Академический Документы

Профессиональный Документы

Культура Документы

RBI committee recommends lowering capital requirements for NBFCs

Загружено:

Vivek SinghИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

RBI committee recommends lowering capital requirements for NBFCs

Загружено:

Vivek SinghАвторское право:

Доступные форматы

14/02/2012

Gmail -

ha ho a commi ee ecommenda ion on nbfi

Vi e Si gh < i e

i gh

@g ai .c

>

ha h

a c

i ee ec

e da i

bfi

F i, Feb 10, 2012 a 7:44 PM

a dh a i gh < a dh a.ii @g ai .c > To: Vivek singh <viveksinghssr@gmail.com>

RBI elea e

epo on NBFC i

Source : Moneycontrol.com

Published on Mon, Aug 29, 2011 at 15:00 Updated at Mon, Aug 29, 2011 at 22:36

e c

ea

The Reserve Bank of India (RBI) on Monday released the Usha Thorat committe report on nonbanking finance companies or NBFCs. The report speaks about the issues and concerns of the NBFCs. (Thorat is a former deputy governor of RBI). He e a e e e ec e da i f Th a -c i ee:

Tie I ca i a f NBFC be a 12% So far, NBFCs' capital adequacy requirement is at 15% wherein there is no stringent stipulation of tier I or tier II capital. If the recommendation is accepted, every NBFC has to have a minimum tier I capital or equity capital of 12%. P i i i g f NBFC d be i i a h ef ba .

In April this year, RBI increased provisioning norms for banks from 10% to 15% on sub-standard assets (where interest payments have not been made for two months) while restructured assets (where concessions have been given to the borrower to prevent the loan from going bad) too have to be provided at 2% as against 0.25-1% earlier. If accepted, NBFCs too have to follow this. NBFC heads feel such provisioning is good on a longer term basis. Interestingly, it has an income tax benefit. The proposed income tax deduction is seen as a big relief. Li idi ai be i d ced f 30 da

RBI has recommended maintaining a liquidity ratio of for 30 days. Which means an NBFC has to set aside cash balance equivalent to its debt payments due every month. This debt may include repayment of bank loans, interest payment to bond subscribers and others. Asset finance companies, especially those with longer repayment cycle, may be impacted. The measure is perceived to be important to check asset liablity mismatch of NBFCs. Ri eigh f NBFC , ed b ba a be ai ed 150% f ca i a a e e e a d 125% f c e cia ea e a e This reflects RBI's intention to bar NBFCs from taking higher exposure in capital market and real estate. Two such sectors are considered to be risk-prone and inclusive of high volatility. However, asset finance companies which basically do business of funding asset purchases would not be impacted due to this.

h p ://mail.google.com/mail/? i=2&ik=9a53f9f46f& ie =p & ea ch=inbo &m g=135679d248c9cb94 1/2

14/02/2012

Gmail -

ha ho a commi ee ecommenda ion on nbfi

NBFC a be gi e be gi e be efi de SARFAESI Ac Under Securitisation and Reconstruction of Financial Assets And Enforcement of Security Interest or SARFAESI Act, an NBFC would not move to the court to auction underlying assets to recover loan dues. It will just publish a newspaper notice before such auction. However, it hardly makes any difference for gold loan companies as gold is "pledged" against the loan. A a a e he RBI e :

Analysts, tracking NBFCs, refused to jump the gun. This is just a recommendation. Based on it, there is no point in giving fresh calls on NBFC stocks. It will take time to put out final guidelines. The committee report is more or less on expected lines, they said adding that they would be closely watching each development.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ +++++++++++++++++++++++++++++++++++++++++

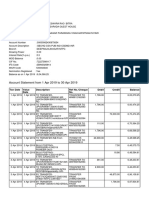

Overview of CPI inflation rates published most recently

c e i fai /c i fai e i d h ba i -2.44 % 0.70 % 0.29 % 0.48 % 0.73 % 0.76 % 0.29 % -1.01 % 0.30 % 0.00 % ea ba i -0.12 % 4.52 % 3.16 % 3.20 % 3.65 % 3.65 % 6.53 % 6.49 % 4.06 % -0.20 % dified 02-10-2012 02-08-2012 02-08-2012 02-08-2012 02-07-2012 02-07-2012 02-06-2012 02-03-2012 01-27-2012 01-27-2012 Inf lation The Netherlands Inf lation Estonia Inf lation Italy Inf lation South Korea Inf lation Belgium Inf lation Indonesia Inf lation Iceland Inf lation India Inf lation China Inf lation Japan january 2012 january 2012 january 2012 january 2012 january 2012 january 2012 january 2012 december 2011 december 2011 december 2011

