Академический Документы

Профессиональный Документы

Культура Документы

Mac 07 RM

Загружено:

Alok SrivastavaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Mac 07 RM

Загружено:

Alok SrivastavaАвторское право:

Доступные форматы

Problems on Relevant Costs for Decision Making

Problem no: 1: Accepting a Special Order

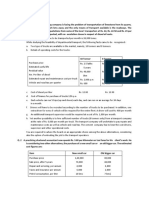

Sutherland manufactures and sells 110,000 laser printers each month. A principal component part in each printer is its paper feed drive. Sutherlands plant currently has the monthly capacity to produce 150,000 drives. The unit costs of manufacturing these drives (up to 150,000 per month) are as follows: Variable costs per unit: Direct materials .. $ 45 Direct labor . 25 Variable M.O.H . 5 Fixed costs per month: Fixed M.O.H .. $1,430,000 Desk-Mate Printers has offered to buy 20,000 paper feed drives from Sutherland to be used in its own printers. Compute the following: a. The average unit cost of manufacturing each paper feed drive assuming that Sutherland manufactures only enough drives for its own laser printers b. The incremental unit cost of producing an additional paper feed drive. c. The per-unit sales price that Sutherland should charge DeskMate to earn $500,000 in monthly pretax profit on the sale of drives to Desk-mate

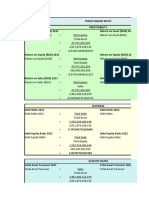

Problem no: 2: Scarce Resources/Constraint Factor Texteriles Company creates different types of bolts of cloth. These bolts of cloth are made on the same machinery. The textile machines have the capacity of 3,600 hours per month. Texteriles is considering producing three different types of cloth: denim, chenille, and gauze with contribution margins per bolt of $14, $22, and $9 respectively. Texteriles knows they can sell only a total of 6,000 bolts of denim, 2,000 bolts of chenille, and/or 1,200 bolts of gauze. A bolt of each type of cloth requires a different amount of machine time as follows: denim takes 0.5 machine hours, chenille takes 1 machinehour, and gauze takes 0.3 machine-hours. What combination of products will maximize the profits of Texteriles?

Problem no: 3: Make or Buy Decision Barometer, Inc., makes part no. 566 on one of its production lines. Each month Bacrometer makes 60,000 of part no. 566 at a variable cost of $2.50 per part. The fixed costs for the production line are $180,000 or $3.00 per part. Bacrometer has been provided a bid for part no. 566 from another manufacturer who will make the part for $2.65 per part. Bacrometer knows the production line could be rented to another manufacturer for $5,000 per month. Should Bacormeter continue to make part no. 566 or should they buy the part and rent the production line?

Problem no: 4: Joint Products Treadwell Pharmaceuticals produces two medications in a joint process: Amoxiphore and Benidrate. With each production run, Treadwell incurs $4,000 in common costs up to the split-off point. Amoxiphore can be sold for $2,700 at the split-off point or be processed further at a cost of $1,600 at which time it can be sold for $4,200. However, if Amoxiphore is sold at the split-off point, its side effects include nausea and headaches. If it is processed further, these side effects are diminished. Demand for Amoxiphore far exceeds Treadwells production capacity.Benidrate can be sold for $2,400 at the split-off point or be processed further at a cost of $3,700 at which time it can be sold for $6,000. a. Determine which product is more profitable to process beyond the split-off point? b. What nonfinancial issues should the company consider regarding its processing decisions?

Вам также может понравиться

- SIRP Report - Jainam & KavishДокумент24 страницыSIRP Report - Jainam & KavishKavish JainОценок пока нет

- Cost Sheet CaseДокумент4 страницыCost Sheet CasetanishaОценок пока нет

- Decision Theory - I-18Документ4 страницыDecision Theory - I-18NIKHIL SINGHОценок пока нет

- Mba Project On OpecДокумент65 страницMba Project On Opecmukesh_saroj0070% (1)

- Service CostingДокумент6 страницService Costingbinu100% (1)

- Problem Set 1 PDFДокумент3 страницыProblem Set 1 PDFrenjith0% (2)

