Академический Документы

Профессиональный Документы

Культура Документы

The Oil and Development in GCC States

Загружено:

yhumanbeingИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

The Oil and Development in GCC States

Загружено:

yhumanbeingАвторское право:

Доступные форматы

The Oil and Development in GCC States

Contents

Page

Introduction Natural history Early history The Importance of Oil Oil price Oil production in Oman Petroleum Development Oman (PDO) Cooperation between GCC states in the Field of Energy The role of oil in GCC states economy The Organization of the Petroleum Exporting States (OPEC) The Organization of Arab Petroleum Exporting States (OAPEC) Conclusion

1 1 1 1 2 3 4 4 7 8 9 10

The Oil and Development in GCC States

Introduction

Petroleum is vital to many industries, and is of importance to the maintenance of industrialized civilization itself, and thus is a critical concern for many nations. Oil accounts for a large percentage of the worlds energy consumption.

Natural history

Petroleum is a naturally occurring liquid found in rock formations, usually beneath the surface of the earth; it is also called crude oil. It consists of a complex mixture of hydrocarbons (any organic compound composed solely of the elements hydrogen and carbon), with traces of various nitrogenous and sulfurous compounds. It is generally accepted that oil, like other fossil fuels, formed from the fossilized remains of dead plants and animals by exposure to heat and pressure in the Earth's crust over hundreds of millions of years. Over time, the decayed residue was covered by layers of mud and silt, sinking further down into the Earths crust and preserved there between hot and pressured layers, gradually transforming into oil reservoirs.

Early history

Oil in an unrefined state has been utilized by humans for over 5000 years. It is in general has been used since early human history to keep fires ablaze, and also for warfare. Ancient Persian language tablets indicate the medicinal and lighting uses of oil in the upper echelons of their society. Ancient China was also known to burn skimmed oil for light. An early petroleum industry was established in the 8th century, when the streets of Baghdad were paved with tar, derived from petroleum through destructive distillation. In the 9th century, oil fields were exploited in the area around modern Baku, Azerbaijan, to produce naphtha. These fields were described by al-Masudi in the 10th century, and by Marco Polo in the 13th century, who described the output of those oil wells as hundreds of shiploads. Petroleum also was distilled by al-Razi in the 9th century, producing chemicals such as kerosene in the alembic, which he used to invent kerosene lamps for use in the oil lamp industry.

The Importance of Oil

Its importance in the world economy evolved slowly. The Industrial Revolution generated an increasing need for energy which was fuelled mainly by coal, with other sources including whale oil. However, it was discovered that kerosene could be extracted from crude oil and used as a light and heating fuel. Petroleum was in great demand, and by the twentieth century had become the most valuable commodity traded on the world market, becouse it became the raw material that makes possible

the functioning of nearly every component of the economy, directly or indirectly. It provides most of the nations power supply - far more than any other source. Oil powers the industries, heats the buildings, and provides the raw material for plastics, paints, textiles, and other materials. But it is in transportation that oil is most essential: Many people underestimate the significance of oil in modern civilisation, and mainly associate oil with the petrol or diesel that they put in their cars. However, the value of oil to our world goes far beyond our personal transportation choices as many of the everyday items we use are either made from oil or are dependent upon oil for their production.The fruit and vegetables on supermarket shelves are highly dependent upon oil - from the fuel oil used to harvest and then transport these goods around the world, to the petrochemical feedstock used to manufacture the pesticides and herbicides that maintain high yields. Even fertiliser is dependent upon large amounts of hydrocarbons for its manufacture. The whole of our modern food chain is completely dependent on oil, meaning that the future of agricultural production is vulnerable to depletion of this non-renewable resource. Many consumer goods are made of plastic, a material utilising petrochemicals in its manufacture. Many common medical and pharmaceutical products also have oil as a basic constituent. The aspirin, originally processed from the bark of the willow tree, is now another of these many oil derivatives. Oil has proven to be such a flexible resource that it now underpins many of the items we take for granted in the modern world, and any interuption of its supply would be very serious. In light of the dual challenge of Peak Oil and anthropogenic climate change it is critical that we develop targeted interventions to ensure that we do not waste important resources. But Americans continue to act as if there is no problem as they buy more and bigger cars and commute longer distances from energy-inefficient suburban developments. America epitomizes the petroleum-dependent lifestyle. It uses a lot of oil. Although, it constitutes only 5% of the worlds population. It consumes 25% of global oil production.. Oil provides 97% of the fuel used by Americas enormous fleet of trucks, trains, planes, ships, buses and cars.

