Академический Документы

Профессиональный Документы

Культура Документы

Excise Duty

Загружено:

Swapnil BhalaИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Excise Duty

Загружено:

Swapnil BhalaАвторское право:

Доступные форматы

CHAPTER - 1 CONCEPTUAL FRAMEWORK 1) Direct Vs Indirect Taxes: Taxes Direct Taxes i) Income Tax, Wealth Tax ii) Paid

directly by person concerned iii) Tax payer pays directly from his income or wealth iv) Paid after income reaches hands of tax payer 2) Indirect Taxes Central Excise, Customs, Service tax Central Sales Tax, VAT, State Excise Tax ii) Paid by one person but he records the same from other person iii) Tax payer pays while purchasing goods and / or services iv) Paid before goods/ services reach the tax payer i)

Advantages of Indirect Taxes Psychological advantage to tax payer Easier to collect Less tax evasion Lower collection cost Control over wasteful expenditure Channelise industrial growth Support local industry [ High Customs Duty low Excise Duty] High revenue [ 71% of tax revenue ]

3) Disadvantages of Indirect Taxes : Tax is uniform whether purchased by rich or poor Reduces demand of goods Increases project cost Shield to inefficient local industries Cost of modern imported m/c & technology Smuggling / tax evasion Inflationary 4) Laws Relating to Central Excise Central excise Act 1944 Central excise rules Central excise valuation rules (2000) Central excise tariff Act (CETA) 1985 Additional duties on goods of SP. Importance Act. 1957 Customs excise & service tax appellate tribunal (CESTAT ) procedure rules 1982 Notifications issued by central excise Deptt. Circulars issued by central excise Deptt.

5)

Important features of Excise Duty (E.D.) Power to impose E.D. is given by constitution to Central Govt. Power to impose E.D. on liquor, opium & narcotics to S. Govt. Any article can be levied C.E. duty if all following conditions are satisfied : a) Duty is on goods [movable & Marketable ] b) Goods must be excisable i.e. mentioned in schedule to CETA 1985 c) Goods must be manufactured or produced d) Such mfg. or production must be in India Goods manufactured in SEZ are excluded excisable goods& no E.D. is livable on such goods Taxable event is manufacture or production in India Once duty liability is fixed, it can be collected from a person at time & place found administratively most convenient for collection Liability to pay E.D. is on manufacturer or producer of excisable goods. When goods are stored in a warehouse without payment of duty the liability to pay duty is on person who stores goods i.e. warehouse keeper. Duty payable is as applicable on date of removal Duty is payable even when Goods are used within factory Goods are captivity consumed within factory for further manufacture Goods given as free samples Goods given as free replacement Duty can be levied on Govt. undertaking also E.D. should be considered as manufacturing expenses & should be considered as an element of cost for inventory valuation Goods manufactured or produced in SEZ are excisable goods but no duty is leviable on these goods 6) Types of Excise Duty i) Basic Excise Duty : (BED) Also termed as CENVAT Levied as per rates specified in Sch. I of CETA 1985 General rate is 8% There is partial exemption to few products ii) Special Excise Duty. (SED) Charged on items given in Sch. II of CETA 1985 At present there is no SED on any product iii) National calamity contingent duty (N.C.C.D) In additional to BED Imposed only on specified goods Various for different goods from 10% to 45% If goods are exempted from Excise duty they are

exempted from N.C.C.D. also. iv) v) vi) 7) Additional Excise Duty on Pan masala & Tobaco products : Introduced w.e.f. 1-3-2005 Imposed by way of surcharge Duty payable at 10% of aggregate of normal rate of excise duties payable. For Pan masala mfd./ unmfd. Tobaco, Cigars, Cigarettes Education Cess : Payable on C.E., Customs, Service Tax, Income Tax Calculated on all duties of Excise @ 3% on duty payable. Thus if duty rate is 16% education cess is 0.48% Duties payable under other Acts : Medical & Toilet preparations Additional duty on mineral products Cess on certain products such as automobiles, Beedis, Jute sugar, Coffee, Tea, etc.

