Академический Документы

Профессиональный Документы

Культура Документы

Business Public Sector Private Sector Non-Profit Organizations

Загружено:

Kriti GuptaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Business Public Sector Private Sector Non-Profit Organizations

Загружено:

Kriti GuptaАвторское право:

Доступные форматы

Meaning

Privatisation means endorsing / assigning the ownership of a public property/business to a private party." Privatization is the incidence or process of transferring ownership of a business, enterprise, agency, public service or property from the public sector (the state or government) to the private sector (businesses that operate for a private profit) or to private non-profit organizations.

Advantages: 1. Basic advantage in privatization is accurateness and accurateness and commitment towards the service as they private organizations are very much concerned about the profits they make ultimately which depend on the quality of service being provided by them and the public response to it. 2. Privatization generates more revenue compared to government enterprises, thus govt can indirectly earn a bit more by leasing out enterprises to private organizations. 3. Customer support and satisfaction basically is of much interest in private enterprises comparatively.

Privatisation places the risk in the hands of business or Private Enterprise.

Private enterprise is more responsive to customer complaints and innovation.

The Govt. should not be a player and an umpire.

Privatisation provides a one off cash boost for Govt. This can be spent on Hospitals etc...

Privatisation leads to lower prices and greater supply.

Competition in privatization increases differentiation.

Read more: http://wiki.answers.com/Q/What_are_advantages_and_disadvantages_of_privatisation#ixzz1kdVLEjje

1)Development would be faster(due to competetion with the other private parties) 2)Innovative solutions (due to again competetion with the other private parties) 3)effective & time bound results 4)cost cuttings 5)improves quality in work 6)in turn more services to public are possible 7)increase the productivity 8)significant Growth in the business 9)controlled monitoring of public property gives public in turn good services

Disadvantages: 1. The biggest threat is reliability. There is nothing that backs up the private organizations, where as govt can back up its enterprises easily in terms of funds. There are more chances of bankruptcy in private orgs where are 0 to few in govt orgs. 2. Though the quality of service may be little compromised, its reliable. 3. Some departments need social responsibility which can be done only by government like police department, traffic management.

Privatisation is expensive and generates a lot of income in fees for specialist advisers such as banks.

2. Public monopolies have been turned into private monopolies with too little competition, so consumers have not benefited as much as had been hoped. This is the main reason why it has been necessary to create regulators (OFWAT, OFGAS etc). This is an important point. It partly depends on how the privatisation took place. For example, the railways were privatised in bit of a rush and there might have been other ways to do it so that more competition was created. It partly depends on the market. Some markets are 'natural monopolies' where competition is difficult. For example, it would be very wasteful and expensive to build two sets of track into Liverpool Street just to create some competition. Natural monopolies create a special justification for public ownership in the general public interest.

3. The nationalised industries were sold off too quickly and too cheaply. With patience a better price could have been had with more beneficial results on the government's revenue. In almost all cases the share prices rose sharply as soon as dealing began after privatisation.

4. The privatised businesses have sold off or closed down unprofitable parts of the business (as businesses normally do) and so services eg transport in rural areas have got worse.

5. Wider share ownership did not really happen as many small investors took their profits and didn't buy anything else.

Read more: http://wiki.answers.com/Q/What_are_advantages_and_disadvantages_of_privatisation#ixzz1kdVUnTmy

1)allways a threat to working staff. 2)as private parties try to extract work from minimum resources,downsizing is the common problem 3)un-employement increases 4)if the private party is inefficent, there is every possiblity of the business winding up. 5)more restrictions on many things 6)purely commercial in natrure and lacks ethical / human morales at times.

ow important is privatisation in India [ Images ]? The first order issue is that of competition policy. When the government hinders competition by blocking entry or FDI, this is

deeply damaging. Once competitive conditions are ensured, there are, indeed, benefits from shifting labour and capital to more efficient hands through privatisation, but this is a second order issue.

The difficulties of governments that run businesses are well-known. PSUs face little "market discipline". There is neither a fear of bankruptcy, nor are there incentives for efficiency and growth. The government is unable to obtain efficiency in utilising labour and capital; hence the GDP of the country is lowered to the extent that PSUs control labour and capital.

When an industry has large PSUs, which are able to sell at low prices because capital is free or because losses are reimbursed by periodic bailouts, investment in that entire industry is contaminated. This was the experience of Japan [ Images ], where the "zombie firms" - loss-making firms that were artificially rescued by the government contaminated investment in their industries by charging low prices and forcing down the profit rate of the entire industry.

Further, in many areas, the government faces conflicts of interest between a regulatory function and an ownership function. As an example, the Ministry of Petroleum crafts policies which cater for the needs of government as owner, which often diverge from what is best for India.

There is a fundamental loss of credibility when a government regulator faces PSUs in its sector: there is mistrust in the minds of private investors, who demand very high rates of return on equity in return for bearing regulatory risk.

These arguments have led many economists to advocate large-scale privatisation, so as to clear the slate, and get on with the task of building a mature market economy. The role model in this regard is Germany [ Images ]. After the collapse of communism and the unification of East and West Germany, an auction was held for selling off all East German PSUs.

Negative bids were permitted; i.e. the government was willing to even pay a private manager to take over a loss-making business if no higher bid was to be found. Through this, Germany was able to erase the heritage of socialism, and get on with the task of running an efficient market economy.

While such a game plan is entirely feasible in India, the present Parliament desires no privatisation. Does this mean that in the immediate future, progress in economic policy on privatisation must merely wait for the next elections?

