Академический Документы

Профессиональный Документы

Культура Документы

Key Points Thinking Like An Economist

Загружено:

disy109Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Key Points Thinking Like An Economist

Загружено:

disy109Авторское право:

Доступные форматы

Key points Thinking Like an Economist

Economists try to approach their subject with a scientists objectivity. Like all scientists, they make appropriate assumptions and build simplified models in order to understand the world around them. The field of economics is divided into two subfields microeconomics and macroeconomics. Microeconomists study decision making by households and firms and the interaction among households and firms in the marketplace. Macroeconomists study the forces and trends that affect the economy as a whole. A positive statement is an assertion about how the world is. A normative statement is an assertion about how the world ought to be. When economists make normative statements, they are acting more as policymakers than scientists. Economists who advise policymakers offer conflicting advice either because of differences in scientific judgments or because of differences in values. At other times, economists are united in the advice they offer, but policymakers may choose to ignore it. Production Possibility Frontier and efficiency

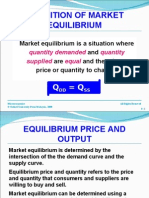

Key points Supply and Demand Economists use the model of supply and demand to analyse competitive markets. In a competitive market, there are many buyers and sellers, each of whom has little or no influence on the market price. The demand curve shows how the quantity of a good demanded depends on the price. According to the law of demand, as the price of a good falls, the quantity demanded rises. Therefore, the demand curve slopes downwards. In addition to price, other determinants of the quantity demanded include income, tastes, expectations, and the prices of substitutes and complements. If one of these other determinants changes, the demand curve shifts. The supply curve shows how the quantity of a good supplied depends on the price. According to the law of supply, as the price of a good rises, the quantity supplied rises. Therefore, the supply curve slopes upwards. In addition to price, other determinants of the quantity supplied include input prices, technology, and expectations. If one of these other determinants changes, the supply curve shifts. The intersection of the supply and demand curves determines the market equilibrium. At the equilibrium price, the quantity demanded equals the quantity supplied. The behaviour of buyers and sellers naturally drives markets toward their equilibrium. When the market price is above the equilibrium price, there is excess supply, which causes the market price to fall. When the market price is below the equilibrium price, there is excess demand, which causes the market price to rise. To analyse how any event influences a market, we use the supply-and-demand diagram to examine how the event affects the equilibrium price and quantity. To do this we follow three steps. First, we decide whether the event shifts the supply curve or the demand curve. Second, we decide which direction the curve shifts. Third, we compare the new equilibrium with the old equilibrium. In market economies, prices are the signals that guide economic decisions and thereby allocate scarce resources. For every good in the economy, the price ensures that supply and demand are in balance. The equilibrium price then determines how much of the good buyers choose to purchase and how much sellers choose to produce.

Key Points Elasticity The price elasticity of demand measures how much the quantity demanded responds to changes in the price. Demand tends to be more elastic if the good is a luxury rather than a necessity, if close substitutes are available, if the market is narrowly defined, or if buyers have substantial time to react to a price change.

The price elasticity of demand is calculated as the percentage change in quantity demanded divided by the percentage change in price. If the elasticity is less than 1, so that quantity demanded moves proportionately less than the price, demand is said to be inelastic. If the elasticity is greater than 1, so that quantity demanded moves proportionately more than the price, demand is said to be elastic. Total revenue, the total amount paid for a good, equals the price of the good times the quantity sold. For inelastic demand curves, total revenue rises as price rises. For elastic demand curves, total revenue falls as price rises. The income elasticity of demand measures how much the quantity demanded responds to changes in consumers income. The cross-price elasticity of demand measures how the quantity demanded of one good responds to the price of another good. The price elasticity of supply measures how much the quantity supplied responds to changes in the price. This elasticity often depends on the time horizon under consideration. In most markets, supply is more elastic in the long run than in the short run. The price elasticity of supply is calculated as the percentage change in quantity supplied divided by the percentage change in price. If the elasticity is less than 1, so that quantity supplied moves proportionately less than the price, supply is said to be inelastic. If the elasticity is greater than 1, so that quantity supplied moves proportionately more than the price, supply is said to be elastic. The tools of supply and demand can be applied in many different kinds of markets. This chapter uses them to analyse the market for wheat, the market for oil, and the market for illegal drugs.

