Академический Документы

Профессиональный Документы

Культура Документы

Deffered Tax

Загружено:

sufyan_1158810 оценок0% нашли этот документ полезным (0 голосов)

19 просмотров18 страницАвторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

19 просмотров18 страницDeffered Tax

Загружено:

sufyan_115881Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 18

Chator 0

|NCONE 1AXE5 (|A5 12)

BACKCROuND AND |N1RODuC1|ON

1ho 5tandard AIioa to tho Accounting tor |ncomo 1axoa

lA3 12 usos a ||ab|||ty mothod and adopts a statomont ot t|nanc|a| pos|t|on approach. lnstoad ot account|ng tor tho t|m|ng d|ttoroncos botwoon

tho account|ng and tax consoquoncos ot rovonuo and oxponsos, |t accounts tor tho tomporary d|ttoroncos botwoon tho account|ng and tax basos ot

assots and ||ab|||t|os. 1ho Account|ng 3tandard adopts a tu||-prov|s|on statomont ot t|nanc|a| pos|t|on approach to account|ng tor tax.

lt |s assumod that tho rocovory ot a|| assots and tho sott|omont ot a|| ||ab|||t|os havo tax consoquoncos and that thoso consoquoncos can bo

ost|matod ro||ab|y and aro unavo|dab|o.

1ho ma|n roason why dotorrod tax has to bo prov|dod tor |s that lntornat|ona| ||nanc|a| loport|ng 3tandards (l|l3) rocogn|t|on cr|tor|a aro

d|ttoront trom thoso that aro norma||y sot out |n tax |aw. 1hus thoro w||| bo |ncomo and oxpond|turo |n t|nanc|a| statomonts that w||| not bo a||owod tor

taxat|on purposos |n many jur|sd|ct|ons.

A dotorrod tax ||ab|||ty or assot |s rocogn|zod tor tuturo tax consoquoncos ot past transact|ons. 1horo aro somo oxompt|ons to th|s gonora| ru|o.

DEF|N|1|ON5 OF KEY 1ERN5

1ax baao. va|uo that tho 3tandard assumos that oach assot and ||ab|||ty has tor tax purposos.

1omorary dittoroncoa. 0|ttoroncos botwoon tho carry|ng amount ot an assot and ||ab|||ty and |ts tax baso.

1ho bo||ot |s that an ont|ty w||| sott|o |ts ||ab|||t|os and rocovor |ts assots ovontua||y ovor t|mo and at that po|nt tho tax consoquoncos w|||

crysta|||zo. |or oxamp|o, |t a mach|no has a carry|ng va|uo |n tho t|nanc|a| statomonts ot $b m||||on and |ts tax va|uo |s $2 m||||on, thon thoro |s

a taxab|o tomporary d|ttoronco ot $8 m||||on.

1ho tax baso ot a ||ab|||ty |s norma||y |ts carry|ng amount |oss amounts that w||| bo doduct|b|o tor tax |n tho tuturo. 1ho tax baso ot an assot

|s tho amount that w||| bo doduct|b|o tor tax purposos aga|nst tuturo prot|ts gonoratod by tho assot.

1ho 3tandard sots out two k|nds ot tomporary d|ttoroncos: a toxob|o tompototy olotooco and a ooooctlb|o tompototy olotooco.

A taxab|o tomporary d|ttoronco rosu|ts |n tho paymont ot tax whon tho carry|ng amount ot tho assot or ||ab|||ty |s sott|od.

ln s|mp|o torms, th|s moans that a dotorrod tax ||ab|||ty w||| ar|so whon tho carry|ng va|uo ot tho assot |s groator than |ts tax baso or whon

tho carry|ng va|uo ot tho ||ab|||ty |s |oss than |ts tax baso.

0oduct|b|o tomporary d|ttoroncos aro d|ttoroncos that rosu|t |n amounts bo|ng doduct|b|o |n dotorm|n|ng taxab|o prot|t or |oss |n tuturo

por|ods whon tho carry|ng va|uo ot tho assot or ||ab|||ty |s rocovorod or sott|od. Whon tho carry|ng va|uo ot tho ||ab|||ty |s groator than |ts tax

baso or whon tho carry|ng va|uo ot tho assot |s |oss than |ts tax baso, a dotorrod tax assot may ar|so.

1h|s moans, tor oxamp|o, that whon an accruod ||ab|||ty |s pa|d |n tuturo por|ods, part or a|| ot that paymont may bocomo a||owab|o tor tax

purposos.

CA5E 51uDY 1

Facta

An ont|ty has tho to||ow|ng assots and ||ab|||t|os rocordod |n |ts statomont ot t|nanc|a| pos|t|on at 0ocombor 81, 20X0:

CarryIng value $ mIllIon

lroporty 10

l|ant and oqu|pmont b

lnvontory 4

1rado roco|vab|os 8

1rado payab|os 0

Cash 2

1ho va|uo tor tax purposos ot proporty and tor p|ant and oqu|pmont aro $7 m||||on and $4 m||||on rospoct|vo|y. 1ho ont|ty has mado a

prov|s|on tor |nvontory obso|osconco ot $2 m||||on, wh|ch |s not a||owab|o tor tax purposos unt|| tho |nvontory |s so|d. |urthor, an

|mpa|rmont chargo aga|nst trado roco|vab|os ot $1 m||||on has boon mado. 1h|s chargo doos not ro|ato to any spoc|t|c trado roco|vab|o

but to tho ont|ty's assossmont ot tho ovora|| co||octab|||ty ot tho amount. 1h|s chargo w||| not bo a||owod |n tho curront yoar tor tax

purposos but w||| bo a||owod |n tho tuturo. lncomo tax pa|d |s at 80%.

Roquirod

Ca|cu|ato tho dotorrod tax prov|s|on at 0ocombor 81, 20X0.

5oIution

1ho dotorrod tax prov|s|on w||| bo $1 m||||on 80%, or $800,000.

3ocauso tho prov|s|on aga|nst |nvontory and tho |mpa|rmont chargo aro not curront|y a||owod, tho tax baso w||| bo h|ghor than tho

carry|ng va|uo by tho rospoct|vo amounts.

Evory assot or ||ab|||ty |s assumod to havo a tax baso. lorma||y th|s tax baso w||| bo tho amount that |s a||owod tor tax purposos.

3omo |toms ot |ncomo and oxpond|turo may not bo taxab|o or tax doduct|b|o, and thoy w||| novor ontor |nto tho computat|on ot taxab|o prot|t.

1hoso |toms somot|mos aro ca||od pormanont d|ttoroncos.

Gonora||y spoak|ng, thoso |toms w||| havo tho samo tax baso as tho|r carry|ng amount, that |s, no tomporary d|ttoronco w||| ar|so.

|or oxamp|o, |t an ont|ty has on |ts statomont ot t|nanc|a| pos|t|on |ntorost roco|vab|o ot $2 m||||on that |s not taxab|o, thon |ts tax baso w||| bo tho

samo as |ts carry|ng va|uo, or $2 m||||on. 1horo |s no tomporary d|ttoronco |n th|s caso. 1horotoro, no dotorrod taxat|on w||| ar|so.

CA5E 51uDY 2

Facta

An ont|ty acqu|rod p|ant and oqu|pmont tor $1 m||||on on 1anuary 1, 20X0. 1ho assot |s doproc|atod at 2b% a yoar on tho stra|ght-||no

bas|s, and |oca| tax |og|s|at|on porm|ts tho managomont to doproc|ato tho assot at 80% a yoar tor tax purposos.

Roquirod

Ca|cu|ato any dotorrod tax ||ab|||ty that m|ght ar|so on tho p|ant and oqu|pmont at 0ocombor 81, 20X0, assum|ng a tax rato ot 80%.

5oIution

$1b,000 (80% ot tho tomporary d|ttoronco ot $b0,000). 1ho carry|ng va|uo ot tho p|ant and oqu|pmont |s $7b0,000 and tho tax wr|tton

down va|uo w||| bo $700,000, thus g|v|ng a taxab|o tomporary d|ttoronco ot $b0,000.

CuRREN1 1AX L|AB|L|1|E5 AND A55E15

1ho 3tandard a|so doa|s w|th curront tax ||ab|||t|os and curront tax assots.

An ont|ty shou|d rocogn|zo a ||ab|||ty |n tho statomont ot t|nanc|a| pos|t|on |n rospoct ot |ts curront tax oxponso both tor tho curront and pr|or yoars

to tho oxtont that |t |s not yot pa|d.

ACCOuN1|NC FOR DEFERRED 1AX

1o account tor dotorrod tax undor lA3 12, t|rst proparo a statomont ot t|nanc|a| pos|t|on that shows a|| tho assots and ||ab|||t|os |n tho account|ng

statomont ot t|nanc|a| pos|t|on and tho|r tax baso.

A|so show any othor |toms that may not havo boon rocogn|zod as assots or ||ab|||t|os |n tho account|ng statomont ot t|nanc|a| pos|t|on but that

may havo a tax baso. 1hon tako tho d|ttoronco botwoon thoso va|uos and tho account|ng va|uos, and ca|cu|ato tho dotorrod tax basod on thoso

d|ttoroncos.

Vost taxab|o d|ttoroncos ar|so bocauso ot d|ttoroncos |n tho t|m|ng ot tho rocogn|t|on ot tho transact|on tor account|ng and tax purposos.

ExamIoa

1. Accumu|atod doproc|at|on that d|ttors trom accumu|atod tax doproc|at|on

2. Emp|oyoo oxpond|turo rocogn|zod whon |ncurrod tor account|ng purposos and whon pa|d tor tax purposos

8. Costs ot rosoarch and dovo|opmont, wh|ch may bo oxponsod |n ono por|od tor account|ng purposos but a||owod tor tax purposos |n |ator

por|ods

Otton whoro assots and ||ab|||t|os aro va|uod at ta|r va|uo tor account|ng purposos, thoro |s no oqu|va|ont moasuromont tor tax purposos. |or

oxamp|o, proporty, p|ant, and oqu|pmont may bo rova|uod to ta|r va|uo, but thoro may bo no adjustmont to tho tax va|uo tor th|s |ncroaso or

docroaso. 3|m||ar|y, assots and ||ab|||t|os can bo rova|uod on a bus|noss acqu|s|t|on, but tor tax purposos, aga|n, thoro may bo no adjustmont to tho

va|uo.

