Академический Документы

Профессиональный Документы

Культура Документы

Sidvin Pharma - Form Vat 105 - July-11

Загружено:

Lakshmi NarayanaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Sidvin Pharma - Form Vat 105 - July-11

Загружено:

Lakshmi NarayanaАвторское право:

Доступные форматы

>

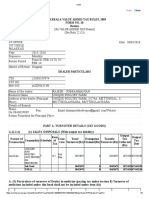

FORM VAT 105 [See Rules 138] RETURN

Return REF. No.:730362164

1. General Information 1.1)LVO CODE 1.2)Tax Period(Month/Quarter) 1.3)Return Type 1.4)Filing Date 1.5)TIN 1.6)Full Name of the dealer 1.7)Address of the dealer 1.8)Tax invoices issued in the month: 2. Particulars of Turnover Local 2)Total TO 2.1)Ret., disc., lab. chg. etc rel. to sales of the month 2.2)Const. Sales/C.A. Sales 2.3)Tax Coll.(VAT) 2.4)Exempted Sales 2.5)Others 2.6)Taxable TO (Local) [Box 2 less (Box 2.1 to Box 2.5)] Inter State 9847523)Total TO(Interstate/Export) 03.1)Ret., disc.,lab. chg, etc. 03.2)ST / Cons. Sales 479593.3)Exempted Sales 17193.4)Direct Exports 3.5)Deemed Exports (against H0 Form) 9350743.6)Sales in Transit (E-I, E-2) 3.7)Sales in the course of import (including High Sea Sales) 3.8)CST Collected 3.9)Taxable turnover (Interstate) [Box No. 3 less (Total of Box 3.1 to Box 3.8)] 4. Net Tax Payable 4.1)Output Tax Payable (Refer Box No.8.3) 4.2)B/f credit of input tax of previous month (Refer Box 4.10) 4.3)Input tax credit (Refer Box No. 11) 4.4)Tax Payable [Box No.4.1-(Box No.4.2+Box No.4.3)] 4.5)Tax deducted at source(Certificate/s Enclosed) 4.6)Tax already paid in the original/revised/corrected return & IT Adjst. of Prev. 6 months 4.7)Balance Tax Payable [Box No.4.4-(Box.No.4.5+Box.No.4.6)] 4.8)Adjustment of any excess credit towards KST/KTEG/KSTECG 4.9)Refund 4.10)Credit/excess payment carried forward 4.11)Net Tax refund as per Inc. Notf. 5. Tax Payment Details Details 5.1)Tax Payable as per Box. No. 4.7 5.2)Interest 5.3)Others 5.4)Total of Box No. 5.1 to Box No 5.3 0 0 0 0 0 0 0 0 0 0 140 JUL-2011 ORIGINAL 20/08/2011 29160562330 SIDVIN PHARMA NO.1031, 20TH CROSS,,5TH BLOCK, RAJAJINAGAR, BANGALORE-560010

