Академический Документы

Профессиональный Документы

Культура Документы

ACCTG 303 Exam 1 Key Financial Terms

Загружено:

sufyanjeewaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

ACCTG 303 Exam 1 Key Financial Terms

Загружено:

sufyanjeewaАвторское право:

Доступные форматы

Intermediate Accounting III ACCTG 303 Section D Spring 2005 Exam #1 April 19, 2005 Name: ____________________________ INSTRUCTIONS:

Instructor J.B. Paperman

a) This exam is closed book. You may use one double-sided sheets of notes. You may use a calculator to assist in computations. b) You must complete this exam on your own. No assistance is allowed except that provided by the instructor. c) If you feel there is ambiguity in a problem, state your assumptions clearly. d) The exam has 9 pages in total and 14 questions with 100 points.

Multiple Choice (5 points each) Circle the MOST correct answer

1.

When a corporation issues its capital stock in payment for services, the LEAST appropriate basis for recording the transaction is the a. market value of the services received. b. par value of the shares issued. c. market value of the shares issued. d. Any of these provides an appropriate basis for recording the transaction. B market value of the service or stock, whichever is more reliable, but par value is not appropriate.

2.

Which of the following best describes a possible result of treasury stock transactions by a corporation? a. May increase but not decrease retained earnings. b. May increase net income if the cost method is used. c. May decrease but not increase retained earnings. d. May decrease but not increase net income. C Never a gain/loss so no income effect. gains go to APIC TS and losses to RE so may decrease but not increase RE.

3.

Cash dividends are paid on the basis of the number of shares a. authorized. b. issued. c. outstanding. d. outstanding less the number of treasury shares. C outstanding (treasury shares have already been subtracted so you dont need to take out again)

4.

A dividend which is a return to stockholders of a portion of their original investments is a a. liquidating dividend. b. property dividend. c. liability dividend. d. participating dividend. A return of investment is a liquidation of the owners investment.

5.

Stock warrants outstanding should be classified as

a. b. c. d.

liabilities. reductions of capital contributed in excess of par value. assets. none of these.

D an INCREASE in contributed capital 6. In computing earnings per share for a simple capital structure, if the preferred stock is cumulative, the amount that should be deducted as an adjustment to the numerator (earnings) is the a. preferred dividends in arrears. b. preferred dividends in arrears times (one minus the income tax rate). c. annual preferred dividend times (one minus the income tax rate). d. none of these.

D subtract one year of dividends. Not deductible so no tax effect 7. What effect will the acquisition of treasury stock have on stockholders' equity and earnings per share, respectively? a. Decrease and no effect b. Increase and no effect c. Decrease and increase d. Increase and decrease Fewer shares

C cash down and SE down when repurchased. so EPS increases. 8.

The if-converted method of computing earnings per share data assumes conversion of convertible securities as of the a. beginning of the earliest period reported (or at time of issuance, if later). b. beginning of the earliest period reported (regardless of time of issuance). c. middle of the earliest period reported (regardless of time of issuance). d. ending of the earliest period reported (regardless of time of issuance).

A beginning of period or when issued

9.

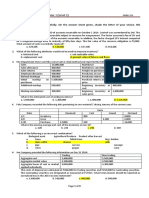

(10 points) Landon Corporation has issued 2,000 shares of common stock and 400 shares of preferred stock for a lump sum of $68,000 cash. INSTRUCTIONS a) Give the entry for the issuance assuming the par value of the common was $5 and the market value $30, and the par value of the preferred was $40 and the market value $50. (Each valuation is on a per share basis and there are ready markets for each stock.) b) Give the entry for the issuance assuming the same facts as (a) above except the preferred stock has no ready market and the common stock has a market value of $25 per share.

