Академический Документы

Профессиональный Документы

Культура Документы

City Limits Magazine, November 1981 Issue

Загружено:

City Limits (New York)Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

City Limits Magazine, November 1981 Issue

Загружено:

City Limits (New York)Авторское право:

Доступные форматы

'\.

THE NEWS MAGAZINE OF NEW YORK CITY HOUSING AND NEIGHBORHOODS NOVEMBER 1981 $1.50

, ,

, \

. ,

. ."

, /',

, !

. . j

, \ .\

.. .'. il

\ '.,

-, \ '! '

. '.

\ \' .

( './

\\ .

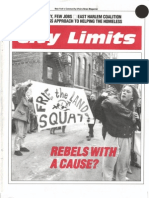

SQUAmRS OR HOMESTEADERS?

Lobbying for Good Repairs

East FlalbushRehabilHation

/ ;ZJI/'

fJ

' "f

' "\'

' I ,"

"t T." : . I ,\

_ ' 0\. / \1, \:"'.

.' ' \

.\

,

" -

Short Term Notes

Smoldering Smoke Detectors

T

HOSE WHO LIVE -IN NEW

York City apartment buildings,

rooming houses and hotels should, by

the New Year, be comforted by the sight

of a smoke detector afftxed to the ceiling

of bedroom or living room. A good deal

of that safe feeling should stem from

City Fire Commissioner Joseph Hyne's

analysis that those detectors would have

spelled the difference between life and

death for 70 percent of those who per-

ished in flres this year.

But that important added protection

could be marred, say some health

advocates, by the type of detector the

owner installs under the new law that

makes them mandatory as of January 1,

1981. Two basic types of smoke detectors

are available on the market: one is based

on ionization and detects the presence of

smoke in the room. The cheaper versions

of this type of detector are susceptible to

being set off by a very smoke-filled

room. The ionization detector also emits

a minute amount of radiation-not

enough from a single u n i ~ to make a dif-

ference to an individual but, as the New

York City Council on the Environment

has noted "any amount of radiation is

too much." The other type of detector is

photo-electric. This unit detects particles

in the air-say from a burning couch or

drapery. Unlike the ionization model it

can't go off from cigarette smoke and it

is totally harmless. It also costs more.

Under the new law, owners can recoup

up to $10 of the expense of purchasing

and installing a detector from each

tenant. Tenants are also responsible for

their upkeep and maintenance which

they should be able to learn from the

manufacturer's instructions that the

owner is supposed to provide.

But what the manufacturers' instruc-

tions for ionized detectors, which most

owners it is presumed will opt for

because of the reduced cost, won't tell

tenants is that these units have a

biological half-life of 200 years during

which time radiation will still be emitted.

CITY LIMITS/November 1981

Nor will it mention that there is no way

to determine if the detector is faulty and

is possibly emitting more radiation than

it should. The ionization detectors are

classifled by the Nuclear Regulatory

Commission as radioactive waste.

"There's no way to see if they will be

properly disposed of," said Jennifer

Brown of the Council on the Environ-

ment.

In a letter to Fire Commissioner

Hynes, the Council raised the prospect

of the accumulation of hundreds of the

detectors in vacant lots where buildings

are demolished, and pointing out that

because of the availability of non-radio-

active detectors, using the ionization

models was unnecessary.

According to one distributor of both

photo-electric and ionization detectors,

Acoman Industries in Long Island City,

the cost difference in the wholesale price

to owners is approximately $5-$6, al-

2

though, depending on the sophistication

of the device, it can be much more.

Landlords, said Shirley Wasserman of

Acoman, will opt for the cheaper models

unless pressured by tenants to buy the

higher-priced photo-electric type.

At hearings ileld by the City Council

last spring on the bill that made the

detectors mandatory for all but one and

two-family homes (even these are not

exempt if they are still in construction or

unbuilt as of January 1) arguments on

both sides of the safety issue produced

scientiflc evidence to boost either a pro-

or anti-ionization detector clause in the

law. But while specialists disagreed about

the radiation threat, there was unanimity

that flre warning devices in individual

apartments were vital and would save

lives.

They were not vital enough, however,

to warrant making the owner's failure to

comply with the new law a 'C' or rent-

impairing violation. When the Council

passed the bill it failed to put the absence

of a smoke detector in the same league

with no heat or a cascading leak. 0

CORRECTION

In our October issue two printing

errors appeared in the article "Public

Housing: Making the Choice" by

William A. Price. The number of

total Boston Housing Authority

public housing units should have been

recorded as 16,500, not 165,000.

At the end of the article, the full

quote from New York City Housing

Authority Chairman Joseph J. Chris-

tian should have read: "We are now .

in a position to incorporate all we

have learned, from our successes and

from our failures, into the design of

housing and communities which will

set new standards . . . Let"us recapture

the crusading zeal which began public

housing-and let us add to this the

hard experience of the years." 0

1

Building a Hole in Fort Green'e

Much to the dismay of the yelping

dogs in adjoining backyards-not to

mention neighbors, the local commun-

ity board and at least one member of

the U.S. House of Representatives-a

city demolition crew recently showed

up at 30 Fort Greene Place in Brooklyn

and, as it's their business to do, built a

vacant lot. The late September execu-

tion of number 30 was efficient

enough; within days, all that remained

of the abandoned three story brown-

stone was a small pile of rubble and a

neatly plowed dirt patch. But the

operation was marred by one small

point: months earlier, Community

Planning Board 2 had requested that

the building be sealed as part of a

hard-fought plan to retain the original

character of Fort Greene Place and two

adjacent blocks.

CONTENTS

Volume 6, Number 9

The major component of that plan is

the new construction of 96 units worth

of federally assisted housing, in the

form of 'ow houses that are to be

consistent with the neighborhood's

older stock, on six vaCflDt lots in the

Tri-Block area. "The whole idea of

infill housing is to fill," Janet Matloff,

Community Board 2 Housing Commit-

tee chairperson told the Daily News.

"Now we have another hole."

The Department of Housing Preser-

vation and Development told the News

that it proposed the demolition earlier

in the year and it was approved by the

Community Board. But both the

Board's records and those of Rep. Fred

Richmond, Democrat of Brooklyn,

who has been involved in the Tri-Block

project, show that local residents never

returned an approval form to let the

ball swing. The razing evi-

dently resulted from a lack of com-

munication between HPD's demolition

and development divisions.

The Fort Greene infill housing proj-

ect is being fmanced with the aid of

federal Section 8 rent subsidy commit-

ments. According to the Tri-Block

plan, the ow and moderate income

families to be housed in the new build-

ings will buy into a cooperative cor-

poration and, all told, will hold a 20

percent share of the properties. It will

be the first such Section 8 subsidized

co-op in the state. And barring any

future mishaps at the city housing

agency, it is hoped the new buildings

will stand for many years to

come. DT.L.

CCITYUMI1S)

Short Term Notes ..................... ! ....... 2

AnUn-FAIRPlan ............................ 4

Market Pr ices for Mitchell-Lamas? .............. 6

Eying an East F1atbush Rehab ................... 8

Alternative Management Plans Merge ............ 12

The Out-of-Towners .......................... 14

Squatters or Homesteaders ..................... 15

A Dim Con Ed Future? ...... ' ................. 18

Lobbying for Good Repairs .................... 20

A Food Project Sets its Thble . . . . . . . . . . . . . . . . .. 22

Coyer pi.oto CRAIG E. BLAIR

3

City Limits is published monthly, except June/July and

August/September double issues, by the Association of Neiab-

borhood Housing Developers, Pratt Institute Center for Com-

munity and Environmental Development and the Urban

Homesteadinl Assistanu Board. Articles in City Limits do not

necessarily reflect the opinion of the sponsoring organizations.

