Академический Документы

Профессиональный Документы

Культура Документы

Cost Plus Pricing Strategy in Construction Industry

Загружено:

Carlose GonsalvesИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Cost Plus Pricing Strategy in Construction Industry

Загружено:

Carlose GonsalvesАвторское право:

Доступные форматы

A cost plus pricing strategy involves setting the price at the production cost plus a certain profit margin.

Needless to say if the production cost is 100 pounds and the desired profit margin is 25% then the price the product needs to be sold would be 125 pounds. However the Building construction industry has seldom used this cost plus pricing strategy for various reasons, mainly due to the fact that its nearly impossible to know the exact end cost of a building at the start of the project. So it would only make sense to charge the end consumer a higher price. Basically the end consumer pays the price for this unknown risk. The Myth about Fixed Cost Contracts in Construction: In actual fact, allowances in a fixed price contract are really just mini cost plus contracts within the fixed price contract ie a Fixed Cost Contract is nothing but a Cost Plus Contract with additional allowances for risks/uncertainity Fixed Cost = Likely Construction Cost + Profit Margin + Cost of Risk/uncertainty But, Cost Plus = Construction Cost + Profit Margin Therefore, Fixed Cost = Cost Plus + Cost of Risk/Uncertainty Thus we see that a fixed cost Contract is essentially a Cost Plus contract with an additional allowance for the cost of risk/uncertainty But as mentioned earlier, due to inherent drawbacks, its impossible to know the exact cost of construction. However by using knowledge management analysis, we can try to minimise the cost of risk/uncertainty, and at a point where the cost of risk is zero, Thus, Fixed Cost = Cost Plus In most cases the cost of risk/uncertainty has to be borne by the end consumer. Through this Business Development Plan I propose, ..............................................................................................................................................

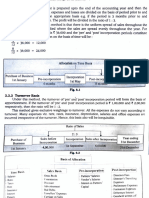

Explanation: As explained earlier a real estate company does not know the actual cost of constructing a building. Needless to say it does not know the cost per flat. It arrives at the final price with reference to previous projects, moreover it tends to quote at a profit margin of 75% to minimise its exposure to risk. Stage A involves signing of the contract between the customer and the real estate company for a flat at a fixed cost. The real estate company goes into a contract with a Main Construction Contractor. This contract could be a Fixed Cost (Lumpsum) contract, or Item-rate contract, etc. The main contractor in turn gets the work done through subcontractors and specialists. Herein lies the big bubble. The more closer you move towards the

chain viz. supplier and the specialists, the costs tend to be more precise, since the quantity, rate and specifications are clear at this stage.

And at each stage there is a profit margin involved. Assume that the actual cost of construction is 100 pounds. 20% Subcontractor Profit = 120 pounds 20% Main Contractor Profit = 144 Pounds 75% Real estate Profit = 252 Pounds (The real estate company profit includes the uncertainty risk) Factors that go against a Cost Plus Contract: Cost of an Item:

Вам также может понравиться

- Znode Whitepaper Total Cost of OwnershipДокумент13 страницZnode Whitepaper Total Cost of OwnershipSatish SolarОценок пока нет

- Lead Estimator for Oil & Gas Operator in DubaiДокумент2 страницыLead Estimator for Oil & Gas Operator in DubaiManoj SinghОценок пока нет

- Contract Practice For Surveyors - Jack RamusДокумент5 страницContract Practice For Surveyors - Jack RamusAiswarya RajeevОценок пока нет

- Are Quantity Surveyors Competent To Valu PDFДокумент10 страницAre Quantity Surveyors Competent To Valu PDFAkintonde OyewaleОценок пока нет

- Vice President in ST Louis MO Resume Karen Hercules-DoerrДокумент2 страницыVice President in ST Louis MO Resume Karen Hercules-DoerrKarenHerculesDoerrОценок пока нет

- Prepared By: Amrita Chatterjee Swarnendu Bhattacharjee: Adamas Institute of Technology, Civil Engineering, 3 YearДокумент79 страницPrepared By: Amrita Chatterjee Swarnendu Bhattacharjee: Adamas Institute of Technology, Civil Engineering, 3 YearMonjit RoyОценок пока нет

