Академический Документы

Профессиональный Документы

Культура Документы

Morris S Arnold Financial Disclosure Report For 2009

Загружено:

Judicial Watch, Inc.Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Morris S Arnold Financial Disclosure Report For 2009

Загружено:

Judicial Watch, Inc.Авторское право:

Доступные форматы

~o 1o Rev.

1/20tO

FINANCIAL DISCLOSURE REPORT I

FOR CALENDAR YEAR 2009

Reportin GovernmentRequired ActbY theof197

(~ U.S.C app. y~

I. Person Reporting (last name, first, middle initial) Arnold, Morris S. 4. Title (Article 111 judges indicate active or senior status; magistrate judges indicate full- or part-time) Judge--Senlor

2. Court or Organlzatien 8th U S Circuit Ct of Appeals 5a. Report Type (check appropriate |ype] [] Nomir.ation, [] Initial Date [] Annual [] Final

3, Date of Report 05/10/2010 6. Reporting Period 01/01!2009 to

12/31/2009

7. Chambers or Office Address P. O. Box 2060 Little Rock, AR 72203-2060

5b. [] Amended Report & On the basis of the Information contained In Ihls Report and any raodifieatlons pertaining thereto, It is, In my opinion, in compliance with appllcahle laws and regulations. Revltwing Officer Date

IMPORTANT NOTES: The instructions accompanying this form must be followed. Complete all parts,

checking the NONE box for each part where.you have no reportable information. Sign on iast page.

I. POSITIONS. tR,por, ing i.aiviauat onty; see pp. 9-1J o/fitlng instructions.)

[] NONE (No reportable positions.) POSITION NAME OF ORGANIZATION~NTITY

II. AGREEMENTS. (R,partlng individuatanl).l $pp. 14-16of fiting instruedons.)

~ NONE ~o reportable agreements.) DATE

I.

~r~ ~:".

~" PARTIES AND TE~S

~ 3-:

Arnold, Morris S.

[ Name FINANCIAL DISCLOSURE REPORTI1 Arnold, Morr|s S. of Person Reporting Page 2 of 14

Date of Report

05/10,2010

IIl. N O N-INVESTMENT IN C O ME. (Reportln~ individua! and spouse; see p~ I z-2 of filing ln~tructlom.)

A. Fliers Non-Investment Income NONE (]go reportable non-investment income.) DATE

I. 2009

SOURCE AND TYPE

University of Arkansas--authors royalties

INCOME

(yours, not spouses) $1,011.00

2. 3. 4.

B. Sp ousets Non-Investment Income - if you ~re married during any portion of the reporting year, complete this section.

(Dollar amount not required except for honoraria.)

[~

NONE (No reportable non-invesOnent income.) DATE SOURCE AND TYPE

1. 2. 3.

4.

IV. REIMBURSEMENTS -tron,po,t~ion,

(Includes those to spo~se and dependent children; se~ pp. 25-27 of filing instructions.)

NONE (No reportable reimbursemems.) SOURCE !. 2. 3. 4. 5. DATES LOCATION PURPOSE I[TEMS PAID OR PROVIDED

FINANCIAL DISCLOSURE REPORT Page 3 of 14

Name of Person Reporting

Date o f Rcport

Arnold, Morris S.

o5~Io/2o~o

V. GIFTS. a.a,.~... ,~o,, ,o ,po,.e and dependent cldldren; see p~. 28-31 of filing instrucaonx)

NONE (No reportable gifts.) SOURCE

I. 2.

3. 4.

DESCRIPTION

5.

FINANCIAL DISCLOSURE REPORT

Page 4 of 14

[ Name of Person Reporting

/

[ Arnold, Morris S.

Date of Report

osnonolo

VII. INVESTMENTS an d TRUSTS - t.~o.,., .oI=., tran~actionJ (tnct=aes those oZspo~s~

NONE (No reportable income, ~sets. or transaction.)

~ D~rlpfion of A~~ (including ~t ~ts) Place(X)" a~r~ch~s~l B. Incom~ during r~po~iag ~ri~ Amount (A-H) T~ (e.g., or int.) C. G~ss v~u~ at end of re~ing Value (J-P) Value C~e 3 (Q~ [ ~ D. T~aclion~ during ~ing period

Type (~.g., r~cmption)

Date

] Value r Gain . (J-P) (A-]I)

Idcntiwof (ifpHvat~ tra~actlon)

:i

I.

Delta Trust and Bard~

Interest

2. 3. 4. 5. 6. 7.

8. 9. 10. 1 I. 12.

