Академический Документы

Профессиональный Документы

Культура Документы

MM DD YY MM DD YY: State of New Jersey Income Tax-Resident Return

Загружено:

Nirali ShahИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

MM DD YY MM DD YY: State of New Jersey Income Tax-Resident Return

Загружено:

Nirali ShahАвторское право:

Доступные форматы

NJ-1040

2010

STATE OF NEW JERSEY

INCOME TAX-RESIDENT RETURN

Place label on form if all preprinted

information is correct. Otherwise, print or

type your name and address.

5R

For Tax Year Jan.-Dec. 31, 2010, Or Other Tax Year Beginning ____________, 2010, Month Ending

, 20

IMPORTANT! YOU MUST ENTER YOUR SSN (s).

Fill in

if application for Federal extension is enclosed or enter confirmation #________.

Your Social Security Number

Last Name, First Name and Initial (Joint filers enter first name and initial of each - Enter spouse/CU partner last name

ONLY if different)

Home Address

(Number and Street, including apartment number or rural route)\

County/Municipality Code (See Table p. 51)

NJ RESIDENCY

STATUS

City, Town, Post Office

If you were a New Jersey resident for

ONLY part of the taxable year, give the

period of New Jersey residency:

M M

From

State

D D

(Fill in only one)

6. Regular

1.

Single

2.

Married/CU Couple, filing

joint return

3.

Married/CU Partner, filing separate

return. Enter Spouses/ CU Partners

Social Security Number in the

boxes above

4.

Head of household

5.

Qualifying widow(er)/

Surviving CU Partner

DEPENDENTS

13. Dependents Last Name,

First Name, Middle Initial

EXEMPTIONS

FILING STATUS

For Privacy Act Notification, See Instructions

Spouses/CU Partners Social Security Number

Y Y

c

d

Domestic

Partner

8. Blind or Disabled

Yourself

Spouse/CU Partner

10. Number of other dependents

........................................

Y Y

ENTER

NUMBERS

HERE

10

11. Dependents attending colleges ...........................

11

12. Totals (For Line 12a - Add Lines 6, 7, 8, and 11)

(For Line 12b - Add Lines 9 and 10) ..................

12a

12b

Fill in oval if dependent does

not have health insurance

including NJ FamilyCare/

Medicaid, Medicare, private

or other (see instructions)

Birth Year

Do you wish to designate $1 of your taxes for this fund?

If joint return, does your spouse/CU partner wish to designate $1?

Date

Spouses/CU Partners Signature (if filing jointly, BOTH must sign)

Yes

Yes

Date

________________________________________________________________________________________________________________________

If you do not need forms mailed to you next year, fill in (See instruction page 16) .............................................

I authorize the Division of Taxation to discuss my return and enclosures with my preparer (below) .........

Paid Preparers Signature

Federal Identification Number

Firms Name

Federal Employer Identification Number

9. Number of your qualified dependent children .......................

________________________________________________________________________________________________________________________

Spouse/CU Partner

Your Signature

D D

Yourself

Under the penalties of perjury, I declare that I have examined this income tax return, including accompanying schedules and statements,

and to the best of my knowledge and belief, it is true, correct, and complete. If prepared by a person other than taxpayer, this declaration is based on all information of which the preparer has any knowledge.

Division

Use

M M

7. Age 65 or Over

To

Spouse/

CU Partner

Yourself

Dependents Social Security Number

GUBERNATORIAL

ELECTIONS FUND

Zip Code

No

No

Note: if you fill in the Yes

oval(s), it will not increase your

tax or reduce your refund.

Pay amount on Line 55 in full.

Write Social Security number(s)

on check or money order and

make payable to:

STATE OF NEW JERSEY - TGI

Mail your check or money order

with your NJ-1040-V payment

voucher and your return to:

NJ Division of Taxation

Revenue Processing Center

PO Box 111

Trenton, NJ 08645-0111

IF REFUND:

NJ Division of Taxation

Revenue Processing Center

PO Box 555

Trenton, NJ 08647-0555

You may also pay by e-check or

credit card. For more information

go to:

www.state.nj.us/treasury/taxation

NJ-1040 (2010) Page 2

Name(s) as shown on Form NJ-1040

Your Social Security Number

14. Wages, salaries, tips, and other employee compensation (Enclose W-2)

Be sure to use State wages from Box 16 of your W-2(s). See Instructions ..........