Oil price

In the 1950's and 60's, the production quotas and indeed the control of the oil prices in the Middle East was set by seven large multinational oil companies. These seven companies- Exxon, Shell, Texaco, Chevron, Mobil, British Petroleum and Gulf were known as the "Seven Sisters" and they kept the price of oil at about $2.50/barrel. Early in the 1960's the Organization of Petroleum Exporting Countries (OPEC) was formed to regulate the production of crude oil and to bring about more realistic prices. In the mid to late 70's the price of oil rose to over $30/barrel. In 2008 the oil price reach the highest peak when was more than 140$/barrel. But today, it typically swings between $70 and $80 per barrel depending on OPEC quotas and world events.

Oil production in Oman

The beginning was in 1963, when the Natih field was discovered, followed closely by success at Fahud and the investment in a pipeline to the coast and all the other hardware necessary to transport and export Oman's crude oil. A pipeline was followed closely by the construction of an industrial complex at Saih al Maleh (later re-named Mina al Fahal). The first export of Omani oil took place on 27 July 1967. Some significant discoveries early in the decade contributed also: Ghaba North in 1972, followed by Saih Nihayda, Saih Rawl, Qarn Alam and Habur. All five fields were on stream by 1975. The oil price hike in 1973 greatly improved the economics of producing oil in remote locations like Amal , Amin and Marmul. By the end of 1984 average daily production had risen to 400,000 barrels a day and reserves stood at 3.8 billion barrels. Then, in 1986, the oil price collapsed. Almost was required to cut costs while increasing production and maintaining reserves. This it did with horizontal wells , which made their debut in 1986, yielded between two and four times the production from any one given well. By the end of 2000 the production was increased. This was due to the increase in production arisen from the application of the latest technology to increase oil recovery in existing fields. And some of the production increase over the years was made up of "new oil" from fields that were not only found but also developed at an everaccelerating pace. The oil production as entered the 1990s was expected the trend to continue. Unfortunately, the field-development strategy for the start of the 21st century based on incremental infill drilling with horizontal wells and extensive waterflooding had its momentum dissipated before the waterflooding projects. The natural productionrate decline of the major oil fields eventually caught up at the start of the millennium. And to make matters worse, the new wells were delivering less oil; the costs were going up. Following a comprehensive review in 2002 that led to a sweeping change programme, production-recovery plans based not only on waterflooding but also on enhanced oil recovery (EOR) techniques: the application of heat, chemicals or gas solvents to alter the way oil or injected water flows in a reservoir. But, in order for them to be sustainable in the long run . but the fact was that the oil is not sustainable in the longer term. Figure Oil production in Oman

Year 1998 1999 2000 2001 2002 2003 Barrel 835000 832000 840000 831000 771000 702000

2004 2005

661000 631000

Petroleum Development Oman (PDO)

The company name was Petroleum Development (Oman): Shell 85%, Compagnies Francaise des Petroles 10% and Partex 5%.On 1 January 1974 the Government of Oman acquired a 25% shareholding in the Petroleum Development (Oman); six months later the shareholding was increased to 60%, backdated to the beginning of the year. As a result, the foreign interest in PD(O) was now made up of the Shell (34%), Compagnie Franaise des Petroles (4%) and Partex (2%). These shareholdings have remained unchanged to the present day. (The Company, however, underwent a change six years later. On 15 May 1980, it was registered by Royal Decree as a limited liability company under the name Petroleum Development Oman now without parentheses in its name. The objective of PDO is to engage efficiently, responsibly and safely in the exploration, production, development, storage and transportation of hydrocarbons in the Sultanate of Oman. The Company seeks a high standard of performance with the aim to further the long term benefits of its Shareholders, its Employees and the society of the Sultanate of Oman at large.

