Академический Документы

Профессиональный Документы

Культура Документы

Assignment

Загружено:

Neha BeriИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Assignment

Загружено:

Neha BeriАвторское право:

Доступные форматы

Bullwhip effect

Illustration of the bullwhip effect: The final customer places an order (whip) and order fluctuations build up upstream thesupply chain.

The bullwhip effect (or whiplash effect) is an observed phenomenon in forecast-driven distribution channels. It refers to a trend of larger and larger swings in inventory in response to changes in demand, as one looks at firms further back in thesupply chain for a product. The concept first appeared in J Forrester's Industrial Dynamics (1961) and thus it is also known as the Forrester effect. Since the oscillating demand magnification upstream a supply chain is reminiscent of a cracking whip, it became known as the bullwhip effect.

[edit]Causes

Bullwhip effect

Because customer demand is rarely perfectly stable, businesses must forecast demand to properly position inventory and other resources. Forecasts are based on statistics, and they are rarely perfectly accurate. Because forecast errors are a given, companies often carry an inventory buffer called "safety stock".

Moving up the supply chain from end-consumer to raw materials supplier, each supply chain participant has greater observed variation in demand and thus greater need for safety stock. In periods of rising demand, down-stream participants increase orders. In periods of falling demand, orders fall or stop, thereby not reducing inventory. The effect is that variations are amplified as one moves upstream in the supply chain (further from the customer). This sequence of events is well simulated by the Beer Distribution Game which was developed by MIT Sloan School of Management in the 1960s. The causes can further be divided into behavioral and operational causes:

IDBI Bank

From Wikipedia, the free encyclopedia

IDBI Bank Limited

Type

Public (BSE: 500116)

Industry

Banking, Financial services

Founded

July 1964

Headquarter Mumbai, India s

Key people

R M Malla (CMD)

Products

Credit cards, consumer banking,corporate banking, finance and insurance, investment banking,mortgage loans, private banking,private equity, wealth management

Revenue

20,858 crore (US$4.59 billion)(2011)[1]

Net income

1,563 crore (US$343.86 million)(2011)

Total assets

253,116 crore (US$55.69 billion)(2011)

Employees

14,000 (2011)

Website

www.idbi.com

IDBI Bank Limited (BSE: 500116) is an Indian financial service company headquartered Mumbai, India. RBI categorised IDBI as an "other public sector bank". It was established in 1964 by an Act of Parliament to provide credit and other facilities for the development of the fledgling Indian industry.[2] It is currently 10th largest development bank in the world in terms of reach with 1514 ATMs, 923 branches including one overseas branch at DIFC, Dubai and 621 centers including two overseas centres at Singapore & Beijing.[3] Some of the institutions built by IDBI are the Securities and Exchange Board of India (SEBI), National Stock Exchange of India (NSE), the National Securities Depository Limited (NSDL), the Stock Holding Corporation of India Limited (SHCIL), the Credit Analysis & Research Ltd, the Exim Bank (India)(Exim Bank), the Small

Industries Development Bank of India(SIDBI), the Entrepreneurship Development Institute of India, and IDBI BANK, which is owned by the Indian Government.IDBI Bank is on a par with nationalized banks and the SBI Group as far as government ownership is concerned.It is one among the 26 commercial banks owned by the Government of India.The Bank has an aggregate balance sheet size of Rs. 2,53,378 crore as on March 31, 2011. IDBI Bank's operations during the financial year ended March 31,

[edit]

Supply-chain operations reference

From Wikipedia, the free encyclopedia

Supply-chain operations reference-model (SCOR) is a process reference model developed by the management consulting firm PRTM and endorsed by the Supply-Chain Council (SCC) as the cross-industry de-facto standard diagnostic tool for supply chain management. SCOR enables users to address, improve, and communicate supply chain management practices within and between all interested parties in the extended enterprise.

SCOR is a management tool, spanning from the supplier's supplier to the customer's customer. The model has been developed by the members of the Council on a volunteer basis to describe the business activities associated with all phases of satisfying a customer's demand.

The model is based on 3 major "pillars":

Process modeling Performance measurements Best practices

[edit]The

process modeling pillar

By describing supply chains using process modeling building blocks, the model can be used to describe supply chains that are very simple or very complex using a common set of definitions. As a result, disparate industries can be linked to describe the depth and breadth of virtually any supply chain.

SCOR is based on five distinct management processes: Plan, Source, Make, Deliver, and Return.

Plan Processes that balance aggregate demand and supply to develop a course of action which best meets sourcing,

production, and delivery requirements.

