Академический Документы

Профессиональный Документы

Культура Документы

Homework

Загружено:

Akshay GopanИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Homework

Загружено:

Akshay GopanАвторское право:

Доступные форматы

Session 1: Solar Photovoltaic Power

CASE II 40 MW PV - Leipzig, Germany

Base case Central grid connection Changing Currency Settings Start Spreadsheet: Show settings. Currency - Choose appropriate currency For up-to-date exchange rates, go to www.xe.com/ucc/ Proposed case 40MW photovoltaic power plant at an installed cost of 130M 800,000 Thin-Film, Cadmium Telluride 50W panels from First Solar, Fixed, 30deg slope Can sell PV generated electricity to grid at 0.67/kWh all year round 6.9% Efficiency, Misc. Losses of 5% Inverter Efficiency of 90%, 72kW Capacity, Misc. Losses Negligible Project life is 25 years

Questions 1. What is the resulting Capacity factor for this proposed setup? 2. At this capacity factor, how much electricity is exported to the grid, in MWh/year? 3. If the panels are not cleaned for one year, and incur eventual miscellaneous losses of 20%, how much electricity would be exported to the grid? Answers 1. The capacity factor for this proposed setup is 11.4% 2. At such a low capacity factor only 40,113MWh/yr of electricity is exported to the grid. 3. If the panels are not cleaned for one year, and incur miscellaneous losses 20%, the electricity exported to the grid reduces to 33,780MWh/yr.

Session 2: Wind Power

CASE II: Part 1 1 MW Wind - Ross Island, New Zealand Note: Start this assignment using the spreadsheets from Case I. This will ensure that the financial variables remain filled in. This comparison will be focused on the technologies. Base case (Start Tab) Analysis Type: Method I Central grid connection Changing Currency Settings Start Spreadsheet: Show settings. Currency - Choose appropriate currency For up-to-date exchange rates, go to www.xe.com/ucc/

Proposed case 1MW wind power plant at an installed cost of NZ$10M 3x330kW Enercon 33 49m Turbines 6.5m/s annual wind speed, measured at 10m Can sell wind generated electricity to grid at NZ$1.25/kWh 1.0% Array Losses, 1% Airfoil Losses, 5% Misc. Losses, 95% Availability Project life is 25 years Questions 1. What is the resulting Capacity factor for this proposed setup? 2. At this capacity factor, how much electricity is exported to the grid, in MWh/year? 3. Display and discuss the Power and Energy Curves. 4. If the turbine blades accumulate ice, and incur airfoil losses of 20%, how much electricity would be exported to the grid?

CASE II: Part 2 1 MW Wind - Ross Island, New Zealand

Note: Start from the spreadsheet created in Part 1 of Case II. Instructions: Create a solar power system that supplies the same amount of electricity exported to grid as the wind power system using the following specifications: Thin-Film, Cadmium Telluride 50W panels from First Solar Can sell solar generated electricity to grid at NZ$1.25/kWh Fixed, 30 deg slope 6.9% efficiency, Misc. losses of 5% Inverter efficiency of 90%, 72 kW Capacity, Misc. Losses negligible Project life is 25 years

You need to determine the amount of solar panels that are needed. The installed cost of an individual panel is NZ$200/panel. Questions: 1. How many solar panels are needed to have same amount of electricity exported to the grid? 2. For these financial specifications, how do the installed capital costs compare? 3. Another important issue when considering renewables is land usage. When locating wind turbines, they are generally placed in a rectangle formation and spaced apart according the following rules of thumb: 3-5 rotor diameters apart in the prevailing wind direction and 1-3 rotor diameters apart in the other direction. For example, one Enercon 33 wind turbine will need approximately (2x(3x34m))*( 2x(1x34m)) = 13,872 m2. Assume that the solar panels use 1 m2 of land each (Other factors in land usage that were not included here are maintenance roads and some spacing between the panels in order to service them). Calculate how much land the wind case and the solar case uses and compare. 4. Considering this climate, the finances, and the land useage, which technology would you choose?

Answers Part 1: 1. The proposed wind system has a Capacity Factor of 40.5% 2. At this capacity factor, 3511MWh/yr of electricity is exported to the grid. 3. The cut-in speed is 3m/s. This is the speed at which the torque on the blades of the wind turbine is just enough to generate usable electric power. Above this wind speed, the rate of increase of power and energy curves is very high, finally saturating (the power curve) at about 13m/s. This is the rated speed and would result in the maximum power and energy generated. Beyond 15m/s, which is the cut-out speed (speed at which energy can be extracted without causing structural failure) the energy generated is zero.

