Академический Документы

Профессиональный Документы

Культура Документы

Strategic Generation Capacity Expansion Planning With Incomplete Information

Загружено:

AdrianmbИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Strategic Generation Capacity Expansion Planning With Incomplete Information

Загружено:

AdrianmbАвторское право:

Доступные форматы

1002

IEEE TRANSACTIONS ON POWER SYSTEMS, VOL. 24, NO. 2, MAY 2009

Strategic Generation Capacity Expansion Planning With Incomplete Information

Jianhui Wang, Member, IEEE, Mohammad Shahidehpour, Fellow, IEEE, Zuyi Li, Member, IEEE, and Audun Botterud, Member, IEEE

AbstractTo study the competitive behavior among individual generating companies (GENCOs), an incomplete information game model is proposed in this paper in which each GENCO is modeled as an agent. Each agent makes strategic generation capacity expansion decisions based on its incomplete information on other GENCOs. The formation of this game model falls into a bi-level optimization problem. The upper level of this problem is the GENCOs own decision on optimal planning strategies and energy/reserve bidding strategies. The lower-level problem is the ISOs market clearing problem that minimizes the cost to supply the load, which yields price signals for GENCOs to calculate their own payoffs. A co-evolutionary algorithm combined with pattern search is proposed to optimize the search for the Nash equilibrium of the competition game with incomplete information. The Nash equilibrium is obtained if all GENCOs reach their maximum expected payoff assuming the planning strategies of other GENCOs remain unchanged. The physical withholding of capacity is considered in the energy market and the HerndahlHirschman Index is utilized to measure the market concentration. The competitive behaviors are analyzed in three policy scenarios based on different market rules for reserve procurement and compensation. Index Termsagent modeling, generation expansion, market design, market power, noncooperative game, physical withholding, power system planning.

Load shedding cost of load . LMP for GENCO s unit at load block in scenario when GENCO s type is and its opponents type is . Number of loads. Number of committed units. Average operating cost of GENCO s unit. Probability for unit outage scenario . Probability when GENCO s type is . Conditional probability when GENCO is . type and its opponents type is Amount of curtailment for load at load block in scenario when GENCO is type and its opponents type is . Forecasted load at bus at load block . Total load at load block . Generation bid for GENCO s unit at load block when its type is . Scheduled generation for GENCO s unit. Reserve bid for GENCO s unit at load block when its type is . Called on reserve of GENCO s unit. GENCO s payoff. GENCO s payoff when its type is . opponents type is Capacity price. Index for unit outage scenarios ( indicating no-outage). Number of unit outage scenarios. GENCO s type. Load curtailment vector. Bus load vector at load block . Unit generation vector. Maximum capacity vector of transmission lines. Shift factor matrix. GENCO s type set. Type combination of all GENCOs but GENCO . Type combination set of all GENCOs but GENCO .

NOMENCLATURE Index for load blocks. Number of load blocks. Expanded capacity of GENCO when its type is . Lower bound of the capacity expansion of GENCO when its type is . Upper bound of the capacity expansion of GENCO when its type is . Annual levelized capital cost of GENCO s. Duration of load block . Index for load. Indicating expected value. Index for units.

and its

Manuscript received July 15, 2007; revised February 25, 2008. First published April 14, 2009; current version published April 22, 2009. Paper no. TPWRS00128-2008. J. Wang and A. Botterud are with the Division of Decision and Information Sciences, Argonne National Laboratory, Argonne, IL 60439 USA (e-mail: jianhui.wang@anl.gov; abotterud@anl.gov). M. Shahidehpour and Z. Li are with the Electrical and Computer Engineering Department, Illinois Institute of Technology, Chicago, IL 60616 USA (e-mail: ms@iit.edu; lizuyi@iit.edu). Digital Object Identier 10.1109/TPWRS.2009.2017435 0885-8950/$25.00 2009 IEEE

WANG et al.: STRATEGIC GENERATION CAPACITY EXPANSION PLANNING WITH INCOMPLETE INFORMATION

1003

I. INTRODUCTION LECTRICITY restructuring has introduced major challenges to the traditional generation capacity planning approaches in the electricity industry [1]. The unbundling of generation and transmission makes the generation expansion planning much more competitive for self-interested independent participants in electricity markets. In conventional planning approaches for new generation resources, the major objective of electric utilities was to achieve the least-cost operation that met a pre-specied system reliability level [2][4]. However, in an electricity market, each generation company (GENCO) can pursue its own payoff maximization by strategically planning and operating its generating units. And the market operator, or the independent system operator (ISO), is responsible for satisfying the system reliability requirements while minimizing the generation supply cost to satisfy the hourly electricity demand. A market-based transmission expansion planning is proposed in [5]. The risk of each planning alternative is assessed based on various power system uncertainties. A payoff-based generation resource planning is discussed in [6] in which Benders decomposition is used to secure the economic and the reliability requirements of the market operation. In a competitive market, a GENCO must consider other GENCOs strategic plans when making decisions on generation capacity expansion. This means that the modeling of competitive behavior is essential in the planning process. Furthermore, the oligopolistic nature of electricity markets makes it more essential to investigate the competitive behavior and monitor the market power exertion in generation planning. A game-theoretic model is proposed in [7] whose analysis is based on the complete information game model. In practice, the generation expansion planning forms a rst-price sealed-bid auction [8] in which individual GENCOs have an incomplete knowledge of other GENCOs planning information. This characteristic makes the planning approach differ from that of the complete information game model. Extensive research has been presented in analyzing bidding strategies in energy markets, which bears an analogy to the generation expansion planning game. It is thus possible to extend the techniques used in the day-ahead energy bidding to study the competitive behavior involved in generation expansion planning. Coalitions and collusions of participants in electricity markets were investigated with a cooperative game approach [1], [9], [10]. A noncooperative incomplete information game approach was applied in [1] and [11] to model a GENCOs optimal bidding strategy as a set of discrete bids. A transmission- constrained incomplete information game was studied in [12]. Each GENCO adjusts its strategic bids for maximizing the expected payoff based on other GENCOs bidding information and its estimation of opponents types. The iterative process continues until none of the GENCOs can attain any higher payoffs based on their strategic bids [12]. A framework for the control of energy services which is based on the leader-follower game theory was proposed [13]. In a competitive generation capacity planning, similar to the incomplete information day-ahead bidding, GENCOs estimate any opponents would-be cost represented by the opponents

