Академический Документы

Профессиональный Документы

Культура Документы

Lucy H Koh Financial Disclosure Report For Koh, Lucy H

Загружено:

Judicial Watch, Inc.Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Lucy H Koh Financial Disclosure Report For Koh, Lucy H

Загружено:

Judicial Watch, Inc.Авторское право:

Доступные форматы

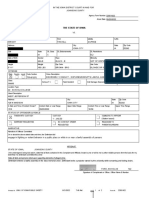

Rev. 1/20!

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization U.S. District Court

5a. Report Type (check appropriate type)

Report Reqtdred by the Ethics in Govermnent Act of 1978 (5 U.S.C. app..~q~ 101-111)

I. Person Reporting (last name, first, middle initial) KOH, LUCY H.

4. Title (Article 111 judges indicate active or senior status; magistrate judges indicate full- or part-time)

3. Date or" Report 05/I 1/201 I

6. Reporting Period 01/01/2010 to 12/31/2010

U.S. District Judge, Active Status

Nomination, ] [] Initial

Date [] Annual [] Final

5b. [] Amended Report 7. Chambers or Office Address 280 South First Street San Jose, CA 95113 8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Reviewing Officer Date

IMPORTANT NOTES: The instructions accompanying this form must be followed. Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I. POSITIONS. meponing individual only; see pp. 9-13 of filing instruaions.)

D

I. 2. 3. 4. 5.

NONE (No reportable positions.)

POSITION

U.S. District Court Judge Superior Court Judge

NAME OF ORGANIZATION/ENTITY

U.S. District Court, Northern District of California Superior Court of California for the County of Santa Clara

II. AGREEMENTS. (Reporting individual only; seepp. 14-16 of filing instructions.)

[~] NONE (No reportable agreements.) DATE PARTIES AND TERMS

Koh, Lucy H.

FINANCIAL DISCLOSURE REPORT Page 2 of 6

Name of Person Reporting KOH, LUCY H.

Date of Report 05/I 1/2011

Ill. NON-INVESTMENT INCOME. (Reporting individual andspouse; seepp. 17-24 of filing instructions.)

A. Fi|ers Non-Investment Income D NONE (No reportable non-investment income.) DATE_

I. 2010 2.2010 3. 4.

SOURCE AND TYPE

State of California -- salary County of Santa Clara -- salary

INCOME (yours, not spouses)

$67,094.45 $3,595.46

B. Spouses Non-Investment Income - if you were married during any portion of the reporting year, complete this section.

(Dolhtr amount not required except for honoraria.)

NONE (No reportable non-investment income.) DATE

1.2010 2.2010 3. 4.

SOURCE AND TYPE

-- salary Executive Office of the President -- salary

IV. REIMBURSEMENTS - transportation, lodging, food, entertainmenL

(Includes those to spouse and dependent children: see pp. 25-27 of filing instructions.)

NONE (No reportable reimbursements.) SOURCE

1. 2. 3. 4. 5.

DATES

LOCATION

PURPOSE

ITEMS PAID OR PROVIDED

FINANCIAL DISCLOSURE REPORT Page 3 of 6

Name of Person Reporting KOH, LUCY H.

Date of Report 05/I 1/2011

V. GIFT S. a.a.des those to ,po~se ~nd dependent children; see pp. 28-31 of filing instructions.)

NONE (No reportable gifts.) SOURCE

I. 2. 3. 4. 5.

DESCRIPTION

VALUE

VI. LIABILITIES. a, ct~des tho,e oSspo.se .nd depende.t children; see pp. 32-33 of filing instructions.) D NONE (No reportable liabilities.)

CREDITOR U.S. Department of Education 2. 3. 4. 5. Fidelity Investments Direct Student Loan Loan against retirement account

DESCRIPTION

VALUECODE

K K

FINANCIAL DISCLOSURE REPORT Page 4 of 6

Name of Person Reporting KOH, LUCY H.

Date of Report O5/I 1/201 I

VII. INVESTMENTS and TRUSTS - income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 af filing instru,tions.)

~] NONE (No reportable income, assets, or transactions.)

A, Description of Assets

(including trust assets)

B. Income during

reporting period (1) (2)

C. Gross value at end

of reporting period (1) (2)

Transactions during reporting period

(0

Value Method Code 3 (Q-W) T T T T T T T T T T T T T

Type (e.g., buy, sell, redemption)

(2)

(3)

(4)

Gain Code I (A-H)

(5)

Identity of buyer/seller (i f private transaction)

Place "(X)" after each asset exempt from prior disclosure

Amount Code ] (A-H)

Type (e,g., div., rent, or int.)