When we look at various industries in India, the gains from privatisation are quite heterogeneous. In some cases, there are hopelessly loss-making PSUs. These operate in industries where private and foreign firms have been able to come in, and the PSU has been left far behind the standards of quality and price set by the private sector.

The PSUs should ideally have been sold off long ago, but today, these firms are irrelevant for the competitive dynamics of the industries that they operate in. The only issue is that of getting the land, the labour and some machinery out of public hands.

When privatisation is achieved, India will benefit because the private buyer will produce more GDP using the same resources, and the flow of budgetary support to these firms will cease. The government should be happy to get these firms out of its hands with negative bids.

The next and most interesting category comprises industries like telecom and airlines. In these areas, India has witnessed the dramatic benefits that come from the entry of private players.

Telecom and airline services in India are now dramatically improved, if not yet up to world-class, by changing rules in a way that permitted limited entry to domestic and foreign players. The privatisation of VSNL [ Get Quote ] was critically important because it was part of the opening up of the ILD sector to competition: the government would arguably have been more tardy in opening up if it had a vested interest through ownership of VSNL.

However, the key innovation, which broke with the stasis of socialism was opening up entry barriers - not privatisation.

In both sectors, the full benefits from permitting foreign competitors, which are only present in very muted fashion, remain to be harnessed. While Spicejet is a good airline, there are bigger benefits waiting to be obtained by having domestic flights run by Lufthansa and Singapore Airlines. In both sectors, the defining issue in policy is the removal of entry barriers, not privatisation.

Looking forward, there is a good chance that in some years, BSNL, MTNL [ Get Quote ] and the merged airline will end up like one of the many defunct PSUs of today. It makes sense for the government to sell today - while the going is good. But the privatisation of these three firms is no longer the most important issue - the further elimination of entry barriers faced by domestic and foreign firms is.

What does this tell us about banking? The decline in market shares of PSU banks, while helped along by strikes of PSU bank unions, has proceeded only slowly. This is partly because there is a fundamentally non-level playing field where private and foreign banks have deposit insurance for only Rs 100,000 of deposits while PSU banks have unlimited deposit insurance. This gives one reason in favour of bank privatisation: it is inherently difficult to achieve competitive conditions without privatisation.

But equally, there is no industry in India where the licence-permit raj hinders entry more than in the case of banking. At a time when the Indian economy is booming, and every kind of business is being created, the one industry where we see no new firms starting up is banking. This has surely got to do with government restrictions on entry.

There is absolutely no industry in India where the opening of branch offices by foreign firms and private firms requires permission from the government. When Ford [ Images ] operates in India, it has to obey rules on FDI, but after that, it never has to go back to the government to take permission to open offices.

What is worse, all foreign banks - put together - are given permission to open 12 branches per year in the full country. There is no worse instance where contemporary Indian policy-making is animated by ideas from the 1960s.

Difference between privatization nd disinvestment PRIVATIZATION - is the process of transferring the ownership of a business of a public sector to the private sector ... DISINVESTMENT - Wen d Govt retains 26% of d shares carrying voting powers while selling d remaining, it would hav disinvested all right but would not have privatised, becz with 26 percent it can use fr vital decisions for which generally a special resolution (three-fourths majority) is required !!

Read more: http://wiki.answers.com/Q/What_is_the_difference_between_privatisation_and_disinvestment#ixzz1kdb7EIab

Introduction Banking sector reforms in India has progressed promptly on aspects like interest rate deregulation, reduction in statutory reserve requirements, prudential norms for interest rates, asset classification, income recognition and provisioning. But it could not match the pace with which it was expected to do. The accomplishment of these norms at the execution stages without restructuring the banking sector as such is creating havoc. This research paper deals with the problem of having non-performing assets, the reasons for mounting of non-performing assets and the practices present in other countries for dealing with non-performing assets. During pre-nationalization period and after independence, the banking sector remained in private hands Large industries who had their control in the management of the banks were utilizing major portion of financial resources of the banking system and as a result low priority was accorded to priority sectors. Government of India nationalized the banks to make them as an instrument of economic and social change and the mandate given to the banks was to expand their networks in rural areas and to give loans to priority sectors such as small scale industries, selfemployed groups, agriculture and schemes involving women. To a certain extent the banking sector has achieved this mandate. Lead Bank Scheme enabled the banking system to expand its network in a planned way and make available banking series to the large number of population and touch every strata of society by extending credit to their productive endeavours. This is evident from the fact that population per office of commercial bank has come down from 66,000 in the year 1969 to 11,000 in 2004. Similarly, share of advances of public sector banks to priority sector increased form 14.6% in 1969 to 44% of the net bank credit. The number of deposit accounts of the banking system increased from over 3 crores in 1969 to over 30 crores. Borrowed accounts increased from 2.50 lakhs to over 2.68 crores. Difficulties with the non-performing assets: 1. Owners do not receive a market return on their capital. In the worst case, if the bank fails, owners lose their assets. In modern times, this may affect a broad pool of shareholders. 2. Depositors do not receive a market return on savings. In the worst case if the bank fails, depositors lose their assets or uninsured balance. Banks also redistribute losses to other borrowers by charging higher interest rates. Lower deposit rates and higher lending rates repress savings and financial markets, which hampers economic growth. 3. Non performing loans epitomize bad investment. They misallocate credit from good projects, which do not receive funding, to failed projects. Bad investment ends up in misallocation of capital and, by extension, labour and natural resources. The economy performs below its production potential. 4. Non performing loans may spill over the banking system and contract the money stock, which may lead to economic contraction. This spillover effect can channelize through illiquidity or bank insolvency; (a) when many borrowers fail to pay interest, banks may experience liquidity shortages. These shortages can jam payments across the country, (b) illiquidity constraints bank in paying depositors e.g. cashing their paychecks. Banking panic follows. A run on banks by depositors as part of the national money stock become inoperative. The money stock contracts and economic contraction follows (c) undercapitalized banks exceeds the banks capital base. Lending by banks has been highly politicized. It is common knowledge that loans are given to various industrial houses not on commercial considerations and viability of project but on political considerations; some politician would ask the bank to extend the loan to a particular corporate and the bank would oblige. In normal circumstances