14

15a. Taxable interest income (See instructions)

(Enclose Federal Schedule B if over $1,500)..........................................................

15a

15b. Tax-exempt interest income (See instructions)............ 15b

(Enclose Schedule) DO NOT include on Line 15a

16. Dividends ................................................................................................................

17. Net profits from business (Enclose copy of Federal Schedule C, Form 1040) .......

18. Net gains or income from disposition of property (Schedule B, Line 4) .................

19. Pensions, Annuities, and IRA Withdrawals (See instruction page 24) ....................

,

17

18

19

20

21. Net pro rata share of S Corporation Income (See instruction page 27)

(Enclose Schedule) .................................................................................................

22. Net gain or income from rents, royalties, patents & copyrights

(Schedule C, Line 3) ...............................................................................................

21

23. Net Gambling Winnings (See instruction page 27) ................................................

23

24. Alimony and separate maintenance payments received ........................................

24

25. Other (Enclose Schedule) (See instruction page 28) .............................................

25

26. Total Income (Add Lines 14, 15a, and 16 through 25) ................................................

26

27a

27b. Other Retirement Income Exclusion (See worksheet and instr. page 30) ....

27b

,

,

,

,

,

,

,

,

,

,

,

16

20. Distributive Share of Partnership Income (See instruction page 27)

(Enclose Schedule) .................................................................................................

27a. Pension Exclusion (See instruction page 28) ..............................................

,

,

22

27c

28

29

30

31

32

33. Health Enterprise Zone Deduction...........................................................................

33

34. Total Exemptions and Deductions (Add Lines 29, 30, 31, 32, and 33) ..................

34

36a. Total Property Taxes Paid (See instruction page 32) ..

36a

35

,

,

,

,

,

,

,

,

,

,

,

.

.

.

.

.

.

.

.

.

.

.

,

,

,

,

,

,

,

,

,

.

.

.

.

.

.

.

.

.

,

,

,

.

.

.

.

.

32. Qualified Conservation Contribution .......................................................................

35. Taxable Income (Subtract Line 34 from Line 28) If zero or less, MAKE NO ENTRY.

.

.

,

,

27c. Total Exclusion Amount (Add Line 27a and Line 27b)...............................................

28. New Jersey Gross Income (Subtract Line 27c from Line 26) ..............................

See instruction page 30.

29. Total Exemption Amount (See instruction page 30 to calculate amount) ................

(Part-Year Residents see instruction page 9)

30. Medical Expenses....................................................................................................

(See Worksheet and instruction page 31)

31. Alimony and Separate Maintenance Payments ......................................................

,

,

36b. Fill in oval if you were a New Jersey homeowner on October 1, 2010.

36c. Property Tax Deduction (See instruction page 35) .................................................

37. NEW JERSEY TAXABLE INCOME (Subtract Line 36c from Line 35)

If zero or less, MAKE NO ENTRY. ..........................................................................

36c

37

38. TAX (From Tax Table, page 53) ..............................................................................

CONTINUE TO PAGE 3

38

NJ-1040 (2010) Page 3

Name(s) as shown on Form NJ-1040

39.

40.

Your Social Security Number

TAX (From Line 38, page 2) ................................................................................................

Credit For Income Taxes Paid to Other Jurisdictions

Enter other jurisdiction code (See instructions).....................................

,

,

,

,

,

,

,

,

,

,

,

.

.

.

.

.

.

.

.

.

.

.

.

,

,

,

,

,

,

,

.

.

.

.

.

,

,

,

,

.

.

.

.

.

.

.

.

.

.

39

40

41.

Balance of Tax (Subtract Line 40 from Line 39) ......................................................

41

42.

Sheltered Workshop Tax Credit ...........................................................................................

42

43.

Balance of Tax after Credit (Subtract Line 42 from Line 41) ...............................................

43

44.