Amount 47959 5792 37668 4499 0 0 4499 0 0 0 0

Amount 4499 0 0 4499

6. Details of Local Sales/ URD Purchases and Output Tax/Purchase Tax Payable 6.11)O/p tax 6.1)Taxable TO of sales at 1 % 0 0Payable(rel. to BNo.6.1) 6.12)O/p tax 6.2)Taxable TO of sales at 4% 0 0Payable(rel. to BNo. 6.2) 6.13)O/p tax 6.3)Taxable TO of sales at 5% 921684 0Payable(rel. to BNo.6.3) 6.14)O/p tax 6.4)Taxable TO of sales at 13.5% 0 0Payable(rel. to BNo.6.4) 6.14.1)O/p tax 6.4.1)Taxable TO of sales at 14% 13390 0Payable(rel. to BNo.6.4.1) 6.15)O/p tax 6.5)Taxable TO of sales at 15% 0 0Payable(rel. to BNo.6.5) 6.16)O/p tax 6.6)Others, if any (please specify) 0 0Payable(rel. to BNo.6.6) 6.17)O/p tax 6.7)Taxable TO of URD purc. at 5% 0 Payable(rel. to BNo.6.7) 6.18)O/p tax 6.8)Taxable TO of URD purc. at 13.5% 0 Payable(rel. to BNo.6.8) 6.18.1)O/p tax 6.8.1)Taxable TO of URD purc. at 14% 0 Payable(rel. to BNo.6.8.1) 6.19)O/p tax 6.9)Taxable TO of URD purc. at other 0 Payable(rel. to rate(specify rate) BNo.6.9) 6.20) Total O/p tax 6.10)Total (Box No.6.1 to 6.9) 935074payable (6.11 to 6.19) 7. Details of Interstate Sales(ISS) and CST Payable 7.1)Taxable TO of ISS at 1% 7.2)Taxable TO of ISS against C Forms at 2% 7.3)Taxable TO of ISS without C Forms at 1% 7.4)Taxable TO of ISS without C forms at 4% 7.5)Taxable TO of ISS without C forms at 5% 7.6)Taxable TO of ISS without C forms at 13.5% 7.6.1)Taxable TO of ISS without C forms at 14% 7.7)Taxable TO of ISS without C forms at 15% 7.8)Others, if any (Specify Rate of Tax) 7.9)Total (of BNo. 7.1 to 7.8)

46084

1875

47959

7.10)O/p tax payable(rel. to BNo. 7.1) 7.11)O/p tax payable(rel. to 0 BNo. 7.2) 7.12)O/p tax payable (rel. to 0 BNo. 7.3) 7.13)O/p tax payable (rel. to 0 BNo. 7.4) 7.14)O/p tax payable (rel. to 0 BNo. 7.5) 7.15)O/p tax payable (rel. to 0 BNo. 7.6) 7.15.1)O/p tax payable (rel. to 0 BNo. 7.6.1) 7.16)O/p tax payable (rel. to 0 BNo. 7.7) 7.17)O/p tax payable (rel. to 0 BNo.7.8) 7.18)Total o/p tax 0payable(Total of 7.10 to 7.17) 0

0 0 0 0 0 0 0 0 0 0

8.1)Total Output Tax (Total of BNo. 6.20 and BNo. 7.18)

47959

8.2)Output Tax deferred to Industries as per Incentive Notifications 8.3)Net Output Tax Payable (BNo. 8.1 - BNo. 8.2) 9. Details of Purchases and Input Tax 9.14)Input tax (rel. to BNo. 9.1) 9.15)Input tax (rel. to 9.2)Net value of purchases at 4% 0 0 BNo. 9.2) 9.16)Input tax (rel. to 9.3)Net value of purchases at 5% 312772 388160 BNo. 9.3) 9.17)Input tax (rel. to 9.4)Net value of purchases at 13.5% 0 0 BNo. 9.4) 9.17.1)Input tax (rel. 9.4.1)Net value of purchases at 14% 13528 5190 to BNo. 9.4.1) 9.18)Input tax (rel. to 9.5)Net value of purchases at 15% 0 0 BNo. 9.5) 9.19)Input tax (rel.to 9.6)Others, if any (pl.specify) 0 0 BNo. 9.6) 9.7)Value of URD purc. to the ext. used/sold during the Month/Quarter 9.1)Net value of purchases at 1% 0 0 9.7.1)B/F from Prev. period 9.7.2)Rel. to Curr.period 9.7.3)Total (9.7.1+9.7.2) 9.8)Value of URD purc. to the ext. not used/sold 9.8.1)B/F from Prev. period 9.8.2)Rel. to Curr. tax period 9.8.3)Total (9.8.1+9.8.2) 9.9)Val. of VAT exempted goods. 9.10)value of Purchase from Composition dealer 9.11)Val of goods imp/purc. in the course of Import/Export/Interstate trade including E-I & E-II purchases 9.12)Val of goods received by stock transfer/consignment transfer 9.13)Total value of purchases (BNo. 9.1 to 9.6,9.7.2,9.8.2 and 9.9 to 9.12) 9.13.1) Aggregate of net purchase price of goods brought which will not be considered to arrive at total or taxable purchase (Optional) 0 0 0 1190 0 0 0 720840 0 9.22)Total input tax (BNo 9.14 to 9.20) 9.21)Input tax carried forward (rel. to BNo. 9.8.3) 0 0 0 0 9.20)Input tax (rel. to BNo. 9.7.3) 0 0 0 15639 0 1894 0 0