Value Code 2 (J-P)

Date Value mm/dd/yy Code 2 (J-P)

I. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17.

Wells Fargo Accounts Stanford Federal Credit Union State of California Savings Plus Program American Funds Washington Mutual A Mutual Funds Frontegra IronBridge Small Cap PIMCO Total Return lnstl Dodge & Cox Balanced Vanguard 2035 Target Retii-ement PIMCO Total Return Admin Vanguard 2035 Target Retirement CA Judges Retirement System II CollegeBoundfund Wells Fargo Investments LLC ScholarShare Advisor

A A

Interest Interest None None None None None None None None None None None

J J J K K K K K J M K K J

1. Income Gain Codes: (See Columns BI and D4) 2, Value Codes (See Columns C I and 133) 3. Value Method Codes (See Column C2)

A ~$1,000 or less F =$50,001 - $100,000 J =$15,000 or less N -$250,001 - $500,000 P3 =$25,000,001 - $50,000,000 Q =Appraisal U =Book Value

B =$ 1,001 - $2,500 G =$100,001 - $1,000,000 K =$15,001 - $50,000 O =$500,00t - $1,000,000 R =Cost (Real Estate Only) V =Other

C =$2,501 - $ 5,000 H 1 =$1,000,001 - $5.000,000 L =$50,001 - $ 100,000 P 1 =$1,000,001 - $5,000,000 P4 =More than $50,000,000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5,000,000 M -$100,001 - $250.000 P2 =$5,000,00t $25,000,000 T =Cash Market

E =$15,001 -$50,000

FINANCIAL DISCLOSURE REPORT Page 5 of 6

Name of Person Reporting KOH, LUCY H.

Dale of Report 05/I 1/2011

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. (lndicate part of report.)

Part Vll. Investments and Trusts The CA Judges Retirement System I1 funds only became available to me after I retired from the California Superior Court to join the U.S. District Court bench in June 2010. ~ ;~. :, :: 529 educational funds, CollegeBoundfund and Wells Fargo Investments LLC ScholarShare Advisor, were inadvertently left off of roy January 20, 2010 Nomination Financial Disclosure Report.

FINANCIAL DISCLOSURE REPORT Page 6 of 6

Name of Person Reporting KOH, LUCY H.

Date of Report 05/11/2011

IX. CERTIFICATION.

! certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. 1 further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S/LUCY H. KOH

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

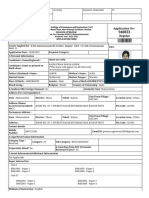

AO 10 Rev. 1/2011

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization U.S. District Court

5a. Report Type (check appropriate type)

Report Required by the Ethics in Government Act of 1978 (5 U.S.C. app. ~q~ 101-111)

I. Person Reporting (last name, first, middle initial) KOH, LUCY H.

4. Title (Article 111 judges indicate active or senior status; magistrate judges indicate full- or part-time)

3. Date of Report 09/15/201 I 6. Reporting PeHod 01/01/2010 to 12/31/2010

Nomination, [] Initial

Date [] Annual [] Final

U.S. District Judge, Active Status

5b. [] Amended Report 7. Chambers or Office Address 280 South First Street San Jose, CA 95113 8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Revie~ving Officer Date

IMPORTANT NOTES: The instructions accompanying this form must be followetL Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I. POSITIONS. (Reporting individual only; seepp. 9-13 of filing instructions.)

~

I.

NONE (No reportablepositions.)

POSITION

U.S. District Judge

NAME OF ORGANIZATION/ENTITY

U.S. District Court, Northern District of Califomia

2. 3. 4. 5.

Superior Court Judge

Superior Court of Califomia for the County of Santa Clara

II. AGREEMENTS. (Reporting individual only; see pp. 14-16 of filing instructions.)

NONE (No reportable agreements.) DATE PARTIES AND TERMS

Koh, Lucv H. A

FINANCIAL DISCLOSURE REPORT Page 2 of 6

Name of Person Reporting KOH, LUCY H.

Date of Report 09/15/2011

Ill. NON-INVESTMENT INCOME. (Reporting individual andspouse; seepp. 17-24 of filing instructions.)