Use Tax Due on Out-of-State Purchases (See instruction page 38)

If no Use Tax, enter ZERO (0.00). ......................................................................................

44

,

,

,

,

,

,

,

45.

Penalty for Underpayment of Estimated Tax. ......................................................................

Fill in

if Form NJ-2210 is enclosed.

45

46.

Total Tax and Penalty (Add Lines 43, 44, and 45) ...........................................................

46

47.

Total New Jersey Income Tax Withheld (From enclosed Forms W-2 and 1099) ...........

47

48.

Property Tax Credit (See instruction page 35) ....................................................................

49.

New Jersey Estimated Tax Payments/Credit from 2009 tax return ....................................

50.

New Jersey Earned Income Tax Credit (See instruction page 40) .....................................

Fill in

Fill in oval if you had the IRS figure your Federal Earned Income Credit

only one

Fill in oval if you are a CU couple claiming the NJ Earned Income Tax Credit

50

51.

EXCESS New Jersey UI/WF/SWF Withheld (See instr. page 40) (Enclose Form NJ-2450) ..........

51

52.

EXCESS New Jersey Disability Insurance Withheld (See instr. page 40) ..........................

(Enclose Form NJ-2450)

52

53.

EXCESS New Jersey Family Leave Insurance Withheld (see instr. page 40) Enclose Form NJ-2450)

54.

Total Payments/Credits (Add Lines 47 through 53) .........................................................

55.

If Line 54 is LESS THAN Line 46, enter AMOUNT YOU OWE............................................

55

Fill in

if paying by e-check or credit card.

If you owe tax, you may make a donation by entering an amount on Lines 58, 59, 60, 61, 62 and/or 63 and adding this to your payment amount.

56.

If Line 54 is MORE THAN Line 46, enter OVERPAYMENT ................................................

Deductions from Overpayment on Line 56 which you elect to credit to:

Your 2011 tax ......................................................................................................................

57.

58.

59.

60.

61.

62.

N.J. Endangered

Wildlife Fund ........................

N.J. Childrens Trust Fund

To Prevent Child Abuse .......

N.J. Vietnam Veterans

Memorial Fund .....................

N.J. Breast Cancer

Research Fund ....................

U.S.S. New Jersey

Educational Museum Fund ...

h $10 h $20

h Other

h $10 h $20

h Other

h $10 h $20

h Other

48

49

54

56

57

53

58

ENTER

AMOUNT

59

OF

60

CONTRIBUTION

h $10 h $20

h Other

61

h $10 h $20

h Other

62

h $10 h $20

h Other

63

63.

Other Designated Contribution .............................

See instruction page 41

64.

Total Deductions from Overpayment (Add Lines 57 through 63) .......................................

64

65.

REFUND (Amount to be sent to you. Subtract Line 64 from Line 56) ....................................

65

SIGN YOUR RETURN ON PAGE 1

,

,

,

,

Вам также может понравиться

- Foreign Earned Income: 34 For Use by U.S. Citizens and Resident Aliens OnlyДокумент3 страницыForeign Earned Income: 34 For Use by U.S. Citizens and Resident Aliens OnlyballsinhandОценок пока нет

- 1040x2 PDFДокумент2 страницы1040x2 PDFolddiggerОценок пока нет

- You Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryОт EverandYou Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryОценок пока нет

- Ve'H (O5.U H + Q ": Frlitf (TFF Califi ,,'R? Q L (O?OДокумент1 страницаVe'H (O5.U H + Q ": Frlitf (TFF Califi ,,'R? Q L (O?OMatthew Robert QuinnОценок пока нет

- Middle East and North Africa Economic Developments and Prospects, October 2013: Investing in Turbolent TimesОт EverandMiddle East and North Africa Economic Developments and Prospects, October 2013: Investing in Turbolent TimesОценок пока нет

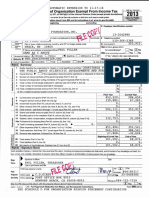

- SCC Irs Form 990 2013Документ27 страницSCC Irs Form 990 2013L. A. PatersonОценок пока нет

