Академический Документы

Профессиональный Документы

Культура Документы

The Relationship

Загружено:

Sulakshana De AlwisИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

The Relationship

Загружено:

Sulakshana De AlwisАвторское право:

Доступные форматы

The relationship between prior performance and diversication: a study of three industries

Ananda Mukherji Department of Management, College of Business and Administration, Southern Illinois University, Carbondale, IL, USA

The extensive research undertaken in studying the relationship between diversication and performance has been largely inconclusive. There have been a number of reasons for mixed results including heterogeneity of samples, pooling of data, and crosssectional analyses. One possible way to address these problems is to make comparisons based on homogeneity of samples, or some other well-dened structural variable, and to study rms longitudinally. More than just the statistical analysis, this paper identies the key role of critical antecedent conditions that affect outcomes from diversication strategies. A sample of 59 rms from three distinctly different industries (food, electronics, and petroleum) are used in this empirical study. Results indicate that statistically signicant differences exist when industry homogeneity is maintained and critical antecedent variables are isolated. More importantly, the role of initial conditions and historical performance levels have an important bearing on diversication efforts and subsequent performance.

A version of this paper was presented at the 33rd Meeting of the Easton Academy of Management in May 1996 in Crystal City, VA, USA.

Management Decision 36/3 [1998] 180188 MCB University Press [ISSN 0025-1747]

The importance of studying issues in corporate strategy has been considerably diluted by the lack of clear-cut research results. The mixed research results should not in any way diminish the importance of corporate strategy related decisions and other strategic moves organizations make to diversify their activities. One would think that the lack of clear-cut research results would imply that managers are likely to be uncertainly rewarded if they choose to diversify the activities of their organizations. As practitioners rely on researchers to provide support for business strategies, the vast amount of research literature with unclear results has not helped managers in making important decisions on diversication. This paper addresses two specic issues. The rst is that corporate strategy research has been criticized on account of its excessive reliance on pooled, heterogeneous samples, and its preference for cross-sectional analyses. This shortcoming in methodology has been addressed in this paper by studying homogeneous samples in a longitudinal manner. However, it is not methodological shortcomings alone that is of concern. The second issue, and of greater interest to managers, that is addressed in this paper is the theoretical reasoning underlying corporate diversication efforts. Unless underlying factors are either addressed or taken into consideration by researchers in the development of their research models, the context, causes, and results of corporate strategy will be inadequately understood. This paper specically addresses the theoretical construction of the model and suggests that researchers, and more importantly managers, must take into account the complex constellation of forces that a business organization is embedded in. Without taking into consideration a rms past performance levels, its stock of critical and relevant assets, and its core competencies it is likely that studies will present a confusing array of results. A lot of corporate strategy research, and this point is well supported in the literature review later in this paper, has produced mixed results on account of ignoring important underlying variables. The result is that managers have not been able to rely substantially on the work of corporate

strategy researchers in making important diversication decisions. It must be understood that decisions to diversify continue to remain important to managers in spite of research results being mixed. The diversication-performance relationship has been the focus of considerable research in corporate strategy (Amit and Livnat, 1988; Bettis, 1981; Bettis and Hall, 1982; Christensen and Montgomery 1981; Rumelt, , 1974, 1982; Wernerfelt and Montgomery 1988) , and has for long intrigued researchers, but research results have generally been mixed (Busija et al., 1997; Markides and Williamson, 1994, 1996). A study by Stimpert and Duhaime (1990) conrmed the view that the results of research were conicting after they studied rms experiencing especially high or low levels of performance. They found that the level of diversication, per se, did not have a signicant effect on performance. One reason for these mixed results could be because of studying rms from a mixed group of industries. This paper takes the stand that studying a mixed group of industries is likely to have its pitfalls, and thus a different focus, based on homogeneous industry groups, may be more fruitful. Keeping in mind homogeneity of samples, this paper further suggests that the initial success of specic industry groups leads to successful diversication outcomes. This proposition regarding antecedent conditions is empirically tested by ranking the performance of three different industries, and analyzing the performance of the diversication efforts of each of the three industries.

The diversication relationship

In spite of the vast amount of research done on the diversication-performance relationship, Ramanujam and Varadarajan (1989), in an extensive review of research in this area, concluded that the ndings of studies attempting to demonstrate the effects of diversication on performance remain inconclusive. Rumelt (1974), for example, concluded that diversied rms in general, and related diversiers in particular, outperformed others. In contrast, Hill and Hansens (1991) longitudinal study of the US pharmaceutical industry found that

[ 180 ]

