Академический Документы

Профессиональный Документы

Культура Документы

Finance Manager or Accounting MGR or Assistant Controller

Загружено:

api-121458205Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Finance Manager or Accounting MGR or Assistant Controller

Загружено:

api-121458205Авторское право:

Доступные форматы

GREGORY T. MILLER, CPA (847) 269-2498 gm1314120@westpost.

net PROFESSIONAL SUMMARY Accounting and Finance professional with CPA and experience in Fortune 500 compa nies including financial services, manufacturing and insurance as well as small construction like company. Controller type functions include cost allocation, c ost reporting, forecasting, budgeting, P&L, bank and ledger reconciliations, con solidations and accounting systems implementation and configuration. Experience has led to a thorough understating of GAAP, Sarbanes-Oxley, logistics, inventory , KPI's, coding, and operational audit. PROFESSIONAL EXPERIENCE CONFIDENTIAL (Oct 2008 - Present) Controller * Oversee daily cash management, in house payroll, AP, AR,IT and HR functions a s well as the administrative functional support for the four business units of this $20m company * Budget/Actual and prior year variance reporting and financial outlook analysis * Prepare and maintain budget, capital budget and re-forecasting * Establish and maintain timely bank and union reporting requirements * Review monthly journal entries, bank reconciliations, balance sheet account re conciliations, sales tax reports, payroll tax reports and returns, union reports and all expenses * Facilitate the external financial statement, bank and insurance audits, IDOT and IRS excise tax (off road fuel) review as well as DOL complaint * Continually search for opportunities to increase efficiencies in processes * Manage a staff of 7 Accomplishments include: Timely issuance of monthly financial statements , crea ted consistent/monthly review of WIP report across BUs, created company budget f or senior management to monitor/evaluate expenses, created hours budget tool for Maintenance BU to manage weekly hours to improve profitability. Created OT rep ort for BUs as a tool to monitor expenses, created monthly account reconciliatio ns to properly manage account activity. Created year end reforecast tool. Save money by changing phone/internet service provider, timely online submission of payroll tax returns and payments. Eliminated late fees with timely union report ing, eliminated manual sales tax reporting process to capture discount. Hired/d eveloped staff to reduce IT costs. Facilitated payroll tax cost savings of $150 k via government programs (2010 HIRE Act). Slow pay vendors to ensure complianc e with bank covenant. BOOKS ARE FUN, LTD (BAF - A Readers Digest Company), Skokie, Illinois (Aug 2 007 to Oct 2008) Director, Finance (Business sold and finance function relocated to Iowa in 2009) * Responsible for the $160m company include supporting the informational needs o f one business unit (BU) and six overhead departments as well as administering t he quarterly forecasts and annual budget. * Provide information for GAAP adjustments on special charges (terminated employ ees) accruals and EBITDA addback. * Ensure accuracy of cost center reports, P&L, cash flow statement and balance sheet. * Identify and communicate overspending for all overhead departments and retail outlet store. * Assemble and issue weekly sales reporting package including metrics data * Maintain/load forecast and budget templates including the balance sheet and ca pital expenditures.

* Explain month end variances for P&L and balance sheet. * Reviewed invoices, and journal entries for proper coding for IT, Operations, H R, Recruiting, Product Development, Finance and the Retail channel. * Maintain tree/hierarchy structure in Essbase Accomplishments include; Created P&Ls and ensure proper expense coding for the n ew Retail stores (up to 23). Meet the informational demands of multiple VPs and Home Office, simultaneously. Served as the primary financial reporting resourc e for month end close, weekly sales reporting, schedule of special charges and v ariance reporting to Home Office under the CFO. PEPSIAMERICAS, Chicago (2004 to 2007) Manager, Logistics/Inventory (manufacturing plant) - Chicago, Illinois (May 200 6 to Aug 2007)) * Promoted to Logistics/Inventory Manager in May 2006 with five direct reports. * Manage day to day full goods and raw material inventory and issue daily report of the changes in value of inventory. Coordinate the monthly inventory counts. * Reviewed documentation for various processes (warehousing, full goods and raw material inventory and route settlement) to ensure compliance with company Stand ard Operating Policies (SOPs) and Sarbanes-Oxley (SOX) requirements. * Assisted with meeting weekly demands of product for 5 distribution centers dur ing * Reviewed and approved all intercompany shipping discrepancies. * Implemented process improvements and SOPs across departmental functions (i.e. out-of-code product (Warehousing), route breakage (Route Settlement) and on-hold product (QC)) to ensure controls are in place to mitigate financial losses. Accomplishments include; Reduced monthly shrinkage from $30k to $10k by implemen ting/monitoring process controls. Major contributor to improving internal audit score from 74 to 94 (out of 100). Worked across functional departments to impl ement SOPs that resulted in higher accuracy of reporting route breakage, reduced write-off of outdated product and ensure the proper analysis of out of code pro duct. Reviewed security camera footage to ensure proper approval /rejection of intercompany discrepancies. Senior Business Process Analyst (Corporate) - Schaumburg, Illinois (Nov 2004 to May 2006) * Maintained SOP methodology, and enhanced communication and awareness through t he re-issuance and rollout of various SOPs, the 3-way alignment between the oper ating policies, key SOX controls and the audit risk matrices; performed operatio nal audits and SOX re-testing. * Conducted pre-audit SOP calls with field locations before audits to ensure com pliance and address any questions. Finance process improvements included adviso ry/PMO role for global accounting policies, facilitated and reported on quarterl y balance sheet review meetings, reviewed documentation for U.S. field key contr ols and internal control standards and assertions. * Reviewed and issued a daily Full Service Vending Flash report to branch person nel and provide FSV Solutions Team with research and recommendations on reportin g. Accomplishments include; Identified process control gaps during audits and made recommendations that tighten the overall control environment for distribution wa rehouses. Trained field locations on the rollout of the PeopleSoft inventory mo dule, issued Customer Development Agreement (CDA) SOP WASHINGTON MUTUAL, Vernon Hills, Illinois (Oct 2003 to Nov 2004) Senior Financial Analyst (Closed by the OTC in Fall 2008) * Liaison between corporate management and process owner management in conjuncti on with compliance of Sarbanes-Oxley (SOX) section 404 documentation process for

