Академический Документы

Профессиональный Документы

Культура Документы

Research Proposal For

Загружено:

Maitri PandyaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Research Proposal For

Загружено:

Maitri PandyaАвторское право:

Доступные форматы

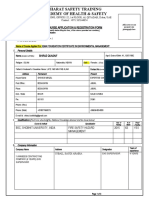

Research Proposal For Comprehensive Project Report

On

Venture Capital Industry in India

(Investment and Reinvestment decision)

Prepared By

1. PANDYA MAITRI M. (107590592037) 2. Pancholi MONIKA N. (107590592047) M.B.A. Semester - IV

Academic Year

2010 - 2012

Submitted To

Gujarat Technological University

Submitted For

Partial fulfillment for the award of the Master in Business Administration (MBA)

Guided By

Assistant Professor Hardik Bhadeshiya

Shree H. N. Shukla College of Management Studies

Affiliated with Gujarat Technological University - MBA Program Recognized by All India Council for Technical Education (AICTE) Near Lalpari Lake, B/H Marketing yard, Amargadh, Bhichri, Rajkot, Gujarat, India Phone: 0281-2925002, 2708070

Website: www.hnsmba.org

1. INTRODUCTION Research: It is the manipulation of things, concepts or symbols for the purpose of generalizing to extend, correct or verify knowledge, whether that knowledge aids in construction of theory or in the practice of an art. Research refers to the systematic method consisting of enunciating the problem, formulating a hypothesis, collecting the facts or data, analyzing the facts and reaching certain conclusion either in the form of solutions(s) towards the concerned problem or in certain generalizations for some theoretical formulation. Research is, thus, an original contribution to the existing stock of knowledge making for its advancement. Research is the pursuit of truth with the help of study, observation, comparison and experiment. In short, Search for knowledge through objective and systematic method of finding solution to a problem is research. The systematic approach concerning generalization and the formulation of a theory is also research. Research Methodology: Research Methodology is a way to systematically solve the Research problem. It may be understood as a science of studying how research is done scientifically. Research as a systematized effort to gain new knowledge. It is careful investigation for search of new facts in any branch of knowledge. The purpose of research methodology section is to describe the procedure for conduction the study. It includes research design, sample size, data collection and procedure of analysis of research instrument. Research always starts with a question or a problem. Its purpose is to find answers to questions through the application of the scientific method. It is a systematic and intensive study directed towards a more complete knowledge of the subject studied. 2. PROBLEM OF THE STUDY:

So by taking into the consideration, the above mentioned facts, I have stated my Research problem as under,

Venture Capital Industry in India (Investment and Reinvestment decision) What is Venture Capital?

The venture capital investment helps for the growth of innovative entrepreneurships in India. Venture capital has developed as a result of the need to provide non-conventional, risky finance to new ventures based on innovative entrepreneurship. Venture capital is an investment in the form of equity, quasi-equity and sometimes debtstraight or conditional, made in new or untried concepts, promoted by a technically or professionally qualified entrepreneur. Venture capital means risk capital. It refers to capital investment, both equity and debt, which carries substantial risk and uncertainties. The risk envisaged may be very high may be so high as to result in total loss or very less so as to result in high gains.

The concept of Venture Capital

Venture capital means many things to many people. It is in fact nearly impossible to come across one single definition of the concept. Jane Koloski Morris, editor of the well known industry publication, Venture Economics, defines venture capital as providing seed, start-up and first stage financing and also funding the expansion of companies that have already demonstrated their business potential but do not yet have access to the public securities market or to credit oriented institutional funding sources. The European Venture Capital Association describes it as risk finance for entrepreneurial growth oriented companies. It is investment for the medium or long term return seeking to maximize medium or long term for both parties. It is a partnership with the entrepreneur in which the investor can add value to the company because of his knowledge, experience and contact base. Meaning of venture capital

Venture capital is money provided by professionals who invest alongside management in young rapidly growing companies that have the potential to develop into significant economic contributors. Venture capital is an important source of equity for start-up companies. Professionally managed venture capital firms generally are private partnerships or closelyheld corporations funded by private and public pension funds, endowment funds, foundations, corporations, wealthy individuals, foreign investors, and the venture capitalists themselves. Venture capital generally: Finance new and rapidly growing companies. Purchase equity securities. Assists in the development of new products or services. Add value to the company through active participation. Take higher risks with the expectation of higher rewards. Have a long-term orientation.

