Академический Документы

Профессиональный Документы

Культура Документы

Market Outlook 12th January 2012

Загружено:

Angel BrokingИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Market Outlook 12th January 2012

Загружено:

Angel BrokingАвторское право:

Доступные форматы

Market Outlook

India Research

January 12, 2012

Dealers Diary

Indian markets are expected to open flat taking cues from flat to marginally positive opening in most of the Asian markets today and flat closing in the global markets yesterday. The Indian markets ended marginally higher yesterday, extending the previous session's rally after the government removed restrictions on foreign investment in India's single-brand retail sector. Also, continued anticipation of further monetary policy easing from China kept investors across the Asian markets in good mood. Globally, most of the US and European markets ended almost flat yesterday and largely erased intraday losses on the ongoing tug between Europes debt troubles and an improving U.S. economy. Meanwhile, preliminary figures from the Germanys Federal Statistics office showed that Germanys economy contracted by 0.25% in 4QCY2011. The markets today will be closely watching out from IIP numbers (estimate 2.1%) and Infosys results to be announced today. In addition, jobless claims data of the US economy will be on radar.

Domestic Indices BSE Sensex Nifty MID CAP SMALL CAP BSE HC BSE PSU BANKEX AUTO METAL OIL & GAS BSE IT Global Indices Dow Jones NASDAQ FTSE Nikkei Hang Seng Straits Times Shanghai Com

Chg (%) 0.1 0.2 1.0 1.3 0.5 0.3 1.1 0.3 2.3 1.0 (1.4) Chg (%) (0.1) 0.3 (0.5) 0.3 0.8 1.0 (0.4)

(Pts) 10.8 11.4 54.4 79.0 29.6 20.2 22.6 79.8 (84.3) (Pts) (13.0) 8.3 (25.9) 25.6 27.3 (9.7)

(Close) 16,176 4,861 5,506 6,075 6,125 6,927 8,394 7,915 5,832 (Close) 12,450 2,711 5,671 8,448 2,747 2,276

112.7 10,140 227.7 10,310

Markets Today

The trend deciding level for the day is 16,183 / 4,860 levels. If NIFTY trades above this level during the first half-an-hour of trade then we may witness a further rally up to 16,238 16,300 / 4,878 4,896 levels. However, if NIFTY trades below 16,183 / 4,860 levels for the first half-an-hour of trade then it may correct up to 16,121 16,066 / 4,843 4,824 levels.

Indices SENSEX NIFTY S2

15,799 4,737

147.7 19,152

S1

15,982 4,793

R1

16,081 4,825

R2

16,265 4,881

Indian ADRs Infosys Wipro ICICI Bank HDFC Bank

Chg (%) 1.7 2.2 1.3 1.6

(Pts) 1.0 0.2 0.4 0.5

(Close) $56.9 $10.5 $30.3 $28.3

News Analysis

Credit growth falls to two-year low of 15.9% 3QFY2012 Result Preview Infosys, HDFC

Refer detailed news analysis on the following page

Advances / Declines Advances Declines

BSE 1,877 963 103

NSE 1,009 453 48

Net Inflows (January 10, 2012)

` cr FII MFs ` cr Index Futures Stock Futures Purch

2,783 508

Sales

2,378 447

Net

405 67

MTD

1,536 (67)

YTD

1,536 (67)

Unchanged

Volumes (` cr) BSE 2,621 11,716 NSE

FII Derivatives (January 11, 2012)

Purch

1,542 1,813

Sales

1,270 1,774

Net

272 38

Open Interest

11,804 26,099

Gainers / Losers

Gainers Company

HDIL Adani Power Wockhardt Adani Enter Jet Air India

Losers Company

Hindustan Copp GVK Power MMTC TCS Grasim Inds

Price (`)

71 77 337 312 204

chg (%)

13.2 11.7 10.8 10.1 7.0

Price (`)

286 14 952 1,137 2,397

chg (%)

(5.7) (3.1) (3.1) (2.5) (2.4)

