Академический Документы

Профессиональный Документы

Культура Документы

Autoline Industries - Initiating Coverage - August 10

Загружено:

alok_deoraИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Autoline Industries - Initiating Coverage - August 10

Загружено:

alok_deoraАвторское право:

Доступные форматы

TechnoSpeak

InitiatingCoverage

AutolineIndustries Ltd.

August31,2010 BUY PRICE` 189 TARGET` 242

AutoAncillary

SHAREHOLDING(%)

Promoters FII FI/MF BodyCorporates Public&Others

26.74 14.19 0.01 15.62 43.44

STOCKDATA

ReutersCode BloombergCode

BSECode NSESymbol Market Capitalization* Shares Outstanding* 52Weeks(H/L) Avg.Daily Volume(6m)

AUIN.BO AUTOLIN 532797 AUTOIND ` 2,306.7mn US$49.2mn 12.20mn ` 218/78 105,133Shares

PricePerformance(%) 1M 24 3M 71 6M 72

200DaysEMA:` 134 *Onfullydilutedequityshares

AutolineIndustriesLtd.(AIL)isengagedinmanufacturingofmorethan800productsinthe Sheet Metal Components and Tubular structure space. AIL has evolved from being a stamping player to a midsized engineering company manufacturing components, assemblies and subassemblies for OEMs in Auto space. AIL is also involved into Value added services that include conceptualizing, styling, design engineering and creating prototypesofAutoComponents. RevivalinAutoSectortoboostdemandforAILsproducts AILderives80.0%ofthedomesticrevenuesand70.0%oftotalrevenuesfromTataMotors. DuringQ1FY11,TataMotorsdomesticsalesofPassengerVehicle(PV)havewitnessedyoy growth of 57.6% mainly on back of successful launch of Indigo Manza. Within the Commercial Vehicle space, the company has witnessed yoy growth of 34.9% during Q1FY11.CurrentlyAILsuppliestoallthevehiclesofTataMotorsexceptforTataNano.AIL alsoprovidesBodyFrames,Silencers,ExhaustsystemsforTataMotorsvehicles. DeriskingitselfbydiversifyingitsClientbase AILisdiversifyingitsclientbasebyincludingmorecustomersinitsclientbaseandnotbeing dependent on Tata Motors. AIL is in talks with Volkswagen, Mercedes, General Motors, M&M and by supplying them it would be able to diversify and add a huge client base. CompanieslikeVolkswagenandMercedeshavesetuphugemanufacturingfacilitiesinIndia. If the Company is able to meet the standards and quality, it would be able to achieve significantgrowthgoingforward. LargelyunaffectedbymovementsinRawMaterialprices AILsmajorrawmaterialisSteelandTataMotorbeingthemajorcustomer,fixessteelprices withsteelsuppliersonbehalfofitsvendors.Thepricesarethenreviewedeveryquarterand areadjustedaccordingtomarketprices.ThepricesoffinishedproductswhichTataMotors wouldprocurefromAIListhenfixedaccordingly.Incaseifsteelpriceshaveincreasedduring the period, the prices for finished products from AIL would then be adjusted accordingly. ThisprotectsAILfromfluctuationinsteelpricesandthusprotectsitsmarginperformance. Thus the margin performance is largelybased on how efficiently it is able to manufacture andmanageitsfixedcosts. Valueadditionthroughengineeringcapabilitiestoimproveprofitability Alongwithsupplyofcomponents,AILhasalsostartedprovidingDesigningandEngineering services. These solutions focus on reducing costs and improving the performance of the vehicles. Based on its satisfactory performance, Tata Motors has now allotted 14 more EngineeringprojectstoAIL.

OUTLOOK&VALUATION

AIL is midsized Engineering company manufacturing components, assemblies and sub assembliesforOEMsinAutospace.Itmanufacturesmorethan800productsinSheetMetal ComponentsandTubularstructurespace.Itiscurrentlyrunningatfullcapacityexceptatits Uttaranchalplantwhichiscurrentlyunderutilized.AILcancatertotheincreasingdemandtill FY2012withcurrentcapacityandincreasingutilizationlevelsatUttaranchalplant.InFY10, itsrevenuesincreased28.7%YoYandAPATgrewby339.8%YoYwithEPSof` 16.9.Going forward,withincreaseinsalespricebyTataMotorsandoverallimprovementindemandfor Autos,weexpectitsRevenuesandAPATtogrowby34.8%&41.1%,respectivelyinFY11E; andby23.4%&45.3%,respectivelyinFY12E.AttheCMPof` 189,thestockisavailableat anattractivevaluationof5.5xitsFY12Eearningsof` 34.6.Weinitiatecoverageonthestock withaBUYratingforatargetpriceof` 242 (7.0xFY12EEarnings).

KEYFINANCIALS (Consolidated)

EQUITYANALYST AlokDeora|+912240934014 alok.deora@sushilfinance.com RESEARCHASSOCIATE ShilpiJain|+912240934004 shilpi.jain@sushilfinance.com

Y/EMar. FY09 FY10 FY11E FY12E

Revenue (`mn) 3,504.6 4,511.2 6,080.0 7,505.0

APAT (`mn) 46.8 206.0 290.6 422.3

AEPS (`) 3.1 16.9 23.8 34.6

AEPS (%Ch.) (87.0) 437.1 41.1 45.3

P/E (x) 60.1 11.2 7.9 5.5

ROCE (%) 4.2 8.2 10.8 13.3

ROE (%) 3.1 9.6 12.1 15.3

P/Sales (x) 0.8 0.5 0.4 0.3

Pleaserefertoimportantdisclosuresattheendofthereport

ForprivateCirculationOnly. Member:BSEL,SEBIRegn.No.INB/F010982338|NSEIL,SEBIRegn.No.INB/F230607435. Phone:+912240936000Fax:+912222665758Email:info@sushilfinance.com

SushilFinancialServicesPrivateLimited

Office:12,HomjiStreet,Fort,Mumbai400001.

