Академический Документы

Профессиональный Документы

Культура Документы

CH 8 Examreview

Загружено:

Sharmaine Altezo CarranzaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CH 8 Examreview

Загружено:

Sharmaine Altezo CarranzaАвторское право:

Доступные форматы

CHAPTER 8 ADDITIONAL PROBLEMS

MULTI-CONCEPT PROBLEMS LO 1,3,5,7,8

PROBLEM 8-6 COST OF ASSETS, SUBSEQUENT BOOK VALUES, AND BALANCE SHEET PRESENTATION

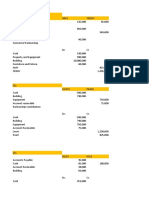

1. Values assigned to each asset: a. Value at time of purchase: $14,000 + $4,800 = $18,800 b. Allocation of purchase price: Supplies expense $200/$3,200 $2,400 = Office furniture $600/$3,200 $2,400 = Equipment $2,400/$3,200 $2,400 = c. Value of this Prepaid License Expense: $1,500 d. Cost of truck Less: accumulated depreciation at time of sale [(12,000 800) 5/8] Book value 2. Depreciation or other expense recorded for each asset during 2007: a. ($18,800 $800)/4 years = $4,500 b. Supplies expense Depreciation of office furniture $450/9 years = Depreciation of equipment $1,800/4 years = c. $1,500/3 years = $500 11/12 = $458 d. Depreciation $11,200/8 years = $1,400 8/12 = $933 Book value at the time of sale Sale price Loss on sale of truck 3. Balance Sheet Presentation: Current assets: Prepaid license expense ($1,500 $458) Property, plant, and equipment: Truck Office furniture Equipment Less: accumulated depreciation 8-1 $5,000 4,800 $ (200) $150 $ 50 $450 $12,000 7,000 $ 5,000 $ 150 $ 450 $1,800

$ 1,042 $18,800 450 1,800 $21,050

($4,500 + $50 + $450) Property, plant, and equipment, net

(5,000) $16,050

LO 2,5

PROBLEM 8-7 COST OF ASSETS AND THE EFFECT ON DEPRECIATION

1. $165,000/10 years = $16,500 depreciation. The correct amount of depreciation is $19,700 [($150,000 + $15,000 + $4,000 + $25,000 + $3,000)/10 years]. 2. Reported income in year 1 is $51,500 ($100,000 $16,500 $25,000 $4,000 $3,000). Reported income should be $80,300 ($100,000 $19,700). 3. A cost is the amount incurred to acquire an asset or pay an expense, and an expense is the amount of an expired asset or a cost that is incurred to generate revenue. LO 5,7,8

PROBLEM 8-8 CAPITAL EXPENDITURES, DEPREICATION, AND DISPOSAL

1. The entry to record depreciation for 2006 is Dec. 31 Depreciation Expense Accumulated DepreciationBuilding To record depreciation for 2006. ($364,000 $14,000)/25 = $14,000. Assets 14,000 The entries for 2007 are Jan. 1 Repairs Expense Cash, Payables, etc. To record repairs in 2007. Assets 21,000 Jan. 1 = Liabilities + 21,000 21,000 Owners Equity 21,000 42,000 42,000 + Owners Equity = Liabilities + 14,000 14,000

Owners Equity 14,000

Building Cash To record pollution control equipment. Assets +42,000 42,000 = Liabilities

The depreciation for 2007 should be calculated as follows: Original cost Less: 2006 depreciation Less: residual value $364,000 (14,000) (14,000)

Plus 2007 capitalized costs Depreciable amount Remaining asset life Depreciation $378,000/30 years = Dec. 31 Depreciation Expense Accumulated DepreciationBuilding To record depreciation for 2007. Assets 12,600 = Liabilities + 12,600

42,000 $378,000 30 years $ 12,600 12,600 Owners Equity 12,600

2. The pollution control equipment extended the life of the asset and should be capitalized rather than expensed. It is difficult to determine whether Merton would rather expense or capitalize the equipment. If the company can expense the equipment for tax purposes, it would normally desire to do so. 3. Original cost of building Pollution device capitalized Less: 2006 depreciation 2007 depreciation Book value 1/1/2008 Less: 2008 depreciation ($12,600 3/12) Book value at sale Sale proceeds Gain on sale $364,000 42,000 (14,000) (12,600) $379,400 3,150 $376,250 392,000 $ 15,750

