sold 06/04/I 0 08/05/I 0 08/05/10 J J J Buy (addl) 02/23/10

J J

T T

Buy (addl) Buy

I. Income Gain Codes: (S~e Columns B I and D4) 2. Value Codes [See Colurnns CI and D3) 3. Value Method Codes (See Column C2)

A -$1,0~0 or {css F =$ 50,001 - $ 100.000 J -$15.0~O or less N =$250.001 o $500.00~ P3 =$25.00~.001 - $50.000.000 Q =Appraisal U =Book Value

B $1,001 - $2.500 G =$ 100.0O I - $1.009.000 K : $15.001 - $50.00~ O $500.001 - $1.00~.0~0 R =Cost (Real Estate Only) V Olhcr

C =$2,501 - $5,000 H I =$ 1,000,001 - $5.000.000 L -$50,001 - $ 100,0~O P I =$ 1,000.001 - $5,000,000 P4 =More than $50.000.000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 = More than $5,0~,000 M =$ 100,001 - $250,000 P2 = $5,000,001 - $25.000,000 T =Cash Market

FINANCIAL DISCLOSURE REPORT Page 6 of 13

Name of Person Reporting Jones, James P.

Date of Report 5/14/201 I

NONE (No reportable income, assets, or transactions.)

Description of Assets Income during

(including trust assets)

Place "(X)" after each asset exempt from prior disclosure

reporting period (I) (2)

Amount Code I (A-H) Typ~ (e.g., div., rent, or int.)

Gross value at end of reporting period O)

Value

Transactions during reporting period (2) Type (e.g., buy, sell,

redemption) Date

(2)

Value

(3)

(4)

(5)

Identity of

Value i Gain

Code 2

(J-P)

Method

Code 3

mm/dd/yy Code 2 i Code I (J-P) i (A-H)

(Q-W) 35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. 51. Dreamworks Animation Inc Class A common stock EMC Corp Mass common stock None None J J T T BCE Inc. common stock Baxter International common stock Best Buy Inc. common stock C B Richard Ellis Group common stock Centerpoint Energy Inccommon stock Chevron Corp common stock Chubb Corp common stock Cisco Systems Inc common stock Comerica Inc common stock Cummins Inc common stock Darden Restaurants lnccommon stock Deere& Cocommon stock Disney Walt Co common stock Dominion Resources Inc common stock A A A A A A A A A A Dividend Dividend Dividend None None Dividend Dividend None Dividend Dividend Dividend Dividend None Dividend J K J J J K J J J J J K K J T T T T T T T T T T T T T T Sold (parl) Buy (addl) Sold (pan) 12/07/I 0 02/I 8/10 08/05/10

J

buyer/seller (if private transaction)

Buy Buy (addl) Buy Buy

04/19/10 08/05/10 05/07/10 02/23/10

Buy Buy Sold (part) Buy

08/20/10 04/26/10 01/14/10 06/03/10

J J J J B

J J A

I. Income Gain Codes: (See Columns B I and D4) 2. Value Codes [See Columns C I and D3) 3. Value Method Codes ~Sc Column C2)

A =$1,000 or less F ~$50.001 - $100.000 J =$15.0~0 or less N =$250.001 - $509.000 P3 =$25.00~.001 - $50.000.000 Q =Appraisal U -Book Value

B =$1,001 - $2,500 G =$100,001 - $ I,OOO,000 K =$15,001 - $50,000 O =$500.001 - $1,00~.00O R =Cost (Real Estate Only) V =Other

C =$2,501 - $5,000 HI =$1,000,00| - $5,090,00~ L =$50,001 - $100.000 PI =$1,000.001 - $5,1)00,00~ P4 -More than $50.000,000 S =Asscssmcnt W =Estimated

D =$5,001 - $15,000 H2 =More than $5,000,000 M =$10~,001 - $250,00~ P2 -$5.000.001 - $25,000,000 T ~Cash Market

E =$15,001 - $50,0(~

FINANCIAL DISCLOSURE REPORT Page 7 of 13

Name of Person Reporting Jones, James P.

