Академический Документы

Профессиональный Документы

Культура Документы

PCR157

Загружено:

Kunmoo KoИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

PCR157

Загружено:

Kunmoo KoАвторское право:

Доступные форматы

A Monthy Review of Companies, Markets, Products and Technology in Paper Chemicals ! April 2010 !

Issue 157

! US natural gas prices start to creep back up ! Consolidation in Brazilian clays causes customer concern ! FutureMarkTM extracts soil nutrient from fibres, fillers and coatings ! Papermakers look for most economic carbonate solutions ! Finlands mills increase consumption of filler talc ! Differential narrows between paper and non-paper TiO2 applications ! European TiO2 price increase goes through at high level ! North American customers feel powerless to resist latex price increase ! EcoSynthetix gains its first North American customer ! Prospect of BASF plant closures causes churn in European latex market ! Europes latex customers push back as monomer prices soar ! Shortage of butyl acrylate pushes up pricing of SA latex ! BASF announces price increase for latex in Europe ! BASF divests US potato starch operations to Carolina Starches ! European starch offtake recovers rapidly ! Europes starch suppliers raise prices despite customer resistance ! Europes suppliers prepare for changes in potato starch regime ! All Starch declares bankruptcy ! National Starch attracts bidders ! Chinese paper industry shifts towards corn as tapioca becomes scarce ! Escalation in price of PNT causes renewed price increase for OBAs ! Price of rosin sizing reaches unprecedented high

2 2 3 3 4 4 5 5 5 6 7 7 7 8 8 9 9 10 10 10 12 13

Paperchem Report Ltd

Paperchem Report Ltd. Registered in England No. 6127839 12 New Fetter Lane, London EC4A 1AG E: cathy@paperchem.co.uk W: www.paperchem.co.uk T:+44 (0) 1792 386771 F: +44 (0) 1792 386772

April 2010

PCR 157

MARKET SUMMARY: Paper manufacturers in North America and Europe are now beginning to believe that the additional orders coming in cannot be entirely attributable to low inventories. Offtake is generally strong across the range of pigments and specialty paper chemicals, and this is reflected in improved Q1 results from all market players. Nevertheless, for many grades of paper and board the industry remains unsuccessful in passing through higher prices and many of the mills are only marginally profitable. This increases purchasers resistance to price increases from chemicals suppliers, particularly given the huge increases in pulp costs. Suppliers are now managing to raise some of their prices but there is a risk that this will drive the most vulnerable mills out of business. Purchasers maintain that a portion of suppliers are trying to exploit the situation and this is leading to inflation in certain areas. Papermakers need to be certain that their suppliers are raising prices because they require more money to cover additional costs. They are being assailed by suppliers desperate to take action to pass on increased raw material pricing. Although the upward movement in raw materials has put an end to the downward erosion in pricing for a number of chemical products, most have simply stabilised. Fixed annual pricing is still the norm for some products, although typically some element of the price can be adjusted subject to certain parameters. Buyers achieved extremely competitive prices at the end of 2009, as a number of suppliers were prepared to concede low prices to gain volumes to boost their cash-flow. Now some paper manufacturers have been obliged to accept increases at the end of Q1 and there is an expectation of further increases in Q2 or Q3. Paper manufacturers have projects in place to achieve reductions in the cost of supply, bringing in representatives from all areas of the mill. It is not merely a matter of price comparison, but an evaluation of alternative recipes.

WHITE PIGMENTS

KAOLIN US natural gas prices start to creep back up

Natural gas was dropping rapidly a few weeks ago but the US government felt that the method of calculating reserves was inaccurate and reworked the model. As a result, prices have changed direction and started to head upwards, crossing the $4.0/mmBTU threshold. There is an increasing trend among US suppliers to incorporate energy clauses in their contracts as this element is always uncertain. Although the Georgia clay suppliers typically have certain strengths, most also retain some presence across other grades. For instance, KaMins Macon plant, while strongest in fine clays, does supply some delaminated grades as well as some coarse delaminated products for LWC and matte grades. Customer sales recovered strongly, although volumes are still not back to those of 2008. Market players are at a loss to explain what is happening. It is not clear whether papermakers are re-stocking a depleted supply chain or whether paper buyers, in anticipation of price increases, are building inventories. With sales primarily in the printing and writing segment, Imerys reported a 5.5% improvement year-on-year to 167.4 million from its Pigments for Paper division. Printers in North America and Europe have been rebuilding inventories, and sales volumes in North America have recovered particularly well. Some customers are struggling to make volume forecasts, with pigment usage down significantly from 2008. Supplier inventory levels have now recovered from the impact of the exceptionally cold weather in Georgia in February. The downturn in 2009 has resulted in some internal transportation issues as well as cost escalation in overseas freight. There are serious logistics problems in the south and the southeast of the US, due to the shortage of tankers. A number of haulage companies went out of business during 2009 when business dropped, and now there is insufficient tanker space to meet demand. One supplier has decided to ship railcars rather than tankers.

Consolidation in Brazilian clays causes customer concern

Despite the rumours of a forthcoming acquisition of Brazilian clays, the kaolin market has been very quiet. There is some belief that takeover negotiations are reaching the final stages, and any contractual plans are tinged with uncertainty. It may not be easy for customers to make changes in supply, as the incumbent Brazilian supply incorporates infrastructure and tank farms. It seems that a sale of CADAM may not be concluded, but that a supply agreement may be worked out between two Georgia clay suppliers, giving one responsibility for the distribution of fine particle clays. Although purchasers may have more options for filler than coating clay, arrangements could be disadvantageous for overall pricing. Over the past year, customers have been faced either with having to pay for volumes they do not require or for dead freight, when they cannot use the full vessel load. It seems that sourcing from Brazil involves total commitment on the part of the customer in order to make it worthwhile. Paperchem Report 2

April 2010

PCR 157

It is unclear whether the European Commission will be able or willing to investigate the Brazilian clay deal, given that the production facilities are in Brazil. Any consolidation in Brazilian supply could lead to some changes in agency agreements in China. A European major has been pushing hard to achieve increases in filler clay. It seems that there was little if any attempt by one major to adjust prices in calcined clay, and an increase was not even discussed at some accounts. As producers try to increase market share, it seems that pricing has come under pressure in China. Although freight has increased generally, the increases have been steeper for container loads, and customers tend to buy cif, making it difficult to charge more for freight. The current price level for imported clay from Georgia or Brazil is in the region of $250-270/mt cif, but companies have to pay import duties, tax and inland freight in addition to this. Australias WA Kaolin is intending to raise its production of coating clay from the middle of 2010. It produces performance paper kaolin and has carried out successful trials in China. Imports of clays to China currently amount to around 320,000 mt/year, while a further 250,000 mt/year is locally sourced. In addition to large ports, China has an efficient river and canal system for further shipment and the motorway network is also good.

