Академический Документы

Профессиональный Документы

Культура Документы

New Product Devp Process Draft Note Revised 30 Jan

Загружено:

Soumya SahuИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

New Product Devp Process Draft Note Revised 30 Jan

Загружено:

Soumya SahuАвторское право:

Доступные форматы

Technical Note

New Product Development Process

Guidelines for Participants of MTM Lab

January 2011

Astad Pastakia Harini Mittal

CEPT University

Ahmedabad

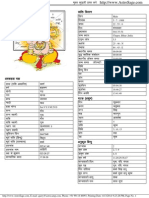

Introduction The new product development process starting from recognition of an opportunity to the final launch of a product may go through several stages. Different scholars and business entities have tried to model this process into discreet stages depending on their perspective and experiences. Drawing upon the common elements of several of the well known models we present here a process model involving seven stages (Figure 1). Of these five stages which will be taken up for practical experience as part of the MTM lab are discussed in some detail. Where necessary, checklists have been provided to facilitate the implementation of studies necessary to complete a particular stage. Participants will be expected to submit a brief report at the end of each of these five stages viz. i) ii) iii) iv) v) Ideation and selection of best ideas Concept development Proof of concept Designing and prototyping Business plan

This note provides inputs for the first three of these stages i.e. all those stages where prior information collection and analysis is called for in order to build the case for the proposed product/service.

1.0

Ideation Stage

In this stage the iterative use of divergent and convergent thinking may be relied upon to come out with a list of possible opportunities for new product/service development. After the brainstorming is over, one may use specific criteria such as uniqueness, practicality, business attractiveness, eco-friendliness etc to select the best ideas for further exploration and development. The ideation process can be greatly enhanced by looking at both market and technical possibilities and trying to marry the two. Market Understanding The objective of the entrepreneur is to move from consumer dissatisfaction and disgust to consumer satisfaction and delight. One may think of all possible situations, which offer scope to improve consumer satisfaction or remove the hardships / irritations of the consumers. It is also possible to think of new ways of adding value for the consumer additional functions and attributes, reduced costs, increased convenience and user-friendliness, eco-friendliness etc. Analysis of the market in a specific sub-sector that one may be interested, can help to identify market discontinuities market segments that may have been ignored in the past or only partially served e.g. pianos for left handed people, mattresses for people with specific back problems etc.

Figure 1: New Product Development Process

Technical Possibilities: Available technology New platforms for new applications

Opportunity Recognition: Ideation (1) Preliminary selection

Market Understanding: Market discontinuities, Consumer dissatisfaction

Preliminary Technical Assessment

Concept Development (2): Product specifications, Price points etc.

Go

Preliminary Market Assessment, including Need assessment

Technical validation, lab testing, modeling, virtual prototype etc.

Proof of Concept (3):

Concept testing with potential consumers

No Go

Building the business case, mobilizing finances

Go

Interaction with production people and technical experts

Designing and Prototyping (4): Stage A to Z

Eliciting consumer feedback and participation

No Go Go

Test Marketing

No Go

Debugging

Go

Production feasibility, Including environmental and social viability

Business Plan (5)

Market feasibility, including financial viability

Launch

One can also think of unmet needs and wants through observation of the plight of people in their day to day routines. A new technology (or even existing technology) could be harnessed to create new products and services to meet unmet needs and wants, once these are clearly identified. Technical Possibilities Matching the market need with the available technology to examine the possibility of producing the new product without much difficulty is an integral part of ideation. New technology and technology platforms offer tremendous scope for developing new applications that meet existing and latent needs of various consumer segments e.g. ICT technologies (CDMA, Remote sensing, GIS, GPS etc) genetic modification of crops, nanotechnology, bio-technology are some of the emerging technologies.