type and the probability distribution of the opponents cost. In this paper, the GENCO can make its own decision on generation expansion based on its estimates of the opponents generation expansion strategies. Meanwhile the simulation of energy and reserve market clearing will yield GENCOs price signals for adjusting generation expansion plans. The proposed process forms the noncooperative generation capacity planning framework with incomplete information. Certain generation planning issues such as the optimal location of new generating units and demand response are not considered since we focus our analyses on strategic interactions of GENCOs in generation planning. Such issues will be considered in our future work. To search for equilibrium in this noncooperative game, we propose a co-evolutionary computation approach. The co-evolutionary computation emphasizes interactive connections among species [14]. The algorithm has proven to converge rapidly and overcome the premature convergence of genetic algorithm (GA) in solving classical problems [15]. The traditional Lagrangian relaxation method was combined with co-evolutionary computation to solve the unit commitment problem, which showed good convergence and faster speed [16]. A hybrid co-evolutionary computation algorithm was proposed that searches for the global optima in games with the local optima [17]. Market policies such as electricity pricing [18] are critical for generation expansion planning. From a planning point of view, a well-designed market is supposed to encourage the generation capacity expansion that maximizes the social welfare. Accordingly, market power should be monitored and curbed in market operations. Physical withholding of generation capacity is one of the common market power exertion techniques for increasing market prices [19]. If a market policy is not properly established, GENCOs may withhold generation capacities by submitting bids to reserve markets or consider scheduled outages of generation assets for maintenance. Consequently, the energy market will be in short supply, which may lead to high energy prices. Three market policy scenarios are considered in this paper. Scenario A corresponds to the existing practice in PJM [20]. Scenario B represents the practice in ERCOT [21]. Scenario C is a hypothetical policy which serves as a reference for comparing the market practices. The difference between these scenarios lies on procuring reserve bids that are submitted to the market. Scenario A: The payment for called on reserve is based on energy price and a pre-specied xed capacity price, while the uncalled reserve is paid at a xed capacity price. Scenario B: The payment for called on reserve is based only on the energy price while the uncalled reserve is paid at the pre-specied xed capacity price. Scenario C: Scenario A is used. In addition, the ISO considers a xed ratio for the scheduled reserve to total generating capacity of a GENCO. The rest of the paper is organized as follows. Section II presents the problem formulation of the proposed strategic generation capacity expansion with incomplete information. Section III discusses the co-evolutionary algorithm and its application to the solution of the proposed problem. Section IV includes the numerical examples. Section V concludes the discussion.

1004

IEEE TRANSACTIONS ON POWER SYSTEMS, VOL. 24, NO. 2, MAY 2009

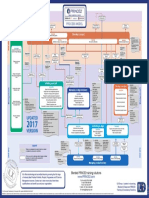

II. PROBLEM FORMULATION In a complete information game, all players have the common knowledge of other players payoff functions and the information on each players payoff and strategy is acknowledged by other players. An equilibrium is reached when no player can increase its payoff by unilaterally changing its strategy. However, in electricity markets, each GENCO as a player in the generation capacity planning game has the complete knowledge on its own payoff function but cannot acknowledge the complete information on other GENCOs payoff functions and planning strategies. So the competitive behaviors among GENCOs constitute an incomplete information game. The assumptions considered in this incomplete information planning game are listed as follows. Each GENCO may have several planning options represented by capital costs, operating costs, and generation capacity limits. The proposed generating units in GENCOs are modeled as different types subject to a joint probability distribution. GENCOs maximize their levelized payoff annually. A generating units energy and reserve bids may not exceed the units generation capacity. Each GENCO has a single candidate unit for planning. However, this assumption is purely for simplifying the discussion on the proposed formulation in this paper and can be relaxed in practice. In this incomplete information game, each GENCO will maximize its own expected payoff by planning certain levels of generation capacity which can be marketed in energy and reserve markets. A GENCO assumes the ISOs role for the simulation of the day-ahead energy and reserve market operations. The market simulation is based on assumed energy and reserve bids submitted by GENCOs when considering the operating conditions and possible scheduled outage scenarios. The formation of this game falls into a bi-level optimization problem depicted in Fig. 1. The lower level of this problem is the GENCOs own decision on optimal planning strategies and energy/reserve bidding strategies. The upper-level problem is the ISOs market clearing problem that minimizes the cost to supply the load, which yields price signals for GENCOs to calculate their own payoffs. The Nash equilibrium is obtained if all GENCOs reach their maximum expected payoff assuming the planning strategies of other GENCOs remain unchanged. In this equilibrium, any GENCOs payoff will decrease if it unilaterally changes its strategy while other GENCOs strategies are xed. The Nash equilibrium may not be found if a sufcient number of generations is not given or may not exist at all because of the complexity of power system operation. In Fig. 1, GENCOs are referred to as species. Species 1 runs its own standard GA after decoding the representatives (other GENCOs generation capacity expansion decisions and energy and reserve bids). GENCO 1 evaluates the tness values of individual GENCOs through the domain model. The domain model is the ISOs market clearing model which calculates the bus LMPs. Each GENCO will use the LMP signals provided by the domain model to calculate its own payoff (tness value) and nd its representative.

Fig. 1. Framework of the proposed co-evolutionary algorithm.

The components of the proposed model are discussed as follows. A. GENCOs Generation Capacity Expansion Model In applying the co-evolutionary computation to the proposed planning game, we assume each GENCO is represented as a species in each evolutionary generation which uses standard GA to nd its own optimal generation capacity expansion strategy. Meanwhile, the interaction among GENCOs planning strategies is through the market clearing process (i.e., the ISO). Each GENCOs updated planning strategy will impact other GENCOs planning strategies which optimize their strategies again by applying the standard GA. This iterative process will continue until the global Nash equilibrium is reached which means each GENCO has offered its best choice of strategy for planning in the sense that no GENCO can increase its payoff when other strategies are xed. To maximize its payoff in the incomplete information game, a GENCO has to model its opponents information. For instance, in energy bidding, if the GENCO does not model its opponents types, its payoff could be lower [8]. In this paper, opponents proposed generating units for generation expansion planning are modeled as different types subject to a joint probability distribution. The minimum and maximum capacity, capacity cost, operating cost, forced outage rate (FOR) form the information set for each type of proposed units. We assume that each GENCO will submit its would-be operating cost as market bid for energy and reserves. The GENCO s generation capacity expansion problem will maximize its expected payoff subject to capacity constraints (3) and (4)

