Академический Документы

Профессиональный Документы

Культура Документы

Bank of Maharashtra

Загружено:

Angel BrokingИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Bank of Maharashtra

Загружено:

Angel BrokingАвторское право:

Доступные форматы

Management Meet Note | Banking

December 15, 2011

Bank of Maharashtra

Management Meet Note

We recently met the management of Bank of Maharashtra. The key take away from the visit were: Asset quality & provisioning: Bank of Maharashtra (BOM) has progressively been able to improve its asset quality over the past one year on back of conservative credit growth, moderate yield loan book and recoveries post CBS implementation. BOMs credit book is relatively more diversified than the other regional banks with exposure to any industry not above 4% except power sector, (13.0% of overall gross advances), of which 71% is towards State electricity boards (SEB) lending. Also, the management initiatives in the form of discontinuing take out financing, stopping loan disbursements in education sector and sugarcane projects (except entrepreneurial ventures), which traditionally have brought upon higher delinquencies for the bank, we believe should keep the banks asset quality relatively healthier to peers. The bank would be restructuring ~`1,200cr of loans to a couple of SEBs in 2HFY2012. While around `440cr is expected to be restructured in 3QFY2012, the rest could be restructured in the subsequent quarters. The management also stated that loans to all other SEBs are performing and they do not expect any kind of stress arising from these exposures. Also the management clarified that there would be no NPV loss on the restructured loans as interest rates will not be lowered down on these loans. The management expect a quarterly run-rate in slippages of ~`125cr and expect relatively higher recoveries over the next 2 quarters, leading to ~`100cr decline in the absolute gross NPA levels. Capital Infusion: The management sounded confident of receiving its full request of `860cr capital from the government. The capital infusion though will be book dilutive, should help in shoring up the banks tier-I ratio above 8% by FY2013. Outlook and valuation: At the CMP, the stock is trading at attractive valuations, in our view, of 0.6x FY2013E ABV vs. its five-year range of 0.71.2x and median of 0.9x. On the back of relatively better NIM, moderate fee income and relatively healthy asset quality, we expect the bank to deliver healthy 25.2% earnings CAGR over FY201113E. We value the stock at 0.8x and hence recommend a Buy rating with a target price of `52 implying an upside of 18.3% from current levels.

BUY

CMP Target Price

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code Banking 2,094 0.8 69/43.5 60,457 10 15,836 4,764 BMBK.BO BOMH@IN

`44 `52

12 Months

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 79.2 8.8 1.1 10.9

Abs. (%) Sensex BOM

3m (6.2) (12.1)

1yr (19.4) (29.3)

3yr 61.1 90.4

Key Financials

Y/E March (` cr) NII % chg Net profit % chg NIM (%) EPS (`) P/E (x) P/ABV (x) RoA (%) RoE (%)

Source: Company, Angel Research

FY2010 1,296 3.2 440 17.2 2.1 10.2 4.3 0.9 0.7 19.7

FY2011 1,968 51.9 330 (24.8) 2.8 6.2 7.1 0.8 0.4 11.3

FY2012E 2,501 27.1 532 61.0 3.2 9.7 4.5 0.6 0.6 15.3

FY2013E 2,738 9.5 710 33.5 3.1 9.7 4.5 0.6 0.7 16.6

Vaibhav Agrawal

022 3935 7800 Ext: 6808 vaibhav.agrawal@angelbroking.com

Shrinivas Bhutda

022 3935 7800 Ext: 6845 shrinivas.bhutda@angelbroking.com

Varun Varma

022 3935 7800 Ext: 6847 varun.varma@angelbroking.com

Please refer to important disclosures at the end of this report

Bank of Maharashtra | Management Meet Note

Exhibit 1: Strong CASA ratio for Bank of Maharashtra (BOM)

