Академический Документы

Профессиональный Документы

Культура Документы

Crude Oil Market Vol Report 12-02-17

Загружено:

fmxconnectИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Crude Oil Market Vol Report 12-02-17

Загружено:

fmxconnectАвторское право:

Доступные форматы

PARITY REPORT Crude Oil 2012-02-17

WTI Crude Oil April 103.60 +0.96 (Range 103.03 103.89)

ATM Vol J12 27.3 -1.1 \ K12 29.1 -2.4 \ M12 30.0 -1.2

Tomorrow's Expected 1-StdDev Range for J12: +/-$1.78

0900-1200:

Apr $75.00 put, paper hit $0.03 (ref $1034.6)

Apr $92.00-$82.00 put spread, traded $0.31 (ref NA)

Apr $92.00-$87.00 put spread, paper hit $0.21 & $0.23

Apr $97.00 put, paper lifted $0.96 (ref $103.72)

Apr $102.00-$99.00 put spread, traded $1.04 & $1.05 (refs NA)

Apr $120.00 call, paper lifted $0.43 (ref NA)

Apr $125.00 call, traded $0.32 (ref NA)

Apr $140.00-$145.00 call spread, traded $0.04 (ref NA)

Apr $150.00 call, traded $0.12 (ref NA)

May $100.00-$125.00 1x3 fence hedged $104.00, traded $0.56 (ref NA)

May $110.00-$120.00 call spread, traded $1.48 & $1.49 (refs NA)

Jun $90.00-$75.00 put 1x2 hedged $104.50, traded $1.00

Jun $115.00-$130.00 call 1x2 hedged $104.10, traded $0.44

Nov-Dec $140.00 horizontal call spread, paper hit $0.19 (refs NA)

Dec'13 $100.00 call, paper lifted $14.00 (ref NA)

1200-1430:

Apr-May $103.00-$103.50 straddle spread, paper hit $3.62 (refs NA)

Apr $92.00-$87.00 put spread, traded $0.20 (ref NA)

Apr $100.00 put hedged $103.50, traded $1.65

Disclaimer: This report, its data and opinions are provided as is and as available and are provided for

general informational and educational purposes only. This report, its data and opinions are not intended to

be a personalized recommendation to buy, hold or sell investments. The report, data and opinions do not

take into account the particular investment objectives, financial situations or needs of individual clients.

Clients should consider whether any advice or recommendation in this research is suitable for their

particular circumstances and, if appropriate, seek professional advice. This is not a solicitation to buy or

sell securities, commodities, options, futures or other derivatives and should not be construed as an

endorsement or recommendation to invest in any such instruments. Prices and information contained in

this report have been obtained from sources, both internal and external, that we consider to be reliable,

but Parity Energy, Inc. has not verified this information and makes no representation or warranty express

or implied as to the completeness, accuracy or correctness of this report or the data and opinions

contained herein. No implied warranty of merchantability or fitness for a particular purpose shall apply.

The price and value of investments referred to in this research may fluctuate rapidly and past

performance is not a guide to future performance. Any statements that are non-factual in nature constitute

only current options, which are subject to change. Clients should verify all claims and do their own

research before investing in any instrument referenced in this publication. Investing in securities and

commodities and in options, futures and other derivatives, is speculative and carries a high degree of risk.

Clients may lose money trading and investing in such investments. Parity Energy Inc. does not accept or

assume any responsibility or liability for itself or any of its employees or agents for any errors or

omissions contained in this report or the data or opinions contained herein or for any losses or damages

incurred or suffered which are claimed to result from this report or the data or opinions contained herein.

Kiplin Perkins - Market Data - Parity Energy, Inc.

tel: +1-646-867-1983 / kiplin.perkins@parityenergy.com \ AIM: kiplinparity \ Yahoo: kiplinparity

