Академический Документы

Профессиональный Документы

Культура Документы

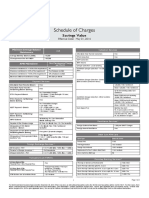

Mauritius Commercial Bank Corporates Rates

Загружено:

Gilbert KoopoosamychettyИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Mauritius Commercial Bank Corporates Rates

Загружено:

Gilbert KoopoosamychettyАвторское право:

Доступные форматы

Account Access Services

Internet Banking

4Monthly subscription fee 4Security Token - First acquisition/ replaced device Rs 100 per company, irrespective of the number of signatories Rs 500 per device

Accounts

Current Account Regular

4Minimum account opening balance 4Minimum credit balance to earn interest 4Service fee 4Debit interest on unauthorised overdrawn balances 4Statement fee on daily/ weekly/ twice monthly/ monthly/ quarterly issuance of paper statements of account [June & December issuance free of charge] Rs 10,000 No interest payable Rs 35 + VAT per month 5% above rate applicable to the overdraft/ account category of customer Rs 15 per issuance

Foreign Currency Account

1,000 EUR/ USD/ AUD 500 GBP/ 1,500 CHF/ 3,000 ZAR 4Minimum credit balance to earn interest 2,000 EUR/ GBP/ USD 7,500 AUD/ CHF 20,000 ZAR 10 USD + VAT quarterly 4Service fee Rates and other fees & charges applicable to Foreign Currency Account are available at our counters. 4Minimum account opening balance

Deposit Account in local currency

4Minimum deposit amount Rs 50,000 [3-month deposits: Minimum Rs 100,000] Interest forfeited

4Deposit withdrawn before maturity within 3 months 4Deposit withdrawn before maturity after 3 months: A penalty rate of 1% p.a. applicable to the redeemed capital Interest payable: -If pre-terminated between 3 and 12 months from date of deposit: Savings rate will apply over the period actually covered by the deposit -If pre-terminated after 12 months from date of deposit: the interest rate applicable will be that of the preceding term. Amount of interest payable will be computed from the deposit date to the pre-terminated date and adjusted accordingly. Rates and other fees & charges applicable to Deposit Account are available at our counters.

Deposit Account in foreign currency

4Minimum deposit amount 4Deposit withdrawn before maturity 5,000 GBP/ USD/ EUR 10,000 AUD/ 50,000 ZAR Penalty rate of 1.5% p.a. charged on the amount being redeemed over the period between the date of pre-termination and the date of maturity of the deposit

Rates and other fees & charges applicable to Deposit Account are available at our counters.

Accounts Transactions or Services

Local Funds Transfer | Internal Transfer

At Counter On Internet Banking 4For credit to a MCB account pertaining to the same customer Rs 15 Free 4For credit to a MCB account not pertaining to the same customer Rs 15 Free Note: Other fees and charges apply in case of debit of a Foreign Currency Account and are available at our counters.

Local Funds Transfer | Domestic Transfer

At Counter On Internet Banking 4For credit to another local bank account through MACSS Rs 100 Rs 75 Note: Other fees and charges apply in case of debit of a Foreign Currency Account and are available at our counters.

International Funds Transfer

4Through SWIFT Rs 325 + overseas bank charges where applicable Note: Other fees and charges apply in case of debit of a Foreign Currency Account and are available at our counters.

Standing Instruction

Rs 6 4Credited to a MCB account 4Credited to another local bank account Rs 25 4Unpaid Standing Instruction Rs 100 Note: An additional postage charge may be claimed in case a payment is made under a standing order direct by the bank to a beneficiary resident outside Mauritius

Direct Debit

4Per direct debit 4Unpaid Direct Debit Rs 6 Rs 100

Credit Card

Set up Fee

4MasterCard/ VISA Corporate 4MasterCard/ VISA Business Free Rs 1,500 + VAT

Annual Fee

4MasterCard/ VISA Corporate 4MasterCard/ VISA Business Rs 1,200 + VAT per card Rs 200 + VAT per card

Cash Advance Fee

4MasterCard/ VISA Corporate 4MasterCard/ VISA Business 2% of amount withdrawn, minimum Rs 50 2% of amount withdrawn, minimum Rs 50

Card Replacement Fee

Rs 500 + VAT 4MasterCard/ VISA Corporate Rs 100 + VAT 4MasterCard/ VISA Business Rs 200 + VAT 4Fleetman Note: Emergency card fee, in case replaced card needs to be delivered urgently abroad, is Rs 2,000 + VAT

