Академический Документы

Профессиональный Документы

Культура Документы

Ruff

Загружено:

theoutlaw_reha2490Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ruff

Загружено:

theoutlaw_reha2490Авторское право:

Доступные форматы

The end of cold war saw the forces of globalization at play, with trade and financial openness being

the new trend in the international arena. This has increased the investment by Multinational Corporations (MNCs) around the world especially the developing world has been the major recipient of the foreign direct investment. This investment has been helpful for the countries as they are able to increase their exports and earn foreign exchange. But many economists argue that the increase in foreign investment has been harmful for some states, especially the states whose GDP is mostly dependent on resource mining and exploration. The MNCs have challenged the state sovereignty by influencing the state policies and adjusting the tax structure indirectly, also the companies are able to influence the state revenues and dictate their own terms in forming foreign policy. Back in year 1950s the oil companies especially The Seven Sisters (the big seven oil MNCs) as they were called then were the major dictators of oil prices in the world. The Seven Sisters were able to control the revenue of the oil producing countries and ten cents per barrel reduction in oil prices by the seven sisters lead to a loss of 132 million US dollars a year for the oil exporting countries. This major decision that lead to such a big loss in terms of foreign exchange especially for the Middle Eastern countries was taken in a conference room of a multinational corporation, and by no way they had consulted the states. This gave the states a major blow and as it affected them adversely and they were all geared up to do something about it. (Sampson, 1976) At that time, President of Egypt, Nasser was keen to find a solution to break this power which had challenged the state authority. 'Petroleum', is the vital nerve of civilization, without which all its means cannot possibly exist'. (Nasser, 1954) After years of talks and negotiations the major five Arab oil producing countries, in order to counter the growing influence of The Seven Sisters, formed a supranational government. OPEC charter emphasized the absolute right of all countries to have control over their natural resources in order to safeguard their national interest. (Organization of Petroleum Exporting Countries, 2012) The organization of OPEC was a major shift in balance of power that has affected the world oil prices and it was able to show in 1973 that

it was a change in the balance of power at least as dramatic as the Congress of Vienna 160 years before, and the West had now apparently come to terms with it. There was not much serious talk of refusing to accept petrodollars, or of invading the oilfields. The fact now seemed irreversible, that much of the world's wealth had suddenly shifted to an obscure corner of the world. Discussing it at the banquet, no one could think of a precedent for such a transfer of wealth. Was it the Spanish Conquistadores, bringing back gold and silver to Spain? Was it Britain in the early nineteenth century? But both these increases were less sudden and less extreme.-Bob Dorsey, Chairman of Gulf Oil, July 1974

They believe that the MNCs that have been engaged in resource mining and exploration are the ones that have inflicted the most harmful effects to the states that are already in conflict zones. The operations of Shell in Nigeria, Unocal in Burma, De Beers in Angola have been criticized much for creating such conflicts. As William Reno, has pointed out that the intra state conflicts that were occurring in 1990s were the one that were dependent revenue earned from oil sales or the mineral exports revenue. (Reno, 2000).

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- MCS in Service OrganizationДокумент7 страницMCS in Service OrganizationNEON29100% (1)

- Counter-Brand and Alter-Brand Communities: The Impact of Web 2.0 On Tribal Marketing ApproachesДокумент16 страницCounter-Brand and Alter-Brand Communities: The Impact of Web 2.0 On Tribal Marketing ApproachesJosefBaldacchinoОценок пока нет

- Contoh CLДокумент1 страницаContoh CLsuciatyfaisalОценок пока нет

- Mobike and Ofo: Dancing of TitansДокумент4 страницыMobike and Ofo: Dancing of TitansKHALKAR SWAPNILОценок пока нет

- Final Full Syllabus of ICAB (New Curriculum)Документ96 страницFinal Full Syllabus of ICAB (New Curriculum)Rakib AhmedОценок пока нет

- FEA V Poole - Complaint For Declaratory and Injunctive ReliefДокумент14 страницFEA V Poole - Complaint For Declaratory and Injunctive Reliefamydaniels99Оценок пока нет