Date of Report 5/14/201 I

VII. INVESTMENTS and TRUSTS - income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including mast assets) Place "(X)" after each asset exempt from prior disclosure Income during reporting period Gross value at end of reporting period Transactions during reporting period

(0

Amount Code I (A-H)

(2)

Type (e.g., div., rent, or int.)

0)

Value Code 2 (J-P)

(2)

Value Method Code 3

(i)

Type (e.g., buy, sell, redemption)

(2) (3) [ (4) Date Value mm/ddtyy Code 2 (J-P)

(5)

Gain Code I (A-H) Identity of buyer/seller (if private transaction)

(Q-W)

52. 53. 54. 55. 56. 57. 58. 59. 60. 61. 62. 63. 64. 65. 66. 67. 68. General Electric Co. common stock Goldman Sachs Group common stock Hewlett Packard Co. common stock Heinz H .I Co common stock Hospira common stock IBM common stock Ingersoll-Rand Company common stock Intel Corp Intl Paper Co common stock l]qCorp common stock A A A A A A A A Dividend Dividend Dividend Dividend None Dividend Dividend Dividend Dividend None J K

J

Emerson Electric Cocommon stock Ford Motor Co common stock Foster Wheeler common stock Freeport McMoran Copper common stock Gap Inc common stock General Dynamics Corp common stock

Dividend None

None

J K K K K T T T Buy Sold K K K J T T T T Sold (part) Sold T T T T T Sold (part) Buy Buy (addl) 04126110 03/29/I 0 01/08/10 J J J A 09101/10 03/23/10 J J A A Buy (addl) 04/26/10 05/10/10 03/10/10 J J K A Buy (addl) 02/25110

A A

Dividend Dividend None

I. Income Gain Codes: ( See Colurmas B I and D4 ) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (See Column C2)

A =$1,000 or tess F =$50,001 - $ 100,000 J =$15.000 or less N =$250.001 - $500.000 P3 =$25.000.001 - $50,000,000 Q =Appraisal U =Book Value

B =$1,001 - $2,500 G = $ 100.001 - $ 1,000.000 K = $15,001 - $50,000 O =$500.001 - $1.000,000 R =Cosl (Real Estate Only) V =Other

C =$2,501 - $5,000 H I = $ 1,000,001 - $ 5.000.000 L =$50,001 - $ 100,000 PI =$1,000.001 - $5,000,000 P4 =More than $50,000,000 S =A~,scssmcnt W =Estimated

D =$5,001 - $15,000 H 2 = M ore than $ 5,000,000 M -$ 100,001 - $250,000 P2 =$5,000,001 - $25,000,000 T =Cash Market

E =$! 5,001 - $50.000

FINANCIAL DISCLOSURE REPORT Page 8 of 1 3

Name of Person Reporting Jones, James P.

Date of Report 5/14/201 I

VII. INVESTMENTS and TRUSTS - i.eo,... ..at.e. transactions a.ct.,~es those of spo~e a.a depe.ac.t children; see pp. 34-60 of filing imtructionx.)

NONE (No reportable income, assets, or transactions.)

Description of Assets Income during Gross value at end Transactions during reporting period

(including trust assets) Place "(x)" after each asset exempt from prior disclosure

reporting period (1) (2) Amount Type (e.g., Code I div., rent,

(A-H) or int.)

of reporting period 0) (2) Value Value Code 2 Method

(J-P) Code 3

(I) Type (e.g., buy, sell, redemption)

(2) (3) (4) Date Value Gain mm/dd/yy Code 2 Code I (J-P) (A-H)

(5)

Identity of

buyer/seller

(if private transaction)

69. 70. 71. 72. 73. 74. 75. 76. 77. 78. 79. 80. 81. 82.