50.0 40.0 30.0 20.0 10.0 -

Exhibit 2: Fee income performance by PSU banks 1HFY2012

1.20 1.00 0.80 0.60 0.40 0.20 ANDHBK DENABK CENTBK

1.6x

UnionBk

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 3: Trend in NPA ratios

Gross NPAs Opening Additions Deductions - Write offs - Recoveries - Upgrades Closing Net NPA Gross NPAs (%) Net NPAs (%) 2QFY11 1,459 235 227 134 77 17 1,467 880 3.6 2.2 3QFY11 1,467 116 207 129 59 19 1,377 799 3.2 1.9 4QfY11 1,377 224 427 47 65 315 1,174 619 2.5 1.3 1QFY12 1,174 187 213 83 66 64 1,148 531 2.4 1.2 2QFY12 1,148 93 147 49 67 30 1,094 284 2.2 0.6

Exhibit 4: Valuation inexpensive for BOM

120 100 80 60 40 20 0 Price(`) 0.4x 0.7x 1x 1.3x

Dec-06

Aug-05

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 5: Valuation snapshot

Company Reco. CMP (`) Tgt. Price (`) Upside (%) FY2013E P/ABV (x) FY2013E Tgt. P/ABV (x) FY2013E P/E (x) FY11-13E EPS CAGR (%) FY2013E RoA (%) FY2013E RoE (%)

J&KBk SynBk BOM UtdBk DenaBk J&KBk

Neutral Buy Buy Buy Neutral Neutral

649 92 44 57 61 649

115 52 70 -

25.4 18.3 23.1 -

0.7 0.6 0.6 0.5 0.4 0.7

0.8 0.8 0.6 -

4.1 4.0 4.5 3.4 2.9 4.1

12 11.8 25.2 12.4 7.5 12

Aug-09

1.3 0.7 0.7 0.6 0.8 1.3

Dec-10

Apr-04

Apr-08

UCOBK

SBI

CANBK

ALLBK

UNBK

IDBI

UTDBK

INDBK

CRPBK

BOB

PNB

OBC

BOI

VIJAYA

SBI

SYNBK

CentBk

CanBk

AndhBk

DenaBk

CorpBk

J&KBK

IDBI

J&KBk

BOB

SynBk

UcoBk

UtdBk

IndBk

BOM

BOM

VijBk

AllBk

OBC

PNB

BOI

IOB

IOB

17.8 16.3 16.6 14 16.4 17.8

Source: Company, Angel Research; CMP as of December 15, 2011

December 15, 2011

Bank of Maharashtra | Management Meet Note

Exhibit 6: Credit break-up 2QFY2012

Industry Infrastructure -of which Power -of which SEB NBFCs -of which HFC -of which MFI Iron and steel Chemicals Engineering Other Metals Textiles Vehicles Construction Total Credit (`cr) 8,772 6,584 4,670 7,418 2,734 33 1,900 1,821 1,797 613 493 489 409 % of Advances 17.2 12.9 9.2 14.6 5.4 0.1 3.7 3.6 3.5 1.2 1.0 1.0 0.8 Industry Food Processing Paper Petroleum Cement Gems and Jewellery Mining Vegetables Tobacco Sugar Computer infra Leather Rubber Tea Total Credit (`cr) 390 342 316 312 194 119 68 56 30 30 25 24 3 % of Advances 0.8 0.7 0.6 0.6 0.4 0.2 0.1 0.1 0.1 0.1 0.0 0.0 0.0 Industry MSME NBFC Retail -of which Housing -of which Education -of which Vehicles -of which Personal -of which Consumer -Others (Retail) Agriculture Whole sale traders CRE Others Total Credit (`cr) 8,193 7,418 5,773 4,538 512 400 255 20 48 5,312 2,217 709 21,285 % of Advances 16.1 14.6 11.3 8.9 1.0 0.8 0.5 0.0 0.1 10.4 4.4 1.4 41.8

Source: Company, Angel Research

December 15, 2011

Bank of Maharashtra | Management Meet Note

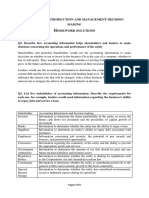

Profit & loss statement

Y/E March (` cr) Net Interest Income - YoY Growth (%) Other Income - YoY Growth (%) Operating Income - YoY Growth (%) Operating Expenses - YoY Growth (%) Pre - Provision Profit - YoY Growth (%) Provision and Cont. - YoY Growth (%) Profit Before Tax - YoY Growth (%) Provision for Taxation - as a % of PBT PAT - YoY Growth (%) FY2010 FY2011 FY2012E FY2013E

