Академический Документы

Профессиональный Документы

Культура Документы

Northampton Finance Director Report For 12-15-2011

Загружено:

Adam Rabb CohenИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Northampton Finance Director Report For 12-15-2011

Загружено:

Adam Rabb CohenАвторское право:

Доступные форматы

CITY OF NORTHAMPTON

SUSAN WRIGHT FINANCE DIRECTOR

Office of the Mayor 210 Main Street Room 12 Northampton, MA 01060-3199 (413) 587-1255 Fax: (413) 587-1275 swright@northamptonma.gov

MEMORANDUM

TO:

City

Council

FROM:

Susan

Wright,

Finance

Director

DATE:

December

8,

2011

RE:

Update

to

City

Council

for

December

15,

2011

Financial

order

to

reduce

appropriations

to

various

departments

related

to

the

ESCO:

As

the

Department

of

Revenue

(DOR)

began

review

of

our

tax

recap

documentation,

they

flagged

the

method

by

which

the

ESCO

contributions

from

departments

were

structured

in

the

budget.

The

original

idea

for

how

the

ESCO

payments

would

be

funded,

was

that

each

affected

department

Northampton

Public

Schools,

Smith

Vocation,

Lilly

and

Forbes

Libraries

and

Central

Services

would

budget

the

annual

amount

for

utilities

(prior

to

the

energy

improvements)

in

their

respective

budgets.

Then,

the

savings

in

those

budgets

from

the

ESCO

improvements

would

be

transferred

back

to

the

city

as

a

revenue,

to

offset

the

cost

of

the

bond.

Total

Bond

Payments

for

ESCO

projects

in

FY2012:

$595,172

How

this

was

going

to

be

paid

out

of

the

budget:

Lilly

Library

$

3,473

Forbes

Library

$

35,722

Central

Services

$

31,616

Northampton

Public

Schools

$147,310

Smith

Vocational

$

92,677

Revenue

from

depts.

in

General

Fund:

$310,798:

Revenue

from

Rebates:

$140,732

Revenue

from

Enterprise

Funds:

$143,642

Total

available

for

ESCO

bond

payment:

$595,172

By

giving

the

departments

their

full

utility

budgets

and

then

taking

back

the

surplus

via

internal

journal

entries,

we

are

in

essence

having

general

fund

expenses

come

back

into

the

general

fund

as

revenue,

which,

from

an

accounting

standpoint,

will

not

be

allowed

by

DOR.

In

our

conversation

with

DOR

officials

they

stated

that

ESCOs

are

quite

new

and

that

another

town

developed

the

same

type

of

funding

structure

for

their

ESCO.

Since

the

DOR

now

has

encountered

two

towns

that

had

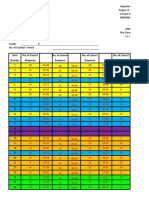

built budgets based on this funding structure, they are considering issuing an official advisory on how ESCO payments should be handled, going forward. Because Northampton is often at the forefront in many areas of municipal innovation, there was no prior guidance on how these budgets should be structured, so it is understandable how we arrived at this point. Fortunately the budget can be aligned to the satisfaction of the DOR by simply reducing the departmental budgets by the amounts that we were going to transfer out of their budgets anyway and by lowering our estimated receipts by the equivalent amount. The net effect of this will be to reduce the revenue side of the equation estimated local receipts - by $310,798 and reduce the expense side of the equation various departmental budgets - by $310,798. New Growth: Since we are about to complete the tax rate setting process, I thought I would share with you a chart related to our new growth. New Growth is the additional tax revenue generated by new construction, renovations and other increases in the property tax base during a calendar year. It does not include value increases caused by normal market forces or by revaluations.