When considering an investment, venture capitalists carefully screen the technical and business merits of the proposed company. Venture capitalists only invest in a small percentage of the businesses they review and have a long-term perspective. They also actively work with the companys management, especially with contacts and strategy formulation. Venture capitalists mitigate the risk of investing by developing a portfolio of young companies in a single venture fund. Many times they co-invest with other professional venture capital firms. In addition, many venture partnerships manage multiple funds simultaneously. For decades, venture capitalists have nurtured the growth of Americas high technology and entrepreneurial communities resulting in significant job creation, economic growth and international competitiveness. Companies such as Digital Equipment Corporation, Apple, Federal Express, Compaq, Sun Microsystems, Intel, Microsoft and Genetech are famous examples of companies that received venture capital early in their development.

Venture capital in INDIA

Venture capital was introduced in India in mid-eighties by All India Financial Institutions with the inauguration of Risk Capital Foundation (RCF) sponsored by IFCI with a view to encourage the technologists and the professional to promote new industries. Consequently the government of India promoted the venture capital during 1986-87 by creating a venture capital fund in the context of structural development and growth of small-scale business enterprises. Since then several venture capital firms/firms (VCFs) are incorporated by Financial Institutions (FIs), public Sector Banks (PSBs), and Private Banks and Private Financial companies. The Indian Venture Capital Industry (IVCI) is just about a decade old industry as compared to that in Europe and US. In this short span it has nurtured close to one thousand ventures, mostly in SME segment and has supported building technocrat/professionals all through. The VC industry, through its investment in high growth companies as well as companies adopting newer technologies backed by first generation entrepreneurs, has made a substantial contribution to economy. In India, however, the potential of venture capital funds, which have garnered over Rs.5000 Crores. The Venture capital investments in India at Rs.1000.05 crore as in 1997, representing 0.1% of GDP, as compared to 5.5% in countries such as Hong Kong.

1. OBJECTIVES OF THE STUDY: When we are going to study something there is specific purpose for our study. It may be for our course, as hobby, for passing our time, to find out genuine solution for any problem or to draw out certain inferences out of the available data. The objectives of our study are: To find out the venture capital investment volume in India.

To study the problem faced by venture capitalist in India. To study the future prospects of venture capital financing.

1. REVIEW OF THE LITERATURE : According to Subash and Nair, (May 2005) According to these peoples though the modern concept of venture capital stated during 1964 and now practiced by almost all economies around the world, there seems to be a slowdown of venture capital activities after 2000. There may be a long list of reasons for this situation, where people feel more risky to put their money in new and emerging ventures. Hardly 5% of the total venture capital investment globally is given to really stage ventures. In all the years people around the world has seen the potentiality of venture capital in promoting different economies of the world by improving the standard of living of the people by expanding business activities, increasing employment and also generating more revenue to the government. According to Kumar, (June 2003) This study focus on the industry should concentrate more on early stage business opportunities instead of later stage. It is the experience world over and especially in the United States of America that the early stage opportunities have generated exceptional returns for the industry. He also suggested that individual capitalists should follow a focused investment strategy. The specialization should be in a board technology segment. According to Chary, (September, 2005) There has been a plethora of literature on venture capital finance, which is helping the practitioners viz., venture capital finance companies and fund manage for better understanding the role of venture capital in economic development. There are number of studies on the venture capital and activities of venture capitalists in developed countries. According to Vijayalakshman & Dalvi, (January, 2006) Whenever Indian policy makers have to encourage any industry. The usual practice is to grant that the industry tax breaks for a limited period. This definitely acts as a positive incentive for that industry. However, what is required is a through understanding to the industry requirement framing and implementation of aggregative strategy for its development. Venture capital funds are not even registered with SEBI in spite of all the