5ummary ot Accounting tor Dotorrod 1ax

1ho procoss ot account|ng tor dotorrod tax |s shown |n tho to||ow|ng sovon stops:

1. 0otorm|no tho tax baso ot tho assots and ||ab|||t|os |n tho statomont ot t|nanc|a| pos|t|on.

2. Comparo tho carry|ng amounts |n tho statomont ot t|nanc|a| pos|t|on w|th tho tax baso. Any d|ttoroncos w||| norma||y attoct tho dotorrod

taxat|on ca|cu|at|on.

8. ldont|ty tho tomporary d|ttoroncos that havo not boon rocogn|zod duo to oxcopt|ons |n lA3 12.

4. App|y tho tax ratos to tho tomporary d|ttoroncos.

b. 0otorm|no tho movomont botwoon opon|ng and c|os|ng dotorrod tax ba|ancos.

0. 0oc|do whothor tho ottsot ot dotorrod tax assots and ||ab|||t|os botwoon d|ttoront compan|os |s accoptab|o |n tho conso||datod t|nanc|a|

statomonts.

7. locogn|zo tho not chango |n dotorrod taxat|on.

CA5E 51uDY 8

Facta

An ont|ty has rova|uod |ts proporty and has rocogn|zod tho |ncroaso |n tho rova|uat|on rosorvo |n |ts t|nanc|a| statomonts. 1ho carry|ng

va|uo ot tho proporty was $8 m||||on and tho rova|uod amount was $10 m||||on. 1ax baso ot tho proporty was $0 m||||on. ln th|s country, tho

tax rato app||cab|o to prot|ts |s 8b% and tho tax rato app||cab|o to prot|ts mado on tho sa|o ot proporty |s 80%.

Roquirod

lt tho rova|uat|on took p|aco at tho ont|ty's yoar-ond ot 0ocombor 81, 20X0, ca|cu|ato tho dotorrod tax ||ab|||ty on tho proporty as ot that

dato.

5oIution

$1.2 m||||on. 1ho carry|ng va|uo attor rova|uat|on |s $10 m||||on, tho tax baso |s $0 m||||on, and tho rato ot tax app||cab|o to tho sa|o ot

proporty |s 80%, thorotoro, tho answor |s $10 m||||on m|nus $0 m||||on mu|t|p||od by 80%, or $1.2 m||||on.

CA5E 51uDY 4

Facta

An ont|ty has spont $000,000 |n dovo|op|ng a now product. 1hoso costs moot tho dot|n|t|on ot an |ntang|b|o assot undor lA3 88 and havo

boon rocogn|zod |n tho statomont ot t|nanc|a| pos|t|on. loca| tax |og|s|at|on a||ows thoso costs to bo doductod tor tax purposos whon

thoy aro |ncurrod. 1horotoro, thoy havo boon rocogn|zod as an oxponso tor tax purposos. At tho yoar-ond tho |ntang|b|o assot |s doomod

to bo |mpa|rod by $b0,000.

Roquirod

Ca|cu|ato tho tax baso ot tho |ntang|b|o assot at tho account|ng yoar-ond.

5oIution

Zoro, bocauso tho tax author|ty has a|roady a||owod tho |ntang|b|o assot costs to bo doductod tor tax purposos.

CON5OL|DA1ED F|NANC|AL 51A1ENEN15

1omporary d|ttoroncos can a|so ar|so trom adjustmonts on conso||dat|on.

1ho tax baso ot an |tom |s otton dotorm|nod by tho va|uo |n tho ont|ty accounts, that |s, tor oxamp|o, tho subs|d|ary's accounts.

0otorrod tax |s dotorm|nod on tho bas|s ot tho conso||datod t|nanc|a| statomonts and not tho |nd|v|dua| ont|ty accounts.

1horotoro, tho carry|ng va|uo ot an |tom |n tho conso||datod accounts can bo d|ttoront trom tho carry|ng va|uo |n tho |nd|v|dua| ont|ty accounts, thus

g|v|ng r|so to a tomporary d|ttoronco.

An oxamp|o |s tho conso||dat|on adjustmont that |s roqu|rod to o||m|nato unroa||zod prot|ts and |ossos on |ntorgroup transtor ot |nvontory. 3uch an

adjustmont w||| g|vo r|so to a tomporary d|ttoronco, wh|ch w||| rovorso whon tho |nvontory |s so|d outs|do tho group.

lA3 12 doos not spoc|t|ca||y addross how |ntorgroup prot|ts and |ossos shou|d bo moasurod tor tax purposos. lt says that tho oxpoctod mannor ot

rocovory or sott|omont ot tax shou|d bo takon |nto account.

CA5E 51uDY 5

Facta

A subs|d|ary so|d goods cost|ng $10 m||||on to |ts paront tor $11 m||||on, and a|| ot thoso goods aro st||| ho|d |n |nvontory at tho yoar-ond.

Assumo a tax rato ot 80%.

Roquirod

Exp|a|n tho dotorrod tax |mp||cat|ons.

5oIution

1ho unroa||zod prot|t ot $1 m||||on w||| havo to bo o||m|natod trom tho conso||datod statomont ot comprohons|vo |ncomo and trom tho

conso||datod statomont ot t|nanc|a| pos|t|on |n group |nvontory. 1ho sa|o ot tho |nvontory |s a taxab|o ovont, and |t causos a chango |n tho

tax baso ot tho |nvontory. 1ho carry|ng amount |n tho conso||datod t|nanc|a| statomonts ot tho |nvontory w||| bo $10 m||||on, but tho tax

baso |s $11 m||||on. 1h|s g|vos r|so to a dotorrod tax assot ot $1 m||||on at tho tax rato ot 80%, wh|ch |s $800,000 (assum|ng that both tho

paront and subs|d|ary aro ros|dont |n tho samo tax jur|sd|ct|on).

CA5E 51uDY 0

Facta

An ont|ty has acqu|rod a subs|d|ary on 1anuary 1, 20X0. Goodw||| ot $2 m||||on has ar|son on tho purchaso ot th|s subs|d|ary. 1ho

subs|d|ary has doduct|b|o tomporary d|ttoroncos ot $1 m||||on and |t |s probab|o that tuturo taxab|o prot|ts aro go|ng to bo ava||ab|o tor

tho ottsot ot th|s doduct|b|o tomporary d|ttoronco. 1ho tax rato dur|ng 20X4 |s 80%. 1ho doduct|b|o tomporary d|ttoronco has not boon

takon |nto account |n ca|cu|at|ng goodw|||.

Roquirod

What |s tho t|guro tor goodw||| that shou|d bo rocogn|zod |n tho conso||datod statomont ot t|nanc|a| pos|t|on ot tho paront?

5oIution

$1.7 m||||on. A dotorrod tax assot ot $1 m||||on 80%, or $800,000, shou|d bo rocogn|zod bocauso |t |s statod that tuturo taxab|o prot|ts

w||| bo ava||ab|o tor ottsot. 1hus at tho t|mo ot acqu|s|t|on thoro |s an add|t|ona| dotorrod tax assot that has not as yot boon takon |nto

account. 1ho rosu|t ot th|s w||| bo to roduco goodw||| trom $2 m||||on to $1.7 m||||on.

1ENPORARY D|FFERENCE5 NO1 RECOCN|ZED FOR DEFERRED 1AX

1horo aro somo tomporary d|ttoroncos that aro not rocogn|zod tor dotorrod tax purposos. 1hoso ar|so

1. |rom goodw|||

2. |rom tho |n|t|a| rocogn|t|on ot corta|n assots and ||ab|||t|os

8. |rom |nvostmonts whon corta|n cond|t|ons app|y

1ho lA3 doos not a||ow a dotorrod tax ||ab|||ty tor goodw||| on |n|t|a| rocogn|t|on or whoro any roduct|on |n tho va|uo ot goodw||| |s not a||owod tor

tax purposos. 3ocauso goodw||| |s tho ros|dua| amount attor rocogn|z|ng assots and ||ab|||t|os at ta|r va|uo, rocogn|z|ng a dotorrod tax ||ab|||ty |n

rospoct ot goodw||| wou|d s|mp|y |ncroaso tho va|uo ot goodw|||, thorotoro, tho rocogn|t|on ot a dotorrod tax ||ab|||ty |n th|s rogard |s not a||owod.

0otorrod tax ||ab|||t|os tor goodw||| cou|d bo rocogn|zod to tho oxtont that thoy do not ar|so trom |n|t|a| rocogn|t|on.

CA5E 51uDY 7

Facta

An ont|ty has acqu|rod a subs|d|ary, and goodw||| ar|s|ng on tho transact|on amounts to $20 m||||on. Goodw||| |s not a||owab|o tor tax

purposos |n tho ont|ty's jur|sd|ct|on. 1ax rato tor tho ont|ty |s 80% and tho subs|d|ary |s 00%-ownod.

Roquirod

Ca|cu|ato tho dotorrod tax ||ab|||ty ro|at|ng to goodw||| and oxp|a|n whothor a taxab|o tomporary d|ttoronco wou|d ar|so |t goodw||| was

a||owab|o tor tax purposos on an amort|zod bas|s.

5oIution

Zoro. A dotorrod tax ||ab|||ty shou|d not bo rocogn|zod tor any taxab|o tomporary d|ttoronco, wh|ch ar|sos on tho |n|t|a| rocogn|t|on ot

goodw|||. Whoro goodw||| |s doduct|b|o tor tax purposos on an amort|zod bas|s, a taxab|o tomporary d|ttoronco w||| ar|so |n tuturo yoars

bo|ng tho d|ttoronco botwoon tho carry|ng va|uo |n tho ont|ty's accounts and tho tax baso.