Вам также может понравиться

- Office of The State ComptrollerДокумент4 страницыOffice of The State ComptrollerflippinamsterdamОценок пока нет

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesОт EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesОценок пока нет

- Town of Galway: Financial OperationsДокумент17 страницTown of Galway: Financial OperationsdayuskoОценок пока нет

- 10232012-Department Head Responses To Budget Study Committee Report 10-19-12Документ23 страницы10232012-Department Head Responses To Budget Study Committee Report 10-19-12keithmontpvtОценок пока нет

- 06 General FundДокумент64 страницы06 General FundSamirahSwalehОценок пока нет

- Lakeport City Council - Final BudgetДокумент119 страницLakeport City Council - Final BudgetLakeCoNewsОценок пока нет

- To: From: CC: Date: ReДокумент11 страницTo: From: CC: Date: ReBrad TabkeОценок пока нет

- SD 21.reporttocitycouncilfy09Документ63 страницыSD 21.reporttocitycouncilfy09GGHMADОценок пока нет

- 2014-2015 City of Sacramento Budget OverviewДокумент34 страницы2014-2015 City of Sacramento Budget OverviewCapital Public RadioОценок пока нет

- Wrrbfy14 BudgetДокумент18 страницWrrbfy14 BudgetMass LiveОценок пока нет

- Kitchener 2013 Budget Preview Nov 5 2012Документ52 страницыKitchener 2013 Budget Preview Nov 5 2012WR_RecordОценок пока нет

- FY 2015-2016 Budget Message - FranklinДокумент4 страницыFY 2015-2016 Budget Message - FranklinThunder PigОценок пока нет

- Fiscal Year 2012-13 Adopted Budget: 260 North San Antonio Road, Suite A Santa Barbara, CA 93110 805-961-8800Документ31 страницаFiscal Year 2012-13 Adopted Budget: 260 North San Antonio Road, Suite A Santa Barbara, CA 93110 805-961-8800Besir AsaniОценок пока нет

- The New Comprehensive Annual Financial Report Format ("GASB 34")Документ8 страницThe New Comprehensive Annual Financial Report Format ("GASB 34")Wachid CahyonoОценок пока нет

- 3134 - 2017 Budget Memo 12.06.16Документ8 страниц3134 - 2017 Budget Memo 12.06.16Brad TabkeОценок пока нет

- Longboat Key Fiscal Year 2021 Recommended BudgetДокумент130 страницLongboat Key Fiscal Year 2021 Recommended BudgetMark BerginОценок пока нет

- 2015 Mid Year ReportДокумент36 страниц2015 Mid Year ReportPennLiveОценок пока нет

- FY2016 Proposed BudgetДокумент107 страницFY2016 Proposed BudgetFauquier NowОценок пока нет

- BRCC Rating and Revenue Plan 2021 2025Документ30 страницBRCC Rating and Revenue Plan 2021 2025gabozauОценок пока нет

- July 20 Grand Forks Bochenski Budget PowerpointДокумент68 страницJuly 20 Grand Forks Bochenski Budget PowerpointJoe BowenОценок пока нет

- 2011 Pay Plan StatementДокумент2 страницы2011 Pay Plan StatementDavid DillnerОценок пока нет

- CK 2010 Audited FinancialsДокумент39 страницCK 2010 Audited FinancialskrobinetОценок пока нет

- FY14 Overview MemoДокумент3 страницыFY14 Overview MemokeithmontpvtОценок пока нет

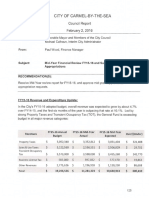

- City of Carmel-By-The-Sea: Council Report February 2, 2016Документ6 страницCity of Carmel-By-The-Sea: Council Report February 2, 2016L. A. PatersonОценок пока нет

- 2010-11 Mid-Year Budget ReportДокумент8 страниц2010-11 Mid-Year Budget ReportClaremont BuzzОценок пока нет

- Wayne Bragg Point PaperДокумент2 страницыWayne Bragg Point PaperThe Valley IndyОценок пока нет

- Mobile Mayor Sam Jones Proposed Budget For 2012Документ25 страницMobile Mayor Sam Jones Proposed Budget For 2012jamieburch75Оценок пока нет

- La Credit ReportДокумент31 страницаLa Credit ReportSouthern California Public RadioОценок пока нет