(1) where

(2)

WANG et al.: STRATEGIC GENERATION CAPACITY EXPANSION PLANNING WITH INCOMPLETE INFORMATION

1005

(3) (4) The present value of capital cost for generation capacity expansion over the economic life of the GENCO s unit is converted to equalized annual costs. In calculating the GENCO s payoff, load blocks and unit outage scenarios are considered in (2). The decision variables for GENCO include generation capacity expansion decision variable , generation bidding variable and reserve bidding variable . Note that the sum of energy and . The market clearing price reserve bids is equal to , scheduled generation , are calculated by simulating the and reserve ISOs market clearing. B. Market Clearing Model The objective of the ISOs market clearing problem is to maximize the social welfare, or equivalently minimize the operating cost with inelastic demands, while satisfying the reliability requirements for supplying the load. In this paper, we represent the reliability requirement by the load shedding cost in the objective function. The ISOs objective (5) is to minimize the possibility of load shedding and the operating cost, subject to load balance constraint (6), line ow limits (7), load curtailment limits (8), and generation limits (9):

The above formulation is used for calculating LMPs in our case studies [1]. C. Generalized Problem Formulation The above problem formulation is a bi-level optimization problem, which can be generalized as follows:

(13) where generalized constraints for a GENCOs capacity expansion model; generalized constraints for the ISOs market clearing model; ISOs objective function for market clearing. In the proposed bi-level optimization problem, the ISO supplies individual GENCOs with LMPs and each generation units scheduled energy and reserves. The individual GENCOs supply the ISOs market clearing model with their capacity expansion decisions as well as energy and reserve bids. III. PROPOSED SOLUTION METHODOLOGY The co-evolutionary computation approach is applied to solve the above bi-level optimization problem. The optimal generation expansion decision and energy and reserve bids are encoded as decision variables for each GENCO. Each GENCO runs the standard GA algorithm to search for its own best tted plan through standard genetic operations such as reproduction, crossover, migration and mutation assuming that the opponents strategies are decoded [14]. There are two possible methods to decode the opponents strategies. One is to decode the strategies once all GENCOs have nished the evolution in the evolutionary generation, which is called batch decoding. The other method is the online decoding which is to update the opponents strategies immediately after a GENCO has nished its evolution in the evolutionary generation. In this paper, the second method is used to update the opponents strategies. This iterative process will continue until certain termination conditions are satised. The owchart of the proposed algorithm is shown in Fig. 2. To improve the tness value of standard GA, a hybrid GA algorithm with pattern search is employed after the standard GA is completed [22]. The nal solution of the standard GA is set as the initial point of the pattern search. Then pattern search sample points search the space and calculate the tness value to nd a minimum around the starting point in a xed pattern. When it nds a new minimum, the pattern search will change its center of pattern and iterate until it cannot nd a new minimum. Then the search step or pattern size is reduced by half. This iterative process will continue until the mesh size of the pattern search

(5)

(6)

(7) (8) (9) When considering generating unit outages, we replace the objective function (5) by (10) to include the cost of called reserve, and generation limits (9) by (11) for the reserve which is limited by the reserve bid (12):

(10)

(11) (12)

1006

IEEE TRANSACTIONS ON POWER SYSTEMS, VOL. 24, NO. 2, MAY 2009

Fig. 3. Eight-bus system.

TABLE I LOAD INFORMATION [MW]

TABLE II GENCOS PLANNING INFORMATION Fig. 2. Flowchart of the proposed bi-level planning algorithm.

is less than an initialized tolerance value. The convergence ensures the local minimum for this pattern search. Obviously, the quality of the nal solution depends on the starting point of the iterative search. If a point is selected that is far from the optimal solution, the pattern search may only search around this point, be trapped by a local minimum, and fail to locate the global optimal solution. However, the GA solution provides a good starting point for pattern search. Thus the combination of GA with pattern search can improve the quality of solution and speed up the convergence. Each GENCO will follow the procedure to update its expansion decision and energy and reserve bids based on the updated information on opponents. IV. CASE STUDIES An eight-bus system shown in Fig. 3 is used to illustrate the proposed approach and its solution. Three GENCOs located at Buses 1, 2, and 3 will invest in generation expansion. Three existing generation units owned by three other GENCOs are located at Buses 4, 6, and 7. Two load blocks that have the same duration within a levelized planning year are listed in Table I. The information for GENCOs types is shown in Table II including generation capacity limits, capital costs, operation costs, and forced outage rates. For example, GENCO 2 has a lower capital cost but has a higher operating cost compared to the other two GENCOs. It is assumed that all generation capacities are made available to energy and reserve markets, and reserves can only be provided by the units proposed for planning. The capital cost is recovered in 20 years and no discount rate is considered for simplicity. Table III shows the data for existing units. The network data are given in Table IV.

TABLE III EXISTING UNITS INFORMATION

TABLE IV TRANSMISSION NETWORK DATA

The parameters of standard GA for each GENCO are set as follows: population size of 30, mutation rate of 0.06, self-generation number of 5, and scattered crossover. The joint probability

WANG et al.: STRATEGIC GENERATION CAPACITY EXPANSION PLANNING WITH INCOMPLETE INFORMATION

1007

distribution of GENCOs type is given as follows:

where represents the probability when GENCO 1s type is , GENCO 2s type is , and GENCO 3s type is . For example, the probability of 0.125 in row 2 and column 3 represents the combination when GENCO 1s type is 2, GENCO 2s type is 2, and GENCO 3s type is 1. The following three policy scenarios simulate the GENCOs competitive behavior in the planning game for different market conditions. The three scenarios are considered according to the PJM market, ERCOT market, and one hypothetical market. Policy Scenario A: The payment for the called on reserve is based on energy price and a pre-specied xed capacity price, while the uncalled reserve is paid at a xed capacity price. We consider the following cases. Case A1: Capacity price is 5 $/MW First we consider the case when the capacity price is set at 5 $/MW in the Policy Scenario A. The equilibrium solution is listed in Table V in which GENCO 1 invests in the minimum capacity in both types while the other two GENCOs invest in the maximum available capacity. Note that the amount of generation submitted to the market as energy bid is the difference between the listed capacity and reserve bid. In this case, energy bids are zero because of the physical withholding of generating assets from the energy market. The capacity of existing units will not meet the demand and reserves will be inevitably scheduled to guarantee the reliability of system operation. So the GENCOs gain an extra prot through the reserve payment which is equal to their capacity times the capacity price. Fig. 4 shows the solution space for GENCO 1 of type 1 by an exhaustive search of possible solutions where represents the ratio of reserve capacity scheduled in the market to the generating unit capacity. We observe that the maximum payoff corresponds to the entire generating capacity bidding in the reserve market. The exhaustive search solution is exactly the same as that of the co-evolutionary computation in Table V which demonstrates that the proposed co-evolutionary algorithm is able to nd the global equilibrium in the game. Case A2: Capacity price is 0 $/MW In this case, no physical withholding would occur. Table VI shows that the planned generation capacity is dramatically decreased in comparison with that in Case A1. The GENCOs expected payoffs are lower except that of GENCO 1 because GENCOs cannot consider the physical withholding for gaining payoffs. GENCOs submit their generation capacity as bids to both markets rather than applying the arbitrage to the reserve market (as in Case A1) when the generation capacity is priced at 0. The reason GENCO 2 has a negative payoff in Table VI is that the LMP at Bus 2, where GENCO 2 is located, is close to its operating cost, which prevents GENCO 2 from recovering its capital cost. Fig. 5 shows the solution of GENCO 3 for every evolutionary generation in the co-evolutionary process. The solution uctuates at the beginning but converges after 25 iterations to the equilibrium listed in Table VI.

Fig. 4. Solution space of GENCO 1s type 1 in Case A1.

TABLE V EQUILIBRIUM IN CASE A1

Fig. 5. Representatives in each evolutionary generation for GENCO 3.

TABLE VI EQUILIBRIUM IN CASE A2

Table VI shows that the three GENCOs submit bids to the reserve market even though the generation capacity is priced at zero. In other words, withholding still exists. To analyze this condition, we also simulate the scenario in which the three GENCOs 1, 2, and 3 bid their entire capacity to the energy market without any withholding. We label this case as nowithholding. Table VII shows the LMPs in both cases when

1008

IEEE TRANSACTIONS ON POWER SYSTEMS, VOL. 24, NO. 2, MAY 2009

TABLE VII LMPS AT LOAD BLOCK 1 AND NO OUTAGE [$/MWH]

TABLE VIII DISPATCH AT LOAD BLOCK 1 AND NO OUTAGE [MW]

TABLE IX EQUILIBRIUM IN CASE B1 Fig. 6. Planning capacities for all GENCOs Type 1.

TABLE X EQUILIBRIUM IN CASE C1

all GENCOs are assumed type 1 without any outages. In the no-withholding case, the LMP at Bus 2 where GENCO 2 is located is 22 $/MWh, which is also equal to the GENCO 2s operating cost. In comparison, LMPs at Buses 1 and 3 where the other GENCOs are located are higher than their operating costs. This will directly lead to the zero payoff for GENCO 2. Due to its huge capital cost, GENCO 2s payoff will be negative. In this case, GENCO 2 might quit its participation in the game to avoid its negative payoff and the game will be considered between the other two GENCO players accordingly. In comparison, Table VIII shows that in the withholding case, three GENCOs withhold from the energy market part of their generation capacities. Hence, the existing expensive units will generate more to supply the load, LMPs increase to 25$/MWh, and the GENCO 2s generation is dispatched more because the new LMP is higher than its operating cost. Policy Scenario B: The payment for the called on reserve is based only on energy price while the uncalled reserve is paid at the pre-specied xed capacity price. Case B1: Capacity price is 5 $/MW A dramatic decrease in payoff is encountered. Table IX shows that GENCO 2 invests in the maximum generation capacity while GENCO 3 invests in the minimum capacity. Furthermore, the three GENCOs do not submit the entire generation capacity to the reserve market even though the generation capacity price is high. The GENCOs can gain more if they submit generation bids to the energy market instead of bidding the capacity to the reserve market. Case B2: Capacity price is 0 $/MW Fig. 6 shows that a solution does not exit for the proposed GENCOs capacity expansion decisions. In this case, various GA parameters are considered which do not result in any equilibria for the GENCOs competition game. Policy Scenario C: Scenario A is used. In addition, the ISO considers a xed ratio of scheduled reserve to the total generating capacity for each GENCO.

TABLE XI EQUILIBRIUM IN CASE C2

A xed ratio of 0.2 is applied here which will satisfy the ISOs reliability requirement and curb market power as discussed in Section D. We consider the following two cases: Case C1: Capacity price is 5 $/MW Case C2: Capacity price is 0 $/MW The issue with this policy is that GENCOs cannot arbitrage generation assets freely between energy and reserves. Tables X and XI show minor differences between the two cases. All three GENCOs invest in minimum generation capacities which indicate that GENCOs cannot gain extra payoffs by excessive physical withholding in the energy market unless they submit reserve bids as well. D. Comparison of the three scenarios The above cases show that physical withholding can be exercised when the reserve is priced at a certain level in Policy Scenarios A and B. But the withholding is limited in Policy Scenario C because of the restriction on reserve bidding. The HHI is calculated here to measure the market concentration in the three policy scenarios. HHI is dened as (14)

WANG et al.: STRATEGIC GENERATION CAPACITY EXPANSION PLANNING WITH INCOMPLETE INFORMATION

1009

Fig. 7. HHI in the three policy scenarios.