A. Filers Non-Investment Income

~

NONE (No reportable non-investment income.)

DATE_ SOURCE AND TYPE

State of California -- salary County of Santa Clara -- salary

INCOME (yours, not spouses)

$67,094.45 $3,595.46

1. 2010 2.2010 3. 4.

B. Spouses Non-Investment Income - tf you were married during any portion of the reporting year, complete this section.

(Dollar amount not required except for honoraria.)

~-~

NONE (No reportable non-investment income.) DATE SOURCE AND TYPE

-- salary Executive Office of the President -= salary

1.2010 2.2010 3. 4.

IV. REIMBURSEMENTS - transportation, lodging, food, entertainmen~

(Includes those to spouse and dependent children; see pp. 25-27 offiling instructions.)

~]

NONE (No reportable reimbursements.)

SOURCE DATES LOCATION

PURPOSE

ITEMS PAID OR PROVIDED

2. 3. 4. 5.

FINANCIAL DISCLOSURE REPORT Page 3 of 6

Name of Person Reporting KOH, LUCY H.

Date of Report 09/15/201 I

V. GIFTS. ancludes those to spouse and dependent children; see pp. 28-31 of filing instructions.)

[~] NONE (No reportable gifts.)

SOURCE

1. 2. 3. 4. 5.

DESCRIPTION

VALUE

VI. LIABILITIES. a.cludes those olspouse .nd dependent children; see pp. 32-33 of filing instructions.)

D NONE (No reportable liabilities.) CREDITOR

U.S. Department of Education 2. 3. 4. 5. Fidelity Investments

DESCRIPTION Direct Student Loan Loan against retirement account

VALUECODE K K

FINANCIAL DISCLOSURE REPORT Page 4 of 6

Name of Person Reporting KOH, LUCY H.

Dale of Report 09/15/201 I

VII. INVESTMENTS and TRUSTS - income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 ,~filing instructions.)

[~] NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Place "(X)" after each assel exempt from prior disclosure Income during reporting period (1) Amount Code 1 (A-H) (2) Type (e.g., div., rent, or int.) Gross value at end of reporting period Transactions during reporting period

(l)

Value Code 2 (J-P)

(2)

Value Method Code 3

(1) Type (e.g., buy, sell, redemption)

(2) (3) Date Value mm/dd/yy Code 2 (J-P)

(4) Gain Code I (A-H)

(Q-W)

1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. Wells Fargo Accounts Stanford Federal Credit Union State of California Savings Plus Program American Funds Washington Mutual A Mutual Funds Frontegra IronBridge Small Cap PIMCO Total Return lnstl Dodge & Cox Balanced Vanguard 2035 Target Retirement PIMCO Total Return Admin. Vanguard2035 Target Retirement CA Judges Retirement System II AllianceBernstein CollegeBoundfundAge Based Portf. 02-04 Fidelity ScholarShare Advisor Calif. 529 Portf. 2025 Class B A A Interest Interest None None None None None None None None None None None J J J K K K

K

(5) Identity of buyer/seller (if private transaction)

T T T T T T

T

J M K K J

T T T T T

I. Income Gain Codes: (See Columns B 1 and D4) 2. Value Codes (See Columns C I and D3) 3. Value Method Codes (See Column C2)

A =$1,000 or less F =$50,001 - $100,000 J =$15.000 or less N =$250,001 - $500,000 P3 =$25,000,001 - $50,000,000 Q =Appraisal U =Book Value

B =$1,001 - $2,500 G =$100,001 - $1,000,000 K =$15,001 - $50,000 O =$500,001 - $ 1,000,000 R =Cost (Real Estate Only) V =Other

C =$2,501 - $5,000 H I =$1,000,001 - $ 5,000,000 L $50,001 - $100,000 P I =$1,000,001 - $5,000,000 P4 More than $50,000,000 S =Assessment W =Estimated

D =$5,001 - $15,000 H 2 =M ore than $ 5,000,000 M =$100,001 - $250.000 P2 -$5,000,001 - $25,000.000 T Cash Market

E $15,001 -$50,000

FINANCIAL DISCLOSURE REPORT Page 5 of 6

Name of Person Reporting KOH, LUCY H.

Date of Report 09/I 5/2011

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS.