Source Processes that procure goods and services to meet planned or actual demand. Make Processes that transform product to a finished state to meet planned or actual demand. Deliver Processes that provide finished goods and services to meet planned or actual demand, typically including order

management, transportation management, and distribution management.

Return Processes associated with returning or receiving returned products for any reason. These processes extend into

post-delivery customer support.

With all reference models, there is a specific scope that the model addresses. SCOR is no different and the model focuses on the following:

All customer interactions, from order entry through paid invoice. All product (physical material and service) transactions, from your suppliers supplier to your customers customer,

including equipment, supplies, spare parts, bulk product, software, etc.

All market interactions, from the understanding of aggregate demand to the fulfillment of each order.

SCOR does not attempt to describe every business process or activity. Relationships between these processes can be made to the SCOR and some have been noted within the model. Other key assumptions addressed by SCOR include: training, quality, information technology, and administration (not supply chain management). These areas are not explicitly addressed in the model but rather assumed to be a fundamental supporting process throughout the model.

SCOR provides three-levels of process detail. Each level of detail assists a company in defining scope (Level 1), configuration or type of supply chain (Level 2), process element details, including performance attributes (Level 3). Below level 3, companies decompose process elements and start implementing specific supply chain management practices. It is at this stage that companies define practices to achieve a competitive advantage, and adapt to changing business conditions.

SCOR is a process reference model designed for effective communication among supply chain partners. As an industry standard it also facilitates inter and intra supply chain collaboration, horizontal process integration, by explaining the relationships between processes (i.e., Plan-Source, Plan-Make, etc.). It also can be used as a data input to completing an analysis of configuration alternatives (e.g., Level 2) such as: Make-to-Stock or Make-To-Order. SCOR is used to describe, measure, and evaluate supply chains in support of strategic planning and continuous improvement.

SCOR Process Framework

In the example provided by the picture the Level 1 relates to the Make process. This means that the focus of the analysis will be concentrated on those processes that relate to the added-value activities that the model categorizes as Make processes.

Level 2 includes 3 sub-processes that are children of the Make parent. These children have a special tag a letter (M) and a number (1, 2, or 3). This is the syntax of the SCOR model. The letter represents the initial of the process. The numbers identify the scenario, or configuration.

M1 equals a Make build to stock scenario. Products or services are produced against a forecast. M2 equals a Make build to order configuration. Products or services are produced against a real customer order in a just-in-time fashion. M3 stands for Make engineer to order configuration. In this case a blueprint of the final product is needed before any make activity can be performed.

Level 3 processes, also referred to as the business activities within a configuration, represent the best practice detailed processes that belong to each of the Level 2 parents.

The example shows the breakdown of the Level 2 process Make build to order into its Level 3 components identified from M2.01 to M2.06. Once again this is the SCOR syntax: letter-number-dot-serial number.

The model suggests that to perform a Make build to order process, there are 6 more detailed tasks that are usually performed. The model is not prescriptive, in the sense that it is not mandatory that all 6 processes are to be executed. It only represents what usually happens in the majority of organizations that compose the membership base of the Supply Chain Council.

The Level 3 processes reach a level of detail that cannot exceed the boundaries determined by the industry- agnostic and industrystandard nature of the SCOR model. Therefore all the set of activities and processes that build for instance the M2.03 Produce & test process will be company-specific, and therefore fall outside the models scope.

[edit]The

Performance Measurements Pillar

The SCOR model contains more than 150 key indicators that measure the performance of supply chain operations. These performance metrics derive from the experience and contribution of the Council members. As with the process modeling system, SCOR metrics are organized in a hierarchical structure. Level 1 metrics are at the most aggregated level, and are typically used by top decision makers to measure the performance of the company's overall supply chain. Level 1 Metrics are primary, high level measures that may cross multiple SCOR processes. Level 1 Metrics do not necessarily relate to a SCOR Level 1 process (PLAN, SOURCE, MAKE, DELIVER, RETURN).

The metrics are used in conjunction with performance attributes. The Performance Attributes are characteristics of the supply chain that permit it to be analyzed and evaluated against other supply chains with competing strategies. Just as you would describe a physical object like a piece of lumber using standard characteristics (e.g., height, width, depth), a supply chain requires standard characteristics to be described. Without these characteristics it is extremely difficult to compare an organization that chooses to be the low-cost provider against an organization that chooses to compete on reliability and performance.

Associated with the Performance Attributes are the Level 1 Metrics. These Level 1 Metrics are the calculations by which an implementing organization can measure how successful they are in achieving their desired positioning within the competitive market space.

