Академический Документы

Профессиональный Документы

Культура Документы

George H Wu Financial Disclosure Report For 2009

Загружено:

Judicial Watch, Inc.Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

George H Wu Financial Disclosure Report For 2009

Загружено:

Judicial Watch, Inc.Авторское право:

Доступные форматы

r

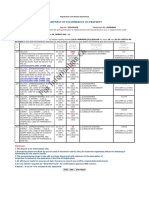

AO 10 Rev. 1/2010

I [

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2009

2. Court or Or[~anization Central D~strict of Cah~orma

5a. Report Type (check appropriate type) [] Nommatiort, Date ~[~l .-X.lmual [] Final

R~,p~,,, R~q,,,,~t bv ~Jt~ ~.~,,~ ,n Government Act of 1978 ~:s ~sc. opp ~" ~o~-~0

3, Dale of Report 04/23;2010

6. Reporting Period 01/01/2009 to 12/31/2009

Person Reporting (last name, fi:s~, mtddle mmaI) Wu, George H.

4. Title (Amcle Ill judges mdtcate active or semor status, magistrate .~udges md~eate full- or part-time) U.S District Court Judge

[] ]mt,.~t

5b. [] Amended Report 7. Chambers or Office 4ddress United Stales Courlhouse 312 North Spring Streel Los Angeles, CA 90012 8. On the basis of the information contained in this Report and any modifications perlaining thereto, ~t is, in my opimon, in compliance with applicable laws and ~ egulations. Reviewing Officer Date

IMPORTANT NOTES: The instructions accompanying this form must be foltorved. Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I, POSITIONS. cn~.,o,ti, g ,,,di,,idu.t n,ty; ~ vv. 9-t z of /mn~ instructions.)

~ NONE (No rc7)ortable positrons.)

POSITION

1 Judicial Board Member, Board of Governors

NAM E OF ORGANIZATION/ENTITY

Association of Business Trial Lawyers. Los Angeles Chapter

2

3

Member, V~sttmg Committee

Universit3, of Chicago Law School

-~.

II. AGREEMENTS. ~o,,,,t~,,a,,.~a,~ o~t~.; ~e, vv. ~-~ of filing in.~trucOon.~.)

NONF (No reportable agreements ) DATE

1

PARTIES AND TERMS

FINANCIAL DISCLOSURE REPORT Page 2 of 6

N~., of Person Rtport,ng w~, George H.

Date of Report

04/23/2010

III. NON-INVESTMENT INCOME. (Re~,ortlng mdlvldual and sp ....

A. Filers Non-lnveslment Income

NONE (No reportable non-investmen! income)

; see pp. !7-24 of f!llng in,tractions.)

DATE

I 2. 3. 4.

SOURCE AND TYPE

INCOME

(yours, not spouses)

B. Spouses Non-Investment Income - if.you were married during anJ~portton of the reporring year, complete 1his

(Dollar amoral( not required except for honoraria )

~-]

NONE (No reportable non-inveslment income ) DATE SOURCE AND TYPE

I 2 3. 4

IV. REIMBURSEMENTS -,ro.~po.~,io., ~odu~.~,~ood, e.te.o,.~.,.t.

(lnctude~ those to spouse and dependent children, ~ce pp 2~-27 of~hng m~tt~t~o~ )

NONE (No reportable reimbmwements.)

SOUR~

1. 2. 3 4. 5

LOCATION

PU RPOSE

ITEMS PAID OR PROVIDED

FINANCIAL DISCLOSURE REPORT Page 3 of 6

.~,. of Per,on Report,ng

I.In|e of Report

V. GIFTS. a,,ct.a.~ ~1,o,. to spous, ..a a.~.a,., chitdren; ~ee pp. 28-31 of firing i~tructions )

NONE 0Vo reportable g~s ) SOURCE DESCRIPTION ~ALUE

2. 3 4. 5

VI. LIABILITIES. a,c+:+,s ,ho,, o~ ....... d dependent children; .se pp. 32-33 offiht,g i+t, tru~tions.)

NONE ~No reportable liabilities) CREDITOR DESCRIPTION VALUE CODE

3 4 5

FINANCIAL DISCLOSURE REPORT

fPerson [ "~ ..... Report, rig

Oa,e of~eport

Page 4 of 6 VII. IN VESTMENTS an d TRUSTS - i .......

A. ~scnptlon of Asse{s (Including ~st asse~s) [ ]

] .~.~, t ......

wu. ~orge tl.

04,23,2~

tions anclud~ those 4spouse a~d dependent childr,; see pp. 3~-60 of filink, in~tructiom.)

NONE (No reportable income, assets, or transactions )

B income during reposing period C Gross ~alue al end of reporun~ period D. T~ansactlons dunng repomng period

exempt rrt, m pdot d,sclosure

~ Code l ~ (A-H~

dt~ , rent. or mt )

Code 2 (J-P)

Me~hod Code 3 (Q-W)

buy, sell, redemphon)

rmm/d~ Code 2 Code I " (J-P) (A-H) ]

huyer/seller (ffpmvate transacuon)

1.

Bank of America accounts

Interest

2. 3. 4 5.