(a) Cash ................................... 68,000 Common Stock ......................... Paid-in Capital in Excess of Par Common ... Preferred Stock ............................ Paid-in Capital in Excess of Par Preferred common preferred $30 x 2,000 $50 x 400 $60,000 20,000 $80,000

10,000 41,000 16,000 1,000

market value

60/80 x $68,000 = 20/80 x $68,000 =

$51,000 17,000 $68,000

common preferred

(b) Cash .................................. 68,000 Common Stock ......................... Paid-in Capital in Excess of Par Common ... Preferred Stock ............................ Paid-in Capital in Excess of Par Preferred Incremental common $25 * 2000 $50,000 Remainder preferred 18,000

10,000 40,000 16,000 2,000

10. (10 points) Camby Corporation's balance sheet reported the following: Capital stock outstanding, 5,000 shares, par $30 per share Paid-in capital in excess of par Retained earnings

$150,000 80,000 100,000

The following transactions occurred this year: (1) Purchased 80 shares of capital stock to be held as treasury stock, paying $60 per share. (2) Sold 60 of the shares of treasury stock at $65 per share. (3) Sold the remaining shares of treasury stock at $50 per share. INSTRUCTIONS (a) Prepare the journal entry for these transactions under the cost method of accounting for treasury stock. (b) Prepare the journal entry for these transactions under the par method of accounting for treasury stock. (a) (1) Treasury Stock (80*$60)............... 4,800 Cash ............................... (2) Cash (60*$65)......................... 3,900 Treasury Stock (60*$60 from 1)...... Paid-in Capital from Treasury Stock .. (3) Cash (20*$50)......................... 1,000 Paid-in Capital from Treasury Stock (plug) 200 Treasury Stock (20*$60 from 1)...... (would limit the PIC from TS to the $300 created in 2) (b) (1) Treasury Stock (80*$30 par)........... 2,400 PIC CS (80*$80,000/5,000) .......... 1,280 Retained Earnings .................... 1,120 Cash ............................... (2) Cash (60*$65)......................... 3,900 Treasury Stock (60*$30 from 1)...... Paid-in Capital - Common Stock .. (3) Cash (20*$50)......................... 1,000

4,800

3,600 300

1,200

4,800

1,800 2,100

Treasury Stock (20*$30 from 1)...... Paid-in Capital - Common Stock ..

600 400

11. (10 points) Prepare the necessary entries from 1/1/03-2/1/05 for the following events using the fair value method. If no entry is needed, write "No Entry Necessary." 1. On 1/1/03, the stockholders adopted a stock option plan for top executives whereby each might receive rights to purchase up to 10,000 shares of common stock at $40 per share. The par value is $10 per share. 2. On 2/1/03, options were granted to each of five executives to purchase 10,000 shares. The options were nontransferable and the executive had to remain an employee of the company to exercise the option. The options expire on 2/1/05. It is assumed that the options were for services performed equally in 2003 and 2004. The BlackScholes option pricing model determines total compensation expense to be $1,100,000. 3. At 2/1/05, four executives exercised their options. The fifth executive chose not to exercise his options, which therefore were forfeited. 1. 1/1/03 No entry necessary. 2/1/03 No entry necessary.

2.

12/31/03 Compensation Expense .................... Paid-in Capital Stock Options ........ 12/31/04 Compensation Expense .................... Paid-in Capital Stock Options ........

550,000 550,000

550,000 550,000

3. 2/1/05 Cash (4 x 10,000 x $40) ................. 1,600,000 Paid-in-Cap Stock Options($1,100,000 x 4/5) 880,000 Common Stock .......................... Paid-in Capital in Excess of Par ...... Paid-in Capital Stock Options .......... 220,000 Paid-in Capital from Expired Stock Options

400,000 2,080,000

220,000

12. (10 points) For each of the unrelated transactions described below, present the entry(ies) required to record the bond transactions. 1. On August 1, 2004, Ryan Corporation called its 10% convertible bonds for conversion. The $6,000,000 par bonds were converted into 240,000 shares of $20 par common stock. On August 1, there was $525,000 of unamortized premium applicable to the bonds. The fair market value of the common stock was $20 per share. Ignore all interest payments. 2. Garnett, Inc. decides to issue convertible bonds instead of common stock. The company issues 10% convertible bonds, par $2,000,000, at 97. The investment banker indicates that if the bonds had not been convertible they would have sold at 94. 3. Gomez Company issues $3,000,000 of bonds with a coupon rate of 8%. To help the sale, detachable stock warrants are issued at the rate of ten warrants for each $1,000 bond sold. It is estimated that the value of the bonds without the warrants is $2,961,000 and the value of the warrants is $189,000. The bonds with the warrants sold at 101.