Cooperation between GCC states in the Field of Energy

The Economic Agreement (1981) provided that Member States should harmonize their policies in the field of oil industry, extraction, refining, marketing, processing, pricing, exploiting of natural gas and development of the energy resources, and that Member States should develop common oil policies and take common positions towards the other world states and at the international and specialized organizations. Article (9) of the Economic Agreement (2001) also provides as follows: For the purpose of achieving integration between Member States in the fields of petroleum and minerals industry and other natural resources, and for enhancing competitive positions of Member States, 1. Member States shall adopt integrated policies in all phases of oil, gas and minerals industry to achieve optimal exploitation of natural resources, while taking into account environmental considerations and the interests of future generations. 2. Member States shall adopt unified policies for oil and gas and shall take common positions in this regard towards non-Member States and at the international and specialized organizations. 3. Member States oil and gas companies working within them shall cooperate in supporting and developing research in the field of oil, gas and natural resources and enhance cooperation with universities in these fields. Achievements

To implement those objectives, Member States have taken several steps to enhance cooperation in the field of energy, such as the following: (1) The GCC Petroleum Strategy The Supreme Council (9th session, Manama, 1988) instructed the Oil Cooperation Committee to develop a long-term petroleum strategy for Member States. Developing that strategy was based on the common features of the Member States, and on the pillars on which the GCC was established; those pillars included achieving coordination, integration and coherence in all fields, and the rules and regulations that followed, in addition to the resolutions, conferences and common GCC agreements as well as the negotiating agreements and policies between Member States and the other international economic groupings and blocs. It was also taken into account that this objective should be in line with the strategic objectives of the local development plans at Member States and the GCC long-term development strategy, which generally focuses on development of human power, improving living standards, diversification of national economic bases, expanding the role of the private sector in Member States and reducing the dependence on oil as the main source of national income. This strategy was also based on the political and economic importance of the GCC Member States at the international level and their pilot role in the oil industry and their oil weight, as Member States possess the biggest confirmed oil reserve and form the largest area of oil production and exportation. This confirms the importance of enhancing the political and economic position of the GCC Member States and their worldwide role through enhancing their role and oil weight. Therefore, the proposed strategy took into account both the internal and external dimensions of the GCC oil relations. The adoption of a GCC unified petroleum strategy is the best method for exploiting the most important natural resources on which their economies depend on. In this connection, the strategic vision of the GCC Member States seeks to achieve a number of main objectives through the adoption of a number of policies and procedures for achieving these objectives and evaluating the targeted performance according to a crystal-clear implementing mechanism and approved tools for following up and evaluation. (2) The Regional Emergency Plan of the Oil Products. The Supreme Council (9th session, Manama, 1988) adopted The GCC Regional Emergency Plan of the Oil Products. The plan aims at cooperation and solidarity of Member States when any Member State is exposed to an emergency that causes discontinuation in the Member State or inability to meet its needs of the consumption of oil products until it becomes able to restore its potentials and depend on its own sources. (3) The Oil Lending System.