Fidelity Ro!to,er IRA. DWS Capttal Growlh CL A Allianz OCC Growth CL C (P(JWCX~ mutual fund Los Angeles County 401(K) Los Angeles Count) 457 Plan

None None None None

K J N M

T T T T

10

14

16 17

1 Income Gain Lo~tes

A -$1.000 or less

B =$ 1,001 . $2,500 O =5500 0Ol - 11,0~ (1~

C =$2 501 - $5 000 Il -$1,000,001 - $S.0~.[100 ~,1 =More lh~ ~50.000,0~

I} - $5,001 - $15,~0 P2 ~15 000 00~ - $25,~0.000

E ~$15,001 - [50 000

(See Colu~ C I a~d O31

N - 1250.001 - 15~.0~ P3 -S25.0~.00 t - $50.0~ 000

FINANCIAL DISCLOSURE REPORT Pag~ 5 of 6 \!111. ADDITIONAL INFORMATION OR EXPLANATIONS.

In Part Vll as to lhe IRA, mutual and pension iunds dehneated thereto, I had in my pasl reportmgs noted the earmngs on flmae accounls as "interest" However, 1 have nc~w concluded that that is probably a m~scharacterizat~on since ] did not w~thdraw or othe~v~se reahze actual momcs/,ncome from those accounts. The funds go up and down during the year depending on the earnings, loses and share values Further, I did not recmve any income tax nott~.eslforms from those entit~es. Therefore, tlus year I have left the B(I) column blank and placed "none" in the B(2) column as to lhose ~tems, but ha~c noted the year-end value of those funds m colnmn C

FINANCIAL DISCLOSURE REPORT Page 6 of 6 IX. CERTIFICATION.

Name of Person Reporting

DafeofReport

~u. ~;co~-g~ ~" I

o,23,2olo

I certify that all iuformation given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was ~Sthheld because it met applicable statutory provisions permitting non-disclosure. I further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S,C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

FILING INSTRUCTIONS Marl s~gned original and 3 addttiona] copies to: Committee on Financial Disclosure Admm~stratwe Office of the United States Courts State 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

Вам также может понравиться

- Holder Travel Records CombinedДокумент854 страницыHolder Travel Records CombinedJudicial Watch, Inc.Оценок пока нет

- 1488 09032013Документ262 страницы1488 09032013Judicial Watch, Inc.100% (1)

- 2161 DocsДокумент133 страницы2161 DocsJudicial Watch, Inc.83% (12)

- Opinion - JW V NavyДокумент7 страницOpinion - JW V NavyJudicial Watch, Inc.100% (1)

- CC 081213 Dept 14 Lapp LДокумент38 страницCC 081213 Dept 14 Lapp LJudicial Watch, Inc.Оценок пока нет

- Stamped ComplaintДокумент4 страницыStamped ComplaintJudicial Watch, Inc.Оценок пока нет

- Stamped ComplaintДокумент4 страницыStamped ComplaintJudicial Watch, Inc.Оценок пока нет

- 11 1271 1451347Документ29 страниц11 1271 1451347david_stephens_29Оценок пока нет

- 1878 001Документ17 страниц1878 001Judicial Watch, Inc.100% (5)

- SouthCom Water Safety ProductionДокумент30 страницSouthCom Water Safety ProductionJudicial Watch, Inc.Оценок пока нет

- Stamped Complaint 2Документ5 страницStamped Complaint 2Judicial Watch, Inc.Оценок пока нет

- Stamped ComplaintДокумент4 страницыStamped ComplaintJudicial Watch, Inc.Оценок пока нет

- State Dept 13-951Документ4 страницыState Dept 13-951Judicial Watch, Inc.Оценок пока нет

- Gitmo Freezer Inspection ReportsДокумент4 страницыGitmo Freezer Inspection ReportsJudicial Watch, Inc.Оценок пока нет

- Gitmo Freezer Inspection ReportsДокумент4 страницыGitmo Freezer Inspection ReportsJudicial Watch, Inc.Оценок пока нет

- Gitmo Water Test ReportДокумент2 страницыGitmo Water Test ReportJudicial Watch, Inc.Оценок пока нет

- Visitor Tent DescriptionДокумент3 страницыVisitor Tent DescriptionJudicial Watch, Inc.Оценок пока нет

- July 2007 BulletinДокумент23 страницыJuly 2007 BulletinJudicial Watch, Inc.Оценок пока нет

- CVR LTR SouthCom Water Safety ProductionДокумент2 страницыCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Оценок пока нет

- SouthCom Water Safety ProductionДокумент30 страницSouthCom Water Safety ProductionJudicial Watch, Inc.Оценок пока нет

- Navy Water Safety ProductionДокумент114 страницNavy Water Safety ProductionJudicial Watch, Inc.Оценок пока нет

- JTF GTMO Water Safety App W ExhДокумент13 страницJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Оценок пока нет

- JW Cross Motion v. NavyДокумент10 страницJW Cross Motion v. NavyJudicial Watch, Inc.Оценок пока нет

- JTF GTMO Water Safety App W ExhДокумент13 страницJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Оценок пока нет