Subscription SlS per year for businesses and sovernment

off'lhds; $9 per year for individuals and community-based

All comsponcience should be addrCssed to:

CITY LIMITS. 424 We 33rd SU'eC!t. New York, N.Y. 10001

(212)

Pt>$tmQ$ter send change 0/ address to: City Umiu. 424 War

jJrd Stret!t. New York, N. Y. I(}()()I

... SeCond.:ciass PQSta8e paid New York, N.Y. 10001

City Limits (ISSN 0199-0(30)

Editor ..... ... , ...... Tom Robbins

Assistant Editor ..................... , .... Ttm Ledwith

Assistant Editor .......................... Susan Baldwin

Business Manager. . . .. . . . . .. . . . . . . . . .. . .. . R.onnie Spence

Design and Layout. ...................... '.' Louis Fulgoni

Copyrighll98J. All rights nserved. Noportion orporti<Jnsqf

this journal may be reprinted withoul the express written per-

mission o/the publishers.

'I."IdI ........ fIIIIdId ................. frvm die New York eo..

.....,,....

CITY LIMITSINovember 1981

State Nixes an Un-FAIR Plan

W

HEN "HIGH-RISK"

property insurance was insti-

tuted in 1968, nobody anticipated

having to worry about what to do with

the profits. The state-sponsored

insurance "pools:' composed of

nUmerous member companies, were

designed to provide basic coverage for

inner city property owners unable to

secure conventional voluntary

insurance. Though rates in these Fair

Access to Insurance Requirements

(FAIR) plans were considerably higher

than conventional rates, it was expected

that the member companies would, at

best, break even on the deal, and pro-

visions were made to subsidize any

operating losses they might incur.

But it appears things have changed:

in late September New York State

Assembly Attorney General Robert

Abrams and Superintendent of Insur-

ance Albert Lewis had to obtain a

court order to stop what they called an

"unconscionable" effort by the New

York Property Insurance Underwriting

Association (NYPIUA-this state's

version of the FAIR plan) to distribute

SS2 million in assets to its member

companies. A joint complaint, filed by

the two officials in state Supreme

Court, charged that the NYPIUA's

move to transfer assets to its 317

members, who would use the funds for

their own investments, endangered the

continued sound operation of the in-

sUJ1lIl,CC association. The court chal-

lenge also charged that the move violat-

ed state insurance and business laws

and could irreparably harm claimants,

policyholders and taxpayers.

Accordina to the challenge, the SS2

million in question came from

NYPIUA investments of policyholders'

premiums, investments enhanced of late

by sky-high interest rates. Representing

a large portion of the Association's

total assets-reportedly $76 million as

of May 31, 1981-the SS2 million

should, said the state challenge, be held

in reserve to cover future claims and

operating expenses. Abrams and Lewis

also asserted that some of the

investment income could be used to ,

lower NYPIUA rates, which are now

, 20 to 40 percent higher than voluntary

insurance premiums.

The law requires that all of the Ass0-

ciation's income, including investment

income, be used to make up for oper-

ating deficits. Transferring any such

income to member companies, it was

charged, would "paint a misleadingly

unfavorable fmancial picture and

artificially create a deficit." Last year

New York State had to ante up S17.S

million to cover alleged NYPIUA

losses. This money came from a state

Security Fund paid by a special tax on

voluntary policyholders' premiums. So

much for "high risk" insurance.

Most AdMIt Role

The FAIR plan f ~ , which has

cast the state Insurance Department in

its most activist,role in recent memory,

. surfaced on September 21 when Super-

intendent Lewis got a one sentence

leltelt from Richard Brueckner, presi-

dent of the NYPIUA, stating that the

multi-million dollar transfer would

occur one week thence, Though DO de-

tails on the causes or possible effects of

4

this siphOning action were provided, it

was later ascertained that it had been

approved, without dissenting votes, at

September 17 meeting of the 13 mem-

ber NYPIUA Boar,d. 10 members of

the Board, the subsequent legal chal-

lenge pointed out, are executives of

member companies that would benefit

from a fund transfer.

On September 23, citing his legal

objections and the Association's failure

to provide background information

about the distribution plan, Lewis di-

rected that the effort be halted. The

next day, Brueckner told the Insurance

Department the transfer would go

through anyway. On the 2Sth, by now

clearly incensed, the 'Superintendent

notified Association officials of a midi-

October departmental hearing to deter-

mine whether disciplinary action was

called for. The temporary court order

blocking the transfer scheme was

secured by Lewis and,the Attorney

General several days later and, pending

a scheduled late October Supreme

Court hearing, the Insurance Depart-

m ~ t hearing was postponed.

As this legal battle wore on, some

community organizations started to re-

examine the FAIR plan's potential for

neighborhood reinvestment. At least

one group, the Northwest Bronx

Community and Oergy Coalition, had

approached the NYPIUA earlier this

year about possible financing. for a

housing rehabilitation project.

The current controversy "really un-

dermines the argument they were using

then," said Jim Buckley, who works

for the Coalition. "They said they

All-Savers

Mortgages?

T

HE FIFTEEN MONTH BUYING

binge for the new All-Savers cer-

tificates was launched October 1 amidst

one of the great advertising drives of

lending industry history. A media blitz to

sell the certificates that offer tax-free in-

terest up to $2,000 was offering some

unprecedented late and evening banking

hours to sweep in new investors.

The dust hasn't settled enough yet to

see exactly how popular the savings in-

struments are, but predictions have been

widespread that total national invest-

ment could wind up doubling the initial

estimate of $250 billion. All of which is

fme for the investors, great for the lend-

ing institutions, who get an enormous

shot in the arm, but a potential problem

for government which could end up with

a tax shortfall twice what it anticipated.

Yet, what about the residential loan-

seekers who, according to the legislation

that created the certificatesas part of the

National Economic R ~ o v e r y Tax Act of

1981, were supposed to be a major bene-

ficiary of the plan? Those looking for

home mortgage loans on single-family

houses, co-ops or multiple dwellings, or

merely home improvement and rehabili-

tation loans were told to look forward to

some relief in the mortgage-parched

lending terrain. Rates could be expected

to drop 2 or 3 points below their present

level, Congress had said, as the lenders

plowed their All-Savers profits back into

the housing loan market.

But, the regulations Congress wrote

into the Act stipulating that performance

were not too well screwed down. Banks

and savings and loans associations were

couldn't do long term lending because

the money would only be around for a

year." He added that the Northwest

Bronx group-which has enjoyed much

. success securing financing for neigh-

borhood projects from conventional

lenders, including insurance companies

-was taken by surprise when news of

told that either the proceeds from the

sale of the certificates during a calendar

quarter or the amount of "new" money

coming into the bank during that

period-the amount deposited above the

transfers made from the now far less

attractive savings accounts and time

deposits-whichever is less, had to go to

these types of loans. .

The regulations leave the banks with a

rather large amount of discretion about

what kinds of loans they will make.

While the lower rate paid to savers on the

certificates helps keep the institution's

costs down there is no guarantee that

savings will be passed on in lower interest

rates.

The Savings Association League of

New York State has estimated that thus

far 20 to 25 percent of the All-Savers

purchases have represented new depos-

its. "If anyone thinks we're going to take

5

the asset transfer broke. "We knew the

FAIR plan made a profit last year,"

Buckley stated, "but we didn't know

anything about this." In light of the

NYPIUA's apparent eagerness to

spread the wealth, Buckley said his

group plans to hold another meeting

with the Association in the near future.