2.0

Concept Development

Considerable spadework is needed prior to designing a new product/service. This includes development of the product concept, its clear articulation, and developing proof of the concept. Only then can one hope to attract financial support for the project. In the concept development stage the innovator would like to move from an initial idea to a clearly articulated product/ service concept. This would include the desirable attributes that consumers think would add value as well as the price range that would make sense in an existing sub-sector, given the available competition. This step is perhaps the most critical in the entire process of new product development, because if the concept is not articulated clearly, it could create problems during the later stages of the process. Once again one would like to marry technical possibilities with market demands, but this time with more specific inputs both from the technical experts as well as potential consumers. To enable this process one would need to carry out preliminary assessments as indicated below. The market assessment should include a needs and wants study of the potential consumers/customers. Preliminary market assessment 1 Preliminary market assessment involves a quick-and-dirty market study. The purpose is to determine whether the proposed product has any commercial prospects. The preliminary market assessment y assesses market attractiveness and potential; y gauges possible product acceptance; y sizes up the competitive situation; and y sculpts the product (shapes the idea into a tentative product design). The task is to find out quickly and for minimal cost as much as possible about market size, growth, segments, customer needs and interest, and competition. Given the limited cost and the short time duration of the study, this type of market assessment is clearly not a professional and scientific piece of market research. Rather its detective work

1

This section is abridged and adopted from Cooper (2001).

and desk research: gathering available information through players in the value chain (for example, talking with retailers, distributors, and technical service people); examining secondary sources (for example, reports and articles published by trade magazines, associations, government agencies, and research and consulting firms); contacting potential users (for example, through a phone blitz or focus groups); and canvassing outside sources (for example, industry experts, magazine editors, or consultants). Its tough work, much like playing detective and following up on leads, but its surprising how much information about a products market prospects can be gleaned from several days of solid sleuthing. Here are some sources of market information that can be accessed relatively inexpensively for Stage 1: y Internet searches. Search through trade magazines, journals, reports, and other published items looking for information on your market, the product type, and your competitors. Your own library. Try your own library, a major public library or other available libraries in town. Key customers. Insights from a limited number of leading, key, or trusted customers can prove very useful at this early stage. Have direct, face-to-face discussions with a few customers. These need not be based on a detailed questionnaire but can be unstructured and exploratory. For industrial goods, try to pick trusted yet representative or leading users. Talk to several people within each firm. If budgets are tight and time is pressing, try telephone interviews. Focus groups. In spite of their limitations, focus groups, made up of a handful of customers, either consumers or industrial users, remain a cost-effective and relatively fast way to gain insights into customer needs, wants, and preferences. Advertisements. Get your hands on your competitors advertisements and trade literature. Find out what they are saying about their productsfeatures and performance characteristics, as well as how competitors are trying to position their products. Consulting and research firms. Some consulting and research firms publish multiclient or standardized reports that provide an overview of an industry. Although they may not be specific to your new product, these reports or studies are a cost-effective way to gain information on market size, trends, and competition. Government agencies. Governments collect a myriad of data. Finding it is the problem. But dont give up before you begin. Some Departments and public institutions (such as WASMO) are more proactive in putting out information in the public domain. Industry experts. Try to meet an industry expert for a day or two and pick his or her brains. Although the effort involved may be high, the knowledge gained may save you weeks of work.

Trade associations. Some industries have excellent trade associations that provide valuable market data. Contact these associations.

Needs and Wants study The consumer needs study can be carried out with the help of informal discussions with potential consumers or a focused group discussion. The checklist given below is adopted from Cooper (2001) 1. How is the potential customer now solving his or her problem? What is the current solution? For example, what particular product is he or she using, and why? 2. What unsolved problems is the customer or user experiencing with the current solution? Are there opportunities here for a new solution or new way of doing things? 3. If the customer had a choice, which product or brand would he or she buy now? Why? Which one or ones would he or she not buy? Why not? These types of questions are important in that they are methods of inferring what the customer is looking for and what he or she wishes to avoid. Here were trying to uncover what the customers unmet and unarticulated needs are and what they see as having value, and what a new solution might look like. 4. What are the customers choice criteriathe criteria that the customer uses to make a purchase decision? What is the relative importance or weight of each criterion in the decision? 5. How do current (competitive) products rate on each of the choice criteria? Which competitor scores highest on each criterion? Whos the lowest? What is it about these products that cause the customer to rate them so high or low, on each criterion? These fairly traditional questions on choice criteria and competitive ratings are important for several reasons. First, an understanding of how the customer makes his or her purchase choice and what criteria are used is a critical input into product design; at a minimum, your new product must address and score high on the important criteria. Second, understanding how competitors products score identifies areas of potential opportunityfor example, a competitive product weaknessthat can be exploited with an improved design. Knowledge of the reasons that underlie these competitive ratings also provides valuable insights to the product designer regarding what to build into your new product and what to avoid. Finally, different patterns of responses among customers may suggest the existence of two or more market segments. There may be a market niche that has been missed by competitorsone that can be successfully targeted by you. 6. What does the customer specifically like about competitive products or current solutions? What does he or she dislike? What problems does the customer have when using competitive products? Often competitive products do have many positive design aspects, which can be borrowed and built into your new product. Theres nothing wrong with copying the good facets of a competitors product, providing one goes well beyond a mere copy. For example, in