- FY 2011-2012 ADOPTED Budget 20110614Документ829 страницFY 2011-2012 ADOPTED Budget 20110614City of GriffinОценок пока нет

- Council Questions - Fiscal Year 2013 Budget Discussion March 2012Документ6 страницCouncil Questions - Fiscal Year 2013 Budget Discussion March 2012Richard G. FimbresОценок пока нет

- Sioux City 2013 Operating BudgetДокумент378 страницSioux City 2013 Operating BudgetSioux City JournalОценок пока нет

- Review of FY 2013 Mid-Year Budget Monitoring ReportДокумент22 страницыReview of FY 2013 Mid-Year Budget Monitoring Reportapi-27500850Оценок пока нет

- Final Budgetfor WebsitДокумент445 страницFinal Budgetfor Websitsally elderaaОценок пока нет

- Atlantic City Recovery Plan in Brief 10.24.2016 - FINALДокумент23 страницыAtlantic City Recovery Plan in Brief 10.24.2016 - FINALPress of Atlantic CityОценок пока нет

- Projected Year-End Financial Results - Third QuarterДокумент7 страницProjected Year-End Financial Results - Third QuarterpkGlobalОценок пока нет

- Nov 2010 Financial Plan InstructionsДокумент2 страницыNov 2010 Financial Plan InstructionsCeleste KatzОценок пока нет

- Shakopee Quarterly Financial Update Q1-2016Документ6 страницShakopee Quarterly Financial Update Q1-2016Brad TabkeОценок пока нет

- Web Pearland 2016 Annualreport CalendarДокумент32 страницыWeb Pearland 2016 Annualreport Calendarapi-306549584Оценок пока нет

- County Executive Marc Elrich's Budget Message For FY21Документ10 страницCounty Executive Marc Elrich's Budget Message For FY21David LublinОценок пока нет

- County Manager's Presentation To Rockingham County Board of Commissioners For 2018/19 Budget.Документ22 страницыCounty Manager's Presentation To Rockingham County Board of Commissioners For 2018/19 Budget.jeffreyhsykesОценок пока нет

- LMT 2011 1st Quarter Finance ReportДокумент14 страницLMT 2011 1st Quarter Finance ReportBucksLocalNews.comОценок пока нет

- North Adams FY2022 Budget ProposalДокумент71 страницаNorth Adams FY2022 Budget ProposaliBerkshires.comОценок пока нет

- BUDGET (12) : Agency Plan: Mission, Goals and Budget SummaryДокумент7 страницBUDGET (12) : Agency Plan: Mission, Goals and Budget SummaryMatt HampelОценок пока нет

- Dumont 2011 Municipal Data SheetДокумент57 страницDumont 2011 Municipal Data SheetA Better Dumont (NJ, USA)Оценок пока нет

- CLLR Thornber Budget OverviewДокумент4 страницыCLLR Thornber Budget Overviewdan_kerinsОценок пока нет

- August 18 2011 FD MemoДокумент8 страницAugust 18 2011 FD MemoMy-Acts Of-SeditionОценок пока нет

- 2010 BudgetДокумент63 страницы2010 BudgetPreston LewisОценок пока нет

- BMAU Policy Brief 15-19-Financing Local Governments - Exploiting The Potential of Local RevenueДокумент4 страницыBMAU Policy Brief 15-19-Financing Local Governments - Exploiting The Potential of Local RevenueKharim SseguyaОценок пока нет

- Dawson Creek 2016 Draft Financial PlanДокумент151 страницаDawson Creek 2016 Draft Financial PlanJonny WakefieldОценок пока нет

- Cbac Presentation: Citizens Budget Advisory Committee Recommendations For Fiscal Year 2011Документ20 страницCbac Presentation: Citizens Budget Advisory Committee Recommendations For Fiscal Year 2011jeanettecriscione762Оценок пока нет

- Ithaca Budget NarrativeДокумент42 страницыIthaca Budget NarrativeTime Warner Cable NewsОценок пока нет

