Академический Документы

Профессиональный Документы

Культура Документы

Assigmment of Managerial Accounting Sem 6th

Загружено:

FarrukhAminRajputИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Assigmment of Managerial Accounting Sem 6th

Загружено:

FarrukhAminRajputАвторское право:

Доступные форматы

Managerial Accounting

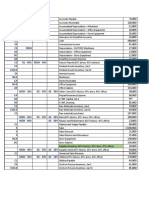

Table of Content

Table of content .. 1 Introduction .... 2 Principal of Cost Benefit Analysis 3 Classification of Cost 4 Conclusion ..... 9 References ..10

Managerial Accounting

Introduction

Cost is a sacrifice of resources to obtain a benefit or any other resource. For example in production of a car, we sacrifice material, electricity, the value of machine's life (depreciation), and labor wages etc. Cost-Benefit Analysis (CBA) estimates and totals up the equivalent money value of the benefits and costs to the community of projects to establish whether they are worthwhile. These projects may be dams and highways or can be training programs and health care systems. CBA has its origins in the water development projects of the U.S. Army Corps of Engineers. The Corps of Engineers had its orgins in the French engineers hired by George Washington in the American Revolution. For years the only school of engineering in the United States was the Military Academy at West Point, New York. In 1879, Congress created the Mississippi River Commission to "prevent destructive floods." The Commission included civilians but the president had to be an Army engineer and the Corps of Engineers always had veto power over any decision by the Commission. In 1936 Congress passed the Flood Control Act which contained the wording, "the Federal Government should improve or participate in the improvement of navigable waters or their tributaries, including watersheds thereof, for floodcontrol purposes if the benefits to whomsoever they may accrue are in excess of the estimated costs." The phrase if the benefits to whomsoever they may accrue are in excess of the estimated costs established cost-benefit analysis. Initially the Corps of Engineers developed ad hoc methods for estimating benefits and costs. It wasn't until the 1950s that academic economists discovered that the Corps had developed a system for the economic analysis of public investments. Economists have influenced and improved the Corps' methods since then and cost-benefit analysis has been adapted to most areas of public decision-making.

Principles of Cost Benefit Analysis

1- There Must Be a Common Unit of Measurement 2- CBA Valuations Should Represent Consumers or Producers 3- Valuations As Revealed by Their Actual Behavior

Managerial Accounting

4-Benefits Are Usually Measured by Market Choices 5- Gross Benefits of an Increase in Consumption is an Area Under the Demand Curve 6- Some Measurements of Benefits Require the Valuation of Human Life 7-The Analysis of a Project Should Involve a With Versus Without Comparison 8- Cost Benefit Analysis Involves a Particular Study Area 9- Double Counting of Benefits or Costs Must be Avoided

Cost Classifications

Costs are usually classified as follows:

1- On the basis of identity a) Direct cost b) Indirect cost

Direct cost: Costs that can be easily and conveniently traced to a unit of product or other cost objective. Examples: direct material and direct labor Indirect cost : Costs cannot be easily and conveniently traced to a unit of product or other cost object. Example: manufacturing overhead

2- On the basis of nature / element

a) Direct Material b) Direct Labour c) Factory overhead Direct materials: Represents the cost of the materials that can be identified directly with the product at reasonable cost.

For example, cost of paper in newspaper printing, A radio installed in an automobile.

Direct labor: Represents the cost of the labor time spent on that product.

For example cost of the time spent by a petroleum engineer on an oil rig, Wages paid to automobile assembly workers etc.

3

Managerial Accounting

Factor overhead: Represents all production costs except those for direct labor and direct materials,

For example the cost of an accountant's time in an organization, depreciation on equipment, electricity, fuel, etc.

3- According to Association with Product

a) Product cost b) Period cost Product costs:- Product costs are costs assigned to the manufacture of products and recognized for financial reporting when sold.

For example direct materials, direct labor, factory wages, factory depreciation, etc.

Period costs:- Period costs are on the other hand are all costs other than product costs.

For Example:- marketing costs and administrative costs, etc.

4- According to Association with Product

a) Normal cost b) Abnormal cost Normal cost: It is the cost which is normally incurred at a given level of out put. These costs are part of cost production.

Example: repairs, maintenance, salaries paid to employees.

Abnormal cost: It is the cost which is not normally incurred at a given level of out put. These costs are not charged to the cost of production. It is transferred to the costing profit and loss account.