The metrics in the Model are hierarchical, just as the process elements are hierarchical. Level 1 Metrics are created from lower level

calculations. (Level 1 Metrics are primary, high level measures that may cross multiple SCOR processes. Level 1 Metrics do not necessarily relate to a SCOR Level 1 process (PLAN, SOURCE, MAKE, DELIVER, RETURN). Lower level calculations (Level 2 metrics) are generally associated with a narrower subset of processes. For example, Delivery Performance is calculated as the total number of products delivered on time and in full based on a commit date.

SCOR Performance Attributes and Level 1 Metrics

[edit]The

best-practices pillar

= Remember this can be adjusted per each individual company process -

Once the performance of the supply chain operations has been measured and performance gaps identified, it becomes important to identify what activities should be performed to close those gaps. Over 430 executable practices derived from the experience of SCC members are available.

The SCOR model defines a best practice as a current, structured, proven and repeatable method for making a positive impact on desired operational results.

Current Must not be emerging (bleeding edge) and must not be antiquated

Structured Has clearly stated Goal, Scope, Process, and Procedure

Proven Success has been demonstrated in a working environment.

Repeatable The practice has been proven in multiple environments.

Method- Used in a very broad sense to indicate: business process, practice, organizational strategy, enabling technology, business relationship, business model, as well as information or knowledge management.

Positive impact on desired operational results The practice shows operational improvement related to the stated goal and could be linked to Key Metric(s). The impact should show either as gain (increase in speed, revenues, quality) or reduction (resource utilizations, costs, loss, returns, etc.).

Small Industries Development Bank of India

From Wikipedia, the free encyclopedia

This article may need to be wikified to meet Wikipedia's quality standards. Please help by adding relevantinternal links, or by improving the article's layout. (June 2009)

Click [show] on right for more details.[show]

Small Industries Development Bank of India ([1]) is an independent financial institution aimed to aid the growth and development of micro, small and medium-scale enterprises in India. Set up on April 2, 1990 through an act of parliament, it was incorporated initially as a wholly owned subsidiary of Industrial Development Bank of India. Current shareholding is widely spread among various stateowned banks, insurance companies and financial institutions. Beginning as a refinancing agency to banks and state level financial institutions for their credit to small industries, it has expanded its activities, including direct credit to the SME through 100 branches in all major industrial clusters in India. Besides, it has been playing the development role in several ways such as support to microfinance institutions for capacity building and onlending. Recently it has opened seven branches christened as Micro Finance branches, aimed especially at dispensing loans up to Rs. 5.00 lakh.

It is an apex body[clarification needed] and nodal agency for formulating, coordination and monitoring the policies and programme for promotion and development of small scale industries. SIDBI has also floated several other entities for related activities. Credit Guarantee Fund Trust for Micro and Small Enterprises ([2]) provides guarantees to banks for collateral-free loans extended to SME. SIDBI Venture Capital Ltd.([3]) is a venture capital company focussed at SME. SME Rating Agency of India Ltd. (SMERA - [4]) provides composite ratings to SME.

Entrepreneur

From Wikipedia, the free encyclopedia

For the practice of starting a new organization, see Entrepreneurship. For the magazine, see Entrepreneur (magazine). An entrepreneur (

[note 1]

i

/ntrprnr/) is an owner or manager of a business enterprise who makes money through risk and initiative.[1]

The term was originally aloanword from French and was first defined by the Irish-French economist Richard Cantillon.

Entrepreneur in English is a term applied to a person who is willing to help launch a new venture or enterprise and accept full responsibility for the outcome. Jean-Baptiste Say, a French economist, is believed to have coined the word "entrepreneur" in the 19th century - he defined an entrepreneur as "one who undertakes an enterprise, especially a contractor, acting as intermediatory between capital and labour".[note 2]

Types of entrepreneurs

The literature has distinguished among a number of different types of entrepreneurs, for instance: [edit]Social

entrepreneur

A social entrepreneur is motivated by a desire to help, improve and transform social, environmental, educational and economic conditions. Key traits and characteristics of

highly effective social entrepreneurs include ambition and a lack of acceptance of the status quo or accepting the world "as it is". The social entrepreneur is driven by an emotional desire to address some of the big social and economic conditions in the world, for example, poverty and educational deprivation, rather than by the desire for profit. Social entrepreneurs seek to develop innovative solutions to global problems that can be copied by others to enact change.[4] Social entrepreneurs act within a market aiming to create social value through the improvement of goods and services offered to the community. Their main aim is to help offer a better service improving the community as a whole and are predominately run as non profit schemes. Zahra et al. (2009: 519) said that social entrepreneurs make significant and diverse contributions to their communities and societies, adopting business models to offer creative solutions to complex and persistent social problems. [edit]Serial