AutolineIndustriesLimited

COMPANYOVERVIEW

AutolineIndustriesLimitedisamajorsupplierofsheetmetalcomponents,subassemblies and assemblies. It has an ultramodern manufacturing facility and has the experience of producinglargevolumesinspecifiedtime andtothe required quality specifications. The products are customized to the requirements of the client, as per their drawings or samplesprovided.Thereisaqualitycheckateverylevelandbeforefinaldispatch. The manufacturing plants are set across different locations with enough of capacity to catertothegrowingdemandofautocomponents. ChakanI ChakanII BhosariUnit(Pune) KudalwadiUnit(Pune) WesternPressingLtd.(PimpriUnit) NirmitiAutocomponentsPvt.Ltd. Sidkul,Pantnagar(Uttarakhand) UnionAutolineSpareParts,LLC ButlerIndiana To further enhance the design capabilities, AIL has taken a major stake in design engineering firm. With this acquisition, company has the unique capability of Offshore Designing&Manufacturingmodel(ODM).Companyiscontinuouslyrenewingtechnology andupgradingqualitystandards,keepinginmindinternationalbenchmarks. Due to excellent qualityinwork, costcompetitiveness,timely deliveriesand stateofthe art tool room with latest CAD/CAM facilities, in short span of time it has become prime vendortoreputedautomanufacturers. Atpresent,companyismanufacturing"A"classsheetmetaldiesandsupplyingabout 130 components to Tata Motor's Indica, Indigo & Marina. It is also supplying 400 components to its Auto Division for LCVs, MCVs and HCVs, besides components for SUVslikeSafari,Sumoandtheirvariants. Variousothercomponentsnumberingmorethan150arebeingsuppliedtoBajajAuto Limited&KineticEngineeringLimitedfor2wheelers&3wheelers. Critical and prestigious components are regularly supplied to Walker Exhaust (India) PrivateLtd,awhollyownedsubsidiaryofaFortune500company. CompanysuppliestractorcomponentstoMahindra&MahindraLimitedandFiatfor theirPalioProject. ExportsofBrakeshoesmeantassparesforMercedesTrailerstoGermany,Singapore, UAEandSaudiArabia. AjointventurebythenameofUnionAutolineSparePartsLLC,UAEhasbeensetupto promoteexportsofAutoComponentsfortheGulfandAfricanMarkets. AILsuppliesmostlyassinglesourcesuppliertoTATAMotors,whichcontributesmore than80%ofcompanysstandalonerevenues. Companyhasaggressivelygrownthroughorganicandinorganicrouteswithanaimto becomeadesigntomanufacturecompany.

August31,2010

AutolineIndustriesLimited

PRODUCTRANGE

Company has wide range of products to offer as per the specifications of the clients. It specializes in providing different sheet metal components and subassemblies which are usedinvariousmannersinproductionofvehicles.Fewofthemajorproductsinclude: AssemblyPanelforFrontandRearDoor PanelTunnel FrontBumpMountingRear ReinforcementWaistInnerandOuterFrontDoor ReinforcementHandBrake TailLampCover SuspensionTower ExhaustSystem SwitchGears AssemblyFootControlModules

MAJORSUBSIDIARYCOMPANIES

NameofSubsidiary

WesternPressing Limited AutolineDimensions SoftwareLimited

Products TubularProducts EngineeringSoftware Services.

Holding Status 100.0% MergedwithAIL 100.0% Providesendto end solutionstoitscustomers onOutsourcedDesignto ManufacturingModel. 49.0% Wouldtake23yearsto breakeven 51.0% ReducingStaketo40.0%

effectiveApril01,2011

Zagato DEPAutolineINC.USA AutolineIndustries USAINC. NirmitiAuto Components

VehicleStylingand Customization DesigningSoftware JacksandPedals PedalSystemsand Hinges

51.0%

Recentlyachieved breakevenpoint 100.0% NoImmediateplansto mergeitwithAIL

August31,2010

3

AutolineIndustriesLimited

INDUSTRYOVERVIEW

TheIndianAutoComponentindustryhaveevolvedfrombeingalowkeysupplierproviding componentstothedomesticmarkettobeingasupplierofkeyautocomponentscentersin Asiaandtodayseenasasignificantplayerintheglobalautomotivesupplychain.Indiais now a supplier of a range of highvalue and critical automobile components to leading globalautomakerssuchasGeneralMotors,Toyota,Ford,andVolkswagenamongstothers basedinvariousgeographies. Automobile Industry was delicensed in July 1991 with the announcement of the New IndustrialPolicy.ThePassengerVehicle(PV)industrywashowever,delicensedin1993.No industrial license is required for setting up of any unit for manufacture of automobiles except in some special cases. At present 100% Foreign Direct Investment (FDI) is permissibleunderautomaticrouteinthissectorincludingPVsegment.Withthegradual liberalizationoftheautomobilesectorsince1991,thenumberofmanufacturingfacilities inIndiahasgrownprogressively.Thesurgeinmanufacturingofautomobileshasledtoa sharp rise in Indian Auto Component demand over the years. In the last 6 years, Auto ComponentIndustryhasgrownatCAGRof19.5%toUS$19.5bninFY2010.