Univ of Arkansas at Little Rock

None

Matured

01/01/09

See note--Section VIII

MINERAL INTERESTS--VARIOUS LANDS IN TEXAS: Southland Champion Mineral, Morgan Keegan, Lutkin, TX Grayburg Mineral Account, Morgan Keegan, Lufkin TX D B Royalty Royalty L K W W

SECURITIES !tELD BY DELTA TRUST INVESTMENTS-Account I Prime Cash Series Money Market Fund--name change Wachovia Bank-from Prime Cash Series Norfolk Southern Windstream A B A None Interest Dividend Dividend J K J T T T Closed Open 01/01109 0 I/01/09 J J Money market change Change fr Prime Cash MM fd

13.

14. 15. 16. 17. SECURITIES HELD BY DELTA TRUST INVESTMENTS-Account 1I Trust Series Prime Cash MM Fund--name change Wachovia Bank--from Prime Cash Series General Electric company A A None Interest Dividend J J T T Closed Open 01101109 01/09/09 J J Money market change Change fr Prime Cash MM fd

I. li..come Gain Codes: (.~e Columnl B I lad D4) 2. Vak~ Codes (See Columns Cl and D31 3, V.lue Me~od Codes (See Column (22)

A =$1,000 or les~ F =$50.001 - $I 00,000 1 =$15,000 or less N -$250,001 - $500.000 P$ -$25,000,001 - SS0,000,O00 Q -Appraisal U -Book Value

B ~IolXII- S2,500 13 =$100,001 - $1,000,000 K -$15.001 - $50,000 O =$500,001 - $1,000,000 R =.Cost ( P.eal Estate Only) V =Other

C =$2,501 - $5.000 HI =$1,000,001. SL000,000 L =$S0.001 - $100,000 PI =$1,000,001 - $5,~00,000 P4 =More than $S0.000.00O S -Assessment W =Estimau~d

E =$15.001 - $50,000 H2 -More than $~,000,000 M "~ 100.001 - $250,000 P2 =$S,000,001 $2~,000,009 T =Ca.~h Market

FINANCIAL DISCLOSURE REPORT

Page 5 of 14

Name of Person Reporting

Date of Report

05/10~010

[ Arnold, Morris S.

VII. INVESTMENTS and TRUSTS - i~o,~e, vaue, t,,~uc~,~ (Includes those uf spouse and dependent children; seepp. 34-60 of fillng instructions.)

[] NONE (No reportable income, assets, or transactions.)

A. Description of As~ets (including trust assets) Place exempt from prior disclosure Proctor and Gamble Dominion Resoursce |nc Upper Decs Calaruos Strategic Total Return Fund . B. Income during reporting period C. Gross value at ~nd of reporting period Value - Code 2 : (J-P) Value Method Code3 (Q-W) T T T Type (e.g., buy, sell, redemption) D. Tran~ctionx during reporling period

Amounl Code l (A-H)

div.. rent, orint.)

: Date [ Value Gain i mm/dd/y}, : Code 2 ~ Code I . (J-P) : (A-H) ; 1! i

Identity of buyerlseller (if private transaction)

18. 19. 20.

A A A

Dividend Dividend Dividend

J J J

21. 22. 23. 24. 25. 26. 27.

Windstream Waeh0via-merger to Wells Fargo Wells Fargo--merger fr Wachovia Pulaski Cry AR, AR Child Hosp 3.3% bond

Dividend None

T Merged :01/02/09 (with line 23) J J J Merger into Wells Fargo Merger from Wachoviz

A A

Dividend Interest

J J

T T

Open Buy

: 01/02/09 05/07/09

SECURITIES HELD BY MORGAN STANLEY #3--Account closed Morgan Stanley Active Assets Money Trust ~ A A

A A A

Interest Dividend

Dividend Dividend Dividend

Closed Sold

Sold Sold Sold

! 03/05/09 07/22/09

07/22/09 07/22/09 01/05109

J J

J J J

Transfer to TIAA-CREF #3 C

A D A

28. Coca Cola

29. 301 31. Discover Financial Services Morgan Stanley Proctor and Gamble

32. 33. 34.

Trinsic Wyeth Units VK Select 10 Industrial 2008-5A A A

None Dividend Dividend

Sold Sold Sold

07/22/09 07/22/09 07/22/09

J J J

A A A

(See Colu,n ns B I and I~) Value Ccdes (g C~umns CI ~nd D3) Vtlue M~tbed Coder (See Column C2)

F =$ 50.001 - $ | 00.000 .I =$15.000 o I~ N -$250.COI - $500,000 P3 -$25,000,001 - S~0,000,000 Q =AppraL~l U =Book V~l~e

13 =$ 100.001 - $1.0~.000 K =$15.001 - l ~0.000 O =$500,001 - $1,000,O00 R -~o~ (R~ Estate Onb~) V =(3ther

H I "$ 1.000.001 - 55.000.000 L =~0.001 - $ 100.00~ ~1 =$1.000,001 - S~,000,000 P4 =Mo~ than S 1Assessment W =Estimated

H2 =Mor~ tkan 55.000.{X)0 M =$| 00.001 - $250.000 P2 -$5,000,001 - $2~,000,000 T =Cn~h Market

FINANCIAL DISCLOSURE REPORT Page 6 of 14

Nam~ ofPerson Reporfl.g Arnold, Morris S.