Important Definitions: i) Goods

To levy Excise Duty article is considered as goods if it satisfies following two conditions: a) It must be movable b) Must be marketable i.e. capable of being bought or sold ii) Excisable goods : These are the goods specified in schedule to CETA 1985. Only these goods can be levied Excise Duty as per the rates specified in the schedule iii) Produced The word produced covers a) b) c) d) Items like coffee, Tea, Tobaco, dairy products etc. which are produced Live products like horse, flower, fish etc. which are produced. By products, scrap etc. which are not manufactured buy they get produced. It also covers manufactured goods.

iv)

Manufacture: a) b) c) d) e) Includes any process incidental or ancillary to the completion of manufactured product Any process specified in schedule I of CETA 1985 as amounting to manufacture [ 35 process given in CETA 1985 ] In case of goods specified in 3rd schedule to CETA repacking, relabeling, putting or altering M.R.P. is treated as manufacture [ Both above are deemed mfg. ] As per various courts decisions manufacture takes place only when process results in a commercially different article or commodity Following are instances when mfg. has taken place Mfg. of table from wood Conversion of pulp into base paper Conversion of sugarcane to sugar

v)

Manufacturer: a) b) c) d) e) The liability to pay duty is on manufacturer Duty cannot be recover from his purchaser Demands for Excise Duty are raised & recovered form manufacturer Manufacturer is a person who actually manufactures or produces excisable goods. Thus person who transforms commodity into another commodity having distinct name & character is the manufacturer.

vi)

Job Worker

The manufacturer can send inputs for job work . Following are eligible to send materials for job work (a) Manufactures (b) Exporters (c) Units in SEZ, FOU, EHTP & STP (d) who are supplying final products to united nations or international organization for their official use or to project funded by them. If job worker is actual manufacturer, he cannot avoid duty liability even if there is agreement with principal that principal would meet all duty liabilities of manufacturer Duty liability is of the job worker who actually manufacturer the goods, unless the raw materials supplier undertakes the responsibility of paying duty

Вам также может понравиться

- Excise DutyДокумент29 страницExcise DutyKishan AndureОценок пока нет

- Duties and Taxes For Govt Purchase ProposalsДокумент45 страницDuties and Taxes For Govt Purchase Proposalsdate_milindОценок пока нет

- Indirect Tax GuideДокумент6 страницIndirect Tax GuideSaloni GuptaОценок пока нет

- Central Excise - Into & Basic ConceptsДокумент21 страницаCentral Excise - Into & Basic ConceptsMruduta JainОценок пока нет

- Mining & Beneficiation Workshop on Finance for Non-Finance ExecutivesДокумент36 страницMining & Beneficiation Workshop on Finance for Non-Finance ExecutivesSaikumar SelaОценок пока нет

- A Project Report: On / inДокумент30 страницA Project Report: On / inNeeraj BhatiОценок пока нет

- Central Excise DutyДокумент19 страницCentral Excise DutyGurneet Kaur GujralОценок пока нет

- Central ExciseДокумент3 страницыCentral ExciseVenkata SwamyОценок пока нет

- LESSON-19 Central Excise Laws: StructureДокумент21 страницаLESSON-19 Central Excise Laws: Structuresudhir.kochhar3530Оценок пока нет

- Imp Indirect TaxДокумент21 страницаImp Indirect TaxAnuj MawadikarОценок пока нет

- NotesДокумент14 страницNotesAmitrajeet kumarОценок пока нет

- Tally Erp 9.0 Material Excise For Manufacturers in Tally Erp 9.0Документ128 страницTally Erp 9.0 Material Excise For Manufacturers in Tally Erp 9.0Raghavendra yadav KMОценок пока нет

- Understanding Excise Duty in IndiaДокумент21 страницаUnderstanding Excise Duty in IndiajaskaranОценок пока нет

- Indirect Taxes: Excise, VAT and GSTДокумент19 страницIndirect Taxes: Excise, VAT and GSTmanikaОценок пока нет

- Central Excise: Meenal P WagleДокумент15 страницCentral Excise: Meenal P WagleMeenal Prasad WagleОценок пока нет

- Tax AssignmentДокумент20 страницTax AssignmentAnamОценок пока нет

- Central ExciseДокумент22 страницыCentral ExcisesadathnooriОценок пока нет

- Chapter 2. VatДокумент97 страницChapter 2. VatVu Thi ThuongОценок пока нет

- Excise Clearance For ExportsДокумент10 страницExcise Clearance For ExportsRadhakrishna UppalapatiОценок пока нет

- P 14Документ728 страницP 14Moaaz Ahmed100% (1)

- ASSIGNMENT 1 (Corporate TAX)Документ10 страницASSIGNMENT 1 (Corporate TAX)SandeepОценок пока нет

- Presentation1 1Документ31 страницаPresentation1 1Faizan AhmedОценок пока нет

- What Is VAT?Документ2 страницыWhat Is VAT?betanetОценок пока нет

- Central Excise ActДокумент19 страницCentral Excise ActPoonam MehtaОценок пока нет

- India Localization With Respect To INDIA: Modus Operandi Session IДокумент31 страницаIndia Localization With Respect To INDIA: Modus Operandi Session IpsroyalОценок пока нет

- VAT FEATURESДокумент3 страницыVAT FEATURESSiva Subramanian100% (2)

