Академический Документы

Профессиональный Документы

Культура Документы

Practice Final Comm371

Загружено:

Kevin GillИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Practice Final Comm371

Загружено:

Kevin GillАвторское право:

Доступные форматы

1

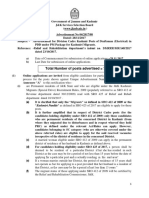

COMM371 Theory of Finance

Practice Final Exam

Wayne T. Penn sat back in his extremely comfortable chair in his extremely

comfortable office looking out over the Lions Gate Bridge. He could see the smoke

billowing out of the oil containers in the English Bay, if he opened his window, he could

smell them too. Mr. Penn thought back on his last few years as Chief Financial Officer of

Apex Drugs and Products. By 2010, Apex had become a major player in prescription

drugs with sizable market share in quite a few of them, and several blockbuster drugs.

Apex also had numerous brand name home products such as Clean detergent and Chef

Girlardee canned food.

The three pillars of Apexs strategy were conservatism, marketing and cost control.

Apex consistently avoided much of the risk of product development and introduction in

the volatile drug industry. Most of its new products were acquired or licensed after their

development by other firms. Others were copies and clever extensions of products

introduced by competitors. Apexs success was built on its expertise in marketing, which

eroded its competitors head start, and on cost control, which ensured substantial

margins. The results were impressive. Selected financial data for Apex (in $ millions):

2006 2007 2008 2009 2010

Sales 2,471.7 2,685.1 3,062.6 3,406.3 3,798.5

Net income 277.9 306.2 348.4 396.0 445.9

EPS 1.75 1.94 2.21 2.51 2.84

DPS 1.00 1.15 1.33 1.50 1.70

Cash 358.8 322.9 436.6 493.8 593.3

Total assets 1,510.9 1,611.3 1,862.2 2,090.7 2,370.3

A/P and other non-interest

bearing liabilities

511.60 565.70 670.50 758.40 883.60

Long-term + short-term debt 7.8 10.3 13.7 10.3 13.9

Net worth 991.5 1,035.3 1,178.0 1,322.0 1,472.8

As he thought more about Apexs past performance, and sat further back in his extremely

comfortable chair in his extremely comfortable office, Mr. Penn fell asleep.

Cash and equivalent 593.3

A/P and other non-interest

bearing liabilities 883.6

A/R 517.3 Long-term + short-term debt 13.9

Inventory 557.3 Total liabilities 897.5

PPE 450.5 Net Worth 1,472.8

Other 251.9

Total assets 2,370.3 Total liabilities + Net worth 2,370.3

Balance Sheet 2010

Assets Liabilities

2

Part I. Please answer the following 4 questions on the attached blank sheets. Each

question is worth 5 points. If you make assumptions, mention them explicitly. (No

need to write a novel).

1) Before Mr. Penn wakes up, describe Apexs capital structure over the period 2006-

2010. What are the likely factors that explain this capital structure? (Your discussion

should be based on simple statistics computed from the available data).

2) Based on the information given above, is this capital structure likely to be optimal? If

yes, explain its merits relative to alternative capital structures. If not, discuss this

capital structures main drawbacks, as well as the relative merits of the different

possible paths to a more suitable capital structure. (No calculations needed).

After several hours of snoozing, Mr. Penn woke up with a start and a stiff neck. He

realized that all industries undergo change at some point and the pharmaceutical industry

was no different. The Harper administration was threatening the industry with tighter

regulation with measures increasing the control of prices, and favoring the development

and diffusion of generic drugs. At the same time, some of Apexs most profitable patents

were about to expire. Also, many industry analysts believed that advances in bio-

technologies would lead, in the longer run, to a new generation of drugs replacing more

traditional ones. Developing these new drugs, as well as building up expertise in the new

industry, was bound to require a considerable R&D effort.

3) Mr. Penns quick forecast was that Apexs sales were likely to grow 11% the

following year, but that its margins (net income/sales) were likely to fall to 7%. He

wondered what his capital structure would look like the following year given that he

did not want to cut the dividend ratio, or issue equity. Please help Mr. Penn out with

these calculations, as he is not very good with numbers. (Calculations needed).