Ananda Mukherji The relationship between prior performance and diversication: a study of three industries Management Decision 36/3 [1998] 180188

diversication resulted in lower performance due to (1) diversication activities shifting resources away from managerial activities, including R&D and advertising, and thus affecting innovation and brand loyalty; and (2) increases in bureaucratic costs were not offset by increased operational efficiencies. On the other hand, studies by Michel and Shaked (1984), and Montgomery and Wilson (1986) concluded that rms diversifying into unrelated areas have been able to generate superior performance over those with predominantly related businesses. Different researchers have either found support for different forms of the diversication-performance relationship, or have concluded that diversication has a negative or no impact on performance. One of the main reasons for these mixed results has been on account of samples chosen for research. Bass et al. (1978) have warned against studying a mixed group of companies or using pooled data unless tests of sample homogeneity yield positive results. According to Ramanujam and Varadarajan (1989), if the possibility can be admitted that the relationship between diversity and performance can be industry- or environment-specic, then pooling of data is a critical issue that needs to be addressed. Hatten et al. (1978) have also concluded that industry level models and indiscriminate pooling of data can produce results that are misleading if used at the rm level. Ghazanfar et al. (1985) argue that careful industry studies are necessary prerequisites for making sense of complex industries, understanding the relationship between diversication and performance. The general research question that has driven enquiry in corporate strategy has been, Does diversication lead to superior performance? As earlier empirical studies indicate, results have been inconclusive. Perhaps we need to reframe our research question to ask, Under what conditions are diversication efforts likely to result in superior performance? The answer to the second question requires a signicantly different approach, both theoretically and empirically, in understanding diversication, especially when compared to the earlier more direct question.

diversication and performance. They suggested that while rm performance was directly affected by the extent of diversication, it was also impacted by industry prot levels, expenditures on R&D, capital outlay, and the mediating inuence of efficiency levels. Their research indicated that the overall relationship is fairly complex, and numerous antecedent, intervening, and mediating variables needed to be considered. There are two critical factors that affect a rms success. One is initial conditions as has been highlighted by Levinthal and Myatt (1994), and the other is the importance of core competencies and strategic assets (Markides and Williamson, 1994, 1996). The scope of this research paper will not permit the study of all these concepts and constructs except to discuss them at a theoretical and conceptual level. The argument being made here is that prior success takes place on account of favorable initial conditions, as well as a rms abilities to develop routines (Nelson and Winter, 1982) that create and sustain success. In the absence of favorable initial conditions and competence based routines, rms are unlikely to experience success. Successful performance can then be considered to be an outcome of both favorable initial conditions, as well as a rms stock of strategic assets and core competencies (see Figure 1).

The importance of initial conditions

Mancke (1974), in a landmark study, developed a stochastic model of interrm protability differences and concluded that chance accounted more for interrm protability differences rather than differences in monopoly power and scale economies. The model suggested that initial successes create conditions for subsequent successes due to the ability of rms to reinvest excess prots back into the business.

Figure 1 Overall research framework

Initial Conditions Firms Assets & Competences

Factors contributing to success

Earlier research in corporate strategy had assumed that there existed a straightforward relationship behind a rms diversication efforts, specically related diversication, and successful performance. A study by Duhaime and Stimpert (1994) established the importance of intervening variables between

Prior Performance

Diversification Strategies

Current Performance

[ 181 ]

Ananda Mukherji The relationship between prior performance and diversication: a study of three industries Management Decision 36/3 [1998] 180188

Initial lack of success is also due to random or chance events. Both Mancke (1974) and Biggadike (1979), using separate arguments, suggest that rm size, market share and growth are critical to success, and are strongly correlated with the level of a rms prot rates. While Mancke (1974) explicitly suggested, based on a conceptual model, that chance has a signicant role in initial successes, Biggadike (1979) made his suggestions based on an empirical study without specically looking into chance as a factor. As it turns out, the role and importance of rm size and other factors have been emphasized by these two researchers following different lines of reasoning. Size is a key to success both to achieve low costs and high market share (Henderson, 1979). Size can be sustained and increased through a string of earlier successes which allow prots to be consistently reinvested. The line of argument being developed here is that early success has a decisive impact on a rms continued good performance, and that diversication efforts of successful rms are likely to be markedly different when compared to those of poorly performing rms. In short, prior performance is a major antecedent variable that needs to be taken into consideration when undertaking studies on diversication related strategies. The importance of initial conditions is strongly emphasized by Levinthal and Myatt (1994) as being critical in affecting rm performance, and these conditions include a rms bundle of co-specialized assets, location, contiguity, reputation, ties to customers, and previous experience in other markets.

Strategic assets and core competencies

As Figure 2 suggests, successful performance is a function of initial conditions, and a rms combination of strategic assets and core competencies. Strategic assets are assets