Balance sheet

Y/E March (` cr) Share Capital Reserve & Surplus Deposits - Growth (%) Borrowings Tier-2 Capital Other Liabilities & Provisions Total Liabilities Cash in Hand and with RBI Bal. with banks, money at call Investments Advances - Growth (%) Fixed Assets Other Assets Total Assets FY2010 FY2011 FY2012E FY2013E

1,296 3.2 591 18.2 1,887 7.5 1,073 11.4 815 2.6 246 (13.0) 569 11.3 129 22.7 440 17.2 440 17.2

1,968 51.9 531 (10.2) 2,499 32.4 1,644 53.2 855 5.0 467 90.1 388 (31.8) 57 14.8 330 (24.8) 34 297 (32.5)

2,501 27.1 592 11.5 3,093 23.7 1,437 (12.6) 1,656 93.6 868 85.9 787 103.0 255 32.4 532 61.0 65 467 57.4

2,738 9.5 651 10.0 3,389 9.6 1,610 12.0 1,779 7.5 728 (16.1) 1,051 33.5 341 32.4 710 33.5 62 648 38.9

866 2,428 63,304 21.1 129 2,668 2,096 71,056 5,315 1,379 21,324 40,315 17.6 660 2,063 71,056

1,144 2,901 66,845 5.6 577 2,500 2,550 76,442 3,846 203 22,491 46,881 16.3 667 2,354 76,442

1,144 3,256 74,866 12.0 645 2,925 2,756 85,517 4,866 428 22,016 54,850 17.0 724 2,634 85,517

1,144 4,413 86,845 16.0 753 3,422 3,191 99,885 5,645 499 25,669 64,175 17.0 820 3,076 99,885

Preference Dividend

PAT available to Eq. SH

- YoY Growth (%)

Key ratios

Y/E March Profitability ratios (%) NIMs* Cost to Income ratio ROA ROE B/S ratios (%) CASA ratio Credit/Deposit ratio CAR - Tier-I Asset Quality (%) Gross NPAs Net NPAs Slippages Loan loss prov. /avg. assets Provision coverage Per Share Data (`) EPS ABVPS (75% cover for NPAs) DPS Note*: All NIM figures are calculated FY2010 FY2011 FY2012E FY2013E

Key ratios

Y/E March Valuation Ratios PER (x) P/ABVPS (x) Dividend Yield DuPont Analysis NII FY2010 FY2011 FY2012E FY2013E

2.1 56.8 0.7 19.7 36.9 63.7 12.8 5.7 3.0 1.6 2.5 0.4 54.7 10.2 48.6 2.0

2.8 65.8 0.4 11.3 40.4 70.1 13.4 8.0 2.5 1.3 1.7 0.5 65.6 6.2 57.3 2.0

3.2 46.5 0.6 15.3 40.1 73.3 13.7 7.9 2.6 0.7 1.5 0.9 85.0 9.7 68.4 2.0

3.1 47.5 0.7 16.6 38.4 73.9 15.1 9.2 3.5 0.7 2.0 0.7 85.0 9.7 69.1 2.0

4.3 0.9 4.6 2.0 0.4 1.6 0.3 1.9 0.6 2.5 1.6 0.9 0.2 0.7 0.7 29.1 19.7

7.1 0.8 4.6 2.7 0.6 2.0 0.1 2.1 0.6 2.8 2.2 0.5 0.1 0.4 0.0 0.4 27.6 11.3

4.5 0.6 4.6 3.1 1.1 2.0 0.0 2.0 0.7 2.7 1.8 1.0 0.3 0.7 0.1 0.6 26.0 15.3

4.5 0.6 4.6 3.0 0.8 2.2 0.0 2.2 0.7 2.9 1.7 1.1 0.4 0.8 0.1 0.7 23.4 16.6

(-) Prov. Exp. Adj NII Treasury Int. Sens. Inc. Other Inc. Op. Inc. Opex PBT Taxes ROA Preference Dividend ROA after Pref Div

Leverage

ROE

December 15, 2011

Bank of Maharashtra | Management Meet Note

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Bank of Maharashtra No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