- 2013 State of The City ReportДокумент6 страниц2013 State of The City ReportScott FranzОценок пока нет

- January 2010 Financial Plan LetterДокумент2 страницыJanuary 2010 Financial Plan LetterElizabeth BenjaminОценок пока нет

- Budget Response FY 2012 FINALДокумент17 страницBudget Response FY 2012 FINALCeleste KatzОценок пока нет

- Kitsap Budget MemoДокумент18 страницKitsap Budget MemopaulbalcerakОценок пока нет

- Assabet Budgets-How Much Does It Cost To Run? Marlborough Council, 1-23-12 AgendaДокумент67 страницAssabet Budgets-How Much Does It Cost To Run? Marlborough Council, 1-23-12 AgendaourmarlboroughОценок пока нет

- KMC Budget English 2019 2020 PDFДокумент58 страницKMC Budget English 2019 2020 PDFAbhishek SatpathyОценок пока нет

- Public Budgeting: Presented by Adelina Anum, S.PD., M.PDДокумент13 страницPublic Budgeting: Presented by Adelina Anum, S.PD., M.PDAizen Barragan BankaiОценок пока нет

- 2012 Budget BookДокумент27 страниц2012 Budget BookGerrie SchipskeОценок пока нет

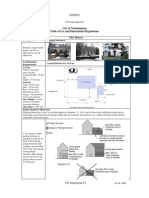

- Table of Use and Dim Regs URAДокумент4 страницыTable of Use and Dim Regs URANorthampton City Councilor At-Large Ryan O'DonnellОценок пока нет

- Wergle Flomp - The Poems That Started It AllДокумент7 страницWergle Flomp - The Poems That Started It AllAdam Rabb Cohen100% (1)

- Northampton Zoning For URBДокумент6 страницNorthampton Zoning For URBAdam Rabb CohenОценок пока нет

- Table of Use and Dim Regs URCДокумент5 страницTable of Use and Dim Regs URCNorthampton City Councilor At-Large Ryan O'DonnellОценок пока нет

- Contemporary Northampton in 2030Документ23 страницыContemporary Northampton in 2030Adam Rabb CohenОценок пока нет

- Appeals Court Affirms Land Court Decision Against Kohl ConstructionДокумент1 страницаAppeals Court Affirms Land Court Decision Against Kohl ConstructionAdam Rabb CohenОценок пока нет

- CDM Northampton Stormwater System Assessment and Plan 2012-05 Vol 2 AppendicesДокумент243 страницыCDM Northampton Stormwater System Assessment and Plan 2012-05 Vol 2 AppendicesAdam Rabb CohenОценок пока нет

- DPW Meeting About North Street 2012-06-25Документ1 страницаDPW Meeting About North Street 2012-06-25Adam Rabb CohenОценок пока нет

- DPW Responds To Petition On North Street Reconstruction 05-24-2012Документ2 страницыDPW Responds To Petition On North Street Reconstruction 05-24-2012Adam Rabb CohenОценок пока нет

- CDM Northampton Stormwater System Assessment and Plan 2012-05 Vol 1Документ93 страницыCDM Northampton Stormwater System Assessment and Plan 2012-05 Vol 1Adam Rabb CohenОценок пока нет

- North Street Presentation 2012-03-06Документ20 страницNorth Street Presentation 2012-03-06Adam Rabb CohenОценок пока нет

- Planning Board Agenda 12-08-2011Документ2 страницыPlanning Board Agenda 12-08-2011Adam Rabb CohenОценок пока нет

- North Street Layout Concepts 2012-03-01Документ3 страницыNorth Street Layout Concepts 2012-03-01Adam Rabb CohenОценок пока нет

- DPW: North Street Information, June 10, 2010Документ4 страницыDPW: North Street Information, June 10, 2010Adam Rabb CohenОценок пока нет

- Don't by Shevaun BranniganДокумент1 страницаDon't by Shevaun BranniganAdam Rabb CohenОценок пока нет