0 47959

0 0 19408 0 727 0 0

37668

10. Ineligible Input Tax Credit 10.1)Non-deductible input tax being restricted u/s 11 10.2)Non-deductible input tax-pre-registration purchases u/s 13 of VAT Act 10.3)Non-deductible input tax-under special rebating scheme u/s 14 read with Section 11 10.4)Non-deductible input tax-under partial rebating scheme u/s 17 of VAT Act 10.5)Non-deductible input tax relating to return of goods purchased 10.6)Others, Please Specify 10.7)Total Ineligible Input Tax Credit (BNo.10.1 to 10.6) 11. Eligible Input Tax Credit [BNo. 9.22 - BNo. 10.7] Payment Details Remarks: PAY_MODE Ref. No. Date Bank Total REMARKS

0 0 0 0 0 0 0 37668

Cheque

731523

20/08/2011

KARNATAKA BANK

4499

I/We hereby declare that the particulars furnished above are true and complete in all respects. Date:................. Place:................ Signature:..................................... Name and designation:...................

Вам также может понравиться

- HTTP 164.100.80.99 Vat2 VatReturn VAT100PrintДокумент3 страницыHTTP 164.100.80.99 Vat2 VatReturn VAT100PrintAnonymous 1uGSx8bОценок пока нет

- Vat Form 100Документ10 страницVat Form 100Shoaib4804174Оценок пока нет

- Tax ReturnДокумент7 страницTax Returnsyedfaisal_sОценок пока нет

- 201111320114552152IT-2 2011withSurchargeWithoutformulawithPEFДокумент7 страниц201111320114552152IT-2 2011withSurchargeWithoutformulawithPEFOmer PashaОценок пока нет

- GSTR1 Stupl 08ABFCS1229J1Z9 November 2021 BusyДокумент92 страницыGSTR1 Stupl 08ABFCS1229J1Z9 November 2021 BusyYathesht JainОценок пока нет

- NTN Top 10 Share Holder's Name Percentage Capital NTN Top 10 Share Holder's Name Percentage CapitalДокумент5 страницNTN Top 10 Share Holder's Name Percentage Capital NTN Top 10 Share Holder's Name Percentage Capitalhati1Оценок пока нет

- FORM 202: Popular EnterpriseДокумент4 страницыFORM 202: Popular Enterprisesam3461Оценок пока нет

- Monthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasДокумент9 страницMonthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasAdriel Torreda NaturalОценок пока нет

- 82202BIR Form 1702-MXДокумент9 страниц82202BIR Form 1702-MXRen A EleponioОценок пока нет

- Akhtar Tax ReturnДокумент7 страницAkhtar Tax Returnsyedfaisal_sОценок пока нет

- Monthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasДокумент4 страницыMonthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasjamquintanesОценок пока нет

- MarchДокумент7 страницMarchRohama TullaОценок пока нет

- IT-2 2011 With Formula and Surcharge and Annex DДокумент15 страницIT-2 2011 With Formula and Surcharge and Annex DPatti DaudОценок пока нет

- 2550MДокумент9 страниц2550MAngel AlfaroОценок пока нет

- 82202BIR Form 1702-MXДокумент9 страниц82202BIR Form 1702-MXJp AlvarezОценок пока нет

- Monthly Value-Added Tax DeclarationДокумент17 страницMonthly Value-Added Tax DeclarationMIRAHNELОценок пока нет