1. Bonds Payable ...................... Premium on Bonds Payable ........... Common Stock .................. Paid-in Capital in Excess of Par . 2. Cash ............................... Discount on Bonds Payable .......... Bonds Payable ....................

6,000,000 525,000 4,800,000 1,725,000 1,940,000 60,000 2,000,000

3. Cash ............................... 3,030,000 Discount on Bonds Payable .......... 151,800 Bonds Payable .................... Paid-in Capital Stock Warrants .. ($189,000+$2,961,000 = $3,150,000) (189,000/3,150,000 x $3,030,000 = $181,800)

3,000,000 181,800

13. (10 points) The following information was taken from the books and records of Simonic, Inc.: 1. Net income $ 840,000 2. Capital structure: a. Convertible 6% bonds. Each of the 300, $1,000 bonds is convertible into 50 shares of common stock at the present date and for the next 10 years. 300,000 b. $10 par common stock, 400,000 shares issued and outstanding during the entire year. 4,000,000 c. Stock warrants outstanding to buy 16,000 shares of common stock at $20 per share 3. Other information: a. Bonds converted during the year None b. Income tax rate 30% c. Convertible debt was outstanding the entire year d. Average market price per share of common stock during the year $32 e. Warrants were outstanding the entire year f. Warrants exercised during the year None INSTRUCTION Compute basic and diluted earnings per share. Basic EPS = $840,000/400,000 shares = $2.10 Bond Adjustment Income effect = 300,000 x .06 x (1-.3) = 12,600 Shares effect = 300 bonds x 50 shares = 15,000 shares Ratio = 12,600/15,000 = .84 Warrant Adjustment (Mkt value > exercise so consider) Issue stock 16,000 shares get cash of $20*16,000 = $320,000 Use cash to repurchase shares = $320,000/$32 = 10,000 shares Net effect 16,000 issued 10,000 repurchased = 6,000 shares Ratio = 0/6,000 = 0 So add warrants then bonds Net Income Adjust ment Adjusted Net Inc. Adjust Adjusted Shares ment Shares EPS

Security

Com. Stock 840,000 $840,000 400,000 400,000 2.10 Warrant ratio of 0 is less than 2.10 so add them Warrants 840,000 840,000 400,000 6,000 406,000 2.07

Bond ratio of 0.84 is less than 2.07 so add them Conv. Bonds 840,000 12,600 852,600 406,000 15,000 421,000 2.03

14. Corporation shows the following on December 31, 2004: Preferred stock 5%, $100 par, 4,000 shares outstanding $ Common stock $10 par, 60,000 shares outstanding Paid-in capital in excess of par Retained earnings Total stockholders' equity

400,000 600,000 200,000 110,000

$1,310,000

INSTRUCTIONS Assuming that all of the company's retained earnings are to be paid out in dividends on 12/31/04 and that preferred dividends were last paid on 12/31/02, show how much the preferred and common stockholders should receive if the preferred stock is cumulative. Because preferred was last paid on 12/31/02 the 03 dividends are in arrears. Because cumulative must pay the arrears 03 dividends and the 04 preferred dividends before paying anything to common Preferred dividend = 5% * 400,000 = $20,000 per year 3 4 Total $20,000 20,000 $40,000 to preferred

Remainder to Common $110,000 - $40,000 = 70,000 to common

10

Вам также может понравиться

- Acc423 Final Exam 100+ Questions Included 2 ExamsДокумент102 страницыAcc423 Final Exam 100+ Questions Included 2 ExamsMaria Aguilar0% (1)

- Acctg 162 – Material 019 (SHE) True or False & ProblemsДокумент4 страницыAcctg 162 – Material 019 (SHE) True or False & ProblemsAngelli LamiqueОценок пока нет

- Beams9esm ch05Документ5 страницBeams9esm ch05David IroayОценок пока нет

- Chapter 02 Stock Investment Investor Accounting and ReportingДокумент3 страницыChapter 02 Stock Investment Investor Accounting and Reportingprins kyla SaboyОценок пока нет