OT.L.

that money and put it in long-term

mortgages when it's only going to be on

deposit for one year, they should think

again," said Ed Kraemer, the League' s

spokesman.

Under the regulations the growth can

be invested in mortgages, but ones that

are far from home.

Iowa's state attorney general felt

strongly enough about where All Savers

dollars were being channeled in his state

to sue 14 out-of-state investment insti-

tutions. Local groups won't have that

kind of clout and will have to work hard

to get even ~ small piece of the All-Savers

action for their neighborhoods. The

regulations also allow the lenders to

decide whether they are living up to their

obligations under the act. There are no

standards to meet and no regulatory

agencies will monitor the use of these

earnings. OT.R.

CITY LIMITS/November 1981

" ' . " i ~ I .. " .... -Lama CO+opS?

T

HERE SEEMS NO LIMIT TO NEW YORK CITY'S

co-op market. Condos and cooperatives, launched all

over town including the unlikeliest of neighborhoods, com-

manding prices for individual apartments that could have

purchased the entire building a few years ago, have captured

whatever there is of a housing market in this city.

But many of the biggest co-op buildings in the city, ac-

counting for some 67,000 apartments in all, haven't been able

to cash in on the bonanza-at least not publicly. Those build-

ings are the Mitchell-Lama cooperatives, the balconied high-

rises clustered in former urban renewal areas and elsewhere

throughout Manhattan, the Bronx, Brooklyn and Queens.

Built as limited profit housing under legislation advanced in

1955 by MacNeill Mitchell in the state Senate and Alfred

Lama in the Assembly, the projects were developed to

provide housing for low and moderate income .families.

Income limitations require families of three or more to earn

no more than seven times their annual rent and six times the

rent for individuals and smaller families. In addition to the

co-ops built under the Mitchell-Lama bill, there are thou-

sands of rentals as well.

Key to making the co-ops affordable were the low purchase

prices, many of them made more affordable by a low interest

loan fund. That fund is long depleted and the rest of the

CITY LIMITS/November 1981 8

Mitchell-Lama subsidy cupboard has been fairly barren for

years, replenished only when year-to-ye;:tT bail-outs are

arranged for the projects.

Meanwhile, the legislature, particularly the Republican-

controlled Senate, has made bail-out money harder and

harder to get. And, at the same time, Mitchell-Lama tenants

have chafed under the resale restrictions that keep the co-op

owners from realizing anything more than the amount they

originally paid, plus their amortization, when they sell.

Now, a plan has been advanced by Governor Carey and

endorsed 'by state housing officials that would allow the

cooperatives to be resold at a market rate while splitting the

profit three ways. Half of the' profit above the owner's

original purchase price and amortization will go to a special

Project Loan Fund to provide energy conservation assistance

'to Mitchell-L,ama developments and to Ieplenish the HOPE

loan fund that would provide loans for the down payments

on apartments. Twenty percent would go to the cooperative

and thirty percent to the seller.

But this plan designed to make all parties happy, including

legislators who would like to be relieved from the yearly bail-

outs, came in for some stiff criticism and numerous sugges-

tions for changes at hearings held by Assemblyman

Alexander "Pete" Grannis, Democrat-Liberal of Manhattan,

in late September. As a result, the sponsors don't expect the

bill to go anywhere in the special session now underway and

before it re-emerges next year in the Assembly it may read

significantly differently from the way it does now. "It just

wasn't the right time for it," said Michael Lenane, housing

specialist for Grannis.

James Garst of the Mitchell-Lama Council, which en-

dorsed the bill as a starting position for negotiations,

characterized comment on the bill as "a wide spectrum of

opinion ranging from unacceptable in context to unaccept-

able in form."

The most thundering opposition came from the

representatives of the Metropolitan Council on Housing who

said the bill spelled not.hin& less than a total retreat from the

kind of low and moderate income housing the Mitchell-Lama

developments represented. That cautionary warning about

preserving the original intention of the state's biggest venture

into subsidized housing was echoed in other testimony but

few others were as inextricably opposed to any easing of the

resale restrictions.

Among those who agreed with the bill's concept but

rejected its particulars was the City of New York which holds

the mortgages on 163 projects and has provided tax abate-

ments to all the Mitchell-Lama developmeQts within its

borders. Housing Commissioner Anthony Gliedman said the

City was interested in recouping some of its tax abatement

investment. The Commissioner promised to develop a

position paper on the subject soon. Other speakers urged a

rearrangement of the split along various combinations so that

either state, owner or cooperative got a bigger piece.

A One-Thne BUp

Sponsors of the bill had no projections of what impact the

bill would have on apartment turnover in the developments,

or what levels prices would reach if uncapped. The bill's pas-

sage would "catalyze decisions to move and sell," said Garst.

But those sales, he said, would be "a one-time blip on the

graph. After that it would flatten out once you've established

a new market price for the apartments."

But wherever prices levelled out that would still be well

above their present cost and out of reach of many, if not most.

of those for whom the housing was originally targeted. Critics

such as the Metropolitan Council have argued that the Gov-

ernor and others are redeeming their own political

investments in the Mitchell-Lama program at the expense of

the program's integrity.

The bill's fashioners counter that present carrying charges

are well below the 25 percent of income used as a basis for

what tenants can afford. Therefore, they say, buyers could

afford to add a purchase money mortgage atop their monthly

rent and still be affordable.

And since part of the projected sales profit is to be plowed

back into a low interest loan fund,they say, lower income pur-

7

chasers won't be shut out. Details of this fund are not yet

worked out and provisions in the bill are markedly vague as

to who would qualify for the loans and how much there

would be available.

If enacted in some form, the of Mitchell-Lama

co-op prices would have varied effects on different projects.

The newest in the program, those on Roosevelt Island already

have rents close to $180 per room. Other projects are located

in such high demand areas that, once offered on the open

market, prices would presumably soon match the astronom-

ical amounts comparable units are

Still the Best Buy

For all their management and construction problems,

Mitchell-Lama projects have long been one of the best buys in

the city. And it has been charged repeatedly that some co-op

owners have found ways to parlay that bargain into sales

prices well above those allowed. The new bill presumably

would put an end to most under the table deals and cut the

state and the cooperative company into the deal as well.

One problem it might not solve, however, is the glaring

racial stratification that has long characterized many

Mitchell-Lama co-ops. At least one massive Mitchell-Lama

co-op, Warbasse Houses in Coney Island, is currently the

target of a federal class action suit charging manipulation of

the waiting lists to keep the development overwhelmingly

white.

"There are still a number of unanswered questions," said

Michael Lenane. "How do you work a limited market price

waiting list with open market sales? Go down the list to see

who can afford it now?" Overall, Lenane said, the question

should be asked, "Is it in synch with the Mitchell-Lama

program to all of a sudden have sales of $90,OOO?"O

CITY LIMITSINovember 1981

East Flalbush Eyes a Project's

RehabilHaflon by Tim Udwitb

V

anderveer Estates, a 30 year old housing complex that

dominates four full blocks and houses . about 10,000

people in .the East F1atbush section of Brooklyn, has been

deteriorating for almost as long as it's been in existence. So

-vhen owner Faymor Realty announced last January that

Vanderveer would get a multi-million dollar shot in the arm,

in the fonn of a federally insured rehabilitation loan for most

of the complex's apartments, many area residents had high

hopes. Hailed as the largest "tenants-in-place" rehabilitation

project ever undertaken in New York City, the Vanderveer

effort, its planners say, won't lead to displacement. Despite

such assurances, some of the development's tenants and

others in East F1atbush are keeping a close watch on the rehab

work itself, and on Vanderveer's chances of remaining a rea-

sonably-priced rental complex.

