Академический Документы

Профессиональный Документы

Культура Документы

Bumper Year Ahead, But Risks Persist: Mongolia Risk Summary

Загружено:

Victor RattanavongИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Bumper Year Ahead, But Risks Persist: Mongolia Risk Summary

Загружено:

Victor RattanavongАвторское право:

Доступные форматы

MONGOLIA

ECONOMIC OUTLOOK

RISK SUMMARY

POLITICAL RISK

Uranium Exploration To Begin

Prime Minister Batbold Sukhbaatar says Mongolia will aim to begin uranium exploration before 2012, according to a report in the Ulan Bator Post. Sukhbaatar said the country needs to speed up operations so that it can exploit the almost 1mn tonnes of reasonably assured uranium reserves in Mongolia soon. Feasibility studies have commenced at the enriched Mardai and Kharaat deposits. We are encouraged by the prime ministers statement and continue to stress that Mongolias investment climate remains strong, despite concerns over recent mining licence problems.

Our short-term political risk rating is 74.0.

Bumper Year Ahead, But Risks Persist

BMI View: We remain bullish on Mongolias medium-term growth prospects, and highlight a generally supportive political culture and business environment which make Mongolia a solid bet for investors. That said, we continue to flag up a number of risks.

We reiterate our long-held view that Mongolia will be one of the worlds fastest-growing economies in the next 10 years, powered by an investment-led mining boom. Strong foreign direct investment will enable the development of the countrys vast mineral resources, leading to a surge in exports and real GDP growth in the high single digits or above through to 2020. Heading into 2011, we highlight a highly favourable macroeconomic environment and hold to our forecast for 7.9% real GDP growth this year, which we expect to be driven by fixed investment in the mining and transport sectors. Indeed, the recent release of preliminary data for full-year 2010 growth by the Mongolian National Statistics Office (MNSO) indicates that mining & quarrying surpassed agriculture last year to become the biggest sector of the economy. While this was no doubt helped by the dire performance of agriculture following a terrible 2009/10 winter, we nevertheless contend that it is indicative of

DATA & FORECASTS

BMI View: The Mongolian togrog continues to perform well, strengthening to MNT1,245/ US$ at one point on January 31 from MNT1,259/US$ at end-2010. We have long been bullish on the unit and continue to expect a robust performance. Indeed, with exports expected to perform well on the back of strong Chinese demand, growth forecast to hit 7.9% in 2011 and foreign investment likely to rise further, we see the togrog hitting MNT1,140/US$ by end-2011.

Population, mn [1] Nominal GDP, US$bn [2] Real GDP growth, % change y-o-y [2] Industrial production index, % y-o-y, ave [3] Budget balance, % of GDP [4] Consumer prices, % y-o-y, eop [5] Exchange rate MNT/US$, eop [6] Goods imports, US$bn [5] Goods exports, US$bn [5] Balance of trade in goods, US$bn [5] Current account, % of GDP [4] Foreign reserves ex gold, US$bn [7] Total external debt stock, % of GDP [9] 2009 2.7 4.2 -1.6 17.8 -5.7 1.8 1,430.00 3.1 2.5 -0.6 -6.3 1.3 44.9 2010e 2.7 4.6 9.3 13.6 0.0 10.0 1,259.00 2.1 1.8 -0.2 -3.9 1.8 43.5 LatestPeriod 10.9 1,245.25 3.3 2.9 -0.4 Sep 31-Jan Jan-Dec Jan-Dec Jan-Dec 2011f 2.7 6.1 7.9 10.1 2.5 9.0 1,140.00 2.7 2.5 -0.1 -2.6 2.1 37.7 2012f 2.8 7.7 9.0 11.4 -0.8 8.0 1,080.00 3.5 3.4 -0.0 -0.1 2.4 33.6

ECONOMIC RISK

Recovery On Course

Mongolian industrial production rose by 13.6% y-o-y over the course of 2010, down from 17.8% y-o-y in the previous year. While the rate of growth dropped, we nevertheless contend that the 2010 number marks a healthy outturn and supports our view that the economic recovery is firmly on course. In particular, we highlight the healthy performance of mining last year, with this component of industrial production rising by 10.1%. In 2011, we forecast the recovery to remain on course, with the economy expected to grow by 7.9%.