4. With the increased airfoil losses of 20%, electricity exported to the grid is 2837MWh/yr. Part 2: 1. The no. of solar PV panels required to export the same amount of electricity as the 1MW Wind Power is 83,330. 2. A comparison of the installed capital costs shows solar to be NZ$16,666,000, while wind is only NZ$10,000,000. 3. A comparison of the land resource required to export 3511MWh/yr of electricity shows wind to take up 26,136m2 ( 3x(4x33)*(2x33) ), while solar requires 83,330m2 almost 3 times the land. 4. The climate is windy most of the year with high wind speeds (still less than the cut off) throughout, the initial cost of wind turbines for the required grid electricity supply is lower than the solar pv option, and even the land required for the wind farm is 3 times less than for the solar farm. Thus, in this case, we choose the wind farm over solar farm as it is cheaper, requires less land and is more suitable to the climatic conditions prevailing.

Session 3: Financial Analysis

CASE II 63.7 MW Wind - Fort Hancock, TX, USA Start from Case Study from the Project Database: Wind Power in Pasco, Washington Note: This case will be the starting point for the values in the spreadsheet that we will not be changing.

Base case (Start Tab) Analysis Type: METHOD II Central grid connection Proposed case 63.7 MW Wind Farm In the financial tab there are many more components included. Since the case study uploaded was in Washington and this analysis is in Texas, some of the costs have changed. So input the following costs: Wind turbines costs $1,000/kW Install 25 km of roads at $25,000/km Install 25 km of transmission line at $35,000/km Install 2 substations at $2,000,000/station Every 8 years you need to replace 20 renewable energy deep-cycle batteries at $5,000/battery (add this cost as a Periodic cost) Questions 1. How many years to break even? What is the impact of the Clean Energy Production Income? What would it take to get a 5 year payback? 2. What is your calculated IRR? Does this seem to be an attractive project to you? Why or why not? 3. Change your location to Montpelier, VT. How did your electricity exported to grid, payback, and IRR change? 4. Change your location to St. Louis, MO. How did your electricity exported to grid, payback, and IRR change? 5. Using the Sensitivity Analysis worksheet, evaluate the sensitivity of NPV to 20% adjustments to Initial Costs and Electricity Export Rate. If your initial estimates for Initial Costs and Electricity Export Rate are 10% too high, how much more or less money will you make? 6. Using the Risk Analysis worksheet, conduct a risk analysis for an NPV with a 10% range in Initial Costs. For this level of uncertainty in Initial Costs, what is the probability that you will make money on this project?

Answers

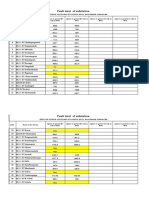

1. To break even, 5.2years were required. The Clean Energy Production Income has an inverse correlation with the payback period. For a clean energy production income of 0.041$/kWh, with a total CE production income being $4,178,567, the payback period is 5years. 2. The calculated IRR was ve, for Fort Hancock, TX, USA (u=4.2m/s, height=10m). Thus, it does not seem to be an attractive project. 3. Answered along with 4th answer in the table shown below. 4. Fort Hancock, TX 101,916 n/a -ve Montpelier, VT 49,202 n/a -ve St. Louis, MO 63,042 n/a -ve

Electricity Exported (MWh/yr) Payback (yr) IRR (pre-tax equity)

5. If the initial estimates for initial cost and electricity export rate are 10% too high, the loss in NPV would be $1,460,006 less (NPVinitial = $31,998,461, NPVfinal = $30,538,455) 6. The probability of making money is 0, since the NPV is all along ve.

Session 4: Fuels and Emissions

Case II 66MW Steam Turbine Fuel Comparison Louisville, Kentucky, USA Questions 1. What is the annual GHG emission reduction for this cofiring plant compared to all types of fuel in the United States? (Both corn stover and Christmas trees have the same emissions factors) 2. What cost of Christmas trees ($/t) makes this plant unattractive (IRR less than 15%)? 3. The stockpile of Christmas tree fuel has run out and now the plant is switching to co-firing 60% corn stover and 40% bagasse at $35/ton. The bagasse gas a CH4 emission factor of 0.991 tCO2/MWh and a N2O emission factor of 0.54 tCO2/MWh. Because your planthas switched to bagasse, you no longer receive Clean Production income. Is this still an attractive project? Discuss.

Answers 1. The annual GHG reduction for this co-firing plant compared to coal combustion in the USA is 531,864.4tCO2/yr. 2. The pre-tax IRR for this configuration was 18.8%. To make this plant an unattractive proposition (IRR<15%), the cost of Christmas tree fuel had to increase to $61/ton. 3. If we change the fuel mixture from Christmas tree & corn stover, to corn stover & bagasse, the GHG emission reduction changed from +531,864.4tCO2/yr to 197,053.2tCO2/yr, i.e., it was an increase in GHG emissions as compared to coal. The IRR in this new case is 8.7%, which is less than the 15% (our hurdle IRR, as mentioned in question 2). Thus, this was an unattractive proposal, for both financial and environmental reasons. The bagasse released high CH4 and N2O (as seen from the emission factors) and since the mass to energy conversion is very low for the bagasse + corn stover fuel mixture as compared to coal, the total CO2 emission was higher than coal. The GHG emission factor for coal was 5 times higher than the mixed fuel, but even then the 10 times higher fuel consumption (in MWh) lead to an overall increase in GHG emission.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- TM 9-1651 Data Transmission System m3, January 1942Документ78 страницTM 9-1651 Data Transmission System m3, January 1942Advocate100% (1)