- CH 05Документ38 страницCH 05Nhok NeoОценок пока нет

- Use The Following Information For Questions 63 andДокумент2 страницыUse The Following Information For Questions 63 andjbsantos09100% (1)

- Chap005-Consolidation of Less-Than-Wholly Owned SubsidiariesДокумент71 страницаChap005-Consolidation of Less-Than-Wholly Owned Subsidiaries_casals100% (3)

- ch16 SolДокумент12 страницch16 SolJohn Nigz Payee100% (1)

- 245574345-ISMChap014 NewДокумент68 страниц245574345-ISMChap014 NewStephenMcDanielОценок пока нет

- CH 21Документ11 страницCH 21Hanif MusyaffaОценок пока нет

- ch06 Beams10e TBДокумент28 страницch06 Beams10e TBKenneth Jay AcideraОценок пока нет

- Advanced Accounting 23Документ77 страницAdvanced Accounting 232Ng0Оценок пока нет

- Final Exam Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Документ7 страницFinal Exam Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Marilou Arcillas PanisalesОценок пока нет

- Ch.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesДокумент7 страницCh.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesFaishal Alghi FariОценок пока нет

- 9.liability Questionnaire QUIZДокумент10 страниц9.liability Questionnaire QUIZMark GaerlanОценок пока нет

- Acc05 Far Handout 2Документ4 страницыAcc05 Far Handout 2Jullia Belgica0% (1)

- Chapter 14 Exercises - Set BДокумент6 страницChapter 14 Exercises - Set BHeather PaulsenОценок пока нет

- Study4smart Quality review MaterialsДокумент33 страницыStudy4smart Quality review MaterialsWed CornelОценок пока нет

- Individual Business CaseДокумент7 страницIndividual Business CaseKatrina Belarmino100% (1)

- Basic Earning Per ShareДокумент2 страницыBasic Earning Per ShareCj LebecoОценок пока нет

- Dividend Policy Multiple Choice: True/FalseДокумент28 страницDividend Policy Multiple Choice: True/FalseRica RegorisОценок пока нет

- Preweek ReviewДокумент31 страницаPreweek ReviewLeah Hope CedroОценок пока нет

- Handout Standard ABC and PERTДокумент3 страницыHandout Standard ABC and PERTdarlenexjoyceОценок пока нет

- Prequalifying Exam Level 2 3 Set B FSUU AccountingДокумент9 страницPrequalifying Exam Level 2 3 Set B FSUU AccountingRobert CastilloОценок пока нет

- CH 24 Quiz AДокумент12 страницCH 24 Quiz AAaron Carter KennedyОценок пока нет

- Solution 6Документ11 страницSolution 6askdgasОценок пока нет

- Understanding Stockholders' Equity ComponentsДокумент50 страницUnderstanding Stockholders' Equity Componentsginish12Оценок пока нет

- 109Документ34 страницы109danara1991Оценок пока нет

- Chapter 4Документ16 страницChapter 4Girma NegashОценок пока нет

- Calculate stock value using dividend growth modelДокумент5 страницCalculate stock value using dividend growth modelEricha MutiaОценок пока нет

- Practice Problems For The Final - 2 - UpdatedДокумент8 страницPractice Problems For The Final - 2 - Updatedmaroo566100% (1)

- Multiple Choice QuestionsДокумент18 страницMultiple Choice QuestionsannewilsonОценок пока нет

- Comprehension Questions: 1. What Are Minimum Lease Payments'?Документ13 страницComprehension Questions: 1. What Are Minimum Lease Payments'?Amit ShuklaОценок пока нет

- Tax Problem SolutionДокумент5 страницTax Problem SolutionSyed Ashraful Alam RubelОценок пока нет

- Summit Professional Review Center: Auditing Problems Shareholders' EquityДокумент6 страницSummit Professional Review Center: Auditing Problems Shareholders' EquityKris Van HalenОценок пока нет

- Name: Solution Problem: P14-2, Issuance and Retirement of Bonds Course: DateДокумент8 страницName: Solution Problem: P14-2, Issuance and Retirement of Bonds Course: DateRegina PutriОценок пока нет

- ch17 InvestmentsДокумент38 страницch17 InvestmentsKristine Wali0% (1)