If the pollution equipment had been expensed (and original life of 25 years was used for depreciation purposes): Original cost Less: Accumulated depreciation ($14,000 2 1/4 years) Book value at 4/1/2008 Sale proceeds Gain on sale $364,000 31,500 $332,500 392,000 $ 59,500

LO 1,5,8,9,10

PROBLEM 8-6A COST OF ASSETS, SUBSEQUENT BOOK VALUES, AND BALANCE SHEET PRESENTATION

Depreciation or amortization and book values a. Depreciation should be calculated as follows: Original cost Add: cab/oven Total cost Less: Residual value Depreciable amount Depreciation expense $26,600/5 years Book value: Total cost Accumulated depreciation Book value b. Depreciation: $2,700 66 2/3%* = $1,800 *Straight-line rate = 100%/3 = 33 1/3%, double-declining-balance rate = 66 2/3%. Book value: $2,700 $1,800 = $900 c. Depreciation: ($8,000 1,000)/8 3/12 = $219 Book value at time of sale: Accumulated depreciation = ($8,000 $1,000) 5/8 = $4,375 Book value = $8,000 $4,375 = $3,625 Book value Sale price Loss on sale d. Amortization: $14,000/4 years = $3,500 $3,500 6/12 = $1,750 Book value: $14,000 $1,750 = $12,250 $3,625 1,500 $2,125 $ 16,000 10,900 $ 26,900 300 $ 26,600 $ 5,320 $ 26,900 5,320 $ 21,580

LO 2,5

PROBLEM 8-7A COST OF ASSETS AND EFFECT ON DEPRECIATION

1. The proper cost to record for the acquisition is $190,000 ($168,000 + $16,500 + $4,400 + $1,100). All costs, except the operating costs for the first year, should be capitalized as part of the cost of the equipment. The operating costs of $26,400 should be expensed. 2. Depreciation reported in year 1 is $21,640 ($216,400/10). Depreciation that should have been reported is $19,000 [($168,000 + $16,500 + $4,400 + $1,100)/10]. Operating costs are not included in the cost of the asset. 3. Key reported income of $55,000 $21,640, or $33,360. The correct amount of income should be as follows: Income before equipment cost Depreciation Operating expenses Net income $ 55,000 (19,000) (26,400) $ 9,600

4. Key should not include operating costs in the value of the asset recorded on the balance sheet. The effect of this error is to overstate assets on the balance sheet. LO 7,8

PROBLEM 8-8A CAPITAL EXPENDITURES, DEPRECIATION, AND DISPOSAL

1. 2006 Depreciation = [($612,000 $12,000)/25 years)] = $24,000 2007 Depreciation = [($612,000 + $87,600 $30,000 $24,000)/24)] = $26,900 2. The cost of the fire equipment increased the value of an asset that will last for more than one year. The cost would have been expensed if it was maintenance. Wagner would prefer to expense the cost of the fire equipment for taxes in order to take advantage of the tax shield immediately. However, Wagner would prefer to capitalize the cost for accounting purposes in order to better match revenue with the costs incurred to generate that revenue. 3. Loss at sale = $612,000 + $87,600 $24,000 $26,900 $360,000 = $288,700 Loss on sale if fire equipment is expensed = $612,000 $24,000 $24,000 $360,000 = $204,000

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Dealer Management System v2.3.Xlsx - GetacoderДокумент19 страницDealer Management System v2.3.Xlsx - Getacoderapsantos_spОценок пока нет

- Act of 3135, As Amended by RДокумент20 страницAct of 3135, As Amended by RRalph ValdezОценок пока нет

- Glossary of Technical IndicatorsДокумент46 страницGlossary of Technical Indicatorssujanreddy100% (1)

- PERMATA ILTIZAM SDN BHD-SME ScoreДокумент8 страницPERMATA ILTIZAM SDN BHD-SME ScoreFazlisha ShaharizanОценок пока нет