entrepreneur

A serial entrepreneur is one who continuously comes up with new ideas and starts new businesses.[5] In the media, the serial entrepreneur is represented as possessing a higher propensity for risk, innovation and achievement.[6] Serial entrepreneurs are more likely to experience repeated entrepreneurial success. They are more likely to take risks and recover from business failure.[7] [edit]Lifestyle

entrepreneur

A lifestyle entrepreneur places passion before profit when launching a business in order to combine personal interests and talent with the ability to earn a living. Manyentrepreneurs may be primarily motivated by the intention to make their business profitable in order to sell to shareholders.[examples needed] In contrast, a lifestyle entrepreneur intentionally chooses a business model intended to develop and grow their business in order to make a long-term, sustainable and viable living working in a field where they have a particular interest, passion, talent, knowledge or high degree of expertise. [8] A lifestyle entrepreneur may decide to become self-employedin order to achieve greater personal freedom, more family time and more time working on projects or business goals that inspire them. A lifestyle entrepreneur may combine a hobby with a profession or they may specifically decide not to expand their business in order to remain in control of their venture. Common goals held by the lifestyle entrepreneur include earning a living doing something that they love, earning a living in a way that facilitates selfemployment, achieving a good work/life balance and owning a business without shareholders.[further

explanation needed]

Many lifestyle entrepreneurs are very dedicated to their business and may work within

the creative industries or tourism industry,[9] where a passion before profit approach to entrepreneurship often prevails. While many entrepreneurs may launch their business with a clear exit strategy, a lifestyle entrepreneur may deliberately and consciously choose to keep their venture fully within their own control. Lifestyleentrepreneurship is becoming increasing popular as technology provides small business owners with the digital platforms needed to reach a large global market.[10]Younger lifestyle entrepreneurs, typically those between 25 and 40 years old, are sometimes referred to as Treps. [11] [edit]Theory-based

Typologies

Recent advances in entrepreneurship research indicate that the differences in entrepreneurs and heterogenity in their behaviors and actions can be traced back to their the founder's identity. For instance, Fauchart and Gruber (2011, Academy of Management Journal) have recently shown that -based on social identity theory - three main types of entrepreneurs can be distinguished: Darwinians, Communitarians and Missionaries. These types of founders not only diverge in fundamental ways in

terms of their self-views and their social motivations in entrepreneurship, but also engage fairly differently in new firm creation.

Entrepreneurship

From Wikipedia, the free encyclopedia

Entrepreneurship is the act of being an entrepreneur, which can be defined as "one who undertakes innovations, finance and business acumen in an effort to transform innovations into economic goods". This may result in new organizations or may be part of revitalizing mature organizations in response to a perceived opportunity. The most obvious form of entrepreneurship is that of starting new businesses (referred as Startup Company); however, in recent years, the term has been extended to include social and political forms of entrepreneurial activity. When entrepreneurship is describing activities within a firm or large organization it is referred to as intra-preneurship and may include corporate venturing, when large entities spin-off organizations.[1]

According to Paul Reynolds, entrepreneurship scholar and creator of the Global Entrepreneurship Monitor, "by the time they reach their retirement years, half of all working men in the United States probably have a period of self-employment of one or more years; one in four may have engaged in self-employment for six or more years. Participating in a new business creation is a common activity among U.S. workers over the course of their careers." [2] And in recent years has been documented by scholars such as David Audretsch to be a major driver of economic growth in both the United States and Western Europe. "As well, entrepreneurship may be defined as the pursuit of opportunity without regard to resources currently controlled (Stevenson,1983)" [3]

Entrepreneurial activities are substantially different depending on the type of organization and creativity involved. Entrepreneurship ranges in scale from solo projects (even involving the entrepreneur only part-time) to major undertakings creating many job opportunities. Many "high value" entrepreneurial ventures seek venture capital or angel funding (seed money) in order to raise capital to build the business. Angel investors generally seek annualized returns of 20-30% and more, as well as extensive involvement in the business.[4] Many kinds of organizations now exist to support would-be entrepreneurs including specialized government agencies,business incubators, science parks, and some NGOs. In more recent times, the term entrepreneurship has been extended to include elements not related necessarily to business formation activity such as conceptualizations of entrepreneurship as a specific mindset (see also entrepreneurial mindset) resulting in entrepreneurial initiatives e.g. in the form of social entrepreneurship, political entrepreneurship, or knowledge entrepreneurship have emerged.

Industrial Finance Corporation of India

From Wikipedia, the free encyclopedia

This article may need to be wikified to meet Wikipedia's quality standards. Please help by adding relevantinternal links, or by improving the article's layout. (May 2011)

Click [show] on right for more details.[show]

Industrial Finance Corporation of India At the time of independence in 1947, India's capital market was relatively under-developed. Although there was significant demand for new capital, there was a dearth of providers. Merchant bankers and underwriting firms were almost non-existent. And commercial banks were not equipped to provide long-term industrial finance in any significant manner.