- Solutions To The Problems of The Theoretical CompetitionДокумент16 страницSolutions To The Problems of The Theoretical CompetitionDejan DjokićОценок пока нет

- QC Notes For Intruments AramcoДокумент4 страницыQC Notes For Intruments AramcoManda Khel Apna DesОценок пока нет

- Presentation On BOPДокумент27 страницPresentation On BOPRatnakar Patil100% (2)

- ELSD IQ OQ ProtocolДокумент7 страницELSD IQ OQ ProtocolRajan RamaswamiОценок пока нет

- Al-Dulaimi MustafaДокумент48 страницAl-Dulaimi MustafaAntonio GuzmanОценок пока нет

- Savio Proxima ENGДокумент39 страницSavio Proxima ENGmarioОценок пока нет

- Biefeld-Brown Effect and Space CurvatureДокумент6 страницBiefeld-Brown Effect and Space CurvaturejayandbobОценок пока нет

- Module 11 ElasticityДокумент101 страницаModule 11 ElasticityAngel OñaОценок пока нет

- Vehicular Emissions TrinidadДокумент4 страницыVehicular Emissions Trinidadstephen_debique9455Оценок пока нет

- Izod and Charpy TestДокумент4 страницыIzod and Charpy TestRishav KaushalОценок пока нет

- Minecraft: Creating A Digital Model of A FarmДокумент5 страницMinecraft: Creating A Digital Model of A FarmMonica SevillaОценок пока нет

- Lesson 5 Packed Tower ScrubbersДокумент20 страницLesson 5 Packed Tower ScrubbersinsomniaticstatОценок пока нет

- Singel OutdoorДокумент4 страницыSingel OutdoorMuhammad WazirОценок пока нет

- KD2250-F-SDMO (Alternator Data Sheet SDMO 2000KVA Prime Generator Set)Документ6 страницKD2250-F-SDMO (Alternator Data Sheet SDMO 2000KVA Prime Generator Set)schraz4575Оценок пока нет

- Network Analysis ManualДокумент68 страницNetwork Analysis ManualRana Zeeshan AfzalОценок пока нет

- 21 FullPaper Design and Fabrication of An Adlai Milling Machine Version 2Документ75 страниц21 FullPaper Design and Fabrication of An Adlai Milling Machine Version 2loureniel de jesus100% (1)

- Manual Bomba de GasolinaДокумент80 страницManual Bomba de GasolinaMario Alberto Llanos LópezОценок пока нет

- Energy Attacks: Energy Manipulation Attack PowersДокумент3 страницыEnergy Attacks: Energy Manipulation Attack PowersSunčica NisamОценок пока нет

- Hybrid PIC-Fluid Simulation of A Waveguide ECR Magnetic Nozzle Plasma ThrusterДокумент13 страницHybrid PIC-Fluid Simulation of A Waveguide ECR Magnetic Nozzle Plasma ThrusterJack HondagneuОценок пока нет

- The Science of Diet & ExerciseДокумент46 страницThe Science of Diet & ExerciseRomkar93Оценок пока нет

- EMI and AC TYPE 1Документ19 страницEMI and AC TYPE 1sanits591Оценок пока нет

- Current Issues: Report OutlineДокумент6 страницCurrent Issues: Report OutlinePangihutan HutaurukОценок пока нет

- EMD 645 Marine Emissions Kits A4Документ2 страницыEMD 645 Marine Emissions Kits A4Martin KratkyОценок пока нет

- Chapter 5b Crystal Imperfections Dislocations PDFДокумент94 страницыChapter 5b Crystal Imperfections Dislocations PDFManjeet SinghОценок пока нет

- BS EN ISO 9934-1-Type of MagnetizationДокумент3 страницыBS EN ISO 9934-1-Type of Magnetizationbhavin178Оценок пока нет

- Philips Lighting Catalog - Global Cahaya GemilangДокумент364 страницыPhilips Lighting Catalog - Global Cahaya Gemilangsinarmulya100% (2)

- Pig Launcher and ReceiverДокумент2 страницыPig Launcher and ReceiverDhanushОценок пока нет

- Form 2 Chapter 2 Nutrient CycleДокумент13 страницForm 2 Chapter 2 Nutrient CycleMohd Amiruddin Malek100% (1)

- Fault Level of SubstationДокумент2 страницыFault Level of SubstationrtadОценок пока нет