Johnson & Johnson common stock JPMorgan Chase & Co common stock L-3 Communications Hldgs common stock Laboratory Corp of America common stock Liberty Media Holdings common stock LowesCos Inc common stock Macys Inc common stock Manulife Financial Coo common stock Marvell Tech Group Ltd common stock Merck & Co Inc common stock

A A A

Dividend Dividend Dividend None None

J J J J K

T T T T T Buy Sold T Sold 11/01/10 02/23/I 0 05/12/101 02/08110 01/08110 03/24/10 05/06110 J J J J J K K A A C A

Sold 11/04/10 J A

A A

Dividend Dividend None None None T

(part)

Sold Sold (part) Buy Sold

Metlifecommon stock Monsanto Co. common stock Morgan Stanley common stock A A A

None Dividend Dividend Dividend None None K J J J

T T Sold T T T Buy

11/09/10 J

02/18/10 J

83. Nestle SA ADR 84. News Corp Lid common stock

85. Nintendo Ltd ADR

1. Income Gain Codes: (See Columns BI and D4) 2. Value Codes (See Columns C I and D3) 3. Value Method Codes (S Column C2)

A -$ 1,000 or less F $50.0OI - $100.000 J =$15.0~0 or less N =$250.001 - $500,000 P3 =$25.000.001 o $50.000.000 Q =Appraisal U =Book Value

B =$1.001 - $2.500 G =$IDO,001 - $1.000,000 K =$ I 5,001 - $50,000 O =$500.001 - $1,000,000 R =Cost (Real Estate Only1 V =Other

C =$2,501 - $5,000 HI =$ I,CO0,001 - $5,000,000 L =$50.001 - $ 100,000 PI =$1,000,001 - $5.000.000 P4 =More than $50,000,000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5.000,0OO M =$ 109,001 - $250.000 P2 =$5,000.001 - $25,000.000 T =Cash Market

E =$15,001 - $50.0OO

FINANCIAL DISCLOSURE REPORT Page 9 of 13

Name of Person Reporting Jones, James P.

Date of Report 5/14/201 I

VII. INVESTMENTS and TRUSTS -~.co,.o, ,,ot~., transactions ancludes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure Income during reporting period

(l) (2)

Gross value at end

of reporting period

Transactions during reporting period

(0 Type (e.g., buy, sell, redemption)

O) Type (e.g., div., rent, or int.)

Value

(2)

Value

Amount Code I (A-H)

Code 2 (J-P)

Method Code 3

(Q-W)

(2) (3) (4) Value Gain Date mm/dd!yy Code2 Code I (J-P) (A-H)

(5) Identity of buyer/seller (if private transaction)

86.

Noble Corpcommon stcok

A A A A A

Dividend Dividend Dividend Dividend Dividend None

J K K K J J

T T

T T T T

87. Norfolk Southern common stock 88. 89. 90. 91. 92. 93. 94. 95. 96. 97. 98. 99. Occidental Petroleum Corpcommon stock Oracle Corp common stock Pfizerlnc common stock Philip Morris lntl Inc common stock PPL Corpcommon stock Praxair, Inc common stock Proctor & Gamble common stock Prudential Financial Inc common stock Quest Diagnostic Inc common stock Ralcorp Holdings Inc common stock Republic Svcs Inccommon stock Reseach in Motion Ltd common stock

Sold (part)

02/03/I 0

A A A A A

Dividend Dividend Dividend Dividend Dividend None J K

Sold

10/26110

Sold

02/25/10 K

Sold Buy Sold Sold J J K

T T T

04/21/10 09/09/I 0 02/12/10 08/17/10

K J J K B A

Dividend None

100. Rio Tinto PLC sponsored ADR 101. Reynolds American lnc common stock 102. Schlumberger Ltd common stock

Dividend None

Dividend

I. Income Gain Codes: {See Columns BI and D4) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (Sec Column C2)

A =$1,000 or less F =$50.001 - $100,000 J =$15.000 or less N =$250.001 - $500,000 P3 =$25,000,001 - $50,000.000 Q =Appraisal U =Book Value

B =$1,001 - $2,500 G =$100,001 - $1.000.000 K =$15,001 - $50,000 O :$500.001 - $1.000,000 R =Cost (Real Estate Only) V =Other

C =$2,501 - $5,000 HI :$1,000,001 - $5.000.000 L =$50.001 - $100.000 PI =$1,000,001 - $5,000.0~O P4 :More than $50.0~0,000 S =As~ssmcnl W =Estimated

D :$5.001 - $15.000 H2 :More than $5.000.000 M =$100.001 - $250.000 P2 -$5,000.001 - $25.000.000 T =Cash Markcl

E =$ I S.001 - $50.0~O

FINANCIAL DISCLOSURE REPORT Page 10 of 13 VII. INVESTMENTS and TRUSTS - i .........