- p4012 (2018)Документ349 страницp4012 (2018)Center for Economic ProgressОценок пока нет

- Disclaimer - : This Spreadsheet Is FreeДокумент218 страницDisclaimer - : This Spreadsheet Is FreePaul BischoffОценок пока нет

- 2020 W-4 FormДокумент4 страницы2020 W-4 FormFOX Business100% (8)

- 1098 STATEMENT YE098 900961 01 197: Annual Tax and Interest Statement 1098 - 2020Документ6 страниц1098 STATEMENT YE098 900961 01 197: Annual Tax and Interest Statement 1098 - 2020Mike TerrellОценок пока нет

- BNI 1120 ReturnДокумент5 страницBNI 1120 ReturndishaakariaОценок пока нет

- Project Homeless Connect 2012 990Документ14 страницProject Homeless Connect 2012 990auweia1Оценок пока нет

- U.S. Individual Income Tax Return: Filing StatusДокумент2 страницыU.S. Individual Income Tax Return: Filing StatusRobert M Hamil.Оценок пока нет

- Instructions For Form 1120Документ31 страницаInstructions For Form 1120A.F. GRANADAОценок пока нет

- File 1099 OnlineДокумент2 страницыFile 1099 OnlineMunirah Bomani ElОценок пока нет

- Maverick Tax Express 941 W Pioneer Pkwy ARLINGTON, TX 76013-6369 817-261-6287Документ19 страницMaverick Tax Express 941 W Pioneer Pkwy ARLINGTON, TX 76013-6369 817-261-6287Vignesh EswaranОценок пока нет

- W-9 Tax FormДокумент4 страницыW-9 Tax FormMika DjokaОценок пока нет

- Robinhood Securities LLC: Tax Information Account 161786165Документ8 страницRobinhood Securities LLC: Tax Information Account 161786165Matthew Stacy0% (1)

- 21 - 1040 (Forecast)Документ153 страницы21 - 1040 (Forecast)cjОценок пока нет

- FD-Schedule C-Profit or Loss From Business (Sole Prop)Документ2 страницыFD-Schedule C-Profit or Loss From Business (Sole Prop)Anthony Juice Gaston BeyОценок пока нет

- Direct Deposit Sign-Up Form (Philippines)Документ3 страницыDirect Deposit Sign-Up Form (Philippines)Noeh PiedadОценок пока нет

- CT W4Документ2 страницыCT W4Alejandro ArredondoОценок пока нет

- Deed in LieuДокумент33 страницыDeed in LieuSteven WhitfordОценок пока нет

- 8850 Wotc Tax FormДокумент2 страницы8850 Wotc Tax Formapi-127186411Оценок пока нет

- Diondre Winstead IndictmentДокумент6 страницDiondre Winstead IndictmentWKRCОценок пока нет

- 70 Kevin Lin PDFДокумент8 страниц70 Kevin Lin PDFKenneth LinОценок пока нет

- Miscellaneous Income: US - 2019 - 1099MISC - 1003104696 - 0Документ2 страницыMiscellaneous Income: US - 2019 - 1099MISC - 1003104696 - 0Mark JamesОценок пока нет

- F 1099 MSCДокумент8 страницF 1099 MSCVenkatapavan SinagamОценок пока нет

- IRS E-File Signature AuthorizationДокумент2 страницыIRS E-File Signature AuthorizationKatia AlvezОценок пока нет

- Drivewealth, LLC 97 Main ST 2Nd Floor CHATHAM, NJ 07928: For Your Investing Account With Cash App Investing LLCДокумент8 страницDrivewealth, LLC 97 Main ST 2Nd Floor CHATHAM, NJ 07928: For Your Investing Account With Cash App Investing LLCAdib RashidОценок пока нет

- Schedule 1 For 2019 Form 1040Документ1 страницаSchedule 1 For 2019 Form 1040CNBC.comОценок пока нет

- Donors Trust 2019 990Документ113 страницDonors Trust 2019 990jpeppardОценок пока нет

- UP Holder Reporting ManualДокумент22 страницыUP Holder Reporting ManualJay SingletonОценок пока нет

