Академический Документы

Профессиональный Документы

Культура Документы

Other Financial Info-Website

Загружено:

Hash Em BeygИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Other Financial Info-Website

Загружено:

Hash Em BeygАвторское право:

Доступные форматы

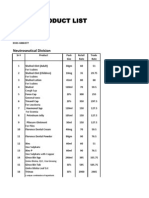

Summary Financial & Operating Data

Consolidated Accounts

MCB Bank Ltd.

Selected Income Statement Data

Year Ended December 31

Interest earned (1)

Interest expensed

Net interest income

Provisions

Non-Interest Income

Operating Income

Non-Interest expense

Profit before taxation

Profit after taxation

2003

2004

2005

10,180.5

2,932.5

7,248.0

781.1

4,691.5

11,158.4

7,622.6

3,535.8

2,141.5

(RS in millions)

9,085.2

2,057.6

7,027.6

279.7

4,233.9

10,981.8

7,434.1

4,112.4

2,477.0

17,757.5

2,781.4

14,976.1

1,144.4

5,382.3

19,214.0

6,563.1

13,340.6

9,214.4

Nine-Month Period Ended September 30

2006

2006

(unaudited)

(unaudited)

(RS in millions)

(US$ in million)

18571.70

306.70

3046.80

50.30

15524.90

256.40

407.90

6.70

3607.30

59.60

18724.30

309.30

5767.10

95.20

13346.60

220.40

8956.00

147.90

MCB Bank Ltd

Per Equity Share Data

Year Ended December 31

2003

2004

2005

(RS in millions)

Nine-Month Period Ended September 30

2006

2006

(unaudited)

(unaudited)

(RS in millions)

(US$ in million)

Earnings per equity share basic (2)

Earnings per equity share diluted (2)

Dividends per equity share (2)

Book value per equity share (2) (3)

5.72

5.72

2.75

24.96

6.10

6.00

2.50

27.45

22.06

22.06

4.25

42.75

17.50

16.40

6.00

49.20

Basic weighted average number of shares (in millions)

Diluted weighted average number of shares (in millions)

406.10

406.10

406.10

406.10

417.70

417.70

511.84

546.30

0.29

0.27

0.10

0.81

MCB Bank Ltd.

Selected Balance Sheet Data

Year Ended December 31

2003

2004

2005

(RS in millions)

Nine-Month Period Ended September 30

2006

2006

(unaudited)

(US$ in million)

Assets:

Cash and balances with treasury banks

Balances with other banks

Investments - net

Lending to financial institutions

Advances - net

Operating fixed assets

Other assets - net

Total assets

24,053.7

1,355.3

128,219.4

10,430.5

97,200.2

4,582.8

6,467.4

272,309.3

23,833.3

5,760.4

67,242.0

10,965.3

137,317.8

7,999.8

6,155.6

259,274.2

23,665.5

1,522.5

70,356.8

9,998.8

180,322.8

8,182.5

5,658.8

299,707.7

29,822.2

1,762.4

66,323.9

19,348.8

183,581.9

8,713.6

9,395.9

318,948.7

492.4

29.1

1,095.1

319.5

3,031.3

143.9

155.1

5,266.4

Liabilities:

Deposits and other accounts

Borrowings from financial institutions

Sub-ordinated loan

Other liabilities

Total liabilities

212,080.7

32,044.4

1,599.4

15,550.0

261,274.5

221,063.9

7,590.9

1,598.7

14,361.5

244,615.0

229,339.9

27,377.5

1,598.1

17,145.5

275,461.0

251,085.0

14,719.1

1,597.4

19,654.5

287,056.0

4,145.9

243.0

26.4

324.5

4,739.8

Shareholder fund and Surplus on Revaluation

11,034.8

14,659.2

24,246.7

31,892.7

526.6

Total liabilities and Share holder funds

272,309.3

259,274.2

299,707.7

318,948.7

5,266.4

MCB Bank Ltd.