Name of Person Reporting Jones, James P.

Date of Report 5/14/2011

lue, t ......tions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure Income during reporting period Gross value at end of reporting period (I) (2) Value Value Code 2 Method (J-P) Code 3 (Q-W) Transactions during reporting period

0)

Amount Code I (A-H)

(2)

Type (e.g., div., rent, or int.)

O)

Type (e.g., buy, sell, redemption)

(2) (3) (4) Date Value mm/dd/yy Code2 O-P)

(5)

Gain Code I (A-H) Identity of buyer/seller (if private transaction)

103. Siemans A G ADR IO4. 105. Suntrust Banks lnc common stock 106. Syrnantec Corp common stock 107. Target Corp common stock 108. Total SA sponsored ADR 109. Unilever 110. UnitedHealth Group Inc common stock I 11. United States Steel Corp 112. Verizon Comm. common stock 113. Wellpoint Inc. common stock 114. Wells Fargo & Co common stock 115. Willis Group Holdings common stock 116. Schwab Govt Money Fund 117. Bedford Co VA muni bond 118. Fairfax Co VA muni bond 119. Hampton VA muni bond C A A A A A A A A A

None

Buy (addl) Sold (part)

02/08/10 08102/10

K J

Dividend None Dividend Dividend None None Dividend Dividend None Dividend None Dividend Interest Interest Interest J J J L K K K T T T T T T T K K J J K K T T T T T T

Sold 104/14II0

Sold (pan)

08/02/10

Buy

03/02/10

Buy

02!26/10

I. Income Gain Codes: (See Columns B I and 134) 2. Value Codes (See Columns C I and D3) 3. Value Method Codes (See Column C2)

A =$1,000 or less F =$50.001 - $100.000 J =$15.000 or less N =$250.001 - $500.000 P3 =$25.000.001 - $50.000.000 Q =Appraisal U =Book Value

B =$1.091 - $2,500 G :$100.0~1 - $1,00~.000 K =$15.091 - $50.0~ O =$51~.001 - $1,00~.000 R Cost (Real Estate Only) V Other

C =$2.501 - $5,000 |11 =$1.000.001 - $ 5.000.0~O L =$50.001 - $100.0~0 P I = $ 1,000.001 - $ 5,000.000 P4 -More than $50,0~0.000 S A,~zssmcnt \\ = Estimated

=$5.001 - $15,000 H2 =More than $5.D00,000 M =$100.001 - $250.000 P2 =$5,000.001 - $25.000.000 =Cash Markcl

E =$15,001- $50.000

FINANCIAL DISCLOSURE REPORT Page 11 of 13

Name of Person Reporting Jones, James P.

Date of Report 5/14/2011

VII. INVESTMENTS and TRUSTS - income, value, transactions (Includes those o.lspouse and dependent children; seepp. 34-60 of filing instruction~.)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure Income during reporting period (I) Amount Code I (A-H) (2) Type (e.g., div., rent, or int.)

Gross value at end of reporting period O) (2) Value Value Code 2 Method (J-P) Code 3 (Q-W) Transactions during reporting period

(1)

Type (e.g., buy, sell, redemption)

(2) (3) (4) Date Value Gain mm!dd/yy Code2 Code I (J-P) (A-H)

(5) Identity of buyer/seller (if private transaction)

120. Henry Co VA muni bond 121. Orange Co VA muni bond 122. Roanoke VA muni bond 123. Rutherford Co TN muni bond 124. Virginia Comwlth Tr muni bond 125. Virginia St Pub Rev muni bond