Overlimit Fee

4MasterCard/ VISA Corporate 4MasterCard/ VISA Business Rs 150 Rs 150

Late Payment Fee

4MasterCard/ VISA Corporate 4MasterCard/ VISA Business Rs 150 Rs 150

Administrative Fee

4Fleetman Rs 75 monthly

Interest Rates

4MCB Prime Lending Rate (PLR) 4MasterCard/ VISA Corporate 4MasterCard/ VISA Business 4Fleetman 8.0% per annum PLR + 7% per annum PLR + 7% per annum 16.75% per annum

Other fees & charges applicable to credit cards are available at our counters.

Reports & Guarantees

Confidential Reports

4Auditors Report 4Testimonial for educational/ medical purpose 4Testimonial for travel purpose - for local residents 4Testimonial for travel purpose - for foreigners 4Letter of reference - For specified amount 4Letter of reference - For unspecified amount 4Clearance certificate For recurrent service: Rs 400 For ad hoc/ outside date request: Rs 800 For the first copy: Rs 100 For each additional copy: Rs 25 For the first copy: Rs 300 For each additional copy: Rs 100 For the first copy: 20 USD For each additional copy: 5 USD 0.05%, minimum Rs 1,000/ maximum Rs 15,000 Rs 1,000 Rs 300

Guarantees

4Performance bonds -For first Rs 5 million: 1.5% p.a. -For any amount above Rs 5 million: 1.0% p.a., minimum Rs 1,500 -For first 180 days: 1.0% p.a., minimum Rs 750 -For each additional period of 90 days or part: 0.25% p.a., minimum Rs 750 -For the first two months: Rs 800 -For each additional period of one month or part: Rs 300 1.0% p.a., minimum Rs 1,500 2.0% p.a., minimum Rs 1,000 1.0% p.a., minimum Rs 1,500 2.0% p.a., minimum Rs 1,500 Rs 500 Rs 1,000

4Tender bonds

4Shipping bonds

4Guarantees to the Customs & covering payment of cheques 4'Aval' of negotiable instruments 4Advance payment bonds/ Retention money bonds 4Guarantees in favour of Corporate/ Government bodies for disbursement of loans/ banking facilities 4Amendment fee 4Cancellation fee

Financing

Lending Rates

8.0% per annum 4MCB Prime Lending Rate (PLR) Interest rates vary according to the sector of activity of customer. More details are available at our counters.

Processing Fee

4Banking facility 4Renewal of facility 4Temporary overdraft facility 4Import loan 4Extension of import loan before maturity 4Extension of import loan after maturity 1% of facility amount or as per loan contract 0.50% of facility amount, minimum Rs 500/ maximum Rs 3,000 Rs 500 Rs 500 Rs 250 Rs 1,000

Prepayment Option Fee

0.75% of facility amount 4Prepayment option fee Note: Prepayment option fee is not applicable for loans falling under the Borrowers' Protection Act

Loan Commitment Fee

4Commitment fee 1% of any undrawn balance as at 3 months after date of letter of conditions + 1% per annum for any subsequent periof of 12 months

Early Repayment Fee

4Early repayment fee:

Interest on the amount paid in advance at the rate applicable to the loan from date the advance payment is made to the agreed date/s of repayment LESS interest on the amount paid in advance at the prevailing rate for fixed deposits for the same period/s as above or as per loan contract.

Note: Early repayment fee is not applicable for loans falling under the Borrowers' Protection Act or in case the prepayment option fee has been paid upfront

Amendment/ Cancellation Fee

4Amendment/ cancellation fee Rs 300

Valuation Survey & Report Fee

4Valuation survey & report fee 0.5% of loan amount, minimum Rs 1,000/ maximum Rs 5,000 Note: Fee is not applicable in case of banking facilities of Rs 50,000 or less and at renewal of a credit facility

Site Inspection Fee

4Site inspection fee Rs 500 per site visit

Legal & Administration Fees

4Pari-Passu documents 4'Cession de Priorit' 4Erasure of charges ('Radiation') 4Part erasure of charges ('Dgrvement') 4Fixed/ Floating charges & Gage sans deplacement Rs 500 Rs 500 Rs 50 Rs 500 Rs 100

Other rates, fees & charges applicable to credit facilities are available at our counters.