- 8 Marginal CostingДокумент50 страниц8 Marginal CostingBhagaban DasОценок пока нет

- ACCOUNTING FOR CORPORATES (BBBH233) - 003 Module 3 - 1573561029351Документ78 страницACCOUNTING FOR CORPORATES (BBBH233) - 003 Module 3 - 1573561029351Harshit Kumar GuptaОценок пока нет

- Operation Management Case Studies CombinedДокумент1 013 страницOperation Management Case Studies CombinedRahulОценок пока нет

- Imt 15Документ5 страницImt 15pratiksha1091Оценок пока нет

- Business Information System of LicДокумент20 страницBusiness Information System of LicJohn MathewОценок пока нет

- Week 1 - Problem SetДокумент3 страницыWeek 1 - Problem SetIlpram YTОценок пока нет

- Team Shooting Stars: - FMS DelhiДокумент6 страницTeam Shooting Stars: - FMS DelhiAkram KhanОценок пока нет

- Chapter 4Документ15 страницChapter 4Arun Kumar SatapathyОценок пока нет

- UdhyogДокумент1 страницаUdhyogVishal KashyapОценок пока нет

- Activity Base Costing (ABC Costing)Документ12 страницActivity Base Costing (ABC Costing)SantОценок пока нет

- A Report On: Analysis of Financial Statements OF Tata Consultancy Services & Maruti SuzukiДокумент38 страницA Report On: Analysis of Financial Statements OF Tata Consultancy Services & Maruti SuzukiSaurabhОценок пока нет

- BRM0012 - Consumer's Perception On Inverters in IndiaДокумент3 страницыBRM0012 - Consumer's Perception On Inverters in Indiavarun kumar Verma0% (2)

- Case Problem 3 Textile Mill SchedulingДокумент4 страницыCase Problem 3 Textile Mill SchedulingSomething ChicОценок пока нет

- Operating CostingДокумент6 страницOperating CostingAvilash Vishal MishraОценок пока нет

- Comparison of HUL P GДокумент8 страницComparison of HUL P GMia KhalifaОценок пока нет

- Question Bank Business StudiesДокумент22 страницыQuestion Bank Business StudiesTushar KhattarОценок пока нет

- Expenses Amount: Shashaank Industries Ltd. Profit and Loss Account For The Year Ended 31st March 2006Документ6 страницExpenses Amount: Shashaank Industries Ltd. Profit and Loss Account For The Year Ended 31st March 2006Srijan SaxenaОценок пока нет

- Ar T.C Om: EadingДокумент8 страницAr T.C Om: Eadingarun1974Оценок пока нет

- IMT Covid19Документ7 страницIMT Covid19Vishwajeet KumarОценок пока нет

- Q Navin PDFДокумент1 страницаQ Navin PDFvijaya senthilОценок пока нет

- Ribons and Bows Case Study AccountingДокумент6 страницRibons and Bows Case Study Accountingsalva89830% (1)

- Clark Material HandlingДокумент26 страницClark Material HandlingKarthik Arumugham100% (1)

- Financial ManagementДокумент16 страницFinancial ManagementManish FloraОценок пока нет

- Mid Term Exam - MBA - Management Accounting - MBAT 202 - OnlineДокумент2 страницыMid Term Exam - MBA - Management Accounting - MBAT 202 - OnlineDullStar MOTOОценок пока нет

- Operations and Supply ChainДокумент54 страницыOperations and Supply ChainLoan PhạmОценок пока нет

- Home Work 3 of E3001Документ3 страницыHome Work 3 of E3001Sk SharmaОценок пока нет

- MGMT Acts PaperДокумент27 страницMGMT Acts PaperAbhishek JainОценок пока нет

- Individual Assignment (Mock Exam) : Answer. 235, 226Документ4 страницыIndividual Assignment (Mock Exam) : Answer. 235, 226ayal geze0% (1)

- Modern Pharma Is Considering The Manufacture of A New Drug, Floxin, For Which The FollowingДокумент7 страницModern Pharma Is Considering The Manufacture of A New Drug, Floxin, For Which The FollowingbansalparthОценок пока нет