- Elm Street Historic District: Round Hill Road Extension - Preliminary Study ReportДокумент20 страницElm Street Historic District: Round Hill Road Extension - Preliminary Study ReportAdam Rabb CohenОценок пока нет

- City Charter Forum II Final 12-06-2011Документ17 страницCity Charter Forum II Final 12-06-2011Adam Rabb CohenОценок пока нет

- Charter Drafting Committee Agenda 2011-11-30 RevisedДокумент1 страницаCharter Drafting Committee Agenda 2011-11-30 RevisedAdam Rabb CohenОценок пока нет

- Iii. The Impact of Information Technology: Successful Communication - Key Points To RememberДокумент7 страницIii. The Impact of Information Technology: Successful Communication - Key Points To Remembermariami bubuОценок пока нет

- Marriot CaseДокумент15 страницMarriot CaseArsh00100% (7)

- Literatures of The World: Readings For Week 4 in LIT 121Документ11 страницLiteratures of The World: Readings For Week 4 in LIT 121April AcompaniadoОценок пока нет

- 1INDEA2022001Документ90 страниц1INDEA2022001Renata SilvaОценок пока нет

- Ikramul (Electrical)Документ3 страницыIkramul (Electrical)Ikramu HaqueОценок пока нет

- 978-1119504306 Financial Accounting - 4thДокумент4 страницы978-1119504306 Financial Accounting - 4thtaupaypayОценок пока нет

- Stress Corrosion Cracking Behavior of X80 PipelineДокумент13 страницStress Corrosion Cracking Behavior of X80 Pipelineaashima sharmaОценок пока нет

- 1b SPC PL Metomotyl 10 MG Chew Tab Final CleanДокумент16 страниц1b SPC PL Metomotyl 10 MG Chew Tab Final CleanPhuong Anh BuiОценок пока нет

- Advanced Financial Accounting and Reporting Accounting For PartnershipДокумент6 страницAdvanced Financial Accounting and Reporting Accounting For PartnershipMaria BeatriceОценок пока нет

- Picc Lite ManualДокумент366 страницPicc Lite Manualtanny_03Оценок пока нет

- OPSS 415 Feb90Документ7 страницOPSS 415 Feb90Muhammad UmarОценок пока нет

- CALIДокумент58 страницCALIleticia figueroaОценок пока нет

- Tesmec Catalogue TmeДокумент208 страницTesmec Catalogue TmeDidier solanoОценок пока нет

- Result 1st Entry Test Held On 22-08-2021Документ476 страницResult 1st Entry Test Held On 22-08-2021AsifRiazОценок пока нет

- Repair and Field Service BrochureДокумент4 страницыRepair and Field Service Brochurecorsini999Оценок пока нет

- 6401 1 NewДокумент18 страниц6401 1 NewbeeshortОценок пока нет

- HDFC Bank-Centurion Bank of Punjab: Presented By: Sachi Bani Perhar Mba-Ib 2010-2012Документ40 страницHDFC Bank-Centurion Bank of Punjab: Presented By: Sachi Bani Perhar Mba-Ib 2010-2012Sumit MalikОценок пока нет

- A List of Run Commands For Wind - Sem AutorДокумент6 страницA List of Run Commands For Wind - Sem AutorJoão José SantosОценок пока нет

- Fix Problems in Windows SearchДокумент2 страницыFix Problems in Windows SearchSabah SalihОценок пока нет

- National Rural Employment Guarantee Act, 2005Документ17 страницNational Rural Employment Guarantee Act, 2005praharshithaОценок пока нет

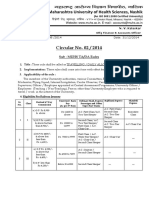

- Circular No 02 2014 TA DA 010115 PDFДокумент10 страницCircular No 02 2014 TA DA 010115 PDFsachin sonawane100% (1)