4) Given these changes in the industry and assuming that they persist, what do you think

Apexs target capital structure should be in the long run? What impediments, if any,

might Mr. Penn face in maintaining this target?

3

Part II. Provide short answers to the following questions. Each question is worth 4

points.

Question 1. Who runs the corporation when the firm is solvent and who runs it in

bankruptcy? Explain how this works!

Question 2. What are the key tax differences between dividend payments and interest

payments?

Question 3. Suppose a firm which has filed for bankruptcy has a complicated capital

structure. There are two classes of stock: ordinary shares and preferred shares. There are

also three types of debt: senior unsecured debt, junior unsecured debt, and secured debt.

Since the firm is not viable, the bankruptcy judge decided to liquidate the firm and use

the proceeds to repay the firms claimants. However, the money raised is not enough to

repay all claims in full. What is the priority rule the judge should use in deciding how to

allocate the proceeds from the liquidation?

Question 4. Consider a firm with two types of bonds outstanding: junior unsecured debt

and senior secured debt. Which of these bonds should have higher yields and why?

Question 5. Briefly explain what debt covenants are, and list two types. Why write

covenants into the debt contract? What happens if a firm violates a debt covenant?

4

ASTEROID PICTURES, INC.

Asteroid Pictures is a movie studio that was founded in 1958 in Hollywood, California by

Maxwell Roid. Earlier 2011, after over fifty years in the movie business, Maxwell Roid

decided to step down from the helm of the company and he handed the control of the

studio over to his grandson, Max (Rock) Roid III. On his first day as the new studio

president, Rock is asked to decide if the studio should go forward with its plans to

produce a new movie. The movie, entitled Queens Speech, is a fictional drama about

how a young queen overcomes her shyness to be able to address her subjects in public.

Given the recent popularity of drama on the royal families, industry buzz is that the

movie has great promise.

Rock has a sinking feeling in his stomach. He realizes that he has a decision to make.

By the end of the day he has to determine if the studio should go forward and make the

movie. Otherwise, the writers can take the script to another studio. Assume that once

Rock tells the writers he will make the movie, he cannot back out of his decision.

The Asteroid Files

Asteroid Pictures is privately held but recent estimates put the equity market value at $2

billion and book value of debt equal to $1 billion and an average coupon of 5.5%. While

Rocks family owns a significant portion of Asteroid Pictures, Inc. they have a well

diversified portfolio of wealth. Recent gyrations in credit markets have pushed the

asteroid bond prices down to a market value of $93.50 / $100 of face value. Asteroids

current credit rating is thought to be BBB. The companys marginal tax rate is 40%.

Assume the company has other divisions that have positive pre-tax income. So if pre-tax

income is negative, it can be used to reduce the taxable income of these other divisions.

The studio has already invested $1.5 million into the movie by purchasing the right to

buy the script and bringing in actors and actresses to audition for the parts. If Asteroid

buys the script they would have to pay the script writers an additional $3 million when

they start shooting the movie. The movie would be shot on location in four different

countries and production costs are expected to be $50 million, all of which would be

required to be paid by the company when shooting for the movie began. Production costs

include paying the director and the cast (the star, Natasha Poshman, alone would get $5

million), travel and lodging costs expenses, and any fees associated with the use of the

property where they would be shooting. Also included in the $50 million in production

costs is $3.2 million for the crew (e.g., make-up people, grips, carpenters) who are

currently under contract with the studio and will get paid money regardless if Asteroid

decides to make this picture or not. Not included in the production costs are the costumes

used in the movie. These costumes originally cost $500,000 and were purchased for a

previous movie Asteroid made several years ago. Asteroid has already agreed to sell

these costumes to a wax museum in Florida for $300,000. They plan to invest the funds

from the sale of these costumes in a project with relatively the same level of risk as the

Queens Speech movie. If they make the movie they will have to postpone the sale of the

costumes for one year.