Trade Finance

Import Transactions

Documentary Credits 4Opening/ Extension commission 4Transmission cost on L/C opening 4Amendment commission 4Negotiation commission 4Acceptance commission 4Insurance fee (warehousing of goods by the bank) 4Administrative fee (warehousing of goods by the bank) 4Processing fee Foreign Bills on Collection 4Payment commission 4Acceptance & payment commission 4Commission for documents to be delivered 'franco' 4Insurance fee (warehousing of goods by the bank) 4Conversion of D/P Tenor to D/A Tenor or extension of payment 4Handling fee on unpaid bill 4Administrative fee (warehousing of goods by the bank) 4Processing fee 4Endorsement (Aval) comission 4Protest fee Local Bills -First six months: 0.5%, min. Rs 1,500 -Each additional quarter: 0.25%, min. Rs 500 Rs 500 Rs 500 + Rs 175 transmission cost 0.25%, min. Rs 500 0.125% per month or part thereof on supplier's credit period, min. Rs 500 0.125% per month or part thereof, min. Rs 150 Rs 150 for each period of 30 days or part thereof Rs 250

0.5%, min. Rs 1,000 + transmission cost of Rs 175 per message 0.50%, min. Rs 1,000 + transmission cost 0.50%, min. Rs 1,000 0.125% per month or part thereof, min. Rs 150 0.50%, min. Rs 1,000 Rs 500 per fortnight Rs 150 for each period of 30 days or part thereof Rs 250 2% p.a., min. Rs 1,000 200 USD or equivalent

4Collection fee 4Endorsement (Aval) comission

0.50%, min. Rs 500 2% p.a., min. Rs 1,000

Other rates, fees & charges applicable on import transactions are available at our counters.

Export Transactions

Letter of Credit 4Pre-advice fee 4Advising commission 4Amendment commission 4Confirmation commission 4Transfer fee Rs 400 Rs 400 Rs 400 (+ transmission charges in case of foreign transfer) As per agency arrangement, min. Rs 500 -Beneficiary in Mauritius: 0.25%, min. Rs 1,000 -Beneficiary outside Mauritius: 0.25%, min. Rs 1,000 + transmission charges Rs 500 Rs 1,000 Rs 1,000

4Unutilised fee 4Cancellation fee Negotiation under Letter of Credit 4Negotiation commission on bills in local currency 4Negotiation commission on bills in foreign currency 4Local fee 4Handling fee 4SWIFT 4Postage Collections 4Negotiation commission on bills in local currency 4Negotiation commission on bills in foreign currency 4Local fee 4Handling fee 4SWIFT 4Postage Discounted Local Bills 4Processing fee Acceptance Financing 4Processing fee (foreign customers)

0.5%, min. Rs 500 + handling fee 0.125%, min. Rs 500 + handling fee Rs 250 Rs 500 Rs 175 As per courier charges

0.5%, min. Rs 500 0.125%, min. Rs 500 Rs 250 Rs 500 Rs 175 As per courier charges

Rs 500

0.05%, min. 50 USD/ max. 100 USD

Other rates, fees & charges applicable on export transactions are available at our counters.

Other Services

Cheque

4Cost of cheque books (standard cheque) 4Stop cheque request 4Cheque returned/ Dishonoured cheque 4Special presentation of cheques (minimum amount of Rs 200,000) Rs 5 per sheet Rs 100 per request, irrespective of number of cheques stopped Rs 250 per cheque -To other local banks: Rs 100 per cheque -From other local banks: Rs 150 per cheque

Office Cheque/ Bank Draft/ Travellers' Cheque

4Issue of bank cheque - By debit of account or paid by MCB cheque 4Issue of bank cheque - Paid by cash 4Issue of bank draft - By debit of account or paid by MCB cheque 4Issue of bank draft - Paid by cash 4Issue of AMEX Traveller's Cheque 4Deposit of drafts & Miscellaneaous Remittances Abroad Rs 150 Rs 200 Rs 200 Rs 300 2.50% Rs 150

Rs 5 per item, minimum Rs 50 per transaction 4Purchase of Traveller's Cheque Note: Other fees and charges apply in case of debit/ credit of a Foreign Currency Account and are available at our counters.