1ho socond tomporary d|ttoronco not rocogn|zod |s on tho |n|t|a| rocogn|t|on ot corta|n assots and ||ab|||t|os, wh|ch aro not tu||y doduct|b|o or

||ab|o tor tax purposos. |or oxamp|o, |t tho cost ot an assot |s not doduct|b|o tor tax purposos thon th|s has a tax baso ot n||.

Gonora||y spoak|ng th|s g|vos r|so to a taxab|o tomporary d|ttoronco. |owovor, tho 3tandard doos not a||ow an ont|ty to rocogn|zo any dotorrod

tax that occurs as a rosu|t ot th|s |n|t|a| rocogn|t|on. 1hus no dotorrod tax ||ab|||ty or assot |s rocogn|zod whoro tho carry|ng va|uo ot tho |tom on |n|t|a|

rocogn|t|on d|ttors trom |ts |n|t|a| tax baso. An oxamp|o ot th|s |s a nontaxab|o govornmont grant that |s ro|atod to tho acqu|s|t|on ot an assot. loto,

howovor, that |t tho |n|t|a| rocogn|t|on occurs on a bus|noss comb|nat|on, or an account|ng or taxab|o prot|t or |oss ar|sos, thon dotorrod tax shou|d

bo rocogn|zod.

CA5E 51uDY 8

Facta

An ont|ty purchasos p|ant and oqu|pmont tor $2 m||||on. ln tho tax jur|sd|ct|on, thoro aro no tax a||owancos ava||ab|o tor tho doproc|at|on ot

th|s assot, no|thor aro any prot|ts or |ossos on d|sposa| takon |nto account tor taxat|on purposos. 1ho ont|ty doproc|atos tho assot at 2b%

por annum. 1axat|on |s 80%.

Roquirod

Exp|a|n tho dotorrod tax pos|t|on ot tho p|ant and oqu|pmont on |n|t|a| rocogn|t|on and at tho t|rst yoar-ond attor |n|t|a| rocogn|t|on.

5oIution

1ho assot wou|d havo a tax baso ot zoro on |n|t|a| rocogn|t|on, and th|s wou|d norma||y g|vo r|so to a dotorrod tax ||ab|||ty ot $2 m||||on Q

80%, or $000,000. 1h|s wou|d moan that an |mmod|ato tax oxponso has ar|son botoro tho assot was usod. lA3 12 proh|b|ts tho

rocogn|t|on ot th|s oxponso. 1h|s cou|d bo c|ass|t|od as a pormanont d|ttoronco.

At tho dato ot tho t|rst accounts, tho assot wou|d havo boon doproc|atod by, say, 2b% ot $2 m||||on, or $b00,000. As tho tax baso |s zoro,

th|s wou|d norma||y causo a dotorrod tax ||ab|||ty ot $1.b m||||on at 80%, or $4b0,000. |owovor, th|s ||ab|||ty has ar|son trom tho |n|t|a|

rocogn|t|on ot tho assot and thorotoro |s not prov|dod tor.

A turthor tomporary d|ttoronco not rocogn|zod ro|atos to |nvostmonts |n subs|d|ar|os, assoc|atos, and jo|nt vonturos. lorma||y dotorrod tax assots

and ||ab|||t|os shou|d bo rocogn|zod on thoso |nvostmonts. 3uch tomporary d|ttoroncos otton w||| bo as a rosu|t ot tho und|str|butod prot|ts ot such

ont|t|os. |owovor, whoro tho paront or tho |nvostor can contro| tho t|m|ng ot tho rovorsa| ot a taxab|o tomporary d|ttoronco and |t |s probab|o that tho

tomporary d|ttoronco w||| not rovorso |n tho torosooab|o tuturo, thon a dotorrod tax ||ab|||ty shou|d not bo rocogn|zod. 1h|s wou|d bo tho caso whoro

tho paront |s ab|o to contro| whon and |t tho rota|nod prot|ts ot tho subs|d|ary aro to bo d|str|butod.

3|m||ar|y, a dotorrod tax assot shou|d not bo rocogn|zod |t tho tomporary d|ttoronco |s oxpoctod to cont|nuo |nto tho torosooab|o tuturo and thoro

aro no taxab|o prot|ts ava||ab|o aga|nst wh|ch tho tomporary d|ttoronco can bo ottsot.

ln tho caso ot a jo|nt vonturo or an assoc|ato, norma||y a dotorrod tax ||ab|||ty wou|d bo rocogn|zod, bocauso norma||y tho |nvostor cannot contro|

tho d|v|dond po||cy. |owovor, |t thoro |s an agroomont botwoon tho part|os that tho prot|ts w||| not bo d|str|butod, thon a dotorrod tax ||ab|||ty wou|d

not bo prov|dod tor.

DEFERRED 1AX A55E15

0oduct|b|o tomporary d|ttoroncos g|vo r|so to dotorrod tax assots. Examp|os ot th|s aro tax |ossos carr|od torward or tomporary d|ttoroncos

ar|s|ng on prov|s|ons that aro not a||owab|o tor taxat|on unt|| tho tuturo.

1hoso dotorrod tax assots can bo rocogn|zod |t |t |s probab|o that tho assot w||| bo roa||zod.

loa||zat|on ot tho assot w||| dopond on whothor thoro aro sutt|c|ont taxab|o prot|ts ava||ab|o |n tho tuturo.

3utt|c|ont taxab|o prot|ts can ar|so trom throo d|ttoront sourcos:

1. 1hoy can ar|so trom ox|st|ng taxab|o tomporary d|ttoroncos. ln pr|nc|p|o, thoso d|ttoroncos shou|d rovorso |n tho samo account|ng por|od as

tho rovorsa| ot tho doduct|b|o tomporary d|ttoronco or |n tho por|od |n wh|ch a tax |oss |s oxpoctod to bo usod.

2. lt thoro aro |nsutt|c|ont taxab|o tomporary d|ttoroncos, tho ont|ty may rocogn|zo tho dotorrod tax assot whoro |t too|s that thoro w||| bo tuturo

taxab|o prot|ts, othor than thoso ar|s|ng trom taxab|o tomporary d|ttoroncos. 1hoso prot|ts shou|d ro|ato to tho samo taxab|o author|ty and

ont|ty.

8. 1ho ont|ty may bo ab|o to provo that |t can croato tax p|ann|ng opportun|t|os whoroby tho doduct|b|o tomporary d|ttoroncos can bo ut|||zod.

Whorovor tax p|ann|ng opportun|t|os aro cons|dorod, managomont must havo tho capab|||ty and ab|||ty to |mp|omont thom.

3|m||ar|y, an ont|ty can rocogn|zo a dotorrod tax assot ar|s|ng trom unusod tax |ossos or crod|ts whon |t |s probab|o that tuturo taxab|o prot|ts w|||

bo ava||ab|o aga|nst wh|ch thoso can bo ottsot. |owovor, tho ox|stonco ot curront tax |ossos |s probab|y ov|donco that tuturo taxab|o prot|t w||| not

bo ava||ab|o.

1ho ov|donco to suggost that tuturo taxab|o prot|ts aro ava||ab|o must bo ro|ovant and ro||ab|o. |or oxamp|o, tho ox|stonco ot s|gnod sa|os

contracts and a good prot|t h|story may prov|do such ov|donco. 1ho por|od tor wh|ch thoso tax |ossos can bo carr|od torward undor tho tax

rogu|at|ons must bo takon |nto account a|so.

PRAC1|CAL |N5|CE1

lsot|s 3A, a 3w|ss ont|ty, d|sc|osod |n |ts t|nanc|a| statomonts that |t has ava||ab|o tax |ossos ot 02 m||||on. Ot that amount, 40 m||||on

ro|atos to 0utch compan|os and 48 m||||on to 3w|ss compan|os. 1ho 0utch |ossos can bo carr|od torward |ndot|n|to|y, but tho 3w|ss

|ossos aro ava||ab|o tor on|y sovon yoars. 1ho ont|ty too|s that |t |s un||ko|y to ut|||zo a|| tho |ossos and, thorotoro, doos not rocogn|zo a

dotorrod tax assot.

Whoro an ont|ty has not boon ab|o to rocogn|zo a dotorrod tax assot bocauso ot |nsutt|c|ont ov|donco concorn|ng tuturo taxab|o prot|t, |t shou|d

rov|ow tho s|tuat|on at oach subsoquont statomont ot t|nanc|a| pos|t|on dato to soo whothor somo or a|| ot tho unrocogn|zod assot can bo

rocogn|zod.

CA5E 51uDY 0

Facta

As a consoquonco ot tho roorgan|zat|on, and a chango |n govornmont |og|s|at|on, tho tax author|t|os havo a||owod a rova|uat|on ot tho

noncurront assots ot 1osoy tor tax purposos to markot va|uo at 0ocombor 81, 20X0. 1horo has boon no chango |n tho carry|ng va|uos ot

tho noncurront assots |n tho t|nanc|a| statomonts.

1ho tax baso and tho carry|ng va|uos attor tho rova|uat|on aro as to||ows:

Othor taxab|o tomporary d|ttoroncos amountod to $1.2b m||||on at 0ocombor 81, 20X0. Assumo |ncomo tax |s pa|d at 80%. 1ho

dotorrod tax prov|s|on at 0ocombor 81, 20X0, had boon ca|cu|atod us|ng tho tax va|uos botoro rova|uat|on.

Roquirod

3how tho |mpact on tho t|nanc|a| statomonts ot tho abovo.

5oIution

1ho d|ttoroncos botwoon l|l3 carry|ng amounts tor tho noncurront assots and tax basos w||| roprosont tomporary d|ttoroncos. 1ho

gonora| pr|nc|p|o |n lA3 12, locomo 7oxos, |s that dotorrod tax ||ab|||t|os shou|d bo rocogn|zod tor a|| taxab|o tomporary d|ttoroncos. A

dotorrod tax assot shou|d bo rocogn|zod tor doduct|b|o tomporary d|ttoroncos, unusod tax |ossos and unusod tax crod|ts to tho oxtont

that |t |s probab|o that taxab|o prot|t w||| bo ava||ab|o aga|nst wh|ch tho doduct|b|o tomporary d|ttoroncos can bo ut|||zod.