A A A A A B

Interest Interest Interest Interest Interest Interest

K K K K K L

T T T T T T Sold (part) 08/01/10 K A

I. Income Gain Codes: (See Colunms BI and D4) 2. Value Co~cs (See Columns CI and D3) 3. Value Mclhod Codes (Scc Column C2)

A =$1.000orlcss F -$50,0OI -$I00.000 J =$15.00Oorless N =$250.001 . $500.000 P3 =$25.000.001- $50.0~O.000 Q =App~i~l U =Book Value

B =$1.001- $2,500 G =$100.0OI- $1.000.000 K $15.0OI- $50.1)00 O $500.001- $1,000.000 R =Cost(Real Esla~e Only) V :Other

C =$2,501 - $5,000 H I ~$1,000,001 L =$50,001 - $100,000 PI =$1.000,001 - $5,0~,00~ P4 -More Ihan $50,000,000 S =Asscssmcnl W =Estimated

D =$5,001 -$15,000 H2 =More than $5,000.0OO M ~$100,001 - $250.0(~ P2 =$5,009,001 - $25.000.000 =Cash Market

E =$15.0OI- $50,000

FINANCIAL DISCLOSURE REPORT Page 1:2 of 13

Name of Person Reporting Jones, James P.

Date of Reporl 5/14/2011

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. (lndicatepartofrepor.)

FINANCIAL DISCLOSURE REPORT Page 13 of 13 IX. CERTIFICATION.

Name of Person Reporting Jones, James P.

Date of Report 5/14/201 I

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. I further certify that earned income from outside emplo)anent and honoraria and the acceptance of gifts ~vhich have been reported are in compliance ~ith the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S/James P. Jones

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FALLS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

Вам также может понравиться

- Simeon T Lake Financial Disclosure Report For 2010Документ9 страницSimeon T Lake Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Procter R Hug JR Financial Disclosure Report For 2010Документ8 страницProcter R Hug JR Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Harvey E Schlesinger Financial Disclosure Report For 2010Документ8 страницHarvey E Schlesinger Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Roger J Miner Financial Disclosure Report For 2010Документ8 страницRoger J Miner Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Dennis F Saylor IV Financial Disclosure Report For 2010Документ9 страницDennis F Saylor IV Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Richard M Gergel Financial Disclosure Report For Gergel, Richard MДокумент16 страницRichard M Gergel Financial Disclosure Report For Gergel, Richard MJudicial Watch, Inc.Оценок пока нет

- Robert J Kelleher Financial Disclosure Report For 2010Документ16 страницRobert J Kelleher Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Roger Vinson Financial Disclosure Report For 2010Документ20 страницRoger Vinson Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- James Knoll Gardner Financial Disclosure Report For 2010Документ11 страницJames Knoll Gardner Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- George Z Singal Financial Disclosure Report For 2010Документ10 страницGeorge Z Singal Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Gerard E Lynch Financial Disclosure Report For 2010Документ9 страницGerard E Lynch Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Richard G Seeborg Financial Disclosure Report For 2010Документ10 страницRichard G Seeborg Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- William D Stiehl Financial Disclosure Report For 2010Документ16 страницWilliam D Stiehl Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- H J Wilkinson III Financial Disclosure Report For 2010Документ10 страницH J Wilkinson III Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Irma E Gonzalez Financial Disclosure Report For 2010Документ8 страницIrma E Gonzalez Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Robert L Jordan Financial Disclosure Report For 2010Документ11 страницRobert L Jordan Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- William Keith Watkins Financial Disclosure Report For 2010Документ8 страницWilliam Keith Watkins Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Barbara Keenan Financial Disclosure Report For 2010Документ22 страницыBarbara Keenan Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Robert P Patterson JR Financial Disclosure Report For 2010Документ9 страницRobert P Patterson JR Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Leonard I Garth Financial Disclosure Report For 2010Документ8 страницLeonard I Garth Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Alan D Lourie Financial Disclosure Report For 2010Документ7 страницAlan D Lourie Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Donald L Graham Financial Disclosure Report For 2010Документ8 страницDonald L Graham Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Henry C Morgan JR Financial Disclosure Report For 2009Документ7 страницHenry C Morgan JR Financial Disclosure Report For 2009Judicial Watch, Inc.Оценок пока нет