- Cover Letter To Requester Re Response Documents130715 - 305994Документ2 страницыCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.Оценок пока нет

- May 2007 BulletinДокумент7 страницMay 2007 BulletinJudicial Watch, Inc.Оценок пока нет

- CVR LTR SouthCom Water Safety ProductionДокумент2 страницыCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Оценок пока нет

- December 2005Документ7 страницDecember 2005Judicial Watch, Inc.Оценок пока нет

- Schoolboard PowerpointДокумент2 страницыSchoolboard PowerpointJudicial Watch, Inc.Оценок пока нет

- Model UNДокумент2 страницыModel UNJudicial Watch, Inc.Оценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- James D. ChristiansonДокумент21 страницаJames D. ChristiansonUn KnownОценок пока нет

- Partnership Agreement - Sample - Taxguru - inДокумент7 страницPartnership Agreement - Sample - Taxguru - inAbhinav BharadwajОценок пока нет

- Usaid Inception Report UpdatedДокумент18 страницUsaid Inception Report UpdatedFayyaz DeeОценок пока нет

- 4 ConsignmentДокумент57 страниц4 Consignmentayushi guptaОценок пока нет

- Chris HallДокумент15 страницChris HallNikki GrantОценок пока нет

- Mindanao Shopping Destination v. DuterteДокумент16 страницMindanao Shopping Destination v. DuterteDevilleres Eliza DenОценок пока нет

- Trademark and Patent Syllabus ACCДокумент11 страницTrademark and Patent Syllabus ACCjayОценок пока нет

- Order Rejecting Plaint - Nandu - 1165Документ24 страницыOrder Rejecting Plaint - Nandu - 1165tanish aminОценок пока нет

- No Nly .: Statement of Encumbrance On PropertyДокумент1 страницаNo Nly .: Statement of Encumbrance On PropertyRajesh KumarОценок пока нет

- Revision 2Документ7 страницRevision 2Maina JonnОценок пока нет

- List of Pagcor Licensed e Sabong OperatorsДокумент3 страницыList of Pagcor Licensed e Sabong OperatorsJedamin EbrahimОценок пока нет

- Rule 128 General Provisions: Page - 1Документ12 страницRule 128 General Provisions: Page - 1PLO COMVALОценок пока нет

- 13 SPOUSES TOH Vs SOLID BANK CORPORATIONДокумент22 страницы13 SPOUSES TOH Vs SOLID BANK CORPORATIONJem Cromwell S. GorospeОценок пока нет

- G.R. No. 226622Документ1 страницаG.R. No. 226622Kristina AlcalaОценок пока нет

- Chapter - 10 Bailment and Pledges 39627 765Документ62 страницыChapter - 10 Bailment and Pledges 39627 765AbidullahОценок пока нет

- Ra 544Документ6 страницRa 544Kate LacapОценок пока нет

- RFBT.3406 AMLA and BP 22 PDFДокумент10 страницRFBT.3406 AMLA and BP 22 PDFMonica GarciaОценок пока нет

- TÀI LIỆUДокумент166 страницTÀI LIỆUkhuyenОценок пока нет

- Qualified Theft CaseДокумент8 страницQualified Theft CaseJeevan SuccorОценок пока нет

- Brownies: Very, Very ChocolateДокумент5 страницBrownies: Very, Very ChocolateShahad Al-FailakawiОценок пока нет

- Cobbledick Layered Process Audits PDFДокумент22 страницыCobbledick Layered Process Audits PDFelyesОценок пока нет

- PRMB Circular No 08 2022 Regarding Final Date For Submission of Annual Contribution and Top Up SchemeДокумент5 страницPRMB Circular No 08 2022 Regarding Final Date For Submission of Annual Contribution and Top Up SchemeSayan duttaОценок пока нет

- The Killing of The Unicorn Dorothy Stratten, 1960-1980 (Bogdanovich, Peter)Документ207 страницThe Killing of The Unicorn Dorothy Stratten, 1960-1980 (Bogdanovich, Peter)alejandro_nnvОценок пока нет

- PNB Records Inspection Rights of Minority ShareholderДокумент9 страницPNB Records Inspection Rights of Minority ShareholderJM GuevarraОценок пока нет

- Legal Ethics - Sanctions and Jurisdiction IssuesДокумент5 страницLegal Ethics - Sanctions and Jurisdiction IssuesaverellabrasaldoОценок пока нет

- Girnar CaseДокумент6 страницGirnar CaseBidisha GhoshalОценок пока нет

- ERG Legal Advisory Committee Review and Assessment 21 March 2023Документ137 страницERG Legal Advisory Committee Review and Assessment 21 March 2023Guido Fawkes100% (1)

- Family Courts Act, 1984Документ20 страницFamily Courts Act, 1984Dishanka VernekarОценок пока нет

- Img - 20240120 - 0001 - New ' KiaДокумент9 страницImg - 20240120 - 0001 - New ' KiajosehoustontexasОценок пока нет

- Cheque PetitionДокумент7 страницCheque PetitionM. NAGA SHYAM KIRANОценок пока нет