CARBONATES

Carbonates volumes have picked up considerably in the US since the early part of the year, although shipments to Canadian mills are less strong. With the uncoated woodfree segment performing particularly well, PCC pricing is stable and volumes are strong.

FutureMarkTM extracts soil nutrient from fibres, fillers and coatings

Following 10 years of process development and three years of research and testing, FutureMarkTM, a specialist in recycled papers, using no more than 8% virgin fibres, has been working to address the challenges of de-inking waste. Having initially provided the top layer at landfill sites, it then developed a way to extract fillers, coatings, fibres and inks to produce FutureMarkTM High-Calcium Paper Lime (HCPL). Being high in calcium and with good nutritional properties like lime, this can be used as a soil nutrient, which FutureMarkTM has been selling as a farm fertiliser since February 2010. It produces nearly 30,000 mt/year of this material, which benefits the environment as less limestone mining is required, and diverts these beneficial materials from landfill. FutureMarkTM HCPL can help to balance the pH of the soil or enrich the soil with a high concentration of calcium. It costs less than conventional liming agents, and has undergone rigorous safety tests and chemical analyses in Illinois and Indiana both by independent and government laboratories.

Papermakers look for most economic carbonate solutions

There are still projects ongoing to convert mills from acid to neutral and these involve higher volumes of carbonates. Where there is a volume increase, customers are able to achieve very stable pricing. Whereas two or three years ago papermakers started to adopt some of the more functional carbonate products, they are now trying to achieve their targets with standard products. Chalk is gaining in popularity as filler since it provides a more economic option. There are some savings obtainable from pre-mix products where GCC and PCC are blended, as this comes at higher solids than PCC filler on its own. Despite fears going forward, energy costs have come down over the year, although a key concern for customers is that they select a supplier with less advantageous energy contracts and are thus penalised competitively. The take-up of coating PCC remains limited, with the high level of fixed costs at the Walsum plant putting a strain on economics. The plant continues to run at 50-60% of its intended operating rates. Chinese producers processed an estimated 6.45 million mt GCC from marble for paper applications in 2008, representing just over a third of total marble processed. This has subsequently increased, with overall production projected to be seven times higher in 2009 than in 1999. Producers are also starting to develop finer grades of GCC and are moving towards increasingly high filler loadings. At 55-60%, filler loadings are high even relative to the European market. With the cost of fibre increasing in significance and typically imported, it is important for papermakers to maximise displacement of fibre. Typically the local producers offer more competitive prices than their international counterparts. However, like the recent paper machines, a large proportion of the GCC satellite plants are modern and therefore it is not always easy for the multinationals to differentiate themselves. Marble deposits are found in a number of areas, with the highest quality in the regions of Anhui, Zhejiang and Guangxi, close to the site of the new Hainan mill. The source of marble for GCC closest to Shanghai is Guangdong. For PCC, coal is the main source of energy used in China to produce burnt lime. Paperchem Report 3

April 2010

PCR 157

TALC Finlands mills increase consumption of filler talc

Paper manufacturers continue in their efforts to displace talc purely for cost reasons. However, in Finland there has recently been resurgence in filler applications for talc, possibly due to the high cost of market pulp. There has been renewed interest after a decrease in filler pricing in 2009. Despite fears of a significant increase in the price of talc for 2010, prices edged up by less than 2%, putting them more or less in line with the rise in clay pricing. Customers that can find alternatives have been successful in retaining flat pricing. There are customer concerns relating to special grades from China, as buyers are facing demands for surcharges to cover freight. Recent developments in coating talc are somewhat difficult to explain, but it seems that, as the catalogue season approaches, offtake to the rotogravure segment is not as high as would normally be expected. Some customers are complaining of a lack of orders, although others are running at full speed. Suppliers are struggling to understand whether there has been a shift from rotogravure to offset. Mondo has nevertheless expanded its sales force in mainland Europe and has been targeting new markets, still following its policy of carrying out its own marketing rather than employing agents. There has also been a shift towards chemical alternatives to talc for pitch and stickies, as these are clearly less expensive than talc. There is similarly contradictory feedback for these applications, as in some parts of Scandinavia sales of talc for pitch and stickies are increasing. Mondos negotiations in China are ongoing, but can only proceed at the pace of the authorities. It is reliant on its Chinese partner as the mine itself is owned by the Chinese government. Both partners are keen to proceed but there are legislative issues that must be worked through. Once everything is finalised it will be necessary to make some transfer of technology, and efforts are ongoing to develop processes to identify new applications and explore the full functionality of talc. Currently talc is used primarily for pitch control in China but Mondo hopes to develop the coating talc market. Talc is not sufficiently competitive when price is the only consideration.

TITANIUM DIOXIDE Differential narrows between paper and non-paper TiO2 applications

It is not always clear which TiO2 price increase is being discussed. Some of the recent initiatives are still under discussion while the latest 5 cts/lb has yet to be negotiated. Buyers do not necessarily feel that their producers are entitled to a price increase every time they make an announcement, and several suppliers have been targeted by a paints company in a class action lawsuit relating to price fixing. Most customers are now on their second increase, but paper applications are generally priced below applications for paints and plastics. However, much depends on the customer size and location, and there are clear indications of an attempt to bring the paper industry in line. Lower paper TiO2 pricing makes the market leaders position precarious, as the Edgemoor plant is still best suited to manufacture TiO2 for paper applications. As offtake to the paper industry sees further deterioration then operating rates suffer. DuPont has started the year well, achieving a 3% improvement in selling prices in its Performance Chemicals division and a 30% increase in volume sales across all its applications. Edgemoor has benefitted in the past quarter from higher operating rates in the paper industry, although some capacity remains unused. Cristal is withdrawing from its west coast business, prompting customers in the area to review their options. DuPont enjoys higher margins from non-paper applications and, while it can be assumed that it has faced some obstacles to producing for other applications in Edgemoor, there are suggestions that availability for new paper customers may be limited in future.

US TiO2 Prices (cts/lb fd) Rutile (paper & board) Laminates Anatase (paper & board) 0.98-1.05 1.11-1.15 0.90-0.96

Customers have become accustomed to quarterly price protection but it seems that for new customers this is no longer an option. It also seems that contractual terms for the April price increase announcement will not include three-monthly price protection. Whereas pricing for domestically produced TiO2 is comfortably in excess of a dollar, Chinese rutile can still be sourced for less than $1.00 fd. One of the challenges for the industry in its re-investment is that resources must be relocated from North America and Europe to Asia. TiO2 suppliers globally need to consider how they can optimise their logistics. Paperchem Report 4

April 2010

PCR 157

The price of anatase TiO2 is also increasing, with two nominations so far this year from some suppliers. The increasing price of sulphuric acid is likely to influence the price of anatase TiO2 as it did on the previous occasion. For those that source directly, there are fears of a double-digit increase should the Chinese government submit to the mounting pressure to recalculate its currency.