banks, before extending any loan, would make a thorough study of the actual need of the party concerned, the prospects of the business in which it is engaged, its track record, the quality of management and so on. Since this is not looked into, many of the loans become NPAs. The loans for the weaker sections of the society and the waiving of the loans to farmers are another dimension of the politicization of bank lending. Most of the depositors money has been frittered away by the banks at the instance of politicians, while the same depositors are being made to pay through taxes to cover the losses of the bank. Comparative Study With Other Countries. I. China: (a) Causes: (i) The State Owned Enterprises(SOEs) believe that there the government will bail them out in case of trouble and so they continue to take high risks and have not really strived to achieve profitability and to improve operational efficiency. (ii) Political and social implications of restructuring big SOEs force the government to keep them afloat,(iii) Banks are reluctant to lend to the private enterprises because while an NPA of an SOE is financially undesirable, an NPA of a private enterprise is both financially and politically undesirable,(iv) Courts are not reliable enforcement vehicles. (b) Measures: (i) Reducing risk by strengthening banks, raising disclosure standards and spearheading reforms of the SOEs by reducing their level of debt, (ii) Laws were passed allowing the creation of asset management companies, foreign equity participation in securitization and asset backed securitization, (iii) The government which bore the financial loss of debt discounting. Debt/equity swaps were allowed in case a growth opportunity existed, (iv) Incentives like tax breaks, exemption from administration fees and clear cut asset evaluation norms were implemented. The AMCs have been using leases, transfers, restructuring, debt- for-equity swaps and asset securitization, among other methods, to dispose of non-performing loans II. Korea: (a) Causes: (i) Protracted periods of interest rate control and selective credit allocations gave rise to an inefficient distribution of funds,(ii) Lack of Monitoring ..... Banks relied on collaterals and guarantees in the allocation of credit, and little attention was paid to earnings performance and cash flows, (b) Measurers: (i) The speedy containment of systemic risk and the domestic credit crunch problem with the injection of large public funds for bank recapitalization, (ii) Corporate Restructuring Vehicles (CRVs) and Debt/Equity Swaps were used to facilitate the resolution of bad loans, (iii) Creation of the Korea Asset Management Corporation (KAMCO) and a NPA fund to fund to finance the purchase of NPAs, (iv) Strengthening of Provision norms and loan classification standards based on forward-looking criteria (like future cash flows) were implemented; (v) The objective of the central bank was solely defined as maintaining price stability. The Financial Supervisory Commission (FSC) was created (1998) to ensure an effective supervisory system in line with universal banking practices. III. Japan: (a) Causes: (i) Investments was made real estate at high prices during the boom. The recession caused prices to crash and turned a lot of these loans bad, (ii) Legal mechanisms to dispose bad loans were time consuming and expensive and NPAs remained on the balance sheet, (iii) Expansionary fiscal policy measures administered to stimulate the economy supported industrial sectors like construction and real estate, which may further exacerbated the problem, (iv) Weak corporate governance coupled with a no-bankruptcy doctrine, (v) Inadequate accounting systems. (b) Measures: (i) Amendment of foreign exchange control law (l997) and the threat of suspension of banking business in case of failure to satisfy the capital adequacy ratio prescribed, (ii) Accounting standards Major business groups established a private standard-setting vehicle for Japanese accounting standards (2001) in line with international standards, (iii) Government Support - The governments committed public funds to deal with banking sector weakness. III. Pakistan : (a) Causes: (i) Culture of "zero equity" projects where there was minimal due diligence was done by banks in giving loans coupled with collusive lending and poor corporate governance, (ii) Poor entrepreneurship, (iii)

Chronic over-capacity/lack of competitive advantage,(iv) Directed lending where the senior management of the public sector banks gave loans to political heavy weights/ military commanders. (b) Measures: (i) The top management of the banks was changed and appointment of independent directors in the board of directors , (ii) aggressive settlements were done by banks with their defaulting borrowers at values well below the actual debt outstanding and/or the amount awarded through the court process ..... i.e., large haircuts/ write offs, (iii) setting up of Corporate and Industrial Restructuring Corporation (CIRC) to take over the non-performing loan portfolios of nationalized banks on certain agreed terms and conditions and issue government guaranteed bonds earning market rates of return,(iv) The Banking Companies (Recovery of Loans, Advances, Credits and Finances) Act, 1997 was introduced in February 1997. Special banking courts have been established under this Act to facilitate the recovery of non-performing loans and advances from defaulted Conclusion I would suggest 3 ways of solving this problem of NPAs. They are (i) recapitalization of banks with Government aid, (ii) disposal and write off of NPAs, (iii) increased regulation.

