Академический Документы

Профессиональный Документы

Культура Документы

Legal Aspect of M&a

Загружено:

pranavnickИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Legal Aspect of M&a

Загружено:

pranavnickАвторское право:

Доступные форматы

LEGAL ASPECT OF MERGER AND ACQUISITION

1. Conditions of Buy-back and General Obligations the Company (a) A company can buy back its shares or other specified securities only by any of the following methods : (I) (II) From existing share/security holders on a proportionate basis through tender offer. From open market through : (III) Book building process Stock exchange

From odd lot shares

(b) A company cannot buy back its shares or other specified securities in such a manner that it would be required to delist. (c) Consideration for buy-back has to be paid in cash only. (d) A company cannot withdraw the offer to buy back after the draft letter of offer has been filed with SEBI or the public announcement of the offer to buy back has been made. (e) A company cannot issue any shares or other specified securities including by way of bonus shares till the date of closure of the offer. (f) The promoters of their associates cannot deal in the shares or other specified securities of the company in the stock exchange during the period the buy- back offer is open. (g) No public announcement of a buy-back can be made during the pendency of any scheme of amalgamation or arrangement or compromise. (h) A company intending to buy back its shares or other specified securities has to appoint a compliance officer and investor service centre. (i) Details of shares bought back and extinguished and destroyed have to be informed to the concern stock exchange(S) within seven days of the extinguishment and destruction.

(j) A company cannot buy back locked-in securities during the lock-in period. (k) Within two days of the completion of buy back, the company has to issue a public announcement giving certain details and in a prescribed manner.

2. Requirement of the Special and Boared Resolutions

(a) In case , where a special resolutions is passed in the general meeting , the explanatory statement to the notice of general meeting should contain information as per schedule I of regulations. (b) A copy of the special resolution passed should be field with SEBI and the relevant stock exchange(s) within seven days of the passing. (c) With regard to the buy-back made under the board resolution, apart from the company being required to file a copy of board resolution with SEBI and relevant stock exchange(S) within two days, it is also required to give a public notice in the least one English national daily, one Hindi national daily and one regional daily within two days of passing of the resolutions.

3. Buy back through Tender Offer and Buy back through Book Building Process

(a) Escrow Account (i) An escrow account is required to be opened on or before the opening of the open offer. (ii) In case , the total considerations payable under buy-back does not exceed Rs. 100 crore, the amount to be deposited in the escrow account shall be 25 per cent of the consideration payable. However , if the consideration payable is in excess of Rs. 100 crore, the amount would be 25 per cent of the first Rs.100 crore and 10 per cent of the excess over Rs. 100 crore. (iii)The deposit in the escrow account can be in the form of cash deposited with a scheduled commercial bank or bank guarantee

in favour of the merchant banker or acceptable securities with an appropriate margin deposited with the merchant banker or a combination thereof. However, a minimum of 1 per cent of the total consideration payable must be in the form of cash deposited with the scheduled commercial bank. (iv)So far as the cash deposited with a commercial bank is concerned , upon closure of the tender offer, 90 per cent thereof can be utilized by transfer to the special account to be opened for payment of consideration to be security holders. The regulation further requires the company to immediately fund the balance amount to make up the entire amount due. (v) Bank guarantees and securities deposited in the escrow account, however , can be returned to the company only after the payment of consideration has been fully made and all formalities relating to the tender offer have been fully completed.

1. Definitions

(a) Acquirer means a person who, directly or indirectly, acquirers or agrees to acquire shares or voting rights in the target company or acquires or agrees to acquire control over the target company, either by himself or with any person acting in concert with the acquirer [regulation 2 (1) (b)]. (b) Control shall include the right to appoint majority of the directors or to control the management or policy decisions exercisable by a person or persons acting individually or in concert, directly or

indirectly, including by virtue agreements or in any other manner [regulation 2 (1) (c)] (c) Person acting in concert [regulation 2 (1) (e)] For considering that a person is acting in concert with the acquirer it must be proved that the acuirer and the said person have or had a common objective or purpose of either making substantial acquisition of shares or voting rights or getting control over the target company ant that there is or was an agreement or understanding (whether formal or informal) between them. It also must be proved that pursuant to this agreement or understanding they have or had cooperated with each other by acquiring or agreeing to acquire shares or voting rights in or control over the target company. Further , the regulations list out certain categories of persons or entities that if one of them in is an acquirer, others within the category, by virtue of their relation or business relationship could be generally deemed to be (presumed to be) acting in concert, unless proved to the contrary. (d) Promoter means any person who is in control of the target company or who has been named as a promoter either in the offer document or in any shareholding pattern field with the stock exchange(S) under the listing agreement whichever is later. In addition, a promoter also means any person belonging to the Promoter Group as defined in the explanation. This is like a deeming provision[regulation 2 (1) (h)]. (e) Target Company means a listed company whose shares or voting rights or control is directly or indirectly acquired or being acquired [ regulation 2 (1) (O).