5

The studios marketing people are estimating the movie would gross $45 million in the

first year of release. In the following year, when Queens Speech is released on DVD,

they expect to sell 500,000 DVDs. In the third year, DVD sales are projected to be

250,000 DVDs. After year three, revenues from the movie should be close to 0. These

DVDs would be sold for $20 each and the cost to making the DVD would be $4 each.

The company will require $100,000 worth of DVDs in inventory beginning 1 year from

today.

The Internal Revenue Service will allow Asteroid to depreciate the cost of the script and

incremental production costs. The company plans on depreciating these costs to zero

over three years using the straight line method of depreciation. Also, the company

expects to sell items from the production of the movie for $1,000,000 in year three and

consider this to be the salvage value from the project.

The company also expects that once the movie is released, the DVD sales of the other

movies they have made previously starring Natasha Poshman should also increase. If the

studio does not make Queens Speech, these other DVDs have annual net profits of $2

million a year and would remain at that level forever. If they do make Queens Speech,

in the first three years following the release of Queen Speech the net profits from these

other DVDs are predicted to increase to $3.5 million. After year three, net profits of the

DVDs for other movies would return to $2 million a year. Ms. Poshman has made three

movies for another studio, not associated with Asteroid and the DVD sales of these

movies are also expected to increase by $500,000 per year for three years following the

release of Queens Speech.

Rock also found a table of information about other companies in the folder labeled Table

1.

6

TABLE 1

Queens Speech Project Data

MGM /

Mirage

Casinos

Disney Pixar Harrahs

Casinos

Book Equity 2.7 B 23.3 B .629 B 1.5 B

Book Debt 5.2 B 14.6 B 0.0 B 3.5 B

Average Coupon on LT Debt 6.7% 5.8% n.a. 7.0%

Shares Outstanding 155 M 1.95 B .05 B .11B

Stock Price per share $33.00 $18.15 57.70 $39.00

YTM on Recent Debt Issue n.a. 5.0% 0 5.8%

Bond Rating BB A n.a. BBB

Tax Rate 35% 35% 35% 35%

Annualized Volatility .40 .35 .42 .40

P/E 19 28 35 14

P/Sales 1.3 1.4 16 1.1

Proportion in Film Business 50% 20% 90% 0.0%

Equity Beta

(estimated w/ daily returns)

.90 1.10 1.00 .80

Equity Beta

(Estimated w/ monthly returns)

1.20 .95 1.30 .90

Current Credit Market Conditions

Ten year BB Industrial Yield 6.50%

Ten year AAA Industrial Yield 4.80%

Ten year Government Yield 4.10%

Two year Government Yield 3.00%

7

Part III. YOUR ASSIGNMENT: DONT LET ASTEROID CRASH TO EARTH (40 POINTS)

1) (5 points) Discuss the issues you would want to consider in evaluating the debt

capacity of the Queens Speech film.

2) (5 points) Using these data, estimate the WACC Rock should use in evaluating this

project. Explicitly state your reasoning behind your assumptions concerning the

expected market return.

3) (5 points) What discount rate or rates should Rock choose for his APV calculations?

4) Cash flows

a) (10 points) Estimate the relevant free cash flows for Rocks decision. Assume

that the expected annual inflation rate is 0%.

b) (5 points) If the tax authorities give Asteroid Pictures a choice in calculating

annual depreciation, would they rather depreciate straight-line to zero or

depreciate to a salvage value of $1,000,000, why?. {Explain, no calculations

necessary}

5) (10 points) Valuation of cash flows: Do you think Rock should go forward with this

movie? Calculate the value of the movie using the WACC method. Do the first part

of the of the APV valuation of the movie, i.e. calculate the value without the tax

shield of debt. Explain conceptually how you would calculate the tax shield of debt

(no actual calculations needed). Do your calculations so far allow you to see what the

value of the tax shield of debt might be?

Part IV. Provide short answers to the following questions. Each question is worth 4

points.

Question 1. Carefully discuss the differences between the sustainable rate of growth and

the economic value added.

Question 2. Carefully discuss the differences between free cash flow, capital cash flow,

and equity cash flow.