Key points Supply and demand Government Policies A price ceiling is a legal maximum on the price of a good or service. An example is rent control. If the price ceiling is below the equilibrium price, the quantity demanded exceeds the quantity supplied. Because of the resulting shortage, sellers must in some way ration the good or service among buyers. A price floor is a legal minimum on the price of a good or service. An example is a minimum or award wage. If the price floor is above the equilibrium price, the quantity supplied exceeds the quantity demanded. Because of the resulting surplus, buyers demands for the good or service must in some way be rationed among sellers. When the government levies a tax on a good, the equilibrium quantity of the good falls. That is, a tax on a market shrinks the size of the market. A tax on a good places a wedge between the price paid by buyers and the price received by sellers. When the market moves to the new equilibrium, buyers pay more for the good and sellers receive less for it. In this sense, buyers and sellers share the tax burden. The incidence of a tax (that is, the division of the tax burden) does not depend on whether the tax is levied on buyers or sellers. The incidence of a tax depends on the price elasticities of supply and demand. The burden tends to fall on the side of the market that is less elastic because that side of the market can respond less easily to the tax by changing the quantity bought or sold.

Consumers Producers and Efficiency Key points Consumer surplus equals buyers willingness to pay for a good minus the amount they actually pay for it, and it measures the benefit buyers get from participating in a market. Consumer surplus can be calculated by finding the area below the demand curve and above the price. Producer surplus equals the amount sellers receive for their goods minus their costs of production, and it measures the benefit sellers get from participating in a market. Producer surplus can be calculated by finding the area below the price and above the supply curve. An allocation of resources that maximises the sum of consumer and producer surplus is said to be efficient. Policymakers are often concerned with the efficiency, as well as the equity, of economic outcomes. The equilibrium of supply and demand maximises the sum of consumer and producer surplus. That is, the invisible hand of the marketplace leads buyers and sellers to allocate resources efficiently.

Markets do not allocate resources efficiently in the presence of market failures such as market power or externalities.

The costs of production Key points 1 The goal of firms is to maximise profit, which equals total revenue minus total cost. 2 When analysing a firms behaviour, it is important to include all the opportunity costs of production. Some of the opportunity costs, such as the wages a firm pays its workers, are explicit. Other opportunity costs, such as the wages the firm owner gives up by working in the firm rather than taking another job, are implicit. 3 A firms costs reflect its production process. A typical firms production function gets flatter as the quantity of an input increases, displaying the property of diminishing marginal product. As a result, a firms total-cost curve gets steeper as the quantity produced rises. 4 A firms total costs can be divided between fixed costs and variable costs. Fixed costs are costs that do not change when the firm alters the quantity of output produced. Variable costs are costs that do change when the firm alters the quantity of output produced. 5 From a firms total cost, two related measures of cost are derived. Average total cost is total cost divided by the quantity of output. Marginal cost is the amount by which total cost would rise if output were increased by one unit. 6 When analysing firm behaviour, it is often useful to graph average total cost and marginal cost. For a typical firm, marginal cost rises with the quantity of output. Average total cost first falls as output increases and then rises as output increases further. The marginal-cost curve always crosses the average-total-cost curve at the minimum of average total cost. 7 A firms costs often depend on the time horizon being considered. In particular, many costs are fixed in the short run but variable in the long run. As a result, when the firm changes its level of production, average total cost may rise more in the short run than in the long run.

