Академический Документы

Профессиональный Документы

Культура Документы

Corporate Governance

Загружено:

Arif ArshadИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Corporate Governance

Загружено:

Arif ArshadАвторское право:

Доступные форматы

CORPORATE GOVERNANCE Ever wondered about the role car brakes play in giving confidence to the person in the

drivers seat? If it is not for this confidence, the driver would never put his foot on the gas pedal to speed up the car. If it is not for this confidence, he may not drive at all. Think of the car as a corporate entity and the brakes as corporate governance. Corporate Governance provides similar confidence to investors. Without this confidence companies cannot flourish. If it is not for this confidence, the investors (shareholders) will not buy shares in companies. The aim of corporate governance principles is to ensure that company is governed and run in the interest of shareholders (the investors). This assurance is important due to the separation of ownership of a company from its control; the company is owned by the shareholders, but run and controlled by the management (directors). Without corporate governance principles there is a risk that the directors may run the company in their own interest instead of shareholders, for instance by paying themselves high salaries, or by manipulating financial performance and paying themselves high bonuses, by hiring Yes-men who act as rubber stamps to their decisions.

Before we move on to corporate governance principles, let us first understand the composition of the board of directors of a company. What does the board of directors look like? This is how the composition of board looks like:

In the eyes of law, a person is a director if he attends board meetings and joins the decision making process of the board. The articles of association of a company give the board the power to appoint one of them as the Chairman of the board. The chairman is the leader of the board and takes charge of board meetings and general meetings such as the AGM. The articles of a company also give power to the board to appoint one or more people from the board as Managing Director (also called CEO). The managing director assigns specific responsibilities to the members of the board, for instance the responsibility of looking after the finances, IT, operations, etc. The directors assigned with specific responsibilities look after the day-to-day running of the business in relation to those responsibilities and are called executive directors. Although the executive directors report to the managing director in their role as executive director, as members of the board, they all work together and take decisions collectively at board meetings, such as approving accounts and proposing dividend. This is how the structure looks like at board meetings when decisions are taken collectively:

What is the difference between Executive and Non-Executive directors? Executive directors are those directors who have management responsibilities in the company for instance the finance director. Managing director is also an executive director. A non-executive director is a director without the responsibility of any management function, i.e. without an executive role. Although they do not take part in executive functions, they have the same powers and responsibilities as directors. They are appointed for various reasons. The first reason is that they have experience and knowledge which should help the board make better decisions collectively. The second reason is that they can act as a check on the powers of the executive directors and make sure they are not running the company in their own interest. The third reason they are appointed is to carry out certain tasks that the executive directors should not. Examples include acting as members of remuneration committee and audit committee. Acting as members of remuneration committee they can decide the salaries of executive directors. This will make sure the executive directors do not misuse their powers and pay themselves high salaries. Being a part of the audit committee they will make sure that the auditors are independent and do not yield to management pressure to give a clean audit report. This will ensure that the directors do not manipulate the financial information for their own interest. Example The directors may keep the books open at the end of an accounting period. This means that January sales are recorded as December sales. When this happens, the financial statements include inflated revenues and assets (receivables/cash). If the auditor is not independent, he may collude with the management and give a clean audit report. The non-executive director will make sure that the auditor is independent. The presence of a non-executive director in the audit committee will deter such a thing from happening. This is what the picture might look like for an organization without an audit committee:

Remember: Appointing non-executive directors is not a requirement of law but represents best practices. Are corporate governance principles voluntary or compulsory? In UK, although some of the principles of good corporate governance are a requirement of law most of them are voluntary. Combined Code The combined code is a voluntary code of best practices in corporate governance. Although the code is intended for listed companies, other companies are encouraged to adopt it. Listed companies must comply with the provisions of combined code. If they do not comply, they should state a reason for non-compliance. All listed companies are required to do this. Following are the broad principles of combined code: The board The principle states that every company should have a board that should be responsible for setting the strategic direction of the company and that each board should have Non-Executive Directors who should be responsible for the following: 1. Checking the integrity of financial statements. 2. Deciding the remuneration of executive directors. 3. Hiring and firing executive directors. Chairman and Chief Executive The chairman is responsible for running the board and the chief executive is responsible for

running the company. There should be a clear division of these responsibilities. These roles should not be exercised by the same person since this would give unquestioned powers in the hand of one man. Also, the CEO should not after retirement become the chairman of the company. Board Balance Atleast half of the board should be comprised of independent non-executive directors. Appointments The appointment of non-executive directors should be the responsibility of nomination committee which should be comprised of independent non-executive directors. Information The board should have access to information to make timely decisions. Performance evaluation There should be an evaluation of the board and the individual directors each year. Remuneration Remuneration of directors should be high enough to attract directors of sufficient caliber, but not excessive. A significant proportion of the remuneration should be linked to company performance. Financial Reporting The board should state in the annual report its responsibility for preparing accounts and the fact that the business is a going concern. Audit Committee The audit committee should consist entirely of independent Non-executive Directors. The committee should be responsible for the following: 1. 2. 3. 4. Monitoring the integrity of financial statements. Keeping an eye on auditors independence. Making recommendations for appointment, removal and remuneration of auditors. Deciding whether non-audit work should be given to auditors.