Non Performing Asset means an asset or account of borrower, which has been classified by a bank or financial institution as sub-standard, doubtful or loss asset, in accordance with the directions or guidelines relating to asset classification issued by The Reserve Bank of India. A loan or lease that is not meeting its stated principal and interest payments. Banks usually classify as nonperforming assets any commercial loans which are more than 90 days overdue and any consumer loans which are more than 180 days overdue. More generally, an asset which is not producing income. A debt obligation where the borrower has not paid any previously agreed upon interest and principal repayments to the designated lender for an extended period of time. The nonperforming asset is therefore not yielding any income to the lender in the form of principal and interest payments. With a view to moving towards international best practices and to ensure greater transparency, it has been decided to adopt the '90 days overdue' norm for identification of NPAs, from the year ending March 31, 2004. 1) Interest and / or installment of principal remain overdue for a period of more than 90 days in respect of a term Loan. 2) The account remains out of order for a period of more than 90 days, in respect of an Overdraft / Cash Credit. 3) The bill remains overdue for a period of more than 90 days in case of the bill purchase and discounted. 4) Interest and / or installment of principal remain overdue for two harvest season but for a period not exceeding two half years in the case of an advance granted for agricultural purpose. 5) Any amount to be received remains over-due for a period of more than 90 days in respect of the other accounts. An account treated as 'out of order' if the outstanding balance remains continuously in excess of the sanctioned limit/ drawing power. In case where the outstanding balance in the principal operating account is less than the sanctioned limit/ drawing power, but there are no credits continuously for six months as on the date of balance sheet or credits are not enough to cover the interest debited during the same period, these account should be treated as 'out of order'. It is called out of order. In liberalizing economy banking and financial sector get high priority. Indian banking sector of having a serious problem due non performing. The financial reforms have helped largely to clean NPA. The

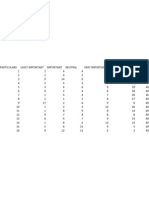

earning capacity and profitability of the bank are highly affected due to this. NPA is defined as an advance for which interest or repayment of principal or both remain outstanding for a period of more than two quarters. The level of NPA act as an indicator showing the bankers credit risks and efficiency of allocation of resource. Reasons: Various studies have been conducted to analysis the reasons for NPA. Whatever may be complete elimination of NPA is impossible. The reasons may be widely classified in two: 1) Over hang component - Over hang component is due to the environment reasons, business cycle etc. 2) Incremental component - Incremental component may be due to internal bank management, credit policy, terms of credit etc. Asset Classification The RBI has issued guidelines to banks for classification of assets into four categories. 1) Standard assets - These are loans which do not have any problem are less risk. 2) Substandard assets - These are assets which come under the category of NPA for a period of less than 12 months. 3) Doubtful assets - These are NPA exceeding 12 months. 4) Loss assets - These NPA which are identified as unreliable by internal inspector of bank or auditors or by RBI. The classification of nonperforming assets of scheduled commercial bank. Table 1 Non Performing Assets Year | PNB public bank | BOB public bank | ICICI private bank | HDFC private bank | 2008 | 3319.3 | 1858.11 | 7570.47 | 903.64 | 2009 | 2767 | 1664 | 9565 | 1984 | 2010 | 3214 | 2196 | 9267 | 1807 | Income recognition and provisioning - Income from NPA is not recognized on accrued basic but is booked as income only when, it is actually received. RBI has also tightened red the provisions norms against asset classification. It ranges from 0.25% to 100% from standard asset to loss asset respectively. This shows the sign of efficiency in public and private sector banks. Management of NPA The table shows that the percentage of NPA was higher. This was due to show ineffective recovery of bank credit, lacuna in credit recovery system, inadequate legal provision etc. Various steps have been taken by the government to recover and reduce NPAs. Some of them are. 1) One time settlement / compromise scheme. 2) Lok adalats. 3) Debt Recovery Tribunals. 4) Securitization and reconstruction of financial assets and enforcement of Security Interest Act 2002. 5) Corporate Reconstruction Companies. 6) Credit information on defaulters and role of credit information bureaus CONCLUSION - The Indian banking sector is facing a serious problem of NPA. The extent of NPA is

comparatively higher in public sectors banks. To improve the efficiency and profitability, the NPA has to be scheduled. Various steps have been taken by government to reduce the NPA. It is highly impossible to have zero percentage NPA. But at least Indian banks can try competing with foreign banks to maintain international standard

Not unless it is accompanied by other essential reforms, such as liberalisation of priority sector norms, but banks now have the freedom to manage their money better.

DR RUPA REGE NITSURE Chief Economist, Bank of Baroda

Also Read

Related Stories

News Now

- Should foreign airlines be allowed to invest in domestic aviation? - Should official concerns on RTI be addressed? - Sunanda K Datta-Ray: In search of the middle class - Is the quality of IIT students declining?

firms - Indian pharmathird to cut medicine rates in Pakistan by a

- Pak 'in principle' decides to grant MFN status to India

Also Read

Related Stories

News Now

Wall Street jumps on overseas optimism

RCom rejigs mgmt, wireless biz head Safawi to leave

January PMI at 8-month high: HSBC

Mahindra Satyam Q3 PAT jumps 5-fold to Rs 308 cr

Govt to order inquiry into CSE allegations on Solar Mission

More

Deregulation of interest rates from the liabilities side without liberalising all rates from the assets side results in a distortion

The Reserve Bank of Indias (RBIs) recent move to deregulate interest rates on savings bank (SB) deposits is seemingly justified in the interest of fairness and equity, as the rate was administered at 3.5 per cent for more than eight years and then raised to four per cent in May, 2011 despite sticky inflationary pressures for more than 40 months. It was considered unfair that depositors, who provide almost one-fourth of the total stock of bank deposits, were not given any protection against rising inflation. Also, the move was deemed essential to promote product innovation and price discovery in the long run, since deregulated SB rates might encourage banks to judiciously manage liquidity and promote efficient resource allocation.