Known as a "tandem" loan, the $24 million project's

ftnancing arrangement involves banks and federal housing

agencies. Citibank, through its subsidiary Citicorp Commun-

ity Development corporation, is providing a short tenn con-

struction loan to cover costs during the complex's planned

CITY LlMITSINovember 1981 8

one year renovation. After the work is done, the department

of Housing and Urban Development will provide Vander-

veer's owners with long tenn ftnancing, in the fonn of a 40

year, 7Y2 percent mortgage. The mortgage will come from the

Government National Mortgage Association, a HUD-spon-

sored low interest mortgage pool, and is to be insured by the

Federal Housing Administration. It will be serviced by

Anchor Savings Bank.

Over $11 million of the total $24 million Vanderveer loan is

being used to payoff the development's previous mortgage.

The rest, at an average of $6,500 per unit, is for repairs,

including the installation of new heating plants, over 15,000

new windows, and bathroom and kitchen Projected

energy cost savings of 20 percent and a "J-51" city real estate

tax abatement, the plan's sponsors say, will keep rent

increases for current residents at a rnil$num once the

renovation -is complete.

Although Faymor's negotiators originally approached

HUD with plans to rehabilitate the entire Vanderveer com-

plex, the fmancing package had to be placed in a lottery with

proposed loans for other projects around the country. To

improve its chances, the Vanderveer plan was broken ,into

five "blocks." By the luck of the ~ r a w , three were approved.

Ken Patton, a vice president of the giant Helrosley-Spear

real estate firm, helped negotiate the deal and has taken an

active role in managing the rehabilitation work, which began

last spring. Patton describes his role as that of a "facilitator"

trying to "help coordinate the work that needs to be done

among the various parties involved." He believes Vanderveer

"beat the odds dramatically" in the federal lottery . As for the

1,0000plus apartments in the two remaining unlucky. sections,

Patton asserts their renovation will be fmanced "by luck or

wit." He says fmancing plans for the two sections will be

submitted to the next HUD lottery in January. Failing there,

Patton says, a city Participation Loan interest subsidy will be

sought for the rest of the project.

J

udging from the optimism Patton exudes, the odds of

success at Vanderveer seem good, but for many people in

the 59 building complex and the neighborhood of one and

two family houses in its shadow, all bets are still off.

Their skepticism stems at least in part from the complex's

rocky past. Locals say Vanderveer, built by Faymor Realty

in 1949, suffered the effects of inadequate maintenance early

on and in the project's first 20 years, its mostly white tenancy

watched the gradual deterioration that resulted. During a

period of rent decontrol in the early '70s that coincided with

an intense block-busting campaign in East Flatbush, a mass

exodus of long-time Vanderveer residents occurred. By the

mid-' 70s , the complex-like the neighborhood-housed a

primarily black, middle class population.

As the decade advanced, so did Vanderveer's problems.

"It was a pretty common strategy," says Lamar Williams, a

former organizer with the local Neighborhood Stabilization

program \vho worked in Vanderveer. "You move in black

families, decrease services, and play on the racism that's

institutionalized in society anyway." Security became a major

problem at the complex. A management scheme which of-

fered a month's free rent to new residents attracted a

substantial transient population. Rifts between American and

immigrant Carribbean blacks hindered tenant organizing,

Williams recalls. Residents' incomes dropped and the com-

plex's deterioration accelerated.

Neighborhood concern is based largely on

the alleged mishandling of a moderate rehabilitation plan

three years ago, when Faymor negotiated a refmancing deal

with the New York Bank for Savings, holder of Vanderveer's

original mortgage. The 1977 agreement freed up two million

dollars for an itemized list of capital impr.ovements to be

completed by January, 1981 but according to the local Neigh-

borhood Stabilization office and the non-profit Flatbush East

Community Development Corporation (FECDC) , only

$100,<XX> worth of improvements were ever made in the

complex. FECDC has registered complaints with both the

bank and its federal regulator, but neither has initiated action

on the matter.

By the time HUD approved the development's renovation

9

plan early this year, conditions at Vanderveer prompted Phil

Gallagher, an East Flatbush resident and co-chair of the

Brooklyn Committee for Better Housing, to protest the

federal agency's decision. In a February letter to the agency's

Area Office, he acknowledged the protest's seemingly para-

doxical nature, but said the HUD approval, in the absence of

a close look at Faymor's record and ability to handle the

ambitious plan, was viewed by area residents as "controver-

sial at best, and seemingly hasty and ill-considered." The

owners' performance at Vanderveer, wrote Gallagher, had

long been characterized by "terrible management and cal-

culated negligence."

I

n mid-October, FECDC, the Neighborhood Stabilization

office and the Vanderveer Estates Tenants Association

called a meeting to see if the current rehabilitation effort was

faring any better. About 50 tenants attended, and, while it's

clear from what they said that work is well under way this

time around, some of them seemed to wish it wasn't.

Concerns were raised at the two hour session about the

quality of some materials being used in the rehabilitation, and

poor maintenance was an ongoing issue. But the most vehe-

ment complaints involved work scheduling; one resident's

home was reportedly robbed when, without notice, someone

entered the empty apartment at rnid-day to work and appa-

rently left it unlocked. In addition, tenants said, because

CITY LIMITSINovember 1981

safety precautions were lacking, window installation and

other rehab work was hazardous to residents.

Project "facilitator" Patton concedes that "there's been

problems" with some contractors, but insists "the overall

quality of the work is fme."

As the work goes on for better or worse at Vanderveer,

many people who live in and around the development are

genuinely baffled. Why is such an ambitious project being

attempted now, they wonder, after so many years of neglect?

Why has a real estate executive well-versed in cooperative

housing appeared on the scene? Why has Citibank chosen

Vanderveer as its ftrst East Flatbush community development

project? Some of the area's more suspicious residents can't

help looking for clues in neighboring Flatbush, where

Citibank is now ftnancing co-op conversions.

Patton says co-oping at Vanderveer "is not necessarily

precluded" by conditions of the federally-aided rehabilitation

CITY LIMITS/November 1981

10

fmancing, "but it's not intended." As for the possibility of

his own Helmsley-Spear taking the reins at Vanderveer after

renovation is complete, says Patton: " N e v ~ r . " But he adds

that Faymor may soon share or even give up ownership of the

complex. "We're actively looking for a new management

team," Patton acknowledges. "We keep that possibility

open."

Meanwhile, a rehabilitation monitoring committee, made

up of representatives from management, Citibank, FECDC,

Neighborhood Stabilization, and the Vanderveer tenants'

group, continues the fairly regular meetings it began last

spring in order to keep communication lines open. "Some-

body's got plans for Vanderveer that they're not telling us

about," observes Michelle Corbin, executive director at

FECDC and a monitoring committee member. She may be

right, but Corbin, like a lot of other people in and around the

Vanderveer, is doing all she can do while the sawdust flies:

waiting and watching. 0

Getting Aid to 7A Administrators

Getting the judge to replace the land-

lord of a declining building and install a

new manager to try and make things

work solves part of a building's problem

-but only a small part. The next crucial

step involves repairs-usually catch-up

repair work that may be backed up for

months, if not years.

The city housing department provides

a number of tools for these building

managers-or 7 A administrators as they

are called for the section of the law under

which they are appointed. One such tool

is a no-interest "Financial Assistance

Payment" of up to $10,000.