benefit available. Venture capital industry is one, which will today prepare a base for a strong tomorrow. What is need for the development of venture capital industry is not only tax breaks but simpler procedures legislation for simplified exit from investment, more transparency and legal backing to participate in business amongst other things. According to Robbie, (1997) He highlights the monitoring policies of funding units by venture capitalists and studies the performance targets, monitoring information, and monitoring actions through a questionnaire-based survey. The survey was administered to 108 British Venture Capital Association members and total of 77 responses were gathered in the study. The findings related to performance targets and other monitoring issues were considerable addition to the literature in the subject. The issue concerning board of directors role in venture backed companies are widely debated topics in academic research. The findings of the study by Fried (1998) emphasize that the board of directors are a more involved in the venture backed firms than boards where members do not have large ownership at stake. The study provides an empirical evidence of variation in the boards involvement and shows its relevance in performance management of funded units. According to Mishra, (July 2004) There is abundant empirical research conducted in developed countries which address the relative investment evaluation criteria taken into account in the screening process for new venture investment proposals. Zopunidis (1994) provides a useful summary of the previous research in this field. The identification of selection criteria has been researched using different methodologies such as simple rating of criteria (perpetual and deal specific responses) Knight, 1986; Dixon, 1991; Hall and Hifer, 1993; Rah, Jung and Lee, 1994, construct analysis (Fried and Hisrich, 1994), Verbal protocols (Zhacharakis and Meyer, 1998), and quantitative compensatory models (Muzyka, Birley and Leleux, 1996; shepherd, 1999). Multi methods (case analysis, study of administrative records, published interviews, questionnaire and personal interviews) approach has also been used (Riquelme, 1994) to enhance understanding of investment critetia and also extend it to other aspects of investment process like deal structuring and divestment. 2. HYPOTHESIS OF THE STUDY:

Hypothesis of the Study can be described here in as under. 1. There is no significant difference of venture capital investment volume in India. 2. There is no significant difference among the venture capitalist facing problem in India. 3. There is no significant difference for venture capital financing in future. 3. RESEARCH DESIGN: The formidable problem that follows the task of defining the research problem is the preparation of the design of the research project, popularly known as the Research design. Decisions regarding what, where, when, how much, by what means concerning an inquiry or a research study constitute a research design, A research design is the arrangement of conditions for collection and analysis of data in a manner that aims to combine relevance to the research purpose with economy in procedure. In fact, the research design is the conceptual structure within which research is conducted; it constitutes the blueprint for the collection, measurement and analysis of data. As such the design includes an outline of what researcher will do from writing the hypothesis and its operational implications to the final analysis of data. So, here in this case Research Design can be mentioned as under. Research design is broadly classified into: Exploratory research design Descriptive research design Casual research design

This research is an Exploratory Research. The major purpose of this research is description of state of affairs as it exists at present. 6.1 Universe of the Study : The first step in developing any sample design is to clearly define the set of objects, technically called the Universe, to be studied. The universe is being finite in mine case of study. There are around 150 types of industries are available like Manufacturing industry,

automobile spare parts, information technology, electronics, mechanical, nanotechnology, textile, sugar, food processing industry, shipping industry and many others.

6.2 Nature of the Study:

The study is purely based on the secondary Data Collection, Internet, Magazine Journal, Newspaper method is being adopted for the same. 6.3 Sample of the Study: While developing a sampling design of the study, one is required to pay attention to the following points: 6.3.1 Sampling Unit:

A decision has to be taken concerning a sampling unit before selecting sample. Here in this study sampling unit is being based on National level as far as geographical aspect is there. 6.3.2 Source List:

It is also known as a sampling frame from which sample is to be drawn. It contains the names of all items of a universe. But limitation is that, such sort of data is entrusted with private information and the confidence hence it is prevent to be enclosed by laws. 6.3.4 Size of the Sample:

This refers to the number of items to be selected from the universe to constitute a sample. This is a major problem to make a research. The size of the sample in this study is not too large or too small, but it is an optimum, which are fulfilling the requirements of efficiency, representativeness, reliability and flexibility. In this study I have taken the sample size of 12 types of industries.