However, the move may not fetch the desired results, since half-hearted deregulation can be worse than none at all. The deregulation of SB rates should have been accompanied with other essential reforms like the reduction in the overall resource preemption levels, liberalisation of priority sector lending norms, deregulation of other administered rates like interest rates on crop loans or export credit and so on for the creation of a fair, market-driven banking system. Moreover, interest rates on other important savings products with which bank deposits directly compete are still administered in India. For instance, interest rates on the small savings, pension and provident fund schemes of the central and state governments are not market-determined.

In the current phase of rising interest rates and increasing volumes of government market borrowings, the SB deregulation may discourage banks to undertake aggressive efforts towards financial inclusion (due to higher cost of funds) and also hamper their efforts to extend low-yielding social advances. If the administered SB rates acted as the subsidy for public sector banks, it may not be forgotten that these were the banks that lent unfailingly to low-yielding social sectors even during the global crisis years. In other Bric countries like China and Brazil, SB rates are regulated precisely for this reason. Deregulation of interest rates from the liabilities side without liberalising all rates from the assets side results in a distortion.

Let us now look at the experience of those countries in which SB rates are deregulated for quite some time. In countries like South Korea, Taiwan, Singapore and Malaysia, SB rates have settled at extremely low levels over the period of time. For instance, at present, the SB rate rules around 0.10 per cent in South Korea, 0.31 per cent in Taiwan, between 0.25 and 0.35 per cent in Singapore and between 0.40 and 0.70 per cent in Malaysia. Even in India, once interest rates start easing, the competitive pressures will force this rate to settle at abysmally low levels. This will then be considered extremely unfair to small savers who lack organised representation. While large and learned depositors will enjoy many choices, small savers from remote rural areas will get exploited because of their ignorance. This means RBI will have to intervene and come out with a minimum floor rate to protect small savers.

As was done in Hong Kong, I think Indian regulators could have implemented the deregulation of SB rates in a calibrated fashion with many checks and balances. As some experts suggested, the regulator could have timed the deregulation when the interest rate trajectory was stable so that the decontrolled rate would not result in abrupt changes. Given Indias present social landscape, the regulator could have come out with a minimum floor and a cap on this historically clean product (with uniform rate to all savers irrespective of their social, economic, locational or educational status) to avoid chaos.

As SB rate deregulation is introduced in India in the present tight liquidity conditions, there is a possibility of an unhealthy rate war among banks, giving way to heightened volatility in their resource profile. This certainly does not augur well for their ability to fund long-term projects. Till the time India lacks reliable alternatives in the form of a liquid and well-developed corporate bond market or easy access for its banking sector to long-term instruments of funds, deregulating the SB rate may not yield the desired results.

One has to wait and watch.

MADAN SABNAVIS Chief Economist, CARE Ratings

Free pricing helps banks manage their costs more efficiently because they can fine-tune them depending on their requirements Deregulation of interest rates on savings deposits is probably the last mile in interest rate reforms in India. Though the timing may be debated, banks will surely see something good in this move. For the system as a whole these deposits constitute a little less than a quarter of overall funds they have increased from around 21 per cent in FY00 to 25 per cent in FY06 and moved down to 23 per cent in FY10. There are four reasons for banks to cheer.

First, the freedom to price around a quarter of available funds gives them better control over an important section of their funds. Second, free pricing helps banks manage their costs more efficiently because they can fine-tune them depending on their own requirements and market conditions. The fact that these deposits are almost constant can give most banks flexibility in pricing, although ironically the mirror image would offer scope for competition to dip into them. Third, banks can increase or decrease this reservoir of funds to the extent that is possible based on their own requirements. This will foster competition between banks and enable them to compete with liquid mutual funds, which are the direct alternative. Also by changing terms of transactions like minimum balance, charges for services and so on, they can encourage or discourage such deposits. Finally, as a consequence of these three factors, asset-liability management becomes easier since banks can factor movement in these deposits to match maturity of assets.

Though it is true that these deposits have been an almost constant factor for the banking system, these dynamics may change gradually once customers see differential interest rates. One cannot conjecture whether this proportion of 23 per cent will move up or down when rates change. This was also observed when banks started very short-term deposits of 15 days and above a move to get customers to roll over these deposits at a rate that was higher than the savings account rate. Customers did move funds to banks offering higher rates on these deposits. By offering higher rates on savings accounts, there could be migration to these deposits not just within the bank, but also across banks. This will cut administrative costs. Therefore, at the micro level, banks will have scope to play with their balance sheet more effectively.

Individuals usually hold cash at home for liquidity, savings deposits for security and convenience, and term deposits for income. While funds may be swapped between banks or across deposits, the overall amount of deposits may not change if rates are increased, given the profile of customers who are already exposed to various alternatives. Therefore, at the macro level the impact may be minimal since it should be recognised that liquid debt funds tend to give higher post-tax yields. Similarly, if the rates come down, customers may not actually withdraw substantially from this account.

We have already seen disparate reactions from banks. The large ones have been silent, while some smaller ones have increased these rates. This will really be the challenge for banks at the micro level where the share of savings accounts is lower, as in the case of foreign banks (about 15 per cent) and old private banks (around 19 per cent). Those that are already at 23-24 per cent may not really have scope to do so, based on past trends in terms of garnering deposits. The onus will be on banks to actually manage this portion of funds.

So, is it good for the banking system? Certainly yes, since it gives banks the freedom to manage their funds more adroitly. The consequences of the impact on the amount of deposits may not change but as long as it is market-determined, the system will be efficient. The real challenge is for the Reserve Bank of India when interest rates come down substantially as they did in 2002-2005 when term deposits gave returns of around five per cent. Logically, the savings rate should have also come down proportionately to close to nil in case a spread of, say, 400-500 basis points is to be maintained as is the case today.