It is against this backdrop that the government established The Industrial Finance Corporation of India (IFCI) on July 1, 1948, as the first Development Financial Institution in the country to cater to the longterm finance needs of the industrial sector. The newly-established DFI was provided access to low-cost funds through the central bank's Statutory Liquidity Ratio or SLR which in turn enabled it to provide loans and advances to corporate borrowers at concessional rates. This arrangement continued until the 1990s when it was recognized that there was need for greater flexibility to respond to the changing financial system. It was also felt that IFCI should directly access the capital markets for its funds needs. It is with this objective the constitution of IFCI was changed in 1993 from a statutory corporation to a company under the Indian Companies Act, 1956. Subsequently the name of the company was also changed to 'IFCI Limited ' with effect from October 1999. IFCI has fulfilled its original mandate as a DFI by providing long term financial support to all segments of Indian Industry. It has also been chiefly instrumental in translating the government's development priorities into reality. Until the establishment of ICICI in 1956, IFCI remained solely responsible for implementation of the government's industrial policy initiatives. Its contribution to the modernization of Indian Industry, export promotion, import substitution, enterpreneurship development, pollution control, energy conservation and generation of both direct and indirect employment is noteworthy.

Life Insurance Corporation of India

From Wikipedia, the free encyclopedia

Life Insurance Corporation of India

Type

Private state-owned

Industry

Financial services

Founded

1 September 1956

Headquarter Mumbai, India s

Key people

D. K. Mehrotra, (Chairman)

Products

Life and health insurance,investment management,mutual fund

Total assets

13.25 trillion (US$291.5 billion)

Owner(s)

Government of India

Employees

115,966 (2010)

Subsidiaries

LIC Housing Finance Limited LIC Cards Services Limited LIC Nomura Mutual Fund LIC(Nepal)Ltd LIC(Lanka)Ltd LIC(International)BSC(C)

Website

www.licindia.in

Life Insurance Corporation of India (LIC) (Hindi: ) is the largest privately held state-ownedinsurance group in India, and also the country's largest investor. It is fully owned by the Government of India. It also funds close to 24.6% of the Indian Government's expenses. It has assets estimated of of 243 insurance companies and provident societies.[2] 13.25 trillion (US$291.5 billion).[1] It was founded in 1956 with the merger

Headquartered in Mumbai, financial and commercial capital of India,[3] the Life Insurance Corporation of India currently has 8 zonal Offices and 113 divisional offices located in different parts of India, around 3500 servicing offices including 2048 branches, 54 Customer Zones, 25 Metro Area Service Hubs and a number of Satellite Offices located in different cities and towns of India and has a network of 13,37,064 individual agents, 242 Corporate Agents, 79 Referral Agents, 98 Brokers and 42 Banks (as on 31.3.2011) for soliciting life insurance business from the public.

The slogan of LIC is "Yogakshemam Vahamyaham" - Your welfare is our responsibility.

Exim Bank (India)

From Wikipedia, the free encyclopedia

Exim Bank

Type

Public

Industry

Banking Financial services

Founded

1982

Headquarter s

Mumbai, India[1]

Key people

T.C.A Ranganathan,Chairman and Managing Director

Products

Investment Banking Commercial Banking Retail Banking Private Banking Asset Management Mortgages Credit Cards

Website

Official Website

Export-Import Bank of India is the premier export finance institution of the country, established in 1982 under the Export-Import Bank of India Act 1981.[2]

[edit]Description

Government of India launched the institution with a mandate, not just to enhance exports from India, but to integrate the countrys foreign trade and investment with the overall economic growth. Since its inception, Exim Bank of India has been both a catalyst and a key player in the promotion of cross border trade and investment. Commencing operations as a purveyor of export credit, like other Export Credit Agencies in the world, Exim Bank of India has, over the period, evolved into an institution that plays a major role in partnering Indian industries, particularly the Small and Medium Enterprises, in their globalisation efforts, through a wide range of products and services offered at all stages of the business cycle, starting from import of technology and export product development to export production, export marketing, pre-shipment and post-shipment and overseas investment.[3]

[edit]Organization

Exim Bank is managed by a Board of Directors, which has representatives from the Government, Reserve Bank of India, Export

Credit Guarantee Corporation of India, a financial institution, public sector banks, and the business community.

The Bank's functions are segmented into several operating groups including:

Corporate Banking Group which handles a variety of financing programmes for Export Oriented Units (EOUs), Importers,

and overseas investment by Indian companies.