If HHI is less than 1000, a market is usually considered to be fully competitive. A market with HHI between 1000 and 1800 is considered moderately competitive. A market with HHI higher than 1800 is considered to be highly concentrated. The goal here is to show the effectiveness of the simulation model for testing the proposed market rules. Fig. 7 depicts the results. In Fig. 7, Case A1 has the highest HHI of 2049.86 and Case A2 has the lowest HHI of 1749.58. This is because the generation capacity price in Case A2 is set to zero which renders a stronger competition among GENCOs. Case B1 also has a high HHI which points out that the move from Policy Scenario A to Policy Scenario B does not change the market concentration much. Due to the nonexistence of equilibrium in Case B2, its HHI cannot be calculated. In Policy Scenario C, where the ratio of a units reserve to the total capacity is xed, the market power is curbed to a great extent which makes the case close to the competitive situation in Case A2. But as discussed before, setting the ratio may discourage investments. In addition, it may be difcult to set the ratio between the ISO and GENCOs in the Policy Scenario C. Physical withholding may not be discovered easily. Even though the ISO xes the ratio of reserve to capacity in Policy Scenario C, GENCOs can schedule part of their generation capacity for maintenance. The discussion on strategic maintenance behavior is beyond the scope of this paper. Our simulation model also illustrates the payoff prole for each GENCO. The results show that the payoff of GENCOs may be zero when generating costs are close to LMPs. So such market simulations are crucial for measuring GENCOs planning risks. In our case studies, GENCO 2s payoff is zero which may lead to its withdrawal from the generation expansion planning game. V. CONCLUSION In comparison with the traditional centralized planning in power systems, generation expansion planning has been separated from transmission planning and performed by GENCOs in the restructured electricity industry. In this competitive environment, GENCOs make their own plans for generation capacity expansion by simulating the clearing process of energy and reserve markets in the real-time operation. The GENCOs objective is to maximize its payoff by implementing a strategic generation capacity expansion planning and maximizing its energy/reserve bidding strategy for its assets in real-time. The ob-

jective of the ISO is to ensure the reliability of power systems based on individual GENCOs proposed plan for generation capacity expansion planning and maximize the social welfare in real-time by utilizing the GENSOs bids for clearing the energy and reserve markets. In generation expansion planning, GENCOs could simulate the market operation to project their payoff. The competition among GENCOs is based on an incomplete information game. A co-evolutionary algorithm is proposed in this paper to model GENCOs as agents in the capacity planning game. The proposed algorithm is shown to be an effective approach to search for the Nash equilibrium. Three policy scenarios are studied. Simulation results show that the market design in Policy Scenario A may encourage physical withholding from the energy market. Also in the Policy Scenario B, market power cannot be avoided. However the competition is stronger if the capacity price is set appropriately. Scenario Policy C is an alternative market design which can be used for market monitoring. Furthermore, the proposed model can be extended to include a multi-period game in large power systems. REFERENCES

[1] M. Shahidehpour, H. Yamin, and Z. Li, Market Operations in Electric Power Systems. New York: Wiley, 2002. [2] M. Ventosa, M. Rivie, A. Ramo, and A. Garcia-Alcalde, An MCP approach for hydrothermal coordination in restructured power markets, in Proc. 2000 IEEE Power Eng. Soc. Summer Meeting, Jul. 2000, vol. 4, pp. 1620. [3] T. Bjorkvoll, S. Fleten, M. Nowak, A. Tomasgard, and S. Wallace, Power generation planning and risk management in a liberalized market, in Proc. 2001 IEEE Porto Power Tech, Sep. 2001, vol. 1. [4] J. Bloom, Long-range generation planning using decomposition and probabilistic simulation, IEEE Trans. Power App. Syst., vol. PAS-101, no. 4, pp. 797802, 1982. [5] M. Buygi, G. Balzer, H. Shanechi, and M. Shahidehpour, Marketbased transmission expansion planning, IEEE Trans. Power Syst., vol. 19, no. 4, pp. 20602067, Nov. 2004. [6] Y. Fu and M. Shahidehpour, Prot-based generation resource planning, IMA J. Manage. Math., vol. 15, no. 4, pp. 273289, 2004, Oxford Univ. Press. [7] A. Chuang, F. Wu, and P. Varaiya, A game-theoretic model for generation expansion planning: Problem formulation and numerical comparisons, IEEE Trans. Power Syst., vol. 16, no. 4, pp. 885891, Nov. 2001. [8] W. Vick, Counterspeculation, auctions, and competitive sealed tenders, J. Fin., vol. 16, no. 1, pp. 837, 1961. [9] R. Ferrero, M. Shahidehpour, and V. Ramesh, Transaction analysis in deregulated power systems, IEEE Trans. Power Syst., vol. 12, no. 3, pp. 13401347, Aug. 1997. [10] X. Bai, M. Shahidehpour, V. Ramesh, and E. Yu, Transmission analysis by Nash game method, IEEE Trans. Power Syst., vol. 12, no. 3, pp. 10461052, Aug. 1997. [11] R. Ferrero, J. Rivera, and M. Shahidehpour, Applications of games with incomplete information for pricing electricity in deregulated power pools, IEEE Trans. Power Syst., vol. 13, no. 1, pp. 184189, Feb. 1998. [12] T. Li and M. Shahidehpour, Strategic bidding of transmission-constrained GENCOs with incomplete information, IEEE Trans. Power Syst., vol. 20, no. 1, pp. 437447, Feb. 2005. [13] A. Keyhani, Leader-follower framework for control of energy services, IEEE Trans. Power Syst., vol. 18, no. 2, pp. 837841, May 2003. [14] H. Chen, K. Wong, D. Nguyen, and C. Chung, Analyzing oligopolistic electricity market using coevolutionary computation, IEEE Trans. Power Syst., vol. 21, no. 1, pp. 143152, Feb. 2006. [15] H. Chen and X. Wang, Cooperative coevolutionary approach and its promising applications in power system, in Proc. 6th Int. Conf. Advances in Power System Control, Operation & Management (APSCOM), 2003, vol. 2, pp. 827832. [16] H. Chen and X. Wang, Cooperative coevolutionary algorithm for unit commitment, IEEE Trans. Power Syst., vol. 17, no. 1, pp. 128133, Feb. 2002.

1010

IEEE TRANSACTIONS ON POWER SYSTEMS, VOL. 24, NO. 2, MAY 2009

[17] Y. Son and R. Baldick, Hybrid coevolutionary programming for Nash equilibrium search in games with local optima, IEEE Trans. Evol. Comp., vol. 8, no. 4, pp. 305315, Aug. 2004. [18] J. Keppo and M. Rasanen, Pricing of electricity tariffs in competitive markets, Elsevier Sci. J. Energy Econ., vol. 21, pp. 213223, 1999. [19] J. Bushnell, Californias electricity crisis: A market apart?, Energy Pol., vol. 32, no. 9, pp. 10451052, Jun. 2004. [20] [Online]. Available: http://www.pjm.com. [21] [Online]. Available: http://www.ercot.com/. [22] The Mathworks, Matlab R14 help les.