From200410 CAGRgrowth of19.5%.

Source:MOHIAutomotiveMissionPlan(AMP)

InvestmentsinAutoAncillarySectorexpectedtoSpike

The rocketing demand for automobiles in India has made Auto Majors put pressure on autocomponentmanufacturerstoincreasecapacity.AccordingtoACMA,demandhasfar outstripped supply primarily because of several new models launched in the domestic market and slow but steady recovery in demand from overseas. Moreover, since penetration levels continue to be low in India, capacity is likely to go up by 20.0% to 25.0%inFY2011.AutoComponentplayersarebeingforcedtoincurhugecapexin2010 11 for setting up new capacities and upgrading the existing ones. According to reports, Auto industry output is getting affected by 5.0% to 7.0% due to supply shortage in components. There is huge scarcity supply even from Chinese players as they are expectinghigherpricestakingintoaccounttheeverincreasingdemand.

August31,2010

AutolineIndustriesLimited

GlobalautofirmsaresettingupfacilityinIndiawhichhasmadeIndiathesmallcarhub for domestic and overseas markets. Hyundais i10 model is manufactured in India and supplied to the world. Recently Global Auto Majors like Volkswagen, Nissan Motor Co. and GM have set up facilities in India and are increasing their commitment to Indian component suppliers. According to industry reports, Hero Motors Ltd and German ZF Groupwilltogetherinvestaround` 800mninthenexttwoyearstoassembleaxleand chassissystems.

Expectedto touchUS$20.9 bnby201516

Source:ACMA

Investments according to ACMA are expected to touch US$20.9 bn by 201516 from currentlevelsofUS$7.4bn.PredictionarebasedonStrongbalancesheetsandfinancial positions which have made it possible for Indian firms to invest in component sector. IndustryEBITDAdeclinedduringtherecessionin200809butwiththerevivalineconomy which has led to strong up move in Auto Sector, the financial position for Auto Componentshaveimprovedsignificantlyandareinstrongpositiontoinvestinincreasing capacities.

DistributionofAutoAncillaryIndustry

AutoAncillaryindustryissubdividedintovarioussegmentswhichplayerspresentineach segment of the industry. Body and Chasis currently make up for 12.0% of the total productswhereAILismajorlyinvolved.

Source:MOHIAutomotiveMissionPlan(AMP)

August31,2010

AutolineIndustriesLimited

Marutihasthreatenedtoreducecomponentsuppliersonpartsshortage

Asperrecentreports,MarutiSuzukiIndiaLtdhasthreatenedtocutcomponentmakers unabletoincreasecapacitiesasanindustrywidecomponentsshortagehassignificantly affected auto production in vehicle market. Maruti has asked suppliers to strengthen their balance sheets and increase capacity or they would drop them from their list of vendors. AutoMajorsarebeingforcedtomakecustomerwaitfordeliveryofvehiclesduetolack ofcriticalcomponentsparts.Duetoextremelyhighdebtlevels,componentsplayershave struggled to expand. All auto players get significantly affected even with delay or shortageinfewcriticalcomponents.

CompetitiveedgeisforcingGlobalAutoMajorstosourcecomponentsfrom India

Indian Auto Components makers are constantly working on improving component quality,producingcomponentsatlowercostascomparedtoglobalcomponentindustry. India has now become a globally trusted brand in the global auto component industry. Alsotheautocomponentmanufacturershaveevolvedandmovedupinthevaluechain. They now provide value added engineering services along with supply of components. Thisimprovestheirmarginandbargainingpower.Asweexpectthecompetitiveedgeto continueinfuture,weexpectextremelystrongoutlookfortheautocomponentindustry inIndia. According to reports, components made in India and China is 10.015.0% cheaper than those manufactured in Europe and the US. According tothe Investment Commission of India, Global automobile manufacturers see India as a manufacturing hub for auto componentsprimarilydueto: LowlabourforceandrawmaterialwhichmakesIndiacostcompetitive. Indiahasanestablishedmanufacturingbase. Major international autocomponent including Delphi, Visteon, Bosch and Meritor havesetupoperationsinIndia. Automobile manufacturers and auto components manufacturers have set up InternationalPurchasingOffices(IPOs)inIndia. FinequalitycomponentsarenowbeingmanufacturedinIndia.

August31,2010

AutolineIndustriesLimited

INVESTMENTARGUMENT

RevivalinAutoSectortoboostdemandforAILsproducts

GrowthofAILatthecurrentmomentisdependentongrowthofAutosector.Thesector hasseenasharprevivalposttheslumpwitnessedduring20082009.Ithasbeenableto getbackontrackduetoGovernmentIncentives(ExciseCuts),EasyavailabilityofFinance andimprovementinoverallliquidityinthesystem. AIL derives 80.0% of the Domestic Revenues and 70.0% of total revenues from Tata Motors. Tata Motors has seen a turnaround across segments in Q1 FY11 with yoy growthof34.9%and57.6%inCVandPVsegmentsrespectively.Ithasexperiencedtotal yoygrowthof47.5%inQ1FY11onstandalonebasis.TherearetwosegmentswhichAIL caterstowhenitsuppliestoTataMotors. PassengerVehicle CommercialVehicle PassengerVehicleSegment:

Source:SIAM

AILs50.0%oftherevenuesgeneratedfromTataMotorsarefromsupplyingcomponents tothePVdivision.CurrentlyAILsuppliestoallthePVvehiclesofTataMotorsexceptfor Tata Nano. AIL also provides Body Frames, Silencers, Exhaust systems for Tata Motors vehicles.AILisinastrongpositiontosupplycomponentstoJLRwhichiscurrentlyrunning athighcapacityutilization. AccordingtotheJLRmanagement,withthecurrentmanpower,JLRisoperatingatclose to full capacity. If AIL meets the required quality standards then it would be able to achieve big orders from JLR which could play significant contrition in driving its future growth.