The Supreme Council (8th session, Riyadh, 1987) approved the Intra-GCC oil lending system. Lending is based on the solidarity of all Member States at the occurrence of any injury that causes breakdown of the structures transporting oil exports to the ports, provided that the injury percentage shall account for 30% of the quantity expected to be exported by the injured State and the expectation that such injury will last for at least one month, subject to the bound shares of OPEC Members. (4) The Common Mining Law. The Ministers of Petroleum (25th meeting, Doha, 2 November 2003) agreed to prepare a GCC Common Mining Law. The Law encourages investors to exploit the available and promising minerals resources in the region. The law specifies the conditions, obligations and rights of all the parties engaged in the exploitation, processing and marketing of the various ores in a commercial form in some Member States. The adoption of such a Law will be in line with the formation of the GCC Common Market, which requires unification of laws, regulations and legislations, particularly in the field of investment; where the investor finds similarity among GCC Member States in respect to his rights and obligations. The Law is currently at the final preparation stages. (5) Coordination in the Filed of Marketing. Enhancing coordination and exchange of information and expertise among the experts at GCC Member States in respect to the marketing of the refined oil products and petrochemicals to the different world markets, and the collective work to eliminate all tax barriers and other barriers that prevent access of the GCC exports of crude oil and products thereof to such markets. (6) Correlations between Energy and Environment. The Supreme Council (9th session, Abu Dhabi, 1998) adopted the following two recommendations concerning the lead-free gasoline and the reduction of sulfur content in diesel: - The GCC Member States stress the importance of Human and Environment protection through offering the lead-free gasoline by the national petroleum companies in the local markets of the GCC Member States.To ensure concurrent implementation of this recommendation among the GCC Member States, due to its relation to the Intra-GCC transportation and communication movement, the GCC Member States stress speeding up the production of this product and marketing it locally by 2002 at the latest with an octane number 90-97. - The GCC Member States stress that all measures shall be taken to reduce the sulfur content in the diesel produced by the national refineries to be compatible with the internationally accepted levels for protection of health and environment from the adverse health impacts of the sulfuric products. The Ministries of Petroleum and affiliate corporations have implemented that resolution by introducing the lead-free gasoline with the designated octane number

during the specified period. They have also adopted the projects for producing the low- sulfur content diesel amongst their strategic priorities.

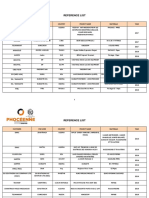

(7) GCC Energy Team. Enhancement of the role of the Energy Team in its dialogue with the Chinese and European parties with a view to achieving various gains for the diverse phases of the GCC petroleum industry and contributing to opening the Chinese and European markets to the GCC exports of crude oil, refined oil products and petrochemicals. (8) Collective Action. Making active the collective action to improve the economies and performance levels of the oil refineries and gas industry with a view to achieving the highest revenues and reducing the loss along with making joint efforts to ensure cleanliness of the environment and safety of plants and manufactures to be always compatible with the developments of the international specifications (9) Trade. Enhancing trade in the petrochemical derivatives (by-products) across the borders of the GCC Member States, and between them and the Arab and international markets that would contribute to the growth of the petrochemical sector. Petroleum Development Companies in GCC states. S. No Company 1 2 3 4 5 6 Petroleum Development (Oman) Saudi Aramco Bahrain National Oil Company Kuwait Petroleum Corporation Abu Dhabi National Oil Company Qatar Petroleum

The role of oil in GCC states economy

As oil prices continue to set new record, GCC states are increasingly shaping trends in financial markets. The increasing of oil prices since 2002 makes them the largest and fastest-growing component of a broad shift in global economic markets, a shift that also includes the private-equity firms, and hedge funds. Exporting of oil with high prices, generates windfall revenues for GCC counties, which became the worlds largest source of net global capital flows. A majority of these revenues have been

recycled into global financial markets, making these states powerful players and help them to build a good infrastructure to attract the investors. Moreover, the influence of oil revenue is likely to continue, but not for long future because of depletion of oil as it is non-renewable resource. Therefore, the exact size of future petrodollar foreign investments will depend on oil prices, which are subject to considerable uncertainty. As shown in the graph bellow Saudi Arabia is the biggest producer of oil in OPIC. Also, the GCC states region posse the most of the oil proven reserves in the word. For example, according to Oil & Gas Journal, as of January 1, 2009, Qatar has 15.2 billion barrels of proven oil reserves. Qatar was the fifteenth largest crude oil exporter in the world in 2008, and of the 12 Organization for Petroleum Exporting States (OPEC) members, ranked eleventh in crude oil exports in 2008. Year-to-date 2009 production averages indicate Qatar produced an estimated 1.2 million barrels per day (bbl/d) of total liquids (830,000 bbl/d of crude and 370,000 bbl/d of non-crude). The countrys crude oil production capacity from 2008 to 2009 increased from 960,000 bbl/d to an estimated 1 million bbl/d. As an OPEC member, Qatar is allocated a specific production target by the Organization. In mid-2009, Qatars implied crude production target was estimated to be 730,000 bbl/d. At current production levels, Qatar carries about 270,000 bbl/d of spare crude capacity.