European TiO2 price increase goes through at high level

The force majeure as a result of the explosion at Stallingborough in March appeared to help suppliers get closer to achieving their price aspirations. By the time production came back on line during the second week in April they had been successful in pushing through 70-90/dmt, sometimes as a phased increase. In reality there was probably sufficient stock in the ports. Prices to the laminates industry have not yet reached 2,000/dmt fd but they are now approaching that point. From a volume standpoint, sales are well ahead of expectations. Customers decline to discuss the portion of previous price initiatives that has not been implemented. Suppliers argue that the laminates industry benefits from some of the lowest pricing of any TiO2 applications, and there were even suggestions that sales to all industries must reach a certain level. It is certainly true that the cost differential with some of the standard applications started to widen in 2006 and one sulphate producer has been diverting volumes away from the laminates industry to focus on more profitable applications.

European TiO2 Prices (/dmt fd) Rutile (paper & board) Laminates 1,870-1,940 1,950-1,980

LATEX

North American customers feel powerless to resist latex price increase

The price of latex continues to climb on a monthly basis, due to the shortage of butadiene as the automotive business recovers. Although butadiene is expected to stabilise at some point during Q2, the price is very high by historic standards and at variance with the budgets of both customers and suppliers. The way in which prices have bounced back is a source of frustration to customers, who are typically paying between $1.20-1.25/dst on a delivered basis. Where latex suppliers have lost business they maintain an interest in regaining it. However, it seems that the nature of competition in the market has changed in as much as Styron and Omnova have an equal interest in making money and they will therefore only compete if business is viable so their pricing is at a sustainable level.

North American SB Latex Prices (cts/dry lb fob) 1.02-1.09

Customers are fairly neutral about the proposed acquisition of Styron although they were aware that Dow wanted to exit the latex business and from that perspective the divestment is positive. There is an expectation that Styron will enjoy a more aggressive spending policy under Bain Capital. For the group itself, there will be renewed opportunities, with far more access to capital. Styron is on target to start operations on 1 August 2010, although it may take some months before all areas of activity in all regions are fully up and running. There were various projects which were abandoned within the Dow organisation because the resources were not available and these are being resurrected, ready to proceed once the company is up and running. Customers do not appear concerned about butadiene sourcing, believing that if Dow has a contractual commitment to supply butadiene to Styron then it will not renege. While the business is transitioning from Dow to Styron it causes some complications with invoicing.

EcoSynthetix gains its first North American customer

FutureMarkTM Paper Company has become the first North American paper manufacturer to adopt biolatex on a commercial basis, having commenced trials during the final weeks of 2009. FutureMarkTM is the only US manufacturer of groundwood coated paper using 100% recycled fibre. Although the initial incentive for adopting biolatex was environmental and it has Paperchem Report 5

April 2010

PCR 157

helped with its perception as a company that seeks to minimise its carbon footprint, it has also had economic benefits. While conventional latex still accounts for more than half of its requirements, FutureMarkTM has been successful in replacing a sizeable portion of its petroleum latex requirements. Moreover, there was no discernible difference in the coated paper containing biolatex from that made entirely with petroleum latex. Since biolatex is derived from renewable feedstock, it has a significant positive impact on carbon emissions, calculated as equivalent to taking 8,000 cars off the road for one year. Carbon emissions will be reduced further by substituting the shipment of EcoSphere binders, which are shipped dry, for conventional latex derived from petroleum-based monomers, which are typically shipped as 50% solution. Since it is shipped in powder form, EcoSphere results in a steep reduction in fuel costs compared to conventional latex and occupies less space during transport. The supplier brought in the necessary equipment and the customer is able to make down the powder on site. FutureMarkTM believes that by adopting EcoSphere it will lower expenditure and environmental impact without sacrificing brightness, opacity and gloss, which are seen by customers as its hallmarks. Customers believe that it will benefit the latex industry to know that different technology is available. Any major breakthroughs will act as a wake-up call to manufacturers of petroleum-based latex. Many papermakers have been trialling the EcoSphere products, but some are not satisfied that it is competitive in terms of price. It seems that, while the properties are suitable for some applications, for others biolatex may contain excessive viscosity or opacity. Many papermakers are intending to trial the products but not necessarily immediately and they recognise that there are challenges. Customers appreciate the expertise of the EcoSynthetix personnel, who already have lengthy experience of working in the latex industry, and are confident that they know how to provide technical service. It is important that EcoSynthetix can convince potential customers that it is not selling starch, as the molecular structure is different. Other papermakers are preparing to have a dialogue with EcoSynthetix.

Prospect of BASF plant closures causes churn in European latex market

European negotiations were prolonged by customers contingency plans for the closure of the former Ciba latex plants at Ribcourt, France and Gutturibay, Spain by the end of Q2 2010. Customers taking specific grades from those plants that are not satisfied with alternatives available from Ludwigshafen are evaluating grades offered by other suppliers. There is also a handful of customers that showed loyalty to the Ribcourt plant management through several changes of ownership. The closest latex facilities for the customers that took latex from Ribcourt are in Italy, Rheinmnster in Southern Germany or even southern England, although this plant has been closed and the logistics to southern Europe are challenging. In the meantime it seems that some customers that typically negotiate their contracts are moving temporarily onto formula-based contracts while they evaluate potential alternatives on the market. Some papermakers have already reviewed their volumes with a view to reallocating tonnage to other suppliers. BASF will no longer be able to provide latex of the requisite quality and performance in all cases, although where it can it will do its utmost to remain as supplier. The combined capacities of Ludwigshafen and Pichelsdorf are insufficient to serve its market and BASF has undoubtedly made a decision to shed certain less profitable locations. While BASF claims that it is eager to maintain the former Ciba latex business, it appears inevitable that its market share will decline as it focuses on fewer grades and concentrates on mills in the vicinity of its plants in a bid to improve profitability. It also gives the impression that it is de-emphasising development work to focus on product supply, particularly given that the pilot coater remains in Ludwigshafen while the rest of the paper chemicals business has relocated to Basel in Switzerland. The forthcoming closures of capacity in Ribcourt and Gutturibay will eliminate 15% of European capacity and this should bring Europes latex supply into better balance. BASF has limited interest in shipping volumes from Ludwigshafen to southern Europe and is focusing on the major paper groups, with the result that the medium sized and smaller groups in southern Europe risk paying a substantial premium. Southern Europe does not have the same issues with over-capacity as the Nordic region and central Europe to a lesser extent. Dow and subsequently BASF withdrew from Spain, although Ciba initially retracted its decision to close Gutturibay. There is a sizeable demand for latex with high-binding power in southern Europe and this cannot be met from Ludwigshafen. There were reports of one supplier shipping from Italy to Spain, while those delivering product to Spain by road were struggling to implement a transport surcharge. BASFs decision represents a significant downsizing in capacity at a time when an increasing number of latex plants are running at high operating rates. Offtake of latex to the European coated paper industry has recovered well, ahead of supplier expectations, and some of the LWC machines in particular have cancelled plans for shutdowns and are running with high capacity utilisation. The overcapacity remains more conspicuous in the Nordic market, although it does not appear that last months strike in Finland has done any particular damage to the paper industry. Customers appear to be refilling their stocks although some industry players are still of the opinion that there will be a collapse in demand later this year. Should demand be sustained through the summer there may well be many raw material shortages. Paperchem Report 6