Mohammad Shahidehpour (F01) is Carl Bodine Professor and Chairman in the Electrical and Computer Engineering Department at the Illinois Institute of Technology, Chicago. Dr. Shahidehpour is the recipient of the 2005 IEEE/PES Prize Paper Award and 2006 IEEE/PSO Prize Paper Award.

Zuyi Li (M03) received the B.S. degree in electrical engineering from Shanghai Jiaotong University, Shanghai, China, in 1995, the M.S. degree in electrical engineering from Tsinghua University, Beijing, China, in 1998, and the Ph.D. degree in electrical engineering from the Illinois Institute of Technology, Chicago, in 2002. Presently, he is an Assistant Professor in the Electrical and Computer Engineering Department at the Illinois Institute of Technology.

Jianhui Wang (M07) received the B.S. degree in management science and engineering and the M.S. degree in technical economics and management from North China Electric Power University, Beijing, China, in 2001 and 2004, respectively, and the Ph.D. degree in electrical engineering from Illinois Institute of Technology, Chicago, in 2007. Presently, he is an Assistant Computational Engineer with the Division of Decision and Information Sciences at Argonne National Laboratory, Argonne, IL.

Audun Botterud (M04) received the M.Sc. degree in industrial engineering and the Ph.D. degree in electrical power engineering from the Norwegian University of Science and Technology, Trondheim, Norway, in 1997 and 2003, respectively. He was previously with SINTEF Energy Research in Trondheim. Presently, he is an Energy System Engineer with the Division of Decision and Information Sciences at Argonne National Laboratory, Argonne, IL. His research interests include power system planning and economics, stochastic optimization, decision analysis, and agent-based modeling.

Вам также может понравиться

- Calderon de La Barca - Life Is A DreamДокумент121 страницаCalderon de La Barca - Life Is A DreamAlexandra PopoviciОценок пока нет

- Teresa of Avila - The Life of ST Teresa, A Carmelite Nun Reprint 1912Документ674 страницыTeresa of Avila - The Life of ST Teresa, A Carmelite Nun Reprint 1912WaterwindОценок пока нет

- The Dilbert PrincipleДокумент343 страницыThe Dilbert PrincipleLorenzo Mendoza100% (11)

- Precision Nutrition. Nutrient TimingДокумент21 страницаPrecision Nutrition. Nutrient TimingPaolo AltoéОценок пока нет

- Synchronous Machines, Theory and PerformanceДокумент246 страницSynchronous Machines, Theory and PerformanceAdrianmb100% (5)

- (Essential Histories) Waldemar Heckel - The Wars of Alexander The Great-Osprey PDFДокумент97 страниц(Essential Histories) Waldemar Heckel - The Wars of Alexander The Great-Osprey PDFJorel Fex100% (3)

- Gayatri Mantram SPДокумент17 страницGayatri Mantram SPvaidyanathan100% (1)

- Strategic Bidding and Generation Scheduling in Electricity Spot-MarketДокумент6 страницStrategic Bidding and Generation Scheduling in Electricity Spot-MarketNorway ChadОценок пока нет

- Gantry CraneДокумент6 страницGantry CraneAdrianmb0% (1)

- Spotify Strategig Possining and Product Life Cycle Four Basic Stages.Документ5 страницSpotify Strategig Possining and Product Life Cycle Four Basic Stages.Jorge YeshayahuОценок пока нет

- p2 Process Model 2017Документ1 страницаp2 Process Model 2017Miguel Fernandes0% (1)

- Price-Takers' Bidding Strategies in Joint Energy and Spinning Reserve Pay-As-Bid MarketsДокумент18 страницPrice-Takers' Bidding Strategies in Joint Energy and Spinning Reserve Pay-As-Bid MarketsXX DDОценок пока нет

- Strategic Bidding of Transmission-Constrained Gencos With Incomplete InformationДокумент11 страницStrategic Bidding of Transmission-Constrained Gencos With Incomplete InformationShimpy RalhanОценок пока нет

- A Game-Theoretic Model For Generation Expansion Planning: Problem Formulation and Numerical ComparisonsДокумент7 страницA Game-Theoretic Model For Generation Expansion Planning: Problem Formulation and Numerical ComparisonsMuhammad BahrulОценок пока нет

- Option Electricity Market DesignДокумент8 страницOption Electricity Market Designdubuli123Оценок пока нет

- Generation Expansion Planning Strategies On Power System: A ReviewДокумент4 страницыGeneration Expansion Planning Strategies On Power System: A Reviewrudreshsj86Оценок пока нет

- Optimal Integrated Generation Bidding and Scheduling With Risk Management Under A Deregulated Power MarketДокумент10 страницOptimal Integrated Generation Bidding and Scheduling With Risk Management Under A Deregulated Power Marketapi-3697505Оценок пока нет

- The Price Prediction For Used Cars Using Multiple Linear Regression ModelДокумент6 страницThe Price Prediction For Used Cars Using Multiple Linear Regression ModelIJRASETPublicationsОценок пока нет

- Energies 14 05726 v2Документ19 страницEnergies 14 05726 v2hangzhou maОценок пока нет

- Dynamic Testing ofДокумент53 страницыDynamic Testing ofibrahimsalahОценок пока нет

- Monroeetal 2020Документ28 страницMonroeetal 2020Айсултан АлимханОценок пока нет

- Batteries 07 00059Документ16 страницBatteries 07 00059lolОценок пока нет

- BE Strategic BiddingДокумент9 страницBE Strategic Biddingkaren dejoОценок пока нет

- Spot Fuel Markets' Influence On The Spot Electricity Market Using Leontief ModelДокумент7 страницSpot Fuel Markets' Influence On The Spot Electricity Market Using Leontief ModelgbshebleОценок пока нет

- Optimal Response of An Oligopolistic Generating Company To A Competitive Pool-Based Electric Power MarketДокумент7 страницOptimal Response of An Oligopolistic Generating Company To A Competitive Pool-Based Electric Power MarketwilliamnuevoОценок пока нет

- Ijert Ijert: Bidding Strategy For Competitive Electricity Market by Using Optimization Technique (Pso & Apso)Документ8 страницIjert Ijert: Bidding Strategy For Competitive Electricity Market by Using Optimization Technique (Pso & Apso)Saurav NandaОценок пока нет

- Market Power and Cost Efficiencies in BankingДокумент55 страницMarket Power and Cost Efficiencies in BankingPradeep KumarОценок пока нет