- Continuous Assignments: Ram Kumar KakaniДокумент10 страницContinuous Assignments: Ram Kumar KakaniKabeer KarnaniОценок пока нет

- Bhel Case StudyДокумент15 страницBhel Case StudySanjeev SinghОценок пока нет

- Mock Paper 1 Process Variacne and Budget With Answers MTQ Batch 2 BI 2014Документ12 страницMock Paper 1 Process Variacne and Budget With Answers MTQ Batch 2 BI 2014Zaira AneesОценок пока нет

- Animal HealthДокумент3 страницыAnimal Healthkritigupta.may1999Оценок пока нет

- Cost Accounting B.Com III YearДокумент4 страницыCost Accounting B.Com III Yeartadepalli patanjaliОценок пока нет

- Marketing Strategies Uncle ChipsДокумент30 страницMarketing Strategies Uncle ChipsNavyanth KalerОценок пока нет

- Nitu's Business School Selection: Riding On An Indifference CurveДокумент11 страницNitu's Business School Selection: Riding On An Indifference Curvesumanth sharma RОценок пока нет

- Cost Sheet QuestionsДокумент5 страницCost Sheet QuestionsDrimit GhosalОценок пока нет

- Assignment Iii Mansa Building Case Study: Submitted by Group IVДокумент14 страницAssignment Iii Mansa Building Case Study: Submitted by Group IVHeena TejwaniОценок пока нет

- Decisions Involving Alternative ChoicesДокумент3 страницыDecisions Involving Alternative ChoicesHimani Meet JadavОценок пока нет

- HMT Marketing MixДокумент67 страницHMT Marketing Mixakashsadoriya5477Оценок пока нет

- Market Structure of Indian IT Industry-InFOSYSДокумент20 страницMarket Structure of Indian IT Industry-InFOSYSNitin ChidarОценок пока нет

- Ma Chapter 3 Standard Costing - LabourДокумент60 страницMa Chapter 3 Standard Costing - LabourMohd Zubair KhanОценок пока нет

- Ilide - Info Review Qs PRДокумент93 страницыIlide - Info Review Qs PRMobashir KabirОценок пока нет

- HS Entrepreneurship Sample ExamДокумент27 страницHS Entrepreneurship Sample ExamKate Queen Curay GumpalОценок пока нет

- Contract Process ProblemsДокумент24 страницыContract Process ProblemsAakef SiddiquiОценок пока нет

- Activity Based CostingДокумент2 страницыActivity Based CostingVivek KheparОценок пока нет

- Capital RevenueДокумент20 страницCapital RevenueYatin SawantОценок пока нет

- Operation Management ASSIGNMENT 02Документ5 страницOperation Management ASSIGNMENT 02Saumya JaiswalОценок пока нет

- Business Communication Project WateenДокумент41 страницаBusiness Communication Project WateenAamir Raza100% (1)

- 2.problems On EOQ - 14.12.2018Документ3 страницы2.problems On EOQ - 14.12.2018Rajesh GuptaОценок пока нет

- Set A - Problems On Relevant Decision MakingДокумент6 страницSet A - Problems On Relevant Decision MakingNitin KhareОценок пока нет

- Incremental Costing ProblemДокумент8 страницIncremental Costing ProblemJessica Faith Ignacio EstacioОценок пока нет

- MCS MatH QSTN NewДокумент7 страницMCS MatH QSTN NewSrijita SahaОценок пока нет

- Problem MДокумент3 страницыProblem Mheny2517100% (1)

- A Cross-Category Analysis of Shelf-Space Allocation, ProductДокумент13 страницA Cross-Category Analysis of Shelf-Space Allocation, ProductAnuradha GaikwadОценок пока нет

- Zerodha TDДокумент22 страницыZerodha TDudayОценок пока нет

- Banking Financial Institutions.Документ18 страницBanking Financial Institutions.Jhonrey BragaisОценок пока нет

- Export Controlled or Sanctioned Countries, Entities and Persons - DoResearchДокумент1 страницаExport Controlled or Sanctioned Countries, Entities and Persons - DoResearchAgung WijanarkoОценок пока нет

- Buying and MerchandisingДокумент155 страницBuying and MerchandisingMJ100% (2)