The Organization of the Petroleum Exporting States (OPEC)

The Organization of the Petroleum Exporting States (OPEC) is a permanent, intergovernmental Organization, created at the Baghdad Conference on September

1014, 1960, by Iran, Iraq, Kuwait, Saudi Arabia and Venezuela. The five Founding Members were later joined by nine other Members: Qatar (1961); Indonesia (1962) suspended its membership from January 2009; Socialist Peoples Libyan Arab Jamahiriya (1962); United Arab Emirates (1967); Algeria (1969); Nigeria (1971); Ecuador (1973) suspended its membership from December 1992-October 2007; Angola (2007) and Gabon (19751994). OPEC had its headquarters in Geneva, Switzerland, in the first five years of its existence. This was moved to Vienna, Austria, on September 1, 1965. OPEC's objective is to co-ordinate and unify petroleum policies among Member States, in order to secure fair and stable prices for petroleum producers; an efficient, economic and regular supply of petroleum to consuming nations; and a fair return on capital to those investing in the industry.

The Organization of Arab Petroleum Exporting States (OAPEC)

Established by an agreement amongst Arab states which rely on the export of petroleum, the Organization of Arab Petroleum Exporting States (OAPEC) is a

10

regional inter-governmental organization concerned with the development of the petroleum industry by fostering cooperation among its members. OAPEC contributes to the effective use of the resources of member states through sponsoring joint ventures. The Organization is guided by the belief in the importance of building an integrated petroleum industry as a cornerstone for future economic integration amongst Arab states. On January 9, 1968, Kuwait, Libya and Saudi Arabia signed in Beirut an agreement establishing OAPEC. The three founding members agreed that the Organization would be located in the State of Kuwait. By 1982 the membership of the Organization has risen to eleven Arab oil exporting states: Algeria (1970), Bahrain (1970), Egypt (1973), Iraq (1972), Kuwait (1968), Libya (1968), Qatar (1970), Saudi Arabia (1968), Syria (1972), Tunisia (1982) and United Arab Emirates (1970). In 1986, Tunisia submitted a request for withdrawal. The Ministerial Council deliberated the request and it was agreed to suspend Tunisias rights and obligations in OAPEC, until such a time that Tunisia chooses to reactivate its membership.

Conclusion

We have staked our entire way of life on a non-renewable resource that may be largely exhausted within the next 30 years. All of the current and projected alternative energy sources will not be able to replace oil in the near future. It doesnt take much imagination to realize that when (not if) we run out of oil, our accustomed way of life will change radically. But even before that day, our oilguzzling lifestyle erodes our national security, destroys the environment, and makes us very vulnerable to fluctuating oil prices.

11

Вам также может понравиться

- Peak OilДокумент18 страницPeak Oilapi-3706215Оценок пока нет

- Pe 451 - Lecture 1Документ30 страницPe 451 - Lecture 1obodyqwerty123Оценок пока нет

- Oil & Gas HandbookДокумент126 страницOil & Gas HandbookAlexis Gonzalez100% (1)

- Oil and Gas Industry OverviewДокумент28 страницOil and Gas Industry OverviewShaliniIlavarapuОценок пока нет

- History Oil of Oil and GasДокумент3 страницыHistory Oil of Oil and Gasugoreg100% (1)

- Presented By: Gautam Ahuja Chemical, 4 YR, 1207535: Submitted To: Dr. BodhrajДокумент15 страницPresented By: Gautam Ahuja Chemical, 4 YR, 1207535: Submitted To: Dr. BodhrajgautamahujaОценок пока нет