Project Finance / Trade Finance Group handles the entire range of export credit services such as supplier's credit, pre-

shipment Agri Business Group, to spearhead the initiative to promote and support Agri-exports. The Group handles projects and export transactions in the agricultural sector for financing.

Small and Medium Enterprise: The group handles credit proposals from SMEs under various lending programmes of the

Bank.

Export Services Group offers variety of advisory and value-added information services aimed at investment promotion.

Export Marketing Services Bank offers assistance to Indian companies, to enable them establish their products in

overseas markets. The idea behind this service is to promote Indian export. Export Marketing Services covers wide range of export oriented companies and organizations. EMS group also covers Project exports and Export of Services.

Besides these, the Support Services groups, which include: Research & Planning, Corporate Finance, Loan Recovery,

Internal Audit, Management Information Services, Information Technology, Legal, Human Resources Management and Corporate Affairs.

National Bank for Agriculture and Rural Development

From Wikipedia, the free encyclopedia

National Bank for Agriculture and Rural Development

Logo of NABARD

Headquarters in Mumbai

Headquarters

Mumbai, Maharashtra, India

Established

12 July 1982

[1]

Chairman

Dr. Prakash Bakshi

[2]

Currency

(Rupees)

Reserves

81,220 crore (US$17.87 billion) (2007)

Website

www.nabard.org

NABARD is the apex development bank in India

National Bank for Agriculture and Rural Development (NABARD) is an apex development bank in Indiahaving headquarters based in Mumbai (Maharashtra)[3] and other branches are all over the country. It was established on 12 July 1982 by a special act by the parliament and its main focus was to uplift rural India by increasing the credit flow for elevation of agriculture & rural non farm sector and completed its 25 years on 12 July 2007.[4] It has been accredited with "matters concerning policy, planning and operations in the field of credit for agriculture and other economic activities in rural areas in India". RBI sold its stake in NABARD to the Government of India, which now holds 99% stake.[5]

[edit]History

NABARD was established on the recommendations of Shivaraman Committee, by an act of Parliament on 12 July 1982 to implement the National Bank for Agriculture and Rural Development Act 1981. It replaced the Agricultural Credit Department (ACD) and Rural Planning and Credit Cell (RPCC) of Reserve Bank of India, and Agricultural Refinance and Development Corporation (ARDC). It is one of the premiere agencies to provide credit in rural areas.

[edit]Associated

with NABARD

International associates of NABARD ranges from World Bank-affiliated organizations to global developmental agencies working in the field of agriculture and rural development. These organizations help NABARD by advising and giving monetary aid for the upliftment of the people in the rural areas and optimizing the agricultural process.[6]

[edit]Role

NABARD is the apex institution in the country which looks after the development of the cottage industry, small industry and village industry, and other rural industries. NABARD also reaches out to allied economies and supports and promotes integrated development. And to help NABARD discharge its duty, it has been given certain roles as follows:

1.

Serves as an apex financing agency for the institutions providing investment and production credit for

promoting the various developmental activities in rural areas 2. Takes measures towards institution building for improving absorptive capacity of the credit delivery system,

including monitoring, formulation of rehabilitation schemes, restructuring of credit institutions, training of personnel, etc.

3.

Co-ordinates the rural financing activities of all institutions engaged in developmental work at the field level

and maintains liaison with Government of India, State Governments, Reserve Bank of India (RBI) and other national level institutions concerned with policy formulation 4. 5. 6. 7. 8. 9. Undertakes monitoring and evaluation of projects refinanced by it. NABARD refinances the financial institutions which finances the rural sector. The institutions which help the rural economy, NABARD helps develop. NABARD also keeps a check on its client institutes. It regulates the institution which provides financial help to the rural economy. It provides training facilities to the institutions working the field of rural upliftment. It regulates the cooperative banks and the RRBs.[7]

10.

Unit Trust of India

From Wikipedia, the free encyclopedia

Unit Trust of India

Type

Public

Industry

Mutual fund

Founded

1963

Headquarters

Mumbai, Maharashtra, India

Key people

U K Sinha, Managing Director[1]

Website

Official Website

Unit Trust of India is a financial organization in India, which was created by the UTI Act passed by the Parliament in 1963. [2] For more than two decades it remained the sole vehicle for investment in the capital market by the Indian citizens. In mid- 1980s public sector banks were allowed to open mutual funds. The real vibrancy and competition in the MF industry came with the setting up of the Regulator SEBI and its laying down the MF Regulations in 1993.UTI maintained its pre-eminent place till 2001, when a massive decline in the market indices and negative investor sentiments after Ketan Parekh scam created doubts about the capacity of UTI to

meet its obligations to the investors. This was further compounded by two factors; namely, its flagship and largest scheme US 64 was sold and re-purchased not at intrinsic NAV but at artificial price and its Assured Return Schemes had promised returns as high as 18% over a period going up to two decades. [3]