- Dbe MesiДокумент5 страницDbe Mesiattl.cherry25Оценок пока нет

- I. Pre-Merger Insights - 1 Acquisition FactoryДокумент12 страницI. Pre-Merger Insights - 1 Acquisition FactoryRadoslav RobertОценок пока нет

- Faisal WorksheetДокумент5 страницFaisal WorksheetAbdul MateenОценок пока нет

- The Consumer Protection ActДокумент4 страницыThe Consumer Protection ActRijurahul Agarwal SinghОценок пока нет

- JOHANSSON - ChapДокумент38 страницJOHANSSON - Chaplow profileОценок пока нет

- Faculty of Commerce and Management Kumaun University, NainitalДокумент8 страницFaculty of Commerce and Management Kumaun University, Nainitalsaddam_1991Оценок пока нет

- Best Practices For Work-At-Home (WAH) Operations: Webinar SeriesДокумент24 страницыBest Practices For Work-At-Home (WAH) Operations: Webinar SeriesHsekum AtpakОценок пока нет

- Module 5 - Possible Products and Services Based On Viability Profitability and Customer Requirement PDFДокумент51 страницаModule 5 - Possible Products and Services Based On Viability Profitability and Customer Requirement PDFJuliana Maaba Tay-isОценок пока нет

- Business Model - Big BasketДокумент3 страницыBusiness Model - Big BasketShivam TiwariОценок пока нет

- Contemporary Case Studies On Fashion Production, Marketing and Operations PDFДокумент245 страницContemporary Case Studies On Fashion Production, Marketing and Operations PDFKevin Sarmiento BarreraОценок пока нет

- Grassroots Leaders For A New Economy: How Civic Entrepreneurs Are Building Prosperous Communities (J-B US Non-Franchise Leadership)Документ3 страницыGrassroots Leaders For A New Economy: How Civic Entrepreneurs Are Building Prosperous Communities (J-B US Non-Franchise Leadership)rosaОценок пока нет

- Rozana Šuštar : Marketing Standardization: TobeornottobeДокумент19 страницRozana Šuštar : Marketing Standardization: TobeornottobePriyanka RaiОценок пока нет

- Seller Smart Mart Stores Pvt. Ltd. Buyer Rakesh Kumar: Retail InvoiceДокумент1 страницаSeller Smart Mart Stores Pvt. Ltd. Buyer Rakesh Kumar: Retail InvoiceNitinKumarОценок пока нет

- A Project Report On CustomerДокумент13 страницA Project Report On CustomerDrishti BhushanОценок пока нет

- LB 2013-2014 Standardized Statements MinervaДокумент9 страницLB 2013-2014 Standardized Statements MinervaArmand HajdarajОценок пока нет

- Proyeksi INAF - Kelompok 3Документ43 страницыProyeksi INAF - Kelompok 3Fairly 288Оценок пока нет

- T8. IAS 36 - 2016 - RevisedДокумент34 страницыT8. IAS 36 - 2016 - RevisedCavipsotОценок пока нет

- Case Study (ENT530)Документ12 страницCase Study (ENT530)Nur Diyana50% (2)

- MA Purchase Price Calculations - The Locked Box MechanismДокумент4 страницыMA Purchase Price Calculations - The Locked Box MechanismYU LiangОценок пока нет

- Finacial Accounting & ManagementДокумент200 страницFinacial Accounting & ManagementmesfinОценок пока нет

- System Development Life Cycle AssignmentДокумент5 страницSystem Development Life Cycle AssignmentAugustine Barlow67% (3)

- Implementing Strategies - Management & Operations IssuesДокумент31 страницаImplementing Strategies - Management & Operations IssuesELMUNTHIR BEN AMMAR100% (1)

- The Introduction of Lean Manufacturing Concepts at QualcommДокумент25 страницThe Introduction of Lean Manufacturing Concepts at Qualcommzakria100100Оценок пока нет

- MIA RPG 14 2017 MacДокумент37 страницMIA RPG 14 2017 MacnazahiahhalimОценок пока нет

- HRM & Finance-Jivraj TeaДокумент88 страницHRM & Finance-Jivraj TeaYash KothariОценок пока нет