Our short-term economic risk rating is 51.9.

a broader trend, with mining activity set to be the main driver of economic expansion in the coming years. The fiscal picture is also improving, in line with our view, with the government having actually posted a fiscal surplus in 2010 according to preliminary data from the MNSO. Moreover, the outlook for the banking sector is also relatively favourable, in line with our long-held view that the worst of the crisis is over. While we are upbeat on Mongolias growth prospects and believe these will provide a multitude of attractive opportunities for investors over the medium term, we note an increasing dependence on international commodity prices and Chinese demand. In addition, inflation will remain a problem through 2011, with the initial spike in H110 driven by a domestic food shortage being maintained through H210 by loose fiscal policy, stronger demand-side pressures and higher international food and commodity prices.

BUSINESS ENVIRONMENT

Minco Gold Forms CNNC JV

Canadas Minco Gold has entered a joint venture agreement with a subsidiary of the China National Nuclear Corporation and has acquired a 51% equity interest on a gold mine in Inner Mongolia. According to Trading Markets, the mine has been producing gold since 1996 and is currently operating at 600 tonnes per day at roughly 85% gold recovery. We expect mining sector output to grow to US$9.9bn by 2014, marking a fourfold increase from 2010, with the majority of this increase occurring in 2013 and 2014 as the Oyu Tolgoi mine comes online.

BMIs business environment rating is 47.0.

Notes: e/f = BMI estimates/forecasts. Sources: 1 World Bank/BMI calculation/BMI; 2 IMF/BOM/BMI; 3 MNSO; 4 BoM/BMI; 5 BoM; 6 BMI; 7 IMF; 8 EBRD; 9 EBRD/BMI.

2011 Business Monitor International. All rights reserved.

All information, analysis, forecasts and data provided by Business Monitor International Ltd is for the exclusive use of subscribing persons or organisations (including those using the service on a trial basis). All such content is copyrighted in the name of Business Monitor International, and as such no part of this content may be reproduced, repackaged, copied or redistributed without the express consent of Business Monitor International Ltd. All content, including forecasts, analysis and opinion, has been based on information and sources believed to be accurate and reliable at the time of publishing. Business Monitor International Ltd makes no representation of warranty of any kind as to the accuracy or completeness of any information provided, and accepts no liability whatsoever for any loss or damage resulting from opinion, errors, inaccuracies or omissions affecting any part of the content.

www.emergingeuropemonitor.com

Analyst: C Graham, R Grieveson Editor: Mark Schaltuper Sub-Editor: Maria Iu Subscriptions Manager: Iwona Hoffman Marketing Manager: Julia Consuegra +44 (0)20 7246 5131 Production: Lisa Church/Chuoc Lam Publishers: Richard Londesborough/Jonathan Feroze

Copyright of Emerging Europe Monitor: Russia & CIS is the property of Business Monitor International and its content may not be copied or emailed to multiple sites or posted to a listserv without the copyright holder's express written permission. However, users may print, download, or email articles for individual use.

Вам также может понравиться

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Intro to Macro Midterm Boot Camp Assignment 1 ReviewДокумент104 страницыIntro to Macro Midterm Boot Camp Assignment 1 Reviewmaged famОценок пока нет

- Future Cities Dubai ReportДокумент24 страницыFuture Cities Dubai ReportVictor RattanavongОценок пока нет

- R13 Currency Exchange Rates SlidesДокумент58 страницR13 Currency Exchange Rates SlidesRahul RawatОценок пока нет

- International Monetary SystemДокумент16 страницInternational Monetary Systemriyaskalpetta100% (2)

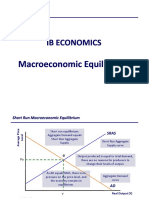

- IB MACRO EQUILIBRIUMДокумент13 страницIB MACRO EQUILIBRIUMPablo Torrecilla100% (1)