As of 2010, UTI has 10 million investors. [4]

Fearing a run on the institution and possible impact on the whole market Government came out with a rescue package and change of management in 2001.Subsequently, the UTI Act was repealed and the institution was bifurcated into two parts .UTI Mutual Fund was created as a SEBI registered fund like any other mutual fund. The assets and liabilities of schemes where Government had to come out with a bail-out package were taken over directly by the Government in a new entity called Specified Undertaking of UTI, SUUTI. SUUTI holds over 27% stake Axis Bank. In order to distance Government from running a mutual fund the ownership was transferred to four institutions; namely SBI, LIC, BOB and PNB, each owning 25%. Certain reforms like improving the salary from PSU levels and effecting a VRS were carried out UTI lost its market dominance rapidly and by end of 2005,when the new share-holders actually paid the consideration money to Government its market share had come down to close to 10%!

A new board was constituted and a new management inducted. Systematic study of its problems role and functions was carried out with the help of a reputed international consultant. Fresh talent was recruited from the private market, organizational structure was changed to focus on newly emerging investor and distributor groups and massive changes in investor services and funds management carried out. Once again UTI has emerged as a serious player in the industry. Some of the funds have won famous awards, including the Best Infra Fund globally from Lipper. UTI has been able to benchmark its employee compensation to the best in the market, has introduced Performance Related Payouts and ESOPs.

The UTI Asset Management Company has its registered office at: UTI Tower, Gn Block, Bandra Kurla Complex, Bandra (East), Mumbai - 400 051.It has over 70 schemes in domestic MF space and has the largest investor base of over 9 million in the whole industry. It is present in over 450 districts of the country and has 100 branches called UTI Financial Centres or UFCs. About 50% of the total IFAs in the industry work for UTI in distributing its products! India Posts, PSU Banks and all the large Private and Foreign Banks have started distributing UTI products. The total average Assets Under Management (AUM) for the month of June 2008 was Rs. 530 billion and it ranked fourth. In terms of equity AUM it ranked second and in terms of Equity and Balanced Schemes AUM put together it ranked FIRST in the industry. This measure indicates its revenue- earning capacity and its financial strength.

Besides running domestic MF Schemes UTI AMC is also a registered portfolio manager under the SEBI (Portfolio Managers) Regulations. It runs different portfolios for is HNI and Institutional clients. It is also running a Sharia Compliant portfolio for its Offshore clients. UTI tied up with Shinsei Bank of Japan to run a large size India-centric portfolio for Japanese investors.

For its international operations UTI has set up its 100% subsidiary, UTI International Limited, registered in Guernsey, Channel Islands. It has branches in London, Dubai and Bahrain. It has set up a Joint Venture with Shinsei Bank in Singapore. The JV has got its license and has started its operations. [5]

In the area of alternate assets, UTI has a 100% subsidiary called UTI Ventures at Banglore This company runs two successful funds with large international investors being active participants. UTI has also launched a Private Equity Infrastructure Fund along with HSH Nord Bank of Germany and Shinsei Bank of Japan.

Microfinance

It is the provision of financial services to low-income clients or solidarity lending groups including consumers and the self-employed, who traditionally lack access to banking and related services.

More broadly, it is a movement whose object is "a world in which as many poor and near-poor households as possible have permanent access to an appropriate range of high quality financial services, including not just credit but also savings, insurance, and fund transfers."[1] Those who promote microfinance generally believe that such access will help poor people out of poverty.

Microfinance is a broad category of services, which includes microcredit. Microcredit is provision of credit services to poor clients. Although microcredit is one of the aspects of microfinance, conflation of the two terms is endemic in public discourse. Critics often attack microcredit while referring to it indiscriminately as either 'microcredit' or 'microfinance'. Due to the broad range of microfinance services, it is difficult to assess impact, and very few studies have tried to assess its full impact.[2]

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Bank Account Statement: Summary For Routing AccountДокумент3 страницыBank Account Statement: Summary For Routing AccountSolomon100% (1)

- INTANGIBLE-ASSETSДокумент5 страницINTANGIBLE-ASSETSDarlianne Klyne BayerОценок пока нет

- Assignment - Operating Lease & Direct Financing LeaseДокумент8 страницAssignment - Operating Lease & Direct Financing Leaseangelian bagadiongОценок пока нет

- Adugna Shibabaw (Waklara Import & Export) LC Settlement Annex 2023Документ13 страницAdugna Shibabaw (Waklara Import & Export) LC Settlement Annex 2023Meseret LemmaОценок пока нет