- Apsr Sor2010Документ118 страницApsr Sor2010Hemant SharmaОценок пока нет

- Turner ConstructionДокумент22 страницыTurner ConstructionGilang Restriwan KurniaОценок пока нет

- SANGA Office Block Renovations - BoQДокумент47 страницSANGA Office Block Renovations - BoQMwesigwa DaniОценок пока нет

- CHAPTER 6 - Development Budget and AppraisalsДокумент14 страницCHAPTER 6 - Development Budget and Appraisalsnaurahiman100% (1)

- Costing of Steel StructureДокумент3 страницыCosting of Steel StructureNithin100% (1)

- Unifomat Estimate TemplateДокумент4 страницыUnifomat Estimate TemplateShehzad Ahmed100% (1)

- PRICE SCHEDULE FOR CIVIL WORKДокумент18 страницPRICE SCHEDULE FOR CIVIL WORKMukesh Jangid100% (1)

- Cost Estimate For Construction of Sand Plant & Pre Fabricated ShedДокумент6 страницCost Estimate For Construction of Sand Plant & Pre Fabricated ShedSyed Adnan AqibОценок пока нет

- RES22 - Facilities Management - Notes - Lecture 6Документ10 страницRES22 - Facilities Management - Notes - Lecture 6benjitan95Оценок пока нет

- CSG Consultants Inc.-Construction Management and Inspection Services - RedactedДокумент19 страницCSG Consultants Inc.-Construction Management and Inspection Services - RedactedL. A. PatersonОценок пока нет

- Accuracy in Estimating Project Cost Construction ContingencyДокумент15 страницAccuracy in Estimating Project Cost Construction ContingencyBspeedman17564Оценок пока нет

- Pag Asa Steel - ReinforcementДокумент2 страницыPag Asa Steel - Reinforcementjremptymak100% (1)

- Problems On Profit Prior To IncorporationДокумент18 страницProblems On Profit Prior To Incorporationcsneha0803Оценок пока нет

- Cem103 Lecture 2 Cost Estimating ComponentsДокумент16 страницCem103 Lecture 2 Cost Estimating ComponentsMrSamspartОценок пока нет

- MEP QS Job OfferДокумент1 страницаMEP QS Job Offerمحمد إسلام عبابنهОценок пока нет

- Foreman Delay Survey Finds Material Wait Top CauseДокумент18 страницForeman Delay Survey Finds Material Wait Top Causevalkiria112Оценок пока нет

- Takeoff SheetДокумент9 страницTakeoff Sheetbsh1978Оценок пока нет

- Factors Affecting Construction Procurement Selection in Sri LankaДокумент65 страницFactors Affecting Construction Procurement Selection in Sri LankaDanushka PrädeepОценок пока нет

- Five-Golden Principles of FIDICДокумент4 страницыFive-Golden Principles of FIDICMintesnot BogaleОценок пока нет

- Unit - I General PrinciplesДокумент21 страницаUnit - I General Principlesop5opsОценок пока нет

- Replacement Cost New Less Depreciation ApproachДокумент3 страницыReplacement Cost New Less Depreciation ApproachElizabeth GoОценок пока нет

- Implementing Target CostingДокумент31 страницаImplementing Target CostingJonnattan MuñozОценок пока нет

- E0001 OverallДокумент30 страницE0001 OverallkamlОценок пока нет

- Construction ProgramДокумент9 страницConstruction ProgramLakshan PriyankaraОценок пока нет

- The Philippine: Construction IndustryДокумент7 страницThe Philippine: Construction Industryfritz molino100% (1)

- Collaborative Procurement 1Документ23 страницыCollaborative Procurement 1lancel8Оценок пока нет

- Estimation and CostingДокумент46 страницEstimation and CostingBALAMURUGAN R100% (1)

- Lean Technology and Waste Minimization in Construction Industry Using SPSSДокумент11 страницLean Technology and Waste Minimization in Construction Industry Using SPSSInternational Journal of Application or Innovation in Engineering & ManagementОценок пока нет