Part VII. Investment and Trusts The CA Judges Retirement System II funds only became available to me after I retired from the California Superior Court to join the U.S. District Court bench in June 2010. 529 educational funds, AllianceBernstein CollegeBoundfund Age Based Portfolio 2002-2004 Alternative C Shares and Fidelity Sch01arShare Advisor Fund California 529 Porfolio 2025-Class B, were inadvertently left off of my January 20, 2010 Nomination Financial Disclosure Report.

FINANCIAL DISCLOSURE REPORT Page 6 of 6 IX. CERTIFICATION.

Name of Person Reporting KOH, LUCY H.

Date of Report 09/I 5/2011

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. 1 further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S/LUCY H. KOH

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND W1LFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 UoS.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

Вам также может понравиться

- Vanessa D Gilmore Financial Disclosure Report For 2010Документ6 страницVanessa D Gilmore Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- ADSF Bankruptcy FilingДокумент207 страницADSF Bankruptcy FilingHannah ColtonОценок пока нет

- Readers Digest PetitionДокумент13 страницReaders Digest PetitionmwoehrОценок пока нет

- Nicholas Gordon Arrest ReportДокумент2 страницыNicholas Gordon Arrest ReportSyndicated NewsОценок пока нет

- Income Tax Department: Computerized Payment Receipt (CPR - It)Документ1 страницаIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990Оценок пока нет

- NLNG Postgraduate ScholarshipДокумент9 страницNLNG Postgraduate ScholarshipSalisu BorodoОценок пока нет

- Yxxymax0 Application-Form PDFДокумент2 страницыYxxymax0 Application-Form PDFnikkey cuetoОценок пока нет

- WarariДокумент4 страницыWarariapi-532208198Оценок пока нет

- 0QFKnrDS Application-Form PDFДокумент2 страницы0QFKnrDS Application-Form PDFDaniele Jenna EsguerraОценок пока нет

- Apply for DOST-SEI ScholarshipДокумент2 страницыApply for DOST-SEI ScholarshipVenice AzaresОценок пока нет

- West Bengal Minorities' Development and Finance Corporation: Application For WB Merit Cum-Means Scholarship 2019-20Документ1 страницаWest Bengal Minorities' Development and Finance Corporation: Application For WB Merit Cum-Means Scholarship 2019-20md saqlinОценок пока нет

- NTS - National Testing ServiceДокумент4 страницыNTS - National Testing ServiceAbid GandapurОценок пока нет

- Gujarat Post Matric Scholarship ApplicationДокумент3 страницыGujarat Post Matric Scholarship ApplicationHarsh PatelОценок пока нет

- TSRTC BUS PASS APPLICATION FORMДокумент1 страницаTSRTC BUS PASS APPLICATION FORMnagaraju chariОценок пока нет

- Hall Ticket Insurance - IbuДокумент2 страницыHall Ticket Insurance - IbuMohamed IbrahimОценок пока нет

- 0ptae1l3 Application-Form PDFДокумент2 страницы0ptae1l3 Application-Form PDFChristian LagmanОценок пока нет

- Arrest Form in Christopher Luis April 12 Arrest in Feb 13 ShootingДокумент1 страницаArrest Form in Christopher Luis April 12 Arrest in Feb 13 ShootingAndreaTorresОценок пока нет

- Andhra Pradesh student bus pass detailsДокумент2 страницыAndhra Pradesh student bus pass detailsChandu SamuelОценок пока нет

- Income Tax Department: Computerized Payment Receipt (CPR - It)Документ1 страницаIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990Оценок пока нет

- Encrypt Signedfinal-Unlocked PDFДокумент2 страницыEncrypt Signedfinal-Unlocked PDFRishabh PathaniaОценок пока нет

- TSRTC Bus Pass PDFДокумент2 страницыTSRTC Bus Pass PDFBhanu KethavОценок пока нет

- WB Minority Scholarship ApplicationДокумент1 страницаWB Minority Scholarship Applicationউসমানী মাদ্রাসা المدرسة العثمانيةОценок пока нет

- India-Israel Defence Ties Reach New HeightsДокумент148 страницIndia-Israel Defence Ties Reach New HeightsManishОценок пока нет

- Makaut Form PDFДокумент1 страницаMakaut Form PDFSwaagato ChakrabortyОценок пока нет

- Pramod KumarДокумент1 страницаPramod KumarSumit RajОценок пока нет

- Supply Application Contractor FormДокумент1 страницаSupply Application Contractor FormPujayantha KumarОценок пока нет