6.4 Sampling Procedure : Finally, one must decide the type of sample on which I am going to use i.e. the technique to be used in selecting the items for the sample. In fact, this technique or procedure stands for the sample design itself. 6.5 Data Collection: The task of data collection begins after a research problem has been defined and research design chalked out. While deciding about the method of data collection to be used for the study, one should keep in mind two types of data viz., Primary and Secondary. The primary data are those which are collected afresh and for the first time, and thus happen

to be original in character. The secondary data on the other hand, are those which have already been collected by someone else and which have already been passed through the statistical process. In this study secondary data collection method is being applied through the Internet Magazine Journal Newspaper

6.1 Limitations of the study:

1. The biggest limitation is time because the time is not sufficient as there is lot of information to be get & to have it interpretation

2. The

data required is secondary & that is not easily available. by its nature is suggestive & not conclusive are high in collecting & searching the data.

3. Study

4. Expenses

Tentative Chapter Plan (1) Introduction (2) Theoretical Framework and Literature review (3) Research Methodology (4) Analysis and interpretation (5) Conclusion Beneficiaries The research benefits to the society at whole. This study enhances the knowledge and provides the further information to the various people like researcher, investors, general public at a large those who want to gain knowledge.

SHORT WRITE UP ON RESEARCHER Researcher 1 Name Education Sex Contact No. E-Mail ID Researcher 2 Name Education Sex Contact No. : Pancholi Monika N. : B.B.A., M.B.A.(Pursuing) : Female : +918530121155 : Pandya Maitri M. : B.B.A., M.B.A. (Pursuing) : Female : +919428655941 : maitri.pandya89@hotmail.com

E-Mail ID

: mpancholi90@gmail.com

REFERENCES

a) National Venture Capital Association 1999 year book

b) I.M. Panday- venture capital development process in India c) I.M. Panday- Venture capital the Indian experience d) www.vcinstitute.com e) www.Indiavca.org f) www.nvca.com

Вам также может понравиться

- COMPARATIVE STUDY On Working Capital Management Between Bhilai Steel Plant & Tisco GroupДокумент78 страницCOMPARATIVE STUDY On Working Capital Management Between Bhilai Steel Plant & Tisco GroupMustafa S TajaniОценок пока нет

- Steps To Start A Small Scale IndustryДокумент3 страницыSteps To Start A Small Scale Industrysajanmarian80% (5)

- Psda 1 CSR Activities For Companies Submitted By-Siddhi Khanna Submitted To - DR Richa Sharma ENROLLMENT NO - A0102321018 Sec - A Mba HR 2021-2023Документ10 страницPsda 1 CSR Activities For Companies Submitted By-Siddhi Khanna Submitted To - DR Richa Sharma ENROLLMENT NO - A0102321018 Sec - A Mba HR 2021-2023Vaishnavi SomaniОценок пока нет

- CSR ProjectДокумент15 страницCSR ProjectPariniti GuptaОценок пока нет

- Customer Behaviour Towards Idea CellularДокумент62 страницыCustomer Behaviour Towards Idea CellularNarinder Bansal100% (3)

- Consumer Behaviour Towards ElectronicsДокумент46 страницConsumer Behaviour Towards Electronicskyle_1947456267% (3)

- Corporate Governance: Legal & Statutory CompliancesДокумент74 страницыCorporate Governance: Legal & Statutory Complianceskasim_khan07Оценок пока нет

- A Study On Consumer Perception Towards Life Insurance in Satna CityДокумент64 страницыA Study On Consumer Perception Towards Life Insurance in Satna CityAbhay Jain100% (1)

- A Comparative Study On Service Quality of Bank of Baroda and ICICI Bank Using Servqual ModelДокумент6 страницA Comparative Study On Service Quality of Bank of Baroda and ICICI Bank Using Servqual ModelEditor IJTSRDОценок пока нет

- Comparative Analysis of Indian Private and Public Sectors With Special Reference To TATA Steel and SAILДокумент53 страницыComparative Analysis of Indian Private and Public Sectors With Special Reference To TATA Steel and SAILManu GCОценок пока нет

- Reasearch and MethodologyДокумент3 страницыReasearch and Methodologynemik007Оценок пока нет