Firms in competitive markets Learning objectives In this chapter, students will: learn what characteristics make a market competitive examine how competitive firms decide how much output to produce examine how competitive firms decide when to shut down production temporarily examine how competitive firms decide whether to exit or enter a market see how firm behaviour determines a markets short-run and long-run supply curves. Key points 1 Because a competitive firm is a price taker, its revenue is proportional to the amount of output it produces. The price of the good equals both the firms average revenue and its marginal revenue. 2 To maximise profit, a firm chooses a quantity of output such that marginal revenue equals marginal cost. Because marginal revenue for a competitive firm equals the market price, the firm chooses quantity so that price equals marginal cost. Thus, the firms marginal-cost curve is its supply curve. 3 In the short run when a firm cannot recover its fixed costs, the firm will choose to shut down temporarily if the price of the good is less than average variable cost. In the long run when the firm can recover both fixed and variable costs, it will choose to exit if the price is less than average total cost. 4 In a market with free entry and exit, profits are driven to zero in the long run. In this long-run equilibrium, all firms produce at the efficient scale, price equals the minimum of average total cost, and the number of firms adjusts to satisfy the quantity demanded at this price.

5 Changes in demand have different effects over different time horizons. In the short run, an increase in demand raises prices and leads to profits, and a decrease in demand lowers prices and leads to losses. But if firms can freely enter and exit the market, then in the long run the number of firms adjusts to drive the market back to the zero-profit equilibrium.

Monopoly Learning objectives In this chapter, students will: learn why some markets have only one seller analyse how a monopoly determines the quantity to produce and the price to charge see how the monopolys decisions affect economic wellbeing see why monopolies try to charge different prices to different customers. Key points 1 A monopoly is a firm that is the sole seller in its market. A monopoly arises when a single firm owns a key resource, when the government gives a firm the exclusive right to produce a good, or when a single firm can supply the entire market at a smaller cost than many firms could. 2 Because a monopoly is the sole producer in its market, it faces a downward-sloping demand curve for its product. When a monopoly increases production by one unit, it causes the price of its good to fall, which reduces the amount of revenue earned on all units produced. As a result, a monopolys marginal revenue is always below the price of its good. 3 Like a competitive firm, a monopoly firm maximises profit by producing the quantity at which marginal revenue equals marginal cost. The monopoly then chooses the price at which that quantity is demanded. Unlike a competitive firm, a monopoly firms price exceeds its marginal revenue, so its price exceeds marginal cost. 4 A monopolists profit-maximising level of output is below the level that maximises the sum of consumer and producer surplus. That is, when the monopoly charges a price above marginal cost, some consumers who value the good more than its cost of production do not buy it. As a result, monopoly causes deadweight losses similar to the deadweight losses caused by taxes. 5 Monopolists often can raise their profits by charging different prices for the same good based on a buyers willingness to pay. This practice of price discrimination can raise economic welfare by getting the good to some consumers who otherwise would not buy it. In the extreme case of perfect price discrimination, the deadweight losses of monopoly are completely eliminated. More generally, when price discrimination is imperfect, it can either raise or lower welfare compared with the outcome with a single monopoly price.

Monopolistic competition Learning objectives In this chapter, students will: analyse competition among firms that sell differentiated products compare the outcome under monopolistic competition and under perfect competition consider the desirability of outcomes in monopolistically competitive markets examine the debate over the effects of advertising examine the debate over the role of brand names.

Key points 1 A monopolistically competitive market is characterised by three attributes: many firms, differentiated products and free entry (or exit). 2 The equilibrium in a monopolistically competitive market differs from that in a perfectly competitive market in two related ways. First, each firm has higher average costs; that is, it operates on the downward-sloping portion of the average-total-cost curve. Second, each firm charges a price above marginal cost. 3 Monopolistic competition does not have all the desirable properties of perfect competition. There is the standard deadweight loss of monopoly caused by the mark-up of price over marginal cost. In addition, the number of firms (and thus the variety of products) can be too large or too small. In practice, the ability of policymakers to correct these inefficiencies is limited. 4 The product differentiation inherent in monopolistic competition leads to the use of advertising and brand names. Critics of advertising and brand names argue that firms use them to take advantage of consumer irrationality and to reduce competition. Defenders of advertising and brand names argue that firms use them to inform consumers and to compete more vigorously on price and product quality.