- Direct TaxДокумент13 страницDirect TaxRajveer Singh SekhonОценок пока нет

- Business Law OverviewДокумент25 страницBusiness Law Overviewapce501Оценок пока нет

- VAT Basics - July 2023Документ8 страницVAT Basics - July 2023maharajabby81Оценок пока нет

- Import of Capital GoodsДокумент24 страницыImport of Capital GoodsPranav KumarОценок пока нет

- Dir Indir DiffДокумент19 страницDir Indir DiffDrNitin PathakОценок пока нет

- CIN Overview SD ModuleДокумент76 страницCIN Overview SD ModuleCampa ColaОценок пока нет

- Excise Duty: (CENVAT, Types of Excise Duty, Basis of Payment of Excise Duty, Who Is Liable To Pay Excise Duty, Excise Duty Calculation)Документ28 страницExcise Duty: (CENVAT, Types of Excise Duty, Basis of Payment of Excise Duty, Who Is Liable To Pay Excise Duty, Excise Duty Calculation)amarx292000Оценок пока нет

- Indirect Taxes & Law PracticesДокумент171 страницаIndirect Taxes & Law PracticeskavitavijayОценок пока нет

- Indirect Tax and Law PracticesДокумент118 страницIndirect Tax and Law PracticesPushpendra Singh0% (1)

- Service TaxДокумент10 страницService TaxMonika GuptaОценок пока нет

- Unit1 GSTДокумент26 страницUnit1 GSTAryan SethiОценок пока нет

- BY Vinod K Raju Musaliar College PathanamthittaДокумент20 страницBY Vinod K Raju Musaliar College PathanamthittaAvinashОценок пока нет

- Eou & Sez Schemes Are One Among Them, Which Provides An Internationally Competitive Duty Oriented Units (Eous) What Does Eou Mean?Документ9 страницEou & Sez Schemes Are One Among Them, Which Provides An Internationally Competitive Duty Oriented Units (Eous) What Does Eou Mean?Surjan SinghОценок пока нет

- Estimation of National Income: There Are Three Methods To Estimate National Income: I) Ii) Iii)Документ9 страницEstimation of National Income: There Are Three Methods To Estimate National Income: I) Ii) Iii)Yougel Tkd GeasonОценок пока нет

- Export Incentives in IndiaДокумент21 страницаExport Incentives in IndiaKarunakaran KrishnamenonОценок пока нет

- 3rdyr 1stF BusinessTax 2324Документ43 страницы3rdyr 1stF BusinessTax 2324zaounxosakubОценок пока нет

- Chapter 5 Vat Concepts and General PrinciplesДокумент18 страницChapter 5 Vat Concepts and General Principlessalonid17Оценок пока нет

- Indirect Taxes - A Review: Applicability of Duties / Taxes - Excise Duty Customs Duty. Vat / CST Service TaxДокумент39 страницIndirect Taxes - A Review: Applicability of Duties / Taxes - Excise Duty Customs Duty. Vat / CST Service TaxarungajankushОценок пока нет

- Central Excise Duty BasicsДокумент20 страницCentral Excise Duty Basicsvulbiz30Оценок пока нет

- Tax232 - Excise Tax PDFДокумент37 страницTax232 - Excise Tax PDFClaire Ann ParasОценок пока нет

- Central ExciseДокумент53 страницыCentral ExciseSuyash JainОценок пока нет

- Vat Vs GST FinalДокумент35 страницVat Vs GST FinalJatin GoyalОценок пока нет

- NMIMS Global Access Course Export Import ProceduresДокумент11 страницNMIMS Global Access Course Export Import ProceduresTeena RawatОценок пока нет

- Tax Base For VAT: Import StageДокумент2 страницыTax Base For VAT: Import StageS. M. Saz Lul HoqueОценок пока нет

- VAT On ImportationДокумент24 страницыVAT On ImportationShamae Duma-anОценок пока нет

- Custom DutyДокумент7 страницCustom DutyPriyanshuОценок пока нет

- Understanding Vietnam's Value Added Tax LawДокумент89 страницUnderstanding Vietnam's Value Added Tax LawThái Minh ChâuОценок пока нет

- Remission of Duties & Taxes On Exported Products (Rodtep) SchemeДокумент21 страницаRemission of Duties & Taxes On Exported Products (Rodtep) SchemeAnupam BaliОценок пока нет

- Central Excise Duty Types and VAT SchedulesДокумент12 страницCentral Excise Duty Types and VAT SchedulesrnaganirmitaОценок пока нет

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisОт EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisОценок пока нет