Since 1978 the city has been offering

these loans with terms so reasonable they

are almost closer to grants, but until last

year their success had been limited. Ad-

ministrators have encountered difficul-

ties wading through mounds of paper-

work and also persuading contractors to

do work when the city is paying the

bill-at a time schedule that virtually

always meant months of waiting.

In July, 1980, with assistance from

two private foundations, a new loan fund

was piggy-backed atop the Financial

Assistance Payments program: operating

as a revolving loan pool the program

was to provide administrators with quick

payments once contractors have com-

pleted their work and the job has been

inspected and approved by the housing

department.

As of September 30, 1981, $311,000

had been spent in 7 A-managed buildings

through the program. Another $509,000

in loans has been committed. This buzz

of activity has prompted the Department

of Housing Preservation and Develop-

ment to give the program its own

director, Susan Carr, and a staff of four .

York Community Trust and $10,000

from the Fund for the City.

In spite of the steady growth in

numbers of 7 As using the Financial As-

sistance Payments program-formerly

called 7 A Seed Money-loans have

tended to be clustered, going to buildings

and in Manhattan and the

Bronx.

According to Carr, one reason for this

is that few community groups in

Brooklyn, where only three loans were

made in the first year of the accelerated

loan program, have focused their atten-

tion on getting these funds for buildings.

A number of tenant advocates in the

Bronx and Manhattan, on the other

hand, have been eagerly pursuing the

loan pool, she said.

Another possible reason is that some

administrators and tenant advocates re-

main skeptical of the advantages of the

program pointing out that while pay-

ment of contractors after inspection may

have increased, getting the city out to in-

spect and approve the work is still a

lengthy process. The city has acknowl-

edged this bottleneck and has assigned

an inspection team to focus particularly

on the 7A payments program.

Repayments of the assistance loan are

set according to the building's needs and

ability to pay, said Carr. Paybacks range

.from $50 per month to $400 per month

starting one month after construction is

complete. These rather lenient terms are

an acknowledgement, says Joseph Shul-

diner who heads the housing depart-

ment's unit overseeing the 7A program,

that most of the 7 A buildings will wind

up in the city's hands anyway for back

taxes. "The key," he says, "is to get the

7 A administrator the cash flow he needs

to run the building." 0

Tenants and 7 A administraton can

inquire for more lnfonnadon about the

7 A Financial Assistance Program at

556-7772.

According to a study by the Fund for

the City of New York which adminis-

trates the quick payment program, most

administrators who received an advance

payment from the revolving pool, which

is then later reimbursed by the city, were

able to meet their bills some five weeks

sooner than they would have without the

program. The loan pool originated with

a $40,000 contribution from the New .. ------------------..

Q

11 CITY LIMITSINovember 1981

AHemative Management

Programs Merge By SUSAN BALDWIN

One of a number of experimental programs launched by

the city housing department two years ago to improve

management in city-owned buildings and pave the way for

their sale to tenants or groups is quietly being phased out and

folded into another older program.

The Management in Partnership Program, under which

community groups manage tax-foreclosed residential build-

ings under the supervision of a private management firm, will

gradually be replaced by the sometimes controversial nine-

year-old Community Management program.

The new program will include five groups from the two-

year-old MIPP program, who will be granted a number of

the privileges of the current 14 Community Management

groups for a probationary one-year period.

"Over the course of this year, these MIPP graduates will

merge with Community Management," said Bruce Dale,

director of the rehabilitation bureau for all the alternative

management programs at the city's Department of Housing

Preservation and Development. "Our goal is to tighten up the

performance of all the groups in this division as soon as

possible because we have no idea how tight the Reagan '

squeeze will be. But we do know the bullet will be bit."

Under MIPP, once touted as the most successful alterna-

tive program, community groups wit}1 no experience in

management, rent collection, repairs, and rehabilitation spent

two yJlrs as community-or junior-partners working and

studying under private managers-senior partners-to learn

these skills. Compared to Community Management, MIPP

was considered by many city hall observers to be more cost-

effective because the private companies with track records in

the business world were presumed to be more efficient than

community groups. But one problem MIPP community par-

ticipants cited was the lack of rehabilitative work done. As a

result, they said, the buildings need more intensive repairs

before they can be sold and put back on the tax rolls.

As of October 1, three MIPP graduates-People's Fire-

house in Brooklyn and Banana Kelly Neighborhood Im-

provement Association and the Alliance for Progress, both in

the Bronx-joined the Community Management ranks with

the stipulation that they must work under the scrutiny of one

of the former senior partners-Coalition Management Train-

ing Corporation (CMTC)-in developing repair and rehab

plans. Two other groups-Manhattan Bowery Project in

Brooklyn and the Community League of West 159th Street in

Manhattan-are expected to become Community Manage-.

ment provisionals late in November. They will also report to

CMTC, the management arm of the New York Urban

Coalition.

Two Brooklyn groups-Ministries for Intergroup Action

(MIA) and Crown Heights Management and Maintenance

Corporation (formerly a Community Management partici-

pant)-have been dropped because of irregularities in their

CITY liMITS/November 1981

12

offices. A third-Bronx-based Morris Heights Neighborhood

Improvement Association, also a former Community Man-

agement participant-was also eliminated from MIPP. And a

fourth-STRESS, Inc. in Manhattan, has been reassigned to

Belson Management Associates, a senior partner whose

contract ends in eight months, for more intensive training.

The contract for the last of the three senior partners-Souk,

Inc. (a subsidiary of the Jackie Robinson Management

Company)-expires in November and will not be renewed.

Supervisory Role

A focus of controversy during the summer was the ap-

proval by the city of the CMTC contract before the Board of

Estimate vote in late August. Some community groups were

angered by this promise of a consultant contract to CMTC,

noting that normal procedure would call for them to enter the

competitive bidding process. After some debate, the Board

did approve them as a demonstration project for six months

at $196,000, not the $500,000 originally requested, with the

proviso that they must be reviewed in the next three to four

months. Their contract began October 1.

"We have just so much money to spend [$322,000] and 100

units to rehab," said Ron Webster, head of the People's

Firehouse management program. "We'll probably

concentrate [the funds] where the tenants )Vant to buy the

buildings. But face it, if we have to spend $10,OOO-a-unit to

fix up a building, then we're only talking about rehabbing 30

apartments. "

The MIPP rehab contracts fall into the more modest cate-

gory of the People's Firehouse, while the more' established

ones amount to $1 million or more with the highest being $1.8

million. The total Community Management contract for this

year comes to $17,841,50l-a figure that includes the

Community Development allowance ($13,912,021) and esti-

mated rent collections ($3,929,490).

Harry DiRienzo, of Banana Kelly, is less optimistic about

the program. A graduate of MIPP under CMTC's tutelage,

he asserted, "There has already been too much overlapping

and waste. MIPP shouldn't have lasted two years. Two

months would have been more like it. And now before any-

thing happens, any work is done, we're being asked to re- .

structure rents-for some apartments at $65-a-room. That's

too much for the people up here, and we won't collect it until

the Section 8 [federal rent subsidy] is in place to cover the

increases. "

"For some of these places here," DiRienzo continued,

"the initial jump they want in rent is from $160 to

$350-a-month all in one shot. I know we wouldn't have got-

ten into Community Management without being in MIPP.

This was politically helpful, but we just won't evict people for

nonpayment of these rents. It's against our principles regard-

ing shelter."

little as a 3O-day turn-around period.