August31,2010

AutolineIndustriesLimited

During last six years Indias PV has grown at CAGR of 15.5%. According to Auto Component Manufacturing Association of India (ACMA), PV sales including exports are expectedtotouch4.1mnunitsby2016fromcurrentlevelsof2.3mn.TataMotorenjoys marketshareofapproximately10.5%inthePVmarket.

From200410 CAGRof 15.5%

Source:ACMA

CommercialVehicleSegment: CommercialVehiclesegmentgottheworstaffectedduringthedownturnexperiencedin 20082009.CVsegmentisnowshowingsignsofrevival.ItgrewataCAGRof12.8%during lastsixyears.AccordingtoACMA,CVsalesincludingexportsareexpectedtotouch0.78 mn units by 2016 from current levels of 0.57 mn. Commercial Vehicles account of approximately50.0%ofthetotalrevenuesAILgeneratesfromTataMotors.

From200410 CAGRof 12.8%

Source:ACMA

August31,2010

8

AutolineIndustriesLimited

DeriskingitselfbydiversifyingitsClientbase

After the global economic downturn, India has become an attractive destination as a global outsourcing hub and manufacturing base for OEMs. AIL generates 70.0% of its consolidatedturnoverfromTataMotors.ThismakesAILsignificantlydependentonTata Motors. With a view to diversify its customer base, AIL is in constant talks with Auto Majors like Volkswagen, Mercedes, General Motors, M&M. Companies like Volkswagen andMercedeshavesetuphugemanufacturingfacilitiesinIndia.IftheCompanyisableto meet the standards and quality specifications, it would be able to achieve significant growthgoingforward. AIL is targeting to reduce the contribution from Tata Motors to 50.0% in 23 years. It wouldbeabletocomfortablydosoifitisabletopenetratethemarketbybaggingorders fromGlobalAutomajorswhohavesetupfacilityinIndia.

LargelyUnaffectedbymovementsinRawMaterialprices

AIL major raw material is Steel and Tata Motor being the major customer, fixes steel priceswithsteel suppliersonbehalfofitsVendors.Theprices arethen reviewed every quarter and are adjusted according to market prices. The prices of finished products whichTataMotorswouldprocurefromAIListhenfixedaccordingly. Thepricesforfinishedproductsarefixedforthevendorsonlyaftertakingintoaccount the price at which Raw Material Prices have been fixed at. This protects AIL from fluctuationinsteelpricesandthusprotectsitsgrossmarginperformance. From February 2010 onwards, Tata Motors raised the selling price for most of the products it procures from its Auto Ancillary vendors by 3.0%. This increase would let players like Autoline cover on the overhead costs like increase in fuel prices, transportationandlabourcostsandthusbeprotectedagainstmargincrunch.

Valueadditionthroughengineeringcapabilitiestoimproveprofitability

AIL has evolved from a pure supplier of Components to providing Designing and Engineering services to the Company. These solutions focus on reducing costs and improving the performance of the vehicles. Based on its satisfactory performance, Tata Motorshasnowallotted14moreEngineeringprojectstoAIL. AutolinehasmadesignificantpresenceovertheyearsinAutomotiveEngineeringServices whichinvolvesthecompleteprocessfromDesigningtoManufacturing.Ithasalsogrown inthissegmentthroughacquisitionsandisnowwellestablishedwithinthisspace.With therisingcostsoffuel,ithasbecomeprimefocusatindustryleveltoreducecosts.The needforengineeringserviceswouldincreaseovertimeandplayerslikeAILwouldhavean edgeoveritspeersinancillaryspace. AILispresentacrosstheValueChainandhasCoreCompetence rightfromStylingtotheManufacturingprocess MARKETING, SALESAND PRODUCT PRODUCT TOOLDESIGN PROTOTYPING MANUFACTURING STYLING DISTRIBUTION DESIGNING ENGINEERING DEVELOPMENT SERVICE AILCoveredSegments

OEM&Dealer Network

August31,2010

AutolineIndustriesLimited

OtherBusinessDrivers

Subsidiaries breaking even: AILs all the subsidiaries except for Zatago of Italy have achievedthebreakevenpoint.AILnowexpectstoincreaseitspresenceinUSAandEurope throughitssubsidiariesandwouldfocusmoreonEngineeringServices.AILsUSsubsidiary which recently achieved the breakeven point incurred a loss in FY 2009 due to the economic slowdown. It has now moved back to profits and we expect to contribute on marginfrontasproductsofferedinUSmarketsenjoyhighermargins.AILisalsoopento furtheracquisitionswhereitfindsvalue.