- Liberty University's 990 Income Tax FormДокумент111 страницLiberty University's 990 Income Tax FormWSETОценок пока нет

- I 843Документ6 страницI 843ayi imaduddinОценок пока нет

- Benfitsform Starbucks BeanstockДокумент1 страницаBenfitsform Starbucks BeanstockAndrew Christopher CaseОценок пока нет

- Irs 941 2011Документ4 страницыIrs 941 2011Wayne Schulz100% (1)

- GKEDC Form 990 Page 1 For 2013 Through 2019Документ7 страницGKEDC Form 990 Page 1 For 2013 Through 2019Don MooreОценок пока нет

- 2016 - Tax ReturnДокумент37 страниц2016 - Tax Returncara harrisОценок пока нет

- Cor Clearing LLC The Landmark Center 1299 Farnam Street SUITE 800 OMAHA, NE 68102Документ10 страницCor Clearing LLC The Landmark Center 1299 Farnam Street SUITE 800 OMAHA, NE 68102luisОценок пока нет

- 2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - RecordsДокумент42 страницы2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - Recordsellen guthrie100% (1)

- 2018-09-06 DOC Re Statement of Information (DSJ Real Estate Holdings, LLC)Документ2 страницы2018-09-06 DOC Re Statement of Information (DSJ Real Estate Holdings, LLC)Doo Soo KimОценок пока нет

- Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign GiftsДокумент1 страницаAnnual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign GiftsCarolina AldanaОценок пока нет

- Reporting Agent Authorization: Sign HereДокумент1 страницаReporting Agent Authorization: Sign HereSam OziegbeОценок пока нет

- Form 8822 (Rev. October 2015)Документ2 страницыForm 8822 (Rev. October 2015)tiffany jeffcoatОценок пока нет

- Preview OR File Copy: Employer's QUARTERLY Federal Tax ReturnДокумент3 страницыPreview OR File Copy: Employer's QUARTERLY Federal Tax Returntravis_prince_2100% (1)

- 2009 Hotrum G Form 1040 Individual Tax Return - Tax2009Документ15 страниц2009 Hotrum G Form 1040 Individual Tax Return - Tax2009jakeОценок пока нет

- SFF IRS Form990 2013Документ27 страницSFF IRS Form990 2013Space Frontier FoundationОценок пока нет

- US TaxRefunds Short NewJerseyДокумент11 страницUS TaxRefunds Short NewJerseyKeziah Cyra PapasОценок пока нет

- 5 XVFPSVKДокумент1 страница5 XVFPSVKIrma AsaroОценок пока нет

- Sheila McCorriston WithdrawalДокумент14 страницSheila McCorriston WithdrawalAnonymous BmFjIMShq9100% (1)

- Ledger Byte Repair Service: Accounts No 1101.001 Account CashДокумент13 страницLedger Byte Repair Service: Accounts No 1101.001 Account CashSania M. JayantiОценок пока нет

- Fall 2023 - Tax ProjectДокумент4 страницыFall 2023 - Tax Projectacwriters123Оценок пока нет

- E TradeДокумент6 страницE TradeImran AzizОценок пока нет

- F1040es 2020Документ12 страницF1040es 2020Job SchwartzОценок пока нет

- Robinhood Securities LLC: Tax Information Account 667446561Документ6 страницRobinhood Securities LLC: Tax Information Account 667446561Allen PrasadОценок пока нет

- 1040 ArmstrongДокумент2 страницы1040 Armstrongapi-458373647Оценок пока нет

- Santos Return PDFДокумент14 страницSantos Return PDFMark Long75% (4)

- RwservletДокумент3 страницыRwservletNick ReismanОценок пока нет

- How To Live Without Social Security NumberДокумент227 страницHow To Live Without Social Security NumberCarolОценок пока нет

- Shahzad Haider: Declaration Acknowledgement SlipДокумент2 страницыShahzad Haider: Declaration Acknowledgement SlipShehzad HaiderОценок пока нет

- RatingДокумент34 страницыRatingRaj YadavОценок пока нет

- IRS Small Business Tax Guide 2018Документ54 страницыIRS Small Business Tax Guide 2018Duane BlakeОценок пока нет