2. Exemptions from Applicability of Regulations 10, 11 and 12 (Regulation 3) Some of the important exemptions are : (a) Allotment in public issue subject to the conditions discussed in the main text above. (b) Allotment in a rights issue subject to the conditions discussed in the main text above. (c) Allotment to underwriters which is du to development.

(d) Inter se transfer, subject to various conditions discussed in the main text above, of shares amongst : Persons constituting a group as defined by the MRTP Act, 1969 Relatives within the meaning of section 6 of the Companies Act, 1956 Qualifying Indian promoters and their foreign collaborators who are shareholders Qualifying promoters Acquirer and persons acting in concert with him

(e) Acquisition of shares in the ordinary course of Business By registered stock brokers on behalf of clients, By registered market makers during the course of market making, By public financial institutions on their on account By banks and public financial institutions as pledges, By certain stipulated international financial institutions like IFC, ADB, etc. By the merchant banker or the promoter of the target company under a safety net scheme under SEBI (DIP) Guidelines, 2000.

(f) acquisition of shares received in exchange of the shares held in another company for which an open offeras made (g) Shares acquired through inheritance. (h) Transfer of shares from the registered venture capital funds or foreign venture capital investors to the promoters of the venture capital undertaking. (i) Acquisition of shares under any SICA, 1985 scheme or in any arrangement or reconstruction including amalgamation or demerger under any Indian or foreign law, (j) Acquisition of shares in an unlisted company.

(k) Acquisition of shares in terms of SEBI ( Delisting of Securities) Guidelines, 2003.

3. Relaxation from the strict Compliance with the Provisions of Chapter II Under newly inserted regulation 29A, SEBI is empowered to grant relaxation from strict compliance of provisions of chapter III to those target companies which meet all the conditions stipulated therein

4. Triggers of Open Offer (Regulations 10, 11 and 12) (a) No acquirer any shares or voting rights which taken together with his existing holdings and shareholdings of the persons acting in concert would aggregate to 15 per cent or more without making pulic announcement of an open offer ( regulation 10). (b) No acquirer , who along with the persons acting in concert, is holding 15 per cent or more but less than 55 per cent of shares or voting rights in a company can acquire, either by himself or through or with the persons acting in concert, more than 5 per cent of shares or voting rights in any financial year without making a public announcement of open offer. This is called creeping acquisition [regulation 11(1)] (c) No acquirer , who along with the person acting in concert, is already holding 55 per cent or more but less than 75 per cent of shares or voting rights in a company can acquire any shares or voting rights without making an offer. In case of the companies who have been allowed to list, with only 10 per cent offered to public, this rule applies to holding between 55 and 90 per cent[regulation 11 (2)] The above position under regulation 11 (2) has recently undergone a change. Vide an amendment dated 30 October 2008, to the sub regulation 11 (2) , SEBI has now permitted the promoters holding between 55 per cent and less than 75 per cent to Acquire up to 5 per cent ( in a financial year) without making an open offer provided such acquisition is made through open market purchase in the normal segment on the stock exchange only. (d) The provisions of regulations 10 and 11 apply to the direct acquisition in a listed company and to the indirect acquisition by

virtue of the acquisitions of companies, irrespective of whether listed or unlisted and whether in India or abroad. (e) Regulation 12 requires that irrespective of whether there has been any acquisition of shares or voting rights, no acquirer can acquire control over a target company without making a public announcement of an open offer. This regulation applies to the direct, as well as, the indirect acquisition of contract of the target company By virtue of acquisition of another company, irrespective of whether such another company is listed or unlisted and whether it is registered in India or abroad. This , however, does not apply if such change of control takes place by the target companys shareholders passing a special resolution in a general meeting .

