Академический Документы

Профессиональный Документы

Культура Документы

2011 11 RBF Economic Review November 2011

Загружено:

esther yeИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

2011 11 RBF Economic Review November 2011

Загружено:

esther yeАвторское право:

Доступные форматы

Vol.

30

No. 11

Month Ended. November 2011

The outlook on global economic and financial conditions has become more uncertain due to the escalating sovereign debt crisis in Europe and poor confidence in the major advanced economies. In other regions, high inflation, geopolitical tensions and natural disasters have contributed to the lowering of growth prospects. Consequently, growth forecasts for Fijis major trading partner economies for 2011 and 2012 have been lowered. In New Zealand, growth has been revised downwards for both years based on the adverse impact of prolonged Euro zone debt crisis. Similarly, Australias growth for this year has been downgraded on subdued domestic demand with a rebound anticipated for next year. As for the Euro zone, escalating debt continued to dampen growth for 2011 and even more in 2012. In Japan, growth for 2011 is expected to improve slightly on reconstruction demand while growth for the US economy is expected to pick-up in 2011 and next year due to a surge in business investment and rebound in consumption. Domestically, recent revisions to growth projections reveal that the Fiji economy is now projected to grow by 2.1 percent in 2011, compared to the earlier anticipated recovery of 2.7 percent. The downward revision is mainly attributed to projected lower-than-expected performances in the manufacturing; and forestry sectors coupled with contractions expected in the fishing; public administration & defence; mining & quarrying; electricity & water; and the health & social work sectors. The major drivers of this years growth are expected to be the agriculture; financial intermediation; transport, storage & communication; hotels & restaurants; real estate & business services and the manufacturing

sectors. For 2012 and 2013, the domestic economy is forecast to grow by 2.3 percent and 1.9 percent respectively. Sector performances to date suggest mixed outcomes. While increases were noted in consumption activity as well as in the tourism, sugar and copra industries, weaker performances were recorded in the construction, electricity and gold sectors. The labour market remained subdued as indicated by the results of the November Job Advertisement Survey. The yearly decline in the number of job advertisements was mainly attributed to the wholesale, retail trade & restaurants & hotels; community, social & personal services and the construction sectors. Inflation in October eased to 9.1 percent from 9.7 in September led largely by declines in energy and food prices. In the coming months, prices are expected to moderate further due to a slowdown in the global economy and the consequent decline in global commodity prices, as well as the phasing out of one-off price adjustments for the electricity tariff and VAT. In the banking sector, broad money (M2) rose on an annual basis by 15.9 percent in October, unchanged from the previous month. This was underpinned by a slowdown in growth of net foreign assets which offset a recovery domestic credit expansion. Over the review period, growth in net foreign assets fell from 41.9 percent in September to 22.1 percent in October while domestic credit grew by 4.5 percent, a turnaround from a contraction of 0.8 percent in September. The recovery in domestic credit was attributed to

improved claims on official entities and a relatively slower decline in claims on government. Over the same period, private sector credit rose over the year by 6.1 percent. Exchange rate movements in October revealed that the Fiji dollar depreciated against the Australian and New Zealand dollar by 4.1 percent and 1.3 percent respectively, but appreciated against the US dollar (5.1%), the Japanese Yen (3.5%) and the Euro (1.0%). On an annual basis, the Fiji dollar fell against the Australian dollar (3.4%), the New Zealand dollar

(2.8%) and the Japanese Yen (1.3%) but rose against the US dollar (5.7%) and the Euro (4.2%). Liquidity in the banking system, measured by bank demand deposits fell further by $74.2 million (-13.0%) over the month to $497.1 million as at 30 November. As at 30 November 2011, foreign exchange reserves stood at $1,464.7 million, equivalent to around 4.8 months of retained imports of goods and non-factor services.

RESERVE BANK OF FIJI

Vol.30 No.11 2011

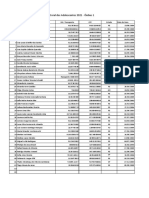

FIJI: FINANCIAL STATISTICS

KEY INDICATORS

Oct-11 Sep-11 Aug-11 Oct-10

1. Consumer Prices * (year-on-year % change) All Items Food 2. Reserves (end of period) Foreign Reserves ($m)1/ 3. Exchange Rates (mid rates, F$1 equals) (end of period) US dollar Pound sterling Australian dollar New Zealand dollar Swiss francs Euro Japanese yen 4. Liquidity (end of period) Liquid Assets Margin to Deposit Ratio (%) Banks' Demand Deposits ($m) 5. Commodity Prices (US$) ** (monthly average) UK Gold Price/fine ounce CSCE No. 11 Sugar Spot Price/Global (US cents/Pound) Crude Oil/barrel 6. Money and Credit (year-on-year % change) Narrow Money Broad Money Currency in Circulation (monthly average) Quasi-Money (Time & Saving Deposits) Domestic Credit 7. Interest Rates (% p.a.) (weighted monthly average) Lending Rate (Excluding Staff) Savings Deposit Rate Time Deposit Rate 14-day RBF Note Rate (month end) 2/ Minimum Lending Rate (MLR) (month end) Overnight Inter-bank Rate 5-Year Government Bond Yield 10-Year Government Bond Yield