April 2010

PCR 157

Europes latex customers push back as monomer prices soar

The price of crude oil has now reached close to $90/barrel, and monomer price developments have followed accordingly. The market is characterised by raw material shortages, with the monthly formula up more than 200/mt. Dows planned maintenance in Germany and a declaration of force majeure by Lyondell Basell at its French facility immediately following the lifting of BASFs force majeure in Ludwigshafen have left some suppliers struggling to cover their raw material requirements. The entire chemical industry is under stress, primarily as a result of the enforced low rates during 2009 when plants are designed to run at a high capacity utilisation. This makes it particularly difficult for them to return to normal speeds. There are warnings that the price of butadiene will be above 1600/mt in Q3. There is new butadiene capacity due to start up in Asia and the Middle East later in the year, but developments in butadiene pricing have been particularly unpredictable. Europes April styrene barge has been confirmed up at 1,150/mt, an increase of 120/mt, but styrene is widely expected to stabilise going forward. The current level brings it very close to its record 1,300/mt in August 2008. Neither the customers nor the latex suppliers are satisfied with the raw material situation as the suppliers are seldom able to pass on more than 70% of their costs when contracts are negotiated, but this seems too substantial for the customers. The larger suppliers are best positioned as they enjoy some backwards integration, a far greater degree of purchasing power and limited exposure to the spot market. Although many had budgeted for an increase, the coated paper manufacturers have calculated on a far lower level of costs than has materialised and are struggling to forecast realistically for the balance of the year. In addition to the increases in styrene and butadiene, the costs of other chemicals have been escalating and this puts producer margins under still greater pressure. There is a risk that there will be a movement away from formula-based contracts, which give producers the opportunity to pass on the full raw material costs. Most customers only took a modest price increase this month but will face a far more significant price rise in May.

Shortage of butyl acrylate pushes up pricing of SA latex

There is also a shortage of butyl acrylate, affecting availability and pricing of SA latex, which has increased by over 20% in the last few months with pricing now well above the 1800/dmt threshold. The main problem for producers is the raw material price rather than availability, but the current problems could last from anywhere between six months and two years. Acrylic acid used in certain SB lattices in small quantities has also been affected by the dramatic rise in the cost of acrylics. There are fears that some of the smaller additives indispensable for latex manufacture and some of the surfactants in the recipe will follow. It seems that supply has been impacted by the explosion at Arkema and outage at Dow in the US in late 2009. The prospects for SA latex should otherwise be good, given the volatile pricing for butadiene and also that SA tends to be the first choice of latex for food applications. The Finnish plant acquired by Chemec from BASF is running at targeted levels, and personnel are fully occupied with gaining technical approvals. There is a high level of activity in the development laboratories, matching products. BASF shows signs of being tough on price increases. Feedback also suggests that there are distinct differences in the formulae between suppliers, and that one major offers a much more advantageous constant than the other. Others maintain that this differential disappears with a monomer adjustment. Papermakers that are negotiating prices are hoping to postpone their price increase until May/June, taking only a moderate increase in April. For monthly latex, there is an increase of 150-200/dmt for May. Raw material pricing in February/March was, after all, comparatively stable. There are reports that one supplier has not demonstrated great diligence in implementing a price increase for April, as customer feedback suggested that the competition was not raising prices. Producers have adopted various approaches, and customers have tried their hardest to postpone implementation for as long as possible. Whereas a couple were better able to absorb the raw material cost increase short-term and only intended to move prices in May, for others it was critical that at least half of these costs were passed on immediately. They maintained that their reaction would be equally fast when prices were coming down. In some cases prices are still being negotiated for June.

European Paper Latex Prices ( /dry mt fd) SB: 1,440-1,550* SA: 1,750-1,850

*The downward adjustment of the lower end of the SB latex price is not intended to suggest that prices are decreasing.

BASF announces price increase for latex in Europe

BASF has announced an increase of up to 20% for emulsions sold in Europe, Africa and the Middle East. The increase Paperchem Report 7

April 2010

PCR 157

is attributed to the huge escalation in raw material costs and will be implemented with immediate effect or as contracts permit. Papermakers are working increasingly hard to displace more latex with starch and have over the past couple of years achieved dramatic reductions in latex usage. They are keeping abreast of all new developments in latex and starch, although for many these are only in the trial stage and there is no clear impression of price. The delay of the start-up of APP Hainan has pushed back the point at which latex supply is likely to become short in China. Nevertheless, mills are operating at high levels and offtake is good. There are continued difficulties with raw material supplies and these ensure that suppliers are relatively successful at pushing for higher prices.

Chinese SB Latex Prices (RMB/lmt ex plant) 6,900-7,300

STARCH

For some North American papermakers, there is very little to report in starch at present, with corn prices stable and low pricing for pearl and modified starches. Papermakers that have chosen to fix the price of corn are enjoying very stable pricing. However, if the price of corn were to decrease substantially, then they would be disadvantaged. The net corn cost is one element of the price, the others being freight and the processing fee, which is the lowest it has been for some time. The freight element is the most likely to present challenges at this time. There are no availability issues with corn starch, although ethanol has picked up slightly. Discussions are ongoing in some groups into the technical possibilities of starch going forward. For instance, there may be options of adding alternative starch materials to enable uncoated freesheet manufacturers to put more ash into the sheet. However, this would also raise challenges, such as how to retain ash in the sheet. Paper manufacturers continue to explore whether they can replace some of their ethylated starch with enzyme conversion. This gives the option to make savings, which are shared if the supplier provides the equipment. The premium for ethylated starch over pearl remains very small at present and this may mean that substitution plans are not seen as urgent.

BASF divests US potato starch operations to Carolina Starches

BASFs sale of the former Ciba potato starch business in Berwick PA to Carolina Starches LLC was officially closed on 31 March 2010. Carolina Starches supplies potato, tapioca and corn starches to US paper mills, sourcing its potato starch from Europe Most paper mills that traditionally enjoyed the benefits of tapioca starch, with its high charge, have now substituted tapioca with alternative starches, although one or two may be awaiting the next forecast to make a decision. Even those still using tapioca are investigating options for substitution. While corn starch might save money, it would force papermakers to make changes in the wet end.