Please refer to important disclosures at the end of this report

Sebi Registration No: INB 010996539

Market Outlook | India Research

Credit growth falls to two-year low of 15.9%

Growth in bank credit of Scheduled Commercial Banks (SCBs) fell to its lowest since the start of FY2011 to 15.9% yoy, although on a high base (24.5% growth in December 2010). Credit offtake during the fortnight was robust at `98,662cr; however, it was cyclically lower by 18.3% compared to credit offtake during the same fortnight last year. Deposit growth came in at 16.9% yoy, while overall deposits in the system rose by strong `155,316cr (although lower by 13.5% compared to the same fortnight last year) during the fortnight. The spread between credit and deposit growth remained negative at 0.9%. Overall systemic credit-to-deposit ratio remains elevated at 74.9% levels. FY2012 in YTD, credit offtake has declined by 18.0% yoy, while deposit mobilization has risen by 26.4% yoy.

Result Preview Infosys

Infosys is slated to announce its 3QFY2012 results. We expect a modest performance by the company, with revenue growing by 4.0% qoq to US$1,816mn, led by volume growth of 4.9% qoq. In INR terms, revenue is expected to grow by whopping 13.9% qoq to `9,222cr because of ~11% qoq INR depreciation. EBITDA margin is expected to expand by 159bp qoq to 32.6%. PAT is expected to come in at `2,197cr. Key points to watch out for are a) managements commentary on the macro picture and initial sense of client budgets for CY2012 and b) revision, if any, in USD revenue growth guidance for FY2012, which we expect to reduce from 1719% yoy to 17-18% yoy. We maintain our Accumulate recommendation on the stock with a target price of `2,990.

HDFC

HDFC is scheduled to announce its 3QFY2012 results. We expect the bank to report healthy NII growth of 18.2% yoy to `1,215cr. Non-interest income is expected to register 12.7% growth yoy, leading to operating income growth of 17.0% yoy to `1,553cr. Operating expenses are expected to grow by 9.9% yoy to `110cr. Pre-provision profit is expected to grow by 17.5% yoy to `1,443cr. Provisioning expenses are expected to increase by 18.5% yoy to `18cr, leading to net profit growth of 17.5% yoy to `1,047cr. At the CMP, HDFCs core business (after adjusting `215/share towards value of the subsidiaries) is trading at 4.4x FY2013E ABV of `107.1 (including subsidiaries, the stock is trading at 4.3x FY2013E ABV of `159.3). We maintain our Neutral recommendation on the stock.

January 12, 2012

Market Outlook | India Research

Quarterly Bloomberg Brokers Consensus Estimates

Infosys Ltd - Consolidated (12/01/2012)

Particulars (` cr) Net sales EBITDA EBITDA margin (%) Net profit 3QFY12E 9,154 3,006 32.8 2,267 3QFY11 7,106 2,363 33.3 1,780 27 y-o-y (%) 29 27 2QFY12 8,099 2,739 33.8 1,906 19 q-o-q (%) 13 10

HDFC Ltd (12/01/2012)

Particulars (` cr) 3QFY12E 1,029 3QFY11 891 y-o-y (%) 16 2QFY12 971 q-o-q (%) 7

Net profit

Economic and Political News

Centre asks states to boost procurement for Food Bill Fitch rates Indian auto components sector 'stable' in 2012 India to cut Iran oil imports, may not seek waiver: sources Rupee fall adds `66,000cr cost to imports in May-Dec

Corporate News

Escorts ties up with Honeywell for technology assistance NMDC signs `509cr contract for steel plant Praj acquires 50% stake in Neela Systems Suzlon wins second order in Brazil

Source: Economic Times, Business Standard, Business Line, Financial Express, Mint

Results Calendar

12/01/2012 13/01/2012 16/01/2012 17/01/2012 18/01/2012 Infosys, HDFC Sintex South Indian Bank TCS, HCL Technologies MindTree, Infotech Enterprises