- Project Report Submitted in Partial Fulfillment For The Award of The Degree ofДокумент67 страницProject Report Submitted in Partial Fulfillment For The Award of The Degree ofMubeenОценок пока нет

- Mouni (Equity Analysis)Документ22 страницыMouni (Equity Analysis)arjunmba119624Оценок пока нет

- New 2 Project PDFДокумент56 страницNew 2 Project PDFVishu Makwana0% (1)

- Fundamental Analysis of Selected Public and Private Sector Banks in India PDFДокумент17 страницFundamental Analysis of Selected Public and Private Sector Banks in India PDFDipesh AprajОценок пока нет

- Investment Pattern and Awareness of Salaried Class Investors in Tiruvannamalai District of TamilnaduДокумент9 страницInvestment Pattern and Awareness of Salaried Class Investors in Tiruvannamalai District of Tamilnadumurugan_muruОценок пока нет

- Big Bazaar - Customer SatisfactionДокумент50 страницBig Bazaar - Customer SatisfactionPankaj Rathi100% (1)

- SynopsisДокумент7 страницSynopsisPreetpal Singh VirkОценок пока нет

- Working CapitalДокумент40 страницWorking CapitalSupriya RajmaneОценок пока нет

- Why Public-Sector Mergers FailДокумент12 страницWhy Public-Sector Mergers FailDivesh RanjanОценок пока нет

- CSR & SUSTANABILTY - IrctcДокумент15 страницCSR & SUSTANABILTY - IrctcabcОценок пока нет

- CHP 2 - Issue ManagementДокумент32 страницыCHP 2 - Issue ManagementFalguni MathewsОценок пока нет

- A Project Report On Comparative Study On Unit Linked Insurance Policy vs. Mutual FundДокумент112 страницA Project Report On Comparative Study On Unit Linked Insurance Policy vs. Mutual FundnirajvasavaОценок пока нет

- A Financial System Refers To A System Which Enables The Transfer of Money Between Investors and BorrowersДокумент8 страницA Financial System Refers To A System Which Enables The Transfer of Money Between Investors and BorrowersAnu SingalОценок пока нет

- Business Dealings in Emerging Economies, Non-Contractual Relations, and Recourse To Law - An AnalysisДокумент12 страницBusiness Dealings in Emerging Economies, Non-Contractual Relations, and Recourse To Law - An AnalysisAnish GuptaОценок пока нет

- Chapter 13 PDFДокумент75 страницChapter 13 PDFAkhilSainiОценок пока нет

- Mutual Fund AnalysisДокумент53 страницыMutual Fund AnalysisVijetha EdduОценок пока нет

- Synopsis CompensationДокумент11 страницSynopsis CompensationDavid GollapudiОценок пока нет

- Research Report On: "Comparative Analysis of Equity & Derivative Market"Документ107 страницResearch Report On: "Comparative Analysis of Equity & Derivative Market"Neetyesh TiwariОценок пока нет

- Performance Analysis of Mutual Fund MbaДокумент31 страницаPerformance Analysis of Mutual Fund MbaShreyasОценок пока нет

- List of Contents: Rayalaseema Hypo Hi-StrengthДокумент57 страницList of Contents: Rayalaseema Hypo Hi-StrengthShams SОценок пока нет

- Project Report On Risk Factors in Capital MarketДокумент56 страницProject Report On Risk Factors in Capital MarketMudrika Jain100% (2)

- BBA Final Year Project (Finance) Christy Thomas 17PUC26084Документ56 страницBBA Final Year Project (Finance) Christy Thomas 17PUC26084Chethan.sОценок пока нет

- Training Report On Loan and Credit Facility at Cooperative BankДокумент86 страницTraining Report On Loan and Credit Facility at Cooperative BanksumanОценок пока нет

- Minor Project On Mutual FundsДокумент37 страницMinor Project On Mutual FundsGauravОценок пока нет

- An Analysis of Mutual Fund Performance of SBI & Investor'sДокумент56 страницAn Analysis of Mutual Fund Performance of SBI & Investor'sabhisinghaОценок пока нет