European starch offtake recovers rapidly

During 2009 the starch industry had to put in place special economy plans and lay off workers, resulting in a decrease in total capacity. In terms of capacity utilisation, starch plants are now running at much higher rates than in 2009 and the speed and extent of growth in offtake has taken the industry by surprise. Although where possible the output of the starch facilities that closed was shifted to other plants in the network, the suppliers did not invest in new capacity. Many starch plants are now operating on maximum capacity and starch availability has shifted rapidly since early March towards a balanced to tight position. There are reports that some customers are having difficulty being supplied, particularly if they wish to increase their regular offtake. The tightening in the market has been evident in that certain suppliers have been forced to refuse business, particularly where companies have under-stated their requirements. They are informing existing customers of strengthening in demand, and have to work hard to ensure that all shipments run smoothly. There has reportedly been some strike action in the plants of one supplier. Starch suppliers cannot readily accept additional tonnage as they need to ensure they have adequate volumes for existing customers. Detailed communication is required before volumes are committed. The volumes that have been taken out in Bergen op Zoom are clearly felt in the market. From time to time, there is a sudden Paperchem Report 8

April 2010

PCR 157

pull on starch from a specific plant or on a particular product line. Certain regions are showing signs of tightening, notably Germany, France and in Italy, where there are particular concerns over availability. Demand from the paper industry has increased, with many mills now requiring full volumes, although buyers do not see major changes in fundamentals and there is no movement in raw material pricing. Stocks have decreased significantly and there is a clear increase in consumption even if the rise in price is still modest. Brown paper machines are running fully, and lead times are sometimes up to 90 days. Demand for starch in paper and corrugated has already recovered substantially and in 2011 is expected to see further growth. There are differences in grades, and fine paper is performing particularly well. Stora Enso has ruled out a previously planned plant closure while other mills that have not run well for some time are now operating. The degree of shift can be relatively minor and yet have a pronounced effect. It takes years to build new mills and yet now several are coming on stream at once. Customers are running many trials and starting up cost-saving projects that had not been contemplated six months ago. They are also prepared to make quick decisions. There is strong demand from the food industry and ethanol production is running well. The weakening of the Euro has boosted paper exports by some 30-35%.

Europes starch suppliers raise prices despite customer resistance

Price negotiations have been difficult for both suppliers and customers. It started slowly but gained momentum as it proceeded. Both majors had informed customers of price increases. There are indications that one major supplier is pushing far harder than its competitors to raise prices to a sustainable level, leaving customers with little room for manoeuvre, and it is clearly prepared to lose volumes in order to achieve its strategies. Another appeared somewhat more erratic in its approach to the increase. Suppliers felt that they saw steep cuts when prices were decreasing and were simply looking for smaller increases. From its initial nomination of 50/mt Roquette is now looking to raise contract prices by 80/mt over the course of 2010, and is asking for a higher level of pricing where customers ask for longer contracts. Although there is only a limited proportion of contracts up for negotiation and increases have typically taken the form of upward adjustments of perhaps 10-25/mt, suppliers have been successful in raising prices where contracts fell due. In exceptional cases contracts were rolled over, typically because pricing was already at a higher level.

European Starch Prices* ( /mt cif) Corn Wheat Potato 280-305 260-275 310-350

Some feel that there are good opportunities in June 2010, with a significant portion of contracts up for negotiation. Others feel that realistically the 300/mt threshold can only be achieved by Q4 and some papermakers believe that suppliers are effectively looking towards the next campaign. There are ambitions to raise the threshold of pricing in the corn starch market towards the mid 300s/mt, with the argument that co-suppliers have limited ability to take on those volumes. The quota in Turkey has been made over to isoglucose and that means that there is little starch available in that market. Although customers are resistant to higher prices, it is important that they can demonstrate an increase in input pricing in order to convince the paper and packaging buyers to pay more. Suppliers now have a visible platform for further increases. There will be a limited number of negotiations during the quarter, but it is certain that suppliers will continue to push upwards with pricing since at current levels they have not been covering their variable costs and it is clear that starch pricing to food applications will increase. There are tests ongoing to replace more latex with starch.

Europes suppliers prepare for changes in potato starch regime

The starch industry is at a crossroads in terms of structure as concerns mount regarding the stability of potato starch. The instability of the potato segment has been hampering new product development. The potato starch market is now short and if papermakers require additional volumes they are forced to pay very high prices. By mid-summer producers aspire to prices of 400/mt. Market forces appear even stronger for cationic applications than for native. The tightness is attributed to the volumes shipped to Asia to compensate for the lack of tapioca. BASF is considering various options for its business, including a possible management buyout, although nothing has been determined at this point. This has resulted in numerous enquiries to co-suppliers, asking for prompt supply. The costs for mainland European suppliers of selling into Finland are huge, given that they are struggling to cover their variable costs even without the cost of freight to Finland. Papermakers are looking for corn starch replacements for cationic potato starches. There is evidence that Roquette is in the process of shifting its production away from potato and towards corn and other alternatives, such as pea. Newspaper reports also Paperchem Report 9

April 2010

PCR 157

indicate that a major potato starch supplier intends to produce higher volumes of pea starch. Negotiations have been taking place, primarily with corrugated customers, for the next quarter, and suppliers are looking for increases in excess of 10% in some cases. Some have made official announcements while others are approaching the market on a case by case basis. Some customers do not expect the situation to last, but suppliers are confident that they are only at the beginning of a prolonged cycle. Although volumes have been agreed in many cases for the year, price validity is often quarterly, sometimes even monthly. There is a clear trend towards higher pricing, with most competitors pushing in the same direction. Some customers are switching to grain starch and this has resulted in a tightening in these markets. Should there be a poor harvest, sourcing could be problematic. Although overall grain starch prices have not increased significantly, suppliers believe that it is only a matter of time before paper customers see increases of greater magnitude across all starch applications.

All Starch declares bankruptcy

It was officially announced on 21 April that All Starch had gone into liquidation. Customers were aware that there were problems because it had been supplying product from co-suppliers, often at particularly low numbers. This made it difficult for others to achieve sustainable pricing, with prices sometimes down in the 100s/mt. This could create an additional element of tightness in the German market. Although it seems that few potential customers have progressed beyond the trial stage, the first contracts had been agreed. The largest buyers had not reached a point where they considered All Starch as a reliable source of wheat starch. All Starch benefitted from subsidies from the German government and was an important employer in a region of high unemployment. Just days before the bankruptcy announcement, an article in the German press announced that a company known as the German Food Retail & Production was planning to invest 200 million near Kiev in the Ukraine to process 400,000 mt/year wheat. This was supposed to create at least 250 jobs.

National Starch attracts bidders

At the time that it issued its quarterly results, Akzo Nobel classified National Starch as a discontinued operation, separating its results from its own. During the financial crisis, Akzo Nobel saw no immediate prospect of selling the business at the right price and, since it had no urgent need to make the divestment, it put the sale on hold. Now it seems that there are two interested parties and a sale could be more imminent. National Starch generated sales of some 877 million in 2009, of which paper applications accounted for about 20%.