Question 3. Carefully discuss the pros and cons associated with WACC and APV

approach.

Question 4. Carefully discuss the pros and cons associated with the discounted cash flow

(DCF) valuation approach and multiple-based approach.

Question 5. Carefully discuss the potential biases associated with the Equity Cash Flow

(ECF) valuation approach and potential fixes.

8

Formula Sheet #1

Days of Inventory = 365(Inv /COGS)

Collection Period = 365(AR /Sales)

Payables Period = 365((AP+Trade Credit) /Purchases)

Gross Profit Margin = (Sales-COGS)/Sales

Net Profit Margin = (EBIT-Tax)/Sales

ROE = Growth in Net Worth = Net Income / Net Worth (Last Period)

ROA = Net Income / Total Assets (Last Period)

V(with debt) = V(all equity) + PV[tax shield] Expected Bankruptcy Costs

PV[tax shield] = t*D

t = corporate tax rate

D = (an estimate of) the market value of the firms debt.

Leverage Turnover Asset Margin Profit

NW

Assets

Assets

Sales

Sales

NI

Leverage ROA ROE - - = - =

NW

Assets

Assets

NI

d) (1

NW

NI

d) (1 ROE d) (1 g - - = - = - =

-

9

Formula Sheet #2

Assets Net in Change - EBIT t) (1 FCF

NWC in Change - CAPX - on Depreciati t EBITD t) (1 FCF

NWC in Change - CAPX - on Depreciati EBIT t) (1 FCF

- =

- + - =

+ - =

. J . J )

f m a f Assets A

r r E r r E r + = =

E D

E

k

E D

D

t k WACC

E D

+

+

+

= ) 1 (

D E

D

D E

E

D E A

+

+

+

=

)

D A A E

(

E

D

+ =

E D

V

E

V

D

+ =

A

E D A

r

V

E

r

V

D

r + =

g WACC

=

1

FCF

MV

g k

E

=

1

E

P

10

Formula Sheet #3

If D is expected to remain stable, then discount tk

D

D using k

D

PVTS = tk

D

D/ k

D

= tD

If D/V is expected to remain stable, then discount tk

D

D using k

A

PVTS = tk

D

D/ k

A

Terminal value at liquidation: SV*(1- t) + t*PPE + Recovery of net working capital

Terminal value at continuation without growth: TV

T

= FCF

T+1

/ k

Terminal value at continuation with growth: TV

T

= FCF

T+1

/(k - g)

EVA = EBIT*(1 - t) - k*NA

Capital Cash Flows:

Take Net Income (builds in tax shields directly).

Add depreciation and special charges.

Subtract change in NWC.

Subtract incremental investment.

Add interest.

Equity Cash Flows:

The size of bias under the equity cash flow valuation approach:

EBIT

less: Interest

Income before taxes

less: Taxes

Net income

plus: Depreciation

less: Capital expenditures

less: Increase in NWC

less: Principal repayments

plus: New borrowing

Equals: Equity Cash Flows

=

T

t

t

r

M r R

G

1

) 1 (

) (

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Maddy - Make Wealth From Intraday Trading - Based On Price Action, 5 Setups For Day Trading (2021)Документ30 страницMaddy - Make Wealth From Intraday Trading - Based On Price Action, 5 Setups For Day Trading (2021)pardhunani143Оценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Deed of Absolute Sale of A Portion of LandДокумент2 страницыDeed of Absolute Sale of A Portion of LandmkabОценок пока нет

- Aravinda Oracle Financial FunctionalДокумент7 страницAravinda Oracle Financial FunctionalSrinivas GirnalaОценок пока нет

- David M. Dodson Case Analysis: Financial Problems Related To The PurchaseДокумент3 страницыDavid M. Dodson Case Analysis: Financial Problems Related To The PurchaseAryanОценок пока нет

- Sangla - IncomeДокумент1 страницаSangla - IncomeCherie TevesОценок пока нет

- Construction Contracts ProblemsДокумент14 страницConstruction Contracts ProblemsAngela A. MunsayacОценок пока нет