This may be tough to accept.

Вам также может понравиться

- The Maruti Story: How A Public Sector Company Put India On WheelsОт EverandThe Maruti Story: How A Public Sector Company Put India On WheelsРейтинг: 3 из 5 звезд3/5 (1)

- Eco Prject PrivДокумент12 страницEco Prject PrivSwayam SethiyaОценок пока нет

- Differentiate Between Privatization and Commercialization of Public Enterprise and Discuss It Merit and DemeritДокумент8 страницDifferentiate Between Privatization and Commercialization of Public Enterprise and Discuss It Merit and DemeritUsman AbubakarОценок пока нет

- 6.18, DR Nayan DeepДокумент10 страниц6.18, DR Nayan Deepramzan.khadim89Оценок пока нет

- Business and Environment - noPWДокумент5 страницBusiness and Environment - noPWcitizendenepal_77Оценок пока нет

- Disinvestment in Public SectorДокумент7 страницDisinvestment in Public SectorRajs MalikОценок пока нет

- The Objective of Firms: o CO-OPERATIVE: Co-Operatives Are Owned, Control and Operated For TheДокумент10 страницThe Objective of Firms: o CO-OPERATIVE: Co-Operatives Are Owned, Control and Operated For TheRashed SifatОценок пока нет

- 20CH10064 - Sneha MajumderДокумент16 страниц20CH10064 - Sneha MajumderRashi GoyalОценок пока нет

- Business Env.. PrivatizationДокумент8 страницBusiness Env.. Privatizationklair_deepika5602Оценок пока нет

- Privatisation and DisinvestmentДокумент10 страницPrivatisation and DisinvestmentSachin MangutkarОценок пока нет

- Multinational CorporationДокумент5 страницMultinational CorporationrameshhackerОценок пока нет

- Privatization & Disinvestment'sДокумент13 страницPrivatization & Disinvestment'sarifshaikh99Оценок пока нет

- Needed)Документ8 страницNeeded)Neelam DarjiОценок пока нет

- Disinvestment of Public Sector Enterprises in IndiaДокумент14 страницDisinvestment of Public Sector Enterprises in IndiaAlen Augustine100% (1)

- Advantages and Problems of PrivatisationДокумент4 страницыAdvantages and Problems of PrivatisationShahriar HasanОценок пока нет

- Multinational CorporationДокумент6 страницMultinational CorporationCatherine JohnsonОценок пока нет

- Multinational Corporation: Market ImperfectionsДокумент32 страницыMultinational Corporation: Market ImperfectionsShyam LakhaniОценок пока нет

- Detailed Report On Privatisation and DisinvestmentДокумент37 страницDetailed Report On Privatisation and DisinvestmentSunaina Jain50% (2)

- Assignment On PrivatisationДокумент12 страницAssignment On Privatisationbahubali50% (8)

- Divestment and PrivatisationДокумент16 страницDivestment and Privatisationlali62Оценок пока нет

- Summary of Chapter 15 - 860102Документ3 страницыSummary of Chapter 15 - 860102ADiОценок пока нет

- Revenue, Competition, Growth: Potential For Privatisation in The Euro AreaДокумент16 страницRevenue, Competition, Growth: Potential For Privatisation in The Euro AreaSergio RauberОценок пока нет

- Assignment On PrivatisationДокумент12 страницAssignment On PrivatisationGaurav PandeyОценок пока нет

- Xs - Zu: Multinational Companies (MNC'S) Impact On Indian EconomyДокумент7 страницXs - Zu: Multinational Companies (MNC'S) Impact On Indian EconomyNur AbibahОценок пока нет

- Swot Analysis InfosysДокумент17 страницSwot Analysis InfosysAlia AkhtarОценок пока нет

- Micro Eco2Документ6 страницMicro Eco2Harshal NaikОценок пока нет

- Problems of Private Sector in IndiaДокумент15 страницProblems of Private Sector in IndiaMayank Digari50% (4)

- Advantages of PrivatisationДокумент2 страницыAdvantages of PrivatisationRigved DarekarОценок пока нет

- From Agenda v10, Summer 1994-95. See Domberger 1994Документ11 страницFrom Agenda v10, Summer 1994-95. See Domberger 1994Core ResearchОценок пока нет

- Causes of PrivatisationДокумент9 страницCauses of PrivatisationNipunОценок пока нет

- Financial Management (II) MFM Sem IV: Disinvestment As A StrategyДокумент4 страницыFinancial Management (II) MFM Sem IV: Disinvestment As A Strategypriyankaoza22Оценок пока нет

- Privatisation and Commercialisation of Government Enterprises inДокумент4 страницыPrivatisation and Commercialisation of Government Enterprises inabiola soliuОценок пока нет

- The Effects of Privatizing GovernmentДокумент4 страницыThe Effects of Privatizing GovernmentClaire Kaye CarsonОценок пока нет

- PrivatizationДокумент3 страницыPrivatizationDilane AmonОценок пока нет

- Unit 1 - Chapter 2 - Business Structure 2023Документ13 страницUnit 1 - Chapter 2 - Business Structure 2023Blanny MacgawОценок пока нет

- C 10 Hindustan Petroleum Company LimitedДокумент4 страницыC 10 Hindustan Petroleum Company LimitedNakshtra DasОценок пока нет

- Role of Public SectorДокумент13 страницRole of Public SectorPrince RathoreОценок пока нет

- Economics AssignmentДокумент16 страницEconomics AssignmentgorigirlОценок пока нет

- Chapter - 12: PrivatizationДокумент9 страницChapter - 12: Privatizationshamawail hassanОценок пока нет