Date of Rnport

os1IO12OlO

VII. INVESTMENTS and TRUSTS - i.,.o..e, ,a~o, transactions (Includes tho.,e of spo ..... d depenclent children; $eepp. .14.60 of fillng instrucgons.)

NONE (TVo reportable income, assets, or transactions.)

Description of Assets (including trot assets) Place(X)"afiereauhasset exempt from priordisclosur~ [ i Income during reporting period Type(e.g., div.,rent, orint.) Gro~s value at end of reporting period " Value Code2 (J-P) Value Method Code3 (Q-W) Transactions during reporting period [ j Type(e.g., i buy, sell, i redemption) : : Date i Value :~ Gain [mm/dd/yy i Code2 ! Code 1 [ i (JP) (A-H) I ! [ Identhyof buyer/seller (ifprivate transaction)

IAm~unt . Code I J (A-H)

35.

36, 37. SECURITIES HELD BY TIAA-CREF #3 Money Market A Interest J T Open 03/05/09 J Transfer in fr M/S 3

38. 39.

40.

Cohen & Steers Realty Fd Columbia Mid Cap Value Fd

Notthem Small Cap Value Fd

A A

A

Dividend Dividend

Dividend

J J

J

T T

T

Buy Buy

Buy

07/23/09 07/23109

7/23/09

J J

J

41. 42. 43. 44. 45.

46. 47. 48.

T Rowe Price Intl Growth & Income Fd T Rowe Price Tax Free Income Fd Royce Value Plus Fund Svc Class Blackrock Capital Appr Fund Pion~er Cullen Value Fund CI A

Thomburg Ltd Term Muni Fund

A A A A A

A

Dividend Dividend Dividend Dividend Dividend

Dividend

J J J J J

J

T T T T T

T

Buy Buy Buy Buy Buy

Buy

7/23/09 7/23109 7/23/09 7/23/09 7/23/09

7/23/09

J J J J J

J

49. 50.

SECURITIES HELD BY MORGAN STANLEY #4--Account closed MS US Govt See Tr D None

None

Sold

Sold

2/13/09

2/13/09

J

J

Loss on sale

Loss on sale

51. MSIF Tr Lad Duration lust

(~e Columns 81 ~ ~) Z Value ~ (S~ ~lumns el ~d D3) 3. V~I~e MeI~ C~s

(S~ Column ~)

F =$50,~1 - $100,~ J -$ I S,~ ~ l~s N =$250,~1 - $5~,~ P3 =$25,~,~1 - $50,~,~ Q =App~l U "~k Value

O =$1~,~1 - $ t.~,000 K -$ ! 5,~ 1 - $50.~ O =SS00,~l - $1.~.~ R ~t (R~ Es~ Only) V =~h~

HI -$1,~,~ 1 - $5.~0,~ L ~50,~ I - $ I ~,~ PI =$1,~,~1 - $5,~0.~0 P4 ~M~e ~an $50,~,~ S =~s~ W =E~mated

H2 ~More than $5.~.000 M =$ 100,~ 1 - ~50,~ P2 =15,~.~1 - $25,~.~0 T ~h Manet

I Name of Person Reporting

Date of Report

PageFINA1NCIAL7 of 14 DISCLOSURE REPORTI1 Arnold, Morris S. VII. INVESTMENTS and TRUSTS NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust asscls) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period (2) (t) Amount Type (e.g., Code I day., rent, : (A-H) orint.) C. Gross value at end of reporting period (i) (2) .... Value Value Method Code 2 Code 3 (J-P) (Q-W) D. Transactions during reperting period il) Type (e.g., buy. sell, redemption) (2) , (3) i i4) Date I Value Gain i mm/dd/yy i Code 2 : Code I , : (J-P) (A.H) I

05/10/2010

(5) Identity of buyer/seller (if private transaction)

52, 53.

54.

MSIF Active Ind AIIoctn A MSIF Emerging Markets A

Vanl~ampen Comstock I

None None

None

Sold Sold

Sold

2/13/09 2/13/09

2/13/09

J J

J

Loss on sale Loss on sale

Loss on sale

55.

56.

MSIF Tr Mid Cap Growth Inst

MSIF US Real -Estate Port A

None

None

Sold

Sold

2/13/09

2/13/09

J

J

Loss on sale

Loss on sale

57. 58. 59.