- DR - Hiren Maniar Is Working As A Faculty in Finance With L&T Institute of Project Management, Vadodara. He May BeДокумент22 страницыDR - Hiren Maniar Is Working As A Faculty in Finance With L&T Institute of Project Management, Vadodara. He May BeEldhose NpОценок пока нет

- SalaryДокумент80 страницSalarykalyanikamineniОценок пока нет

- WCM PSBДокумент41 страницаWCM PSBVISHAKHA BHALERAOОценок пока нет

- Chaitanya Chemicals - Capital Structure - 2018Документ82 страницыChaitanya Chemicals - Capital Structure - 2018maheshfbОценок пока нет

- Group3 Working Capital Management at Tata SteelДокумент19 страницGroup3 Working Capital Management at Tata SteelKamlesh TripathiОценок пока нет

- Home Loan Portfolio-A Review of Literature: International Journal of Current Advanced Research September 2017Документ4 страницыHome Loan Portfolio-A Review of Literature: International Journal of Current Advanced Research September 2017Chhaya ThakorОценок пока нет

- M&a in Indian BanksДокумент48 страницM&a in Indian Banksvikas_kumar820Оценок пока нет

- The Robot SuicideДокумент3 страницыThe Robot SuicideCherrychell MortelОценок пока нет

- Project in E-I-C Analysis at Il&f Invest Smart Stock LTD Mba FinanceДокумент87 страницProject in E-I-C Analysis at Il&f Invest Smart Stock LTD Mba FinanceBabasab Patil (Karrisatte)Оценок пока нет

- A Comprehensive Study On Sebi Guidelines Regarding Investor ProtectionДокумент88 страницA Comprehensive Study On Sebi Guidelines Regarding Investor ProtectionMohammad Ejaz AhmedОценок пока нет

- Dividend Decision ICICI by ImtiazaliДокумент26 страницDividend Decision ICICI by ImtiazaliImtiyazMoverОценок пока нет

- "Merger and Consolidation of Icici Ltd. and Icici Bank": A Project Report ONДокумент90 страниц"Merger and Consolidation of Icici Ltd. and Icici Bank": A Project Report ONRidhima SharmaОценок пока нет

- Company Analysis of IrctcДокумент20 страницCompany Analysis of IrctcUnnati GuptaОценок пока нет

- 1 EmployeeДокумент96 страниц1 EmployeeHarshada KadamОценок пока нет

- A Study On Financial Performance Analysis With Special Reference To Elgi Ultra IndustryДокумент53 страницыA Study On Financial Performance Analysis With Special Reference To Elgi Ultra IndustryLogaNathanОценок пока нет

- Project On Venture CapitalДокумент60 страницProject On Venture CapitalbabataukirОценок пока нет

- 004-Gaurang Bhatt-The Concept of Venture CapitalДокумент60 страниц004-Gaurang Bhatt-The Concept of Venture Capitalswapshri03Оценок пока нет

- Venture Capital in INDIAДокумент83 страницыVenture Capital in INDIAnawaz100% (2)

- Literature ReviewДокумент13 страницLiterature ReviewSukhraj Kaur Chhina100% (5)

- Venture Capital in IndiaДокумент58 страницVenture Capital in IndiaNaandi Narvekar100% (1)

- Venture Capital in IndaiДокумент66 страницVenture Capital in IndaiTahir HussainОценок пока нет

- Project On Study of Venture Capital in IndiaДокумент156 страницProject On Study of Venture Capital in IndiaAnkitaChoudharyОценок пока нет

- Venture CapitalДокумент75 страницVenture CapitalNagireddy Kalluri100% (1)

- Banking and Insurance: "I Never Invest in Someone Who Says They'reДокумент27 страницBanking and Insurance: "I Never Invest in Someone Who Says They'remiketyagiОценок пока нет

- A PDFДокумент2 страницыA PDFKanimozhi CheranОценок пока нет

- Intermediate Accounting (15th Edition) by Donald E. Kieso & Others - 2Документ11 страницIntermediate Accounting (15th Edition) by Donald E. Kieso & Others - 2Jericho PedragosaОценок пока нет