January 12, 2012

Market Outlook | India Research

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

January 12, 2012

Вам также может понравиться

- Converting Units of Measure PDFДокумент23 страницыConverting Units of Measure PDFM Faisal ChОценок пока нет

- News CorpДокумент17 страницNews CorpIshita SharmaОценок пока нет

- The Way To Sell: Powered byДокумент25 страницThe Way To Sell: Powered bysagarsononiОценок пока нет

- Technical & Derivative Analysis Weekly-14092013Документ6 страницTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Budokon - Mma.program 2012 13Документ10 страницBudokon - Mma.program 2012 13Emilio DiazОценок пока нет

- Sons and Lovers AuthorДокумент9 страницSons and Lovers AuthorArmen NeziriОценок пока нет

- Community Action and Core Values and Principles of Community-Action InitiativesДокумент5 страницCommunity Action and Core Values and Principles of Community-Action Initiativeskimberson alacyangОценок пока нет

- BtuДокумент39 страницBtuMel Vin100% (1)

- Market Outlook 24th February 2012Документ4 страницыMarket Outlook 24th February 2012Angel BrokingОценок пока нет

- Market Outlook 23rd February 2012Документ4 страницыMarket Outlook 23rd February 2012Angel BrokingОценок пока нет

- Market Outlook 11th January 2012Документ4 страницыMarket Outlook 11th January 2012Angel BrokingОценок пока нет

- Market Outlook 22nd November 2011Документ4 страницыMarket Outlook 22nd November 2011Angel BrokingОценок пока нет

- Market Outlook 7th September 2011Документ3 страницыMarket Outlook 7th September 2011Angel BrokingОценок пока нет

- Market Outlook 6th January 2012Документ4 страницыMarket Outlook 6th January 2012Angel BrokingОценок пока нет

- Market Outlook 13th March 2012Документ4 страницыMarket Outlook 13th March 2012Angel BrokingОценок пока нет

- Market Outlook 5th January 2012Документ3 страницыMarket Outlook 5th January 2012Angel BrokingОценок пока нет

- Market Outlook 28th December 2011Документ4 страницыMarket Outlook 28th December 2011Angel BrokingОценок пока нет

- MphasisДокумент4 страницыMphasisAngel BrokingОценок пока нет

- Market Outlook 12th October 2011Документ4 страницыMarket Outlook 12th October 2011Angel BrokingОценок пока нет

- Market Outlook 20th March 2012Документ3 страницыMarket Outlook 20th March 2012Angel BrokingОценок пока нет

- Market Outlook 17th February 2012Документ4 страницыMarket Outlook 17th February 2012Angel BrokingОценок пока нет

- Market Outlook 14th March 2012Документ3 страницыMarket Outlook 14th March 2012Angel BrokingОценок пока нет

- Market Outlook 27th December 2011Документ3 страницыMarket Outlook 27th December 2011Angel BrokingОценок пока нет

- Market Outlook 26th August 2011Документ3 страницыMarket Outlook 26th August 2011Angel BrokingОценок пока нет

- Market Outlook 27th March 2012Документ4 страницыMarket Outlook 27th March 2012Angel BrokingОценок пока нет

- Market Outlook: Dealer's DiaryДокумент4 страницыMarket Outlook: Dealer's DiaryAngel BrokingОценок пока нет

- Market Outlook 21st February 2012Документ4 страницыMarket Outlook 21st February 2012Angel BrokingОценок пока нет

- Market Outlook 9th April 2012Документ3 страницыMarket Outlook 9th April 2012Angel BrokingОценок пока нет

- Market Outlook 2nd January 2012Документ3 страницыMarket Outlook 2nd January 2012Angel BrokingОценок пока нет

- Market Outlook 4th January 2012Документ3 страницыMarket Outlook 4th January 2012Angel BrokingОценок пока нет

- Market Outlook: Dealer's DiaryДокумент4 страницыMarket Outlook: Dealer's DiaryAngel BrokingОценок пока нет

- Market Outlook 5th August 2011Документ4 страницыMarket Outlook 5th August 2011Angel BrokingОценок пока нет