- Chapter - 4 Industrial Development: Merits of PrivatizationДокумент2 страницыChapter - 4 Industrial Development: Merits of PrivatizationGhalib HussainОценок пока нет

- PrivatizationДокумент7 страницPrivatizationAkash MehtaОценок пока нет

- What Is PrivatizationДокумент10 страницWhat Is PrivatizationmandeeppathakОценок пока нет

- Me (1) (1) 1Документ20 страницMe (1) (1) 1Mohammad TousheedОценок пока нет

- Need For The Slow Pace of PrivatizationДокумент5 страницNeed For The Slow Pace of PrivatizationSanchit Garg0% (3)

- Disinvestment An OverviewДокумент8 страницDisinvestment An OverviewRavindra GoyalОценок пока нет

- Chapter - 2 Disinvestment and Public Sector Undertakings in IndiaДокумент24 страницыChapter - 2 Disinvestment and Public Sector Undertakings in Indiamohd sheerafОценок пока нет

- DBB1103-Unit 10-PrivatizationДокумент17 страницDBB1103-Unit 10-PrivatizationaishuОценок пока нет

- Benefits and CostsДокумент5 страницBenefits and CostsRuth Na MunyahОценок пока нет

- MNC or Multinational CorporationДокумент26 страницMNC or Multinational CorporationTanzila khan100% (6)

- Investopedia ExplainsДокумент28 страницInvestopedia ExplainsPankaj JoshiОценок пока нет

- LPG Policy of India and Its EffectsДокумент15 страницLPG Policy of India and Its EffectsAsifОценок пока нет

- Management Entrepreneurship and Development Notes 15ES51Документ142 страницыManagement Entrepreneurship and Development Notes 15ES51Amogha b94% (18)

- Privatisation and DisinvestmentДокумент7 страницPrivatisation and DisinvestmentMehak joshiОценок пока нет

- Has Privatization Promoted Efficiency in EthiopiaДокумент28 страницHas Privatization Promoted Efficiency in Ethiopiaatinkut SintayehuОценок пока нет

- GBE Mock AnswersДокумент4 страницыGBE Mock AnswersAlma AlzolaОценок пока нет

- Privatization Can Be of Three Prominent TypesДокумент2 страницыPrivatization Can Be of Three Prominent TypesLeslin BruttusОценок пока нет

- Progressive India: Group MembersДокумент16 страницProgressive India: Group MembersPrashant RawatОценок пока нет

- Strategy of Industrial Growth (1947-1990) &Документ22 страницыStrategy of Industrial Growth (1947-1990) &Geeta GhaiОценок пока нет

- Research Report "Privatization of PTCL": Business Research Methods Submitted To Group MembersДокумент61 страницаResearch Report "Privatization of PTCL": Business Research Methods Submitted To Group MembersTanveer Hassan SiddiquiОценок пока нет

- Microeconomics 20th Edition McConnell Solutions Manual 1Документ9 страницMicroeconomics 20th Edition McConnell Solutions Manual 1russell100% (51)

- BY:-Kriti Gupta Manish Kumar Mannat Kaur Mayanka Singhal Mehak AhujaДокумент26 страницBY:-Kriti Gupta Manish Kumar Mannat Kaur Mayanka Singhal Mehak AhujaKriti GuptaОценок пока нет

- Godrej & WiproДокумент19 страницGodrej & WiproKriti GuptaОценок пока нет

- Accounts AssignmentsДокумент1 страницаAccounts AssignmentsKriti GuptaОценок пока нет

- Accounts AssignmentsДокумент1 страницаAccounts AssignmentsKriti GuptaОценок пока нет

- As Accounting Unit 1 RevisionДокумент12 страницAs Accounting Unit 1 RevisionUmar KhanОценок пока нет

- Accounting and Financial Close - Group Ledger IFRS (1GA - FR) : Test Script SAP S/4HANA Cloud - 06-10-20Документ56 страницAccounting and Financial Close - Group Ledger IFRS (1GA - FR) : Test Script SAP S/4HANA Cloud - 06-10-20cricriAF33830Оценок пока нет

- Grdae 9 - Ems - Financial Literacy SummaryДокумент17 страницGrdae 9 - Ems - Financial Literacy SummarykotolograceОценок пока нет

- Financial Tax Register ReportДокумент4 страницыFinancial Tax Register ReportBRОценок пока нет

- Self-Instructional Manual (SIM) For Self-Directed Learning (SDL)Документ34 страницыSelf-Instructional Manual (SIM) For Self-Directed Learning (SDL)sunny amarillo100% (1)

- Universal Garage Chart of Accounts: 100 Assets 300 Owner'S Equity 110 Current AssetsДокумент12 страницUniversal Garage Chart of Accounts: 100 Assets 300 Owner'S Equity 110 Current AssetsAmanuel DemekeОценок пока нет

- Transaction Types: (Receivables in R12)Документ7 страницTransaction Types: (Receivables in R12)ankitjust4u89Оценок пока нет

- Accounting ProcessДокумент53 страницыAccounting ProcessAlPHA NiNjAОценок пока нет

- Chapter 5 - Books of Accounts & Double-Entry SystemДокумент16 страницChapter 5 - Books of Accounts & Double-Entry SystemhiroОценок пока нет

- AccountsДокумент135 страницAccountsChinnam LalithaОценок пока нет

- China - The Banking SystemДокумент3 страницыChina - The Banking Systemamitsonik100% (1)

- Treasury Rules TR STRДокумент407 страницTreasury Rules TR STRHumayoun Ahmad FarooqiОценок пока нет