LandAssets AIL is having a 51.0% stake in a 100 acre land in heart of Chakan, Pune. Originally AIL acquiredtheLandforaJointVenturearoundtwoyearsback.Howeverduringthisperiod, hugefacilitiesweresetupbyAutomajorslikeVolkswagen,GM,MercedesBenz,Daimler, andM&MHyundaiinthatarea.DuetothisthevalueoftheLandappreciatedsignificantly andthecompanyconverteditintoresidentialland.Currentlythetotalindustrialvalueof theLandiscloseto` 1,000mnhowevertheresidentialvalueisestimatedcloseto` 2,500 mnofwhich51.0%belongstoAIL.AILhasnowdecidedtodeveloptheresidentiallandand itisintalkswithdevelopersforthedevelopment.Itexpectstogenerateannualreturnsof ` 750to` 1,000mnforthenext45yearsfromthisprimeland.

COMPARATIVEANALYSIS

CompanyName(FY10) AIL AutomotiveStampings&AssembliesLtd AutomotiveCorporationofGoa Ltd JBMAutoLtd

Source:CapitalLine

Revenues (`.Inmn) 4,511.2 4,525.3 2,463.2 2,472.5

EBIDTA (%) 12.0 6.2 0.3 10.4

EPS PE (`.) (x) 16.9 11.2 5.1 27.1 (3.4) NA 12.6 5.6

ROE ROCE (%) (%) 9.6 8.2 10.7 13.3 (1.7) (2.6) 8.5 11.6

RISKSANDCONCERNS

Highly dependent on single OEM: AIL is dependent on Tata Motors and it generates 80.0% of total revenues and 70.0% of consolidated revenues from Tata Motors. Such a highdependencecanprovetomeriskyifthereisashutdownorslowdownforacertain period which could significantly affect players like AIL. However AIL is not intentionally diversifyingitscustomerbasebytalkingtootherAutomajorsforsupplyingcomponents. IncreaseinInterestratesUpmoveininterestratesaffectthedemandforAutoswhich in turn affect the demand for Auto Ancillary products. Expected hardening of interest ratesandincreaseininflationcouldnegativelyimpacttheautoindustry.Thiscouldlead to delay in orders by customers which could badly affect Auto Ancillary companies like AIL. FluctuationinExchangerateAILrecentlystartedexportingconsignmentstoUSAandis expecting further orders from them. Fluctuation in exchange rates could negatively impact the performance of your Company. Company has not entered into derivative contractsyetandmightenteronceitsexportspickup. High levels of inflation The industry is investing to increase capacities to cater to the demand.Howeverconsideringthethinmargintheindustrycommands,theyneedtobe awareoftheirreturnoninvestmentinviewofinflationincommodityprices,power,fuel andmanpowercost.

August31,2010

10

AutolineIndustriesLimited

PROFIT&LOSSSTATEMENT(Consolidated)

Y/EMarch NetSales RawMat.Consumed StaffCost AdminandSellingExp Misc.Expenditure TotalExpenditure PBIDT Interest Depreciation PBTinclOI Tax PAT MinorityInterest APAT FY09

3,504.6 2,807.8 260.2 173.7 0.3

`.mn

BALANCESHEETSTATEMENT(Consolidated)

Ason31 March ShareCapital Reserves&Surplus NetWorth MinorityInterest SecuredLoans UnsecuredLoans TotalLoanfunds DeferredTaxLiability CapitalEmployed NetBlock Goodwill Investments Inventories SundryDebtors Cash&BankBal OtherCurrAssets CurrentAssets CurrLiab&Prov NetCurrentAssets MiscellaneousExp TotalAssets

st

`.mn

FY12E

122.0 2,791.6 2,913.6 387.3 1,530.5 281.6 1,812.2 76.1 5,187.3 2,782.6 361.4 243.9 550.1 1,089.8 790.0 936.4 3,366.3 1,594.2 1,772.2 27.3 5,187.3

FY10

4,511.2 3,342.1 443.5 203.3

FY11E

6,080.0 4,518.6 611.0 275.0 5,404.6 705.8 135.9 187.4 382.4 76.5 305.9 15.3 290.6

FY12E

7,505.0 5,577.7 754.3 320.6 6,652.5 890.0 135.9 198.4 555.7 111.7 444.5 22.2 422.3

FY09

149.0 1,984.3 2,133.4 380.4 1,039.5 432.5 1,472.0 59.4 4,045.2 2,483.8 361.4 225.2 308.2 487.7 28.7 960.2 1,784.9 858.6 926.3 48.5 4,045.2

FY10

122.0 2,146.2 2,268.2 387.3 1,530.5 281.6 1,812.2 76.1 4,543.8 2,768.5 361.4 243.9 336.2 802.2 74.0 936.4 2,148.8 1,006.1 1,142.8 27.3 4,543.8

FY11E

122.0 2,408.5 2,530.6 387.3 1,530.5 281.6 1,812.2 76.1 4,806.1 2,781.0 361.4 243.9 445.7 882.8 431.6 936.4 2,696.6 1,304.0 1,392.5 27.3 4,806.1

3,242.0 3,988.9 290.6 80.3 121.4 88.9 22.7 66.2 19.4 46.8 543.1 108.2 168.3 266.6 49.6 217.0 11.0 206.0

FINANCIALRATIOSTATEMENT(Consolidated)

Y/EMarch Growth(%) NetSales APAT EBITDA Profitability(%) EBITDAMargin Adj.PATMargin ROCE ROE PerShareData(Rs.) Adj.EPS Adj.CEPS BVPS Valuations(X) PER P/BV EV/EBITDA EV/Netsales Mcap/Netsales TurnoverDays Debtorsdays Creditorsdays GearingRatio TotalDebttoEquity FY09