developing its successful luxury automobile, the Lexus, Toyota took a hard look at luxury cars around the world, particularly European ones. Toyota borrowed the best ideas from these; many of the design concepts in the Lexus are simply copied from other luxury cars. Knowledge of the positive facets of competitive products is obviously a valuable input to the designer. Similarly, identification of customer dislikes and problems in competitive products opens up opportunities for significant design improvement. Remember: The objective is to design a superior product; that means it must be superior to the leading competitive products. An understanding of where the competitor failsits Achilles heelis half the battle! 7. What specific features, attributes, and performance is the customer looking for in a new product? Which of these are must haves and which are only desirable but not essential? 8. What trade-offs is the customer prepared to make (for example, among various possible performance deliverables, or product features, or features versus price)? An understanding of the customers stated requirementsboth musts and shouldsis obviously a critical design input. But note that this customer-stated wish list is usually fairly sterile, and it is not specific enough to build a winning new product design. A knowledge of customer trade-offs reveals the relative preferences among various product features and attributes and indicates relative value or importance of different design features to the customer. 9. How does the customer use (and abuse) the product? What is the customers use system in which the product must operate? And how does it fit into (or interact with) other components of the system? 10. What are the customers economics? How does your potential product affect his or her economics in use? These last two questions are both critical and difficult. The first looks beyond the product itself; it probes the role the product plays in the total system. And it applies to all kinds of products, from prepared food entres (where the kitchen and household are the system) to telecommunications components and software. The economics or value in use is fundamental to understanding how you can deliver a product that yields better economic valuefor example, by saving the customer money over the total life of the product or in some other facet of his system. Preliminary Technical assessment2 The preliminary technical assessment, a second facet of concept development, subjects the proposed product to the businesss technical staffR&D, engineering, and operationsfor appraisal. The purpose is to establish preliminary rough technical and product performance objectives; undertake a very preliminary technical feasibility study; and pinpoint possible technical risks. Specific tasks might include discussions among technical and operations people; a preliminary literature search (for example, a titles search); a preliminary patent search; and acquisition and review of competitive literature. The key questions concern the technical viability of the product:

Based on Cooper (2001)

Approximately what will the product requirements or specifications be? (Note that the product definition may still be fairly vague and fluid at this early stage.) How would these requirements be achieved technically? Is there a foreseeable technical solution? Is invention or new science required? What are the odds that the product is technically feasible? At what cost and time? Do you have the technological capability to develop it yourselves? Or do you need a partner or outside supplier for some development work? Can the product be manufactured or produced? How, with what equipment, and at what cost? Or should you consider outsourcing or a partner? What intellectual property and product regulatory issues are involved? What are the key technical risks? And how might we handle each?

y y

y y 3.0

Proof of Concept

The product concept developed so far needs to be tested first for technical validity and then with the consumers. This would give us the necessary confidence to work out a plan for product development. Technical validity: The technical validation can be carried out in a variety of ways laboratory testing, practical experiments, modeling and simulation, developing a working model, developing a virtual model etc. Concept testing with consumers: The product concept as developed after validation may be shared with the potential consumers to confirm whether it matched well with what the consumers had in mind. The concept may be suitably modified before proceeding to the next stage. Concept tests differ from user needs-and-wants studies in two major ways: First, in a concept test you have something to show the customer to solicit feedback; second, you are seeking very different types of information than in a user needs-and-wants study. The concept test is not a prospecting study but rather a test or validation that the proposed product concept is indeed a winner; intent to purchase is established. Note that at this early stage you still dont have a developed product. The purpose of this concept test is to see if youre heading in the right direction. By this time you should have, at minimum, a written description of the product and its benefits, features, performance characteristics, and likely price. In addition, you may have something concrete to show the customerline drawings, artists renderings, a model, a PowerPoint slide show, a crude working model, or even a virtual prototype of the product on your laptop. The better you are able to convey what the final product will be and do, the more accurate gauge of purchase intent you will get. Get as close to the final product as you can in your concept presentation:

Hewlett-Packard investigated the development of a new computer pointing device to replace the mouse, namely, fixed mounted cylinders that are twirled with the operators thumb. The product had not yet been developed, but customer reaction was sought through a full-proposition concept test. Customers were shown a video, which demonstrated a mock-up and simulation of the product, and a simulation on a computer screen was used to vividly portray how the new device would work. Note that although H-P did not actually have a prototype or product to test with the customer, this concept test came very close to itwell before development had begun! Once the technical investigation has yielded a technically feasible concept, then a full proposition concept can be shown to the customera model, a set of drawings, a storyboard, a spec sheet, a dummy brochure, or a virtual prototypeand his or her response can be gauged: Given what youve told us, this is what weve come up with in terms of a proposed product. What do you think of it? Would you buy it? What Information to Seek? A concept test seeks customer reaction to the product in an attempt to assess market acceptance and expected sales revenues. Information objectives typically include the following: 1. A measure of the customers interest in the proposed product and a determination of why interest level is high or low 2. A measure of the customers liking for the product concept, and what facets he or she likes most, and what he or she likes least 3. A comparative measure of the customers preference for the concept relative to competitive brands or products the customer now uses, and the reasons for these preferences 4. An indication of what the customer might expect to pay for the product 5. An indication of the customers purchase intent at a specified price 6. Information useful in finalizing the positioning strategy. Annexure 1 shows a typical questionnaire format. Note that there is a combination of closedended questions (to which the customer selects an answer, for example on a 15 or 010 scale) and open-ended questions (which result in a verbal answer or discussion). The closedended questions provide concrete, numeric data that can be aggregated and analyzed across many customers. But numbers alone tend to be sterile; hence open-ended responses are also sought to lend richness and greater understanding. Using the Results of a Concept Test: Use the results of a concept test with caution. They merely provide an indication of likely product acceptance. There are no guarantees, and the results should not be used blindly. For most new products, particularly concepts in categories familiar to the customer, concept tests are likely to overstate the market acceptance. For example, a result of 30 percent of respondents definitely would buy is not likely to translate into a market share of 30 percent for several reasons. First, respondents tend to have a positive response bias. There are many reasons for this: the so-called Hawthorn effect, whereby people under observation tend to respond more positively or enthusiastically than those not being studied; the desire to give socially acceptable or pleasing answers to the interviewer; and the fact that its easy to say yes when theres no money or commitment involved. Second, although a respondent might say that hell buy your product, in the case of a frequently repurchased product, he may

continue to buy the competitors as well, that is, split his purchases. If he buys both products equally, the original result of 30 percent definitely would buy actually translates into a 15 percent market share. Third, not all potential buyers in the defined target market will be exposed or exposed sufficiently to the new product. Advertising, promotion, and sales force may reach less than half of the total target market. The intent to purchase figure must be cut down by a factor that reflects market exposure (or audience reach) on launch. 4.0 Designing and Prototyping

Having established proof of concept and built a case for developing the new product/ service, one is now in a position to start designing the prototype and developing it. This again is an iterative process which may move into several stages and take anything from a few days to a few years, depending on the complexity of the product being developed. Throughout this process the product development team is expected to interact with the production team/ technical experts on one hand and take feedback from potential consumers on the other. Very often, it may be possible to actively involve consumer(s) in the product development process, if they have the necessary motivation and ideas to enhance the process. 5.0 Business Plan Development

Development of the final prototype is a signal that the product/ service may most likely be ready for the market. Test marketing may be planned, while simultaneously developing a business plan. The business plan should take into account the following: a) technical and production feasibility b) environmental and social feasibility c) market feasibility d) financial viability In the case of an on-going business, it is of utmost importance that the new product/service fits in with the existing business and product lines of the company. However, this would need to be taken into consideration during the initial assessment itself.