- Peak OilДокумент55 страницPeak OilMahant MotheyОценок пока нет

- Petroleum Refining ProcessДокумент37 страницPetroleum Refining ProcessMikaella ManzanoОценок пока нет

- Crude Oil & GeopoliticsДокумент31 страницаCrude Oil & Geopoliticsbhayaji007Оценок пока нет

- Energy Resource Fact Sheets Facts About OilДокумент5 страницEnergy Resource Fact Sheets Facts About OilSunny KionisalaОценок пока нет

- Everything About Fuels ChevronДокумент32 страницыEverything About Fuels ChevronGeorgios PapakostasОценок пока нет

- Energy CrisesДокумент79 страницEnergy CrisesRana Zafar Arshad100% (1)

- BPДокумент41 страницаBPjadesso1981100% (2)

- Chevron EverythingYouNeedToKnowAboutFuels v3 1a DESKTOPДокумент32 страницыChevron EverythingYouNeedToKnowAboutFuels v3 1a DESKTOPNamal FernandoОценок пока нет

- Chapter IiДокумент12 страницChapter Ii21-02923Оценок пока нет

- The Global Oil and Gas IndustryДокумент22 страницыThe Global Oil and Gas Industrychandakharshit007Оценок пока нет

- World Oil ProductionДокумент25 страницWorld Oil ProductionSuleiman BaruniОценок пока нет

- History of Oil Industry & Crude Oil CompositionДокумент21 страницаHistory of Oil Industry & Crude Oil CompositionNuman KhawajaОценок пока нет

- How Oil is Formed in 4 StepsДокумент41 страницаHow Oil is Formed in 4 StepsAbba YakubuОценок пока нет

- Petroleum industry overviewДокумент3 страницыPetroleum industry overviewAngelo Abara SolivenОценок пока нет

- Crude OilДокумент10 страницCrude Oill3gsdОценок пока нет

- The Advantages and Disadvantages of OilДокумент3 страницыThe Advantages and Disadvantages of OilViviana Claros MartinezОценок пока нет

- Classification: Benchmark (Crude Oil)Документ68 страницClassification: Benchmark (Crude Oil)raj bhutiyaОценок пока нет

- The End of Cheap Oil: A Public Service PresentationДокумент35 страницThe End of Cheap Oil: A Public Service PresentationHarjono Zainal AbidinОценок пока нет

- Hassan Review of Global Oil GasДокумент20 страницHassan Review of Global Oil GasRee KeedОценок пока нет

- University of Zakho College of Engineering Petroleum DepartmentДокумент10 страницUniversity of Zakho College of Engineering Petroleum Departmentl3gsdОценок пока нет

- Oil Essay: Raj Aishwary Jain Emws 4/30/2010Документ12 страницOil Essay: Raj Aishwary Jain Emws 4/30/2010Raj JainОценок пока нет

- Assignment CMT668Документ18 страницAssignment CMT668Khairun NiesaОценок пока нет

- EI21 EnhancedOilRecovery FinalДокумент13 страницEI21 EnhancedOilRecovery FinalWelsen DestifenОценок пока нет

- Transportation EnergyДокумент35 страницTransportation EnergyreidljonesОценок пока нет

- 0 Oil and Gas - A HistoryДокумент62 страницы0 Oil and Gas - A HistoryGabriel Alva AnkrahОценок пока нет

- SSW#1 Basics of Industrial EcologyДокумент8 страницSSW#1 Basics of Industrial EcologyAisara AmanovaОценок пока нет

- Demand and Supply Crude OilДокумент25 страницDemand and Supply Crude OilRohan R TamhaneОценок пока нет

- Coal BedДокумент17 страницCoal BedPRIYAH CoomarasamyОценок пока нет

- Tdap Report On Petroleum PDFДокумент57 страницTdap Report On Petroleum PDFJawad RawalaОценок пока нет

- Crude Oil Trading GuideДокумент12 страницCrude Oil Trading GuideNil DorcaОценок пока нет