33 Whitehall Street, 17th Floor, New York, NY 10004

Parity Energy Straddle Values in Dollars with Volatility as of Today's Close

Month

J12

K12

M12

N12

Q12

U12

V12

X12

Z12

F13

G13

H13

J13

K13

M13

N13

Q13

U13

Crude Oil

6.24

9.87

12.50

14.34

16.08

17.68

18.94

20.22

21.06

22.01

22.97

23.69

24.33

24.98

25.39

25.82

26.24

26.57

H12

J12

K12

M12

N12

Q12

U12

V12

X12

Z12

F13

G13

H13

J13

K13

M13

N13

Q13

27.2%

29.1%

30.0%

29.9%

29.8%

29.9%

29.6%

29.6%

29.2%

29.0%

28.8%

28.6%

28.4%

28.1%

27.7%

27.4%

27.1%

26.8%

Months

J12

K12

M12

N12

Q12

U12

V12

X12

Z12

F13

G13

H13

J13

K13

M13

N13

Q13

U13

Crude CSO's

0.03

0.28

0.38

0.49

0.53

0.62

0.63

0.67

0.76

0.72

0.63

0.70

0.72

0.78

0.80

0.82

0.84

0.86

Month

H12

J12

K12

M12

N12

Q12

U12

V12

X12

Z12

F13

G13

H13

J13

K13

M13

N13

Q13

0.1769

0.3524

0.4350

0.5068

0.5873

0.6528

0.7425

0.8191

0.8650

0.8774

0.8867

0.8967

0.9213

0.8968

0.9216

0.9524

0.9828

1.0123

Natural Gas

55.8%

47.3%

43.0%

40.7%

40.2%

39.9%

41.3%

42.0%

39.5%

34.9%

32.4%

31.1%

31.0%

29.4%

28.9%

28.5%

28.2%

28.1%

Previous Day's Active Option Contracts with Parity Energy Indications

Month

Apr '12

May '12

Jun '12

Dec '12

Strike

82 P

85 P

87 P

92 P

95 P

100 P

103 P

112 C

115 C

120 C

140 C

150 C

120 C

130 C

90 P

105 C

110 C

120 C

130 C

150 C

Settle

0.07

0.11

0.15

0.36

0.63

1.65

2.81

0.85

0.64

0.43

0.17

0.10

1.19

0.72

1.64

6.00

4.00

1.92

1.12

1.41

change

-0.04

-0.06

-0.08

-0.17

-0.27

-0.49

-0.62

0.05

0.04

0.03

0.00

-0.01

0.09

0.07

-0.18

0.37

0.27

0.16

0.10

-0.05

Parity Value

0.07

0.11

0.16

0.36

0.63

1.64

2.79

0.86

0.62

0.44

0.25

0.24

1.19

0.73

1.67

6.00

4.00

1.90

1.11

1.38

change

-0.04

-0.05

-0.06

-0.18

-0.32

-0.65

-0.90

0.09

0.04

0.04

0.04

0.04

0.12

0.10

-0.27

0.61

0.45

0.22

0.14

0.00

Parity Vol

41.2%

38.4%

36.5%

32.3%

30.3%

28.0%

27.3%

30.6%

33.3%

38.5%

59.5%

70.0%

33.8%

39.9%

33.8%

30.0%

29.9%

32.0%

35.9%

30.8%

change

0.4

0.4

0.4

-0.3

-0.7

-0.9

-1.1

-1.8

-1.8

-1.4

0.3

1.1

-0.8

-0.1

0.0

-0.3

-0.2

-0.3

0.0

-0.5

Parity Delta

-0.9

-1.5

-2.2

-6.4

-12.2

-30.7

-47.6

10.4

5.6

2.9

0.8

0.7

7.2

3.2

-15.6

47.2

32.1

12.0

5.1

4.7

Volume

2827

1576

1590

2794

2731

3507

1944

2260

3441

2729

1724

2696

3965

4962

3244

1751

1721

3198

3766

3210

High Open Interest Option Contracts with Parity Energy Indications

Month

Apr '12

Jun '12

Dec '12

Dec '13

Strike

120 C

80 P

85 P

90 P

95 P

100 P

140 C

60 P

70 P

80 P

85 P

90 P

100 P

110 C

120 C

125 C

Settle

0.43

0.57

0.98

1.64

2.68

4.24

0.72

0.62

1.43

2.84

3.85

5.07

8.33

8.17

4.80

3.70

change

0.03

-0.08

-0.12

-0.18

-0.25

-0.33

0.04

-0.03

-0.06

-0.11

-0.13

-0.15

-0.21

0.08

-0.02

-0.06

Parity Value

0.44

0.59

1.01

1.67

2.69

4.24

0.75

0.65

1.45

2.82

3.80

5.02

8.31

8.19

4.84

3.75

change

0.04

-0.10

-0.17

-0.27

-0.42

-0.59

0.13

-0.06

-0.14

-0.24

-0.28

-0.32

-0.46

0.32

0.22

0.17

Parity Vol

38.5%

37.7%

35.7%

33.8%

32.1%

30.8%

39.9%

40.9%

38.1%

35.4%

34.1%

32.8%

30.3%

28.5%

27.8%

27.9%

change

-1.4

0.1

0.1

0.0

-0.2

-0.2

0.5

-0.2

-0.4

-0.4

-0.3

-0.3

-0.3

-0.3

-0.2

-0.2

Parity Delta

2.9

-5.8

-9.7

-15.6

-24.8

-37.5

2.8

-3.7

-7.5

-14.2

-18.6

-23.8

-36.9

44.1

26.2

19.3

Strike OI

26619

35911

41615

35125

31000

30410

28907

25286

27041

58072

26437

38653

65752

25601

38029

26092

130 C

2.91

-0.06

2.96

0.11

28.2%

-0.3

14.1

36604

150 C

1.41

-0.05

1.38

0.00

30.8%

-0.5

4.7

51910

100 P

13.35

-0.04

13.34

-0.30

26.1%

-0.3

-42.3

25487

Copyright 2012 Parity Energy, Inc. All Rights Reserved

Kiplin Perkins - Market Data - Parity Energy, Inc.