Safe Deposit Lockers

4Annual rental fee -Type A: Rs 1,200 + VAT -Type B: Rs 1,800 + VAT -Type C: Rs 2,500 + VAT -Type D: Rs 4,000 + VAT -Type E: Rs 800 + VAT

Night Safe

4Annual rental fee -First wallet: Rs 150 -On each additional wallet up to 3: Rs 100 -On each additional wallet in excess of 4: Rs 150

Copies, photocopies & Duplicate Printouts

4Interest tax certificate 4Statement of account or other documents Rs 15 per copy -Electronic archives: Rs 15 + Rs 5 per sheet -Manual archives: Rs 100 + Rs 5 per sheet

Payroll

4Through electronic list processing 4Through Internet Banking (Bulk Payment) Re 1 per item + Rs 500 monthly Re 1 per item [Payments to other local banks through MACSS are charged Rs 75 per credit item]

Disclaimer The MCB Rates and Fees shall apply to the products and services provided by the Mauritius Commercial Bank Ltd ('the Bank') as from the 30th November 2011. The Bank may, from time to time, amend, add or substitute its interests, fees, charges, commissions and accessories or any one or more of them. Such amendments shall be duly communicated to its customers by way of notices in all Bank's branches and on its website www.mcb.mu For more information on the MCB Rates and Fees, please do contact us on 202 6060.

Вам также может понравиться

- Simplified Nri Savings Account Tarrif Structure W.E.F April 01, 2014Документ5 страницSimplified Nri Savings Account Tarrif Structure W.E.F April 01, 2014gaddipati_ramuОценок пока нет

- RBI SBI Demand Draft Exchange RatesДокумент11 страницRBI SBI Demand Draft Exchange RatesJithin VijayanОценок пока нет

- Savings Accounts: Non Resident External Savings Account (NRE) Non Resident Ordinary Savings Account (NRO)Документ15 страницSavings Accounts: Non Resident External Savings Account (NRE) Non Resident Ordinary Savings Account (NRO)Jennifer AguilarОценок пока нет

- Regular Saving AccountДокумент92 страницыRegular Saving AccountSimu MatharuОценок пока нет

- Account Tariff Structure Basic Savings AccountДокумент1 страницаAccount Tariff Structure Basic Savings Accountgaddipati_ramuОценок пока нет

- Schedule of Fees and Charges August 17 2012Документ8 страницSchedule of Fees and Charges August 17 2012nayanghimireОценок пока нет

- Senior Citizen Saving Account: As A Senior Citizen, You Can Enjoy A Host of Benefits On Your AccountДокумент13 страницSenior Citizen Saving Account: As A Senior Citizen, You Can Enjoy A Host of Benefits On Your AccountRohan MohantyОценок пока нет

- No Frill EnglishДокумент2 страницыNo Frill EnglishRupali WaliaОценок пока нет

- Schedule of Charges Deutsche Bank 4Документ3 страницыSchedule of Charges Deutsche Bank 4Sayantika MondalОценок пока нет

- Schedule of Charges Deutsche Bank 3Документ3 страницыSchedule of Charges Deutsche Bank 3Sayantika MondalОценок пока нет

- Monthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Документ2 страницыMonthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Shoaib MohammedОценок пока нет

- Schedule of Charges: Savings ValueДокумент2 страницыSchedule of Charges: Savings ValueNavjot SinghОценок пока нет

- Particulars Sanman Savings Bank Account Standard Charges (RS.)Документ2 страницыParticulars Sanman Savings Bank Account Standard Charges (RS.)Bella BishaОценок пока нет

- Ready Line SOC Jan June 2024Документ1 страницаReady Line SOC Jan June 2024umarОценок пока нет

- Rca SocДокумент3 страницыRca SocKrishna Kiran VyasОценок пока нет

- Account Access Services: Internet BankingДокумент7 страницAccount Access Services: Internet BankingUmair RNОценок пока нет

- "Being Me" Savings Account: W.E.F. 1st April 2014Документ2 страницы"Being Me" Savings Account: W.E.F. 1st April 2014praveenpersonelОценок пока нет

- Notification FinalДокумент4 страницыNotification FinalBrahmanand DasreОценок пока нет

- United Bank of India Annex-Iii AS ON 01.06.2014 Deposit AccountsДокумент5 страницUnited Bank of India Annex-Iii AS ON 01.06.2014 Deposit Accountsbisas_rishiОценок пока нет

- Important TNCДокумент20 страницImportant TNCsanthoshsk3072002Оценок пока нет

- ICICI Bank Current Account ChargesДокумент3 страницыICICI Bank Current Account Chargesashishtiwari92100% (1)

- Yes Bank Smart SalaryДокумент2 страницыYes Bank Smart SalaryVicky SinghОценок пока нет