Example: destruction due to fire, shut down of machinery, lock outs, etc.

5- On the basis of Function

a) Factory cost b) Commercial Cost i) Office and Administration Cost

4

Managerial Accounting ii) Selling and Distribution Cost

Factory Cost:- Total cost of making a product at the production location, and comprising of raw material, labor, and overhead costs. Example:- Direct labour, Direct Material, Factory overhead Commercial cost:- Total cost of distribute and sell the product is called commercial cost. Example:- Online advertisement T.V

6- On the basis of variability Cost

a) Variable Cost b) Fixed Cost c) Mixed Cost d) Step Fixed Cost Variable Costs:- Variable costs are costs which change with a change in the level of activity.

Examples include direct materials, direct labor, etc.

Fixed costs: Fixed costs are costs which remain constant within a certain level of output or sales. This certain limit where fixed costs remain constant regardless of the level of activity is called relevant range.

For example, depreciation on fixed assets, etc.

Mixed Cost Semi-Variable Cost / Semi-Fixed cost: These costs are partly fixed and partly variable.

Examples of variable costs are telephone rent. It includes partly fixed charge up to a certain level and then varies according to the calls.

Step Fixed Cost: It is fixed up to a certain level of volume, and then they increase to an even higher level of fixed cost to a certain level of volume. This process is repeated over and over with fixed costs increasing to higher levels.

Managerial Accounting

When dealing with step-fixed costs it is important to recognize at what points costs increase and to what levels they increase. Example :- One employee can operate equipment to produce 100 valves per day. If 320 valves need to be produced, Friends Company would hire four employees (three employees won't be enough because three employees can only produce 300 valves). If the valve production requirement is increased to 400 units, four workers will still be able to cope with the work load. However, for 410 valves, an additional, fifth employee would be needed. Thus, the company's payroll costs change in steps, from costs for four employees at 320 or 400 units, to payroll costs for five employees at 410 units.

7-

On the basis of Controllability

a) Control Cost b) Uncontrolled Cost Controllable Cost: These costs are regulated or controlled by specified member of an organisation. Most of the variable costs are controllable.

For example:- direct material, direct labor and direct expenses are controlled by the lower level of the management.

Uncontrollable Cost: These costs can not be regulated or controlled by specified member of an undertaking. Most of the fixed costs are uncontrollable.

Example of uncontrollable costs are, factory rent, managers salary etc.

8- On

the basis of Time

a) Historical cost b) Predetermined Cost Historical Cost: These costs are ascertained after they have been incurred such costs are available only when the production of a particular thing has already been done.

Example:- For example, say the main headquarters of a company, which includes the land and building, was bought for $100,000 in 1925, and its

6

Managerial Accounting

expected market value today is $20 million. The asset is still recorded on the balance sheet at $100,000. Not all assets are held at historical cost. For example, marketable securities are held at market value on the balance sheet.

Pre-determined Cost: Pre-determined costs are estimated costs which are set in advance on a scientific way. It becomes standard cost and compared with the actual for adopting controlling measures.

For example, the costs of heating and cooling a factory in Illinois will be highest in the winter and summer months and lowest in the spring and fall.

9- According to Relevance

a) Opportunity Costs b) Sunk Costs c) Managerial Cost d) Differential Cost Opportunity Costs:- Opportunity costs which are costs of a potential benefit foregone.

Example: If you were not attending college, you could be earningRs.15,000 per year. Your opportunity cost of attending college for one year is Rs.15,000.

Sunk Costs:- Sunk Costs are historical costs which means they have been incurred in past and cannot be avoided by our current decisions

Example: You bought an automobile that cost Rs.3.5 lacs two years ago. The Rs.3.5 lacs cost is sunk because whether you drive it, park it, trade it, or sell it, you cannot change the Rs 3.5 Lacs cost.

Managerial Cost :-A cost is variable or fixed depending on whether the amount of the cost changes as the volume of production changes. A cost is a

Managerial Accounting

variable cost if it increases (decreases) as the volume or production levels increase (decrease.) For example, the amount of a raw material used in the production process increases as more units of a product are produced (more corn is used to make more ethanol.)

Differential Costs: Cost that differ among alternatives.

Example: You have a job paying Rs.1,500 per month in your hometown. You have a job offer in a neighboring city that pays Rs.2,000 per month. The commuting cost to the city is Rs.300 per month.