Chinese paper industry shifts towards corn as tapioca becomes scarce

Although there is a gradual upward move in corn starch pricing in China, competition between suppliers has limited this to around $30/mt. Some of the more established suppliers still offer longer contracts of three to four months. Suppliers of corn starch to the Chinese paper industry are finding that customers that were never prepared to consider corn starch in the past are now willing to switch. Suppliers of corn starch are spending far more time than previously with their customers as they run trials and ultimately convert to their products. It still needs to be a progressive initiative and suppliers need to pick their customers, depending on willingness to pay. Given the availability issues and high price of pulp, payment of pulp is the top priority for papermakers, followed by the banks. Suppliers of chemicals find that they are only paid once the main priorities are dispensed with. While increases of $20/mt were realistically achieved for Q2 and price increases for cationics are now more readily accepted, one US-based supplier saw a push-back from the customer base. As buyers sense the inevitability of higher starch prices, some mills are delaying their bidding. Although incremental increases are expected, there is likely to be a degree of price stabilisation within the next several months. The Asian export market for European grain starches has re-started, and starch suppliers find that they can achieve higher prices for export volumes than those sold in Europe. Moreover the weakening of the Euro against the US dollar makes their pricing appear more attractive. Suppliers are receiving a number of requests, many of them fob, and some are at more attractive numbers than their European business. Demand from China remains high, given the poor tapioca crop, and suppliers are pushing higher prices through. The tapioca crop is down by 20% on normal yields and availability is expected to deteriorate in Q3, as predictions for the next crop are not optimistic. The April crop survey will provide evidence of whether current predictions are well founded. I t seems that the mealie bug infestation has spread to all areas of Thailand, pushing export prices up by 21% in Q1. It prevents the roots from growing and is difficult to control with pesticides, which can only be used at night. There is no immediate relief in sight, and it is probable that Thailand will see a two-crop cycle before tapioca starts to recover. Chinas efforts to plant sufficient trees for future harvesting have aggravated the drought problems in southern China, causing the river running from Guangxi Province in China to dry up and affecting Vietnam and Thailand. Japans papermakers may well be the worst affected as they are heavily reliant on US imports as an alternative to tapioca. Paperchem Report 10

April 2010

PCR 157

If the oil price continues to increase, then the price of bio-ethanol looks certain to recover further and corn starch prices will inevitably increase. Tapioca chips can also be used in bio-fuel.

PAPER MARKETS

The strengthening Canadian dollar continues to pose huge challenges to the countrys papermakers. As the oil and even the pulp industry recover the situation is likely to become more difficult for papermakers. Some 70% of the countrys newsprint industry is in bankruptcy protection and this seems to penalise those that are not. Volumes have failed to recover and there are fears that the industry has yet to bottom out during 2010. In the US, mills are running with relatively full order books. The majors have eliminated capacity and it now appears that supply and demand are well balanced. However, it is difficult to envisage a successful recovery if the industry should again collapse. The high volumes that have been seen to date in Europe are expected to continue, with plans to work through public holidays during May as well as the holiday period during the summer. Both StoraEnso and UPM reported an improvement in overall volumes in Q1 2010 compared with the year-earlier period. Although coated paper volumes have improved considerably year-on-year, they are far from the levels of 2008. Demand for graphic papers appears to be seeing some sustained improvement. Prices for newsprint and magazine paper in particular have declined sharply year-on-year. The paper industry itself is still trying to understand whether the increase in production represents purely demand or whether customers are buying to fill stocks. In addition to the closures at Varkaus, detailed below, Stora Enso has reached agreement to divest its two integrated mills at Kotka, Finland and its paper laminates facility in Malaysia to OpenGate Capital, a private equity company. Usage of recovered paper in Europe declined year-on-year throughout 2009 but started to show growth from the beginning of 2010, according to figures released by the Confederation of European Paper Industries (CEPI). This boosts demand for products that provide additional strength, including starch. The table shows figures from the past six months:

Total Recovered Paper Utilisation (in million mt*) Sep-09 % chg/mth % chg yr-on-yr Current mth* Cumulative* Source: CEPI 11.7 -5.3 3.65 31.54 Oct-09 6.7 -0.4 3.90 35.44 Nov-09 -1.9 3.3 3.82 39.26 Dec-09 -11.2 6.7 3.39 42.65 Jan-10 9.4 5.7 3.71 3.71 Feb-10 -3.2 5.4 3.60 7.31

Smurfit Kappa and International Paper are expanding their conversion operations in the UK and China respectively. Smurfit Kappas acquisition from Mondi allows it to benefit more fully from integration in the UK market as well as making it a more convincing leader in corrugated packaging. Mondi is focusing its corrugated business in central Europe and in Turkey. As part of the deal Mondi is acquiring eight sack converting operations in southern Europe from Smurfit Kappa. IP is gaining facilities from SCA in China. The Swedish Paper Workers Union has called out strikes at Billeruds mills in Scrblacka and Grvon, resulting in losses of around SK7 million/day. There are concerns that the strike action could escalate. As pulp prices continue to rise, at least one European dcor paper company has introduced a surcharge on paper to cover its additional pulp costs. It seems that the new APP mill in Hainan, China is likely to start up several months late, due to problems with sourcing pulp. Chinese demand for coated fine paper has improved markedly from Q1 2009, and prices have also increased. Over the coming five years, Chinas demand for coated woodfree paper is forecast to grow by 8.1%/year. As noted in Akzo Nobels quarterly report, paper consumption is only 25 kg/person/year in emerging markets compared with 170 kg/person/year in mature markets. Nevertheless, a sudden collapse in the Chinese economy and paper industry probably poses the single Paperchem Report 11

April 2010

PCR 157

biggest threat to developments in other parts of the globe. Nippon Paper Group has agreed with Yuen Foong Yu Paper Manufacturing (Taiwan) that Nippon Paper will take a stake in YFY Cayman, which controls the groups containerboard business.

PAPER CHEMICALS

There have clearly been some problems for customers in dealing with BASF as it works through its changes, but it has completed the structural integration of Ciba this month on target, and expects sales growth for the rest of the year. Some customers find it difficult to find out about future plans or to identify their contact in BASF with the right degree of expertise to give advice on technical issues. Customers that have had products discontinued have been offered assistance with substitution. It involves a good deal of effort on the part of the papermaker to ensure that any new chemicals in the formulation are acceptable to the final customer. Therefore if customers are forced to accept alternatives then they will search the market first to ascertain whether there is a better option available from a competitor. BASF has been at the forefront of price initiatives and is also looking to raise prices through its agency, BTC. It plans some maintenance shutdowns, including the whole of its Nanjing Verbund site in China, during Q2. Akzo Nobel saw growth resume in its specialty chemicals business in Q4 2009, increasing to 10% in Q1 2010. Sales prices, however, are still declining, down by 5% in Q4 2009 and by 4% in Q1 2010. Eka ranks third globally in the areas of retention and sizing chemicals. Although there are no current plans, the specialty paper chemicals division should be a beneficiary of the vast site in Ningbo, China that is currently under construction, as this means that additional plants can be added without the requirement to go through the elaborate permitting. It also means that there is access on site to all the relevant support, such as human resources, information technology and legal. Ashland Hercules Water Technologies improved its sales by 4% year-on-year to $449 million in the three months to March 2010. It achieved particularly strong growth in Latin America, where sales were up 24%, with European sales up 17% and sales in the Asia Pacific region up 16%. The Paper Services division of Nalco achieved 8% organic growth in Q1, primarily due to the strong recovery in Asia, although it also came close to double-digit growth in North America. With its paper chemicals activities now within Performance Chemicals, Clariant reports higher sales in all its business lines, and particularly strong demand for dyes. Plant utilisation rates have improved but raw materials and logistics are increasing. It is planning price increases to offset the higher raw material costs. Despite an improved Q1, it anticipates that the global economy will only recover slowly, and faces continuing expenditure in restructuring and impairment. Kemira reported an improvement in operating profit in Q1 2010 to 15.2 million from 7.5 million in Q1 2009, boosted primarily by higher sales of pulping chemicals. It has also seen a recovery in demand for packaging board, especially in Asia and Eastern Europe. Chinas specialty chemicals manufacturers are also under a good deal of raw material pressure and are seeking to implement price increases in order to pass on these costs.