- Modular Refinery PaperДокумент21 страницаModular Refinery PaperAnonymous aIYYkSAОценок пока нет

- Oil Extraction Process ExplainedДокумент7 страницOil Extraction Process ExplainedsddsdssdsОценок пока нет

- 01 Book Salager Briceo PDFДокумент41 страница01 Book Salager Briceo PDFPedro BortotОценок пока нет

- Us RefiningДокумент14 страницUs Refiningapi-482524077Оценок пока нет

- Group Members (Group 5) ProfessorДокумент8 страницGroup Members (Group 5) ProfessorRufus GodonouОценок пока нет

- Hindustan Petroleum Corporation LTDДокумент17 страницHindustan Petroleum Corporation LTDRohith ThampiОценок пока нет

- Petrochemical ProjectДокумент121 страницаPetrochemical ProjectSachin JainОценок пока нет

- Group C Presentation - Petrochemicals (UPDATED)Документ52 страницыGroup C Presentation - Petrochemicals (UPDATED)sunliasОценок пока нет

- Reviewing the Global Oil and Gas Industry from Ancient Times to the Modern EraДокумент20 страницReviewing the Global Oil and Gas Industry from Ancient Times to the Modern EratejaОценок пока нет

- Hassan Review of Global Oil GasДокумент20 страницHassan Review of Global Oil GasFaisal Shafiq100% (1)

- What Is Oil Shale? From Rock To Oil Projects in The PipelineДокумент52 страницыWhat Is Oil Shale? From Rock To Oil Projects in The Pipelineibrahim irhomaОценок пока нет

- Hassan Review of Global Oil GasДокумент20 страницHassan Review of Global Oil Gascivalerick549Оценок пока нет

- Che 568 Lecture NoteДокумент9 страницChe 568 Lecture NoteCharles ObiefunaОценок пока нет

- Crude Oil: A Naturally Occurring Liquid FuelДокумент21 страницаCrude Oil: A Naturally Occurring Liquid FuelPatricia MarianОценок пока нет

- Chevron - Everything You Need To Know About Marine Fuels - v8-21 - DESKTOPДокумент32 страницыChevron - Everything You Need To Know About Marine Fuels - v8-21 - DESKTOPDuane RaymondОценок пока нет

- Changing Face Oil IndustryДокумент40 страницChanging Face Oil IndustrySanjayОценок пока нет

- Hubbert Center Newsletter Discusses Peak Oil and AlternativesДокумент6 страницHubbert Center Newsletter Discusses Peak Oil and AlternativesmhdstatОценок пока нет

- New Seven Sisters: Group 3: Abhishek Kumar Anuj Malviya Mohit Kapoor Ravi Dudeja Stuti SethiДокумент33 страницыNew Seven Sisters: Group 3: Abhishek Kumar Anuj Malviya Mohit Kapoor Ravi Dudeja Stuti SethiMohit KapoorОценок пока нет

- CH 1 (Introduction) - 2018 BДокумент41 страницаCH 1 (Introduction) - 2018 Bnafisa afariОценок пока нет

- Term PaperДокумент32 страницыTerm PaperUdeme JohnОценок пока нет

- 50 Surprising Facts You Never Knew About OilДокумент3 страницы50 Surprising Facts You Never Knew About OilSATHIASEELAN SIVANANDAM, AdvocateОценок пока нет

- Economics and Geopolitics of Oil and GasДокумент12 страницEconomics and Geopolitics of Oil and Gasm_arrive89Оценок пока нет

- SP-1127 - Layout of Plant Equipment and FacilitiesДокумент11 страницSP-1127 - Layout of Plant Equipment and FacilitiesParag Lalit SoniОценок пока нет

- SP 2269Документ31 страницаSP 2269Vijayakumar AllimuthuОценок пока нет

- ZAU-84-104810-VA-5793-20001-0000-02-Scope of Work For CMMS and CCMSДокумент143 страницыZAU-84-104810-VA-5793-20001-0000-02-Scope of Work For CMMS and CCMSPazhamalai Rajan100% (1)