Figure 2 Conceptual model of rm performance

SUCCESSFUL PERFORMANCE

Asset maintenence

Strategic Assets Enhanced Assets INITIAL CONDITIONS

Competence creation Asset enhancement

Core Competences

Asset creation

New Strategic Assets

that underpin a rms cost or differentiation advantage in a particular market and that are imperfectly imitable, imperfectly substitutable and imperfectly tradeable. Core competencies are the pool of experience, knowledge and systems, etc. that exist elsewhere in the same corporation and can be deployed to reduce the cost or time required to either create a new strategic asset or expand the stock of an existing one (Markides and Williamson, 1994, pp. 149-59). The important issue is really that of strategic relatedness between assets and competencies, and the ability to create and sustain competitive advantage through them. Success, therefore, is the ability to use competitive advantage to deliver a given set of customer benets at lower costs than competitors, or provide customers with a bundle of benets its rivals cannot match (Porter, 1980). Thus, in order to achieve success, a rm should be able to capitalize on favorable initial conditions, and then to create and sustain a position of competitive advantage. This it can do by having a stock of strategic assets and creating core competencies (see Figure 2), which in turn create further strategic assets leading to newer core competencies. Success can thus be considered to be a rough proxy of a rms capabilities and competencies, and measuring success can, arguably, be a measure of these important antecedent conditions. As mentioned earlier, measuring these antecedent conditions is beyond the scope of this paper, however, measuring success as a key antecedent to successful diversication is used instead. What is being suggested is that a rm needs to rst be successful at what it is currently doing (i.e. have favorable initial conditions, own sufficient strategic assets, possess core competencies, and create conditions of competitive advantage) before it can obtain success in diversied business activities. Diversication activities from a position of weakness (implying unfavorable initial conditions, non-strategic assets, and imitable and non-unique capabilities) is likely to be rewarded by lower levels of success in new endeavors. There has been much controversy and discussion in the literature of industrial organization economics about whether the rm or industry, or some other intra-industry group stratication, is the appropriate unit of analysis (McGee and Thomas, 1986). This paper makes a case against heterogeneous studies and suggests that this trend needs to be reviewed. In spite of the strong arguments in favor of homogenized groupings, most research has been in the direction of analyzing pooled or mixed data in a cross-sectional

[ 182 ]

Ananda Mukherji The relationship between prior performance and diversication: a study of three industries Management Decision 36/3 [1998] 180188

manner. A review of current research indicates that single-industry studies are few, and inter-industry studies fewer. The few studies that have specically researched industries are those covering beer (Hatten et al., 1978; Hatten and Hatten, 1985), retailing (Porter, 1974), food (Hall and Sweeney, 1986) food processing (Palepu, 1985), and pharmaceuticals (Hill and Hansen, 1991), among others.

Basis for empirical study

Researchers have suggested that a combination of factors create initial conditions for rms to do well (1994), and these include rm size, growth, and large market share (Biggadike, 1979; Henderson, 1979), chance (Mancke, 1974), and luck (Barney, 1986). This paper does not look into the factors that create initial business success, instead it looks into the consequences of initial conditions as far as diversication efforts are concerned. Early success allows a sequence of events to take place including increased market power, scale economies, and enhanced protability Such conditions aid diversica. tion efforts and sustain post-diversication activities compared to the diversication efforts of those rms that start from a condition of poor performance. To validate these assertions, this paper is limited to studying and comparing the diversication efforts and subsequent performance of three different industries. The aim is to develop an appropriate background based on a wide literature review on the subject of diversication and performance on an industry-specic basis, followed by a supportive, though limited, empirical analysis. This paper, however, addresses the very areas that have been discussed earlier, in that it is industry-specic and it makes interindustry comparisons. It also uses longitudinal data and in the process avoids some of the pitfalls inherent in cross-sectional studies. It also uses prior performance level as an important antecedent variable that is a proxy for initial conditions, possession of assets, and core competencies. Based on the framework and conceptual model given in Figures 1 and 2, it is argued that performance is a reasonable proxy for critical antecedent variables like initial conditions, strategic assets, and core competencies, and measuring performance would be a reasonable way to capture the presence of these critical variables. The three industries being studied are food, electronics and petroleum, and these have been chosen because of their varying levels of performance, unique structural differences, and the specic type of technology used. The

analysis will also establish if prior performance level is a signicant antecedent condition to post-diversication performance. Three industries have been chosen from the Fortune 500 list of companies. Fortune typically classies rms into industry groups based on their primary business line derived from the sale of their dominant product(s). In 1993, there were 27 industry groups classied ranging from aerospace to transportation equipment. The median sales revenue ranged from a high of $5.50 bn., (pharmaceuticals) to a low of $0.78 bn. (furniture). The thrust of this empirical study is that rms in industries that perform well have more successful diversications due to advantages of favorable initial conditions and superior core competencies compared to rms in industries that perform relatively poorly That is, diversied rms of high . performing industries will outperform diversied rms of poorly performing industries. Details of the characteristics of the three industries under study are given in Tables I and II. As can be seen, each industry has a set of unique characteristics that distinguishes it from the other two industries. An assessment of the nancial performance of three industries for the years 1988-1993 is given in Tables III and IV Based on available . nancial gures, industries have been ranked in order of performance. The two performance measures used to rank the industries are (1) return on assets (ROA), and (2) average return (AR) calculated by averaging returns on assets, sales, and equity (ROA+ROS+ROE/3). These variables are considered robust measures of performance by a number of academicians (Bettis, 1981; Bass et al., 1978). Most strategy planning is done by managers based on expected future returns measured by parameters like ROA, ROI and ROE, among others. Based on these two nancial measures, industries have been ranked as follows: 1 Food. 2 Electronics. 3 Petroleum. Firms from each of the three industries have been further divided into more diversied and less diversied based on the level of diversication as indicated from their SIC codes. The method section explains this process in more detail.

Hypotheses

Based on some of the more important literature on the subject and the reasoning advanced in this paper, the following are hypothesized:

[ 183 ]

Ananda Mukherji The relationship between prior performance and diversication: a study of three industries Management Decision 36/3 [1998] 180188

H1: The category of more diversied rms from the best performing industry will outperform the more diversied rms of the second best performing industry . H2: The category of more diversied rms from the best performing industry will outperform the more diversied rms of the third best performing industry . H3: The category of more diversied rms from the best performing industry will outperform all rms of the second best performing industry . H4: The category of more diversied rms from the best performing industry will outperform all rms of the third best performing industry .