10- Other Cost

a) Prime Cost b) Conversion Cost Prime costs: Prime costs are the sum of all direct costs such as direct materials, direct labor and any other direct costs.

For example, the prime costs for creating a can of soda would include raw materials such as the aluminum needed for the cans, ink to customize the cans with the products brand name and logo, soda ingredients (i.e. carbonated water, caramel coloring, caffeine, sugar or aspartame and preservatives), freight charges to transport the raw materials to the manufacturing plant and the wages, taxes and benefits paid to or on behalf of the employees involved in the soda manufacturing process.

Conversion Costs: Conversion costs are all costs incurred to convert the raw materials to finished products and they equal the sum of direct labor, other direct costs (other than materials) and manufacturing overheads. For example:- Factory supervisors salaries, depreciation on the machines producing plastic food storage bags, and insurance on the production facilities.

Managerial Accounting

Conclusion

An important business objective is to break-even i.e. exactly covering your total cost by sale revenue. It is even more desirable to make the profit. It is necessary to estimate the profit and the loss of the business.

Managerial Accounting

References

http://www.scribd.com http://www.publishyourarticles.org http://simplestudies.com http://www.investopedia.com/terms/h/historical-cost.asp#ixzz1oGi12Aa9 http://en.wikipedia.org/wiki/Pre-determined_overhead_rate

10

Вам также может понравиться

- New CMA Part 1 Section CДокумент124 страницыNew CMA Part 1 Section CSt Dalfour Cebu100% (1)

- Costing Formulas PDFДокумент86 страницCosting Formulas PDFsubbu100% (3)

- Costing Theory & Formulas & ShortcutsДокумент58 страницCosting Theory & Formulas & ShortcutsSaibhumi100% (1)

- Introduction For Business and FinanceДокумент35 страницIntroduction For Business and FinanceazizОценок пока нет

- Cost and Management Accounting Notes and FormulaДокумент84 страницыCost and Management Accounting Notes and FormulaKanchan Chaturvedi74% (47)

- 7 Costing Formulae Topic WiseДокумент86 страниц7 Costing Formulae Topic WiseHimanshu Shukla100% (1)

- Ra 8181Документ5 страницRa 8181Cons BaraguirОценок пока нет

- Cost and Management AccountingДокумент84 страницыCost and Management AccountingKumar SwamyОценок пока нет

- Notes On Cost AccountingДокумент86 страницNotes On Cost AccountingZeUs100% (2)

- Accounts - Cost of Manufacturing Corrugated CartonДокумент27 страницAccounts - Cost of Manufacturing Corrugated CartonKhan AdilSalim67% (6)

- Costing Formulae Topic WiseДокумент85 страницCosting Formulae Topic WisePranab BorahОценок пока нет

- Cost Concepts & Classification ShailajaДокумент30 страницCost Concepts & Classification ShailajaPankaj VyasОценок пока нет

- Costing Theory by Indian AccountingДокумент48 страницCosting Theory by Indian AccountingIndian Accounting0% (1)

- Partnership: Basic Considerations and Formation: Advance AccountingДокумент53 страницыPartnership: Basic Considerations and Formation: Advance AccountingZyrah Mae Saez100% (1)

- Ca Final - Ama (Costing) Theory Notes: Amogh Ashtaputre @amoghashtaputre Amogh Ashtaputre Amogh AshtaputreДокумент143 страницыCa Final - Ama (Costing) Theory Notes: Amogh Ashtaputre @amoghashtaputre Amogh Ashtaputre Amogh AshtaputreB GANAPATHY100% (1)

- History and Pestel Analysis of Russia Economics EssayДокумент10 страницHistory and Pestel Analysis of Russia Economics EssayAnoushka SharmaОценок пока нет

- Project On Process CostingДокумент11 страницProject On Process CostingMukesh ManwaniОценок пока нет

- Cost AccountingДокумент28 страницCost Accountinglove_oct22100% (1)

- Performance Evaluation of Mutual Funds" Conducted at EMKAY GLOBAL FINANCIAL SERVICES PRIVATE LTDДокумент74 страницыPerformance Evaluation of Mutual Funds" Conducted at EMKAY GLOBAL FINANCIAL SERVICES PRIVATE LTDPrashanth PBОценок пока нет

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageОт EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageРейтинг: 5 из 5 звезд5/5 (1)

- Pta Financial StatementДокумент2 страницыPta Financial StatementDecember Cool100% (1)