- Quarterly Tax Value-Added Return: Kawanihan NG Rentas InternasДокумент5 страницQuarterly Tax Value-Added Return: Kawanihan NG Rentas InternasStephanie LayloОценок пока нет

- 1 67 8 (A) Tax Amount in Box 8 (A) 2 68 8 (A) Tax Amount in Box 8 (A) 3 67,68 8 Duplicate Tax Rates in Line Nos 67,68Документ12 страниц1 67 8 (A) Tax Amount in Box 8 (A) 2 68 8 (A) Tax Amount in Box 8 (A) 3 67,68 8 Duplicate Tax Rates in Line Nos 67,68Ganesh ChavanОценок пока нет

- FeburaryДокумент8 страницFeburaryRohama TullaОценок пока нет

- Form VAT-R2: (See Rule 16 (2) ) DdmmyyДокумент4 страницыForm VAT-R2: (See Rule 16 (2) ) DdmmyyPRAHLAD_KUMAR8424Оценок пока нет

- JanuaryДокумент8 страницJanuaryRohama TullaОценок пока нет

- 1702-RT June 2013 Schedules 10 To 13Документ2 страницы1702-RT June 2013 Schedules 10 To 13Gkt MarcosОценок пока нет

- Mvat f231Документ5 страницMvat f231pgotaphoeОценок пока нет

- The Red Marks Contain Instructions. To View The Tips, Place Cursor in That CellДокумент15 страницThe Red Marks Contain Instructions. To View The Tips, Place Cursor in That Cellsiddharthzala0% (1)

- Al-Abbas Sugar Mill: Common Size B/SДокумент3 страницыAl-Abbas Sugar Mill: Common Size B/Samirrahimi2020Оценок пока нет

- GST RoadmapДокумент14 страницGST Roadmapsiddhumesh1Оценок пока нет

- CST AppealДокумент3 страницыCST AppealvnbanjanОценок пока нет

- To The Presentation: Tax System in BangladeshДокумент74 страницыTo The Presentation: Tax System in BangladeshSalahuddin AhmedОценок пока нет

- Taxation in SA 2009 2008 - 09pdfДокумент132 страницыTaxation in SA 2009 2008 - 09pdfvikramaditya_n84Оценок пока нет

- 24 Vat Ratio TamplateДокумент4 страницы24 Vat Ratio TamplateAnupam BaliОценок пока нет

- Anf 5A Application Form For Epcg Authorisation IssueДокумент6 страницAnf 5A Application Form For Epcg Authorisation IssueBaljeet SinghОценок пока нет

- "Part-I B: Return of Total Income/Statement of Final Taxation Under The Income Tax Ordinance, 2001 (For Company) IT-1Документ6 страниц"Part-I B: Return of Total Income/Statement of Final Taxation Under The Income Tax Ordinance, 2001 (For Company) IT-1hina08855Оценок пока нет

- Excise Tax Return: For Tobacco ProductsДокумент4 страницыExcise Tax Return: For Tobacco ProductsrjgingerpenОценок пока нет

- New VAT Audit FormatДокумент12 страницNew VAT Audit FormatparulshinyОценок пока нет

- ACW291 CHP 10 SST - 231117 - 154211Документ70 страницACW291 CHP 10 SST - 231117 - 154211hemaram2104Оценок пока нет

- Tax System in BD-NewДокумент74 страницыTax System in BD-NewSalahuddin AhmedОценок пока нет

- Results Conference CallДокумент14 страницResults Conference CallLightRIОценок пока нет

- 2550Mv 2Документ7 страниц2550Mv 2nelsonОценок пока нет

- Bir Form No. 1702Документ6 страницBir Form No. 1702Mary Monique Llacuna Lagan100% (1)

- Quotation: Customer Code: 10009469 Information VAT Number - 300055945410003Документ2 страницыQuotation: Customer Code: 10009469 Information VAT Number - 300055945410003Marcial Jr. MilitanteОценок пока нет