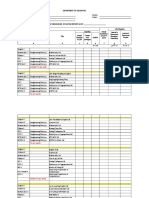

Table II Financial performance of the three industries (1988-1993) Avg median measures Sales revenue ($ mn.) Prots ($ mn.) ROA (%) ROS (%) ROE (%) Average return (AR) Food 1806 68.7 6.3 3.0 16.2 8.5 Electronics Petroleum 1604 63.5 4.3 3.8 12.7 6.9 4798 117.5 3.3 2.7 9.5 5.2

simple-to-compute, unweighted, SIC-based continuous diversication measures were not only appropriate, but were comparable to Rumelts (1974) categorical measures. A total of 59 rms satised the three conditions just discussed, and also had reported data for the period. It is important to note that the sample size is small and the results, therefore, should be treated with caution. If the preliminary results are supportive of the hypothesized relationships, then the study can be extended and followed up with larger samples and different industry groups, and subjected to more rigorous statistical analyses. Of the 59 rms, 18 were in the food industry, 21 in electronics, and 20 in petroleum (with a breakup 11:7, 6:15, and 4:16 for rms categorized as more diversied and less diversied). The small sample size could be a potential source of concern as the overall sample and the individual cell frequencies may not adequately represent the population. To address this concern of sample representativeness, a chi-square test was carried out. The chisquare analysis gave a value of 7.42, which was not signicant (for p < 0.01, df = 2). The chi-square value was arrived after incorporating Yates correction (Downie and Heath, 1965) so as to compensate for an overestimated chi-square computation on account of the small observed and expected frequencies. From a statistical point of view, this sample could be taken to be an approximation of the general population, and is appropriate given the exploratory nature of the study For . conrmatory type studies and analyses, larger sample sizes and frequencies are strongly recommended. The period under study (1985 to 1993) has been largely characterized by slow and steady growth of the US economy It is important to . account for this factor to ensure that strong business cycle effects do not signicantly affect performance or distort analysis. The economy grew approximately at an annual compounded rate of 2.1 per cent (simple rate

Method

As mentioned earlier, the three industry groups were chosen based on information from Fortune 500 list of rms. For a rm to qualify from each industry, the following steps were undertaken: 1 The existence of a rm in an industry was traced for a 9-year period from 1985 to 1993. The rm had to be continuously in the industry during this period, so as to avoid any distortions to the analysis from the effects of rms that merely dabbled in diversication, or did so for just a few years. 2 Performance gures for the years 1988 to 1993 (six years) were taken from Standard and Poors COMPUSTAT nancial data base. 3 For each industry group, rms were classied as less diversied or more diversied based on the four-digit SIC codes they were operating in. If the rm was operating broadly within the industry (same most signicant digit SIC code), then it was classied as less diversied. If the rm was operating across industries (different most signicant digit SIC code), then it was classied as more diversied. This is based on the concept of broad and narrow spectrum diversication suggested by Lubatkin et al. (1993). These authors have also suggested that

Table I Characteristics of the three industries under study Characteristics Manufacturing process Capital intensity R&D intensity Advertisingintensity Type of good Outlet type [ 184 ] Food Batch/assembly Medium Medium High Consumer Convenience Electronics Batch/assembly Medium/high High Medium Consumer/industrial Non-convenience Petroleum Continuous process High High High Consumer/industrial Convenience

Ananda Mukherji The relationship between prior performance and diversication: a study of three industries Management Decision 36/3 [1998] 180188

2.4 per cent) in real terms during the decade 1984 to 1993 (National Income and Product Account of the US, 1993). The key variables used in determining performance and to test the hypotheses are (1) return on assets ROA; (2) return on investment ROI; and (3) return on equity ROE. Performance based on returns like

Table III Statistical results: more diversied food rms verus more diversied electronics and petroleum rms Means Measures ROA Food Electronics Petroleum ROI Food Electronics Petroleum ROE Food Electronics Petroleum Mean 8.57 4.52 3.41 15.35 7.52 5.63 24.23 9.66 10.03 Standard deviation 2.69 5.26 2.36 4.71 8.25 3.82 9.00 9.80 6.76 ANOVA F-value P-value Tukeys Difference

4.475

0.0187

5.1571

6.30

0.00466

7.8233 9.7183

ROA, ROI and ROE, over which there is some modicum of control, are popular with managers, and are used extensively by academicians in research as they allow research results to be compared across studies (Cannella and Hambrick, 1993; Datta, 1991; Hall and St. John, 1994; Hall and Sweeney, 1986; Hill and Hansen, 1991; Stimpert and Duhaime, 1990; Sutton, 1990). The denitions of the measurement terms as provided by COMPUSTAT are given below: 1 ROA. Income before extraordinary items divided by total assets (total assets = sum of current assets, net plant and other noncurrent assets). 2 ROI. Income before extraordinary items divided by total invested capital (total invested capital = sum of total long term debt, preferred stock, minority interest and total common equity). 3 ROE. Income before extraordinary items, that is, income or loss after all expenses before dividends divided by common equity . Firms categorized as more diversied and less diversied in each of the three industries were tested for differences in performance measures, and tested whether these differences were statistically signicant. In order to do this, an analysis of variance (ANOVA) was carried out to test differences in means among all the groups. The Tukey method using the studentized range distribution was used to make pair-wise comparisons between the means of the various groups. If only pair-wise comparisons are made, as was done in this analysis, the Tukey method gives narrower condence limits and is, therefore, the preferred method over the Scheffe method (Nater et al., 1990).