Вам также может понравиться

- Buy Back of SecuritiesДокумент5 страницBuy Back of SecuritiesRishi ShrivastavaОценок пока нет

- Buy Back of SecuritiesДокумент7 страницBuy Back of SecuritiesTaruna SanotraОценок пока нет

- Buy Back of SharesДокумент7 страницBuy Back of SharesChandan Kumar TripathyОценок пока нет

- Buyback of Shares Vis-A-Vis M&aДокумент21 страницаBuyback of Shares Vis-A-Vis M&aDrRajesh GanatraОценок пока нет

- Buy Back of Shares - Complete ProcedureДокумент18 страницBuy Back of Shares - Complete ProcedurePramod Kumar SaxenaОценок пока нет

- p13 Dec 2023 Sol - MergedДокумент13 страницp13 Dec 2023 Sol - Merged18kumari.nОценок пока нет

- 5% or More Shares or Voting RightsДокумент6 страниц5% or More Shares or Voting RightsRohit SutharОценок пока нет

- Buy Back of Shares Under The Companies Act, 1956 - An InsightДокумент4 страницыBuy Back of Shares Under The Companies Act, 1956 - An InsightHrdk DveОценок пока нет

- Accounts I ProjectДокумент6 страницAccounts I ProjectUrvi ShahОценок пока нет

- Supplementary Paper 13Документ9 страницSupplementary Paper 13Ram2289Оценок пока нет

- Buy Back of SharesДокумент3 страницыBuy Back of SharesNagalakshmi ChagantiОценок пока нет

- Advanced Financial Accounting: An Outlook On The Process and The How It Was Implemented byДокумент9 страницAdvanced Financial Accounting: An Outlook On The Process and The How It Was Implemented byNishant AjitsariaОценок пока нет

- A Company May Buy-Back Its Securities Out Of:: Free Reserves and Securities Premium AccountДокумент8 страницA Company May Buy-Back Its Securities Out Of:: Free Reserves and Securities Premium Accountvishal_90Оценок пока нет

- SEBI Takeover Code - UpdatedДокумент24 страницыSEBI Takeover Code - UpdatedSagarОценок пока нет

- Project Report On Buy - Back of Shares-KhushbuДокумент7 страницProject Report On Buy - Back of Shares-KhushbucahimanianandОценок пока нет

- ProvisionsДокумент18 страницProvisionsSimpy BharotОценок пока нет

- Buy Back of SharesДокумент6 страницBuy Back of SharesSathish V MenonОценок пока нет

- ICDR Ammendments Chapter XA (1) NikДокумент26 страницICDR Ammendments Chapter XA (1) NikSanjeev Kumar ChoudharyОценок пока нет

- Taxguru - in-Buy-Back of Securities Shares Under Companies Act 2013Документ10 страницTaxguru - in-Buy-Back of Securities Shares Under Companies Act 2013Abhinay KumarОценок пока нет

- 6 Updates Buy Back of SecДокумент14 страниц6 Updates Buy Back of SecsanathgowdaОценок пока нет

- Issue of WarrantsДокумент1 страницаIssue of WarrantsDhruvi KothariОценок пока нет

- Top 3 SEBI Orders Under The Takeover Code in The Year 2017Документ11 страницTop 3 SEBI Orders Under The Takeover Code in The Year 2017dhruv vashisthОценок пока нет

- Objectives of Insolvency LawДокумент13 страницObjectives of Insolvency LawKaran VermaОценок пока нет

- Buy-Back Process Under Companies Act & RulesДокумент8 страницBuy-Back Process Under Companies Act & Rulesdevendra bankarОценок пока нет

- SEBI Board Meeting: PR No.38/2021Документ11 страницSEBI Board Meeting: PR No.38/2021Jai VermaОценок пока нет

- ProjectCoach-SyndicationLetter (TermLoan) - EXECUTED05 09 2022 - RedactedДокумент7 страницProjectCoach-SyndicationLetter (TermLoan) - EXECUTED05 09 2022 - Redactedoratschilde.aiОценок пока нет

- ICDR Guidelines - IGP - April 05 2019Документ6 страницICDR Guidelines - IGP - April 05 2019Srishti 2k22Оценок пока нет

- Chapter 5C: Privately Placed Debt Securities ' Listing RegulationsДокумент5 страницChapter 5C: Privately Placed Debt Securities ' Listing RegulationsGhanwa AsifОценок пока нет

- Promoters' Contribution-1Документ13 страницPromoters' Contribution-1Manali RanaОценок пока нет

- Prospectus: Yudh Bir Singh Thakur Dharm Pal Yadav Raj Sekhar M. Singh B R PrasannakumarДокумент47 страницProspectus: Yudh Bir Singh Thakur Dharm Pal Yadav Raj Sekhar M. Singh B R PrasannakumarDharm Pal YadavОценок пока нет