- Financial Amendment Form: 1 General InformationДокумент3 страницыFinancial Amendment Form: 1 General InformationRandolph QuilingОценок пока нет

- TSRTC Bus Pass SajidДокумент1 страницаTSRTC Bus Pass SajidSYED'SОценок пока нет

- CPP Membership Application: National Institute of Accounting Technicians in The PhilippinesДокумент1 страницаCPP Membership Application: National Institute of Accounting Technicians in The PhilippinesBev DGОценок пока нет

- TSRTC Bus PassДокумент2 страницыTSRTC Bus PassKajal rayОценок пока нет

- Call Letter for Phase-I ExamДокумент2 страницыCall Letter for Phase-I ExamSasikumar ChakkarapaniОценок пока нет

- Savannah Police Report: Malik JonesДокумент3 страницыSavannah Police Report: Malik Jonessavannahnow.comОценок пока нет

- KYC Form - For IndividualДокумент2 страницыKYC Form - For IndividualBheeshm Prakash NayakОценок пока нет

- (For Individuals and Hufs Having Income From Profits and Gains Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Документ54 страницы(For Individuals and Hufs Having Income From Profits and Gains Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Jaydeep WayalОценок пока нет

- IBPS - Clerk - VI - Recruitment of Clerk PDFДокумент2 страницыIBPS - Clerk - VI - Recruitment of Clerk PDFAnonymous 2l8XJIVОценок пока нет

- SSC Fee Deposit ChallanДокумент1 страницаSSC Fee Deposit ChallanKalmesh AparnaОценок пока нет

- Travell Wright Criminal Complaint For Attack On TPUSA EventДокумент4 страницыTravell Wright Criminal Complaint For Attack On TPUSA EventThe College FixОценок пока нет

- Sanjana CA Final Registration PDFДокумент6 страницSanjana CA Final Registration PDFS.K. BansalОценок пока нет

- Form 16-2017-18Документ4 страницыForm 16-2017-18Yaswitha SadhuОценок пока нет

- FEDERALLY DECLARED DISASTER TAX RELIEFДокумент3 страницыFEDERALLY DECLARED DISASTER TAX RELIEFAkОценок пока нет

- Application No.: LLR Endorsement AcknowledgementДокумент1 страницаApplication No.: LLR Endorsement AcknowledgementsrinadhОценок пока нет

- Mushtaq & IshfaqДокумент1 страницаMushtaq & IshfaqAʌĸʌsʜ AƴʌŋОценок пока нет

- Sourav Exam PDFДокумент2 страницыSourav Exam PDFsuman das0% (1)

- Public Arrest Report For 14aug2015Документ4 страницыPublic Arrest Report For 14aug2015api-214091549Оценок пока нет

- Backward Classes & Minorities Welfare Dept.: Version No: 1 Verification Code: 9925 Lock Date: 15/10/2018 IpaddressДокумент3 страницыBackward Classes & Minorities Welfare Dept.: Version No: 1 Verification Code: 9925 Lock Date: 15/10/2018 IpaddressPatel PraweenОценок пока нет

- Recruitment of Various Posts PDFДокумент3 страницыRecruitment of Various Posts PDFSandeep PathakОценок пока нет

- Form PDF 332687981310321Документ65 страницForm PDF 332687981310321dhimanbasu1975Оценок пока нет

- Public Arrest Report For 6mar2015Документ8 страницPublic Arrest Report For 6mar2015api-214091549Оценок пока нет

- Application No: RegularДокумент2 страницыApplication No: RegularBussiness EmpireОценок пока нет

- (For Individuals and Hufs Not Having Income From Profits and Gains of Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Документ33 страницы(For Individuals and Hufs Not Having Income From Profits and Gains of Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)harish.nayakОценок пока нет

- 2021 Undergraduate Scholarships Online Application Form Form C - Certificate of Good Moral CharacterДокумент2 страницы2021 Undergraduate Scholarships Online Application Form Form C - Certificate of Good Moral CharacterMaddie Alexandra SmithОценок пока нет

- VAHAN 4.0 (Citizen Services) Onlineapp01 135 8000Документ1 страницаVAHAN 4.0 (Citizen Services) Onlineapp01 135 8000jack sonОценок пока нет

- International Application FormДокумент4 страницыInternational Application FormMais OmarОценок пока нет