According to Dale, the MIPP and Community Manage-

ment staffs will probably be merged within the next six

months. In the meantime, Denise Caldwell, a former

Community Management coordinator and director of MIPP,

is making firm contract commitments between CMTc' and

the MIPP graduates in an effort to get work carried out in as

"We've had complaints from tenants about their b ~ d i n g s

while in MIPP, and they're absolutely legitimate," she ex-

plained. "We are not going to make these people buy their

buildings before they're ready for sale, and we're not going to

leave the graduate groups holding the bag for work that is not

done." 0 .

Thousands

Seek

Harlem

Brownstones

More than 5,000 applications have

been sent by the city housing department

to city residents who have shown some

interest in the 12 vacant landmark

brownstones in Harlem that are to be

sold by lottery sometime in December.

The deadline for applying was October

21.

The proposed upset prices for the

buildings range from as low as S5,000 to

$42,000 for a fashionable late 19th cen-

tury structure designed by Stanford

White on Strivers Row on West 139th

Street.

Minimum household income for qua-

lifying must be S20,OOO-a-year. Lottery

participants must present proof of

income in the form of tax returns or W2

forms in order to enter the lottery. But

the Department of Housing Preservation

and Development has said that incomes

of $40,000 to S50,000 would be pre-

ferable as families in this income bracket

would have an easier time handling the

expense of carrying the proposed

2O-year, low-interest loan and mortgage

costs. HPD has reserved S1 million from

its old Section 312 funding-federal one

percent construction loan funds-to

cover this pilot project.

Following an outpouring of Harlem

residents opposing the lottery at a stormy

July meeting, the l30ard of Estimate vot-

ed six to five in favor of the lottery plan

with the stipulation that residents of

Manhattan Community Boards 9 and 10

where these properties are located would

have their names placed in the lottery

pool three times, while outsiders' names

would only be entered once. Also, a resi-

dent must rehabilitate the property with-

in a two-year period and live there a min-

imum of three years before reselling it.

"We are not happy with the decision,

but it went through and we can't stop it

now, but we certainly can monitor it,"

said Lois Penny, a local homeowner and

leader of the Anti-Lottery Committee

that attempted to block its city hall ap-

proval. "And you better believe we'll

13

know whether it's a fair lottery," she

added. "We're t finished yet. We cer-

tainly are not lying down and playing

dead."

The lottery foes see the auctioning of

these 12 vacant brownstones as the be-

ginning of a possible major displacement

movement in Harlem where the city is

estimated to own somewhere between

7,000 and 12,000 properties, many of

which are occupied.

Two of the vacant brownstones are in

the Community Board 9 area, while the

remaining ten are located in Board 10's

territory. The thirteenth building that

was scheduled to be sold in the lottery

was redeemed by the original owner, but

the city had no record of this transaction

until several weeks ago.

Both the local Den:lOcratic Council-

man Fred Samuel and the Congressman

Charles Rangel "enthusiastically" sup-

port the lottery as well as future sales in

Harlem. 0 S.B.

CITY LIMITS/November 1981

,

Rent Complaint Board:

The Ouf-of-Towners

The 'Conciliation and Appeals Board,

responsible for enforcing the rent stabil-

ization law in about 800,000 New York

City apartments, is frequently cited by

stabilized tenants as one of the weakest

links in a generally weak regulatory sys-

tem. CAB members and staff blame the

Board's shortcomings on chronic under-

funding and short-staff mg. Its landlord-

funded sponsor, the Rent Stabilization

Association, was in fact charged by the

state Attorney General in June with

failing to adequately fmance the enforce-

ment agency. Others, including the New

York State Tenant and Neighborhood

Coalition, an organizing and lobbying

group, have attacked the system's per-

formance on the grounds that it is

influenced more by political machina-

tions than any intention to provide

sound tenant protections. In an illustra-

tion of this point, NYSTNC has charged

that at least two CAB members live

outside New York City, in violation of

the Public Officers .Law. According to

the Coalition, these and other Board

members, mayoral ap intees all, were

chosen on the basis of their political ties.

"It's not a bad deal-$15,000 a year for

one afternoon a week," NYSTNC

spokesman Bill Rowen said of the CAB

positions. "These are patronage plums."

Tenant and Landlord Members

The two members charged with violat-

ing residency requirements are Marc

Goodman representing tenants and

Frank Barrera, a landlord representative.

The nine member Board is equally split

between owner and renter members,

along with a Chairman. Goodman, an

accountant and former president of

School Board 11 in the Bronx, has served

on the CAB since 1974. Barrera, a real

estate attorney who has worked for the

Brooklyn and New York State Boards of

Realtors, has been on the CAB since

1969 and is said to be planning to leave

the agency at year's end.

Goodman is listed in the Bronx

telephone directory with a CO-OD City

CITY LIMITS/November 1981

address, but could not be reached there

in repeated calls. His wife was reached at

a New City number listed, in her name,

in the Rockland County directory. After

some hesitation, Mrs. Goodman said her

husband didn't live in New City and

supplied the Bronx listing. In August

Goodman told the Westsider he owned

"a vacation horne upstate," insisting

that he voted and paid taxes in New York

City. But according to Bill Rowen, who

heads the NYSTNC Tenant Protections

Committee that raised the residency

issue, "Everybody in the Democratic

organization in the Bronx knows he

doesn't live in the city."

Barrera, reached at a Garden City,

Long Island number and queried about

the NYSTNC charge, conceded: "No, I

don't live in New York City."

utters to Koch

The residency issue was raised by

Rowen in a series of three letters to

Mayor Edward Koch sent in March,

May and August, all of which ques-

tioned the two members' legal status in

light of the Public Officers law, which

requires that such positions be filled by

city residents. The letters also pointed

out that four of the Board members'

four year terms, including those of

Goodman and Barrera, officially expired

on December 31, 1980, but the members

have been allowed to remain. Rowen

urged that tenant organizations be pro-

vided the opportunity to recommend

new appointments.

On August 14, shortly after the third

letter was sent, Rowen and the NYSTNC

committee got their frrst response from

City Hall, in the form of a letter from

Deputy Mayor Nathan Leventhal with

an attached opinion from the city

Corporation Counsel. The opinion said

CAB members are indeed mandated to

live in New York. Leventhal stated in his

letter that, in 'light of the legal opinion,

"all candidates for appointment to the

CAB will be required to be New York

City residents." Leventhal stated there

was nothing illegal about members serv-

14

ing beyond their terms' expiration.

While stressing that Board decisions

were legally valid even if some members

violated the residenc requirement,

Leventhal added that he had asked CAB

Chairman Emmanuel "Wally" Popoli-

zio (who hails from the mayor's Green-

wich Village club) to find

out whether any current members lived

outside the city. Anybody found to be in

violation of the law, 1!.eventhal wrote,

"will no longer be allowed to serve. I

assure you," he concluded, "that deter-

mination will . be made within the next

few days." Goodman and Barrera

are still full- fledged CAB members.

In order to reappoint Board members

whose terms have expired or will expire

at the end of the year, and to appoint

replacements for as many as four

members who may be the CAB,

the mayor will soon submit recommen-

dations to the City Council Rules Com-

mittee. After that committee holds

preliminary hearings, the matter must be

referred to the full Council for con-

firming vote.

The Rules Committee hearings,

Rowen said, will provide tenants with an

opportunity to challenge improper ap-

pointees and relate "CAB horror

stories" to Council members. NYSTNC

and other tenant groups have long

assailed the Board for failing to fulfill its

lawful responsibilities. Major complaints

have included the CAB's inability,

and! or reluctance, to closely monitor

services in stabilized units, compel

owners to inform new tenants of previ-

ous occupants' names and rent levels,

and handle rent overcharge complaints

in a timely, effective way.OT.L.