OPTICAL BRIGHTENERS

Escalation in price of PNT causes renewed price increase for OBAs

The price of para-nitrotoluene (PNT), the precursor to diamino stilbenic acid (DAS), appears once again to be escalating. There are only three or four PNT producers, with one US producer ceasing to manufacture PNT in 2009, and therefore market pricing can move up very rapidly. DAS pricing is even more volatile, as one large Chinese producer has a market leading position. Demand for ONT, the co-product of PNT, has dropped dramatically, as little fertiliser is required due to delayed spring planting in the south-west of China because of drought conditions. Manufacturers cannot produce ONT unless it can be sold and therefore output of both raw materials has rapidly decreased. There are excessive stocks of agrochemicals, prompting nitrotoluene producers to raise the prices of PNT to recover the poor margins of ONT. This, combined with inventory build-up by DAS producers, has led to a 45% increase in the price of PNT. The price of DAS itself is now starting to rise, reaching RMB45/mt before the end of April. Other raw materials have also risen in price: sulphanilic acid (SANS), used for Paperchem Report 12

April 2010

PCR 157

tetrasulphonated OBAs, has moved up by 43% since February 2009 and aniline-2,5-disulphonic acid (ALDS), used for hexasulphonated OBAs, by 32% since May 2009, due to higher prices for aromatics and sulphuric acid. It is reported that the Indian manufacturer of DAS has closed down, due to environmental problems as it was unable to process its wastewater, but Indian producers have increased PNT capacity. OBA manufacturers have gone to considerable lengths to improve raw material sourcing, but DAS suppliers are unwilling to accept more than monthly pricing and in April alone the price has increased by 45%. There are fears that the industry could see similar movement to that in 2008 and suppliers have typically put long-term contracts in place. The market is so competitive that suppliers do not have the latitude to include clauses linking prices to raw material. In China there is little indication to date that OBA suppliers are looking to increase prices, but suppliers are aware that the industry lost a good deal of money in 2008, since prices were fixed for at least one year In North America, customers have already been warned of price increases both from the established suppliers and from some of the Chinese exporters. BASF has announced a price increase of at least 5% for all its OBAs sold to the North American paper industry. The increase took effect on 15 April or as contracts permit. Some deny that the situation resembles 2008, although most have taken some inflationary increases, and suppliers are talking of a 5-10% increase. Paper manufacturers recognise that the market was bound to rebound after it decreased further and further over the past 18 months. The multinational suppliers were forced to lower prices in 2009 to pick up volumes as customers increasingly gave business to Asian suppliers. Many of the European paper mills have material in inventory and therefore the price increase will take some time to filter through. If suppliers need to make immediate raw material purchases then they will be at higher prices and they will decline to agree prices with long validity. All contracts have clauses allowing producers to pass through increases in extreme circumstances. The increase comes at a time when manufacturers are experiencing higher demand across their customer base. However, customers point to continued over-capacity and the frequency and number of new offers. There is no sign of the necessary consolidation in the industry, and Clariants move to Spain is the only evidence so far of a supplier taking capacity off line. Competitors and customers comment that many technical people from Ciba have left the company. The OBA industry has become substantially commoditised with no major technology. There are instances of suppliers providing a price quotation with no attempt to be competitive. An increasing number of Indian and Chinese OBA producers are looking to sell in Europe as they find that volumes in Asia are below expectations. Asian manufacturers now account for a good chunk of European supply and this is likely to grow at the expense of the multinationals, primarily because their overheads are substantially lower. European manufacturers are also penalised when they buy raw materials due to the weakening of the Euro. Although there is considerable pressure on raw materials, there is no indication at present of supply shortages. However, producers have depleted stocks compared to 2008 and therefore fluctuations in raw material prices will impact more rapidly on costs.

DYES

PNT is also used to manufacture direct yellow 11 dye, which is extensively used in the manufacture of brown paper. One leading manufacturer appears to be asking its customers to pay double the spot price for additional quantities. In the US it is reported that a leading supplier has put its customers of direct yellow 131 on allocation. BASF has also informed customers that the price of dyes will increase from May 2010.

ROSIN SIZES

Price of rosin sizing reaches unprecedented high

The price of rosin sizes is increasing on a weekly basis, and suppliers are more or less sold out for Q2, having completely depleted their inventories. With Indonesia sold out of rosin, the situation is driven by the Chinese. There was a huge drop in production in 2009, linked to the slump in demand, and inventories were run down. Since the price has plummeted, noone troubled to collect rosin. There are limited applications that require rosin sizes and some papermakers may be able to switch to other types of sizing. The price has soared from 600/mt at the beginning of the year to a current unprecedented level of 1400/mt. Some contracts were agreed in December at a fixed price. Some quotations for Chinese products have reached 1700-1800/mt. The new harvest will be available on the market from July 2010 and it is hoped that this may ease the situation. Paperchem Report 13

April 2010

PCR 157

PROCESS CHEMICALS

Suppliers of process chemicals are communicating with their customers, providing them with their outlook on feedstock. These contain warnings that some commodities are in short supply and predictions of inflationary pressures. Purchasers do their best to postpone any proposed increase and some of these dialogues may continue for weeks or even months.