- Personal Banking Personal Banking Personal BankingДокумент1 страницаPersonal Banking Personal Banking Personal BankingSaravanan ParamasivamОценок пока нет

- AccountingДокумент7 страницAccountingalestingyoОценок пока нет

- Chapter 1 IntroДокумент10 страницChapter 1 IntrosanyakathuriaОценок пока нет

- Schedule of ChargesДокумент14 страницSchedule of ChargeskrishmasethiОценок пока нет

- New Schedule of Charges - Value Based Current Accounts - 15 Dec 2012Документ2 страницыNew Schedule of Charges - Value Based Current Accounts - 15 Dec 2012anon_948025741Оценок пока нет

- Crown Salary Account 01042014Документ2 страницыCrown Salary Account 01042014Vikram IsgodОценок пока нет

- Sabka Basic Savings Account Complete KYC 10-10-2013Документ2 страницыSabka Basic Savings Account Complete KYC 10-10-2013Nikhil Raj SharmaОценок пока нет

- Service Charges and FeesДокумент10 страницService Charges and FeesBella BishaОценок пока нет

- Sosc Ver 210313Документ3 страницыSosc Ver 210313Shashank AgarwalОценок пока нет

- Annex 2 Super Savings AccountДокумент2 страницыAnnex 2 Super Savings AccountPhani BhupathirajuОценок пока нет

- Credit Card OptionДокумент8 страницCredit Card OptionAlfred LacandulaОценок пока нет

- July 2013: Current, Call and Savings AccountsДокумент1 страницаJuly 2013: Current, Call and Savings AccountsBala MОценок пока нет

- Fees and Charges For Debit CardДокумент2 страницыFees and Charges For Debit CardAnandraojs JsОценок пока нет

- New Schedule of Charges For Current AccountДокумент2 страницыNew Schedule of Charges For Current AccountKishan DhootОценок пока нет

- Rationalization ServiceДокумент5 страницRationalization Servicesachin9984Оценок пока нет

- SUPERCARD Most Important Terms and Conditions (MITC)Документ14 страницSUPERCARD Most Important Terms and Conditions (MITC)Diwana Hai dilОценок пока нет

- Emirates NBD RatesДокумент1 страницаEmirates NBD Ratesmanish450inОценок пока нет

- HDB - Interest Rates and ChargesДокумент2 страницыHDB - Interest Rates and ChargesManish PandeyОценок пока нет

- Services ProvidedДокумент15 страницServices ProvidedParul AroraОценок пока нет

- September 2014: Current, Call and Savings AccountsДокумент1 страницаSeptember 2014: Current, Call and Savings AccountsAseForkliftRepairingОценок пока нет

- Standard Fee and Charges GIBL Nov 18 20191Документ10 страницStandard Fee and Charges GIBL Nov 18 20191aashish koiralaОценок пока нет

- Pca 14 6Документ2 страницыPca 14 6Arora MathewОценок пока нет

- Schedule of Charges: Smart Salary ExclusiveДокумент2 страницыSchedule of Charges: Smart Salary ExclusivevedavakОценок пока нет

- Islamic SOC Jan June 2013 FinalДокумент16 страницIslamic SOC Jan June 2013 Finalfaisal_ahsan7919Оценок пока нет

- Titanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowДокумент2 страницыTitanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowGaurav Singh RathoreОценок пока нет

- Schedule of Charges Deutsche BankДокумент3 страницыSchedule of Charges Deutsche BankSayantika MondalОценок пока нет

- PersonalBanking SOC 26Dec13EnДокумент1 страницаPersonalBanking SOC 26Dec13EnHasnain MuhammadОценок пока нет

- KFS Current ACДокумент23 страницыKFS Current ACFakharОценок пока нет

- CBQ - Tariff of ChargesДокумент9 страницCBQ - Tariff of Chargesanwarali1975Оценок пока нет

- Basic Savings Bank Deposit Account SocsДокумент6 страницBasic Savings Bank Deposit Account Socstrue chartОценок пока нет

- Mojo Platinum Credit Card: INR 1000 INR 1000Документ4 страницыMojo Platinum Credit Card: INR 1000 INR 1000Saksham Goel100% (2)

- From Kotak WebsiteДокумент20 страницFrom Kotak WebsiteHimadri Shekhar VermaОценок пока нет

- Most Important Terms and ConditionsДокумент20 страницMost Important Terms and Conditionsdharmendra palОценок пока нет