- ESTIMATING & CONTRACT MEASUREMENT PRINCIPLESДокумент228 страницESTIMATING & CONTRACT MEASUREMENT PRINCIPLESNg Zhe ShengОценок пока нет

- Contractor Estimate WorksheetДокумент3 страницыContractor Estimate WorksheetQi ZengОценок пока нет

- C.H. - 0+465.5 Section No5Документ1 страницаC.H. - 0+465.5 Section No5Fran LuqueОценок пока нет

- Construction Value Engineering SpreadsheetДокумент15 страницConstruction Value Engineering SpreadsheetJM PanganibanОценок пока нет

- Benefits of Bill of QuantitiesДокумент7 страницBenefits of Bill of QuantitiesMuhammad ImranОценок пока нет

- Chapter 8 Estimating Quantities & CostingДокумент13 страницChapter 8 Estimating Quantities & CostingOngeriJ100% (1)

- CIQS Estimate ClassificationДокумент2 страницыCIQS Estimate Classificationttplan800100% (1)

- Final-Corrected Calculation (Concrete)Документ6 страницFinal-Corrected Calculation (Concrete)ChungHuiPingОценок пока нет

- Cost Management BIM StanfordДокумент17 страницCost Management BIM StanfordrafiqОценок пока нет

- Firm's References for Pier Construction Supervision ProjectДокумент18 страницFirm's References for Pier Construction Supervision ProjectMwesigwa DaniОценок пока нет

- Dubai SearchДокумент2 страницыDubai SearchMisty MannОценок пока нет

- TSA ENVIRONS LTD1630kg10stop (Kohler)Документ17 страницTSA ENVIRONS LTD1630kg10stop (Kohler)khalilur rahman100% (1)

- The Construction Productivity ImperativeДокумент10 страницThe Construction Productivity ImperativeNugraha Eka SaputraОценок пока нет

- Cost Plus Construction Contract - AwarenessДокумент196 страницCost Plus Construction Contract - Awarenessyakarim100% (1)

- Specification and Quantity Surveying Dejene DibabaДокумент124 страницыSpecification and Quantity Surveying Dejene Dibabadejenedib06Оценок пока нет

- General Construction Estimate ReferenceДокумент4 страницыGeneral Construction Estimate Reference?????Оценок пока нет

- Estimation & CostingДокумент31 страницаEstimation & CostingKrztofer PrnzОценок пока нет

- Earthwork: 02340 Soil StabilizationДокумент1 страницаEarthwork: 02340 Soil StabilizationhasanplanningОценок пока нет

- Profit Planning and Activity Based BudgetingДокумент50 страницProfit Planning and Activity Based BudgetingcahyatiОценок пока нет

- Bidding Documents (Two Stage Two Envelopes-TSTE) TorgharДокумент63 страницыBidding Documents (Two Stage Two Envelopes-TSTE) TorgharEngr Amir Jamal QureshiОценок пока нет

- Contract. EthicsДокумент27 страницContract. EthicsNeib Kriszah AlbisОценок пока нет

- Automation of Construction Quantity Take-Off in A BIM ModelДокумент10 страницAutomation of Construction Quantity Take-Off in A BIM ModelKhusnul KhotimahОценок пока нет

- AQS 2151 Pre-Contract Administration For Quantity SurveyorsДокумент24 страницыAQS 2151 Pre-Contract Administration For Quantity Surveyorsmuhammadhafizuddin4256Оценок пока нет

- BoQ - Structure Steel Request CostingДокумент12 страницBoQ - Structure Steel Request CostingRanu JanuarОценок пока нет

- Stations of The CrossДокумент6 страницStations of The CrossdeevoncОценок пока нет

- 2008 Effects of Long-Term Participation in The Monroe Institute Programs-Phase 1 - Cam DanielsonДокумент38 страниц2008 Effects of Long-Term Participation in The Monroe Institute Programs-Phase 1 - Cam DanielsonniknikОценок пока нет