- Robert R Beezer Financial Disclosure Report For 2010Документ9 страницRobert R Beezer Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Stephen F Williams Financial Disclosure Report For 2010Документ9 страницStephen F Williams Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Steven J McAuliffe Financial Disclosure Report For 2010Документ15 страницSteven J McAuliffe Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Howard A Matz Financial Disclosure Report For 2010Документ12 страницHoward A Matz Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- James B Loken Financial Disclosure Report For 2010Документ10 страницJames B Loken Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Joan B Gottschall Financial Disclosure Report For 2010Документ10 страницJoan B Gottschall Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Milan D Smith Financial Disclosure Report For 2010Документ16 страницMilan D Smith Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- William T Moore JR Financial Disclosure Report For 2010Документ20 страницWilliam T Moore JR Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- James E Gritzner Financial Disclosure Report For 2010Документ10 страницJames E Gritzner Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Russel H Holland Financial Disclosure Report For 2010Документ20 страницRussel H Holland Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Dolly M Gee Financial Disclosure Report For Gee, Dolly MДокумент9 страницDolly M Gee Financial Disclosure Report For Gee, Dolly MJudicial Watch, Inc.Оценок пока нет

- Peter J Messitte Financial Disclosure Report For 2010Документ9 страницPeter J Messitte Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Walter T McGovern Financial Disclosure Report For 2010Документ7 страницWalter T McGovern Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Thomas L Ambro Financial Disclosure Report For 2010Документ21 страницаThomas L Ambro Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Sandra S Beckwith Financial Disclosure Report For 2010Документ20 страницSandra S Beckwith Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- John A Woodcock JR Financial Disclosure Report For 2010Документ12 страницJohn A Woodcock JR Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Robert S Lasnik Financial Disclosure Report For 2010Документ7 страницRobert S Lasnik Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- James C Mahan Financial Disclosure Report For 2010Документ14 страницJames C Mahan Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- James L Dennis Financial Disclosure Report For 2010Документ8 страницJames L Dennis Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- David J Folsom Financial Disclosure Report For 2009Документ10 страницDavid J Folsom Financial Disclosure Report For 2009Judicial Watch, Inc.Оценок пока нет

- William Eugene Davis Financial Disclosure Report For 2010Документ8 страницWilliam Eugene Davis Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Marsha J Pechman Financial Disclosure Report For 2010Документ8 страницMarsha J Pechman Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- William L Garwood Financial Disclosure Report For 2010Документ15 страницWilliam L Garwood Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Patrick J Schiltz Financial Disclosure Report For 2010Документ9 страницPatrick J Schiltz Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Samuel Conti Financial Disclosure Report For 2010Документ7 страницSamuel Conti Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Stephen M McNamee Financial Disclosure Report For 2010Документ12 страницStephen M McNamee Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- David G Campbell Financial Disclosure Report For 2010Документ11 страницDavid G Campbell Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Catharina D Haynes Financial Disclosure Report For 2010Документ18 страницCatharina D Haynes Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Merrick B Garland Financial Disclosure Report For 2010Документ10 страницMerrick B Garland Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Loretta A Preska Financial Disclosure Report For 2010Документ14 страницLoretta A Preska Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Richard L Voorhees Financial Disclosure Report For 2010Документ8 страницRichard L Voorhees Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Edwin M Kosik Financial Disclosure Report For 2009Документ9 страницEdwin M Kosik Financial Disclosure Report For 2009Judicial Watch, Inc.Оценок пока нет

- Joseph F Weis Financial Disclosure Report For 2010Документ8 страницJoseph F Weis Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Timothy B Dyk Financial Disclosure Report For 2010Документ12 страницTimothy B Dyk Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Richard J Holwell Financial Disclosure Report For 2010Документ9 страницRichard J Holwell Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Glen E Conrad Financial Disclosure Report For 2010Документ10 страницGlen E Conrad Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceОт EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceОценок пока нет

- CC 081213 Dept 14 Lapp LДокумент38 страницCC 081213 Dept 14 Lapp LJudicial Watch, Inc.Оценок пока нет