- Assignment Reading Imperfect Market Versus Imperfect Regulation in The US ElectricityДокумент33 страницыAssignment Reading Imperfect Market Versus Imperfect Regulation in The US ElectricityZhang YuzhenОценок пока нет

- Optimal Unit Commitment of Distributed Generation Resources Using Cuckoo Optimization AlgorithmДокумент8 страницOptimal Unit Commitment of Distributed Generation Resources Using Cuckoo Optimization AlgorithmAli AlSowaidiОценок пока нет

- New Market Power Driven Multistage Trans-Mission Expansion Strategy in Power MarketsДокумент8 страницNew Market Power Driven Multistage Trans-Mission Expansion Strategy in Power MarketssunitharajababuОценок пока нет

- JIANG-AI2017 Article Agent-basedSimulationForSymmet PDFДокумент10 страницJIANG-AI2017 Article Agent-basedSimulationForSymmet PDFCarlos VillaОценок пока нет

- JIANG-AI2017 Article Agent-basedSimulationForSymmet PDFДокумент10 страницJIANG-AI2017 Article Agent-basedSimulationForSymmet PDFCarlos VillaОценок пока нет

- Application of Fuzzy Logic To Priced-Based Unit Commitment Under Price UncertaintyДокумент5 страницApplication of Fuzzy Logic To Priced-Based Unit Commitment Under Price UncertaintyHafeez AnsariОценок пока нет

- Electricity Price Forecasting Using Artificial Neural NetworkДокумент9 страницElectricity Price Forecasting Using Artificial Neural NetworkIJRASETPublicationsОценок пока нет

- Energy Journal PaperДокумент18 страницEnergy Journal Paperelpepe potatzioОценок пока нет

- Artikel Jurnal Edisi 23 Bulan Desember 2023 PDFДокумент6 страницArtikel Jurnal Edisi 23 Bulan Desember 2023 PDFcaraka2007Оценок пока нет

- Optimal Unit Commitment of Distributed Generation Resources Using Cuckoo Optimization AlgorithmДокумент8 страницOptimal Unit Commitment of Distributed Generation Resources Using Cuckoo Optimization Algorithmبشرى جودةОценок пока нет

- Two-Settlement Electricity Markets With Price Caps and Cournot Generation FirmsДокумент21 страницаTwo-Settlement Electricity Markets With Price Caps and Cournot Generation FirmsislammuddinОценок пока нет

- SSRN Id3280688Документ47 страницSSRN Id3280688Andres Felipe Leguizamon LopezОценок пока нет

- Power Generation and Transmission Expansion Planning Procedures in Asia: Market Environment and Investment ProblemsДокумент48 страницPower Generation and Transmission Expansion Planning Procedures in Asia: Market Environment and Investment ProblemsdanielraqueОценок пока нет

- Electrical & Electronic SystemsДокумент6 страницElectrical & Electronic SystemsSaadat BahramiОценок пока нет

- A Novel Opposition Based Tuned Chaotic Differential Evolution Technique For Techno Economic Analysis by Optimal Placement of Distributed GenerationДокумент23 страницыA Novel Opposition Based Tuned Chaotic Differential Evolution Technique For Techno Economic Analysis by Optimal Placement of Distributed Generationredstitch15Оценок пока нет

- Energy System Planning Analysis Using The Integrated Energy and Macroeconomy ModelДокумент9 страницEnergy System Planning Analysis Using The Integrated Energy and Macroeconomy ModelDániel TokodyОценок пока нет

- Forecasting Electricity MarketsДокумент9 страницForecasting Electricity MarketsThiyagarjanОценок пока нет

- Evaluating Different Scenarios For Tradable Green Certificates by Game Theory ApproachesДокумент15 страницEvaluating Different Scenarios For Tradable Green Certificates by Game Theory Approachesprabin gautamОценок пока нет

- Gridview: - Modeling To Predict Economic ValueДокумент2 страницыGridview: - Modeling To Predict Economic ValueAra AkramОценок пока нет

- Dynamic Pricing and Prices Spike Detection For Industrial Park With Coupled Electricity and Thermal DemandДокумент12 страницDynamic Pricing and Prices Spike Detection For Industrial Park With Coupled Electricity and Thermal DemandfluidjОценок пока нет

- Short Term Unit CommitmentДокумент14 страницShort Term Unit CommitmentSaheem ZafarОценок пока нет

- A Genetic Algorithm Based Security Constrained Economic Dispatch Approach For LMP CalculationДокумент11 страницA Genetic Algorithm Based Security Constrained Economic Dispatch Approach For LMP CalculationSEP-PublisherОценок пока нет

- Individual Assignment - Paper BДокумент2 страницыIndividual Assignment - Paper BSani ZehraОценок пока нет

- Saber 1Документ22 страницыSaber 1Izudin SoftićОценок пока нет

- Price ForecastingДокумент6 страницPrice ForecastingMuhammad Saad Shafiq QadriОценок пока нет

- A Decentralized Trading Algorithm For An Electricity Market With Generation UncertaintyДокумент9 страницA Decentralized Trading Algorithm For An Electricity Market With Generation UncertaintyJohnОценок пока нет

- Project ManagementДокумент26 страницProject ManagementManjesh RОценок пока нет

- Traffic Condition Prediction Based - HMA FIS - EnergyДокумент22 страницыTraffic Condition Prediction Based - HMA FIS - EnergyTeddy ScottОценок пока нет

- A Machine Learning Approach For Collusion Detection in Electricity Markets Based On Nash Equilibrium TheoryДокумент11 страницA Machine Learning Approach For Collusion Detection in Electricity Markets Based On Nash Equilibrium TheoryFahim KarimiОценок пока нет

- A Genetic Algorithm Approach For Solving Ac-Dc Optimal Power Flow ProblemДокумент14 страницA Genetic Algorithm Approach For Solving Ac-Dc Optimal Power Flow ProblemJoe RanteОценок пока нет

- Electric Vehicle Analysis Report Executive Summary: 1.1 BackgroundДокумент3 страницыElectric Vehicle Analysis Report Executive Summary: 1.1 Backgroundwocim20084Оценок пока нет

- Generation Expansion Planning Considering Renewable EnergiesДокумент11 страницGeneration Expansion Planning Considering Renewable EnergiesAJER JOURNALОценок пока нет