- Book Value Per Share Basic Earnings PerДокумент61 страницаBook Value Per Share Basic Earnings Perayagomez100% (1)

- Partnership Liquidation: Answers To Questions 1Документ28 страницPartnership Liquidation: Answers To Questions 1El Carl Sontellinosa0% (1)

- 21 Intangible AssetsДокумент6 страниц21 Intangible AssetsAdrian MallariОценок пока нет

- Investments: Learning ObjectivesДокумент52 страницыInvestments: Learning ObjectivesElaine LingxОценок пока нет

- ExamView - Homework CH 4Документ9 страницExamView - Homework CH 4Brooke LevertonОценок пока нет

- TB Chapter05Документ79 страницTB Chapter05Yusairah Benito DomatoОценок пока нет

- Debt Securities PDFДокумент7 страницDebt Securities PDFChin-Chin Alvarez SabinianoОценок пока нет

- Current liability problems and solutionsДокумент5 страницCurrent liability problems and solutionsNoSepasi FebriyaniОценок пока нет

- Revenue Recognition: Assignment Classification Table (By Topic)Документ102 страницыRevenue Recognition: Assignment Classification Table (By Topic)Fajar RamadhanОценок пока нет

- Ratio Analysis and Financial Ratios from Chanakya Business SchoolДокумент15 страницRatio Analysis and Financial Ratios from Chanakya Business Schoolsajith santy0% (1)

- ch17 SolДокумент26 страницch17 SolJohn Nigz PayeeОценок пока нет

- Acctg 12 Second SeatworkДокумент6 страницAcctg 12 Second SeatworksarahbeeОценок пока нет

- Unit 7 QuizДокумент2 страницыUnit 7 QuizKimberly A AlanizОценок пока нет

- Fitz Music Company Financial Accounting 2 ReviewДокумент5 страницFitz Music Company Financial Accounting 2 ReviewFitz Gerald BalbaОценок пока нет

- ACCT 101 Pre-Quiz Number Five - F - 2017Документ8 страницACCT 101 Pre-Quiz Number Five - F - 2017Rics GabrielОценок пока нет

- Chapter 13 Stockholders Equity NotebookДокумент14 страницChapter 13 Stockholders Equity Notebook10aleversonОценок пока нет

- IAS 33 - Mul Choice - SVДокумент5 страницIAS 33 - Mul Choice - SVTuan Huy Cao pcpОценок пока нет

- Chapter 13 14 Review QuestionsДокумент6 страницChapter 13 14 Review QuestionsHERSIОценок пока нет

- Essay QuestionsДокумент5 страницEssay QuestionsJully GonzalesОценок пока нет

- AIS 301 701 Practice Exam 3 Final VersionДокумент16 страницAIS 301 701 Practice Exam 3 Final VersionRafaelAlexandrianОценок пока нет

- CMA 2013 SampleEntranceExam Revised May 15 2013Документ77 страницCMA 2013 SampleEntranceExam Revised May 15 2013Ava DasОценок пока нет

- Divisi Soal (PA1 & PA2)Документ2 страницыDivisi Soal (PA1 & PA2)Muhammad Riddwan FirdausОценок пока нет

- NYIF Accounting Module 10 Excercise With AnswersssДокумент3 страницыNYIF Accounting Module 10 Excercise With AnswersssShahd OkashaОценок пока нет

- POST OFFICE ACCOUNT OPENINGДокумент2 страницыPOST OFFICE ACCOUNT OPENINGRajdeep BanerjeeОценок пока нет

- Documentary CreditДокумент15 страницDocumentary CreditArmantoCepongОценок пока нет

- Deloitte Tax Espresso - September 2013Документ4 страницыDeloitte Tax Espresso - September 2013Nicholas AngОценок пока нет

- Bir Form 1903 - Registration Corp (Blank)Документ2 страницыBir Form 1903 - Registration Corp (Blank)Dennis Tolentino100% (3)

- Kerima AliДокумент89 страницKerima AliMohammed ademОценок пока нет

- Leave and License AgreeДокумент4 страницыLeave and License AgreeYogesh SaindaneОценок пока нет

- Income From House Property Practical 1Документ1 страницаIncome From House Property Practical 1Jitendra SharmaОценок пока нет