Relations with shareholders Since the contact of the shareholders will be mainly with the Chairman or Managing Director, the chairman should ensure that the views of the shareholders are communicated to the board.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- LR Approved Manufacturers of Steel Castings 100104 PDFДокумент41 страницаLR Approved Manufacturers of Steel Castings 100104 PDFmaxwell onyekachukwuОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Annex 2 List of Resolutions Adopted by The SOLAS ConferencesДокумент2 страницыAnnex 2 List of Resolutions Adopted by The SOLAS ConferencesRaj GraffitiОценок пока нет

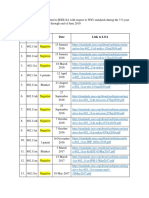

- WiFi LoAs Submitted 1-1-2016 To 6 - 30 - 2019Документ3 страницыWiFi LoAs Submitted 1-1-2016 To 6 - 30 - 2019abdОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- (Complaint Affidavit For Filing of BP 22 Case) Complaint-AffidavitДокумент2 страницы(Complaint Affidavit For Filing of BP 22 Case) Complaint-AffidavitRonnie JimenezОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- MIH International v. Comfortland MedicalДокумент7 страницMIH International v. Comfortland MedicalPriorSmartОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Ang vs. TeodoroДокумент2 страницыAng vs. TeodoroDonna DumaliangОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Bdo Cash It Easy RefДокумент2 страницыBdo Cash It Easy RefJC LampanoОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- CH05 Transaction List by Date 2026Документ4 страницыCH05 Transaction List by Date 2026kjoel.ngugiОценок пока нет

- Business Plan V.3.1: Chiken & Beef BBQ RestaurantДокумент32 страницыBusiness Plan V.3.1: Chiken & Beef BBQ RestaurantMohd FirdausОценок пока нет

- Full Download Introduction To Brain and Behavior 5th Edition Kolb Test Bank PDF Full ChapterДокумент36 страницFull Download Introduction To Brain and Behavior 5th Edition Kolb Test Bank PDF Full Chapternaturismcarexyn5yo100% (16)

- Bantolo V CastillonДокумент3 страницыBantolo V Castillongoma21Оценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- NHA V BasaДокумент3 страницыNHA V BasaKayeОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Midnights Children LitChartДокумент104 страницыMidnights Children LitChartnimishaОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Architect / Contract Administrator's Instruction: Estimated Revised Contract PriceДокумент6 страницArchitect / Contract Administrator's Instruction: Estimated Revised Contract PriceAfiya PatersonОценок пока нет

- PILMICO-MAURI FOODS CORP V CIRДокумент18 страницPILMICO-MAURI FOODS CORP V CIRhowieboiОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- SPF 5189zdsДокумент10 страницSPF 5189zdsAparna BhardwajОценок пока нет

- Grande V AntonioДокумент17 страницGrande V Antoniochristopher1julian1aОценок пока нет

- Wind River Energy Employment Terms and ConditionsДокумент2 страницыWind River Energy Employment Terms and ConditionsyogeshОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Business ValuationДокумент5 страницBusiness Valuationvaibhavi DhordaОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Criminal Procedure (Identification) Act, 2022 A Constitutional CritiqueДокумент28 страницThe Criminal Procedure (Identification) Act, 2022 A Constitutional CritiqueArunОценок пока нет

- SAP PST Keys ReferenceДокумент8 страницSAP PST Keys ReferenceMilliana0% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Arbitration ClauseДокумент5 страницArbitration ClauseAnupama MahajanОценок пока нет

- Chapter 1Документ25 страницChapter 1Annie Basing-at AngiwotОценок пока нет

- 18.2 Gargallo vs. DOHLE Seafront Crewing August 2016Документ10 страниц18.2 Gargallo vs. DOHLE Seafront Crewing August 2016French Vivienne TemplonuevoОценок пока нет

- Yanmar 3TNV88XMS 3TNV88XMS2 4TNV88XMS 4TNV88XMS2 Engines: Engine Parts ManualДокумент52 страницыYanmar 3TNV88XMS 3TNV88XMS2 4TNV88XMS 4TNV88XMS2 Engines: Engine Parts Manualshajesh100% (1)

- Bus Ticket Invoice 1465625515Документ2 страницыBus Ticket Invoice 1465625515Manthan MarvaniyaОценок пока нет

- Ultra 3000 Drive (2098-In003 - En-P)Документ180 страницUltra 3000 Drive (2098-In003 - En-P)Robert BarnetteОценок пока нет

- Fraud Detection and Deterrence in Workers' CompensationДокумент46 страницFraud Detection and Deterrence in Workers' CompensationTanya ChaudharyОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- United States v. Samuel Roth, 237 F.2d 796, 2d Cir. (1957)Документ49 страницUnited States v. Samuel Roth, 237 F.2d 796, 2d Cir. (1957)Scribd Government DocsОценок пока нет

- Lee Vs SimandoДокумент10 страницLee Vs SimandoAJ SantosОценок пока нет