8.21

0.00126

14.1963 14.5673

Notes: 1 = signicant difference between diversied food and diversied petroleum; 2 = signicant difference between diversied food and all petroleum; 3 = signicant difference among means of diversied food, diversied electronics, and diversied petroleums rms; 4 = signicant difference among means of diversied food and all electronic and all petroleum rms; 5 = signicant for p < 0.05 level; 6 = signicant for p < 0.01 level.

Table IV Statistical results: diversied food rms versus all other rms (whether diversied or not) Means Measures ROA Food Electronics Petroleum ROI Food Electronics Petroleum ROE Food Electronics Petroleum Mean 8.57 4.99 3.40 15.35 8.01 5.40 24.23 10.04 9.93 Standard deviation 2.69 4.93 2.14 4.71 7.59 3.53 9.00 8.89 6.10 ANOVA F-value P-value Tukeys Difference

Results

Based on the detailed statistical values, as given in the Tables III and IV the results are , strongly supportive of the four hypotheses being tested. Accounting measures used to analyze performance differences among more diversied and less diversied rms from the three industries appear to bear out the line of argument made throughout the paper that initial conditions have signicant consequences for subsequent diversication successes. As far as the various performance measures are concerned, all three measures of performance strongly support the four hypotheses. While ROA as a measure is signicant at p < 0.05, ROI and ROE are both signicant at p < 0.01 level. (a) ROA. This measure of performance is found to be signicant at the 0.05 level with

5.07

0.01035

5.1632

7.59

0.00146

7.3374 9.9494

9.84

0.00036

14.1903 14.2983

Notes: 1 = signicant difference between diversied food and diversied petroleum; 2 = signicant difference between diversied food and all petroleum; 3 = signicant difference among means of diversied food, diversied electronics, and diversied petroleums rms; 4 = signicant difference among means of diversied food and all electronic and all petroleum rms; 5 = signicant for p < 0.05 level; 6 = signicant for p < 0.01 level.

[ 185 ]

Ananda Mukherji The relationship between prior performance and diversication: a study of three industries Management Decision 36/3 [1998] 180188

F-values of 4.47 and 5.07 when comparing diversied food rms (ranked as best performing industry) with diversied electronics and diversied petroleum rms (ranked as second and third best performing industries). Tukeys studentized range indicated signicance at the 0.05 level between the means of diversied food and diversied petroleum rms. This also holds for diversied food and all petroleum rms. There is no signicant difference in ROA levels between the means of diversied food and diversied electronics, or between diversied food and all electronics rms. (b) ROI. This measure of performance indicates that diversied food rms outperform diversied electronics, all electronics, diversied petroleum, and all petroleum rms at highly signicant levels (p < 0.01) with F-values of 7.59 and 6.30 respectively The . ROI means are also signicantly different from each other, thus lending strong support to the four hypotheses. (c) ROE. This measure of performance also indicates that diversied food rms outperform diversied electronics, all electronics, diversied petroleum and all petroleum rms at highly signicant levels (p < 0.01) with F-values of 8.21 and 9.84 respectively The . ROE means are also signicantly different from each other, thus lending strong support for the four hypotheses.

Discussion and conclusions

As the results indicate, rms in industries that show signs of prior successful performance continue to have diversied rms that perform well. Firms from such industries consistently outperform rms from lesser performing industries, whether diversied or not. In other words, rms that exhibit poor prior performance have a lower probability of success in their diversication efforts. The assertion made at the beginning of this paper was that signicant results are likely when there are greater efforts at grouping on performance similarities or other measures of sample homogeneity This study also . establishes the importance of prior performance as an important antecedent to subsequent diversication efforts and rm performance. The results also indicate that rms in the sample from industries performing relatively poorly tend to make greater efforts to diversify (80 per cent and 71 per cent for petroleum and electronics rms) compared to rms in the better performing industry (39 per cent in the case of rms in the food industry). This difference in diversication efforts also reinforces the concept of the escape hypothesis