2.7 (84.5) (40.8) 8.2 1.3 4.2 3.1 3.1 11.3 143.1 60.1 1.3 16.1 1.3 0.8 46 94 0.7

CASHFLOWSTATEMENT(Consolidated)`.mn

Y/EMarch PBIT Depreciation ProvisionforTax ChginWorkingcap Chginothers Cashflowfrom operations ChginGrossPPE ChginInvestments Chginothers Cashflowfrom investing Chgindebt ChginShareCapital ChginMinInt DividendPaid Chginothers Cashflowfrom financing Chgincash Cashatstart Cashatend FY09 88.9 114.5 (22.7) (503.0) (4.3) (326.6) (368.8) (85.0) (23.1) (476.9) 210.9 23.9 159.1 (14.3) 387.6 767.1 (36.5) 65.2 28.7 FY10

266.6 121.1 (49.6) (171.2) 48.9 215.8 (405.8) (18.6) 0.0 (424.5)

FY10

28.7 339.8 86.9 12.0 4.5 8.2 9.6 16.9 30.7 185.8 11.2 1.0 8.3 1.0 0.5 52 102 0.8

FY11E

34.8 41.1 29.9 11.6 4.8 10.8 12.1 23.8 39.2 207.3 7.9 0.9 6.4 0.7 0.4 53 100 0.7

FY12E

23.4 45.3 26.1 11.8 5.6 13.3 15.3 34.6 50.9 238.6 5.5 0.8 5.1 0.6 0.3 53 100 0.6

FY11E

382.4 187.4 (76.5) 107.8 15.3 616.5 (200.0) 0.0 0.0 (200.0) 0.0 0.0 (15.3) (43.6) 0.0 (58.9) 357.6 74.0 431.6

FY12E

555.7 198.4 (111.1) (21.2) 22.2 644.0 (200.0) 0.0 0.0 (200.0) 0.0 0.0 (22.2) (63.3) 0.0 (85.6) 358.4 431.6 790.0

340.1 (27.0) (4.1) (28.6) (26.6)

253.9 45.3 28.7 74.0

Source:Company,SushilFinanceResearchEstimates

August31,2010

11

AutolineIndustriesLimited

OUTLOOK&VALUATION

AIL is midsized Engineering company manufacturing components, assemblies and sub assemblies for OEMs in Auto space. It manufactures more than 800 products in Sheet Metal Components and Tubular structure space. It is currently running at full capacity except at its Uttaranchal plant which is current underutilized. AIL can cater to the increasing demand till FY 2012 with current capacity and increasing utilization levels at Uttaranchalplant.InFY10,itsRevenuesincreased28.7%YoYandAPATgrewby339.8% YoY with EPSof` 16.9. Going forward,with increaseinsalesprice byTata Motorsand overallimprovementindemandforAutos,weexpectitsRevenuesandAPATtogrowby 34.8%&41.1%respectivelyinFY11E;andby23.4%&45.3%,respectivelyinFY12E.Atthe CMPof` 189, thestockisavailableatanattractivevaluationof5.5xitsFY12Eearningsof ` 34.6. We initiate coverage on the stock with a BUY rating for a target price of ` 242 (7.0xFY12EEarnings).

PleaseNotethatourtechnicalcallsaretotallyindependentofourfundamentalcalls. Additional information with respect to any securities referred to herein will be available upon request.

Sushil Financial Services Private Limited and its connected companies, and their respective directors, Officers and employees(tobecollectivelyknownasSFSPL),may,fromtimetotime,havealongorshortpositioninthesecurities mentioned and may sell or buy such securities. SFSPL may act upon or make use of information contained herein priortothepublicationthereof. This sheet is for private circulation only and the said document does not constitute an offer to buy or sell any securitiesmentionedherein.Whileutmostcarehasbeentakeninpreparingtheabove,Weclaimnoresponsibilityfor itsaccuracy.Weshallnotbeliableforanydirectorindirectlossesarisingfromtheusethereofandtheinvestorsare requestedtousetheinformationcontainedhereinattheirownrisk.

August31,2010

12

Вам также может понравиться

- Auto - AncillaryДокумент22 страницыAuto - Ancillarysahilgoyal25Оценок пока нет

- IIM-Auto Components 2Документ27 страницIIM-Auto Components 2singhania1989nehaОценок пока нет

- Munjal Kiriu IndustriesДокумент15 страницMunjal Kiriu IndustriesSubhash BajajОценок пока нет

- Acm A DelegationДокумент36 страницAcm A Delegationvenkatesh_1829Оценок пока нет

- E - Commerce in Automotive Component IndustryДокумент12 страницE - Commerce in Automotive Component IndustryfaruquepgdmОценок пока нет

- Steering Indian Automobile Industry: Towards GlobalizationДокумент8 страницSteering Indian Automobile Industry: Towards GlobalizationRinku PandyaОценок пока нет

- Auto Components IndustryДокумент6 страницAuto Components Industryyankee_akhil4554Оценок пока нет

- Part A IFB Full Project Final REPORTДокумент37 страницPart A IFB Full Project Final REPORTSrinivas Gowda100% (2)

- Company ProfileДокумент6 страницCompany ProfilePushpanathan ThiruОценок пока нет

- Amtek Auto InustryДокумент10 страницAmtek Auto InustryVedantam GuptaОценок пока нет

- Roots Internship ReportДокумент54 страницыRoots Internship Reportaishwaryasatheesh80% (5)