60.

MSIF US Large Cap Gr Purl A MSIF Tr US Small Cap Val last E V Income Fund of Boston

None None None

Sold Sold Sold

2/13/09 2/13/09 2/13/09

J J J

Loss on sale Loss on sale Loss on sale

61. 62. 63.

64. 65. 66. 67.

SECURITIES HELD BY DELTA TRUST INVESTMENTS INC-IRA -Wachovia Bank-formerly Prime Money Market -Dillards

-Mattel lnc -Wachovia Corp 2nd New--Merger to Wells Farg~ -Wells Fargo Company-Merger fr Wachovia MFS Core Equity Fund Class B

Dividend

T Formerly Prime M M Fund

Merged (with line 66) Open

01/02/09 01/02/09

J J

Merged to Wells Fargo Merged from Wachovia

68.

-Gabelli Equity Trust Inc.

I. Income Gain Codes: (See Columm B I and D4)

A -$1,000 or less F -$50,00t - $100,000

B -$1.OO 1 - $2,~;00 (3 -$100,001 - $1,000,000

C -$2,501 - $5,000 HI -$I,OG0,001 - $5,000,000

H2 -More than

2. Value Codes (See Co~urnnt C l trod D3) 3. Value Mehod Codes (See Column C~)

| -$15,000 or less N -$250,001 - $.i00,000 p~ -$25.000,001 $50,000,000 Q -Appraisal O ~Book Value

K =$15,001 . $50.000 O -$500,001 . $1,000,000 R -Cost (Real Estate Only) V =Other

L =$50,001 - $100,000 PI =$1,000,001 -$5.000,000 P4 =Mole thxtl $50,000,000 S -Assessment W =Estimated

M -,~ 100,001 - $250,000 P2 =$~i.000.001 - $25,000,000 T -Cash Market

[ Name FINANCIAL DISCLOSURE REPORTI I Arnold, Morris S. of Person Reporting

Date of Report 05/10/2010

Page 8 of 14

VII. INVESTMENTS and TRU STS -inco~,e. ,.at, e, transactions (Includes those of spouse and dependent children: see pp. 34-60 of fillng instructions.)

[---] NONE (No reportable income, assets, or transactions.)

A. Description of Assets (incloding Irust assct~) B. Income during reporting period C, Gross value at end of ~eporting period.. [ ~ ] ................. D, Transactions during reporling period .. ! (2) I O) ! i4) ~ Date I Value s, Gain !mm/dd/yy i Code 2 ~: Code I ~ (A-H) [ (J-P) i[ I

Amount Place "(X)" alter each asset I Type (e.g.. Code I [ div., rent, exempt from prior disclosure , (A-H) or int.)

(0 I (2)"

O)

Value Code 2 (J-P)

(2) !

Value Method

(1)

(~)

Identity of buyerlsellcr (ifpriva~ tran.~action)

i Type (e.g., i buy, sell, I redemption) COdeo "~3 (_-W. i

69, 70.

-Gab~lli Healthcare & Wellness -Liberty All Star Equity Fund

72. 73. 74. 75. 76. 77. 78. 79. 80. 81. 82. 83. 84. 85.

SECURITIES HELD BY MORGAN STANLEY #1--IRA-- Account closed -MS Liquid Asset Fund -Chevron Texaco -Cisco Systems -Eastman Kodak -Exxon Mobil -General Electric -Intel -NokiaCp Adr -Pepsicolnc. -Southwest Airlines -Walmart Stores -Walmart De Mexico SaV Ord -ING Group

Dividend

Closed Closed Closed Closed Closed Closed Closed Closed Closed Closed Closed Closed Closed Closed

3/2/09 3/2/09 3/2/09 3/2/09 3/2/09 3/2/09 3/2/09 3/2/09 3/02/09 3/2/09 3/2/09 3/2/09 3/2-/09 3/2/09

J J J J J J J J J J J J J J

I Transfer toTIAA-CRE IRAs

(See Coturnns BI and D4) (~ ~lumns CI ~nd D3) 3. V~Iur M~ ~ {S~ Column ~)

F =$~0.0<31 - $100,000 N =$250,~1 - S5~,~ Q =App~M U =B~k Valu~

G =.$109,001 - $1.000.009 O =$5~,~1 - $1,~,~ R ~ (Real ~ Only) V ~=r

HI =$1,~.~1 - $5.~.~ PI =$I,~,~I -$~,~0,~ S =A~enl W

H2-Mme ~ $5,~.~ ~ =~,~,~l ~ Manet

Name of Person Reporting

Da te of Report

FIN,~NCIAL DISCLOSURE REPORT ] Arnold, Morris S. Page 9 of I4

VII. I NVESTMENTS an d TRUSTS - ,.~o,.~, ~.. ~r.~.o.~o~ a~a~a~,,~o.~ o~.~o~ .~do~..~.~, .~U~.~:

NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assts) PI=ce "(X)" after each asset exempt from prior disclosure ; B. Income during reporting period C. Gross valu* tt end of reporting period Value Code 2 (J-P) Value Method Code3 (Q-W) Type (e.g., buy, sell, redemption) D. Transactions during reponlng period