tel: +1-646-867-1983 / kiplin.perkins@parityenergy.com \ AIM: kiplinparity \ Yahoo: kiplinparity

33 Whitehall Street, 17th Floor, New York, NY 10004

Вам также может понравиться

- Crude Oil Market Vol Report 12-03-19Документ2 страницыCrude Oil Market Vol Report 12-03-19fmxconnectОценок пока нет

- Crude Oil Market Vol Report 12-03-06Документ2 страницыCrude Oil Market Vol Report 12-03-06fmxconnectОценок пока нет

- Crude Oil Market Vol Report 12-03-21Документ2 страницыCrude Oil Market Vol Report 12-03-21fmxconnectОценок пока нет

- Crude Oil Market Vol Report 12-03-20Документ2 страницыCrude Oil Market Vol Report 12-03-20fmxconnectОценок пока нет

- SCSMarket Commentary WTIBrentДокумент3 страницыSCSMarket Commentary WTIBrentfmxconnectОценок пока нет

- SCSMarket Commentary NGДокумент1 страницаSCSMarket Commentary NGfmxconnectОценок пока нет

- Crude Oil Market Vol Report 12-03-12Документ2 страницыCrude Oil Market Vol Report 12-03-12fmxconnectОценок пока нет

- Crude Oil Market Vol Report 12-03-14Документ2 страницыCrude Oil Market Vol Report 12-03-14fmxconnectОценок пока нет

- Crude Oil Market Vol Report 12-03-13Документ2 страницыCrude Oil Market Vol Report 12-03-13fmxconnectОценок пока нет

- SCSMarket Commentary WTIBrentДокумент3 страницыSCSMarket Commentary WTIBrentfmxconnectОценок пока нет

- Crude Oil Market Vol Report 12-03-09Документ2 страницыCrude Oil Market Vol Report 12-03-09fmxconnectОценок пока нет

- Crude Oil Market Vol Report 12-03-05Документ2 страницыCrude Oil Market Vol Report 12-03-05fmxconnectОценок пока нет

- SCSMarket Commentary WTIBrentДокумент3 страницыSCSMarket Commentary WTIBrentfmxconnectОценок пока нет

- Crude Oil Market Vol Report 12-03-08Документ2 страницыCrude Oil Market Vol Report 12-03-08fmxconnectОценок пока нет

- Crude Oil Market Vol Report 12-03-07Документ2 страницыCrude Oil Market Vol Report 12-03-07fmxconnectОценок пока нет

- SCSMarket Commentary WTIBrentДокумент3 страницыSCSMarket Commentary WTIBrentfmxconnectОценок пока нет

- Crude Oil Market Vol Report 12-03-02Документ2 страницыCrude Oil Market Vol Report 12-03-02fmxconnectОценок пока нет

- SCSMarket Commentary NGДокумент1 страницаSCSMarket Commentary NGfmxconnectОценок пока нет

- SCSMarket Commentary WTIBrentДокумент3 страницыSCSMarket Commentary WTIBrentfmxconnectОценок пока нет

- SCSMarket Commentary NGДокумент1 страницаSCSMarket Commentary NGfmxconnectОценок пока нет

- SCSMarket Commentary NGДокумент1 страницаSCSMarket Commentary NGfmxconnectОценок пока нет

- SCSMarket Commentary WTIBrentДокумент3 страницыSCSMarket Commentary WTIBrentfmxconnectОценок пока нет

- SCSMarket Commentary WTIBrentДокумент3 страницыSCSMarket Commentary WTIBrentfmxconnectОценок пока нет

- Crude Oil Market Vol Report 12-02-29Документ2 страницыCrude Oil Market Vol Report 12-02-29fmxconnectОценок пока нет

- Crude Oil Market Vol Report 12-02-24Документ2 страницыCrude Oil Market Vol Report 12-02-24fmxconnectОценок пока нет

- Crude Oil Market Vol Report 12-02-23Документ2 страницыCrude Oil Market Vol Report 12-02-23jmacaraeg488Оценок пока нет

- Crude Oil Market Vol Report 12-02-17Документ2 страницыCrude Oil Market Vol Report 12-02-17fmxconnectОценок пока нет