- Project Report: Cost Analysis of Automotive Companies Using Regression AnalysisДокумент5 страницProject Report: Cost Analysis of Automotive Companies Using Regression AnalysisvishalpahariyaОценок пока нет

- Semco GroupДокумент8 страницSemco GroupNeeraj Kumar SingalОценок пока нет

- Sundram FastenersДокумент4 страницыSundram Fastenersmpcd07Оценок пока нет

- Triton Valves LTDДокумент5 страницTriton Valves LTDspvengi100% (1)

- Automotive Spare Parts and ComponentsДокумент57 страницAutomotive Spare Parts and Componentssarvesh.bhartiОценок пока нет

- Part A IFB Full Project Final REPORT PDFДокумент37 страницPart A IFB Full Project Final REPORT PDFPrajwal Gowda100% (1)

- Industiral Project Kalayani Lemerez Murtaza 19BSP1631Документ4 страницыIndustiral Project Kalayani Lemerez Murtaza 19BSP1631murtaza mannanОценок пока нет

- History and Development of Amul Indusries Pvt. Ltd.Документ79 страницHistory and Development of Amul Indusries Pvt. Ltd.asn8136Оценок пока нет

- Practical Project Execution Alloy Wheels Manufacturing PlantДокумент5 страницPractical Project Execution Alloy Wheels Manufacturing PlantSanjay KumarОценок пока нет

- Tata MotorsДокумент64 страницыTata MotorsAlfan KotadiaОценок пока нет

- Auto Components Industry in IndiaДокумент7 страницAuto Components Industry in IndiaTalha AzizОценок пока нет

- Thailand AutoBook 2019 PreviewДокумент43 страницыThailand AutoBook 2019 PreviewChris LAUОценок пока нет

- SIPCOT Industrial ParkДокумент12 страницSIPCOT Industrial ParkPrashanth Rajashekar0% (1)

- Sahil Product Costing11Документ76 страницSahil Product Costing11Jasmandeep brarОценок пока нет

- Fundamental & Tech. AnalysisДокумент8 страницFundamental & Tech. AnalysisSonu KumarОценок пока нет

- Indian MNCsДокумент35 страницIndian MNCsShweta ShrivastavaОценок пока нет

- Sundram Fasteners SДокумент4 страницыSundram Fasteners SKrishna S SОценок пока нет

- Innoventive Industries LTD: Innovative Product LineДокумент8 страницInnoventive Industries LTD: Innovative Product Linenitinahir20105726Оценок пока нет

- Part A IFB Full Project Final REPORTДокумент37 страницPart A IFB Full Project Final REPORTPrajwal GowdaОценок пока нет

- HR ProjectДокумент95 страницHR Projectborn2bgr8Оценок пока нет

- Sanjeev Auto Parts Inplant Project ...Документ36 страницSanjeev Auto Parts Inplant Project ...Sagar Shinde100% (1)

- Cover Story - Toyota Kirloskar Auto Parts Transmissions For IMV Programme - Automotive Products FinderДокумент2 страницыCover Story - Toyota Kirloskar Auto Parts Transmissions For IMV Programme - Automotive Products FinderGolak MahantaОценок пока нет

- MR P P KadleДокумент30 страницMR P P KadleVinay GoyalОценок пока нет

- KTCPLДокумент22 страницыKTCPLBhanwar Singh RathoreОценок пока нет

- Our Vision and MissionДокумент5 страницOur Vision and MissionYogesjh KalraОценок пока нет

- 1.0 Executive Summary: Automotive Sector (Contributes 95% To Total Revenue)Документ15 страниц1.0 Executive Summary: Automotive Sector (Contributes 95% To Total Revenue)Koustav S MandalОценок пока нет

- Working Capital ReportДокумент22 страницыWorking Capital Reportdivyansh khandujaОценок пока нет

- Marketing Strategy Opted by The Apollo Tyres1Документ90 страницMarketing Strategy Opted by The Apollo Tyres1Shivalya MehtaОценок пока нет

- Automotive Components India PDFДокумент30 страницAutomotive Components India PDFyogipatilОценок пока нет

- Market Adaptation of Volkswagen PoloДокумент36 страницMarket Adaptation of Volkswagen PoloRohit Sopori100% (1)

- Omax Ar 09Документ80 страницOmax Ar 09jughead201985Оценок пока нет

- Case Tata IndicaДокумент3 страницыCase Tata IndicaSumit ManchandaОценок пока нет

- Opportunities in Automotive Engineering Services in IndiaДокумент18 страницOpportunities in Automotive Engineering Services in IndiaGopalAnandanОценок пока нет

- Automotive NewsДокумент3 страницыAutomotive NewsDharamjeet SinghОценок пока нет

- Auto PartsДокумент3 страницыAuto Partsvicky_tiwari1023Оценок пока нет

- Missing-Plant Layout, Turnover, Employee and Workers Salary, No. of Machines in Each Shop. IsoДокумент3 страницыMissing-Plant Layout, Turnover, Employee and Workers Salary, No. of Machines in Each Shop. IsoAkhil GuliaОценок пока нет

- CHAPTER 1 Profile of The Company Hi Tech Arai PVT LTDДокумент12 страницCHAPTER 1 Profile of The Company Hi Tech Arai PVT LTDThanga Raja100% (1)

- Toyota Kirloskar Motor PVT LTDДокумент4 страницыToyota Kirloskar Motor PVT LTDibrahimbilal2812Оценок пока нет