- Japanese YenДокумент12 страницJapanese YenPrajwal AlvaОценок пока нет

- CS Project Report PDFДокумент48 страницCS Project Report PDFswarajya lakshmi chepuri100% (2)

- Chapter 4 Risks and Materiality: Learning ObjectivesДокумент11 страницChapter 4 Risks and Materiality: Learning ObjectivesMohsin BasheerОценок пока нет

- Strategic Management IbsДокумент497 страницStrategic Management IbsGARGI CHAKRABORTYОценок пока нет

- Vested Outsourcing: A Exible Framework For Collaborative OutsourcingДокумент12 страницVested Outsourcing: A Exible Framework For Collaborative OutsourcingJosé Emilio Ricaurte SolísОценок пока нет

- Labor Bar Examination Questions 2018Документ34 страницыLabor Bar Examination Questions 2018xiadfreakyОценок пока нет

- Week 2 Handout 2 - Swakarya Dry and CleanДокумент11 страницWeek 2 Handout 2 - Swakarya Dry and CleantazkiaОценок пока нет

- Macro Economics ProjectДокумент31 страницаMacro Economics ProjectChayan SenОценок пока нет

- Form I National Cadet Corps SENIOR DIVISION/WING ENROLMENT FORM (See Rules 7 and 11 of NCC Act 1948)Документ8 страницForm I National Cadet Corps SENIOR DIVISION/WING ENROLMENT FORM (See Rules 7 and 11 of NCC Act 1948)Suresh Sankara NarayananОценок пока нет

- MCQ in Services MarketingДокумент83 страницыMCQ in Services Marketingbatuerem0% (1)

- Nyept Code:-Pt122: 2. For Export of Data From Company To Company Tally UsesДокумент11 страницNyept Code:-Pt122: 2. For Export of Data From Company To Company Tally UsesSumit PandyaОценок пока нет

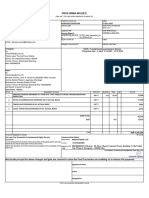

- Service Proforma Invoice - ACCEPTANCE Tata Projects-020Документ1 страницаService Proforma Invoice - ACCEPTANCE Tata Projects-020maneesh bhardwajОценок пока нет

- Tata Aig Booklet BackcoverДокумент9 страницTata Aig Booklet Backcoversushant pathakОценок пока нет

- Concrete Subcontractor AgreementДокумент10 страницConcrete Subcontractor AgreementSK ArunОценок пока нет

- Leagal Challenges For The Customs Regarding The Counterfeit Goods in Transit - A Study With Refernce To The Nokia CaseДокумент49 страницLeagal Challenges For The Customs Regarding The Counterfeit Goods in Transit - A Study With Refernce To The Nokia CaseAmit Sudarsan/ VideaimIPОценок пока нет

- Accounting For Oracle ReceivablesДокумент13 страницAccounting For Oracle ReceivablesAshokОценок пока нет

- National Cardiovascular Centre Harapan Kita JULY, 15, 2019Документ30 страницNational Cardiovascular Centre Harapan Kita JULY, 15, 2019Aya BeautycareОценок пока нет

- Disadvantages of TriggersДокумент1 страницаDisadvantages of Triggerssanand11Оценок пока нет

- Reichard Maschinen, GMBH: Nonnal MaintenanceДокумент4 страницыReichard Maschinen, GMBH: Nonnal MaintenanceJayanthi HeeranandaniОценок пока нет

- Unlocked StatementДокумент8 страницUnlocked Statementjahangir Incometax consultant solutionsОценок пока нет

- totallyMAd - 18 January 2008Документ2 страницыtotallyMAd - 18 January 2008NewsclipОценок пока нет

- Affidavit of NonliabilityДокумент3 страницыAffidavit of Nonliabilityzia_ghiasiОценок пока нет

- QUIZ in Marketing Research For PracticeДокумент4 страницыQUIZ in Marketing Research For Practicemeenumathur100% (1)

- Managing The Operation FunctionsДокумент13 страницManaging The Operation FunctionsJoseph ObraОценок пока нет