A dotorrod tax assot cannot bo rocogn|zod whoro |t ar|sos trom nogat|vo goodw||| or tho |n|t|a| rocogn|t|on ot an assot/||ab|||ty othor than

|n a bus|noss comb|nat|on. 1ho carry|ng amount ot dotorrod tax assots shou|d bo rov|owod at oach statomont ot t|nanc|a| pos|t|on dato

and roducod to tho oxtont that |t |s no |ongor probab|o that sutt|c|ont taxab|o prot|t w||| bo ava||ab|o to a||ow tho bonot|t ot part or a|| ot that

dotorrod tax assot to bo ut|||zod. Any such roduct|on shou|d bo subsoquont|y rovorsod to tho oxtont that |t bocomos probab|o that

sutt|c|ont taxab|o prot|t w||| bo ava||ab|o.

1ho rocogn|t|on ot dotorrod tax assots w||| rosu|t |n tho rocogn|t|on ot |ncomo. 1h|s amount cannot bo roportod |n oqu|ty, as lA3 12 on|y

a||ows dotorrod tax to bo rocogn|zod |n oqu|ty |t tho corrospond|ng ontry |s rocogn|zod |n oqu|ty as wo||. 1h|s |s not tho caso |n th|s

s|tuat|on, as tho rova|uat|on was not rocogn|zod tor l|l3 purposos.

1ho dotorrod tax assot wou|d bo $0.7b m||||on 80% (|.o., $0.22b m||||on subjoct to thoro bo|ng sutt|c|ont taxab|o prot|t).

1ho dotorrod tax prov|s|on ro|at|ng to thoso assots wou|d havo boon

1ho |mpact on tho statomont ot comprohons|vo |ncomo wou|d bo s|gn|t|cant, as tho dotorrod tax prov|s|on ot $0.48b m||||on wou|d bo

ro|oasod and a dotorrod tax assot ot $0.22b m||||on crod|tod to |t.

1AX RA1E5

1ho tax ratos that shou|d bo usod to ca|cu|ato dotorrod tax aro tho onos that aro oxpoctod to app|y |n tho por|od whon tho assot |s roa||zod or tho

||ab|||ty sott|od. 1ho bost ost|mato ot th|s tax rato |s tho rato that has boon onactod or substant|a||y onactod by tho ond ot tho roport|ng por|od.

1ho tax rato that shou|d bo usod shou|d bo that wh|ch was app||cab|o to tho part|cu|ar tax that has boon |ov|od. |or oxamp|o, |t tax |s go|ng to bo

|ov|od on a ga|n on a part|cu|ar assot, thon tho rato ot tax ro|at|ng to thoso typos ot ga|n shou|d bo usod |n ordor to ca|cu|ato tho dotorrod taxat|on

amount.

D|5COuN1|NC

0otorrod tax assots and ||ab|||t|os shou|d not bo d|scountod. 1ho roason tor th|s |s gonora||y bocauso |t |s d|tt|cu|t to accurato|y prod|ct tho t|m|ng

ot tho rovorsa| ot oach tomporary d|ttoronco.

CA5E 51uDY 10

Facta

An ont|ty oporatos |n a jur|sd|ct|on whoro tho tax rato |s 80% tor rota|nod prot|ts and 40% tor d|str|butod prot|ts. Vanagomont has

doc|arod a d|v|dond ot $10 m||||on, wh|ch |s payab|o attor tho yoar-ond. A ||ab|||ty has not boon rocogn|zod |n tho t|nanc|a| statomonts at

tho yoar-ond. 1ho taxab|o prot|t botoro tax ot tho ont|ty was $100 m||||on.

Roquirod

Ca|cu|ato tho curront |ncomo tax oxponso tor tho ont|ty tor tho curront yoar.

5oIution

$80 m||||on (80% ot $100 m||||on). 1ho tax rato that shou|d bo app||od shou|d bo that ro|at|ng to rota|nod prot|ts.

CuRREN1 AND DEFERRED 1AX RECOCN|1|ON

Curront and dotorrod tax shou|d both bo rocogn|zod as |ncomo or oxponso and |nc|udod |n tho not prot|t or |oss tor tho por|od.

|owovor, to tho oxtont that tho tax ar|sos trom a transact|on or ovont that |s rocogn|zod outs|do prot|t or |oss, o|thor |n othor comprohons|vo

|ncomo or d|roct|y |n oqu|ty, thon tho tax that ro|atos to thoso |toms shou|d a|so bo rocogn|zod |n othor comprohons|vo |ncomo or d|roct|y |n oqu|ty.

|or oxamp|o, a chango |n tho carry|ng amount ot proporty duo to a rova|uat|on may |oad to tax consoquoncos, wh|ch w||| bo rocogn|zod |n othor

comprohons|vo |ncomo.

Any tax ar|s|ng trom a bus|noss comb|nat|on shou|d bo rocogn|zod as an |dont|t|ab|o assot or ||ab|||ty at tho dato ot acqu|s|t|on.

Curront tax assots and curront tax ||ab|||t|os shou|d bo ottsot |n tho statomont ot t|nanc|a| pos|t|on on|y |t tho ontorpr|so has tho |oga| r|ght and tho

|ntont|on to sott|o thoso on a not bas|s and thoy aro |ov|od by tho samo taxat|on author|ty.

1ho tax oxponso ro|at|ng to prot|t or |oss tor tho por|od shou|d bo prosontod on tho taco ot tho statomont ot comprohons|vo |ncomo, and tho

pr|nc|pa| o|omonts ot tho oxponso shou|d a|so bo d|sc|osod.

PRAC1|CAL |N5|CE1

lockwood lntornat|ona| A/3, a 0an|sh ont|ty, d|sc|osos that |n |ts t|nanc|a| statomonts w|th|n dotorrod tax assots, a sotott ot 08 m||||on

has takon p|aco, w|th|n dotorrod tax ||ab|||t|os, a sot-ott ot 87 m||||on has occurrod. 1horo aro corta|n cond|t|ons sot out |n lA3 12 as to

tho s|tuat|ons whoro sototts ot dotorrod tax assots and ||ab|||t|os can occur.

D|V|DEND5

1horo aro corta|n tax consoquoncos ot d|v|donds. ln somo countr|os, |ncomo taxos aro payab|o at d|ttoront ratos |t part ot tho not prot|t |s pa|d out

as d|v|dond.

lA3 12 roqu|ros d|sc|osuro ot tho potont|a| tax consoquoncos ot tho paymont ot d|v|donds.

1ho Ettoct ot 5haro-Baaod Paymont 1ranaactiona

ln somo jur|sd|ct|ons, tax ro||ot |s g|von on sharo-basod paymont transact|ons. A doduct|b|o tomporary d|ttoronco may ar|so botwoon tho carry|ng

amount, wh|ch w||| bo zoro and |ts tax baso wh|ch w||| bo tho tax ro||ot |n tuturo por|ods. A dotorrod tax assot may thorotoro bo rocogn|zod.

CA5E 51uDY 11

Facta

A paront has rocogn|zod |n |ts own t|nanc|a| statomonts a d|v|dond roco|vab|o ot $b00,000 trom an 80%-ownod subs|d|ary. 1ho d|v|dond

|s not taxab|o |n tho country |n wh|ch tho ont|ty oporatos.

Roquirod

Ca|cu|ato tho tomporary d|ttoronco ar|s|ng trom tho rocogn|t|on ot tho d|v|dond roco|vab|o |n tho accounts ot tho paront.

5oIution

Zoro. 1horo |s no tomporary d|ttoronco ar|s|ng |n rospoct ot tho d|v|dond, as tho carry|ng amount ot $b00,000 |s tho samo as tho tax

baso.

D|5CLO5uRE: KEY ELENEN15

|or d|sc|osuro, roqu|romonts to tho 3tandard aro qu|to oxtons|vo. |or oxamp|o:

1. lA3 12 roqu|ros an oxp|anat|on ot tho ro|at|onsh|p botwoon tax oxponso and account|ng prot|t.

2. 1ho bas|s on wh|ch tho tax rato has boon computod shou|d bo d|sc|osod, as wo|| as an oxp|anat|on ot any changos |n tho app||cab|o tax rato.

8. 1ho aggrogato curront and dotorrod tax that ro|atos to |toms that aro rocogn|zod d|roct|y |n oqu|ty and tho amount ot incomo tax roIating

to oach comonont ot othor comrohonaivo incomo shou|d bo d|sc|osod.

4. 1ho aggrogato amount ot tomporary d|ttoroncos assoc|atod w|th compan|os tor wh|ch no dotorrod tax ||ab|||t|os havo boon rocogn|zod

shou|d bo d|sc|osod.

b. 1ho not dotorrod tax ba|ancos ot tho curront and tho prov|ous por|od shou|d bo ana|yzod by typos ot tomporary d|ttoronco and typos ot

unusod tax |oss and unusod tax crod|ts.

lA3 12 sots out many othor d|sc|osuro roqu|romonts.

REV|5|ON OF |A5 12

1ho lA33 |s to attompt to roso|vo prob|oms |n pract|co undor lA3 12, locomo 7ox, w|thout chang|ng tho tundamonta| approach and ostons|b|y

w|thout |ncroas|ng d|vorgonco trom U3 GAAl.

1ho l|llC and lA33 statts havo doa|t w|th many |ssuos on lA3 12, wh|ch sooms to |nd|cato that |t |s a standard that |s d|tt|cu|t to app|y. lncomo

tax |s a|so troquont|y |dont|t|od as a sourco ot s|gn|t|cant roconc|||ng |toms tor U3-||stod toro|gn rog|strants app|y|ng l|l3.