- Indian Automobile IndustryДокумент44 страницыIndian Automobile Industryakkkii13Оценок пока нет

- TOYOTA Indus Motor Co FinalДокумент8 страницTOYOTA Indus Motor Co FinalImran Memon0% (1)

- Agriauto Industries LimitedДокумент22 страницыAgriauto Industries Limitedwaqas ali ahmadОценок пока нет

- Retail Research: Precision Camshafts Limited (PCL) - IPO NoteДокумент8 страницRetail Research: Precision Camshafts Limited (PCL) - IPO NoteshobhaОценок пока нет

- ITR PPT (KALPESH Bhoir)Документ14 страницITR PPT (KALPESH Bhoir)Harsh KbddhsjОценок пока нет

- The Royal Bank of Scotland Takeover of ABNДокумент76 страницThe Royal Bank of Scotland Takeover of ABNMarmik SoniОценок пока нет

- AhlДокумент25 страницAhlHassaan DarОценок пока нет

- Tata Executive SummaryДокумент2 страницыTata Executive SummaryShaojun YaoОценок пока нет

- Plastic Products in IndiaaaДокумент5 страницPlastic Products in IndiaaaMohit MudgalОценок пока нет

- Automotive Glass Replacement Shop Revenues World Summary: Market Values & Financials by CountryОт EverandAutomotive Glass Replacement Shop Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- LPP Excel SolverДокумент2 страницыLPP Excel SolverJayant JainОценок пока нет

- Department of Sales and Promotion Name Abdur Raffay Khan Submitted To Irfan NasirДокумент2 страницыDepartment of Sales and Promotion Name Abdur Raffay Khan Submitted To Irfan NasirZainОценок пока нет

- MarketIntegration 3Документ11 страницMarketIntegration 3Franz Althea BasabeОценок пока нет

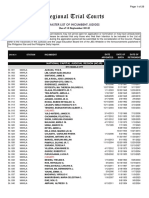

- Regional Trial Courts: Master List of Incumbent JudgesДокумент26 страницRegional Trial Courts: Master List of Incumbent JudgesFrance De LunaОценок пока нет

- Primary Election Voter Guide 2012Документ12 страницPrimary Election Voter Guide 2012The Florida Times-UnionОценок пока нет

- Contract I Reading ListДокумент11 страницContract I Reading ListBUYONGA RONALDОценок пока нет

- AIMA Report Dikshita and Deeksha Western RegionДокумент13 страницAIMA Report Dikshita and Deeksha Western RegionJimmy PardiwallaОценок пока нет

- Study On India Japan Economic Partnership AgreementДокумент32 страницыStudy On India Japan Economic Partnership AgreementJayanta SarkarОценок пока нет

- Andy Bushak InterviewДокумент7 страницAndy Bushak InterviewLucky ChopraОценок пока нет

- Derivatives Qs PDFДокумент5 страницDerivatives Qs PDFLara Camille CelestialОценок пока нет

- chính trị học so sánhДокумент18 страницchính trị học so sánhTrần Bích Ngọc 5Q-20ACNОценок пока нет

- Q2e LS5 U07 VideoTranscriptДокумент2 страницыQ2e LS5 U07 VideoTranscriptTrần Chí Bảo XuyênОценок пока нет

- NTSE MAT Solved Sample Paper 1 PDFДокумент17 страницNTSE MAT Solved Sample Paper 1 PDFAlmelu AvinashОценок пока нет

- Case For High Conviction InvestingДокумент2 страницыCase For High Conviction Investingkenneth1195Оценок пока нет

- LumaxДокумент1 страницаLumaxpawan1501Оценок пока нет

- Microfinance & Rural Banking Conventional and IslamicДокумент20 страницMicrofinance & Rural Banking Conventional and IslamicIstiaqueОценок пока нет

- NTPCДокумент26 страницNTPCShradha LakhmaniОценок пока нет

- Inside Job TermsДокумент8 страницInside Job TermsKavita SinghОценок пока нет

- Operation ManagementДокумент15 страницOperation ManagementRabia RasheedОценок пока нет

- NDT and Tpi Control1Документ87 страницNDT and Tpi Control1KyОценок пока нет

- India Map in Tamil HDДокумент5 страницIndia Map in Tamil HDGopinathan M0% (1)

- Daw LanceДокумент18 страницDaw LanceSaad Ul HasanОценок пока нет

- 2019 - ACA Exam Dates and Deadlines - WebДокумент2 страницы2019 - ACA Exam Dates and Deadlines - WebSree Mathi SuntheriОценок пока нет

- Bryanston Inve Vijay Karpe 22090934Документ2 страницыBryanston Inve Vijay Karpe 22090934Karan RathodОценок пока нет

- Retail Store Icq 3Документ2 страницыRetail Store Icq 3Nidhi VermaОценок пока нет

- Agro IndustrializationДокумент24 страницыAgro IndustrializationDrasko PeracОценок пока нет

- Vermisoks Case PDFДокумент16 страницVermisoks Case PDFTre CobbsОценок пока нет

- Welfare Economics of Amartya SenДокумент12 страницWelfare Economics of Amartya SenromypaulОценок пока нет

- 6 Ch14 - Central BanksДокумент63 страницы6 Ch14 - Central BanksNgọc Ngô Thị MinhОценок пока нет

- Chapter 1 Microeconomics For Managers Winter 2013Документ34 страницыChapter 1 Microeconomics For Managers Winter 2013Jessica Danforth GalvezОценок пока нет