Nine-Month Period

Ended September 30

Year Ended December 31

2003

2004

2005

2006

(unaudited)

(percentages)

Profitability Ratios

Return on average total assets (4)

Return on average net worth (4)

Dividend payout ratio (5)

Net interest margin (4)(6)

Gross loan to deposit ratio (4)(7)

Cost income ratio (8)

Capital Adequacy (9)

Total capital adequacy ratio

Tier-I capital adequacy ratio

Tier-II capital adequacy ratio

Asset Quality

Gross non-performing loans as a percentage of gross Loans

Coverage ratio (10)

0.87

29.95

27.50

4.66

49.04

67.33

0.96

28.38

25.00

3.78

65.14

65.95

3.19

64.82

40.22

6.52

82.04

33.61

3.85

52.01

57.47

8.30

76.25

30.73

11.61

8.45

3.16

9.67

6.59

3.07

12.79

9.53

3.26

15.92

12.93

2.99

10.58

61.92

6.14

75.73

4.46

93.10

4.25

96.72

Notes:

(1) Interest earned includes dividends and capital gains earned on equity and preference shares and units

of mutual funds.

(2) Per equity share data for the years ended December 31, 2003 and 2004 is based on the number of

equity shares outstanding as of December 31, 2005. Per equity share data for the six-month period

ended June 30, 2005 is based on the number of equity shares outstanding as of June 30, 2006.

(3) Represents the difference between total assets and total liabilities, divided by the number of total

equity shares outstanding at the end of each reporting period.

(4) June data has been presented on an annualized basis.

(5) Represents the ratio of total dividends payable on equity shares relating to each fiscal year, excluding

the dividend distribution tax, as a percentage of paid-up capital. Dividends of each fiscal year are

typically paid in the following fiscal year.

(6) Represents the ratio of net interest income (including dividend and capital gain income) to average

interest earning assets.

(7) Gross loans divided by total deposits.

(8) Represents the ratio of administrative expenses to operating income.

(9) Capital adequacy ratios are computed in accordance with applicable SBP guidelines and as reported

to the SBP.

(10) Provisions divided by gross non-performing loans.

Вам также может понравиться

- City Bread Matrial CostДокумент14 страницCity Bread Matrial CostHash Em BeygОценок пока нет

- Product List: F.M EnterprisesДокумент2 страницыProduct List: F.M EnterprisesHash Em BeygОценок пока нет

- Wateen TeleДокумент20 страницWateen TeleHash Em BeygОценок пока нет

- Socio-Economic Impact of Cellular Phones Growth in Pakistan An Emperical AnalysisPJSSArtical03Документ15 страницSocio-Economic Impact of Cellular Phones Growth in Pakistan An Emperical AnalysisPJSSArtical03Hash Em BeygОценок пока нет

- ER009 - Factors Affecting The Adoption of Internet BankingДокумент38 страницER009 - Factors Affecting The Adoption of Internet BankingRamis HussainОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Cpa Review School of The Philippines ManilaДокумент2 страницыCpa Review School of The Philippines ManilaAljur Salameda50% (2)

- Miaa Vs CA Gr155650 20jul2006 DIGESTДокумент2 страницыMiaa Vs CA Gr155650 20jul2006 DIGESTRyla Pasiola100% (1)

- Page 6Документ1 страницаPage 6Ekushey TelevisionОценок пока нет

- Transmittal of Documents To TeachersДокумент15 страницTransmittal of Documents To TeachersPancake Binge&BiteОценок пока нет

- Miske DocumentsДокумент14 страницMiske DocumentsHNN100% (1)

- Agra SocLeg Bar Q A (2013-1987)Документ17 страницAgra SocLeg Bar Q A (2013-1987)Hiroshi Carlos100% (1)

- Certificate Programme: Unit 2: Legal Requirements in Setting Up Ngos: India &south Asia 1Документ48 страницCertificate Programme: Unit 2: Legal Requirements in Setting Up Ngos: India &south Asia 1Deepak Gupta100% (1)