- 1488 09032013Документ262 страницы1488 09032013Judicial Watch, Inc.100% (1)

- Opinion - JW V NavyДокумент7 страницOpinion - JW V NavyJudicial Watch, Inc.100% (1)

- 2161 DocsДокумент133 страницы2161 DocsJudicial Watch, Inc.83% (12)

- 1878 001Документ17 страниц1878 001Judicial Watch, Inc.100% (5)

- Stamped ComplaintДокумент4 страницыStamped ComplaintJudicial Watch, Inc.Оценок пока нет

- 11 1271 1451347Документ29 страниц11 1271 1451347david_stephens_29Оценок пока нет

- Gitmo Water Test ReportДокумент2 страницыGitmo Water Test ReportJudicial Watch, Inc.Оценок пока нет

- SouthCom Water Safety ProductionДокумент30 страницSouthCom Water Safety ProductionJudicial Watch, Inc.Оценок пока нет

- Stamped ComplaintДокумент4 страницыStamped ComplaintJudicial Watch, Inc.Оценок пока нет

- Stamped ComplaintДокумент4 страницыStamped ComplaintJudicial Watch, Inc.Оценок пока нет

- Stamped Complaint 2Документ5 страницStamped Complaint 2Judicial Watch, Inc.Оценок пока нет

- Holder Travel Records CombinedДокумент854 страницыHolder Travel Records CombinedJudicial Watch, Inc.Оценок пока нет

- Gitmo Freezer Inspection ReportsДокумент4 страницыGitmo Freezer Inspection ReportsJudicial Watch, Inc.Оценок пока нет

- State Dept 13-951Документ4 страницыState Dept 13-951Judicial Watch, Inc.Оценок пока нет

- Visitor Tent DescriptionДокумент3 страницыVisitor Tent DescriptionJudicial Watch, Inc.Оценок пока нет

- Gitmo Freezer Inspection ReportsДокумент4 страницыGitmo Freezer Inspection ReportsJudicial Watch, Inc.Оценок пока нет

- JTF GTMO Water Safety App W ExhДокумент13 страницJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Оценок пока нет

- CVR LTR SouthCom Water Safety ProductionДокумент2 страницыCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Оценок пока нет

- CVR LTR SouthCom Water Safety ProductionДокумент2 страницыCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Оценок пока нет

- Navy Water Safety ProductionДокумент114 страницNavy Water Safety ProductionJudicial Watch, Inc.Оценок пока нет

- SouthCom Water Safety ProductionДокумент30 страницSouthCom Water Safety ProductionJudicial Watch, Inc.Оценок пока нет

- JTF GTMO Water Safety App W ExhДокумент13 страницJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Оценок пока нет

- December 2005Документ7 страницDecember 2005Judicial Watch, Inc.Оценок пока нет

- Model UNДокумент2 страницыModel UNJudicial Watch, Inc.Оценок пока нет

- Cover Letter To Requester Re Response Documents130715 - 305994Документ2 страницыCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.Оценок пока нет

- JW Cross Motion v. NavyДокумент10 страницJW Cross Motion v. NavyJudicial Watch, Inc.Оценок пока нет

- July 2007 BulletinДокумент23 страницыJuly 2007 BulletinJudicial Watch, Inc.Оценок пока нет

- May 2007 BulletinДокумент7 страницMay 2007 BulletinJudicial Watch, Inc.Оценок пока нет

- LAUSD Semillas AckДокумент1 страницаLAUSD Semillas AckJudicial Watch, Inc.Оценок пока нет

- Risk Management GuidanceДокумент9 страницRisk Management GuidanceHelen GouseОценок пока нет

- NMIMS Offer LetterДокумент4 страницыNMIMS Offer LetterSUBHAJITОценок пока нет

- Tutorial MEP1553 - Insulation DiagnosticsДокумент4 страницыTutorial MEP1553 - Insulation DiagnosticsSharin Bin Ab GhaniОценок пока нет