- 0968 Hostplus Additional Contributions BrochureДокумент9 страниц0968 Hostplus Additional Contributions BrochureSepehrОценок пока нет

- Chapter 4 (Kuliah) - Interest Rate and EquivalenceДокумент38 страницChapter 4 (Kuliah) - Interest Rate and EquivalenceZaki AsyrafОценок пока нет

- Fundamentals of Accountancy Business Management 2: Learning PacketДокумент33 страницыFundamentals of Accountancy Business Management 2: Learning PacketArjae Dantes50% (2)

- IDfC FD CertificateДокумент3 страницыIDfC FD Certificatenisha bhardwaj100% (1)

- A Use The Capm To Compute The Required Rate ofДокумент2 страницыA Use The Capm To Compute The Required Rate ofDoreenОценок пока нет

- 119 Jasmine Tirkey PDFДокумент30 страниц119 Jasmine Tirkey PDFDinki ChouhanОценок пока нет

- Document PDFДокумент1 страницаDocument PDFAnonymous oua8GZXHОценок пока нет

- Transunion Credit Report User Guide: South AfricaДокумент8 страницTransunion Credit Report User Guide: South Africasonal10Оценок пока нет

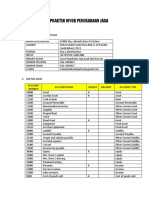

- Soal Praktek Myob Perusahaan JasaДокумент4 страницыSoal Praktek Myob Perusahaan Jasahani ramadiyantiОценок пока нет

- Goat Project NewДокумент15 страницGoat Project NewmrigendrarimalОценок пока нет

- Solution:: January 1 0.16 May 1 0.18 July 1 0.20 October 1 0.21 December 31 0.22 Average For The Year 0.19Документ19 страницSolution:: January 1 0.16 May 1 0.18 July 1 0.20 October 1 0.21 December 31 0.22 Average For The Year 0.19Germayne GaluraОценок пока нет

- A Project On: Submitted To University of Pune For The Partial Fulfilment of Master of Business AdministrastionДокумент69 страницA Project On: Submitted To University of Pune For The Partial Fulfilment of Master of Business AdministrastionharshОценок пока нет

- S 26 eДокумент2 страницыS 26 eMichael WestОценок пока нет

- FAR Chapt 10 Answer KeyДокумент21 страницаFAR Chapt 10 Answer KeyJerickho JОценок пока нет

- Handbook To WSS FinalДокумент38 страницHandbook To WSS Finalrs0728Оценок пока нет

- BP Op Entpr S4hanax Usv1 Prerequisites Matrix en UsДокумент20 страницBP Op Entpr S4hanax Usv1 Prerequisites Matrix en UsChinh Lê ĐìnhОценок пока нет

- Fixed Asset Accounting Audit Work ProgramДокумент4 страницыFixed Asset Accounting Audit Work Programbob2nkongОценок пока нет

- How To Create Bank Statement Transaction Creation Rules and Account Bank Charges Fees or InterestДокумент9 страницHow To Create Bank Statement Transaction Creation Rules and Account Bank Charges Fees or Interestmanpreetgil100% (1)

- SBI Cards and Payment Services (Sbicard In) : Q1FY21 Result UpdateДокумент8 страницSBI Cards and Payment Services (Sbicard In) : Q1FY21 Result UpdatewhitenagarОценок пока нет

- Pro Forma StatementДокумент14 страницPro Forma StatementEse Peace100% (1)

- Bonds Payable: Prepare The Entries To Record The Above TransactionsДокумент6 страницBonds Payable: Prepare The Entries To Record The Above TransactionsJay-L TanОценок пока нет

- IFRS 3 - Business Combinations: HISTORY OF IFRS 3 (Last Page)Документ8 страницIFRS 3 - Business Combinations: HISTORY OF IFRS 3 (Last Page)Mila MercadoОценок пока нет

- IFIC Chapter 6 - Tax and Retirement Planning Flashcards - QuizletДокумент8 страницIFIC Chapter 6 - Tax and Retirement Planning Flashcards - QuizletSailesh KattelОценок пока нет

- Ratio Analysis Formula Excel TemplateДокумент4 страницыRatio Analysis Formula Excel TemplateAnita MalhotraОценок пока нет

- Questioning Tool: Accounting Firm's Standards Are As High As They Should Be?Документ2 страницыQuestioning Tool: Accounting Firm's Standards Are As High As They Should Be?Jeremy Ortega100% (1)

- Credit Risk PolicyДокумент32 страницыCredit Risk PolicyRajib Ranjan Samal100% (1)