7 internal control activities and the evaluation of risk on documented deficien cies provided by external auditors. * Due to a corporate reorganization, we assumed the responsibilities of the Deri vative Accounting department while the SOX duties moved to the Home Office in Se attle. * Prepared and distributed daily derivative report to senior management. This r eport showed the net impact ($1M - $90M) in accounting income from hedging the M ortgage Servicing Rights under FAS133. * Reconciled and analyzed the P&L and balance sheet derivative accounts. * Gained understanding of derivative instruments and hedge accounting while docu menting and implementing internal controls processes to ensure the integrity and accuracy of the daily derivative report and process. Accomplishments include: Consolidating various data input sources into one templ ate for the daily Derivative report. Instituted 12 KPIs in scorecard to enhance the daily report process. HOUSEHOLD INTERNATIONAL (Currently HSBC), Prospect Heights, Illinois Senior Financial Accountant (Aug 2002 to Oct 2003) (BU was transferred to North Carolina in 2004) Senior Accountant (Feb 2000 to Aug 2002) * Promoted to Senior Financial Accountant, supervised two senior accountants on the monthly financial reporting package and various journal entries. Maintained tree/hierarchy structure in PeopleSoft G/L module. * Responsible for month end close, account reconciliation's, ad-hoc and monthly expense variance analysis. * Prepared and issued the monthly P&L, balance sheet and reporting package. * Reviewed balance sheet accounts such as receivables, payables, and reserve acc ounts monthly. * Prepared and analyzed loan sales and securitizations tax schedules for quarter ly and annual corporate tax returns. * Maintenance of hierarchical data/trees for PeopleSoft G/L module. Accomplishments include: Streamlining financial reporting package process result ing in higher data integrity and decreasing time to assemble the package from 3 days to 1. Improved account reconciliations resulting in a more timely submissio n. Documented and tested every loan transaction as part of an implementation o f a new mortgage servicing system. ZURICH INSURANCE COMPANIES, Schaumburg, Illinois (Mar 1997 to Feb 2000) Cost Analyst * Responsible for monthly expense reporting package, posting of allocations and analytical review of results, account reconciliations, expense variance analysis , and month end close and corporate type budgets. * Liaison between business units (BU) and SAP consultants on all expense allocat ions. * Maintained cost allocation rules and enhancements to determine new data rules, refined needs and reviewed statistics. * Trained finance managers on SAP cost allocations, journal entry input and orga nizational hierarchies. * Maintenance of hierarchical data/trees for SAP CO module. Accomplishments include; Conversion of the home grown internal cost allocation t o the SAP CO module for the organization. Temporarily managed the department wh ile manager on maternity leave. Prior to March 1997 (5 years) Accountant/Audit Reimbursement Analyst (Aetna/Blue Cross Blue Shield and CNA)

* Responsible for month end close, expense variance analysis, worked with depart ment liaisons in developing and updating process level allocations. * Documented all expense allocations and methodologies as well as consolidate ex pense variance explanations for the corporate variance package. * Prepared and analyzed cost center expense reports, account reconciliations, ca sh draws and quarterly variance reports. * Maintained Cost Reporting System to ensure appropriate expense allocations. * Performed desk reviews and field audits of federally funded National Health Ce nters to ensure compliance with Medicare rules and regulations. * Analyzed the financial statements, trial balances and statistical data and pot ential fraud and abuse. EDUCATION CPA, November 1998 Bachelor of Science in Accounting, 1991 Northeastern Illinois University, Chicago, Illinois COMPUTER SKILLS PeopleSoft (HSBC and PepsiAmericas), Essbase (BAF), Visio (PepsiAmericas), Power Point (PepsiAmericas), Word (all), SAP (Zurich), Oracle (BAF), Access (CNA and HSBC), and Intermediate Excel skills (pivot tables, v-lookup and if/then stateme nts)