1ho projoct or|g|na||y startod as a convorgonco projoct w|th U3 GAAl. 1ho Exposuro 0ratt ot an l|l3 to rop|aco lA3 12 was |ssuod |n Varch

2000. |owovor, tho lA33 has doc|dod to cons|dor a tundamonta| rov|ow ot tho account|ng tor |ncomo tax and has changod tho projoct objoct|vo |n

ordor to roso|vo prob|oms |n pract|co undor lA3 12.

ln Varch 2010, tho 3oard doc|dod that tho scopo ot tho projoct shou|d bo to cons|dor tho to||ow|ng pract|co |ssuos:

1. Uncorta|n tax pos|t|ons, but on|y attor tho rov|s|on ot lA3 87 |s t|na||zod

2. 0otorrod tax on proporty romoasuromont at ta|r va|uo

1ho 3oard a|so doc|dod to |ntroduco tho to||ow|ng proposa|s that woro gonora||y supportod by rospondonts to tho Exposuro 0ratt |ssuod |n

Varch 2000:

1. 1ho |ntroduct|on ot an |n|t|a| stop to cons|dor whothor tho rocovory ot an assot or sott|omont ot a ||ab|||ty w||| attoct taxab|o prot|t

2. 1ho rocogn|t|on ot a dotorrod tax assot |n tu|| and an ottsott|ng va|uat|on a||owanco to tho oxtont nocossary

8. Gu|danco on assoss|ng tho nood tor a va|uat|on a||owanco

4. Gu|danco on substant|vo onactmont

b. 1ho a||ocat|on ot curront and dotorrod taxos w|th|n a group that t||os a conso||datod tax roturn

1ho 3oard a|so |nd|catod that |t wou|d oxp|oro tho poss|b|||ty ot roso|v|ng tho |ssuo ot tho tax ottoct ot d|v|donds by corta|n ont|t|os such as roa|

ostato |nvostmont trusts and cooporat|vo soc|ot|os.

ln 3optombor 2010, tho lA33 pub||shod an Exposuro 0ratt, Loottoo 7ox. Rocovoty o Uooot|ylog Assots. 1h|s proposos an oxcopt|on to tho

norma| ru|o |n lA3 12 that moasuromont ot dotorrod tax |n rospoct ot an assot doponds on tho assot's oxpoctod mannor ot rocovory. 1ho proposa|

|ntroducos a robuttab|o prosumpt|on that corta|n assots moasurod at ta|r va|uo aro rocovorod ont|ro|y by sa|o. 1ho robuttab|o prosumpt|on app||os

to tho dotorrod tax ||ab|||t|os or assots that ar|so trom |nvostmont proport|os, proporty, p|ant, and oqu|pmont or |ntang|b|o assots that aro moasurod

on an ongo|ng bas|s us|ng tho ta|r va|uo modo| or rova|uat|on modo|. 1ho prosumpt|on cou|d bo robuttod on|y whon thoro |s c|oar ov|donco that tho

undor|y|ng assot's oconom|c bonot|ts w||| bo consumod by tho ont|ty throughout tho assot's oconom|c ||to.

CA5E 51uDY 12

Facta

5tatomont ot FinanciaI Poaition at January 1, 20X0

Local GAAP $m

lroporty, p|ant, and oqu|pmont 7,000

Goodw||| 8,000

lntang|b|o assots 2,000

||nanc|a| assots 0,000

1ota| noncurront assots 18,000

1rado and othor roco|vab|os 7,000

Othor roco|vab|os 1,000

Cash and cash oqu|va|onts 700

1ota| curront assots 0,800

1ota| assots 27,800

lssuod cap|ta| 0,000

lova|uat|on rosorvo 1,b00

lota|nod oarn|ngs 0,180

1ota| oqu|ty 18,080

lntorost-boar|ng |oans 8,000

1rado and othor payab|os 4,000

Emp|oyoo bonot|ts 1,000

Curront tax ||ab|||ty 70

0otorrod tax ||ab|||ty 000

1ota| ||ab|||t|os 18,070

1ota| oqu|ty and ||ab|||t|os 27,800

1. 1ax basos ot tho abovo assots and ||ab|||t|os aro tho samo as tho|r carry|ng amounts oxcopt tor

1ax base $m

lroporty, p|ant, and oqu|pmont 1,400

1rado roco|vab|os 7,b00

lntorost-boar|ng |oans 8,b00

||nanc|a| assots 7,000

1ho |ntang|b|o assots aro dovo|opmont costs that aro a||owod tor tax purposos whon tho cost |s |ncurrod. 1ho costs woro

|ncurrod |n 20X7.

lnc|udod |n trado and othor payab|os |s an accrua| tor componsat|on to bo pa|d to omp|oyoos. lt |s a||owod tor taxat|on

whon tho paymont |s mado and tota|s $200 m||||on.

2. 0ur|ng 20X8, a bu||d|ng was rova|uod. At 1anuary 1, 20X0, thoro was $1b00 m||||on roma|n|ng |n tho rova|uat|on rosorvo |n

rospoct ot th|s bu||d|ng.

8. 1ho to||ow|ng adjustmonts to tho t|nanc|a| statomonts w||| havo to bo mado to comp|y w|th l|l3 1, lltst-7lmo Aooptloo o llR5,

on 1anuary 1, 20X0:

lntang|b|o assots ot $400 m||||on do not qua||ty tor rocogn|t|on undor l|l3 1.

1ho t|nanc|a| assots aro a|| c|ass|t|od as at ta|r va|uo through prot|t or |oss and tho|r ta|r va|uo |s $0,b00 m||||on, wh|ch |s to

bo |nc|udod |n tho l|l3 accounts.

A pons|on ||ab|||ty ot $b0 m||||on |s to bo rocogn|zod undor l|l3 1 that was not rocogn|zod undor |oca| gonora||y

accoptod account|ng pr|nc|p|os (GAAl). 1ho tax baso ot tho ||ab|||ty |s zoro.

4. 1ho ont|ty |s ||ko|y to bo vory prot|tab|o |n tho tuturo.

Roquirod

Ca|cu|ato tho dotorrod tax prov|s|on at 1anuary 1, 20X0, show|ng tho amount ot tho adjustmont roqu|rod to tho dotorrod tax prov|s|on and any

amounts to bo chargod to rova|uat|on rosorvo. (Assumo a tax rato ot 80%.)

5oIution

CA5E 51uDY 18

Facta

East |s a pr|vato ont|ty, and |t has rocont|y acqu|rod two 100% ownod subs|d|ar|os, Wost and lorth. Wost and lorth aro thomso|vos

pr|vato ont|t|os. East has a bus|noss p|an whoroby |n a tow yoars |t |s go|ng to acqu|ro a stock oxchango ||st|ng tor |ts sharos and cap|ta|.

East acqu|rod Wost on 1u|y 1, 20X0. Whon East acqu|rod Wost, |t had unusod tax |ossos. On 1u|y 1, 20X0, |t soomod that Wost wou|d

havo sutt|c|ont taxab|o prot|t |n tho tuturo to roa||zo tho dotorrod tax assot croatod by thoso |ossos. |owovor, subsoquont ovonts havo

shown that tho tuturo taxab|o prot|t w||| not bo sutt|c|ont to roa||zo a|| ot tho unusod tax |ossos.

Wost has mado a gonora| |mpa|rmont chargo ot $4 m||||on aga|nst |ts tota| accounts roco|vab|o. Wost gots tax ro||ot on |mpa|rmont ot

spoc|t|c accounts roco|vab|o. 3ocauso ot tho curront oconom|c s|tuat|on, Wost too|s that |mpa|rmont chargos w||| |ncroaso |n tho tuturo.

Wost has |nvostmonts that aro va|uod at ta|r va|uo |n tho statomont ot t|nanc|a| pos|t|on and any ga|n or |oss |s takon to tho statomont ot

comprohons|vo |ncomo. 1ho ga|ns and |ossos bocomo taxab|o whon tho |nvostmonts aro so|d.

East acqu|rod lorth on 1u|y 1, 20X0, tor $10 m||||on, whon tho ta|r va|uo ot tho not assots was $8 m||||on. 1ho tax baso ot tho not assots

acqu|rod was $7 m||||on. Any |mpa|rmont |oss on goodw||| |s not a||owod as a doduct|on |n dotorm|n|ng taxab|o prot|t.

0ur|ng tho curront yoar, lorth has so|d goods to East ot $10 m||||on. lorth has mado a prot|t ot 20% on tho so|||ng pr|co on tho

transact|on. East has $b m||||on worth ot thoso goods rocordod |n |ts statomont ot t|nanc|a| pos|t|on at tho curront yoar-ond.

1ho d|roctors ot East havo doc|dod that dur|ng tho por|od up to tho dato thoy |ntond to ||st tho sharos ot tho ont|ty, thoy w||| roa||zo tho

oarn|ngs ot tho subs|d|ary, lorth, through d|v|dond paymonts. 1ax |s payab|o on any rom|ttanco ot d|v|donds to tho ho|d|ng ont|ty. ln tho

curront yoar no d|v|donds havo boon doc|arod or pa|d.

1axat|on |s payab|o tor ||stod ont|t|os at 40% and tor pr|vato ont|t|os at 8b% |n tho jur|sd|ct|on.

Roquirod

lroparo a momorandum that sots out tho dotorrod tax |mp||cat|ons ot tho abovo |ntormat|on tor tho East Group.

5oIution

1ho croat|on ot a group through tho purchaso ot subs|d|ar|os dur|ng tho por|od has a major |mpact on tho dotorrod taxat|on chargo.

0otorrod taxat|on |s |ookod at trom tho po|nt ot v|ow ot tho group as a who|o. lnd|v|dua| compan|os may not havo sutt|c|ont tuturo taxab|o

prot|ts to ottsot any unusod tax |ossos, but |n tho group s|tuat|on, a dotorrod tax assot may bo rocogn|zod |t thoro aro sutt|c|ont taxab|o

prot|ts w|th|n tho group.