(Vol. 4, pp. 82) which suggests that rms attempt to overcome the problems of poor performance by diversifying. Individual rms have relatively little control over the way a particular industry performs. This applies to rms both in high as well as in low performing industries. Initial conditions, as discussed earlier in the paper, create situations that are likely to contribute to successful diversication. Given this situation, what options do rms in the relatively poorer performing industries have? It appears that the options are quite limited. While it may appear that there is a certain amount of determinism with this kind of reasoning, the data and the results support it. This would imply that rms in an industry that is doing poorly will have a harder time making a success of diversication compared to rms from relatively more successful industries. This also implies that diversication as a strategy may not be an appropriate response to poor performance. The difficulties rms face in successfully diversifying are many and formidable. There is a lot of uncertainty involved in predicting future success. Choice, decision making, luck, and circumstances play important, though difficult to analyze, roles in rms performance. The results indicate that industry groups or other structural classications provide more signicant and meaningful results, both for academicians and managers. Creating competitive advantage through acquiring strategic assets, developing successful routines, and possessing core competencies are prerequisites for organizations before embarking on diversication activities. Thus these activities have to be seriously considered and mastered by organizations if successful post-diversication performance is the desired outcome. This paper essentially suggests that the analysis of the diversication-performance relationship needs to be made much more homogeneous and ne-grained. More analysis is needed at a industry-specic or structure-specic classication. This will allow particular industries and structures to be studied, so that performance can then be meaningfully compared across industries and structural groupings, as well as within industries. One of the reasons why research using a mixed sample has been, and is likely to be inconclusive is not only because of a multiplicity of measures, but also because rms in the sample are from widely differing industry groups. This study has fullled what it intended to do, that is to establish the efficacy and importance of doing research on homogeneous groups rather than concentrate on heterogeneous or mixed groups.

[ 186 ]

Ananda Mukherji The relationship between prior performance and diversication: a study of three industries Management Decision 36/3 [1998] 180188

The concept of initial conditions has been used frequently in this paper. Obviously, initial conditions form a key set of signicant antecedent conditions in explaining strategic behavior and rm performance. This is explained most eloquently by Porter (1991) who suggests that care must be taken by researchers in model building, especially when explaining and building the chain of causality What may appear as antecedents . may in actuality be consequences if we move further along the chain of causality This, . according to Porter, is a fundamental problem when drawing the boundary between exogenous and endogenous variables. Conceptualizing and analyzing strategic management issues are made more difficult because any model that is tested is only a small (not to mention simplied) representative of a very complex real-life situation. The issue of diversication and subsequent rm performance is extremely complex, and research can typically model and test a small portion of this complex social phenomenon. This paper addresses some of these concerns in the diversication-performance literature in that research is done on homogeneous samples. The aim of this paper is to suggest that under certain initial conditions, including prior successful performance, subsequent diversication efforts are likely to be rewarded. What then are options that managers are faced with in making decisions to diversify their organizations? One important consideration is to assess how the industry they are in is performing. If the industry is doing well, along with the rm in question, evidence suggests that diversication efforts may be successful. Another important, perhaps critical, condition is to assess the rms ability and wherewithal to diversify successfully In this, decision-makers have to not only . assess historical performance levels, but also to carefully examine the rms stock of critical and appropriate assets, core competencies that can be leveraged, the rms ability to enhance existing assets, and its capacity to create new strategic assets and competencies (see Figure 2). Consequently, the decision to diversify is not limited to what industry or market to enter, but to assess this in the context of the rms current performance, and its capabilities. On the other hand, for rms in industries that are performing poorly, the decision to diversify is fraught with greater difficulties. If this situation is compounded by the rm possessing non-strategic assets, and that the rm does not have the capability to leverage its assets strategically, then the decision to diversify needs to be questioned. Managers

from poorly performing industries may consider diversifying after substantial investments and efforts have been made to become competitive. Francis (1992) mentions that the competitiveness of an individual rm results partly from its possession of a set of attributes, including institutional arrangements, which have been built over a substantial period of time through the activities of its managers. He goes on to state that being competitive and successful is not simply a matter of having purchased the right mix of factors and making the most apposite strategic decisions; it is at least as much a matter of engaging in the process of building up the right resources over the long haul (Francis, 1992, p. 62).

References

Amit, R. and Livnat, J. (1988), Diversication strategies, business cycles and economic performance, Strategic Management Journal, Vol. 9, pp. 99-110. Barney, J.B. (1986), Strategic factor markets: expectations, luck and business strategy, Management Science, Vol. 32 No. 10, pp. 1231-41. Bass, F.M., Cattin, P. and Wittink, D.R. (1978), Firm effects and industry effects in the analysis of market structure and protability, Journal of Marketing Research, Vol. 15, pp. 3-10. Bettis, R.A. (1981), Performance differences in related and unrelated diversied rms, Strategic Management Journal, Vol. 2, pp. 379-83. Bettis, R.A. and Hall, W.K. (1982), Diversication strategy, accounting determined risk, and accounting determined return, Academy of Management Journal, Vol. 25, pp. 254-64. Biggadike, R. (1979), The risky business of diversication, Harvard Business Review, Vol. 57 No. 3, pp. 103-111. Busija, E.C., ONeill, H.M. and Zeithaml, C.P. (1997), Diversication strategy, entry mode and performance: evidence of choice and constraints, Strategic Management Journal, Vol. 18, pp. 321-8. Cannella, A.A. and Hambrick, D.C. (1993), Effects of executive departures on the performance of acquired rms, Strategic Management Journal, Vol. 14, pp. 137-52. Christensen, H.K. and Montgomery, C.A. (1981), Corporate economic performance: diversication strategy versus market structure, Strategic Management Journal, Vol. 2, pp. 327-43. Datta, D.K. (1991), Organizational t and acquisition performance: effects of post acquisition integration, Strategic Management Journal, Vol. 12, pp. 281-97. Downie, N.M. and Heath, R.W. (1965), Basic Statistical Methods, 2nd ed., Harper and Row, New York, NY.