- Impact Assessment AAK: Taxes and the Local Manufacture of PesticidesОт EverandImpact Assessment AAK: Taxes and the Local Manufacture of PesticidesОценок пока нет

- Chapter 8 Stat Con DigestsДокумент6 страницChapter 8 Stat Con DigestsClarisse Anne Florentino AlvaroОценок пока нет

- Moorish Science Handbook......... Goes With Circle 7.................................... Csharia LawДокумент318 страницMoorish Science Handbook......... Goes With Circle 7.................................... Csharia Lawamenelbey98% (52)

- People vs Omaweng (Consent to searchДокумент1 страницаPeople vs Omaweng (Consent to searchCharles Roger Raya100% (2)

- Sesbreno v. CA, Delta Motors Corp., & Pilipinas BankДокумент2 страницыSesbreno v. CA, Delta Motors Corp., & Pilipinas BankPMVОценок пока нет

- GOVINDRAMEN A V THE COMMISSIONER OF POLICE and ORS 2021 SCJ 179 DONEДокумент7 страницGOVINDRAMEN A V THE COMMISSIONER OF POLICE and ORS 2021 SCJ 179 DONEJonathan BruneauОценок пока нет

- History Class 9 FRENCH REVOLUTIONДокумент18 страницHistory Class 9 FRENCH REVOLUTIONAngadОценок пока нет

- Unclean HandsДокумент2 страницыUnclean HandsSUCCESSIN100% (1)

- 360 Degrees DiplomacyДокумент3 страницы360 Degrees DiplomacyGerman Marshall Fund of the United StatesОценок пока нет

- Senior-citizen tax discounts clarifiedДокумент2 страницыSenior-citizen tax discounts clarifiedJianSadakoОценок пока нет

- Krizza Shayne Yuson: AnswerДокумент6 страницKrizza Shayne Yuson: AnswerKrizzaShayneRamosArqueroОценок пока нет

- Bombay Tenancy and Agricultural Lands Act 1948Документ4 страницыBombay Tenancy and Agricultural Lands Act 1948Keith10w0% (1)

- Contempt of The Lawful Authority of Public ServantsДокумент12 страницContempt of The Lawful Authority of Public ServantsMOUSOM ROYОценок пока нет

- Recognised Course Providers ListДокумент13 страницRecognised Course Providers ListSo LokОценок пока нет

- Final ObliconДокумент4 страницыFinal ObliconPortgas D. AceОценок пока нет

- Attack The Debt CollectorДокумент3 страницыAttack The Debt CollectorGabe Perazzo100% (1)

- People Vs VelosДокумент2 страницыPeople Vs VelosCyril FriasОценок пока нет

- Citibank V.dinopol, GR 188412Документ7 страницCitibank V.dinopol, GR 188412vylletteОценок пока нет

- 121-160 JurisprudenceДокумент44 страницы121-160 JurisprudencejilliankadОценок пока нет

- OSHA Complaint Regarding Oakdale Federal Correctional ComplexДокумент4 страницыOSHA Complaint Regarding Oakdale Federal Correctional ComplexmcooperkplcОценок пока нет

- IpmsДокумент2 страницыIpmsmutu_bunutОценок пока нет

- Class Topic: Political Question G.R. No. 196231 January 28, 2014Документ2 страницыClass Topic: Political Question G.R. No. 196231 January 28, 2014DEAN JASPERОценок пока нет

- RULES ON APPOINTMENT AND POWERS OF TRUSTEESДокумент14 страницRULES ON APPOINTMENT AND POWERS OF TRUSTEESHanzel Uy VillonesОценок пока нет

- Promoting IP rights in local governanceДокумент5 страницPromoting IP rights in local governanceBenjamin Jovan SisonОценок пока нет

- NM Civil Guard Filed Verified ComplaintДокумент39 страницNM Civil Guard Filed Verified ComplaintAlbuquerque JournalОценок пока нет

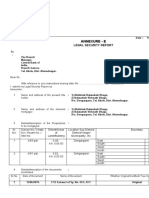

- Annexure - E: Legal Security ReportДокумент7 страницAnnexure - E: Legal Security Reportadv Balasaheb vaidyaОценок пока нет

- Digest PP vs. UBIÑAДокумент1 страницаDigest PP vs. UBIÑAStef OcsalevОценок пока нет

- Jurisdiction of Civil Courts Under The Code of Civil ProcedureДокумент6 страницJurisdiction of Civil Courts Under The Code of Civil ProcedureBeebee ZainabОценок пока нет

- Letter From ElectedsДокумент2 страницыLetter From ElectedsJon RalstonОценок пока нет

- Philippine Court Decision Appeal NoticeДокумент2 страницыPhilippine Court Decision Appeal NoticeQueenie LeguinОценок пока нет