Lower East Side Tenants:

SQUAmRS OR HOMESTEADERS? By Tim Ledwith

O

UTSIDE, IN THE LATE MORN-

ing sun of October 20, a fresh coat

of paint dried on the street level facades

of the solid looking Lower East Side

buildings. Inside, in a crowded living

room turned tenants' office, members of

the 272, 274 and 278 East 7th Street

Tenants Association met with friends

from the community to talk about the

three city-owned buildings' uncertain

future. Residents told of their two-front

battle against years of neglect in the

buildings and a current effort by the city

housing agency to evict them. As the

story unfolded, the gathering of.50

seemed to become convinced that its

eventual outcome will bode well or badly

not only for the occupants themselves,

but for the fate of Loisada, as their

neighborhood is called, and the lot of in

rem tenants in neighborhoods all over

New York.

While a gas range flared to warm the

crowd, the East 7th Street tenants

announced a plan to put the heat on their

municipal landlord. They demanded in a

press release distributed at the meeting

that the Department of Housing Preser-

vation and Development sue the City of

New York for failing to provide essential

services in the buildings, located between

Avenues C and D. The demand drama-

tized the tenants' contention that, in the

absence of responsible management on

the city's part, the three buildings have

survived only through residents' home-

steading efforts. "If it wasn't for tenants

maintaining the property, " charged

tenant spokesman Rolando Politi, "this

place would have been gone long ago."

Liz Gonzalez, the East 7th Street resi-

dents' legal aid attorney, added that an

"Article 78" proceediQg would be

instituted against the city for its handling

of the three buildings since May, 1978,

when they were foreclosed for tax ar-

rears. Gonzalez said the legal action,

which is used to challenge local govern-

ments to follow their own mandated

rules and regulations, would essentially

be based on "the fact that they took over

15

. ~ .

~ ' 1 ~ _

,. t_

- .

CITY LIMITS/November 1981

properties that were in bad shape and

made them much worse by not doing

anything with them." To emphasize the

point, she produced three HPD compu-

ter print-outs listing housing code

violations found in the buildings over the

last three years; unfolded, each was

several feet long.

Two days after the meeting, while 22

of the occupants were scheduled to ap-

pear in Manhattan HousQlg Court on an

eviction proceeding brought by the city

housing agency, Article 78 papers were

med in state Supreme Court. The ag-

gresSive legal strategy's immediate effect

was to postpone the eviction case for two

weeks. At month's end, the Supreme

Court case was still pending.

Legal Scramble

The late October legal scramble

marked anew, decisive phase in the East

7th Street properties' tumultuous recent

history. The buildings went in rem after

years of declining services, deterioration,

suspected arson, landlord-tenant struggle

and changing ownership-forces that

frequently pave the way to abandon-

ment. After tax foreclosure, HPD

informed the tenants they would be re-

located and the buildings closed down as

part of the agency's "consolidation"

program for city-owned property. But

here communications appear to have

failed: legal tenants were still in the

buildings when water service was cut off

in two of them, and code violations went

unrepaired. As setvices declined, so did

occupancy. According to current resi-

dents, the number of tenanted apart-

ments plummeted from 62 (of a total 72)

in January, 1977 to as few as 10 two

years later. By late 1980, the situation on

East 7th Street reached such a drastic

point that the housing committee of

Community Board Three recommended

the properties immediately be put up for

auction by the city.

Meanwhile, new residents were begin-

ning to take over units in the three

buildings. Though progress was slowed

by internal dissension fostered by the

vagueries of ownership and control, by

early 1981 the occupants were expanding

their ranks and some repair work was

under way. Tenants association members

say they removed four tons of debris

from the buildings and unclogged a

CITY LIMITS/November 1981

backed-up drainage and sewage system.

On February 8, a bank account to

cover operating and repair costs was

opened by the association, and residents

started paying into it monthly rents of

$100 per unit. By I the end of June,

recognizing the tenants' progress, the

community board reversed its previous

stance, voting to support the tenants'

request that HPD spare their buildings

from the auction block and let them into

the Department's Tenant Interim Lease

program (TIL, an in rem alternative

management program, offers tenants an

11 month lease and some money for

building system repairs, and is intended

to lead to the purchase of apartments by

low income residents).

On July 9, the city housing agency told

Community Board Three the East 7th

Street properties wouldn't be admitted to

the interim lease program and, because

new occupants were ineligible for reloca-

tion under the consolidation program,

they would be evicted. As summer

passed without litigation being initiated

1R

against the occupants b HPD, the ten-

ants association sought a meeting on the

matter with Housing Commissioner

Anthony GlieclIDan. In an October 3 let-

ter to tenant representative Politi,

Gliedrnan nixed the meeting request,

saying his understanding of the East 7th

Street situation was that two of the

buildings had already beep closed due to

poor conditions and the third was "in

the process of being closed."

As for their prospects of entering any

government-aided rehabilitation pro-

gram, the commissioner indicated the

three buildings would require work the

city can no longer afford. Though he

cited the "revitalization of empty deter-

iorated buildings" as matter of high

priority for this Agen , " Gliedman

said "the amount of [section 8] funds

available for the gut rehabilitation of

buildings has been cut drastically by the

federal administration." He suggested

the East 7th Street tenants might submit

proposals for the housing agency's

Urban Homesteading an Sweat Equity

programs next year, cautioning that

"this will be a highly competitive City-

wide competition.'"

Eviction

Confmning HPD's previously stated

intention to clear out occupants,

Gliedman added that "the only remain-

ing tenants, with one or t""o exceptions,

are not legal tenants and are being evict-

ed by this Agency."

The tenants flatly reject the implica-

tion that they are squatters, describing

their membership which the association

puts at around 70, as a mixture of home-

steaders, legal tenants and self-help

developers. "Squatting is an insulting

term," said tenant Politi,

who has lived on East 7th Street since

last winter. "It sounds like you're sitting

here doing nothing. We are doing preser-

vation and development here. " The

HPD position fails to consider that

point, he charged. "They're just

thinking in terms of dollars once again."

That charge is echoed by other resi-

dents, who say a drift toward gentrifi-

cation in Loisada is being encouraged by

housing agency Policies. Said Denise

Miller, who has lived in one of the East

7th Street buildings since February:

Supporters and tenants gather at East Seventh Street buildings meeting.

"This place is crazy with speculators.

- The city wants to sell the buildings to

someone big." Decision-making power

on questions of in rem auctioning,

consolidation and rehabilitation assist-

ance, another resident added, "needs to

be given to people in community groups,

community boards and community

management groups."

. The case's broader implications ap-

parently haven't been lost on

hood activists in the Lower East Side and

elsewhere: 46 housing, civil rights,

church and political organizations gave

their support to a position statement re--

leased by the East 7th 'Street group in

early October; following the October 20

meeting, numerous organiZations joined

the residents' Article 78 proceeding as

"friends of the court."

While that case was pending in Su-

preme Court in late October, and all

other legal action involving the three

properties remained on hold, so did

major repairs in the buildings. If the

tenants are able to stay in place, the work

ahead will be major: the buildings need

extensive roofmg, plumbing and' heating

system overhauls. A city estimate placed

the prospective renovation cost at

17

$300,000 per building. The occupants,

who recently commissioned an architect

to do their own estimates, believe they

can make the repairs for half that

amount. .