[ 187 ]

Ananda Mukherji The relationship between prior performance and diversication: a study of three industries Management Decision 36/3 [1998] 180188

Duhaime, I.M. and Stimpert, J.L. (1994), Seeing the big picture: The inuence of industry diversication and business strategy on rm performance, unpublished working paper, The University of Memphis, Memphis, TN. Francis, A. (1992), The process of national industrial regeneration and competitiveness, Strategic Management Journal, Vol. 13, pp. 61-78. Ghazanfar, A., McGee, J. and Thomas, H. (1985), Conceptual framework for making sense of complex industries, presented at the Global Strategies Symposium, Stockholm School of Economics. Hall, E.H. and St. John. C.H. (1994), A methodological note on diversity measurement, Strategic Management Journal, Vol. 15, pp. 153-68. Hall, L. and Sweeney, J. (1986), Protability of mergers in food manufacturing, Applied Economics, Vol. 18, pp. 709-27. Hatten, K.J., Schendel, D.E. and Cooper, A.C. (1978), A strategic model of the US brewing industry: 1952-1971, Academy of Management Journal, Vol. 21 No. 4, pp. 592-610. Hatten, K.J. and Hatten, M.L. (1985), Some empirical insights for strategic marketers: The case of beer, in Thomas, H. and Gardner, D.M. (Eds), Strategic Marketing and Management, John Wiley, New York, NY. Henderson, B.D. (1979), Henderson on Corporate Strategy Mentor, New York, NY. Hill, C.W.L. and Hansen, G.S. (1991), A longitudinal study of the causes and consequences of changes in diversication in the US pharmaceutical industry 1977-1986, Strategic Management Journal, Vol. 12, pp. 187-99. Levinthal, D. and Myatt, J. (1994), Coevolution of capabilities and industries: The evolution of mutual fund processing, Strategic Management Journal, Vol. 15 No. S2, pp. 45-62. Lubatkin, M., Merchant, H. and Srinivasan, N. (1993), Construct validity of some unweighted product-count diversication measures, Strategic Management Journal, Vol. 14, pp. 433-49. Mancke, R.B. (1974), Causes of interrm profitability differences: A new interpretation of the evidence, The Quarterly Journal of Economics, Vol. 88 No. 2, pp. 181-93. Markides, C.C. and Williamson, P.J. (1994), Related diversication, core competencies and corporate performance, Strategic Management Journal, Vol. 15, pp. 149-66. Markides, C.C. and Williamson, P.J. (1996), Corporate diversication and organization

structure: A resource-based view, Academy of Management Journal, Vol. 39 No. 2, pp. 340-67. McGee, J. and Thomas, H. (1986), Strategic groups: Theory research and taxonomy, Strategic , Management Journal, Vol. 7, pp. 141-60. Michel, A. and Shaked, I. (1984), Does business diversication affect performance?, Financial Management, Vol. 13, pp. 18-25. Montgomery, C.A. and Wilson, V (1986), Merg.A. ers that last: A predictable pattern?, Strategic Management Journal, Vol. 7, pp. 91-6. Nater, J., Wasserman, W. and Kunter, M.H. (1990), Applied Linear Statistical Models: Regression, Analysis of Variance, and Experimental Design, Irwin, Boston, MA. National Income and Product Account of the US (1993), Department of Commerce, Washington, DC. Nelson, R. and Winter, S. (1982), An Evolutionary Theory of Economic Change, Harvard University Press, Cambridge, MA. Palepu, K. (1985), Diversication strategy prot , performance and the entropy measure, Strategic Management Journal, Vol. 6, pp. 239-55. Porter, M.E. (1974), Consumer behavior, retailer power and market performance in consumer good industries, The Review of Economics and Statistics, Vol. 56 No. 4, pp. 419-36. Porter, M.E. (1980), Competitive Strategy: Techniques for Analyzing Industries and Competitors, Free Press, New York, NY. Porter, M.E. (1991), Towards a dynamic theory of strategy, Strategic Management Journal, Vol. 12, pp. 95-117. Ramanujam, V and Varadarajan, P. (1989), . Research on corporate diversication: a synthesis, Strategic Management Journal, Vol. 10, pp. 523-51. Rumelt, R.P. (1974), Strategy, Structure and Economic Performance, Harvard Business School Press, Boston, MA. Rumelt, R.P. (1982), Diversication strategy and protability, Strategic Management Journal, Vol. 3, pp. 359-70. Stimpert, J.L. and Duhaime, I.M. (1990), Is successful diversication possible?, unpublished working paper, The University of Memphis, Memphis, TN. Sutton, R. (1990), Organizational processes: A social psychological perspective, Research in Organizational Behavior, Vol. 12, pp. 205-53. Wernerfelt, B. and Montgomery, C.A. (1988), Tobins q and the importance of focus in rm performance, Strategic Management Journal, Vol. 7, pp. 246-50.

Application questions

1 The author states that the research into the relationship between diversication and performance has been largely inconclusive. Why would that be? 2 What are the drivers behind diversication? 3 Discuss your organizations diversication history Why do you think it has devel. oped the way it has?