- Important Information About Form 1099-G: D D Flaumenbaum 2481 Haff Ave North Bellmore Ny 11710-2735Документ1 страницаImportant Information About Form 1099-G: D D Flaumenbaum 2481 Haff Ave North Bellmore Ny 11710-2735ddouglasf2357Оценок пока нет

- US50Документ12 страницUS50aalentОценок пока нет

- 2012 Top CompanyДокумент3 страницы2012 Top CompanyDavid GemmeОценок пока нет

- Track Time 24Документ1 страницаTrack Time 24Jean Carlos Escurra LagosОценок пока нет

- Filename PDFДокумент3 страницыFilename PDFIvette PizarroОценок пока нет

- Sarbanes-Oxley Act of 2002Документ26 страницSarbanes-Oxley Act of 2002Bagus SetyoОценок пока нет

- 21st Century Skills For 21st Century JobsДокумент49 страниц21st Century Skills For 21st Century JobsUma SharmaОценок пока нет

- US Internal Revenue Service: I1099ltc 07Документ2 страницыUS Internal Revenue Service: I1099ltc 07IRSОценок пока нет

- XAT Essay Writing TipsДокумент17 страницXAT Essay Writing TipsShameer PhyОценок пока нет

- Dustincates2021 TaxesДокумент15 страницDustincates2021 TaxesIllest Alive20650% (2)

- Gov. Rick Perry 2007 TaxesДокумент60 страницGov. Rick Perry 2007 TaxesHouston ChronicleОценок пока нет

- 05 Social Security How Work Affects Your Benefits En-05-10069Документ10 страниц05 Social Security How Work Affects Your Benefits En-05-10069api-309082881Оценок пока нет

- Adeyinka Oluwafunsho (134) $693.5 Thu Sep 03 11 48 00 EDT 2020 PDFДокумент1 страницаAdeyinka Oluwafunsho (134) $693.5 Thu Sep 03 11 48 00 EDT 2020 PDFGrace AdeyinkaОценок пока нет

- Frequently Asked Questions: US Rotary Clubs and The IRSДокумент3 страницыFrequently Asked Questions: US Rotary Clubs and The IRSDavid Jhan CalderonОценок пока нет

- W2 Matthew RussellДокумент2 страницыW2 Matthew Russellmatthewrussell661Оценок пока нет

- Appendix 24 - Qrror - Far 5Документ1 страницаAppendix 24 - Qrror - Far 5Mark Joseph BajaОценок пока нет

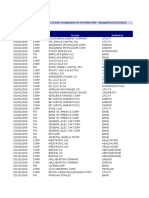

- Issue Date Issue Type Issuer Industry: US$ Bond Issues From High Grade Companies in US (Mar-09) - (Hypothetical Data)Документ10 страницIssue Date Issue Type Issuer Industry: US$ Bond Issues From High Grade Companies in US (Mar-09) - (Hypothetical Data)ayush jainОценок пока нет

- Paul W. Rhode, Gianni Toniolo-The Global Economy in The 1990s - A Long-Run Perspective-Cambridge University Press (2006) PDFДокумент335 страницPaul W. Rhode, Gianni Toniolo-The Global Economy in The 1990s - A Long-Run Perspective-Cambridge University Press (2006) PDFАрсен ТирчикОценок пока нет

- ENTIRE Fall 2016 Symposium Slide ShowДокумент102 страницыENTIRE Fall 2016 Symposium Slide ShowLydia DePillisОценок пока нет

- Downloadfile 30 PDFДокумент114 страницDownloadfile 30 PDFYianniAnd Sophia0% (1)

- Raw Customer Churn DataДокумент21 страницаRaw Customer Churn DataMahnoor KhanОценок пока нет

- IL-1040 InstructionsДокумент16 страницIL-1040 InstructionsRushmoreОценок пока нет

- Agent List MLSДокумент360 страницAgent List MLSaaa dddОценок пока нет

- F 1040 VДокумент2 страницыF 1040 VNotarys To Go0% (1)

- Charles SchwabДокумент45 страницCharles SchwabThe Washington PostОценок пока нет