Академический Документы

Профессиональный Документы

Культура Документы

Pharma2020 120108125556 Phpapp02

Загружено:

Aakash DeepИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Pharma2020 120108125556 Phpapp02

Загружено:

Aakash DeepАвторское право:

Доступные форматы

"The Indian Pharmaceutical Industry : Crystal ball gazing into the year 2020 AD".

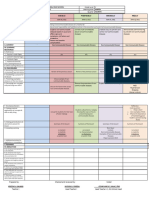

Demographic, epidemiological and economic shifts are transforming the pharmaceuticals market. The population is growing and aging; new areas of medical need are emerging; and the diseases from which people in developing countries suffer are increasingly like those that trouble people living in the developed world. These changes will generate some huge opportunities for Pharma. Older people typically consume more medicines than younger people; four in five of those aged over 75 take at least one prescription product, while 36% take four or more. So the grey factor will boost the need for medicines dramatically. Global warming could also have a major effect on the worlds health. In February 2007, the Intergovernmental Panel on Climate Change (IPCC) reported that the global average temperature had increased by about 0.2C per decade between 1990 and 2005. The IPCC projects that the average temperature will increase by another 0.2C per decade for the next two decades, even if the concentration of all greenhouse gases remains constant at year 2000 levels, and that it will very likely increase still more, if mankinds output of greenhouse gases continues to rise. many scientists believe that global warming could bring diseases such as malaria, cholera, diphtheria and dengue fever to more developed regions and even accelerates the proliferation of many common bacteria. In short, all these changes are creating new openings for Pharma. At one time, infectious diseases were the biggest killers. This is still true of sub-Saharan Africa and South Asia. But, elsewhere, chronic diseases are now the leading cause of death, a pattern that will become even stronger as the population of the developing world gets older, fatter and less physically active. In 2004, an estimated 639m people living in developing countries suffered from hypertension. By 2025, the number is forecast to reach at least one billion more than twice the projected rate of increase in that same population over the same timeframe. The picture is very similar when it comes to diabetes. The number of people with diabetes in developing countries is expected to rise from 84m in 1995 to 228m in 2025, with India, the Middle East and South East Asia bearing the worst of the burden (see sidebar, Indias insulin dependence).Demand for

medicines that treat illnesses formerly associated almost exclusively with the developed world is thus expanding in the developing world, at the same time that some countries are becoming increasingly affluent. The E7 countries look especially attractive. Our economic modelling suggests that the real GDP of the E7 countries will triple from US $5.1 trillion in 2004 to $15.7 trillion in 2020, whereas that of the G7 countries will grow by just 40%, from$25.8 trillion to $36.1 trillion. Their wealth relative to that of the G7 will rise from 19.7% to 43.4% over the same period. 2. The richer countries become, the more they tend to spend on healthcare. The E7 populations are also aging faster than those of the G7; by 2020, 338m of the people living in the E7 countries will be at least 65 years of age, compared with 152.8m of the people living in the G7 countries. But the G7 countries will still be more than twice as wealthy as the E7 countries, and better able to afford the higher healthcare costs associated with an aging population. So it is likely that both the G7 and the E7 countries will spend a larger proportion of their GDP on medicines than they do now. But the rate of growth in the G7 economies will almost certainly be much slower than it is in the E7 economies and that disparity could eventually make a significant difference. By 2020, the global pharmaceuticals market would be worth about $1.3 trillion, with the E7 countries accounting for about 19% of sales. China would be the second or third biggest market in the world, and Turkey and India might well be in the top 10. Epidemiological factors such as an increased patient pool by 2020, increasing accessibility to drugs due to an increase in investment in medical infrastructure, a greater acceptance of new medicines and greater affordability are the drivers of this growth. Affordability will result in half of the forecasted growth, with rising incomes and increasing insurance coverage lowering the cost of drugs. Increases in income will result in an additional 73 million people in middle and upper class segments, while 650 million people will have health

insurance by 2020. While private insurance will grow by 15 per cent by 2020, the majority of people will be provided insurance through government-sponsored schemes which focus on the bottom of the pyramid segment of society. While growth in the pharmaceuticals market has thus far been driven by rising affordability, the industry needs to be more proactive in enhancing accessibility and acceptance of modern medicine, cautioned Mitra. Despite this shift in disease profile, the growth opportunities in mass therapies will remain significant for 2 reasons. First, the gap between prevalence and treatment rates remains high in the range of diseases spanning anti-infective ,gastro-intestinal, respiratory & pain management therapies. While a fifth of the population exhibits some degree of anaemia, only 25% receive treatment. similarly, for anti-peptic disorders, diarrhoea, the treatment levels languish at 30%.second,nearly 140million people will move above poverty line during the next decade, which should increase the spending on basic health care & the consumption of mass therapy drugs for acute ailments.ove the past few years, small players grabbed the opportunities in small therapies& grow strongly by driving market penetration to a new level. The major factors contributing to the growth of pharma sector of india over next decade, globally accounts orderly as, Income demographics-nearly 40% Medical infrastructure-20% Health insurance penetration-15% Gradual shift in disease profile-10% Population growth & other factors-15%.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Internal Environ Strategy TextBookДокумент48 страницInternal Environ Strategy TextBookAakash DeepОценок пока нет