- Crude Oil Market Vol Report 12-02-14Документ2 страницыCrude Oil Market Vol Report 12-02-14fmxconnectОценок пока нет

- Crude Oil Market Vol Report 12-02-15Документ2 страницыCrude Oil Market Vol Report 12-02-15fmxconnectОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Icfai File Merge1Документ108 страницIcfai File Merge1satyavaniОценок пока нет

- Guide To Dividend Taxation - Silva HuntДокумент25 страницGuide To Dividend Taxation - Silva HuntAmadorCuencaLópezОценок пока нет

- Quizesfm 2Документ2 страницыQuizesfm 2Prince MalabaОценок пока нет

- Gitman Chapter 7 Stock ValuationДокумент71 страницаGitman Chapter 7 Stock ValuationMa Angeli GomezОценок пока нет

- Trading Checklist 1Документ12 страницTrading Checklist 1rangghjОценок пока нет

- SOF Questions - With - AnswersДокумент33 страницыSOF Questions - With - AnswersКамиль БайбуринОценок пока нет

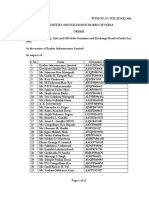

- Order in The Matter of Exelon Infrastructure LimitedДокумент22 страницыOrder in The Matter of Exelon Infrastructure LimitedShyam SunderОценок пока нет

- Assessing Dividend PolicyДокумент40 страницAssessing Dividend PolicyMohsin Ul Amin KhanОценок пока нет

- Audit of Property, Plant and Equipment and Intangible AssetsДокумент8 страницAudit of Property, Plant and Equipment and Intangible AssetsEsse ValdezОценок пока нет

- FASB 144 Impairment of AssetsДокумент9 страницFASB 144 Impairment of AssetsPriyadarshi BhaskarОценок пока нет

- Forex MarketДокумент102 страницыForex Marketbiker_ritesh100% (1)

- Chapter 8Документ26 страницChapter 8ENG ZI QINGОценок пока нет

- Port-Folio Management: Module Code: MBA 721Документ31 страницаPort-Folio Management: Module Code: MBA 721RabiaChaudhryОценок пока нет

- FA MCQ On PrinciplesДокумент9 страницFA MCQ On Principlestiwariarad100% (1)

- Dictionary of Consulting JargonsДокумент27 страницDictionary of Consulting JargonsAkash TripathiОценок пока нет

- Shahriar Zaman - MID ECO 1Документ5 страницShahriar Zaman - MID ECO 1Shahriar Zaman AsifОценок пока нет

- CH 16Документ63 страницыCH 16Marleen GloriaОценок пока нет

- Project On: HDFC Gold Exchange Trade FundДокумент5 страницProject On: HDFC Gold Exchange Trade FundNeha CheemaОценок пока нет

- Depreciation MethodsДокумент21 страницаDepreciation MethodsPawan PoynauthОценок пока нет

- Derivatives Mishaps and What We Can Learn From Them: Big Losses by Financial InstitutionsДокумент1 страницаDerivatives Mishaps and What We Can Learn From Them: Big Losses by Financial InstitutionsUten nstОценок пока нет

- XA Risk Reward RatioДокумент4 страницыXA Risk Reward Ratiocarlos.ernesto.aa2023Оценок пока нет

- Financial Management - Module 3Документ20 страницFinancial Management - Module 3Jane BiancaОценок пока нет

- Costing ReviewerДокумент9 страницCosting ReviewerPrince LitchОценок пока нет

- Application of The Value Averaging Investment Method On The Us Stock MarketДокумент10 страницApplication of The Value Averaging Investment Method On The Us Stock MarketN C NAGESH PRASAD KOTIОценок пока нет

- Barron's May 2001 Erin Arvedlund Story Re Bernard MadoffДокумент3 страницыBarron's May 2001 Erin Arvedlund Story Re Bernard MadoffAnonymousОценок пока нет

- Chapter Eleven: Credit Risk Measurement and Management of The Loan PortfolioДокумент24 страницыChapter Eleven: Credit Risk Measurement and Management of The Loan PortfolioNhon HoangОценок пока нет

- How Much Is The Minimum Stock Investment in The Philippines?Документ4 страницыHow Much Is The Minimum Stock Investment in The Philippines?Laws HackerОценок пока нет

- Herbert Smith - HK IPO Guide - 2010Документ122 страницыHerbert Smith - HK IPO Guide - 2010hyan812Оценок пока нет

- 15-Mca-Or-Accounting and Financial ManagementДокумент4 страницы15-Mca-Or-Accounting and Financial ManagementSRINIVASA RAO GANTAОценок пока нет

- Working Capital ManagementДокумент5 страницWorking Capital ManagementDiya MukherjeeОценок пока нет