- TRAINING. NOTES Commercial TaxДокумент116 страницTRAINING. NOTES Commercial TaxVipin Thomas100% (1)

- Excise Tax Return: For Alcohol ProductsДокумент4 страницыExcise Tax Return: For Alcohol ProductsAngela ArleneОценок пока нет

- Appendix Form No. 1 Return of Taxable Commodities TransactionsДокумент3 страницыAppendix Form No. 1 Return of Taxable Commodities TransactionsYashu GoelОценок пока нет

- CH 4Документ12 страницCH 4AbhishekОценок пока нет

- Cash Flow Statement For The Year Ended March 31 2009Документ2 страницыCash Flow Statement For The Year Ended March 31 2009rupesh9020232320Оценок пока нет

- Central Taxes State Taxes: The List of Taxes Which Will Be Eliminated AreДокумент6 страницCentral Taxes State Taxes: The List of Taxes Which Will Be Eliminated ArekiranpatnaikОценок пока нет

- Form 231 Sharp EnterprisesДокумент8 страницForm 231 Sharp Enterprisesqaid_duraiyaОценок пока нет

- Property Tax Reform DOF SlidesДокумент25 страницProperty Tax Reform DOF SlidesClarissa DegamoОценок пока нет

- June ReturnДокумент3 страницыJune ReturnPavan JayaprakashОценок пока нет

- Bir Forms PDFДокумент4 страницыBir Forms PDFgaryОценок пока нет

- TXVNM 2019 Dec AДокумент8 страницTXVNM 2019 Dec AMinh AnhОценок пока нет

- Vat 100 Mistake On WebsiteДокумент1 страницаVat 100 Mistake On WebsitesaurabhtechieОценок пока нет

- 1702 NewДокумент11 страниц1702 NewDIVINE WAGTINGANОценок пока нет

- International BusinessДокумент10 страницInternational BusinessGauravTiwariОценок пока нет

- Marine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryОт EverandMarine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Totalizing Fluid Meter & Counting Devices World Summary: Market Values & Financials by CountryОт EverandTotalizing Fluid Meter & Counting Devices World Summary: Market Values & Financials by CountryОценок пока нет

- General Merchandise (Nondurable Goods) Wholesale Revenues World Summary: Market Values & Financials by CountryОт EverandGeneral Merchandise (Nondurable Goods) Wholesale Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Agricultural Trade in the Global South: An Overview of Trends in Performance, Vulnerabilities, and Policy FrameworksОт EverandAgricultural Trade in the Global South: An Overview of Trends in Performance, Vulnerabilities, and Policy FrameworksОценок пока нет

- Jonathan Bishop's Election Address For The Pontypridd Constituency in GE2019Документ1 страницаJonathan Bishop's Election Address For The Pontypridd Constituency in GE2019Councillor Jonathan BishopОценок пока нет

- 99 Names of AllahДокумент14 страниц99 Names of Allahapi-3857534100% (9)

- Chapter 12Документ72 страницыChapter 12Samaaraa NorОценок пока нет

- EAD-533 Topic 3 - Clinical Field Experience A - Leadership AssessmentДокумент4 страницыEAD-533 Topic 3 - Clinical Field Experience A - Leadership Assessmentefrain silvaОценок пока нет

- Q1Документ16 страницQ1satyamОценок пока нет

- Dividend Discount ModelДокумент54 страницыDividend Discount ModelVaidyanathan Ravichandran100% (1)

- Remote Lab 1013Документ3 страницыRemote Lab 1013cloud scapeОценок пока нет

- EMCEE ScriptДокумент3 страницыEMCEE ScriptSunshine Garson84% (31)

- EvaluationДокумент4 страницыEvaluationArjay Gabriel DudoОценок пока нет

- 4-Cortina-Conill - 2016-Ethics of VulnerabilityДокумент21 страница4-Cortina-Conill - 2016-Ethics of VulnerabilityJuan ApcarianОценок пока нет