- Item AnalysisДокумент7 страницItem AnalysisJeff LestinoОценок пока нет

- Basics of An Model United Competition, Aippm, All India Political Parties' Meet, Mun Hrishkesh JaiswalДокумент7 страницBasics of An Model United Competition, Aippm, All India Political Parties' Meet, Mun Hrishkesh JaiswalHRISHIKESH PRAKASH JAISWAL100% (1)

- Intro To Law CasesДокумент23 страницыIntro To Law Casesharuhime08Оценок пока нет

- Human Development IndexДокумент17 страницHuman Development IndexriyaОценок пока нет

- DE1734859 Central Maharashtra Feb'18Документ39 страницDE1734859 Central Maharashtra Feb'18Adesh NaharОценок пока нет

- Notice: Grant and Cooperative Agreement Awards: Public Housing Neighborhood Networks ProgramДокумент3 страницыNotice: Grant and Cooperative Agreement Awards: Public Housing Neighborhood Networks ProgramJustia.comОценок пока нет

- Walt Whitman Video Worksheet. CompletedДокумент1 страницаWalt Whitman Video Worksheet. CompletedelizabethannelangehennigОценок пока нет

- FAMILYДокумент3 страницыFAMILYJenecel ZanoriaОценок пока нет

- Journal Entry EnrepДокумент37 страницJournal Entry Enreptherese lamelaОценок пока нет

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsОт EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsОценок пока нет

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonОт EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonРейтинг: 5 из 5 звезд5/5 (9)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantОт EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantРейтинг: 4 из 5 звезд4/5 (104)

- How To Budget And Manage Your Money In 7 Simple StepsОт EverandHow To Budget And Manage Your Money In 7 Simple StepsРейтинг: 5 из 5 звезд5/5 (4)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОт EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОценок пока нет

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsОт EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsОценок пока нет

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationОт EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationРейтинг: 4.5 из 5 звезд4.5/5 (18)

- The Best Team Wins: The New Science of High PerformanceОт EverandThe Best Team Wins: The New Science of High PerformanceРейтинг: 4.5 из 5 звезд4.5/5 (31)

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessОт EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessРейтинг: 4.5 из 5 звезд4.5/5 (4)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyОт EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyРейтинг: 5 из 5 звезд5/5 (1)

- Budgeting: The Ultimate Guide for Getting Your Finances TogetherОт EverandBudgeting: The Ultimate Guide for Getting Your Finances TogetherРейтинг: 5 из 5 звезд5/5 (14)

- How to Save Money: 100 Ways to Live a Frugal LifeОт EverandHow to Save Money: 100 Ways to Live a Frugal LifeРейтинг: 5 из 5 звезд5/5 (1)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.От EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Рейтинг: 5 из 5 звезд5/5 (89)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)От EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Рейтинг: 3.5 из 5 звезд3.5/5 (9)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsОт EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsРейтинг: 4 из 5 звезд4/5 (4)

- The Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitОт EverandThe Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitОценок пока нет

- Rich Nurse Poor Nurses: The Critical Stuff Nursing School Forgot To Teach YouОт EverandRich Nurse Poor Nurses: The Critical Stuff Nursing School Forgot To Teach YouРейтинг: 4 из 5 звезд4/5 (2)

- Smart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestОт EverandSmart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestРейтинг: 5 из 5 звезд5/5 (1)

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayОт EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayРейтинг: 3.5 из 5 звезд3.5/5 (2)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesОт EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesРейтинг: 4.5 из 5 звезд4.5/5 (30)

- Inflation Hacking: Inflation Investing Techniques to Benefit from High InflationОт EverandInflation Hacking: Inflation Investing Techniques to Benefit from High InflationРейтинг: 4.5 из 5 звезд4.5/5 (5)

- Bitcoin Secrets Revealed - The Complete Bitcoin Guide To Buying, Selling, Mining, Investing And Exchange Trading In Bitcoin CurrencyОт EverandBitcoin Secrets Revealed - The Complete Bitcoin Guide To Buying, Selling, Mining, Investing And Exchange Trading In Bitcoin CurrencyРейтинг: 4 из 5 звезд4/5 (4)