- Collection of Sum of Money - Assignment BДокумент5 страницCollection of Sum of Money - Assignment BMark ValenciaОценок пока нет

- Flow Bill Explanation (Papiamentu)Документ2 страницыFlow Bill Explanation (Papiamentu)Shanon OsborneОценок пока нет

- Mymaxicare Rates 2021Документ2 страницыMymaxicare Rates 2021Ariane ComboyОценок пока нет

- Adjudication Order in Respect of M/s Arihant Thermoware Limited in The Matter of M/s Arihant Thermoware LimitedДокумент11 страницAdjudication Order in Respect of M/s Arihant Thermoware Limited in The Matter of M/s Arihant Thermoware LimitedShyam SunderОценок пока нет

- Fin 311 Chapter 02 HandoutДокумент7 страницFin 311 Chapter 02 HandouteinsteinspyОценок пока нет

- Draftsman (Electrical)Документ7 страницDraftsman (Electrical)suhail ahmadОценок пока нет

- Value Based Questions in Economics Class XIIДокумент8 страницValue Based Questions in Economics Class XIIkkumar009Оценок пока нет

- Kumpulan Quiz UAS AkmenДокумент23 страницыKumpulan Quiz UAS AkmenPutri NabilahОценок пока нет

- Inflation and UnemploymentДокумент55 страницInflation and UnemploymentShubham AgarwalОценок пока нет

- CAEmploymentGuide2014 PDF 23april2014Документ156 страницCAEmploymentGuide2014 PDF 23april2014Jessica100% (1)

- Content Problem Sets 4. Review Test Submission: Problem Set 08Документ8 страницContent Problem Sets 4. Review Test Submission: Problem Set 08gggОценок пока нет

- Factsheet MalaysiaДокумент4 страницыFactsheet MalaysiapaksengОценок пока нет

- Business Studies Paper 1 June 2011 PDFДокумент5 страницBusiness Studies Paper 1 June 2011 PDFPanashe MusengiОценок пока нет

- MGMT 565 Assignment 3 TeamДокумент3 страницыMGMT 565 Assignment 3 TeamPierce CassidyОценок пока нет

- MGT-521 Human Resource Management: HRM: End Term Evaluation AssignmentДокумент8 страницMGT-521 Human Resource Management: HRM: End Term Evaluation AssignmentKaran TrivediОценок пока нет

- L2 Business PlanДокумент26 страницL2 Business PlanMohammad Nur Hakimi SulaimanОценок пока нет

- Evaluation On The Effectiveness of The CДокумент104 страницыEvaluation On The Effectiveness of The CAilene Quinto0% (1)

- L5 Financial PlansДокумент55 страницL5 Financial Plansfairylucas708Оценок пока нет

- LEER PRIMERO Christian Suter - Debt Cycles in The World-Economy - Foreign Loans, Financial Crises, and Debt Settlements, 1820-1990-Westview Press - Routledge (1992)Документ247 страницLEER PRIMERO Christian Suter - Debt Cycles in The World-Economy - Foreign Loans, Financial Crises, and Debt Settlements, 1820-1990-Westview Press - Routledge (1992)Juan José Castro FrancoОценок пока нет

- HAJI ALI IMPORT EXPORT-Exim-Islampur-395Документ8 страницHAJI ALI IMPORT EXPORT-Exim-Islampur-395Eva AkashОценок пока нет

- Crown Valley Financial Plaza 100% Leased!Документ2 страницыCrown Valley Financial Plaza 100% Leased!Scott W JohnstoneОценок пока нет

- Problems - Share-Based PaymentsДокумент3 страницыProblems - Share-Based PaymentshukaОценок пока нет

- Chapter 05 Consolidation of Less Than WHДокумент93 страницыChapter 05 Consolidation of Less Than WH05 - Trần Mai AnhОценок пока нет

- The Role of Monetary Policy in Zimbabwe's Hyperinflation EpisodeДокумент36 страницThe Role of Monetary Policy in Zimbabwe's Hyperinflation EpisodeGerald kОценок пока нет