References Cooper, Robert (2001) Winning at New Products: Accelerating the Process from Idea to Launch. Boston: Harvard Business Publishing, Digital Chapters. Khandwalla Pradip N., (2004) Lifelong Creativity: An Unending Quest. New Delhi: McGraw-Hill Publishing Company Ltd. Innovator's Toolkit: Ten Practical Strategies to Help you Develop and Implement Innovation. Harvard Business School Press, Boston, 2009

Annexure 1 The Typical Concept Test Questionnaire 1a. First, are you interested in the proposed product? You can answer on this fivepoint scale (show them the scale): not interested at all quite interested not too interested very interested somewhat

1b. Why so interested (or not interested)? __________________________________

2a. To what extent do you like the product? not interested at all quite interested not too interested very interested somewhat

2b. Identify the things you like the most about it: ____________________________ 2c. What things do you like least about it? __________________________________

3a. You are already purchasing (or familiar with) Brand X. How would you compare the new product with Brand X? not interested at all quite interested not too interested very interested somewhat

3b. Why did you like it more (or less than Brand X? __________________________

4. Assume this new product was already available. How much would you expect to pay for it (you can ask this price question relative to a product they are familiar with or now buy)?____________________________________________________________ 5a. Lets assume the new product is on the market at a price of $Y. What is the likelihood that you would buy it? not interested at all quite interested not too interested very interested somewhat

5b. Why. . .what made you answer the way you did (in 5a)? ____________________ 5c. (If negative): What would you like to see changed in the product? Any suggestions?______________________________________________________

Вам также может понравиться

- Interview With Sai Priya Mahajan, Co-Founder - Eatlo - CrazyEngineersДокумент5 страницInterview With Sai Priya Mahajan, Co-Founder - Eatlo - CrazyEngineersSoumya SahuОценок пока нет

- Acquisition 1Документ37 страницAcquisition 1Soumya SahuОценок пока нет

- CommonwealthScholarships Prospectus 2015 JH Update 06.10.14Документ14 страницCommonwealthScholarships Prospectus 2015 JH Update 06.10.14Soumya SahuОценок пока нет

- Dashman CompanyДокумент2 страницыDashman CompanySoumya SahuОценок пока нет

- Mis Assignment: Concept Report On Business IntelligenceДокумент32 страницыMis Assignment: Concept Report On Business IntelligenceSoumya SahuОценок пока нет

- Innovation Growth, Ecosytem and Knowledge EconomiesReportДокумент24 страницыInnovation Growth, Ecosytem and Knowledge EconomiesReportSoumya SahuОценок пока нет

- Mis Assignment: Concept Report On Business IntelligenceДокумент32 страницыMis Assignment: Concept Report On Business IntelligenceSoumya SahuОценок пока нет

- ABC Costing Reveals Hidden Costs for Mitticool ProductsДокумент10 страницABC Costing Reveals Hidden Costs for Mitticool ProductsSoumya SahuОценок пока нет

- CommonwealthScholarships Prospectus 2015 JH Update 06.10.14Документ14 страницCommonwealthScholarships Prospectus 2015 JH Update 06.10.14Soumya SahuОценок пока нет

- Innovation Ecosystem PDFДокумент19 страницInnovation Ecosystem PDFSoumya SahuОценок пока нет

- Barton Enron CaseДокумент9 страницBarton Enron CaseMohammad Delowar HossainОценок пока нет

- Rep Eco2708Документ76 страницRep Eco2708gafoggASasОценок пока нет

- A AshishДокумент50 страницA AshishSoumya SahuОценок пока нет

- Presentations TipsДокумент21 страницаPresentations Tipsapi-253601657Оценок пока нет

- Paul TrottДокумент13 страницPaul TrottSoumya Sahu17% (6)

- The Role of Business Incubators in DevelopingДокумент199 страницThe Role of Business Incubators in DevelopingSoumya Sahu100% (2)

- Annual Report For The Year 2009-2010Документ97 страницAnnual Report For The Year 2009-2010Rama SamirajuОценок пока нет

- Business ManualДокумент72 страницыBusiness ManualPhilip OgilvieОценок пока нет

- Case Study of Ross Abernathy ANANYA AM1911Документ7 страницCase Study of Ross Abernathy ANANYA AM1911Soumya SahuОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Chapter 5 ATW 108 USM Tutorial SlidesДокумент21 страницаChapter 5 ATW 108 USM Tutorial Slidesraye brahmОценок пока нет

- Effect of Agricultural Transformation Agenda Support Program Phase 1 Atasp 1 On Farmers' Performance in Southeast, NigeriaДокумент12 страницEffect of Agricultural Transformation Agenda Support Program Phase 1 Atasp 1 On Farmers' Performance in Southeast, NigeriaEditor IJTSRDОценок пока нет

- Pest Analysis of Mcdonalds in Malaysia Marketing EssayДокумент4 страницыPest Analysis of Mcdonalds in Malaysia Marketing Essaybenj_morgan100% (1)