[ 188 ]

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Points From Dept MeetingДокумент1 страницаPoints From Dept MeetingSulakshana De AlwisОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Chapter 006Документ34 страницыChapter 006Sulakshana De AlwisОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Negotiation StrategiesДокумент85 страницNegotiation StrategiesSulakshana De AlwisОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Home CPC Workers Suspend Strike Till TuesdayДокумент2 страницыHome CPC Workers Suspend Strike Till TuesdaySulakshana De AlwisОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Leadership Vs Management 2Документ8 страницLeadership Vs Management 2Sulakshana De Alwis0% (1)

- Global Investor: Highlights of The International Arena: Executive SummaryДокумент7 страницGlobal Investor: Highlights of The International Arena: Executive SummarySulakshana De AlwisОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Sample Rating CriteriaДокумент2 страницыSample Rating CriteriaSulakshana De AlwisОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Info DeskДокумент1 страницаInfo DeskSulakshana De AlwisОценок пока нет

- PYPX PlannerДокумент4 страницыPYPX PlannerhgendiОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Art and Aesthetics: Name Matrix NoДокумент3 страницыArt and Aesthetics: Name Matrix NoIvan NgОценок пока нет

- Timothy Leary - Space Migration SMIILE PDFДокумент53 страницыTimothy Leary - Space Migration SMIILE PDFRichard Woolite100% (1)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Report On Attendance: No. of School Days No. of Days Present No. of Days AbsentДокумент2 страницыReport On Attendance: No. of School Days No. of Days Present No. of Days AbsentJenelin Enero100% (4)

- Neonaticide and NursingДокумент6 страницNeonaticide and Nursingapi-471591880Оценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- NGOTips - Fostering Effective NGO GovernanceДокумент5 страницNGOTips - Fostering Effective NGO GovernanceKakak YukaОценок пока нет

- Bare AnalysisДокумент22 страницыBare AnalysisBrendan Egan100% (2)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Waiting For GodotДокумент9 страницWaiting For GodotKОценок пока нет

- Bayan, Karapatan Et Al Vs ErmitaДокумент2 страницыBayan, Karapatan Et Al Vs ErmitaManuel Joseph FrancoОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Lesson Plan - Contemporary Arts From The PhilippinesДокумент4 страницыLesson Plan - Contemporary Arts From The PhilippinesEljay Flores96% (25)

- Rational Model of Decision Making: January 2016Документ7 страницRational Model of Decision Making: January 2016Benjamin NaulaОценок пока нет

- Fulltext01 PDFДокумент42 страницыFulltext01 PDFLă Țîțe SouzîtăОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Map of The Agora of AthensДокумент1 страницаMap of The Agora of Athensrosana janОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Macbeth - Themes and MotifsДокумент5 страницMacbeth - Themes and MotifsCat Caruso100% (3)

- Ten Best Conspiracy Websites Cabaltimes - Com-8Документ8 страницTen Best Conspiracy Websites Cabaltimes - Com-8Keith KnightОценок пока нет

- BONES - Yolanda, Olson - 2016 - Yolanda Olson - Anna's ArchiveДокумент96 страницBONES - Yolanda, Olson - 2016 - Yolanda Olson - Anna's ArchivekowesuhaniОценок пока нет

- PV8b IMH Carmarthen MBA Programmes of Study Handbook 2019-20Документ27 страницPV8b IMH Carmarthen MBA Programmes of Study Handbook 2019-20Vernon WhiteОценок пока нет

- Chapter 6 - Leadership and Team Building (Adair J, 2004)Документ40 страницChapter 6 - Leadership and Team Building (Adair J, 2004)hss601Оценок пока нет

- A Brief History of The Wartegg Drawing TestДокумент18 страницA Brief History of The Wartegg Drawing Tests_omeone4usОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Leadership Theories and Styles: A Literature Review: January 2016Документ8 страницLeadership Theories and Styles: A Literature Review: January 2016Essa BagusОценок пока нет

- 9 Vidhyas From ShashtraДокумент4 страницы9 Vidhyas From ShashtrabantysethОценок пока нет

- LR Situation Form (1) 11Документ13 страницLR Situation Form (1) 11Honey Cannie Rose EbalОценок пока нет

- Leadership & Team EffectivenessДокумент29 страницLeadership & Team Effectivenessshailendersingh74100% (1)

- CH 12. Risk Evaluation in Capital BudgetingДокумент29 страницCH 12. Risk Evaluation in Capital BudgetingN-aineel DesaiОценок пока нет

- Joy To The WorldДокумент4 страницыJoy To The WorldFrancois du ToitОценок пока нет

- A Group Assignment: in A Flexible-Offline ClassesДокумент28 страницA Group Assignment: in A Flexible-Offline ClassesRecca CuraОценок пока нет

- The Problem of EvilДокумент13 страницThe Problem of Evilroyski100% (2)

- Anselm's Doctrine of AtonementДокумент4 страницыAnselm's Doctrine of AtonementFelix KirkbyОценок пока нет

- Yes, Economics Is A Science - NYTimes PDFДокумент4 страницыYes, Economics Is A Science - NYTimes PDFkabuskerimОценок пока нет

- Buried BodiesДокумент2 страницыBuried BodiesNeil Ian S. OchoaОценок пока нет