December 15, 2011

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Oilseeds and Edible Oil UpdateДокумент9 страницOilseeds and Edible Oil UpdateAngel BrokingОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Daily Metals and Energy Report September 16 2013Документ6 страницDaily Metals and Energy Report September 16 2013Angel BrokingОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Special Technical Report On NCDEX Oct SoyabeanДокумент2 страницыSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- WPIInflation August2013Документ5 страницWPIInflation August2013Angel BrokingОценок пока нет

- Technical & Derivative Analysis Weekly-14092013Документ6 страницTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertДокумент4 страницыRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- International Commodities Evening Update September 16 2013Документ3 страницыInternational Commodities Evening Update September 16 2013Angel BrokingОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Daily Agri Tech Report September 14 2013Документ2 страницыDaily Agri Tech Report September 14 2013Angel BrokingОценок пока нет

- Daily Agri Tech Report September 16 2013Документ2 страницыDaily Agri Tech Report September 16 2013Angel BrokingОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Metal and Energy Tech Report November 12Документ2 страницыMetal and Energy Tech Report November 12Angel BrokingОценок пока нет

- Commodities Weekly Outlook 16-09-13 To 20-09-13Документ6 страницCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Market Outlook 13-09-2013Документ12 страницMarket Outlook 13-09-2013Angel BrokingОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Commodities Weekly Tracker 16th Sept 2013Документ23 страницыCommodities Weekly Tracker 16th Sept 2013Angel BrokingОценок пока нет

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Документ4 страницыDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Derivatives Report 16 Sept 2013Документ3 страницыDerivatives Report 16 Sept 2013Angel BrokingОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Currency Daily Report September 16 2013Документ4 страницыCurrency Daily Report September 16 2013Angel BrokingОценок пока нет

- Daily Agri Report September 16 2013Документ9 страницDaily Agri Report September 16 2013Angel BrokingОценок пока нет

- Sugar Update Sepetmber 2013Документ7 страницSugar Update Sepetmber 2013Angel BrokingОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Market Outlook: Dealer's DiaryДокумент13 страницMarket Outlook: Dealer's DiaryAngel BrokingОценок пока нет

- IIP CPIDataReleaseДокумент5 страницIIP CPIDataReleaseAngel BrokingОценок пока нет

- Derivatives Report 8th JanДокумент3 страницыDerivatives Report 8th JanAngel BrokingОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Technical Report 13.09.2013Документ4 страницыTechnical Report 13.09.2013Angel BrokingОценок пока нет

- TechMahindra CompanyUpdateДокумент4 страницыTechMahindra CompanyUpdateAngel BrokingОценок пока нет

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressДокумент1 страницаPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingОценок пока нет

- Metal and Energy Tech Report Sept 13Документ2 страницыMetal and Energy Tech Report Sept 13Angel BrokingОценок пока нет

- MetalSectorUpdate September2013Документ10 страницMetalSectorUpdate September2013Angel BrokingОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Daily Agri Tech Report September 06 2013Документ2 страницыDaily Agri Tech Report September 06 2013Angel BrokingОценок пока нет

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateДокумент6 страницTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingОценок пока нет

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechДокумент4 страницыJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingОценок пока нет

- MarketStrategy September2013Документ4 страницыMarketStrategy September2013Angel BrokingОценок пока нет

- General Banking Activities in Bangladesh A Case Study On Standard Bank LimitedДокумент59 страницGeneral Banking Activities in Bangladesh A Case Study On Standard Bank Limitedtanvirsakib007Оценок пока нет

- Edu Copy-Wingreens Farms-Sustainable GrowthДокумент11 страницEdu Copy-Wingreens Farms-Sustainable GrowthHarsh ShahОценок пока нет

- Principles of Banking 9th EditionДокумент374 страницыPrinciples of Banking 9th EditionDoãn VyОценок пока нет

- Classroom-Ready Lessons For Agriculture Instruction: Lesson Libraries: Lesson ExtrasДокумент13 страницClassroom-Ready Lessons For Agriculture Instruction: Lesson Libraries: Lesson ExtrasOliver Talip100% (1)

- Chapter 8 (Banking) PresentationДокумент88 страницChapter 8 (Banking) PresentationShannin MaeОценок пока нет

- BSP Circular 425Документ3 страницыBSP Circular 425G Ant Mgd100% (1)