- Market Outlook 16th March 2012Документ4 страницыMarket Outlook 16th March 2012Angel BrokingОценок пока нет

- Market Outlook 9th January 2012Документ3 страницыMarket Outlook 9th January 2012Angel BrokingОценок пока нет

- Market Outlook 24th November 2011Документ3 страницыMarket Outlook 24th November 2011Angel BrokingОценок пока нет

- Market Outlook 12th March 2012Документ4 страницыMarket Outlook 12th March 2012Angel BrokingОценок пока нет

- Market Outlook 10th April 2012Документ3 страницыMarket Outlook 10th April 2012Angel BrokingОценок пока нет

- Persistent Company UpdateДокумент4 страницыPersistent Company UpdateAngel BrokingОценок пока нет

- Market Outlook 30th Decmber 2011Документ3 страницыMarket Outlook 30th Decmber 2011Angel BrokingОценок пока нет

- Market Outlook 2nd April 2012Документ4 страницыMarket Outlook 2nd April 2012Angel BrokingОценок пока нет

- Market Outlook 7th December 2011Документ4 страницыMarket Outlook 7th December 2011Angel BrokingОценок пока нет

- Market Outlook 14th September 2011Документ4 страницыMarket Outlook 14th September 2011Angel BrokingОценок пока нет

- Market Outlook 16th February 2012Документ4 страницыMarket Outlook 16th February 2012Angel BrokingОценок пока нет

- Market Outlook 28th March 2012Документ4 страницыMarket Outlook 28th March 2012Angel BrokingОценок пока нет

- Market Outlook 5th October 2011Документ4 страницыMarket Outlook 5th October 2011Angel BrokingОценок пока нет

- Mid-Quarter Monetary Policy ReviewДокумент3 страницыMid-Quarter Monetary Policy ReviewAngel BrokingОценок пока нет

- Market Outlook 10th January 2012Документ4 страницыMarket Outlook 10th January 2012Angel BrokingОценок пока нет

- Exide Industries (EXIIND) : Finally, Margins Surprise "Positively"Документ1 страницаExide Industries (EXIIND) : Finally, Margins Surprise "Positively"prince1900Оценок пока нет

- Marudyog 20110607Документ3 страницыMarudyog 20110607hemen_parekhОценок пока нет

- Technical Format With Stock 17.09Документ4 страницыTechnical Format With Stock 17.09Angel BrokingОценок пока нет

- Market Outlook 25th August 2011Документ3 страницыMarket Outlook 25th August 2011Angel BrokingОценок пока нет

- Daily Technical Report: Sensex (16860) / NIFTY (5104)Документ4 страницыDaily Technical Report: Sensex (16860) / NIFTY (5104)Angel BrokingОценок пока нет

- Technical Format With Stock 14.09Документ4 страницыTechnical Format With Stock 14.09Angel BrokingОценок пока нет

- Market Outlook 07.07Документ3 страницыMarket Outlook 07.07Nikhil SatamОценок пока нет

- Market Outlook: India Research Dealer's DiaryДокумент3 страницыMarket Outlook: India Research Dealer's DiaryAngel BrokingОценок пока нет

- Infosys Ltd-Q2 FY12Документ4 страницыInfosys Ltd-Q2 FY12Seema GusainОценок пока нет

- Derivatives Report 9th April 2012Документ3 страницыDerivatives Report 9th April 2012Angel BrokingОценок пока нет

- Market Outlook 26th September 2011Документ3 страницыMarket Outlook 26th September 2011Angel BrokingОценок пока нет

- Hexaware CompanyUpdateДокумент3 страницыHexaware CompanyUpdateAngel BrokingОценок пока нет

- Market Outlook 30th September 2011Документ3 страницыMarket Outlook 30th September 2011Angel BrokingОценок пока нет

- Market Outlook 13th January 2012Документ6 страницMarket Outlook 13th January 2012Angel BrokingОценок пока нет