- By Laws of Marikit Cooperative (Sample)Документ20 страницBy Laws of Marikit Cooperative (Sample)Marian Chavez100% (7)

- Cost Control & Cost ReductionsДокумент92 страницыCost Control & Cost ReductionsAniketh Upadrasta100% (3)

- Costing in BriefДокумент47 страницCosting in BriefRezaul Karim TutulОценок пока нет

- Cost MeasurementДокумент37 страницCost MeasurementMrudula V.100% (1)

- Cost Accounting IДокумент147 страницCost Accounting IBilisummaa LammiiОценок пока нет

- DSFDFJM LLKДокумент27 страницDSFDFJM LLKDeepak R GoradОценок пока нет

- CA Final AMA Theory Complete R6R7GKB0 PDFДокумент143 страницыCA Final AMA Theory Complete R6R7GKB0 PDFjjОценок пока нет

- Cost NotesДокумент16 страницCost NotesKomal GowdaОценок пока нет

- Operational Costing: & Operating CostДокумент40 страницOperational Costing: & Operating CostAmit DovariОценок пока нет

- Ch2 - Basic Cost Management Concepts - OutlineДокумент8 страницCh2 - Basic Cost Management Concepts - OutlineirquadriОценок пока нет

- MG WE FNSACC517 Provide Management Accounting InformationДокумент9 страницMG WE FNSACC517 Provide Management Accounting InformationGurpreet KaurОценок пока нет

- Cost Accounting - Chap1Документ29 страницCost Accounting - Chap1Alber Howell MagadiaОценок пока нет

- Accounting CostingДокумент156 страницAccounting CostingMorning32100% (1)

- Cost AccountingДокумент28 страницCost AccountingVirendra JhaОценок пока нет

- Cost SheetДокумент15 страницCost SheetDikshit Kothari100% (2)

- CDS SambyalДокумент3 страницыCDS SambyalTAPOSH MUNJALОценок пока нет

- Chapter2 - Cost Classification and ConceptsДокумент11 страницChapter2 - Cost Classification and ConceptsshubhОценок пока нет

- Cost AccountingДокумент28 страницCost Accountingrenjithrkn12Оценок пока нет

- Cost and Cost ClassificationДокумент10 страницCost and Cost ClassificationAmod YadavОценок пока нет

- 2the NotesДокумент84 страницы2the NotesKunal ParmarОценок пока нет

- Lesson About CostДокумент8 страницLesson About CostMariana MogîldeaОценок пока нет

- 2the NotesДокумент84 страницы2the NotesParamjeet SinghОценок пока нет

- IPCC Costing Theory Formulas ShortcutsДокумент57 страницIPCC Costing Theory Formulas ShortcutsCA Darshan Ajmera86% (7)

- CA IPCC Costing Guess Questions THEORYДокумент34 страницыCA IPCC Costing Guess Questions THEORYKrishnaKorada92% (12)

- OperatingДокумент32 страницыOperatingMithSoniОценок пока нет

- Management Accounting: Basic of CoastingДокумент8 страницManagement Accounting: Basic of CoastingJagruti100Оценок пока нет

- Meaning of CostДокумент8 страницMeaning of CostSwarup Singh DeoОценок пока нет

- Introduction To Cost Accounting Final With PDFДокумент19 страницIntroduction To Cost Accounting Final With PDFLemon EnvoyОценок пока нет

- Chapter Two: Cost Terminology and Classification: Learning OutcomesДокумент8 страницChapter Two: Cost Terminology and Classification: Learning OutcomesKanbiro Orkaido100% (1)

- MadmДокумент9 страницMadmRuchika SinghОценок пока нет

- Unit Vi - Cost Theory and Estimation: C F (X, T, PF)Документ10 страницUnit Vi - Cost Theory and Estimation: C F (X, T, PF)Bai NiloОценок пока нет

- Product Costing Analysis ReportДокумент9 страницProduct Costing Analysis ReportDeepti TripathiОценок пока нет

- Type of Cost: Direct CostsДокумент3 страницыType of Cost: Direct CostsMapicoОценок пока нет

- ADV. Cost24 MarchДокумент63 страницыADV. Cost24 MarchtatekОценок пока нет

- Ankita ProjectДокумент17 страницAnkita ProjectRaman NehraОценок пока нет

- Period Cost Is Related To Level of Production and SaleДокумент6 страницPeriod Cost Is Related To Level of Production and SaleMd. Saiful AlamОценок пока нет