- How Should These Rules Be Referred To?Документ142 страницыHow Should These Rules Be Referred To?Alia Arnz-DragonОценок пока нет

- Prepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Документ4 страницыPrepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Jayr BV100% (1)

- Unit 5 Essential Questions and Vocab ExamplesДокумент5 страницUnit 5 Essential Questions and Vocab Examplesjonathan dycusОценок пока нет

- Economics of Money Banking and Financial Markets 9th Edition by Mishkin Test BankДокумент27 страницEconomics of Money Banking and Financial Markets 9th Edition by Mishkin Test BankĐỗ Ngọc Huyền Trang100% (1)

- Earnings Management Research A Review of Contempor PDFДокумент16 страницEarnings Management Research A Review of Contempor PDFfajarОценок пока нет

- Business English WordsДокумент10 страницBusiness English WordsAnna EgriОценок пока нет

- EMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaДокумент7 страницEMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaNikhil Jain100% (1)

- Module-3 Types of Financial ServicesДокумент141 страницаModule-3 Types of Financial Serviceskarthik karthikОценок пока нет

- Kiem Tra - LMS - So 1 - DAДокумент8 страницKiem Tra - LMS - So 1 - DAHuỳnh Minh Gia Hào100% (1)

- ANNEXURE - I BORROWER'S BASIC FACT SHEET - FOR SMEs OTHER THAN INDIVIDUALSДокумент3 страницыANNEXURE - I BORROWER'S BASIC FACT SHEET - FOR SMEs OTHER THAN INDIVIDUALSHusnainShahid100% (1)

- Chapter 16 - The Financial SystemДокумент8 страницChapter 16 - The Financial SystemArsalОценок пока нет

- Module 1 - Introduction and Management Decision Making - Homework SolutionsДокумент4 страницыModule 1 - Introduction and Management Decision Making - Homework SolutionsAbelОценок пока нет

- Special Assignment (Loan Function of Banks)Документ9 страницSpecial Assignment (Loan Function of Banks)Michee BiagОценок пока нет

- Problem 14-4 (IAA)Документ8 страницProblem 14-4 (IAA)NIMOTHI LASE0% (1)

- A Research Report ON: Consumer Attitude Towards Education Loan in India Provided by Indian BankДокумент28 страницA Research Report ON: Consumer Attitude Towards Education Loan in India Provided by Indian BankKavindra SahuОценок пока нет

- FAQ For DB Ozone Legal FightДокумент11 страницFAQ For DB Ozone Legal FightbrijsingОценок пока нет

- Australian TaxationДокумент45 страницAustralian TaxationEhtesham HaqueОценок пока нет

- Calculating Your Net Worth: Assets LiabilitiesДокумент1 страницаCalculating Your Net Worth: Assets LiabilitiesgowthamОценок пока нет

- Mod9 (Itl)Документ27 страницMod9 (Itl)Tiara LlorenteОценок пока нет

- Farmers Suicide in IndiaДокумент32 страницыFarmers Suicide in IndiaSajjad Sayyed100% (1)

- BBLS - Risk Management - v.0.1 PDFДокумент27 страницBBLS - Risk Management - v.0.1 PDFNitishОценок пока нет

- Accounting Standards AS 7, 9 and 3: DTRTI LucknowДокумент44 страницыAccounting Standards AS 7, 9 and 3: DTRTI LucknowvivekОценок пока нет

- Macro Eco NotesДокумент55 страницMacro Eco NotesSiya saniyaОценок пока нет

- FULL Download Ebook PDF International Financial Management 9th Edition by Cheol Eun PDF EbookДокумент41 страницаFULL Download Ebook PDF International Financial Management 9th Edition by Cheol Eun PDF Ebookkathy.galayda516100% (35)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthОт EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthРейтинг: 4 из 5 звезд4/5 (20)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 4.5 из 5 звезд4.5/5 (14)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisОт EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisРейтинг: 5 из 5 звезд5/5 (6)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 3.5 из 5 звезд3.5/5 (8)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialРейтинг: 4.5 из 5 звезд4.5/5 (32)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursОт EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursРейтинг: 4.5 из 5 звезд4.5/5 (8)