- Blankcontract of LeaseДокумент4 страницыBlankcontract of LeaseJennyAuroОценок пока нет

- Nyandarua BursaryAPPLICATION FORMДокумент5 страницNyandarua BursaryAPPLICATION FORMK Kamau100% (1)

- Mrunal Updates - Money - Banking - Mrunal PDFДокумент39 страницMrunal Updates - Money - Banking - Mrunal PDFShivangi ChoudharyОценок пока нет

- People vs. BartolayДокумент6 страницPeople vs. BartolayPrince CayabyabОценок пока нет

- 70ba5 Inventec KRUG14 DIS 0503Документ97 страниц70ba5 Inventec KRUG14 DIS 0503Abubakar Siddiq HolmОценок пока нет

- Kenneth A. Dockins v. Benchmark Communications, 176 F.3d 745, 4th Cir. (1999)Документ12 страницKenneth A. Dockins v. Benchmark Communications, 176 F.3d 745, 4th Cir. (1999)Scribd Government DocsОценок пока нет

- Position Paper in Purposive CommunicationДокумент2 страницыPosition Paper in Purposive CommunicationKhynjoan AlfilerОценок пока нет

- Filamer Christian Institute V IACДокумент6 страницFilamer Christian Institute V IACHenson MontalvoОценок пока нет

- Statement by Bob Rae On The Death of Don SmithДокумент1 страницаStatement by Bob Rae On The Death of Don Smithbob_rae_a4Оценок пока нет

- KB4-Business Assurance Ethics and Audit December 2018 - EnglishДокумент10 страницKB4-Business Assurance Ethics and Audit December 2018 - EnglishMashi RetrieverОценок пока нет

- Maint BriefingДокумент4 страницыMaint BriefingWellington RamosОценок пока нет

- Rfso S A0011749958 1Документ3 страницыRfso S A0011749958 1Marian DimaОценок пока нет

- Heterosexism and HomophobiaДокумент6 страницHeterosexism and HomophobiaVictorОценок пока нет

- CA CHP555 Manual 2 2003 ch1-13Документ236 страницCA CHP555 Manual 2 2003 ch1-13Lucas OjedaОценок пока нет

- Admixtures For Concrete, Mortar and Grout ÐДокумент12 страницAdmixtures For Concrete, Mortar and Grout Ðhz135874Оценок пока нет

- Internal Orders / Requisitions - Oracle Order ManagementДокумент14 страницInternal Orders / Requisitions - Oracle Order ManagementtsurendarОценок пока нет

- Double Shot Arcade Basketball System: Assembly InstructionsДокумент28 страницDouble Shot Arcade Basketball System: Assembly Instructionsمحمد ٦Оценок пока нет

- Bantolo V CastillonДокумент3 страницыBantolo V Castillongoma21Оценок пока нет

- Digest Esguerra Vs TrinidadДокумент2 страницыDigest Esguerra Vs TrinidadladygeorginaОценок пока нет

- Econ Essay On Royal Mail Between PrivitisationДокумент2 страницыEcon Essay On Royal Mail Between PrivitisationAhila100% (1)

- Human Rights and Its Ratification in India What Are Human Rights?Документ5 страницHuman Rights and Its Ratification in India What Are Human Rights?Aadya PoddarОценок пока нет

- Making Money On Autopilot V3 PDFДокумент6 страницMaking Money On Autopilot V3 PDFGatis IvanansОценок пока нет

- 09-01-13 Samaan V Zernik (SC087400) "Non Party" Bank of America Moldawsky Extortionist Notice of Non Opposition SДокумент14 страниц09-01-13 Samaan V Zernik (SC087400) "Non Party" Bank of America Moldawsky Extortionist Notice of Non Opposition SHuman Rights Alert - NGO (RA)Оценок пока нет