- NPCIL Recruitment Portal - Print Application Form PDFДокумент2 страницыNPCIL Recruitment Portal - Print Application Form PDFdeepupaulОценок пока нет

- Arrest Report of Victor Rios - Jacksonville Sheriffs Office - Feb. 05, 2021Документ4 страницыArrest Report of Victor Rios - Jacksonville Sheriffs Office - Feb. 05, 2021Omar Rodriguez OrtizОценок пока нет

- Horan Arrest ReportДокумент2 страницыHoran Arrest ReportJacob EngelsОценок пока нет

- Vinh Nguyen Arrest AffidavitДокумент4 страницыVinh Nguyen Arrest AffidavitKirstin ThomasОценок пока нет

- Michael A Chagares Financial Disclosure Report For 2010Документ6 страницMichael A Chagares Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- George H Wu Financial Disclosure Report For 2010Документ6 страницGeorge H Wu Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Lacey A Collier Financial Disclosure Report For 2010Документ6 страницLacey A Collier Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Opinion - JW V NavyДокумент7 страницOpinion - JW V NavyJudicial Watch, Inc.100% (1)

- 1488 09032013Документ262 страницы1488 09032013Judicial Watch, Inc.100% (1)

- CC 081213 Dept 14 Lapp LДокумент38 страницCC 081213 Dept 14 Lapp LJudicial Watch, Inc.Оценок пока нет

- 1878 001Документ17 страниц1878 001Judicial Watch, Inc.100% (5)

- Gitmo Freezer Inspection ReportsДокумент4 страницыGitmo Freezer Inspection ReportsJudicial Watch, Inc.Оценок пока нет

- Stamped ComplaintДокумент4 страницыStamped ComplaintJudicial Watch, Inc.Оценок пока нет

- Stamped ComplaintДокумент4 страницыStamped ComplaintJudicial Watch, Inc.Оценок пока нет

- 2161 DocsДокумент133 страницы2161 DocsJudicial Watch, Inc.83% (12)

- 11 1271 1451347Документ29 страниц11 1271 1451347david_stephens_29Оценок пока нет

- Stamped ComplaintДокумент4 страницыStamped ComplaintJudicial Watch, Inc.Оценок пока нет

- Gitmo Freezer Inspection ReportsДокумент4 страницыGitmo Freezer Inspection ReportsJudicial Watch, Inc.Оценок пока нет

- Gitmo Water Test ReportДокумент2 страницыGitmo Water Test ReportJudicial Watch, Inc.Оценок пока нет

- Holder Travel Records CombinedДокумент854 страницыHolder Travel Records CombinedJudicial Watch, Inc.Оценок пока нет

- State Dept 13-951Документ4 страницыState Dept 13-951Judicial Watch, Inc.Оценок пока нет

- Stamped Complaint 2Документ5 страницStamped Complaint 2Judicial Watch, Inc.Оценок пока нет

- CVR LTR SouthCom Water Safety ProductionДокумент2 страницыCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Оценок пока нет

- JTF GTMO Water Safety App W ExhДокумент13 страницJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Оценок пока нет

- Visitor Tent DescriptionДокумент3 страницыVisitor Tent DescriptionJudicial Watch, Inc.Оценок пока нет

- SouthCom Water Safety ProductionДокумент30 страницSouthCom Water Safety ProductionJudicial Watch, Inc.Оценок пока нет

- CVR LTR SouthCom Water Safety ProductionДокумент2 страницыCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Оценок пока нет

- JTF GTMO Water Safety App W ExhДокумент13 страницJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Оценок пока нет

- Navy Water Safety ProductionДокумент114 страницNavy Water Safety ProductionJudicial Watch, Inc.Оценок пока нет

- JW Cross Motion v. NavyДокумент10 страницJW Cross Motion v. NavyJudicial Watch, Inc.Оценок пока нет

- SouthCom Water Safety ProductionДокумент30 страницSouthCom Water Safety ProductionJudicial Watch, Inc.Оценок пока нет

- December 2005Документ7 страницDecember 2005Judicial Watch, Inc.Оценок пока нет

- May 2007 BulletinДокумент7 страницMay 2007 BulletinJudicial Watch, Inc.Оценок пока нет

- Cover Letter To Requester Re Response Documents130715 - 305994Документ2 страницыCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.Оценок пока нет