- Manpower AgreementДокумент7 страницManpower AgreementJaideep Roy ChaudhuryОценок пока нет

- Solutions Images Bingham 11-02-2010Документ46 страницSolutions Images Bingham 11-02-2010Nicky 'Zing' Nguyen100% (7)

- Wey Ifrs 2e CCCДокумент19 страницWey Ifrs 2e CCCAnonymous 1SUDEbgFОценок пока нет

- Excel - Professional Services Inc.: Management Firm of Professional Review and Training Center (PRTC)Документ7 страницExcel - Professional Services Inc.: Management Firm of Professional Review and Training Center (PRTC)Phoeza Espinosa VillanuevaОценок пока нет

- Deposit Statement - Individual: Customer: Ankhbayar Khorloo Term: 2023/10/18 - 2024/01/18 Account: 5032678971 (MNT)Документ7 страницDeposit Statement - Individual: Customer: Ankhbayar Khorloo Term: 2023/10/18 - 2024/01/18 Account: 5032678971 (MNT)Luk LukОценок пока нет

- Cash Register Express Manual PDFДокумент91 страницаCash Register Express Manual PDFJorge ValencianoОценок пока нет

- FAR-01 Contributed CapitalДокумент3 страницыFAR-01 Contributed CapitalKim Cristian MaañoОценок пока нет

- ACCT 501-Midterm FlashcardsДокумент17 страницACCT 501-Midterm FlashcardscarterkddОценок пока нет

- Principles of Accounts - Sir Eddie: Saraswati Vidya NiketanДокумент5 страницPrinciples of Accounts - Sir Eddie: Saraswati Vidya NiketanRafena MustaphaОценок пока нет

- Bank Reconciliation: DepositsДокумент42 страницыBank Reconciliation: DepositsMomoyОценок пока нет

- Transaction Code.282-Tx - Code.drДокумент4 страницыTransaction Code.282-Tx - Code.drKamran MallickОценок пока нет

- Theories Cash and Cash EquivalentsДокумент9 страницTheories Cash and Cash EquivalentsJavadd KilamОценок пока нет

- Saints of India and Destiny K N RaoДокумент36 страницSaints of India and Destiny K N RaomitrasahОценок пока нет

- LEVEL 2 Online Quiz - Answers SET AДокумент10 страницLEVEL 2 Online Quiz - Answers SET AVincent Larrie MoldezОценок пока нет

- Basic AccountsДокумент51 страницаBasic AccountsNilesh Indikar100% (1)

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceДокумент33 страницыTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit Balancekrishna vishwakarmaОценок пока нет

- Review Part 1Документ4 страницыReview Part 1Ronald CatapangОценок пока нет

- Session - 2 & 3 - Recording in Primary Books and Posting in Secondary Books - Reading - Material PDFДокумент27 страницSession - 2 & 3 - Recording in Primary Books and Posting in Secondary Books - Reading - Material PDFShashank Pandey100% (1)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)От EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Рейтинг: 3.5 из 5 звезд3.5/5 (9)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОт EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОценок пока нет

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantОт EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantРейтинг: 4 из 5 звезд4/5 (104)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsОт EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsОценок пока нет

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.От EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Рейтинг: 5 из 5 звезд5/5 (89)

- How To Budget And Manage Your Money In 7 Simple StepsОт EverandHow To Budget And Manage Your Money In 7 Simple StepsРейтинг: 5 из 5 звезд5/5 (4)

- Happy Go Money: Spend Smart, Save Right and Enjoy LifeОт EverandHappy Go Money: Spend Smart, Save Right and Enjoy LifeРейтинг: 5 из 5 звезд5/5 (4)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationОт EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationРейтинг: 4.5 из 5 звезд4.5/5 (18)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsОт EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsОценок пока нет

- The Best Team Wins: The New Science of High PerformanceОт EverandThe Best Team Wins: The New Science of High PerformanceРейтинг: 4.5 из 5 звезд4.5/5 (31)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyОт EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyРейтинг: 5 из 5 звезд5/5 (1)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsОт EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsРейтинг: 4 из 5 звезд4/5 (4)

- The Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitОт EverandThe Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitОценок пока нет

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessОт EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessРейтинг: 4.5 из 5 звезд4.5/5 (4)

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayОт EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayРейтинг: 3.5 из 5 звезд3.5/5 (2)

- How to Save Money: 100 Ways to Live a Frugal LifeОт EverandHow to Save Money: 100 Ways to Live a Frugal LifeРейтинг: 5 из 5 звезд5/5 (1)

- Smart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestОт EverandSmart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestРейтинг: 5 из 5 звезд5/5 (1)

- Budgeting: The Ultimate Guide for Getting Your Finances TogetherОт EverandBudgeting: The Ultimate Guide for Getting Your Finances TogetherРейтинг: 5 из 5 звезд5/5 (14)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesОт EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesРейтинг: 4.5 из 5 звезд4.5/5 (30)

- The Financial Planning Puzzle: Fitting Your Pieces Together to Create Financial FreedomОт EverandThe Financial Planning Puzzle: Fitting Your Pieces Together to Create Financial FreedomРейтинг: 4.5 из 5 звезд4.5/5 (2)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouОт EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouРейтинг: 5 из 5 звезд5/5 (5)

- Passive Income Ideas: A Comprehensive Guide to Building Multiple Streams of Income Through Digital World and Offline Businesses to Gain the Financial FreedomОт EverandPassive Income Ideas: A Comprehensive Guide to Building Multiple Streams of Income Through Digital World and Offline Businesses to Gain the Financial FreedomРейтинг: 5 из 5 звезд5/5 (1)

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsОт EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsОценок пока нет