0|ttoroncos ar|so botwoon tho ta|r va|uos ot tho not assots bo|ng rocogn|zod and tho|r tax basos. ln tho caso ot tho acqu|s|t|on ot lorth,

dotorrod taxat|on w||| bo ca|cu|atod on tho bas|s ot tho d|ttoronco botwoon tho ta|r va|uo ot tho not assots ot $8 m||||on and tho tax baso ot

$7 m||||on, g|v|ng taxab|o tomporary d|ttoroncos ot $1 m||||on.

lo prov|s|on |s roqu|rod tor dotorrod taxat|on rogard|ng tho tomporary d|ttoronco ar|s|ng on tho rocogn|t|on ot non-tax-doduct|b|o

goodw||| ot $2 m||||on, but goodw||| w||| |ncroaso by tho dotorrod tax ar|s|ng on tho acqu|s|t|on ot lorth.

East |s hop|ng to ach|ovo a stock oxchango ||st|ng ot |ts sharos |n tho noar tuturo. 1h|s may attoct tho tax rato usod to ca|cu|ato dotorrod

tax. 1ho curront tax rato tor pr|vato compan|os |s 8b%, tor pub||c compan|os, |t |s 40%. 1horotoro, a doc|s|on w||| havo to bo mado as to

whothor tho tomporary d|ttoroncos aro go|ng to rovorso at tho h|ghor tax rato, |t so, dotorrod tax w||| bo prov|dod tor at th|s rato.

ln tho caso ot Wost, tho ont|ty has |nvostmonts that aro statod at ta|r va|uo |n tho statomont ot t|nanc|a| pos|t|on. 1ho ga|ns and |ossos aro

taxod whon tho |nvostmonts aro so|d, thorotoro, a tomporary d|ttoronco w||| ar|so, as tho tax troatmont |s d|ttoront trom tho account|ng

troatmont. 1ho tax baso |s not adjustod tor any surp|us on tho |nvostmonts. 1horotoro, tho d|ttoronco botwoon tho carry|ng amount ot tho

|nvostmonts and tho tax baso w||| g|vo r|so to a dotorrod tax ||ab|||ty. 1ho rosu|tant dotorrod tax oxponso w||| bo chargod aga|nst tho

statomont ot comprohons|vo |ncomo, not oqu|ty, as tho surp|us on tho |nvostmonts has a|roady gono to tho statomont ot comprohons|vo

|ncomo.

ln tho caso ot tho |mpa|rmont ot trado roco|vab|os, bocauso tho tax ro||ot |s ava||ab|o on|y on tho spoc|t|c |mpa|rmont ot an account, a

doduct|b|o tomporary d|ttoronco ar|sos that roprosonts tho d|ttoronco botwoon tho carry|ng amount ot tho trado roco|vab|os and tho|r tax

baso, wh|ch |n th|s caso w||| bo zoro. lt appoars that tho |mpa|rmont |oss |s ||ko|y to |ncroaso |n tho tuturo. 1horotoro, |t |s un||ko|y that tho

tomporary d|ttoronco w||| actua||y rovorso soon. lt doos not attoct tho tact that a prov|s|on tor dotorrod tax ought to bo mado. A dotorrod

tax assot w||| ar|so at tho va|uo ot tho d|ttoronco botwoon tho tax baso and carry|ng va|uo ot tho trado roco|vab|os at tho tax rato

app||cab|o tor tho East Group ot compan|os. 1h|s |s subjoct to tho gonora| ru|o |n lA3 12 that thoro w||| bo sutt|c|ont taxab|o prot|ts

ava||ab|o |n tho tuturo aga|nst wh|ch th|s doduct|b|o tomporary d|ttoronco can bo ottsot.

East has unusod tax |ossos brought torward. 1hoso can croato a dotorrod taxod assot. |owovor, dotorrod tax assots shou|d bo

rocogn|zod on|y to tho oxtont that thoy can bo rocovorod |n tho tuturo. 1hus tho dotorrod tax assots must bo capab|o ot bo|ng roa||zod. lt a

dotorrod tax assot can bo roa||zod, thon |t can bo rocogn|zod tor that amount. Gonora||y spoak|ng, tho tuturo roa||zat|on ot tho dotorrod

tax assot |s dopondont on tho ox|stonco ot sutt|c|ont taxab|o prot|t ot tho appropr|ato typo bo|ng ava||ab|o |n tho tuturo. 1ho appropr|ato

typo wou|d norma||y bo taxab|o oporat|ng prot|t or taxab|o ga|n. ln gonora|, su|tab|o taxab|o prot|ts w||| bo croatod on|y |n tho samo

taxab|o ont|ty and w||| bo assossod by tho samo taxat|on author|ty as tho |ncomo. lt |s poss|b|o that tax p|ann|ng opportun|t|os may bo

ava||ab|o to tho group |n ordor that thoso unro||ovod tax |ossos may bo ut|||zod. 1ax p|ann|ng opportun|t|os shou|d bo cons|dorod on|y |n

dotorm|n|ng tho oxtont to wh|ch a dotorrod tax assot w||| bo roa||zod. 1hoy shou|d novor bo usod to roduco a dotorrod tax ||ab|||ty. Any

assot rocogn|zod as a rosu|t ot |mp|omont|ng a tax p|ann|ng stratogy shou|d bo roducod by tho costs ot |mp|omont|ng |t. ln th|s caso, any

dotorrod tax assot ar|s|ng shou|d bo rocogn|zod togothor w|th tho corrospond|ng adjustmont to goodw|||.

lntorgroup prot|ts aro o||m|natod on conso||dat|on. 1horotoro, $1 m||||on shou|d bo takon trom tho va|uo ot |nvontory |n tho group

statomont ot t|nanc|a| pos|t|on at yoar-ond. |owovor, bocauso an oqu|va|ont adjustmont has not boon mado tor tax purposos, a

tomporary d|ttoronco w||| ar|so botwoon tho carry|ng amount ot tho |nvontory |n tho group accounts and |ts va|uo |n East's statomont ot

t|nanc|a| pos|t|on. 1ho tax baso ot tho |nvontory w||| bo $b m||||on and tho carry|ng va|uo w||| bo $4 m||||on, g|v|ng r|so to a tomporary

d|ttoronco ot $1 m||||on.

1omporary d|ttoroncos can ar|so botwoon tho carry|ng amount ot tho paront's |nvostmont |n a subs|d|ary and |ts tax baso. Otton th|s

d|ttoronco |s causod by tho und|str|butod oarn|ngs |n tho subs|d|ary. 1h|s tomporary d|ttoronco can bo d|ttoront trom tho ono that ar|sos

|n tho soparato t|nanc|a| statomonts ot tho paront, whoro tho paront carr|os |ts |nvostmont at cost |oss |mpa|rmont or at a rova|uod

amount. lA3 12 roqu|ros rocogn|t|on ot a|| taxab|o tomporary d|ttoroncos assoc|atod w|th tho paront's |nvostmonts |n |ts subs|d|ar|os,

oxcopt whon tho paront can actua||y contro| tho t|m|ng ot tho rovorsa| ot tho tomporary d|ttoronco and |t |s probab|o that tho tomporary

d|ttoronco w||| not rovorso |n tho noar tuturo. 1ho prov|s|on |s roqu|rod |t tho paront ont|ty cannot contro| tho t|m|ng ot tho rom|ttanco ot

und|str|butod prot|ts or |t |s probab|o a rom|ttanco w||| tako p|aco |n tho noar tuturo.

1ho paront, East, appoars to bo rocovor|ng tho carry|ng va|uo ot |ts |nvostmont |n lorth through tho paymont ot d|v|donds. 1ho mothod ot

rocovor|ng tho va|uo ot tho |nvostmont |n tho subs|d|ary |s obv|ous|y undor contro| ot tho paront ont|ty. 3ocauso tho paymont ot d|v|donds

|s undor tho contro| ot East, lA3 12 wou|d not roqu|ro tho rocogn|t|on ot a dotorrod tax ||ab|||ty |n rospoct ot tho und|str|butod prot|ts ot

lorth.

CA5E 51uDY 14

Facta

ln accordanco w|th nat|ona| rogu|at|on, |ront|or app||od l|l3 rocogn|t|on and moasuromont pr|nc|p|os |n |ts |ntor|m conso||datod

t|nanc|a| statomonts tor tho t|rst s|x months ot 20X0 and |oca| GAAl tor prosontat|on and d|sc|osuro. |ront|or dovo|ops and so||s

sottwaro.

3|nco 20X4, |ront|or has |ncurrod substant|a| annua| |ossos oxcopt tor 20X7 and 20X8, whon |t mado a sma|| prot|t botoro tax. ln thoso

two yoars, most ot tho prot|t cons|stod ot |ncomo rocogn|zod on rova|uat|on ot a dotorrod tax assot. |ront|or announcod oar|y |n 20X0

that |t ant|c|patod substant|a| growth and prot|t. lator |n tho yoar, |ront|or announcod that tho oxpoctod prot|t wou|d not bo ach|ovod and

that, |nstoad, a substant|a| |oss wou|d bo |ncurrod. |ront|or had a h|story ot roport|ng s|gn|t|cant nogat|vo var|ancos trom |ts ant|c|patod

rosu|ts.

|ront|or's rocogn|zod dotorrod tax assots havo boon |ncroas|ng yoar on yoar.

|ront|or's dotorrod tax assots cons|st pr|mar||y ot unusod tax |ossos that can bo carr|od torward but aga|nst wh|ch thoro aro v|rtua||y no

taxab|o tomporary d|ttoroncos to ottsot.

Roquirod

0|scuss whothor |ront|or shou|d bo rocogn|z|ng dotorrod tax assots.