Business strategy Learning objectives In this chapter, students will: see what market structures lie between monopoly and competition examine what outcomes are possible when a market is an oligopoly learn about the prisoners dilemma and how it applies to oligopoly and other issues. Key points 1 Oligopolists maximise their total profits by forming a cartel and acting like a monopolist. Yet, if oligopolists make decisions about production levels individually, the result is a greater quantity and a lower price than under the monopoly outcome. The larger the number of firms in the oligopoly, the closer the quantity and price will be to the levels that would prevail under competition. 2 The prisoners dilemma shows that self-interest can prevent people from maintaining cooperation, even when cooperation is in their mutual interest. The logic of the prisoners dilemma applies in many situations, including arms races, advertising, common-resource problems and oligopolies.

Externalities Learning objectives In this chapter, students will: learn what an externality is see why externalities can make market outcomes inefficient examine how people can sometimes solve the problem of externalities on their own consider why private solutions to externalities sometimes do not work examine the various government policies aimed at solving the problem of externalities Key points When a transaction between a buyer and seller directly affects a third party, that effect is called an externality. Negative externalities, such as pollution, cause the socially desirable quantity in a market to be less than the equilibrium quantity. Positive externalities, such as technology spillovers, cause the socially desirable quantity to be greater than the equilibrium quantity. Those affected by externalities can sometimes solve the problem privately. For instance, when one business confers an externality on another business, the two businesses can internalise the externality by merging. Alternatively, the interested parties can solve the problem by signing a contract. According to the Coase

theorem, if people can bargain without cost, then they can always reach an agreement in which resources are allocated efficiently. In many cases, however, reaching a bargain among the many interested parties is difficult, so the Coase theorem does not apply. When private parties cannot adequately deal with external effects, such as pollution, the government often steps in. Sometimes the government prevents socially inefficient activity by regulating behaviour. Other times it internalises an externality using Pigovian taxes. Another way to protect the environment is for the government to issue a limited number of pollution permits. The end result of this policy is largely the same as imposing Pigovian taxes on polluters

Public goods and common resources Learning objectives In this chapter, students will: learn the defining characteristics of public goods and common resources examine why private markets fail to provide public goods consider some of the important public goods in our economy see why the costbenefit analysis of public goods is both necessary and difficult examine why people tend to use common resources too much consider some of the important common resources in our economy. Key points 1 Goods differ in whether they are excludable and whether they are rival. A good is excludable if it is possible to prevent someone from using it. A good is rival if one persons enjoyment of the good prevents other people from enjoying the same good. Markets work best for private goods, which are both excludable and rival. Markets do not work as well for other types of goods. 2 Public goods are neither rival nor excludable. Examples of public goods include fireworks displays, defence, and the creation of fundamental knowledge. Because people are not charged for their use of the public good, they have an incentive to free ride when the good is provided privately. Therefore, governments provide public goods, making their decision about the quantity based on costbenefit analysis. 3 Common resources are rival but not excludable. Some examples are common grazing land, clean air and congested roads. Because people are not charged for their use of common resources, they tend to use them excessively. Therefore, governments try to limit the use of common resources Common resources The Tragedy of the Commons Definition: Tragedy of the Commons a parable that illustrates why common resources get used more than is desirable from the standpoint of society as a whole. Example: small, medieval town where sheep graze on common land. Over time, as the population grows, so does the number of sheep. Given the fixed amount of land, the grass will begin to disappear as the land loses its ability to replenish itself. The townspeople will no longer be able to raise sheep because the private incentives (using the land for free) outweigh the social incentives (using the land carefully). When one familys flock grazes on the common land, it reduces the quality of the land available for others. Because people ignore this negative externality the result is an excessive number of sheep. This problem could have been prevented if the town had regulated the number of sheep in each familys flock, internalised the externality by taxing sheep or auctioned off a limited number of sheep-grazing permits. Alternatively, the town could have divided the common property between its citizens, thus making the land excludable and turning it into a private good.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Mankiw10e Lecture Slides Ch01Документ28 страницMankiw10e Lecture Slides Ch01Mariam Mahdi MohamedОценок пока нет

- Business Economics - Session 1 (LMS)Документ28 страницBusiness Economics - Session 1 (LMS)Abhimanyu AnejaОценок пока нет

- Economics 10th Edition Colander Solutions Manual DownloadДокумент18 страницEconomics 10th Edition Colander Solutions Manual DownloadAvery Barnes100% (25)