- Energies: Importance of Reliability Criterion in Power System Expansion PlanningДокумент18 страницEnergies: Importance of Reliability Criterion in Power System Expansion PlanningVinoth Kumar SubramaniОценок пока нет

- Game Theory Based Charging Solution For Networked Electric Vehicles: A Location-Aware ApproachДокумент13 страницGame Theory Based Charging Solution For Networked Electric Vehicles: A Location-Aware ApproachgkpОценок пока нет

- A Column-and-Constraint Generation Algorithm To Find Nash Equilibrium in Pool-Based Electricity MarketsДокумент8 страницA Column-and-Constraint Generation Algorithm To Find Nash Equilibrium in Pool-Based Electricity MarketsM8ow6fОценок пока нет

- A New Framework For Capacity Market in Restructured Power SystemsДокумент17 страницA New Framework For Capacity Market in Restructured Power SystemsAnnaRajОценок пока нет

- Effect of Loss of Load Probability Distribution On Operating Reserve Demand Curve Performance in Energy-Only Electricity MarketДокумент4 страницыEffect of Loss of Load Probability Distribution On Operating Reserve Demand Curve Performance in Energy-Only Electricity MarketTrần Mạnh QuỳnhОценок пока нет

- Generation AssetsДокумент9 страницGeneration AssetsPramurtta Shourjya MajumdarОценок пока нет

- Simulating DSM Impact in The New Liberalized Electricity MarketДокумент8 страницSimulating DSM Impact in The New Liberalized Electricity MarketDoankhoa DoanОценок пока нет

- Synopsis Specimen Previous YearДокумент8 страницSynopsis Specimen Previous YearAmartyaОценок пока нет

- Optimal Reliability-Based Placement of Plug-In Electric Vehicles in Smart Distribution NetworkДокумент7 страницOptimal Reliability-Based Placement of Plug-In Electric Vehicles in Smart Distribution NetworkKitty RaoОценок пока нет

- Application of Games With Incomplete Information For Pricing Electricity in Deregulated Power R.W. Ferrero J. Rivera S.M. ShahidehpourДокумент6 страницApplication of Games With Incomplete Information For Pricing Electricity in Deregulated Power R.W. Ferrero J. Rivera S.M. ShahidehpourEvans EjegiОценок пока нет

- Electricity Markets: New Players and Pricing UncertaintiesОт EverandElectricity Markets: New Players and Pricing UncertaintiesSayyad NojavanОценок пока нет

- Differential EquationsДокумент303 страницыDifferential Equationschitratr_bala7846Оценок пока нет

- Digsilent GridДокумент1 страницаDigsilent GridAdrianmbОценок пока нет

- C IIT Dept. Applied Mathematics, December 6, 2008Документ1 страницаC IIT Dept. Applied Mathematics, December 6, 2008AdrianmbОценок пока нет

- Grammar of EsperantoДокумент216 страницGrammar of EsperantoatoetomОценок пока нет

- Chapter 15 NegotiationsДокумент16 страницChapter 15 NegotiationsAdil HayatОценок пока нет

- Sir Rizwan Ghani AssignmentДокумент5 страницSir Rizwan Ghani AssignmentSara SyedОценок пока нет

- Learning Objectives: Understanding The Self Module 1 - Sexual SelfДокумент11 страницLearning Objectives: Understanding The Self Module 1 - Sexual SelfMiss MegzzОценок пока нет

- "Management of Change ": A PR Recommendation ForДокумент60 страниц"Management of Change ": A PR Recommendation ForNitin MehtaОценок пока нет

- Midterm Examination: General MathematicsДокумент5 страницMidterm Examination: General MathematicsJenalyn CardanoОценок пока нет

- Slides - Simple Linear RegressionДокумент35 страницSlides - Simple Linear RegressionJarir AhmedОценок пока нет

- FASUPДокумент60 страницFASUPPranjal KumarОценок пока нет

- HaДокумент15 страницHaNicole Easther GabilangosoОценок пока нет

- TARA FrameworkДокумент2 страницыTARA Frameworkdominic100% (1)

- N Advocates Act 1961 Ankita218074 Nujsedu 20221008 230429 1 107Документ107 страницN Advocates Act 1961 Ankita218074 Nujsedu 20221008 230429 1 107ANKITA BISWASОценок пока нет

- Renal CalculiДокумент12 страницRenal CalculiArieОценок пока нет

- Maria Da Piedade Ferreira - Embodied Emotions - Observations and Experiments in Architecture and Corporeality - Chapter 11Документ21 страницаMaria Da Piedade Ferreira - Embodied Emotions - Observations and Experiments in Architecture and Corporeality - Chapter 11Maria Da Piedade FerreiraОценок пока нет

- NyirabahireS Chapter5 PDFДокумент7 страницNyirabahireS Chapter5 PDFAndrew AsimОценок пока нет

- Study On Perfromance Appraisal System in HPCLДокумент12 страницStudy On Perfromance Appraisal System in HPCLomkinggОценок пока нет

- High-Frequency Injection-Based SensorlessДокумент12 страницHigh-Frequency Injection-Based SensorlessRiad BOUZIDIОценок пока нет

- Demonstration MethodДокумент16 страницDemonstration Methodfrankie aguirreОценок пока нет

- Hindu Dharma Parichayam - Swami Parameswarananda SaraswatiДокумент376 страницHindu Dharma Parichayam - Swami Parameswarananda SaraswatiSudarsana Kumar VadasserikkaraОценок пока нет

- Vocabulary ListДокумент2 страницыVocabulary List謝明浩Оценок пока нет

- I. Inversion: Grammar: Expressing EmphasisДокумент7 страницI. Inversion: Grammar: Expressing EmphasisSarah BenraghayОценок пока нет

- Design of Solar Power System For Home ApplicationДокумент43 страницыDesign of Solar Power System For Home ApplicationsanthosecvpОценок пока нет

- Comparative Analysis of Severe Pediatric and Adult Leptospirosis in Sa o Paulo, BrazilДокумент3 страницыComparative Analysis of Severe Pediatric and Adult Leptospirosis in Sa o Paulo, BrazilShofura AzizahОценок пока нет

- Introduction To Consumer Behavior: by Dr. Kevin Lance JonesДокумент18 страницIntroduction To Consumer Behavior: by Dr. Kevin Lance JonesCorey PageОценок пока нет

- Whats New PDFДокумент74 страницыWhats New PDFDe Raghu Veer KОценок пока нет