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- 1572 - Anantha Narayanan FFS CalculationДокумент1 страница1572 - Anantha Narayanan FFS CalculationAnantha NarayananОценок пока нет

- Kiraan Supply Mesin AutomotifДокумент6 страницKiraan Supply Mesin Automotifjamali sadatОценок пока нет

- Quotation - 1Документ4 страницыQuotation - 1haszirul ameerОценок пока нет

- SL Generator Ultrasunete RincoДокумент2 страницыSL Generator Ultrasunete RincoDariaОценок пока нет

- Economics Exam Technique GuideДокумент21 страницаEconomics Exam Technique Guidemalcewan100% (5)

- Assignment November11 KylaAccountingДокумент2 страницыAssignment November11 KylaAccountingADRIANO, Glecy C.Оценок пока нет

- Optical Transport Network SwitchingДокумент16 страницOptical Transport Network SwitchingNdambuki DicksonОценок пока нет

- ABBindustrialdrives Modules en RevBДокумент2 страницыABBindustrialdrives Modules en RevBMaitry ShahОценок пока нет

- TransistorsДокумент21 страницаTransistorsAhmad AzriОценок пока нет

- MEMORANDUM OF AGREEMENT DraftsДокумент3 страницыMEMORANDUM OF AGREEMENT DraftsRichard Colunga80% (5)

- Oil List: Audi Front Axle DriveДокумент35 страницOil List: Audi Front Axle DriveAska QianОценок пока нет

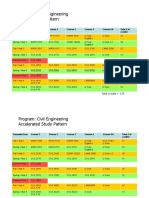

- HKUST 4Y Curriculum Diagram CIVLДокумент4 страницыHKUST 4Y Curriculum Diagram CIVLfrevОценок пока нет

- New Presentation-Group AuditingДокумент23 страницыNew Presentation-Group Auditingrajes wariОценок пока нет

- Sheetal PatilДокумент4 страницыSheetal PatilsheetalОценок пока нет

- PM 50 Service ManualДокумент60 страницPM 50 Service ManualLeoni AnjosОценок пока нет

- Brain Injury Patients Have A Place To Be Themselves: WHY WHYДокумент24 страницыBrain Injury Patients Have A Place To Be Themselves: WHY WHYDonna S. SeayОценок пока нет

- TechBridge TCP ServiceNow Business Case - Group 6Документ9 страницTechBridge TCP ServiceNow Business Case - Group 6Takiyah Shealy100% (1)

- Concise Selina Solutions Class 9 Maths Chapter 15 Construction of PolygonsДокумент31 страницаConcise Selina Solutions Class 9 Maths Chapter 15 Construction of Polygonsbhaskar51178Оценок пока нет

- 01 - TechDocs, Acft Gen, ATAs-05to12,20 - E190 - 202pgДокумент202 страницы01 - TechDocs, Acft Gen, ATAs-05to12,20 - E190 - 202pgေအာင္ ရွင္း သန္ ့Оценок пока нет

- Emerging Technology SyllabusДокумент6 страницEmerging Technology Syllabussw dr100% (4)

- BAMДокумент111 страницBAMnageswara_mutyalaОценок пока нет

- HDO OpeationsДокумент28 страницHDO OpeationsAtif NadeemОценок пока нет

- Fortnite Task Courier Pack 1500 V Bucks - BuscarДокумент1 страницаFortnite Task Courier Pack 1500 V Bucks - Buscariancard321Оценок пока нет

- 02 CT311 Site WorksДокумент26 страниц02 CT311 Site Worksshaweeeng 101Оценок пока нет

- Thermal Physics Lecture 1Документ53 страницыThermal Physics Lecture 1Swee Boon OngОценок пока нет

- Corelink Mmu600ae TRM 101412 0100 00 enДокумент194 страницыCorelink Mmu600ae TRM 101412 0100 00 enLv DanielОценок пока нет

- Diagnosis ListДокумент1 страницаDiagnosis ListSenyorita KHayeОценок пока нет

- 2010 Information ExchangeДокумент15 страниц2010 Information ExchangeAnastasia RotareanuОценок пока нет

- Pediatric Fever of Unknown Origin: Educational GapДокумент14 страницPediatric Fever of Unknown Origin: Educational GapPiegl-Gulácsy VeraОценок пока нет

- Extraction of Mangiferin From Mangifera Indica L. LeavesДокумент7 страницExtraction of Mangiferin From Mangifera Indica L. LeavesDaniel BartoloОценок пока нет