For an ov erv iew of current inf lation (CPI) of all countries, click here

This website contains current data about inflation. In order to be able to show this data, we make use of a large number of sources of information that we believe to be reliable. For more information and our disclaimer, click here.

h p ://mail.google.com/mail/? i=2&ik=9a53f9f46f& ie =p & ea ch=inbo &m g=135679d248c9cb94

2/2

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Federal Reserve BankДокумент10 страницFederal Reserve BankCarla DiCapri100% (1)

- Project Preparation and Appraisal of Hotel ResortДокумент81 страницаProject Preparation and Appraisal of Hotel ResortJatin RamaniОценок пока нет

- Cholamandalam Investment and Finance Initiation ReportДокумент44 страницыCholamandalam Investment and Finance Initiation ReportgirishrajsОценок пока нет

- Term Project: Credit Card BusinessДокумент17 страницTerm Project: Credit Card BusinessOnur YılmazОценок пока нет

- Working Capital FinancingДокумент44 страницыWorking Capital FinancingShoib ButtОценок пока нет

- Janalakshmi Financial Services PVT LTD Coca ReportДокумент72 страницыJanalakshmi Financial Services PVT LTD Coca ReportSelvaKumarMbaОценок пока нет

- Negotiable Instruments LawДокумент5 страницNegotiable Instruments LawYanhicoh CySaОценок пока нет

- Tamba HanaДокумент2 страницыTamba HanaircasinagaОценок пока нет

- Chapter 5 Interest Rate Risk - The Repricing ModelДокумент19 страницChapter 5 Interest Rate Risk - The Repricing ModelTiên CẩmОценок пока нет

- Syllabus in Commercial ReviewДокумент17 страницSyllabus in Commercial ReviewMarielle GarboОценок пока нет

- CASH AND CASH EQUIVALENTS TheoДокумент1 страницаCASH AND CASH EQUIVALENTS Theovenice cambryОценок пока нет

- Internship Sindh BankДокумент34 страницыInternship Sindh BankKR Burki100% (1)

- What Are SMEsДокумент2 страницыWhat Are SMEsarshaikh83Оценок пока нет

- EFPE 2002: Private Equity InvestmentsДокумент19 страницEFPE 2002: Private Equity InvestmentsKARTHIK145Оценок пока нет

- Customer Inquiry ReportДокумент5 страницCustomer Inquiry ReportWidia AprilianaОценок пока нет

- CPT Mock Test Paper ReviewДокумент40 страницCPT Mock Test Paper ReviewbaburamОценок пока нет

- Gruh Finance-MBA-Project Report Prince DudhatraДокумент51 страницаGruh Finance-MBA-Project Report Prince DudhatrapRiNcE DuDhAtRaОценок пока нет

- Ecf 320 - Money, Banking and Financial MarketsДокумент22 страницыEcf 320 - Money, Banking and Financial MarketsFredrich KztizОценок пока нет

- 15624702052231UoGssBO9TQOUnD5 PDFДокумент5 страниц15624702052231UoGssBO9TQOUnD5 PDFvenkateshbitraОценок пока нет

- MCCP LeafДокумент2 страницыMCCP LeafManish GoelОценок пока нет

- LBP Waives Penalty Charges on HSBTC LoanДокумент325 страницLBP Waives Penalty Charges on HSBTC Loanchey_anneОценок пока нет

- Cost sheet for 2-3BHK luxury apartments in Brigade Buena VistaДокумент1 страницаCost sheet for 2-3BHK luxury apartments in Brigade Buena VistapriyankarghoshОценок пока нет

- The Goldman Sachs Group - Financial Analysis AssignmentДокумент4 страницыThe Goldman Sachs Group - Financial Analysis AssignmentJeremy RichuОценок пока нет

- Samba Financial GroupДокумент17 страницSamba Financial GroupNoor Ul AinОценок пока нет

- Lakshwiz Bazaar - Marketing Case Study Challenge.Документ3 страницыLakshwiz Bazaar - Marketing Case Study Challenge.Dushyant Singh SolankiОценок пока нет

- PMCM Company Deck June 2018Документ32 страницыPMCM Company Deck June 2018Hannes Sternbeck FryxellОценок пока нет

- BrochureДокумент591 страницаBrochureRajkumarОценок пока нет

- Resolution For Open AccountДокумент15 страницResolution For Open AccountLouie Jay AbisОценок пока нет

- All Chapters in Finmar TextДокумент133 страницыAll Chapters in Finmar TextShr BnОценок пока нет

- Name of Secty AgencyДокумент3 страницыName of Secty Agencytisay12100% (1)