. Amount Type (e.g., . Code 1 div., rent, (A-H) or inL) ,

; Date i mm]dd/yy i

Value Code 2 (J-P)

Gain Code 1 (A-H)

Identity of buyer;seller (if private transaction)

86. 87. 88. 89. 90. 91. 92. 93. 94. 95. 96. 97. 98. 99.

-Morgan Stanley 11I *33MH01 6.250% -prt StategFund

Closed Closed

3/2/09 3/2/09

J J

SECURITIES HELD B~ TIAA.-CREF-IRA #1 -Money market fund -Chevr~nTexaco -Exxon Mobil -Intel -Pepsico Inc. -Wal Mart Stores -Walmart De Mexico Sa V Ord

Dividend

T Open Open Open Open Open Open Open 3/2/09 3/2/09 3/2/09 3/2/09 3/2/09 3/2/09 3/2/09 J J J J J J

Transferred in fr M/S IRA

SECURITIES HELD BY MORGAN STANLEY-IRA ROLLOVER--Acct closed -MLLiquid Asset Fund

None Closed Sold Sold Sold 3/02/09 2/17/09 2/17/09 2/13/09 K J J J

Transfer out to TIAA-CREF

100. -Focus Frowth Fund D 101, -U S Government See Tr D 102. -MSIF Tr Ltd Duration Inst

Loss on sale Loss on sale Loss on sale

(S~ Co]u~s B I ~d ~ )

F =$50,~ I - $ I ~,~0

G -$ 100,~ 1 - $ t ,~,O~

H l =$1 ,~,~ l - $5,~0,0~

H2 -More k~ n ~S,0~,~0

]. Vtlu~ M~h~ C~ (See Col~ C2)

O -Ap~isal U -B~k Value

R ~ost (g~l ~mte Only) V~

S -~s~t W ~E~i~md

T ~ Ma&et

FINANCIAL DISCLOSURE REPORT

Name of Person Reporling Arnold, Morris S.

Date of Report

Page i0 of 14

05/10/2010

VII. INVESTMENTS and TRUSTS - i .... ~ value, transactions (Includes those of spouse and dependent children; $eepp. 34-60 oZfillng in$tructlon~l

NONE ~o reportable income, ~sets, or transactions.)

A. ~scdptlon of Asse~ (including ~t ~ts) PIac~ "(X)" after ~ch asset ~pt ~ prior disclos~ B. i~ome during ~ing ~riod (I) .... (2) Amount Type (e.g.+ C~ 1 div., ~n~ (A-H) ] orin~) C, D. ~ T~tions during reining pe~od Gross value at end of rcpoaing ~ri~ (I) (~) (0 " , (~) [-(3)-~ (4) VaIu~ Valu~ Type (~,g., ~ Dale~ Value ~ Gain buy, sell, ~ m~d~yy i C~e 2 [ C~e I ~de 2 Melhod redemption) (J-P) ~de3 ;, [ (I-P) ~ (A-H) ~ (Q-~ Sold Sold 2/13/09 2/17/09 J J

Identity of buyer/seller (ifprivate t~nsaction)

103. -MSIF Tr Hi Income Yield eo~ last 104. MSIF Emerging Markets Inst

Loss on sale Loss on sale

105. -Van Kampen Comstock I

106. -MS1F Tr Mid Cap Crowth Inst

Sold

Sold

2/17/09

2/17/09

J

J

Loss on sale

Loss on sale

107. -MSIF Tr US Small Cap Val last 108. EV Income Fund of Boston 109.

110. SECURITIES HELD BY TIAA-CREF-IRA #2 I l 1. Money market fund 112. -Cisco System 113. -Cisco System C Dividend L T

Sold Sold

2/17/09 2/19/09

I J

Loss on sale Loss on sale

Transferred in from M/S Open Open Sold 07/01/09 7/01/09 7/2/09 J J J A Transferred in from MIS

114. -Eastman Kodak 115. -Eastman Kodak

116, -General Electric 117. -General Electric

Open Sold

Open Sold

7/01/09 7/2/09

7/01109 7/2/09

J J

J J A

Transferred in from M/S A

Transferred in from M/S

I 18, -Noki~t Cp Adr 119. -Nokla Cp Adr

Open Sold

7/01109 7/2/09

J J A

Transferred in from MIS

(See Columrts B I and IM) 2. Value C~ (~ Columns Cl t~ D3) 3. Value M~ C~ (S~ ~l~mn C2)