- Capital Structure Issues: V. VI. V.1 Mergers and Acquisitions Definition and DifferencesДокумент26 страницCapital Structure Issues: V. VI. V.1 Mergers and Acquisitions Definition and Differenceskelvin pogiОценок пока нет

- Marketing 3.0 From Products To Customers To The Human Spirit PDFДокумент3 страницыMarketing 3.0 From Products To Customers To The Human Spirit PDFArif KruytОценок пока нет

- BAC Annual Balance Sheet - Bank of America Corp. Annual FinancialsДокумент3 страницыBAC Annual Balance Sheet - Bank of America Corp. Annual FinancialsFaizan AhmedОценок пока нет

- Target Costing and Cost Analysis For Pricing Decisions: Answers To Review QuestionsДокумент48 страницTarget Costing and Cost Analysis For Pricing Decisions: Answers To Review QuestionsMJ Yacon0% (1)

- Advertising Agency XYZ Proposal SummaryДокумент13 страницAdvertising Agency XYZ Proposal SummaryanneОценок пока нет

- This Study Resource Was: Supply Chain ManagementДокумент4 страницыThis Study Resource Was: Supply Chain ManagementLê Khắc HùngОценок пока нет

- Theories of Industrial LocationДокумент18 страницTheories of Industrial Locationprof_akvchary100% (2)

- SSRN Id2206253Документ28 страницSSRN Id2206253Alisha BhatnagarОценок пока нет

- Lesson 4 Evaluating A Firm S Internal CapabilitiesДокумент5 страницLesson 4 Evaluating A Firm S Internal Capabilitiesintan renitaОценок пока нет

- SBP - Analyst Briefing NoteДокумент3 страницыSBP - Analyst Briefing Notemuddasir1980Оценок пока нет

- Quality Ranking Whitepaper FinalДокумент38 страницQuality Ranking Whitepaper Finalpeter990xОценок пока нет

- Fibonacci Golden Zone StrategyAAAДокумент34 страницыFibonacci Golden Zone StrategyAAAPs Christ Daniel Rocha MoralesОценок пока нет

- Final Guidehouse 247 CFE Whitepaper 1Документ16 страницFinal Guidehouse 247 CFE Whitepaper 1Ananda LagoОценок пока нет

- Macro Tut 4Документ6 страницMacro Tut 4TACN-2M-19ACN Luu Khanh LinhОценок пока нет

- JPM - Insurance PrimerДокумент104 страницыJPM - Insurance Primerbrettpeven50% (2)

- Weekly Brief 14 October 2022Документ8 страницWeekly Brief 14 October 2022saifulbohariОценок пока нет

- Rs2,500.00 PKR: Receipt For Eii RawalpindiДокумент1 страницаRs2,500.00 PKR: Receipt For Eii RawalpindiEmirates International InstituteОценок пока нет

- LinearEquationsInOneVariable InvestmentДокумент3 страницыLinearEquationsInOneVariable InvestmentKurt Byron AngОценок пока нет

- Ceteris Paribus Is A Latin Phrase MeaningДокумент14 страницCeteris Paribus Is A Latin Phrase MeaningSheena LidasanОценок пока нет

- Bond Yields and Yield Calculations ExplainedДокумент17 страницBond Yields and Yield Calculations ExplainedJESSICA ONGОценок пока нет

- Press Release: Carbon Trade Exchange Global "Re-Launch" Free'Документ3 страницыPress Release: Carbon Trade Exchange Global "Re-Launch" Free'Leo LeoОценок пока нет

- Framework For Assessing Multinational StrategiesДокумент10 страницFramework For Assessing Multinational StrategiesKuladeepa KrОценок пока нет

- Fundamentals of Financial Management 15th Edition Brigham Test BankДокумент18 страницFundamentals of Financial Management 15th Edition Brigham Test BankGeraldTorresfdpam100% (11)

- DocumentДокумент29 страницDocumenthisgrace100% (1)

- Production and Costs (Ch7) : ECON 140 - Multiple Choice QuestionsДокумент23 страницыProduction and Costs (Ch7) : ECON 140 - Multiple Choice QuestionsSonoОценок пока нет

- IFY Economics Exam 2122 V4Документ13 страницIFY Economics Exam 2122 V4thugnatureОценок пока нет

- Industry Dynamics and The Forces Driving ChangeДокумент17 страницIndustry Dynamics and The Forces Driving ChangeAymanAlamОценок пока нет