- Check Fraud Running Rampant in 2023 Insights ArticleДокумент4 страницыCheck Fraud Running Rampant in 2023 Insights ArticleJames Brown bitchОценок пока нет

- Notifier AMPS 24 AMPS 24E Addressable Power SupplyДокумент44 страницыNotifier AMPS 24 AMPS 24E Addressable Power SupplyMiguel Angel Guzman ReyesОценок пока нет

- Unit Process 009Документ15 страницUnit Process 009Talha ImtiazОценок пока нет

- Ibbotson Sbbi: Stocks, Bonds, Bills, and Inflation 1926-2019Документ2 страницыIbbotson Sbbi: Stocks, Bonds, Bills, and Inflation 1926-2019Bastián EnrichОценок пока нет

- Information Security Chapter 1Документ44 страницыInformation Security Chapter 1bscitsemvОценок пока нет

- ADS 460 Management Principles and Practices: Topic 1: Introduction To ManagementДокумент33 страницыADS 460 Management Principles and Practices: Topic 1: Introduction To ManagementNURATIKAH BINTI ZAINOL100% (1)

- Separation PayДокумент3 страницыSeparation PayMalen Roque Saludes100% (1)

- Pneumatic Fly Ash Conveying0 PDFДокумент1 страницаPneumatic Fly Ash Conveying0 PDFnjc6151Оценок пока нет

- Configuring Master Data Governance For Customer - SAP DocumentationДокумент17 страницConfiguring Master Data Governance For Customer - SAP DocumentationDenis BarrozoОценок пока нет

- How Yaffs WorksДокумент25 страницHow Yaffs WorkseemkutayОценок пока нет

- TAB Procedures From An Engineering FirmДокумент18 страницTAB Procedures From An Engineering Firmtestuser180Оценок пока нет

- BST Candidate Registration FormДокумент3 страницыBST Candidate Registration FormshirazОценок пока нет

- Enerparc - India - Company Profile - September 23Документ15 страницEnerparc - India - Company Profile - September 23AlokОценок пока нет

- Catalogo AWSДокумент46 страницCatalogo AWScesarОценок пока нет

- Sweet Biscuits Snack Bars and Fruit Snacks in MexicoДокумент17 страницSweet Biscuits Snack Bars and Fruit Snacks in MexicoSantiagoОценок пока нет

- Everlube 620 CTDSДокумент2 страницыEverlube 620 CTDSchristianОценок пока нет

- BS 8541-1-2012Документ70 страницBS 8541-1-2012Johnny MongesОценок пока нет

- P394 WindActions PDFДокумент32 страницыP394 WindActions PDFzhiyiseowОценок пока нет

- On CatiaДокумент42 страницыOn Catiahimanshuvermac3053100% (1)

- MRT Mrte MRTFДокумент24 страницыMRT Mrte MRTFJonathan MoraОценок пока нет

- Astm E53 98Документ1 страницаAstm E53 98park991018Оценок пока нет

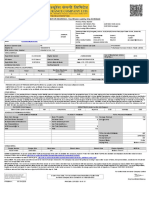

- MOTOR INSURANCE - Two Wheeler Liability Only SCHEDULEДокумент1 страницаMOTOR INSURANCE - Two Wheeler Liability Only SCHEDULESuhail V VОценок пока нет

- Lab 6 PicoblazeДокумент6 страницLab 6 PicoblazeMadalin NeaguОценок пока нет

- Rating SheetДокумент3 страницыRating SheetShirwin OliverioОценок пока нет

- (X-09485) XYLENE RECTIFIED Extra Pure (Mix Isomers)Документ9 страниц(X-09485) XYLENE RECTIFIED Extra Pure (Mix Isomers)Bharath KumarОценок пока нет

- FIRE FIGHTING ROBOT (Mini Project)Документ21 страницаFIRE FIGHTING ROBOT (Mini Project)Hisham Kunjumuhammed100% (2)

- Anaphylaxis Wallchart 2022Документ1 страницаAnaphylaxis Wallchart 2022Aymane El KandoussiОценок пока нет

- Cabling and Connection System PDFДокумент16 страницCabling and Connection System PDFLyndryl ProvidoОценок пока нет