- CHAPTER 1 - 3 Q Flashcards - QuizletДокумент17 страницCHAPTER 1 - 3 Q Flashcards - Quizletrochacold100% (1)

- Coorg Chicken CurryДокумент1 страницаCoorg Chicken CurryAnitha VinukumarОценок пока нет

- Relative Clauses: A. I Didn't Know You Only Had OnecousinДокумент3 страницыRelative Clauses: A. I Didn't Know You Only Had OnecousinShanti AyudianaОценок пока нет

- PTE GURU - Will Provide You Template For Following SST, SWT, RETELL, DI and ESSAY and at The End Some Good Knowledge of Scoring SystemДокумент6 страницPTE GURU - Will Provide You Template For Following SST, SWT, RETELL, DI and ESSAY and at The End Some Good Knowledge of Scoring Systemrohit singh100% (1)

- SheenaДокумент5 страницSheenamahamed hassan kuusoowОценок пока нет

- Architecture AsiaДокумент84 страницыArchitecture AsiaBala SutharshanОценок пока нет

- Notice - Carte Pci - Msi - Pc54g-Bt - 2Документ46 страницNotice - Carte Pci - Msi - Pc54g-Bt - 2Lionnel de MarquayОценок пока нет

- Hunting the Chimera–the end of O'Reilly v Mackman_ -- Alder, John -- Legal Studies, #2, 13, pages 183-20...hn Wiley and Sons; Cambridge -- 10_1111_j_1748-121x_1993_tb00480_x -- 130f73b26a9d16510be20781ea4d81eb -- Anna’s ArchiveДокумент21 страницаHunting the Chimera–the end of O'Reilly v Mackman_ -- Alder, John -- Legal Studies, #2, 13, pages 183-20...hn Wiley and Sons; Cambridge -- 10_1111_j_1748-121x_1993_tb00480_x -- 130f73b26a9d16510be20781ea4d81eb -- Anna’s ArchivePrince KatheweraОценок пока нет

- Financial Report: The Coca Cola Company: Ews/2021-10-27 - Coca - Cola - Reports - Continued - Momentum - and - Strong - 1040 PDFДокумент3 страницыFinancial Report: The Coca Cola Company: Ews/2021-10-27 - Coca - Cola - Reports - Continued - Momentum - and - Strong - 1040 PDFDominic MuliОценок пока нет

- Depreciated Replacement CostДокумент7 страницDepreciated Replacement CostOdetteDormanОценок пока нет

- QuickRecharge - Ae Is Launched by Paynet - OneДокумент2 страницыQuickRecharge - Ae Is Launched by Paynet - OnePR.comОценок пока нет

- Report WritingДокумент3 страницыReport WritingSeema SinghОценок пока нет

- UAS English For Acc - Ira MisrawatiДокумент3 страницыUAS English For Acc - Ira MisrawatiIra MisraОценок пока нет

- Car Rental 2Документ17 страницCar Rental 2ArunОценок пока нет

- AJWS Response To July 17 NoticeДокумент3 страницыAJWS Response To July 17 NoticeInterActionОценок пока нет

- EnglishДокумент3 страницыEnglishYuyeen Farhanah100% (1)

- Test Bank For We The People 10th Essentials Edition Benjamin Ginsberg Theodore J Lowi Margaret Weir Caroline J Tolbert Robert J SpitzerДокумент15 страницTest Bank For We The People 10th Essentials Edition Benjamin Ginsberg Theodore J Lowi Margaret Weir Caroline J Tolbert Robert J Spitzeramberleemakegnwjbd100% (14)

- UFC 3-270-01 Asphalt Maintenance and Repair (03!15!2001)Документ51 страницаUFC 3-270-01 Asphalt Maintenance and Repair (03!15!2001)Bob VinesОценок пока нет

- Challenges in Leadership Development 2023Документ26 страницChallenges in Leadership Development 2023Girma KusaОценок пока нет

- All Region TMLДокумент9 страницAll Region TMLVijayalakshmiОценок пока нет