PLANT & PROJECTS SUMMARY

PAPER MANUFACTURERS

US: Georgia-Pacific plans to make a significant investment in state-of-the-art proprietary tissue-manufacturing technology, possibly committing more than $500 million to the project. It anticipates that two machines incorporating the technology, together with converting equipment, will come on stream during 2012. The investment will target the premium end of the tissue and towel market. SWITZERLAND: Mayr-Melnhof Karton has announced its intention to shut down its cartonboard mill in Deisswil, due to prohibitive emissions regulations. The mill produced some 112,000 mt on three BMs in 2009, and employed 255 people. FINLAND: Stora Enso will close down the newsprint and directory paper production at its Varkaus mill by end-Q3, eliminating a combined annual capacity of 290,000 mt/year and affecting around 200 jobs. The European newsprint market is forecast to show 18% surplus capacity in 2010. Additionally, the Varkaus mill is not located sufficiently close to the customer base and uses fresh rather than recycled fibre. PM2 at Varkaus is already curtailed until further notice. Stora Enso has reversed its decision to shut down the fine paper production. TURKEY: AK GIDA SAN ve TIC has ordered a 60,000 mt/year tissue line for its new mill in Pamukova, valued at 15-20 million. Scheduled start-up: Q2 2011. The delivery includes automation systems. The production line will be optimised to maximise energy savings and enhance final product quality. AUSTRALIA: Amcor Packaging has placed an order for process equipment and control systems for the testliner machine at its Botany mill in Sydney. The main machine is scheduled to come on line during H2 2011. CHINA: Nine Dragons Paper plans to invest in a 400,000 mt/year capacity linerboard machine for its Tianjin site. Scheduled to come on stream in Q1 2011, PM32 will target the local markets in northern China. Nine Dragons also intends to upgrade the 400,000 mt/year capacity PM3 in Dongguan and the 430,000 mt/year PM20 in Taicang to produce light coated white top linerboard. The machines are scheduled to re-start between Q4 2010 and April 2011. Construction is currently under way on PM27 in Dongguan and PM34 in Tianjin, each with a capacity of 550,000 mt/year coated duplex board and scheduled to come on stream in 2011. Nine Dragons also plans to build the 250,000 mt/year design capacity PM 28 in Dongguan to manufacture recycled printing and writing paper and to upgrade the 200,000 mt/year PM21 in Taicang for P&W paper. Max Fortune Industrial will install a 60,000 mt/year capacity tissue line in its green field mill near Fuzhou city, Fujian province. It will produce facial, towel and toilet tissue using virgin pulp. Start-up: March 2011.

FORTHCOMING MEETINGS

TITLE: DATE: LOCATION: CONTACT: PaperCon 2010: Coating & Graphic Arts Conference 2-5 May Atlanta GA Craig McKinney, Tappi CMcKinney@tappi.org PulPaper 2010 1-3 June Helsinki Fair Centre, Finland Suomen Messut Tel: +358 9 15091 PTS Paper Symposium 7-9 September Small Congress Hall, Munich, Germany Dr Reinhard Sangl Email: reinhard.sangl@ptspaper.de 14

TITLE: DATE: LOCATION: CONTACT:

TITLE: DATE: LOCATION: CONTACT:

Paperchem Report

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Recycling Facilities in The US Industry ReportДокумент36 страницRecycling Facilities in The US Industry ReportArnu Felix CamposОценок пока нет

- 7115 w17 QP 12Документ12 страниц7115 w17 QP 12mrsundeepsОценок пока нет

- Instr-Tes200 en PDFДокумент2 страницыInstr-Tes200 en PDFDaniel IliescuОценок пока нет

- Noting & DraftingДокумент35 страницNoting & DraftingAnand Dubey100% (2)

- JCI - Brandul Comaniei - Exemplul 2017Документ21 страницаJCI - Brandul Comaniei - Exemplul 2017AncaAndreeaGrigorasОценок пока нет

- 783 PDFДокумент628 страниц783 PDFTahir BhattiОценок пока нет

- A Study On Customer Satisfaction Towards Itc Classmate NotebookДокумент5 страницA Study On Customer Satisfaction Towards Itc Classmate NotebookNagendra ReddyОценок пока нет

- Business PlanДокумент57 страницBusiness PlanKrisGerselMicahLirazan70% (10)

- Cash Tickets MonitoringДокумент8 страницCash Tickets MonitoringSeth Cabrera0% (1)

- Project PresentationДокумент19 страницProject PresentationRaushan KumarОценок пока нет

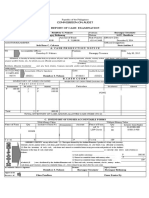

- Invoice: Invoice Tax Date Cust Ord Acct Ref Date Due Order No. 005463400 Invoice ToДокумент2 страницыInvoice: Invoice Tax Date Cust Ord Acct Ref Date Due Order No. 005463400 Invoice ToA PirzadaОценок пока нет

- PHD Thesis Cover Page DesignДокумент7 страницPHD Thesis Cover Page Designlisadavidsonsouthbend100% (2)

- Homepage Brochure31Документ14 страницHomepage Brochure31Haider AliОценок пока нет

- Hofmann-Wellenhof B., Moritz H. - Physical Geodesy - 2005Документ421 страницаHofmann-Wellenhof B., Moritz H. - Physical Geodesy - 2005Максим Валерьевич ТарасовОценок пока нет

- Saunders - Stigma of PrintДокумент54 страницыSaunders - Stigma of PrintkavezicОценок пока нет

- Press Tool Questions PaperДокумент15 страницPress Tool Questions PaperSaurabh Kumar 53Оценок пока нет

- 35863Документ204 страницы35863bhgthert100% (1)

- Corporate Social Responsibility in Infosys Foundation: Sandhya MishraДокумент8 страницCorporate Social Responsibility in Infosys Foundation: Sandhya MishraSAGAR PUROHITОценок пока нет

- A New Dimension in Logistics in The Paper IndustryДокумент8 страницA New Dimension in Logistics in The Paper Industryaqeel shoukatОценок пока нет

- Bidding DocumentsДокумент23 страницыBidding DocumentsMunawar SaeedОценок пока нет

- Folding Machine CFM 345: Operational ManualДокумент4 страницыFolding Machine CFM 345: Operational ManualDejan MilosavljevicОценок пока нет

- Appointment RecieptДокумент3 страницыAppointment RecieptDEVAОценок пока нет

- Contoh TIket BasДокумент2 страницыContoh TIket BasSyahir TopupОценок пока нет

- Nirma Bhabhi ApplicationДокумент3 страницыNirma Bhabhi Applicationsuresh kumarОценок пока нет

- Iso 801 2 1994Документ11 страницIso 801 2 1994alicardozoОценок пока нет

- Brochure Flowserve FRBH Worthington® Heavy Duty Paper Stock and Process PumpДокумент8 страницBrochure Flowserve FRBH Worthington® Heavy Duty Paper Stock and Process PumpCarlos Daniel Michel LeytonОценок пока нет

- The Times of India: Emerging Strategies For GrowthДокумент4 страницыThe Times of India: Emerging Strategies For GrowthSankar RamОценок пока нет

- In Gomorrah New Jersey There Is Only One Newspaper TheДокумент1 страницаIn Gomorrah New Jersey There Is Only One Newspaper Thetrilocksp SinghОценок пока нет

- Good Documentation PractiseДокумент49 страницGood Documentation PractiseJohn OoОценок пока нет

- Ziare NewspapersДокумент121 страницаZiare NewspapersDiaconu AndreeaОценок пока нет