- 33 Sebi Icdr Regulations 2009Документ56 страниц33 Sebi Icdr Regulations 2009adblog2Оценок пока нет

- Companies Act 1956Документ6 страницCompanies Act 1956DHIRENDRA KUMARОценок пока нет

- Guidelines On Private PlacementsДокумент5 страницGuidelines On Private Placementsfarizan77Оценок пока нет

- PDFFile5b28ce17e1dee4 27330345Документ6 страницPDFFile5b28ce17e1dee4 27330345Rajini YadavОценок пока нет

- Right of First Refusal To Significant Holders. The Company Hereby Grants To Each InvestorДокумент11 страницRight of First Refusal To Significant Holders. The Company Hereby Grants To Each InvestorshirdhiОценок пока нет

- Decree Providing Detailed Regulations For Implementation of A Number of Articles of The Law On SecuritiesДокумент21 страницаDecree Providing Detailed Regulations For Implementation of A Number of Articles of The Law On Securitiesmassa_tОценок пока нет

- Buy Back SebiДокумент19 страницBuy Back SebisangeetagoeleОценок пока нет

- The Securities Act, 1993Документ175 страницThe Securities Act, 1993Rushane SomersОценок пока нет

- 5.acceptance of Deposits by CompaniesДокумент39 страниц5.acceptance of Deposits by Companiessamartha umbareОценок пока нет

- Sample TermsheetДокумент4 страницыSample Termsheetkborah100% (7)

- Buy Back of SharesДокумент9 страницBuy Back of SharesShilpa LallerОценок пока нет

- 7 ProspectusДокумент8 страниц7 ProspectusVarun BhomiaОценок пока нет

- Malaysian Code On Take-Overs and Mergers 2010Документ8 страницMalaysian Code On Take-Overs and Mergers 2010MustaqimYusofОценок пока нет

- Procedures of Mergers and Acquisition in IndiaДокумент10 страницProcedures of Mergers and Acquisition in IndiaVignesh KymalОценок пока нет

- Section 42, The Companies Act, 2013Документ4 страницыSection 42, The Companies Act, 2013Damon SalvatoreОценок пока нет

- 2.buyback of SharesДокумент2 страницы2.buyback of SharesJay KoliОценок пока нет

- Analysis and InterpretationДокумент15 страницAnalysis and InterpretationPriyanka GuptaОценок пока нет

- Buy-Back of Securities and Equity Shares With Differential RightsДокумент52 страницыBuy-Back of Securities and Equity Shares With Differential RightsSandeep As SandeepОценок пока нет

- Advance Subscription AgreementДокумент8 страницAdvance Subscription AgreementYanz RamsОценок пока нет

- CHP 4 Buy BackДокумент52 страницыCHP 4 Buy BackRonak ChhabriaОценок пока нет

- Buy Back of SharesДокумент32 страницыBuy Back of SharesSiddhant Raj PandeyОценок пока нет

- Topic 4 - ProspectusДокумент7 страницTopic 4 - Prospectussivaramjayaprakash26Оценок пока нет

- SGX-ST Listing Manual Amendments - Effective 1 January 2011: Listing Rules For Secondary Fund Raising (Catalist)Документ5 страницSGX-ST Listing Manual Amendments - Effective 1 January 2011: Listing Rules For Secondary Fund Raising (Catalist)John HowardОценок пока нет

- Corporate Law PSDA: Submitted ToДокумент7 страницCorporate Law PSDA: Submitted ToharshkumraОценок пока нет

- Acceptance of Deposits by Companies: After Studying This Unit, You Would Be Able ToДокумент35 страницAcceptance of Deposits by Companies: After Studying This Unit, You Would Be Able ToShashiОценок пока нет

- CP 5 Acceptance of Deposits-UnlockedДокумент38 страницCP 5 Acceptance of Deposits-UnlockedKarthik Imperious100% (1)

- Takeover CodeДокумент20 страницTakeover CodeMahimna KandpalОценок пока нет

- General Solicitation under New Rule 506: Crowd Funding on SteroidsОт EverandGeneral Solicitation under New Rule 506: Crowd Funding on SteroidsРейтинг: 5 из 5 звезд5/5 (1)

- Crowdfunding in 2014 (Understanding a New Asset Class)От EverandCrowdfunding in 2014 (Understanding a New Asset Class)Оценок пока нет

- A - A - Benjamin Zephaniah PoemsДокумент6 страницA - A - Benjamin Zephaniah PoemsJakub KonopkaОценок пока нет