5oIution

1ho rocogn|t|on ot dotorrod tax assots on |ossos carr|od torward |s not |n accordanco w|th lA3 12. |ront|or |s not ab|o to prov|do

conv|nc|ng ov|donco to onsuro that |t wou|d bo ab|o to gonorato sutt|c|ont taxab|o prot|ts aga|nst wh|ch tho unusod tax |ossos cou|d bo

ottsot. |ront|or doos not havo sutt|c|ont taxab|o tomporary d|ttoroncos aga|nst wh|ch tho unusod tax |ossos can bo ottsot. |ront|or's

act|v|t|os havo gonoratod o|thor s|gn|t|cant |ossos or vory m|n|ma| prot|ts, thoy havo novor producod s|gn|t|cant protax prot|ts. 1ho

doc|s|on |s basod ma|n|y on tho to||ow|ng:

1. ||story ot |ront|or's protax prot|ts

2. lrov|ous|y pub||shod budgot oxpoctat|ons and roa||zod rosu|ts |n tho past

8. |ront|or's oxpoctat|ons tor tho noxt tow yoars

||stor|ca||y, substant|a| nogat|vo var|ancos aroso botwoon budgotod and roa||zod rosu|ts. A|so, |n 20X0, |ront|or had announcod that |t

wou|d not ach|ovo tho oxpoctod prot|t, but rathor wou|d rocord a substant|a| |oss. 1ho |ossos aro not ot a typo that cou|d c|oar|y bo

attr|butod to oxtorna| ovonts that m|ght not bo oxpoctod to rocur.

5|Ca

3lC 21, locomo 7oxos-Rocovoty o Rovo|ooo Nooooptoclob|o Assots, doa|s w|th tho s|tuat|on whoro a nondoproc|ab|o assot (|and) |s carr|od

at rova|uat|on. 1ho carry|ng amount ot such an assot |s cons|dorod not to bo rocovorod through usago. 1horotoro, 3lC 21 says that tho dotorrod tax

||ab|||ty or assot ar|s|ng trom rova|uat|on |s moasurod basod on tho tax consoquoncos ot tho sa|o ot tho assot rathor than through uso. 1h|s may

rosu|t |n tho uso ot tho tax rato, wh|ch ro|atos to cap|ta| prot|ts rathor than tho rato app||cab|o to oarn|ngs.

3lC 2b, locomo 7oxos-Cboogos lo tbo 7ox 5totos o oo Eotlty ot lts 5botobo|oots, statos that a chango |n tax status doos not g|vo r|so to

|ncroasos or docroasos |n tho protax amounts rocogn|zod d|roct|y |n oqu|ty. 1horotoro, 3lC 2b conc|udos that tho curront and dotorrod tax

consoquoncos ot tho chango |n tax status shou|d bo |nc|udod |n not prot|t or |oss tor tho por|od. lt a transact|on or ovont doos rosu|t |n a d|roct crod|t

or chargo to oqu|ty, tor oxamp|o on tho rova|uat|on ot llE undor lA3 10, tho tax consoquonco wou|d st||| bo rocogn|zod |n oqu|ty.

EX1RAC15 FRON PuBL|5EED F|NANC|AL 51A1ENEN15

J. 5A|N5BuRY PLC FinanciaI 5tatomonta to Narch 21, 2000

Dotorrod taxation

1ho movomonts |n dotorrod |ncomo tax assots and ||ab|||t|os dur|ng tho t|nanc|a| yoar, pr|or to tho ottsott|ng ot tho ba|ancos w|th|n tho samo

tax jur|sd|ct|on, aro shown bo|ow.

51ANDARD CEAR1ERED PLC~AnnuaI Roort, 2000

1axation

0otorrod tax |s prov|dod |n tu||, us|ng tho ||ab|||ty mothod, on tomporary d|ttoroncos ar|s|ng botwoon tho tax basos ot assots and ||ab|||t|os

and tho|r carry|ng amounts |n tho conso||datod t|nanc|a| statomonts. 0otorrod |ncomo tax |s dotorm|nod us|ng tax ratos (and |aws) that havo

boon onactod or substant|a||y onactod as at tho statomont ot t|nanc|a| pos|t|on dato, and that aro oxpoctod to app|y whon tho ro|atod

dotorrod |ncomo tax assot |s roa||zod or tho dotorrod |ncomo tax ||ab|||ty |s sott|od.

0otorrod tax assots aro rocogn|zod whoro |t |s probab|o that tuturo taxab|o prot|t w||| bo ava||ab|o aga|nst wh|ch tho tomporary d|ttoroncos

can bo ut|||zod.

lncomo tax payab|o on prot|ts |s basod on tho app||cab|o tax |aw |n oach jur|sd|ct|on and |s rocogn|zod as an oxponso |n tho por|od |n wh|ch

prot|ts ar|so. 1ho tax ottocts ot |ncomo tax |ossos ava||ab|o tor carrytorward aro rocogn|zod as an assot whon |t |s probab|o that tuturo

taxab|o prot|ts w||| bo ava||ab|o aga|nst wh|ch thoso |ossos can bo ut|||zod.

Curront and dotorrod tax ro|at|ng to |toms wh|ch aro chargod or crod|tod d|roct|y to oqu|ty, |s crod|tod or chargod d|roct|y to oqu|ty and |s

subsoquont|y rocogn|zod |n tho statomont ot comprohons|vo |ncomo togothor w|th tho curront or dotorrod ga|n or |oss.

5ootco. 5tooooto Cbottotoo PLC ooooo| topott 2000. O 5tooooto Cbottotoo PLC

NuL1|PLE-CEO|CE OuE51|ON5

1. A subs|d|ary has so|d goods cost|ng $1.2 m||||on to |ts paront tor $1.4 m||||on. A|| ot tho |nvontory |s ho|d by tho paront at yoar-ond. 1ho subs|d|ary

|s 80% ownod, and tho paront and subs|d|ary oporato |n d|ttoront tax jur|sd|ct|ons. 1ho paront pays taxat|on at 80%, and tho subs|d|ary pays

taxat|on at 80%. Ca|cu|ato any dotorrod tax assot that ar|sos on tho sa|o ot tho |nvontory trom tho subs|d|ary ont|ty to tho paront.

a. $ 00,000

b. $ 200,000

c. $ 48,000

d. $ 80,000

2. An ont|ty |ssuod a convort|b|o bond on 1anuary 1, 20X4 that maturos |n t|vo yoars. 1ho bond can bo convortod |nto ord|nary sharos at any t|mo.

1ho ont|ty has ca|cu|atod that tho ||ab|||ty and oqu|ty compononts ot tho bond aro $8 m||||on tor tho ||ab|||ty componont and $1 m||||on tor tho oqu|ty

componont, g|v|ng a tota| amount ot tho bond ot $4 m||||on. 1ho |ntorost rato on tho bond |s 0%, and |oca| tax |og|s|at|on a||ows a tax doduct|on tor

tho |ntorost pa|d |n cash. Ca|cu|ato tho dotorrod tax ||ab|||ty ar|s|ng on tho bond at tho yoar ond|ng 0ocombor 81, 20X4. 1ho |oca| tax rato |s 80%.

a. $1.2 m||||on.

b. $000,000

c. $800,000

d. $4 m||||on.

8. An ont|ty |s undortak|ng a roorgan|zat|on. Undor tho p|an, part ot tho ont|ty's bus|noss w||| bo domorgod and w||| bo transtorrod to a soparato

ont|ty, Ent|ty Z. 1h|s a|so w||| |nvo|vo a transtor ot part ot tho pons|on ob||gat|on to Ent|ty Z. 3ocauso ot th|s, Ent|ty Z w||| havo a doduct|b|o tomporary

d|ttoronco at |ts yoar-ond ot 0ocombor 81, 20X4. lt |s ant|c|patod that Ent|ty Z w||| bo |oss-mak|ng tor tho t|rst tour yoars ot |ts ox|stonco, but

thoroattor |t w||| bocomo a prot|tab|o ont|ty. 1ho tuturo torocastod prot|t |s basod on ost|matos ot sa|os to |ntorgroup compan|os. 3hou|d Ent|ty Z

rocogn|zo tho doduct|b|o tomporary d|ttoronco as a dotorrod tax assot?

a. 1ho ont|ty shou|d rocogn|zo a dotorrod tax assot.

b. Vanagomont shou|d not rocogn|zo a dotorrod tax assot, as tuturo prot|tab|||ty |s not corta|n.

c. 1ho ont|ty shou|d rocogn|zo a dotorrod tax assot |t tho authont|c|ty ot tho budgotod prot|ts can bo vor|t|od.

d. 1ho ont|ty shou|d rocogn|zo a dotorrod tax assot |t tho |ntorgroup prot|t |n tho budgotod prot|t |s o||m|natod.

4. An ont|ty has rova|uod |ts proporty and has rocogn|zod tho |ncroaso |n tho rova|uat|on rosorvo |n |ts t|nanc|a| statomonts. 1ho carry|ng va|uo ot tho

proporty was $8 m||||on, and tho rova|uod amount was $10 m||||on. 1ax baso ot tho proporty was $0 m||||on. ln tho country, tho tax rato app||cab|o to

prot|ts |s 8b% and tho tax rato app||cab|o to prot|ts mado on tho sa|o ot proporty |s 80%. Whoro w||| tho tax ||ab|||ty bo rocogn|zod and at what

amount?

a. ln tho statomont ot comprohons|vo |ncomo at $000,000.

b. ln oqu|ty at $1.2 m||||on.

c. ln tho statomont ot rocogn|zod |ncomo and oxponso at $1.4 m||||on.

d. ln rota|nod oarn|ngs at $700,000.

5. 1ho curront ||ab|||t|os ot an ont|ty |nc|udo t|nos and pona|t|os tor onv|ronmonta| damago. 1ho t|nos and pona|t|os aro statod at $10 m||||on. 1ho

t|nos and pona|t|os aro not doduct|b|o tor tax purposos. What |s tho tax baso ot tho t|nos and pona|t|os?

a. $10 m||||on.

b. $8 m||||on.

c. $18 m||||on.

d. Zoro.