- 48 - 1997 SummerДокумент42 страницы48 - 1997 SummerLinda ZwaneОценок пока нет

- VTP Renault 6.14.1 Web Version - Pdf.pagespeed - Ce.c T5zGltXA PDFДокумент176 страницVTP Renault 6.14.1 Web Version - Pdf.pagespeed - Ce.c T5zGltXA PDFIbrahim AwadОценок пока нет

- BIR Form 2307Документ20 страницBIR Form 2307Lean Isidro0% (1)

- Executive Order No. 786, S. 1982Документ5 страницExecutive Order No. 786, S. 1982Angela Igoy-Inac MoboОценок пока нет

- EU MEA Market Outlook Report 2022Документ21 страницаEU MEA Market Outlook Report 2022ahmedОценок пока нет

- Labor LawДокумент6 страницLabor LawElden Cunanan BonillaОценок пока нет

- Victory Magazine 2012 PDFДокумент19 страницVictory Magazine 2012 PDFijojlОценок пока нет

- Nilfisck SR 1601 DДокумент43 страницыNilfisck SR 1601 DGORDОценок пока нет

- Instruction Manual Series 880 CIU Plus: July 2009 Part No.: 4416.526 Rev. 6Документ44 страницыInstruction Manual Series 880 CIU Plus: July 2009 Part No.: 4416.526 Rev. 6nknico100% (1)

- BSNL PRBT IMImobile HPДокумент13 страницBSNL PRBT IMImobile HPMithil AgrawalОценок пока нет

- Super Duty - Build & PriceДокумент8 страницSuper Duty - Build & PriceTyler DanceОценок пока нет

- 1.SITXWHS003 Student Assessment Tasks 1Документ58 страниц1.SITXWHS003 Student Assessment Tasks 1Yashaswi GhimireОценок пока нет

- Marketing Theory and PracticesДокумент4 страницыMarketing Theory and PracticesSarthak RastogiОценок пока нет

- NV 2Документ2 страницыNV 2Joshua ApongolОценок пока нет

- Test P1 Chapter 10Документ10 страницTest P1 Chapter 10Prince PersiaОценок пока нет

- Partial Discharge Diagnostic Testing and Monitoring Solutions For High Voltage CablesДокумент55 страницPartial Discharge Diagnostic Testing and Monitoring Solutions For High Voltage CablesElsan BalucanОценок пока нет

- Satisfaction Attributes and Satisfaction of Customers: The Case of Korean Restaurants in BataanДокумент10 страницSatisfaction Attributes and Satisfaction of Customers: The Case of Korean Restaurants in BataanMaraОценок пока нет

- The Soyuzist JournalДокумент15 страницThe Soyuzist Journalcatatonical thingsОценок пока нет

- Final Lpd1Документ6 страницFinal Lpd1MONIC STRAISAND DIPARINEОценок пока нет

- Abhijit Auditorium Elective Sem 09Документ3 страницыAbhijit Auditorium Elective Sem 09Abhijit Kumar AroraОценок пока нет

- CV - Nguyen Quang HuyДокумент5 страницCV - Nguyen Quang HuyĐoan DoãnОценок пока нет

- Bare Copper & Earthing Accessories SpecificationДокумент14 страницBare Copper & Earthing Accessories SpecificationJayantha SampathОценок пока нет

- For Visual Studio User'S Manual: Motoplus SDKДокумент85 страницFor Visual Studio User'S Manual: Motoplus SDKMihail AvramovОценок пока нет

- Unit I Lesson Ii Roles of A TeacherДокумент7 страницUnit I Lesson Ii Roles of A TeacherEvergreens SalongaОценок пока нет

- 03 Marine Multispecies Hatchery Complex Plumbing Detailed BOQ - 23.10.2019Документ52 страницы03 Marine Multispecies Hatchery Complex Plumbing Detailed BOQ - 23.10.2019samir bendreОценок пока нет

- TelekomДокумент2 страницыTelekomAnonymous eS7MLJvPZCОценок пока нет

- Steps To Control Water Depletion Jun2019Документ2 страницыSteps To Control Water Depletion Jun2019chamanОценок пока нет