F =$50,001 - $100,000 J =$15 ,~0 or les ~ N =$250,~1 - $5~,~ Q =App~l~l U =B~k Vitue

G =$ I ~,~ I * gl,0~,0~ K =~ 15,~ I - $50,~ O =$5~,~ l - $1.~,~ R ~ost (R~I Es~e Only) V ~Ot~r

H L =$50,001 - $ I ~,0~ PI S =Ass~tment W =Esti~ted

M =$1 ~,~ I - ~50,~

T ~h

FINA~NCIAL DISCLOSURE REPORT Page 1 1 of 14

Name of Person Reporting Arnold, Morris S.

Date of Report

o5/~o~01o

VII. INVESTMENTS and TRUSTS - ~,,co,,,e, va~e, tra~actians(l~cludesthaseofspouseanddependenrchildren;seepp..!4-6~Toff!linglnstructions.)

NONE (No reportable income, assets, or transactions.)

~ Description of Assets (including l~ust a~et~) Place "(X)" tfl.er each a~et exempt fiom prior disclosure B. Income during reporting period C. ~ Gross "value at end ! of reporting period Value Code 2 (J-P) D. Transactioos during reporting period

,Cl~ ~)

Amount Code I (A-H) Type (e.g., div., rent, or int.)

~ ~2),

Value Method Code 3 (Q-W)

Type (e.g., buy, sell, redemption)

, Dale ! Value [mm/dd/yy Code 2 (I-P)

Gain Code I (A-It)

Identity of buyer/seller (if private transaction)

120. -Southwesl Airlines 121. -Southwest Airlines 122. -ING Group 123, -Ing Group 124. -Morgan Stanley III *33MH01 6,35% 125. -Morgan Stanley Iii *6.35% 126. -Prt Strategic Fund 127. -Prt Strategic Fund 28. American Century Inflation Bond Fd 129. Cohen & Steers Realty Shares 130. Colurabia Mid Cap Value Fund 13 I. Northern Small Cap Value Fund

132. T Rowe Price lntl Growth & Income 133. Royce Value Plus Fund 134. Blackrock Capital Appr Fund

Open Sold Open Sold Open Sold Open Sold Buy Buy Buy Buy

Buy Buy Buy

7/01109 7102/09 7/01/09 7/2t09 7101/09 7/02/09 7/01/09 7/2/09 7/6/09 7/6/09 7/6/09 7/6/09

7/6/09 7/6/09 7/6/09

J J J J J J J J J J J J

J J J

Transferred in from M/S A Transferred in from MiS A Transferred in from M/S A Transferred in from M/S A

135. Pimeo Total Return Fund 136. PioneerCullen Value Fund

Buy Buy

7/6/09 7/6/09

J J

FINANCIAL DISCLOSURE REPORT Page 12 of 14

Na~,e of Per~on Reporting

Date of Report

Arnold, Morris S.

05/10/2010

VII. INVESTMENTS and TRUSTS - inco~.e, v,t,o, tr,nsacnons anctade, tho,e o~" spo,,e and dependent children; see pp. 34-60 of fillng Instructions.)

NONE (No reportable income, assets, or transactions.)

A. D~scription of Assets : B. Income during C. Gross value at end [ D. Transactions during reporling period

(including trust assets)

Place "(X)" afler each asset exempt from prior disclosure

reporting period

Type(e.g.,

of reporting period

Value Code 2 i (.I-P)

I ~l

Type(e,g.,

[Amount , Code I i (A-H) i

die., r~nt,

or int,)

Value Method Code 3 (Q-W)

buy, sell,

redemption)

I Date , Value mm/dd/yy ! Code 2 i ! I (IP) [

Gain Code I (A-H)

Idcntityof

buyer/seller

(if private transaction)

137. 138.

139. Teachers Insurance & Annuity Assn College Retirement Eq Fund 140. 141. TIAA-CREF (Retirement) 142, 143. ING Select Plus Deferred Variable Annuity A Interest J T B Interest K T E Interest O T

I. Income Gain Codes: (See Columns BI and D4) 2. Value Coda (See Columns CI and D3) 3. Value M tlahod Codes (See Column C2)

A =$1,000 or less F =$50,00I - $100,000 J -$ I 5,000 o I~ N -$2.~0,001 - 2500,000 P3 -$25,000,001 - 250,000,000 Q -Appraisal U ~Book Value

B =$ 1.001 - 12500 G =$100.001 - $1.000,000 K =$15.001 - S50.000 O =$500,001 - $1,000,(~10 R ",C~st (Real Eslat Only) V -Other

C =$2,501 -$5,000 H I ~$1,000.001 . 25,000,000 L =$50,001 - $100,0OO PI --$1,000,001 - $5,0C0,000 P4 =More than S =Ass~sment W ~Esdmated

D =25.001 - $15.000 H2 =More than M "2100,~01 - S250,000 P2 -$5,000,001 - 225,000,000 T -,Cash Market

E =21S,001 - $ 50.000

FINANCIAL DISCLOSURE REPORT Page 13 of 14

] Name of Person Reporting

Date of Report I

I Arnold, Morris S.