- 6 - More Differentiation PDFДокумент20 страниц6 - More Differentiation PDFDan EnzerОценок пока нет

- Compiled Intro Micro (1) - Scarcity-2Документ36 страницCompiled Intro Micro (1) - Scarcity-2delima kharismaОценок пока нет

- Chapter 3 National Income Test BankДокумент44 страницыChapter 3 National Income Test BankmchlbahaaОценок пока нет

- Solutions For Chapter 4 Questions 2, 6, 7 and 14Документ6 страницSolutions For Chapter 4 Questions 2, 6, 7 and 14anna100% (1)

- AQA MCQ Microeconomics Book 1Документ49 страницAQA MCQ Microeconomics Book 1Mohammed Yusuf AshrafОценок пока нет

- Modern Theory of WageДокумент6 страницModern Theory of Wagegazal1987Оценок пока нет

- 17 Economics PDFДокумент12 страниц17 Economics PDFMohitОценок пока нет

- Answer D - Scarcity.: Business Economics Chapter 1 MCQДокумент53 страницыAnswer D - Scarcity.: Business Economics Chapter 1 MCQaarhaОценок пока нет

- Elasticity EconomicsДокумент14 страницElasticity EconomicsYiwen LiuОценок пока нет

- Majorship Let Reviewer in Social ScienceДокумент42 страницыMajorship Let Reviewer in Social ScienceMechelle Landicho Bacay67% (3)

- BEFA All Units NotesДокумент205 страницBEFA All Units NotesKonnoju Varun KumarОценок пока нет

- Ebook Economics and Contemporary Issues 8Th Edition Moomaw Test Bank Full Chapter PDFДокумент32 страницыEbook Economics and Contemporary Issues 8Th Edition Moomaw Test Bank Full Chapter PDFpauldiamondwe8100% (10)

- Pigou - 1917 - The Value of MoneyДокумент29 страницPigou - 1917 - The Value of MoneyjpkoningОценок пока нет

- Labor SupplyДокумент24 страницыLabor Supplymanitomarriz.bipsuОценок пока нет

- Introduction To Economics: Haramaya University College of Business and Economics Department of EconomicsДокумент79 страницIntroduction To Economics: Haramaya University College of Business and Economics Department of EconomicsDaniel SitotaОценок пока нет

- Basic MicroeconomicsДокумент88 страницBasic MicroeconomicsNorie L. ManiegoОценок пока нет

- IB Economics HL Practice Test - Topics 2.1-2.3Документ11 страницIB Economics HL Practice Test - Topics 2.1-2.3Daniil SHULGAОценок пока нет

- COMM 220 Practice Problems 2 2Документ11 страницCOMM 220 Practice Problems 2 2Saurabh SaoОценок пока нет

- Assignment 1Документ3 страницыAssignment 1ramizulОценок пока нет

- 261 PreTest 1 F12 Mohabbat 1 PDFДокумент50 страниц261 PreTest 1 F12 Mohabbat 1 PDFCeline YoonОценок пока нет

- PST ECON 2015 2023Документ47 страницPST ECON 2015 2023PhilipОценок пока нет

- Market MikroДокумент21 страницаMarket Mikrogurumurthy poobalanОценок пока нет

- MEA Unit IIДокумент123 страницыMEA Unit IIAnonymous 15luafNJoОценок пока нет

- Edexcel-IGCSE-9-1-Economics (Definition From Chp-1-10)Документ3 страницыEdexcel-IGCSE-9-1-Economics (Definition From Chp-1-10)Han Myo Oo SohanОценок пока нет

- ECON102 C - Monthly Log 1 - AnasariasДокумент7 страницECON102 C - Monthly Log 1 - AnasariasKimberly Shane AnasariasОценок пока нет

- Test Bank For Microeconomic Theory and Applications 11th Edition BrowningДокумент32 страницыTest Bank For Microeconomic Theory and Applications 11th Edition BrowningNuha Abdelkarim100% (1)

- Game Theory, Econometrics, and Innovation & Competition PolicyДокумент47 страницGame Theory, Econometrics, and Innovation & Competition PolicyJames CookeОценок пока нет