- SuperCard MITC PDFДокумент47 страницSuperCard MITC PDFPrudhvi RajОценок пока нет

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaОт EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaОценок пока нет

- Active Directory FactsДокумент171 страницаActive Directory FactsVincent HiltonОценок пока нет

- RetrieveДокумент8 страницRetrieveSahian Montserrat Angeles HortaОценок пока нет

- Chapter Two Complexity AnalysisДокумент40 страницChapter Two Complexity AnalysisSoressa HassenОценок пока нет

- Political Positions of Pete ButtigiegДокумент12 страницPolitical Positions of Pete ButtigiegFuzz FuzzОценок пока нет

- MBA - Updated ADNU GSДокумент2 страницыMBA - Updated ADNU GSPhilip Eusebio BitaoОценок пока нет

- Floor Paln ModelДокумент15 страницFloor Paln ModelSaurav RanjanОценок пока нет

- Defeating An Old Adversary Cement Kiln BallsДокумент5 страницDefeating An Old Adversary Cement Kiln BallsManish KumarОценок пока нет

- Dr. Li Li Prof. Feng Wu Beijing Institute of TechnologyДокумент20 страницDr. Li Li Prof. Feng Wu Beijing Institute of TechnologyNarasimman NarayananОценок пока нет

- Belimo Fire & Smoke Damper ActuatorsДокумент16 страницBelimo Fire & Smoke Damper ActuatorsSrikanth TagoreОценок пока нет

- FBW Manual-Jan 2012-Revised and Corrected CS2Документ68 страницFBW Manual-Jan 2012-Revised and Corrected CS2Dinesh CandassamyОценок пока нет

- Bismillah SpeechДокумент2 страницыBismillah SpeechanggiОценок пока нет

- ATLAS HONDA Internship ReportДокумент83 страницыATLAS HONDA Internship ReportAhmed Aitsam93% (14)

- Chapter 1: Investment Landscape: Financial GoalsДокумент8 страницChapter 1: Investment Landscape: Financial GoalsshubhamОценок пока нет

- IEEE Conference Template ExampleДокумент14 страницIEEE Conference Template ExampleEmilyОценок пока нет

- Pthread TutorialДокумент26 страницPthread Tutorialapi-3754827Оценок пока нет

- United States v. Manuel Sosa, 959 F.2d 232, 4th Cir. (1992)Документ2 страницыUnited States v. Manuel Sosa, 959 F.2d 232, 4th Cir. (1992)Scribd Government DocsОценок пока нет

- Powerpoint Presentation R.A 7877 - Anti Sexual Harassment ActДокумент14 страницPowerpoint Presentation R.A 7877 - Anti Sexual Harassment ActApple100% (1)

- 133 The Science and Understanding of TheДокумент14 страниц133 The Science and Understanding of TheCarlos RieraОценок пока нет

- Preventing OOS DeficienciesДокумент65 страницPreventing OOS Deficienciesnsk79in@gmail.comОценок пока нет

- SQL Datetime Conversion - String Date Convert Formats - SQLUSA PDFДокумент13 страницSQL Datetime Conversion - String Date Convert Formats - SQLUSA PDFRaul E CardozoОценок пока нет

- Tracker Pro Otm600 1.5Документ19 страницTracker Pro Otm600 1.5Camilo Restrepo CroОценок пока нет

- Residential BuildingДокумент5 страницResidential Buildingkamaldeep singhОценок пока нет

- SettingsДокумент3 страницыSettingsrusil.vershОценок пока нет

- Interest Rates and Bond Valuation: All Rights ReservedДокумент22 страницыInterest Rates and Bond Valuation: All Rights ReservedAnonymous f7wV1lQKRОценок пока нет

- Minor Ailments Services: A Starting Point For PharmacistsДокумент49 страницMinor Ailments Services: A Starting Point For PharmacistsacvavОценок пока нет

- EE1000 DC Networks Problem SetДокумент7 страницEE1000 DC Networks Problem SetAmit DipankarОценок пока нет

- Legal Ethics HW 5Документ7 страницLegal Ethics HW 5Julius Robert JuicoОценок пока нет

- Validation of AnalyticalДокумент307 страницValidation of AnalyticalJagdish ChanderОценок пока нет

- Sworn Statement of Assets, Liabilities and Net WorthДокумент3 страницыSworn Statement of Assets, Liabilities and Net WorthShelby AntonioОценок пока нет