05/10/2010 ]

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS.

Pan VI I-Line 2: i~-7"-] of Un versity of Arkansas at Little Rock bonds matured in a prior year and erroneously were not omitted from the date o f maturity or in succeeding reports.

Part VII: All securities held in Morgan Stanley regular accounts were sold or transferred to TIAA.CREF brokerage accounts in 2009. All Morgan Stanley IRA accounts were sold or transferred to TIAA-CREF accounts in 2009.

FINANCIAL DISCLOSURE REPORT Page 14 of 14

N,m~ or P,~o. R,po~i~

Arnold, Morris S.

D.t, of Report

05/10/2010

IX. CERTIFICATION.

I certify that all information given above (including informatfon pertaining to my spouse and minor or dependent children, If any) Is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld becaute it met applicable statutory provisions permitting non-dlsclosure. [ further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported ure in compliance with the provisions ors U.S.C. app. 501 el. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signalur, :

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

FILING INSTRUCTIONS Mail signed original and 3 additional copies to: Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-30 l One Columbus Circle, N.E. Washington, D.C. 20544

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- 2161 DocsДокумент133 страницы2161 DocsJudicial Watch, Inc.83% (12)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- 1488 09032013Документ262 страницы1488 09032013Judicial Watch, Inc.100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- 1878 001Документ17 страниц1878 001Judicial Watch, Inc.100% (5)

- Cost Leadership and Differentiation An Investigation of The Fundamental Trade-OffДокумент38 страницCost Leadership and Differentiation An Investigation of The Fundamental Trade-Offjulie100% (3)

- Certificat Incorporare COURIER EXCHANGE LTDДокумент29 страницCertificat Incorporare COURIER EXCHANGE LTDvasilebahica81Оценок пока нет

- Andrew Catalog 38 2001.CV01Документ769 страницAndrew Catalog 38 2001.CV01Cf PaulОценок пока нет

- Room Rental AgrmtДокумент2 страницыRoom Rental AgrmtJanardhan Surya0% (1)

- Y3 Module 1 Familiarize Basic Concepts of EntrepreneurshipДокумент33 страницыY3 Module 1 Familiarize Basic Concepts of Entrepreneurshipbryan tolab73% (15)

- 32 San Jose VS NLRCДокумент14 страниц32 San Jose VS NLRCJan Niño JugadoraОценок пока нет

- CC 081213 Dept 14 Lapp LДокумент38 страницCC 081213 Dept 14 Lapp LJudicial Watch, Inc.Оценок пока нет

- 11 1271 1451347Документ29 страниц11 1271 1451347david_stephens_29Оценок пока нет

- State Dept 13-951Документ4 страницыState Dept 13-951Judicial Watch, Inc.Оценок пока нет

- Stamped Complaint 2Документ5 страницStamped Complaint 2Judicial Watch, Inc.Оценок пока нет

- July 2007 BulletinДокумент23 страницыJuly 2007 BulletinJudicial Watch, Inc.Оценок пока нет

- Stamped ComplaintДокумент4 страницыStamped ComplaintJudicial Watch, Inc.Оценок пока нет

- Gitmo Freezer Inspection ReportsДокумент4 страницыGitmo Freezer Inspection ReportsJudicial Watch, Inc.Оценок пока нет

- Gitmo Freezer Inspection ReportsДокумент4 страницыGitmo Freezer Inspection ReportsJudicial Watch, Inc.Оценок пока нет

- CVR LTR SouthCom Water Safety ProductionДокумент2 страницыCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Оценок пока нет

- SouthCom Water Safety ProductionДокумент30 страницSouthCom Water Safety ProductionJudicial Watch, Inc.Оценок пока нет

- JTF GTMO Water Safety App W ExhДокумент13 страницJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Оценок пока нет

- Cover Letter To Requester Re Response Documents130715 - 305994Документ2 страницыCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.Оценок пока нет

- Model UNДокумент2 страницыModel UNJudicial Watch, Inc.Оценок пока нет

- December 2005Документ7 страницDecember 2005Judicial Watch, Inc.Оценок пока нет

- June 2004Документ17 страницJune 2004Judicial Watch, Inc.Оценок пока нет

- September 2004Документ24 страницыSeptember 2004Judicial Watch, Inc.Оценок пока нет