- Calax ItpbДокумент1 страницаCalax ItpbCharlon MayoОценок пока нет

- Free Trade ZoneДокумент3 страницыFree Trade ZoneCatherine JohnsonОценок пока нет

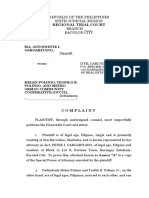

- Civil Complaint-Specific Performance With Damages Damages-Antoinette GargaritanoДокумент9 страницCivil Complaint-Specific Performance With Damages Damages-Antoinette GargaritanoRobocop Torrijos100% (3)

- Trading Agreement - Capital 88Документ1 страницаTrading Agreement - Capital 88Eduardo Velarde QuevedoОценок пока нет

- Canadian Securities Institute Learning Catalogue: Csi Learning Solutions GuideДокумент11 страницCanadian Securities Institute Learning Catalogue: Csi Learning Solutions Guidemuhammadanasmustafa0% (1)

- FTSE-100 FDs' accountancy qualifications drift in boom years but trust makes qualifications gold againДокумент2 страницыFTSE-100 FDs' accountancy qualifications drift in boom years but trust makes qualifications gold againNur HowladerОценок пока нет

- Week Five:: Reporting andДокумент38 страницWeek Five:: Reporting andIzham ShabdeanОценок пока нет

- Seoane v. FrancoДокумент3 страницыSeoane v. FrancoMariz RegalaОценок пока нет

- 20 - Segismundo - Gilead - Exercise #1Документ1 страница20 - Segismundo - Gilead - Exercise #1Maria IsabellaОценок пока нет

- Dynamic Books Invoice No 4048Документ1 страницаDynamic Books Invoice No 4048Pioneer Book ZoneОценок пока нет

- Perbadanan Pengurusan Sentosa Court Pejabat Pengurusan Sentosa Court Ac-3 No.4 JLN TMN Sri Sentosa, JLN Klang Lama 58000 Kuala LumpurДокумент16 страницPerbadanan Pengurusan Sentosa Court Pejabat Pengurusan Sentosa Court Ac-3 No.4 JLN TMN Sri Sentosa, JLN Klang Lama 58000 Kuala LumpurkswongОценок пока нет

- UV Plastic Manufacturing: Estimate/QuotationДокумент1 страницаUV Plastic Manufacturing: Estimate/QuotationManoj EmmidesettyОценок пока нет

- Bop Internship ReportДокумент70 страницBop Internship Reportiqarah100% (4)

- Research Division: Federal Reserve Bank of St. LouisДокумент25 страницResearch Division: Federal Reserve Bank of St. LouisTBP_Think_TankОценок пока нет

- Domicile Is A Person's Permanent Place of Dwelling. It Is A Legal RelationshipДокумент2 страницыDomicile Is A Person's Permanent Place of Dwelling. It Is A Legal RelationshipLhine Kiwalan0% (1)

- Oxford Brokes University Research Project on May & Baker Nigeria PLCДокумент37 страницOxford Brokes University Research Project on May & Baker Nigeria PLCAaryanОценок пока нет

- Essentials of Investments 11th Edition Bodie Test BankДокумент30 страницEssentials of Investments 11th Edition Bodie Test Bankallenorrknoiztexsp100% (15)

- India: Venture Capital ReportДокумент15 страницIndia: Venture Capital ReportHarsh KediaОценок пока нет

- Cake | Extra | James | Sukree Die Hard Strategy Results and LearningДокумент72 страницыCake | Extra | James | Sukree Die Hard Strategy Results and LearningAkshay SinghОценок пока нет

- Ratio Analysis of Three Different IndustriesДокумент142 страницыRatio Analysis of Three Different IndustriesAbdullah Al-RafiОценок пока нет

- Bsbmgt517 - Cac Learner GuideДокумент62 страницыBsbmgt517 - Cac Learner GuidehamZAОценок пока нет

- PCAB License Requirements SummaryДокумент3 страницыPCAB License Requirements SummaryJorge ParkerОценок пока нет

- Remittance Form for Overseas TransferДокумент5 страницRemittance Form for Overseas TransferPrabhu KnОценок пока нет