Such questions, the occupants con-

tended even as the legal battle wore on,

could best be resolved through an out of

court settlement with the city housing

agency. "TherC:s still no open commun-

ication with Gliedman's office:" Politi

lamented. Efforts like those of the East

7th Street tenants, he added, constitute

"an alternative for poor people and the

city itself, but they don't want to recog-

nize it."D

CITY LIMITSINovember 1981

'.

...... ,_ .. 'I'

,.'

"

; ...

-

'}

.. IIr

A Panel Sees a Dim Con Ed Future

T

WO-AND-ONE-HALF-YEARS

after- it was formed to seek solu-

tions to New York City's astronomical

energy costs, a study panel has reached

an unpublicized and unheralded deci-

sion, The Public Utility Review Board

voted 5 to 3 last June that the logical

step was to have the state's power

authority take charge of the generating

and transmitting equipment currently

owned and operated by Con Edison.

The difficulty the Board had reaching

that decision may be a good indication

of how difficult it will be to achieve

that goal, ,

PURB was created by resolution of

the New York City Council in late 1978

to study methods of providing electri-

city at the lowest feasible cost to New

Yorkers. The PURB bill would have

passed several weeks earlier but the

Majority Leader's staff had misplaced

the stenographer's copy of the legis-

lation, apparently the only copy in

existence. Recovering from that set-

back, the City Council leadership, not

yet nationally reknowned as an archi-

tect of balanced political bodies, used

its formidable gifts to sculpt a Board

CITY LIMITS/November 1981

By RICHARD SCHRADER

impervious to political or economic

leverage.

Among the initial nine board

members were vice presidents of both

Con Ed and the Long Island Lighting

Company, the Executive Director of

the New York Chamber of Commerce

and the president of a gasworks local

whose members stood to lose their

rights to strike 'if the utility were

publicly owned. Within the six

months of PURB, the Con Ed repre-

sentative asked that the Board be

dissolved, Eugene Mastropieri, the

chairman of the council committee that

designed PURB was indicted for fraud,

embezzlement and conspiracy, PURB

stationary was printed after arduous

negotiating with Majority leader

Thomas Cuite and the Rev. Morton

Van Allen, PURB's first chairperson,

resigned in anguish after he too,

suffered indictments for fraud, embez-

zlement and conspiracy. Rev. Van'

Allen went to jail (having just con-

cluded an introductory Business Ad-

' ministration course at Harvard),

Councilman Mastropieri took leave of

his council seat, and Mr. Cuite, ever

18

attentive to matters of s tecraft,

assigned his staff in the rovision ,of

legal and secretarial service to PURB.

Martin Seham, the leg counsel for

the Owners Commitee, a.tt association

of large commercial bull . g owners

including the

l

Empire Stae Building

and Rockefeller Center, ecarne the

new chairman. Theodore Barry and

Associates were selected t prepare Part

One of the study, "Caus s of High

Electric Rates." Barry atfHbuted the

major causes of hig}} electricity rates in

New York to: a low load factor, bur- ,

geoning underground dis 'bution costs,

higher local taxes and fue costs. In

July, 1980, the Board awarded Barry

the contract for the secon half of the

study, "Economic,Electri Supply."

The law firm of Berle Bu ell and Case

was hired to study meth of aiding

low income customers through rate re-

form and direct as'sist&nce programs.

, Members of POWER (feople Out-

raged With Energy RateS) the coalition

of church, tenant and senibr citizen

organizations that origin y lobbied the

Review Board bill throu the City

Council, testified before tHe PURB

concerning a wide range of energy

matters. Slowly, painstakingly, all the

disparate fragments of New York's

energy policy began to assume more

coherent patterns. Before many alterna-

tive scenarios, be it conservation,

cogeneration, recycling, equalized rate

schedules or future methane produc-

tion, stood Con Edison's intricate

ftnancial arrangements. Each policy

possessed a dazzling array of uncer-

tainties, some fraught with troubling

ftscal implications. But only those

investments that enhanced the Com-

pany's earnings per share, price/

earnings ratios and stockholder divi-

dends received serious attention from

company management or utility regula-

tions. And always, those plants that

were most capital intensive, ftt the

taxing needs of the company's account-

ants and lent itself to centralized

construction spurred management

enthusiasm. To replace 5,000 mega-

watts of power in the early 1990s-

nearly half the installed

Ed envisioned building on the banks of

the Hudson in Ulster County four coal

plants and resurrecting the ghost of

nuclear power. The entire tab would

run to $20 billion.

T

HEODORE BARRY'S PART

Two forgot its meatier predeces-

sor. Load factor and distribution

network were curiously absent from the

new text. Instead through a series of

convoluted graphs, the engineering ftrm

sought to stir rather tired waters: re-

lieve the Company's property tax

burdens, waive the prohibition on coal,

and remove any remaining restraints on

Con Ed's right to shower the city be-

neath a rain of sulfur oxides, particu-

lates an4 carbons of all varieties.

POWER had raised the issue of

public power early in the Board's

deliberations. In this context, public

power came to mean an acquisition of

the Company's 'generation and trans-

mission system by the Power Authority

, of the State of New York (P ASNY) a .

utility that already supplies

electricity to the MT A, municipal

hospitals and most city buildings.

P ASNY hardly offers a haven for

those who would trod the soft path;

proud owners of the Indian Point III

MEMBERS OF THE PUBUC

UTILITY REVIEW BOARD

Martin SebalD Chair-legal counsel

for the Owners' Committee, an asso-

ciation of large conunmercial building

owners.

Edward Livingston-Con Edison

Vice-President in charge of Commun-

ity Relations.

Amalia Betanzos--President of the

Wildcat Corporation, a job training

agency that places ex-offenders.

Ira Freibeher-Lilco Vice President.

Robert Emerick-President of

POWER, a coalition of church, tenant,

trade union and senior citizen organi-

zations.

Charles Hughes-President of Local

372, District Council 37, American

Federation of State, County and Muni-

cipal Employees.

William Kirnme-President of Local

101, Transport Workers Union.

Rev. Floyd Flake-Baptist minister

from Jamaica, Queens.

Donald Moore-Director, N. Y.

Chamber of Commerce.

nuclear factlity in Peekskill, the agency

most frequently dons the corporate veil

as submissive business partner to more

assertive investor-owned utilities. Still,

cogeneration, hydro, and conservation

programs have all received open

responses from the agency.

PURB's fmal recommendations came

at a stormy meeting last June. The

usual banter ensued: predictable out-

bursts by Con Ed, coupled with yet

another suggestion to dissolve the

Board; windy diatribes' by consUmer

advocates and antagonists alike; and

overall, a faintly veiled hostility

between the utility representatives and

everyone else.

After the endless debates, the scores

of charts and numbing statistics, after

the meticulously prepared testimonies,

the calculation of advantages, the cir-

cuitous investigation of risks, through

that murk only a single thought pos-

.sessed much clarity: a future with Con

Ed meant only more rate increases,

degraded environments, abused

I 19

customers and disastrous mishaps. So

PURB spoke with the bifurcated con-

sciousness that the City Council had

given it. Burn coal, slash the fuel use

and gross receipts tax but Con Ed

should no longer be in the business of

generating or transmitting electricity.

When Seham of the Owner's Commit-

tee cast the ftfth and deciding vote for

a PASNY takeover calling the

Authority a "last, best hope" PURB

moved the city and state nearer than

ever before to closing down the Com-

pany's franchise. j

The resolutions must still clear Mr.

Cuite's City Council, then steer

through the goblins in Albany. And

P ASNY has all manner of protest. But

public power has never come this far in