- CP-190 - Quality Management System For Project DeliveryДокумент54 страницыCP-190 - Quality Management System For Project DeliverycgnanaponОценок пока нет

- BU48A02B00 00E N - 007 (ProSafe ProjRef)Документ12 страницBU48A02B00 00E N - 007 (ProSafe ProjRef)Broken WindowОценок пока нет

- KLD 65 4800088401 ZV L03 00001 0000Документ21 страницаKLD 65 4800088401 ZV L03 00001 0000chandana kumarОценок пока нет

- SP 2329Документ133 страницыSP 2329Waqar KhanОценок пока нет

- SP-1131 - Handover and As-Built DocumentationДокумент47 страницSP-1131 - Handover and As-Built DocumentationVin Bds80% (5)

- Reference List For Compressor Application 2009Документ10 страницReference List For Compressor Application 2009sugeng wahyudiОценок пока нет

- SP-2415 PDO Behavior Based Safety SystemДокумент26 страницSP-2415 PDO Behavior Based Safety SystemShivinder BhandariОценок пока нет

- AGORIA Focuses On Three Key Markets WithДокумент13 страницAGORIA Focuses On Three Key Markets WithJallal DianeОценок пока нет

- SP-1246 Part 1 Technical RequirementsДокумент27 страницSP-1246 Part 1 Technical RequirementsBurning TrainОценок пока нет

- Field Development PlanДокумент23 страницыField Development PlanDjamel EddineОценок пока нет

- HSE Specification - Flora and Fauna ProtectionДокумент11 страницHSE Specification - Flora and Fauna ProtectionrwerwerwОценок пока нет

- Iptc 16523 MS P PDFДокумент12 страницIptc 16523 MS P PDFTatianyОценок пока нет

- Maximizing Yibal's Remaining ValueДокумент9 страницMaximizing Yibal's Remaining Valuemohamadi42Оценок пока нет

- Instrumentation Engineer ResumeДокумент4 страницыInstrumentation Engineer ResumebecpavanОценок пока нет

- Completion Log Delivery in ExplorationДокумент18 страницCompletion Log Delivery in ExplorationAshraf MohammedОценок пока нет

- Organisation Study - Project Report For Mba Iii Semester - MG University - Kottayam - KeralaДокумент62 страницыOrganisation Study - Project Report For Mba Iii Semester - MG University - Kottayam - KeralaSasikumar R Nair79% (19)

- 13-Ref List Phoceenne Rev.1 (2010-2017)Документ25 страниц13-Ref List Phoceenne Rev.1 (2010-2017)Jawad BasraОценок пока нет

- CV - Balaji Harikrishnan - Civil and Structural EngineerДокумент8 страницCV - Balaji Harikrishnan - Civil and Structural EngineerRizwan ShaikhОценок пока нет

- OperatingReview2014 EngДокумент37 страницOperatingReview2014 EngBinduPrakashBhattОценок пока нет

- Fahud Asset1Документ107 страницFahud Asset1ShivaShankarОценок пока нет

- SP-2113 - Specification For Commissioning and Start-Up (Key Principals)Документ23 страницыSP-2113 - Specification For Commissioning and Start-Up (Key Principals)Teguhprabowo Cena100% (1)

- Oman - PredisposalДокумент41 страницаOman - PredisposalmarcspecstevenОценок пока нет

- 01 Section T1 - Invitation To Tender VFДокумент12 страниц01 Section T1 - Invitation To Tender VFSatish ShindeОценок пока нет

- HSSR Me 4 2017Документ36 страницHSSR Me 4 2017sasaОценок пока нет

- Zeeco FlareДокумент70 страницZeeco Flaredr.c.is.dr.c50% (2)

- Alcon LLC Company Profile ConstructionДокумент28 страницAlcon LLC Company Profile ConstructionYousuf AlrushediОценок пока нет

- SP-1131 - Handover and As-Built DocumentationДокумент21 страницаSP-1131 - Handover and As-Built DocumentationJaison JosephОценок пока нет