- Phrasal Verbs Related To MoneyДокумент3 страницыPhrasal Verbs Related To MoneyFrancisco Antonio Farias TorresОценок пока нет

- Loan Foreclosure LetterДокумент3 страницыLoan Foreclosure LetterBabu BОценок пока нет

- Broker Business PlanДокумент18 страницBroker Business PlanJulie FlanaganОценок пока нет

- Bengkalis Muria - Jurnal Khusus - Hanifah Hilyah SyahДокумент9 страницBengkalis Muria - Jurnal Khusus - Hanifah Hilyah Syahreza hariansyahОценок пока нет

- Acs102 Fundamentals of Actuarial Science IДокумент6 страницAcs102 Fundamentals of Actuarial Science IKimondo King100% (1)

- CAJEGAS CHLOE WorksheetДокумент8 страницCAJEGAS CHLOE WorksheetChloe Cataluna100% (1)

- Geopacific Resources NL - ASX Quarterly Report Dec 2011 - Nabila Gold ProjectДокумент11 страницGeopacific Resources NL - ASX Quarterly Report Dec 2011 - Nabila Gold ProjectIntelligentsiya HqОценок пока нет

- Tabreed06 ProspectusДокумент142 страницыTabreed06 ProspectusbontyonlineОценок пока нет

- Atty. Dionisio Calibo, vs. CA (Cred Trans)Документ2 страницыAtty. Dionisio Calibo, vs. CA (Cred Trans)JM CaupayanОценок пока нет

- Deed of Conditional Sale-1Документ3 страницыDeed of Conditional Sale-1Prince Rayner Robles100% (1)

- BP, Reliance in $7.2 BN Oil Deal: Market ResponseДокумент22 страницыBP, Reliance in $7.2 BN Oil Deal: Market ResponseAnkit PareekОценок пока нет

- BusOrg - Chapter 2Документ3 страницыBusOrg - Chapter 2Zyra C.Оценок пока нет

- Aditing II Q From CH 3,4,5Документ2 страницыAditing II Q From CH 3,4,5samuel debebeОценок пока нет

- What Factors Influence Financial Inclusion Among Entrepreneurs in Nigeria?Документ9 страницWhat Factors Influence Financial Inclusion Among Entrepreneurs in Nigeria?International Journal of Innovative Science and Research TechnologyОценок пока нет

- Transpo ReviewerДокумент22 страницыTranspo ReviewerPéddiéGréiéОценок пока нет

- Testing Point FigureДокумент4 страницыTesting Point Figureshares_leoneОценок пока нет

- El Paso County 2016 Code of EthicsДокумент16 страницEl Paso County 2016 Code of EthicsColorado Ethics WatchОценок пока нет

- Income Tax Declaration Form For The FY-2016-17Документ1 страницаIncome Tax Declaration Form For The FY-2016-17umeshОценок пока нет

- Adam Szyszka (Auth.) - Behavioral Finance and Capital Markets - How Psychology Influences Investors and Corporations (2013, Palgrave Macmillan US)Документ336 страницAdam Szyszka (Auth.) - Behavioral Finance and Capital Markets - How Psychology Influences Investors and Corporations (2013, Palgrave Macmillan US)Diffa mayscaОценок пока нет

- Yaba, Brixzel's AssignmentДокумент4 страницыYaba, Brixzel's AssignmentYaba Brixzel F.Оценок пока нет

- Final Assignment - IUB - MBA - Managerial EconomicsДокумент12 страницFinal Assignment - IUB - MBA - Managerial EconomicsMohammed Iqbal HossainОценок пока нет

- Tax - Dealings in PropertyДокумент18 страницTax - Dealings in PropertyErik Paul PonceОценок пока нет

- Form Credit Application NewДокумент2 страницыForm Credit Application NewRSUD AnugerahОценок пока нет

- Lesson 16 - Engineering Economics 02Документ1 страницаLesson 16 - Engineering Economics 02Darvid Wycoco IIОценок пока нет

- List of Contents: Rayalaseema Hypo Hi-StrengthДокумент57 страницList of Contents: Rayalaseema Hypo Hi-StrengthShams SОценок пока нет

- Tabel EkotekДокумент44 страницыTabel EkotekAkbar AgudaОценок пока нет