7.45 1.03 3.14 n.i 2.00 n.t. n.i n.i 7.49 1.04 3.23 n.i 2.00 n.t n.i n.i 7.49 0.84 3.30 n.i 2.00 n.t n.i n.i 7.44 1.02 5.02 2.83 3.50 n.t n.i n.i 36.6 15.9 5.2 1.5 4.5 38.2 15.9 5.7 1.0 -0.8 39.4 17.4 7.8 3.1 -0.5 10.6 4.7 12.8 1.0 -1.8 1665.2 26.3 109.5 1771.9 26.7 111.1 1755.8 27.9 110.1 1342.0 35.3 82.9 12.5 571.2 14.3 661.8 15.4 678.9 9.7 311.6 0.5727 0.3552 0.5347 0.6983 0.4954 0.4050 43.31 0.5448 0.3489 0.5574 0.7075 0.4891 0.4011 41.85 0.5779 0.3546 0.5411 0.6773 0.4740 0.4001 44.31 0.5416 0.3398 0.5536 0.7184 0.5323 0.3889 43.90 1543.0 1626.2 1632.7 1264.9 9.1 8.2 9.7 9.1 10.4 10.9 1.6 3.9

1/

Foreign reserves includes monetary gold, Special Drawing Rights, reserve position in the Fund and foreign exchange assets consisting of currency and deposits actually held by the Reserve Bank. With the introduction of the new Monetary Policy Framework on 17 May 2010, the minimum lending rate was set at 50 basis points above the Overnight Policy Rate.

2/

Note: n.a n.i n.t Sources:

*

Not Available No Issue No Trade Fiji Bureau of Statistics Bloomberg

**

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Christ in The Bible - Jude - A. B. SimpsonДокумент9 страницChrist in The Bible - Jude - A. B. Simpsonhttp://MoreOfJesus.RR.NUОценок пока нет

- L1 Support-Windows Server Interview Question & AnswersДокумент6 страницL1 Support-Windows Server Interview Question & AnswersSmile Ever100% (3)

- Essay R JДокумент5 страницEssay R Japi-574033038Оценок пока нет

- Pronunciation SyllabusДокумент5 страницPronunciation Syllabusapi-255350959Оценок пока нет

- Supply Chain and Logistics Management: Distribution PoliciesДокумент8 страницSupply Chain and Logistics Management: Distribution PoliciesKailas Sree ChandranОценок пока нет

- Just Design Healthy Prisons and The Architecture of Hope (Y.Jewkes, 2012)Документ20 страницJust Design Healthy Prisons and The Architecture of Hope (Y.Jewkes, 2012)Razi MahriОценок пока нет

- 8299 PDF EngДокумент45 страниц8299 PDF Engandrea carolina suarez munevarОценок пока нет

- Gillette vs. EnergizerДокумент5 страницGillette vs. EnergizerAshish Singh RainuОценок пока нет

- Session - 30 Sept Choosing Brand Elements To Build Brand EquityДокумент12 страницSession - 30 Sept Choosing Brand Elements To Build Brand EquityUmang ShahОценок пока нет

- Declarations On Higher Education and Sustainable DevelopmentДокумент2 страницыDeclarations On Higher Education and Sustainable DevelopmentNidia CaetanoОценок пока нет

- 10 Types of Innovation (Updated)Документ4 страницы10 Types of Innovation (Updated)Nur AprinaОценок пока нет

- 2010 Final Graduation ScriptДокумент8 страниц2010 Final Graduation ScriptUmmu Assihdi100% (1)

- Week 8 - 13 Sale of GoodsДокумент62 страницыWeek 8 - 13 Sale of Goodstzaman82Оценок пока нет

- Quiz On Cash and Cash EquivalentДокумент5 страницQuiz On Cash and Cash EquivalentJomel BaptistaОценок пока нет

- Weavers, Iron Smelters and Factory Owners NewДокумент0 страницWeavers, Iron Smelters and Factory Owners NewWilliam CookОценок пока нет

- Information Security NotesДокумент15 страницInformation Security NotesSulaimanОценок пока нет

- 2020 Macquarie University Grading and Credit Point System PDFДокумент2 страницы2020 Macquarie University Grading and Credit Point System PDFRania RennoОценок пока нет

- Engineering Management Past, Present, and FutureДокумент4 страницыEngineering Management Past, Present, and Futuremonty4president100% (1)

- Marketing Chapter001Документ22 страницыMarketing Chapter001Reham MohamedОценок пока нет

- Art. 19 1993 P.CR - LJ 704Документ10 страницArt. 19 1993 P.CR - LJ 704Alisha khanОценок пока нет

- Coral Dos Adolescentes 2021 - Ônibus 1: Num Nome RG / Passaporte CPF Estado Data de NascДокумент1 страницаCoral Dos Adolescentes 2021 - Ônibus 1: Num Nome RG / Passaporte CPF Estado Data de NascGabriel Kuhs da RosaОценок пока нет

- Hack Tata Docomo For Free G..Документ3 страницыHack Tata Docomo For Free G..Bala Rama Krishna BellamОценок пока нет

- "Underdevelopment in Cambodia," by Khieu SamphanДокумент28 страниц"Underdevelopment in Cambodia," by Khieu Samphanrpmackey3334100% (4)

- 21 ST CLQ1 W4 CAДокумент11 страниц21 ST CLQ1 W4 CAPatrick LegaspiОценок пока нет

- Islam and PatriarchyДокумент21 страницаIslam and PatriarchycarolinasclifosОценок пока нет

- Itinerary KigaliДокумент2 страницыItinerary KigaliDaniel Kyeyune Muwanga100% (1)

- John 5:31-47Документ5 страницJohn 5:31-47John ShearhartОценок пока нет

- 202E13Документ28 страниц202E13Ashish BhallaОценок пока нет

- Icici History of Industrial Credit and Investment Corporation of India (ICICI)Документ4 страницыIcici History of Industrial Credit and Investment Corporation of India (ICICI)Saadhana MuthuОценок пока нет

- MOP Annual Report Eng 2021-22Документ240 страницMOP Annual Report Eng 2021-22Vishal RastogiОценок пока нет