- RCL and EDSA Shipping Liable for Damaged CargoДокумент2 страницыRCL and EDSA Shipping Liable for Damaged CargoCherrie May OrenseОценок пока нет

- Step by Step InstructionsДокумент7 страницStep by Step Instructionssar originariusОценок пока нет

- An Introduction To ReinsuranceДокумент188 страницAn Introduction To Reinsurancecruzer11290Оценок пока нет

- BWM - 2014 - Band6 (Reconstruction and The Historic City Rome and Abroad - An Interdisciplinary Approach)Документ289 страницBWM - 2014 - Band6 (Reconstruction and The Historic City Rome and Abroad - An Interdisciplinary Approach)ebjlОценок пока нет

- Hidesign PPBMДокумент6 страницHidesign PPBMHarsheen JammuОценок пока нет

- MSL and KOL Regulatory ComplianceДокумент11 страницMSL and KOL Regulatory ComplianceMihir GhariaОценок пока нет

- Quantum Mechanics in a BoxДокумент12 страницQuantum Mechanics in a BoxNasser AlkharusiОценок пока нет

- Area Perimeter Lesson Plan 1Документ3 страницыArea Perimeter Lesson Plan 1api-541765085Оценок пока нет

- Ug848 VC707 Getting Started GuideДокумент24 страницыUg848 VC707 Getting Started GuideDedy KurniawanОценок пока нет

- SBC Calcuation of Square FoundaionДокумент4 страницыSBC Calcuation of Square FoundaionManan ParikhОценок пока нет

- Kinsey-Women 11 03Документ3 страницыKinsey-Women 11 03Madalina Turtoi0% (1)

- PDF - Eeglab Wiki Tutorial A4Документ235 страницPDF - Eeglab Wiki Tutorial A4satya raghavendraОценок пока нет

- Herbal Simples Approved For Modern Uses of Cure by Fernie, William Thomas, 1830Документ416 страницHerbal Simples Approved For Modern Uses of Cure by Fernie, William Thomas, 1830Gutenberg.org100% (4)

- Bingham Family Conflict Leads to Sale of Louisville NewspapersДокумент1 страницаBingham Family Conflict Leads to Sale of Louisville NewspapersvimalsairamОценок пока нет

- Optical Measurement Techniques and InterferometryДокумент21 страницаOptical Measurement Techniques and InterferometryManmit SalunkeОценок пока нет

- EvidenceДокумент3 страницыEvidenceAdv Nikita SahaОценок пока нет

- Noahides01 PDFДокумент146 страницNoahides01 PDFxfhjkgjhk wwdfbfsgfdhОценок пока нет

- Bcs25eb ManualДокумент4 страницыBcs25eb ManualFlávio De Jesus SilvaОценок пока нет

- Who Is A MuslimДокумент3 страницыWho Is A Muslimmihir khannaОценок пока нет

- Mao ZedongДокумент18 страницMao ZedongSangsangaОценок пока нет

- Module 3 ORGANIZATIONAL BEHAVIORДокумент105 страницModule 3 ORGANIZATIONAL BEHAVIORSruti AcharyaОценок пока нет

- PharmacognosyДокумент67 страницPharmacognosyAbdul Manan90% (29)

- Social-Comic Anagnorisis in La Dama DuendeДокумент8 страницSocial-Comic Anagnorisis in La Dama DuendeNinne BellifemineОценок пока нет

- IELTS Speaking Help SampleДокумент3 страницыIELTS Speaking Help SamplePhuong MaiОценок пока нет

- 03 Lab Exercise 1 GARCIAДокумент13 страниц03 Lab Exercise 1 GARCIACyra GarciaОценок пока нет

- Buddhist Logic Explained, Including Key Concepts of Sautrāntika SchoolДокумент8 страницBuddhist Logic Explained, Including Key Concepts of Sautrāntika School张晓亮Оценок пока нет

- Critical Analysis of News Articles - BodyДокумент8 страницCritical Analysis of News Articles - BodyCliff Pearson100% (3)

- CV Rébecca KleinbergerДокумент5 страницCV Rébecca Kleinbergermaeld29Оценок пока нет