- Market Outlook 29th November 2011Документ3 страницыMarket Outlook 29th November 2011Angel BrokingОценок пока нет

- Daily Technical Report: Sensex (16719) / NIFTY (5068)Документ4 страницыDaily Technical Report: Sensex (16719) / NIFTY (5068)Angel BrokingОценок пока нет

- Technical Report 20th July 2011Документ3 страницыTechnical Report 20th July 2011Angel BrokingОценок пока нет

- Market Outlook 20th September 2011Документ4 страницыMarket Outlook 20th September 2011Angel BrokingОценок пока нет

- Nestlé India (NESIND) : Royalty To Increase To 4.5% by CY18Документ1 страницаNestlé India (NESIND) : Royalty To Increase To 4.5% by CY18drsivaprasad7Оценок пока нет

- Market Outlook 27th September 2011Документ3 страницыMarket Outlook 27th September 2011angelbrokingОценок пока нет

- Special Technical Report On NCDEX Oct SoyabeanДокумент2 страницыSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingОценок пока нет

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertДокумент4 страницыRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingОценок пока нет

- WPIInflation August2013Документ5 страницWPIInflation August2013Angel BrokingОценок пока нет

- Metal and Energy Tech Report November 12Документ2 страницыMetal and Energy Tech Report November 12Angel BrokingОценок пока нет

- Daily Agri Report September 16 2013Документ9 страницDaily Agri Report September 16 2013Angel BrokingОценок пока нет

- Daily Metals and Energy Report September 16 2013Документ6 страницDaily Metals and Energy Report September 16 2013Angel BrokingОценок пока нет

- International Commodities Evening Update September 16 2013Документ3 страницыInternational Commodities Evening Update September 16 2013Angel BrokingОценок пока нет

- Currency Daily Report September 16 2013Документ4 страницыCurrency Daily Report September 16 2013Angel BrokingОценок пока нет

- Oilseeds and Edible Oil UpdateДокумент9 страницOilseeds and Edible Oil UpdateAngel BrokingОценок пока нет

- Daily Agri Tech Report September 16 2013Документ2 страницыDaily Agri Tech Report September 16 2013Angel BrokingОценок пока нет

- Daily Agri Tech Report September 14 2013Документ2 страницыDaily Agri Tech Report September 14 2013Angel BrokingОценок пока нет

- Commodities Weekly Outlook 16-09-13 To 20-09-13Документ6 страницCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingОценок пока нет

- Derivatives Report 16 Sept 2013Документ3 страницыDerivatives Report 16 Sept 2013Angel BrokingОценок пока нет

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Документ4 страницыDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingОценок пока нет

- Market Outlook: Dealer's DiaryДокумент13 страницMarket Outlook: Dealer's DiaryAngel BrokingОценок пока нет

- Metal and Energy Tech Report Sept 13Документ2 страницыMetal and Energy Tech Report Sept 13Angel BrokingОценок пока нет

- Commodities Weekly Tracker 16th Sept 2013Документ23 страницыCommodities Weekly Tracker 16th Sept 2013Angel BrokingОценок пока нет

- Derivatives Report 8th JanДокумент3 страницыDerivatives Report 8th JanAngel BrokingОценок пока нет

- Technical Report 13.09.2013Документ4 страницыTechnical Report 13.09.2013Angel BrokingОценок пока нет

- Sugar Update Sepetmber 2013Документ7 страницSugar Update Sepetmber 2013Angel BrokingОценок пока нет

- MetalSectorUpdate September2013Документ10 страницMetalSectorUpdate September2013Angel BrokingОценок пока нет

- MarketStrategy September2013Документ4 страницыMarketStrategy September2013Angel BrokingОценок пока нет

- Market Outlook 13-09-2013Документ12 страницMarket Outlook 13-09-2013Angel BrokingОценок пока нет

- IIP CPIDataReleaseДокумент5 страницIIP CPIDataReleaseAngel BrokingОценок пока нет