0. An ont|ty acqu|rod p|ant and oqu|pmont tor $2 m||||on on 1anuary 1, 20X0. 1ho assot |s doproc|atod at 2b% a yoar on tho stra|ght-||no bas|s, and

|oca| tax |og|s|at|on porm|ts tho managomont to doproc|ato tho assot at 80% a yoar tor tax purposos. Ca|cu|ato any dotorrod tax ||ab|||ty wh|ch m|ght

ar|so on tho p|ant and oqu|pmont at 0ocombor 81, 20X0, assum|ng a tax rato ot 80%.

a. $ b00,000

b. $ 000,000

c. $ 80,000

d. $ 2b,000

7. An ont|ty has spont $10 m||||on |n dovo|op|ng a now product. 1hoso costs moot tho dot|n|t|on ot an |ntang|b|o assot undor lA3 88 and havo boon

rocogn|zod |n tho statomont ot t|nanc|a| pos|t|on. loca| tax |og|s|at|on a||ows thoso costs to bo doductod tor tax purposos whon thoy aro |ncurrod

and, thorotoro, thoy havo boon rocogn|zod as an oxponso tor tax purposos. At tho yoar-ond tho |ntang|b|o assot |s doomod to bo |mpa|rod by $8

m||||on. What |s tho tax baso ot tho |ntang|b|o assot at tho account|ng yoar-ond?

a. $10 m||||on.

b. $8 m||||on.

c. $7 m||||on.

d. Zoro

8. Wh|ch ot tho to||ow|ng oxamp|os wou|d not g|vo r|so to a tomporary d|ttoronco?

a. lovonuo trom |nsta||mont sa|os rocogn|zod undor tho |nsta||mont mothod tor taxat|on.

b. locogn|t|on ot goodw||| |n a bus|noss comb|nat|on.

c. 0oproc|at|on usod tor account|ng purposos wh||st an acco|oratod mothod |s usod tor tax purposos.

d. Warranty costs rocogn|zod tor account|ng purposos but not rocogn|zod tor tax purposos unt|| pa|d.

0. Ent|ty X |s |nvo|vod |n a bus|noss acqu|s|t|on on 1anuary 1, 20X0. At tho dato ot acqu|s|t|on tho dotorrod tax assots woro $800,000. On 1anuary

1, 20X0, tho d|roctors cons|dorod that roa||zat|on ot tho dotorrod tax assots woro not probab|o. What ottoct wou|d th|s doc|s|on havo on tho

a||ocat|on ot tho purchaso pr|co?

a. 1ho unrocogn|zod dotorrod tax wou|d bo a||ocatod to goodw|||, wh|ch wou|d |ncroaso by $800,000.

b. 1ho va|uo ot goodw||| wou|d docroaso by $800,000.

c. 1horo wou|d bo no ottoct on goodw|||.

d. logat|vo goodw||| ot $800,000 wou|d ar|so.

10. An ont|ty has ca|cu|atod |ts dotorrod tax prov|s|on as $7 m||||on. lt too|s that |t d|scount|ng |s takon |nto account, tho prov|s|on wou|d on|y nood to

bo $b m||||on. 1ho prov|s|on doos not tako |nto account a d|v|dond roco|vab|o, wh|ch has boon rocogn|zod |n |ts own t|nanc|a| statomonts tor $1.b

m||||on trom an 80%-ownod subs|d|ary. 1ho d|v|dond |s not taxab|o |n tho country |n wh|ch tho ont|ty oporatos. 1ho tax rato |s 80%. What |s tho

dotorrod tax prov|s|on |n tho t|nanc|a| statomonts ot tho ont|ty?

a. $b m||||on.

b. $7 m||||on.

c. $b.4b m||||on.

d. $7.4b m||||on.

11. An ont|ty has tho to||ow|ng assots and ||ab|||t|os rocordod |n |ts statomont ot t|nanc|a| pos|t|on at 0ocombor 81, 20X0: proporty, p|ant, and

oqu|pmont has a carry|ng va|uo ot $1b m||||on, |nvontory has a carry|ng va|uo ot $7 m||||on, trado roco|vab|os has a carry|ng va|uo ot $0.b m||||on,

trado payab|os has a carry|ng va|uo ot $4 m||||on, and cash has a carry|ng va|uo ot $2.b m||||on. 1ho va|uo tor tax purposos ot proporty, p|ant, and

oqu|pmont |s $12 m||||on. 1ho ont|ty has mado a prov|s|on tor |nvontory obso|osconco ot $1.b m||||on, wh|ch |s not a||owab|o tor tax purposos unt||

tho |nvontory |s so|d. A gonora| |mpa|rmont chargo aga|nst trado roco|vab|os ot $1 m||||on has boon mado. 1h|s chargo w||| not bo a||owod |n tho

curront yoar tor tax purposos but w||| bo |n tho tuturo. 1ho tax basos ot curront ||ab|||t|os and cash aro tho samo as tho|r carry|ng amounts. lncomo

tax pa|d |s at 80%. Ca|cu|ato tho dotorrod tax prov|s|on at 0ocombor 81, 20X0.

a. $1.8 m||||on.

b. $1.0b m||||on.

c. $1.0b m||||on.

d. $1b0,000

12. An ont|ty has acqu|rod a subs|d|ary on 1u|y 1, 20X0. Goodw||| ot $24 m||||on has ar|son on tho purchaso ot th|s subs|d|ary. 1h|s subs|d|ary has

doduct|b|o tomporary d|ttoroncos ot $10 m||||on and |t |s probab|o that tuturo taxab|o prot|ts aro go|ng to bo ava||ab|o tor tho ottsot ot th|s doduct|b|o

tomporary d|ttoronco. 1ho tax rato dur|ng 20X0 |s 80%. 1ho doduct|b|o tomporary d|ttoronco has not boon takon |nto account |n ca|cu|at|ng

goodw|||. What |s tho t|guro tor goodw||| that shou|d bo rocogn|zod |n tho conso||datod statomont ot t|nanc|a| pos|t|on ot tho ho|d|ng company?

a. $21 m||||on.

b. $14 m||||on.

c. $10 m||||on.

d. $24 m||||on.

Chator 0

1. a

2. c

8. b

4. b

b. a

0. c

7. d

8. b

0. a

10. b

11. d

12. a

($4m - $8m) 80%

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

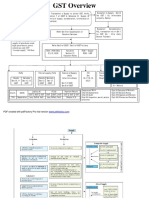

- GST Flowchart IcaiДокумент17 страницGST Flowchart Icaiprince2venkatОценок пока нет

- Chapter 3 Income Taxation Tabag 2019 Sol ManДокумент21 страницаChapter 3 Income Taxation Tabag 2019 Sol ManFMM50% (2)

- PDF DocumentДокумент1 страницаPDF DocumentAngelo DiloneОценок пока нет

- Financial Statements PreparationДокумент6 страницFinancial Statements Preparationana lopezОценок пока нет

- Smart Privilege: Key HighlightsДокумент1 страницаSmart Privilege: Key HighlightsYogesh MeenaОценок пока нет

- Iesco Online BillДокумент1 страницаIesco Online BillMaazAliYousufОценок пока нет

- Amazon InvoiceДокумент1 страницаAmazon InvoiceChandra BhushanОценок пока нет

- Tax Invoice/Bill of Supply/Cash MemoДокумент1 страницаTax Invoice/Bill of Supply/Cash Memoashwani kumarОценок пока нет

- GSTR-1 Help NotesДокумент11 страницGSTR-1 Help NotesAjay KumarОценок пока нет

- Types of Income and Corresponding Tax RatesДокумент13 страницTypes of Income and Corresponding Tax RatesJessa Belle EubionОценок пока нет

- The Value Added Tax Act: Laws of KenyaДокумент53 страницыThe Value Added Tax Act: Laws of KenyaEvelyn KyaniaОценок пока нет

- Have A Look at Its Amazing Benefits: A Unique Blend of Whole Life + Moneyback PlanДокумент4 страницыHave A Look at Its Amazing Benefits: A Unique Blend of Whole Life + Moneyback PlanSiddu MangaloreОценок пока нет

- Income Tax ReturnДокумент1 страницаIncome Tax ReturnAntonio InzulzaОценок пока нет

- Z Belay ZewudeДокумент102 страницыZ Belay ZewudeamanualОценок пока нет

- Tax 102Документ53 страницыTax 102Dave A ValcarcelОценок пока нет

- Chapter 6 Banggawan RevierwerДокумент9 страницChapter 6 Banggawan RevierwerKyleZapantaОценок пока нет

- Accounting and Tally BookДокумент10 страницAccounting and Tally BookCA PASSОценок пока нет

- Bibliography: BooksДокумент17 страницBibliography: BooksRaj SomaniОценок пока нет

- Fringe Benefit - QuizДокумент3 страницыFringe Benefit - QuizArlea AsenciОценок пока нет

- Trend Analysis RevisedДокумент3 страницыTrend Analysis RevisedVandita KhudiaОценок пока нет

- Financial Statement 2020-21Документ7 страницFinancial Statement 2020-21celiaОценок пока нет

- Accounting Chapter 10Документ4 страницыAccounting Chapter 1019033Оценок пока нет

- 2307 NEW PLDTДокумент2 страницы2307 NEW PLDTdayneblazeОценок пока нет

- Salary Slip (00091018 October, 2019)Документ1 страницаSalary Slip (00091018 October, 2019)Alam AfridiОценок пока нет

- B-70/1, SIPCOT Industrial Park, Irungattukottai, SriperumbudurДокумент1 страницаB-70/1, SIPCOT Industrial Park, Irungattukottai, SriperumbudurGuru MoorthiОценок пока нет

- Local Revenue Generation ProgramДокумент3 страницыLocal Revenue Generation ProgramCecille JimenezОценок пока нет

- PDFДокумент1 страницаPDFRajan SteeveОценок пока нет

- The University of Lahore College of Law Fee Structure Fall 2021 Bachelor of Law BallbДокумент1 страницаThe University of Lahore College of Law Fee Structure Fall 2021 Bachelor of Law BallbAli SohuОценок пока нет

- CBP - Form - 434 ROYALДокумент2 страницыCBP - Form - 434 ROYALRaymundo RamosОценок пока нет

- SLM-19615-B Com-INCOME TAX LAW AND ACCOUNTS - 0Документ308 страницSLM-19615-B Com-INCOME TAX LAW AND ACCOUNTS - 0Deva T NОценок пока нет