- LAUSD Semillas AckДокумент1 страницаLAUSD Semillas AckJudicial Watch, Inc.Оценок пока нет

- 13-1150 Response Re Judicial WatchДокумент1 страница13-1150 Response Re Judicial WatchJudicial Watch, Inc.Оценок пока нет

- Atlanta IntraregionalДокумент4 страницыAtlanta IntraregionalJudicial Watch, Inc.Оценок пока нет

- July 2006Документ24 страницыJuly 2006Judicial Watch, Inc.Оценок пока нет

- 13-1150 Responsive Records 2 - RedactedДокумент29 страниц13-1150 Responsive Records 2 - RedactedJudicial Watch, Inc.Оценок пока нет

- December 2005 Bulletin 2Документ14 страницDecember 2005 Bulletin 2Judicial Watch, Inc.Оценок пока нет

- STAMPED ComplaintДокумент4 страницыSTAMPED ComplaintJudicial Watch, Inc.Оценок пока нет

- Marketing Mix For Insurance IndustryДокумент7 страницMarketing Mix For Insurance IndustryReema NegiОценок пока нет

- Churachandpur - Project ProfileДокумент19 страницChurachandpur - Project ProfileAmusers100% (2)

- CV Victor Morales English 2016 V4Документ3 страницыCV Victor Morales English 2016 V4Juan C Ramirez FloresОценок пока нет

- PDFДокумент4 страницыPDFgroovercm15Оценок пока нет

- Adani Mundra Port LTDДокумент2 страницыAdani Mundra Port LTDGiriraj Asawa MaheshwariОценок пока нет

- Task 3 Mallika KalleДокумент1 страницаTask 3 Mallika KalleMallika KalleОценок пока нет

- Share Transfer AuditДокумент18 страницShare Transfer Auditsudhir.kochhar3530Оценок пока нет

- Blueprint Senior 2Документ26 страницBlueprint Senior 2Soraya Hani100% (3)

- Netsuite Vendor Prepayment ProcessДокумент17 страницNetsuite Vendor Prepayment ProcessOmg JrosieОценок пока нет

- PLM vs. IAC, 140 SCRA 22 PDFДокумент17 страницPLM vs. IAC, 140 SCRA 22 PDFMykaОценок пока нет

- CCPStatement 1Документ3 страницыCCPStatement 1Kristina WoodОценок пока нет

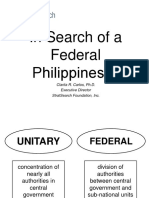

- In Search of A Federal Philippines - Dr. Clarita CarlosДокумент61 страницаIn Search of A Federal Philippines - Dr. Clarita CarlosJennyfer Narciso MalobagoОценок пока нет

- Evidence of Market Manipulation in The Financial CrisisДокумент21 страницаEvidence of Market Manipulation in The Financial Crisiscapatul14Оценок пока нет

- 10 Common Small Business Startup MistakesДокумент4 страницы10 Common Small Business Startup MistakesQayoom MangrioОценок пока нет

- Eos-Voting-Disclosure-Q2-2015 EmpresasДокумент78 страницEos-Voting-Disclosure-Q2-2015 EmpresasEdgar salvador Arreola valenciaОценок пока нет

- Supply Chain ProfitabilityДокумент31 страницаSupply Chain ProfitabilitysaiОценок пока нет

- Boynton SM CH 14Документ52 страницыBoynton SM CH 14jeankopler50% (2)

- ILO Declaration For Fair GlobalisationДокумент7 страницILO Declaration For Fair GlobalisationjaishreeОценок пока нет

- Singapore-Listed DMX Technologies Attracts S$183.1m Capital Investment by Tokyo-Listed KDDI CorporationДокумент3 страницыSingapore-Listed DMX Technologies Attracts S$183.1m Capital Investment by Tokyo-Listed KDDI CorporationWeR1 Consultants Pte LtdОценок пока нет

- Entrepreneurship: Topic-Success Story of Arunachalam MurugananthamДокумент14 страницEntrepreneurship: Topic-Success Story of Arunachalam MurugananthamDichin SunderОценок пока нет

- GST - Most Imp Topics - CA Amit MahajanДокумент5 страницGST - Most Imp Topics - CA Amit Mahajan42 Rahul RawatОценок пока нет

- Entrepreneurship Development ProgrammeДокумент10 страницEntrepreneurship Development ProgrammeJitendra KoliОценок пока нет

- Avante Global Services Pvt. LTD.: L&T ECC DivisionДокумент1 страницаAvante Global Services Pvt. LTD.: L&T ECC DivisionPardeep KhosaОценок пока нет