- TechMahindra CompanyUpdateДокумент4 страницыTechMahindra CompanyUpdateAngel BrokingОценок пока нет

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressДокумент1 страницаPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingОценок пока нет

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateДокумент6 страницTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingОценок пока нет

- Daily Agri Tech Report September 06 2013Документ2 страницыDaily Agri Tech Report September 06 2013Angel BrokingОценок пока нет

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechДокумент4 страницыJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingОценок пока нет

- Group 1 RDL2Документ101 страницаGroup 1 RDL2ChristelОценок пока нет

- Assignment OUMH1203 English For Written Communication September 2023 SemesterДокумент15 страницAssignment OUMH1203 English For Written Communication September 2023 SemesterFaiz MufarОценок пока нет

- Opinions and ThoughtsДокумент2 страницыOpinions and Thoughtsfikri alfaroqОценок пока нет

- Reducing Healthcare Workers' InjuriesДокумент24 страницыReducing Healthcare Workers' InjuriesAnaОценок пока нет

- Notes On Statement AssumptionДокумент5 страницNotes On Statement Assumptionsangamesh mbОценок пока нет

- Elements of Service-Oriented Architecture: B. RamamurthyДокумент15 страницElements of Service-Oriented Architecture: B. RamamurthySaileshan SubhakaranОценок пока нет

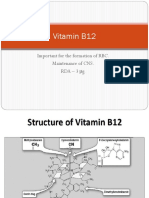

- Vitamin B12: Essential for RBC Formation and CNS MaintenanceДокумент19 страницVitamin B12: Essential for RBC Formation and CNS MaintenanceHari PrasathОценок пока нет

- Paige AMCA Silencer PaperДокумент8 страницPaige AMCA Silencer Paperapop1971Оценок пока нет

- Emotion and Decision Making: FurtherДокумент28 страницEmotion and Decision Making: FurtherUMAMA UZAIR MIRZAОценок пока нет

- Cost-Benefit Analysis of The ATM Automatic DepositДокумент14 страницCost-Benefit Analysis of The ATM Automatic DepositBhanupriyaОценок пока нет

- Daily Lesson Plan: Week DAY Date Class Time SubjectДокумент3 страницыDaily Lesson Plan: Week DAY Date Class Time SubjectHasanah HassanОценок пока нет

- Shortcut To Spanish Component #1 Cognates - How To Learn 1000s of Spanish Words InstantlyДокумент2 страницыShortcut To Spanish Component #1 Cognates - How To Learn 1000s of Spanish Words InstantlyCaptain AmericaОценок пока нет

- mc1776 - Datasheet PDFДокумент12 страницmc1776 - Datasheet PDFLg GnilОценок пока нет

- Letter of Reccommendation For LuisaДокумент3 страницыLetter of Reccommendation For Luisaapi-243184335Оценок пока нет

- Modbus Quick StartДокумент3 страницыModbus Quick StartNash JungОценок пока нет

- Economic History Society, Wiley The Economic History ReviewДокумент3 страницыEconomic History Society, Wiley The Economic History Reviewbiniyam.assefaОценок пока нет

- Cultural Practices and Academic Performance of Blaan Pupils in Sinapulan Elementary SchoolДокумент15 страницCultural Practices and Academic Performance of Blaan Pupils in Sinapulan Elementary SchoolLorОценок пока нет

- Evidence Law PDFДокумент15 страницEvidence Law PDFwanborОценок пока нет

- Direct Shear TestДокумент10 страницDirect Shear TestRuzengulalebih ZEta's-ListikОценок пока нет

- Elderly Suicide FactsДокумент2 страницыElderly Suicide FactsThe News-HeraldОценок пока нет

- Productivity in Indian Sugar IndustryДокумент17 страницProductivity in Indian Sugar Industryshahil_4uОценок пока нет

- Day1 1Документ17 страницDay1 1kaganp784Оценок пока нет

- Electrostatics Formulas and Numerical ProblemsДокумент11 страницElectrostatics Formulas and Numerical ProblemsManish kumar100% (2)