- July 2007 BulletinДокумент23 страницыJuly 2007 BulletinJudicial Watch, Inc.Оценок пока нет

- Schoolboard PowerpointДокумент2 страницыSchoolboard PowerpointJudicial Watch, Inc.Оценок пока нет

- Model UNДокумент2 страницыModel UNJudicial Watch, Inc.Оценок пока нет

- Work Life BalanceДокумент69 страницWork Life BalanceSagar Paul'gОценок пока нет

- Insurance Product Information Document (IPID) : International Student Insurance EuropeДокумент2 страницыInsurance Product Information Document (IPID) : International Student Insurance EuropeHoàng ĐứcAnhОценок пока нет

- OpTransactionHistory01 09 2023Документ3 страницыOpTransactionHistory01 09 2023NathamОценок пока нет

- Financial Accounting Iii Sem: Multiple Choice Questions and AnswersДокумент24 страницыFinancial Accounting Iii Sem: Multiple Choice Questions and AnswersRamya Gowda100% (1)

- 5 - Audit of Purchasing Disbursement CycleДокумент71 страница5 - Audit of Purchasing Disbursement CycleJericho Pedragosa100% (1)

- Micro BankingДокумент6 страницMicro BankingPratik SavaliaОценок пока нет

- AGENCY COURSE SYLLABUSДокумент109 страницAGENCY COURSE SYLLABUSAshAngeLОценок пока нет

- Organizational Structure ofДокумент16 страницOrganizational Structure ofakanksha singhОценок пока нет

- Bank challan definitionДокумент3 страницыBank challan definitionRamachandran RamОценок пока нет

- Review Questions: Chart of AccountsДокумент4 страницыReview Questions: Chart of AccountsHasan NajiОценок пока нет

- Amaia Payment SchemesДокумент6 страницAmaia Payment SchemesMhack ColisОценок пока нет

- Icici Prudential Asset Management Company LTD.: Revision and Practice Test Kit Version 3Документ21 страницаIcici Prudential Asset Management Company LTD.: Revision and Practice Test Kit Version 3Neeraj KumarОценок пока нет

- Asset Management - Overview, Principles and Terminology: Draft International Standard Iso/Dis 55000Документ25 страницAsset Management - Overview, Principles and Terminology: Draft International Standard Iso/Dis 55000Peter Guerrero BacaОценок пока нет

- What Is Green PIN?: Atmcard@iobnet - Co.in FДокумент1 страницаWhat Is Green PIN?: Atmcard@iobnet - Co.in FSathya NarayananОценок пока нет

- AdaДокумент8 страницAdaperapericprcasОценок пока нет

- List of Recapitalized CMOs As at February 16 2017 For CMO Data UpdateДокумент525 страницList of Recapitalized CMOs As at February 16 2017 For CMO Data UpdateMarketing B100% (1)

- Service Tax E Book by CA Pritam MahureДокумент695 страницService Tax E Book by CA Pritam MahurevickytatkareОценок пока нет

- General Ledger & Trial BalanceДокумент5 страницGeneral Ledger & Trial BalancecassaaaeyОценок пока нет

- 0452 s05 QP 1Документ12 страниц0452 s05 QP 1Kenzy99Оценок пока нет

- Bank For Business in The UAE - NBFДокумент48 страницBank For Business in The UAE - NBFSheikh AbdullahОценок пока нет

- Report ZreportДокумент7 страницReport ZreportAnagh PagareОценок пока нет

- The Kingdom of The ShylockДокумент148 страницThe Kingdom of The ShylockDavid YogaОценок пока нет

- Deutsche Bank Research Container Shipping ReportДокумент8 страницDeutsche Bank Research Container Shipping ReportbenlauhhОценок пока нет

- PNB v. Rodriguez Case DigestДокумент3 страницыPNB v. Rodriguez Case DigestKian Fajardo100% (2)

- CRM in BankingДокумент32 страницыCRM in BankingRaveena RaneОценок пока нет

- Contra Charging AR - APДокумент3 страницыContra Charging AR - APb_rakes2005Оценок пока нет

- PolicyДокумент4 страницыPolicyJiso ThomasОценок пока нет

- Black BookДокумент104 страницыBlack BookSoni PalОценок пока нет

- Accounting TransactionsДокумент100 страницAccounting TransactionsOfelia RagpaОценок пока нет

- Sip 1Документ8 страницSip 1vickyОценок пока нет