- Ipm ProjectДокумент9 страницIpm ProjectAakash DeepОценок пока нет

- Shalin FinalllllДокумент12 страницShalin FinalllllAakash DeepОценок пока нет

- CODIST I ICT Innovation ICT Applications M Banking Batchelor enДокумент20 страницCODIST I ICT Innovation ICT Applications M Banking Batchelor enAakash DeepОценок пока нет

- Principles of Fringes: Significant Benefit and Service ProgrammesДокумент5 страницPrinciples of Fringes: Significant Benefit and Service ProgrammesAakash DeepОценок пока нет

- Study Note: This Module Should Take AroundДокумент42 страницыStudy Note: This Module Should Take Aroundlavate amol bhimraoОценок пока нет

- HRMДокумент9 страницHRMAakash DeepОценок пока нет

- Shalin's ProjectДокумент9 страницShalin's ProjectAakash DeepОценок пока нет

- Cost Chapter4Документ12 страницCost Chapter4Vishnu PrasathОценок пока нет

- Project ManagementДокумент36 страницProject Managementnoahzgambo319378% (9)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- JPS-The Eleventh Meeting of The Pan Arab Gastroenterology Logy and Nutrition Society - Medics Index MembersДокумент20 страницJPS-The Eleventh Meeting of The Pan Arab Gastroenterology Logy and Nutrition Society - Medics Index MembersMedicsindex Telepin Slidecase100% (4)

- 10 Contra-Indication and ActionsДокумент2 страницы10 Contra-Indication and ActionsJoanna AaronОценок пока нет

- Kankanaey Cultures 1Документ10 страницKankanaey Cultures 1hanzellebganОценок пока нет

- Abdellah's 21 Nursing Problem TheoryДокумент14 страницAbdellah's 21 Nursing Problem TheoryJyoti Verma100% (1)

- Teori SIM Kumpulan Soal Jawab 001 051Документ10 страницTeori SIM Kumpulan Soal Jawab 001 051Nur Azima AhmadОценок пока нет

- Acupuncture Review and Analysis of Reports On Controlled Clinical Trials PDFДокумент96 страницAcupuncture Review and Analysis of Reports On Controlled Clinical Trials PDFPongsathat TreewisootОценок пока нет

- Mapeh Reviewer 3rd QuarterДокумент3 страницыMapeh Reviewer 3rd QuarterIceyYamaha60% (5)

- DENT Neurologic CME 2018 ProgramДокумент4 страницыDENT Neurologic CME 2018 Programyos_peace86Оценок пока нет

- Conf Program FINAL31212Документ156 страницConf Program FINAL31212Anand gowdaОценок пока нет

- WHO ReferencesДокумент4 страницыWHO ReferencesalberiocygnusОценок пока нет

- Second-Periodical Test Mapeh 10Документ6 страницSecond-Periodical Test Mapeh 10Juvy SingianОценок пока нет

- Hidden Story of Cancer - Brian Scott PeskinДокумент723 страницыHidden Story of Cancer - Brian Scott Peskinawakejoy93% (14)

- Kuensel IssuesДокумент12 страницKuensel IssuesDeepen SharmaОценок пока нет

- Background On Mental HealthДокумент10 страницBackground On Mental HealthAmor GarciaОценок пока нет

- European Herbal Traditional Medicine Practitioners Association PDFДокумент40 страницEuropean Herbal Traditional Medicine Practitioners Association PDFNining SudrajatОценок пока нет

- Biomarkers - Theoretical AspectsДокумент8 страницBiomarkers - Theoretical AspectsmishaelalexОценок пока нет

- Marsella & Yamada 2010 Culture and PsychopathologyДокумент14 страницMarsella & Yamada 2010 Culture and PsychopathologyFahad KhanОценок пока нет

- FNCP ProperДокумент3 страницыFNCP ProperSoniaMarieBalanayОценок пока нет

- Physical Edu-12 FC CHAP 4 NEWДокумент18 страницPhysical Edu-12 FC CHAP 4 NEWVikas JiОценок пока нет

- Black S Medical Dictionary PDFДокумент2 413 страницBlack S Medical Dictionary PDFAlexandr Trotsky100% (1)

- To Hospitals: Dr. Maheswari JaikumarДокумент47 страницTo Hospitals: Dr. Maheswari JaikumarAkhil SharmaОценок пока нет

- Volume III C2 UnderstandingtheMiasmsДокумент64 страницыVolume III C2 UnderstandingtheMiasmstakne_007100% (1)

- Dll-Mapeh 7Документ2 страницыDll-Mapeh 7KyRIeОценок пока нет

- FTR Registration FormДокумент2 страницыFTR Registration Formpinipini367% (6)

- Effects of Music in Occupational Therapy: by Ginna KayserДокумент34 страницыEffects of Music in Occupational Therapy: by Ginna KayserGabriiella ChaviraОценок пока нет

- DAN AG Monte Aribal Family Final PaperДокумент81 страницаDAN AG Monte Aribal Family Final Paperallenh016Оценок пока нет

- C. Family Nursing Care Plan: Saint Louis UniversityДокумент2 страницыC. Family Nursing Care Plan: Saint Louis UniversityLEONELLGABRIEL RAGUINDIN0% (1)

- Community Health Nursing 2Документ32 страницыCommunity Health Nursing 2stawberry shortcakeОценок пока нет

- Imei Cardiac DiseaseДокумент4 страницыImei Cardiac DiseaseMakОценок пока нет