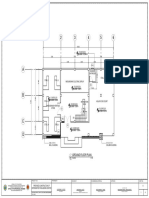

- Ground Floor Plan: Office of The Provincial EngineerДокумент1 страницаGround Floor Plan: Office of The Provincial EngineerAbubakar SalikОценок пока нет

- Adjusting Entries - Sample Problem With AnswerДокумент19 страницAdjusting Entries - Sample Problem With AnswerMaDine 19100% (3)

- Apostolic United Brethren Standards For Members/YouthДокумент60 страницApostolic United Brethren Standards For Members/YouthKatie JoyОценок пока нет

- Chapter 1Документ25 страницChapter 1Annie Basing-at AngiwotОценок пока нет

- The Procurement Law No. 26 (2005) PDFДокумент27 страницThe Procurement Law No. 26 (2005) PDFAssouik NourddinОценок пока нет

- Human Rights and Its Ratification in India What Are Human Rights?Документ5 страницHuman Rights and Its Ratification in India What Are Human Rights?Aadya PoddarОценок пока нет

- Larsen & Toubro LimitedДокумент17 страницLarsen & Toubro LimitedRæhul SÄlvé100% (3)

- UK (Lloyds Bank - Print Friendly Statement1)Документ2 страницыUK (Lloyds Bank - Print Friendly Statement1)shahid2opuОценок пока нет

- 12779/GOA EXPRESS Second Ac (2A)Документ2 страницы12779/GOA EXPRESS Second Ac (2A)Altamash ShaikhОценок пока нет

- Ultra 3000 Drive (2098-In003 - En-P)Документ180 страницUltra 3000 Drive (2098-In003 - En-P)Robert BarnetteОценок пока нет

- PILMICO-MAURI FOODS CORP V CIRДокумент18 страницPILMICO-MAURI FOODS CORP V CIRhowieboiОценок пока нет

- Practice in The Trial of Civil SuitsДокумент54 страницыPractice in The Trial of Civil SuitsCool dude 101Оценок пока нет

- Bus Ticket Invoice 1465625515Документ2 страницыBus Ticket Invoice 1465625515Manthan MarvaniyaОценок пока нет

- FortiClient EMSДокумент54 страницыFortiClient EMSada ymeriОценок пока нет

- Position PAperДокумент11 страницPosition PAperDan CuestaОценок пока нет

- Legal Ethics and Practical Exercises DigestДокумент10 страницLegal Ethics and Practical Exercises Digestalma vitorilloОценок пока нет

- Cibse Lighting LevelsДокумент3 страницыCibse Lighting LevelsmdeenkОценок пока нет

- Csec Physics Study ChecklistДокумент10 страницCsec Physics Study ChecklistBlitz Gaming654100% (1)

- Sample IPCRF Summary of RatingsДокумент2 страницыSample IPCRF Summary of RatingsNandy CamionОценок пока нет

- Explanatory Note To The Revision of FIATA Model Rules For Freight Forwarding ServicesДокумент16 страницExplanatory Note To The Revision of FIATA Model Rules For Freight Forwarding ServicesFTU.CS2 Tô Hải YếnОценок пока нет

- Kojin Karatani - Isonomia and The Origins of PhilosophyДокумент165 страницKojin Karatani - Isonomia and The Origins of PhilosophyRafael Saldanha100% (1)

- Yayen, Michael - MEM601Документ85 страницYayen, Michael - MEM601MICHAEL YAYENОценок пока нет

- Mrunal Updates - Money - Banking - Mrunal PDFДокумент39 страницMrunal Updates - Money - Banking - Mrunal PDFShivangi ChoudharyОценок пока нет

- Guide 7000 - Application For Permanent Residence - Federal Skilled Worker ClassДокумент62 страницыGuide 7000 - Application For Permanent Residence - Federal Skilled Worker ClassIgor GoesОценок пока нет

- LT Bill Dec16Документ2 страницыLT Bill Dec16nahkbceОценок пока нет

- Η Πολιτική Νομιμοποίηση της απόθεσης των παιδιώνДокумент25 страницΗ Πολιτική Νομιμοποίηση της απόθεσης των παιδιώνKonstantinos MantasОценок пока нет

- HSN Table 12 10 22 Advisory NewДокумент2 страницыHSN Table 12 10 22 Advisory NewAmanОценок пока нет

- Bdo Cash It Easy RefДокумент2 страницыBdo Cash It Easy RefJC LampanoОценок пока нет

- HIRING OF VEHICLEsДокумент2 страницыHIRING OF VEHICLEsthummadharaniОценок пока нет