- Word MeДокумент15 страницWord Mepawanijain96269Оценок пока нет

- Learning Objectives: Cost Terms, Concepts, and ClassificationsДокумент5 страницLearning Objectives: Cost Terms, Concepts, and ClassificationsEnp Gus AgostoОценок пока нет

- Module 3Документ45 страницModule 3Gandeti SantoshОценок пока нет

- Project Work: Management AccountingДокумент37 страницProject Work: Management AccountingDeepak KumarОценок пока нет

- Costing: - Chapter 01 - Cma Intermediate - MacampusДокумент5 страницCosting: - Chapter 01 - Cma Intermediate - MacampusRaja NarayananОценок пока нет

- Cost Accounitng NotesДокумент17 страницCost Accounitng NotesDarlene JoyceОценок пока нет

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesОт EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesОценок пока нет

- Bankruptcy Act of 1984 Under Chapter 67 of The Brunei Darussalam Laws.Документ11 страницBankruptcy Act of 1984 Under Chapter 67 of The Brunei Darussalam Laws.Madison SheenaОценок пока нет

- Pre and Post Shipment Unit IVДокумент15 страницPre and Post Shipment Unit IVvishesh_2211_1257207100% (1)

- Icai TenderДокумент29 страницIcai TenderRamnish MishraОценок пока нет

- Taxation - Defined - August 22, 2013Документ93 страницыTaxation - Defined - August 22, 2013Asdqwe ZaqwsxОценок пока нет

- Medical Group: 1-888-236-2263. Our Office Hours Are Monday Through Friday 8:00a.m.to 4:30p.mДокумент3 страницыMedical Group: 1-888-236-2263. Our Office Hours Are Monday Through Friday 8:00a.m.to 4:30p.menergizerabbyОценок пока нет

- ACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsДокумент1 страницаACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsNikko Bowie PascualОценок пока нет

- Statement of Account - ApartmentДокумент4 страницыStatement of Account - ApartmentBryan Jayson BarcenaОценок пока нет

- ResMethods - Session5Документ59 страницResMethods - Session5David Adeabah OsafoОценок пока нет

- Activity 6 - Long-Term Construction ContractsДокумент2 страницыActivity 6 - Long-Term Construction ContractsDe Chavez May Ann M.Оценок пока нет

- Market Breadth BrochureДокумент10 страницMarket Breadth BrochureStevenTsaiОценок пока нет

- A747 308 81 41 37195 - Rev 1Документ1 страницаA747 308 81 41 37195 - Rev 1Shaik AbdullaОценок пока нет

- PNB Housing Finance Limited Legal Title Opinion Report: Pawan Kumar Advocate Civilcourt GorakhpurДокумент6 страницPNB Housing Finance Limited Legal Title Opinion Report: Pawan Kumar Advocate Civilcourt GorakhpurMritunjai SinghОценок пока нет

- Decision AnalysisДокумент2 страницыDecision AnalysisNatalie O'Beefe LamОценок пока нет

- Topic HIGHLIGHTS of The Topic: Philippine Housing Network MatrixДокумент8 страницTopic HIGHLIGHTS of The Topic: Philippine Housing Network MatrixAaron EspirituОценок пока нет

- Mco-7 emДокумент8 страницMco-7 emKhundrakpam Satyabarta100% (3)

- Akdas Brief Dan SelfДокумент18 страницAkdas Brief Dan SelfAwun Sukma100% (1)

- BAUTISTA BAFIMARX ACT181, Activity 2Документ3 страницыBAUTISTA BAFIMARX ACT181, Activity 2Joshua BautistaОценок пока нет

- Hype Cycle For Supply Chain Management, 2009Документ65 страницHype Cycle For Supply Chain Management, 2009ramapvkОценок пока нет

- The Financial Management Practices of Small and Medium EnterprisesДокумент15 страницThe Financial Management Practices of Small and Medium EnterprisesJa MieОценок пока нет

- In Re WalkerДокумент28 страницIn Re Walkerzulu333Оценок пока нет

- Business Plan: Rakibul HassanДокумент21 страницаBusiness Plan: Rakibul HassanRakibz HassanОценок пока нет

- LIM GAW Vs CIRДокумент7 страницLIM GAW Vs CIRMarion JossetteОценок пока нет

- Spaze TowerДокумент1 страницаSpaze TowerShubhamvnsОценок пока нет