- 13 Steps For Investing (Motley Fool)Документ49 страниц13 Steps For Investing (Motley Fool)api-26637661Оценок пока нет

- Sustainability of Freight Forwarding FinДокумент49 страницSustainability of Freight Forwarding FinVictor Rattanavong0% (1)

- Sustainability of Freight Forwarding FinДокумент49 страницSustainability of Freight Forwarding FinVictor Rattanavong0% (1)

- 成語資料庫Документ165 страниц成語資料庫Victor RattanavongОценок пока нет

- AIIB Full Digital Infrastructure Report - Final With Appendix 2020-01-10Документ103 страницыAIIB Full Digital Infrastructure Report - Final With Appendix 2020-01-10Victor RattanavongОценок пока нет

- Chapter 8 Myfinancelab Solutions Pearsoncmgcom PDFДокумент89 страницChapter 8 Myfinancelab Solutions Pearsoncmgcom PDFChristopher Carpenter100% (7)

- Roland Berger Tab Digital Future of b2b Sales 1Документ16 страницRoland Berger Tab Digital Future of b2b Sales 1Abhishek KumarОценок пока нет

- ISEAS Perspective 2018 2@50Документ8 страницISEAS Perspective 2018 2@50Ayub PramudiaОценок пока нет

- Selection Process On TrackДокумент6 страницSelection Process On TrackVictor RattanavongОценок пока нет

- Global Middle Class 2030: 2.4 Billion 3.8 Billion 5.4 BillionДокумент12 страницGlobal Middle Class 2030: 2.4 Billion 3.8 Billion 5.4 BillionVictor RattanavongОценок пока нет

- Study On The High Speed Railway Project (Jakarta-Bandung Section), Republic of IndonesiaДокумент20 страницStudy On The High Speed Railway Project (Jakarta-Bandung Section), Republic of IndonesiaVictor RattanavongОценок пока нет

- Architecture Strategy of High Speed Railway Indonesia ChinaДокумент8 страницArchitecture Strategy of High Speed Railway Indonesia ChinaVictor RattanavongОценок пока нет

- Architecture Strategy of High Speed Railway Indonesia ChinaДокумент8 страницArchitecture Strategy of High Speed Railway Indonesia ChinaVictor RattanavongОценок пока нет

- Key Opportunities in ASEAN - Integration and Growth: Singapore's Chairmanship Thailand's ChairmanshipДокумент4 страницыKey Opportunities in ASEAN - Integration and Growth: Singapore's Chairmanship Thailand's ChairmanshipVictor RattanavongОценок пока нет

- Lao People's Democratic Republic Resource-Based Growth and Economic ChallengesДокумент3 страницыLao People's Democratic Republic Resource-Based Growth and Economic ChallengesVictor RattanavongОценок пока нет

- Chevron Annual Report SupplementДокумент64 страницыChevron Annual Report SupplementVictor RattanavongОценок пока нет

- Advanced Macroeconomics: An easy guideДокумент420 страницAdvanced Macroeconomics: An easy guideLucas OrdoñezОценок пока нет

- Hsslive XII Eco Macro ch2 National Income PDFДокумент7 страницHsslive XII Eco Macro ch2 National Income PDFIRSHAD KIZHISSERIОценок пока нет

- Monetary Policy: Based On "Macroeconomics" by Dornbusch and Fischer and "Elements of Economics" by TullaoДокумент12 страницMonetary Policy: Based On "Macroeconomics" by Dornbusch and Fischer and "Elements of Economics" by TullaoDiane UyОценок пока нет

- Programme Project Report (PPR) For Bachelor of CommerceДокумент48 страницProgramme Project Report (PPR) For Bachelor of CommerceshishirkantОценок пока нет

- Calculating National Income MethodsДокумент11 страницCalculating National Income MethodsJaivardhan KanoriaОценок пока нет

- International Parity Conditions You Can TrustДокумент51 страницаInternational Parity Conditions You Can Trustrohan100% (1)

- SA LIII 42 201018 Utsa PatnaikДокумент11 страницSA LIII 42 201018 Utsa PatnaikRaghubalan DurairajuОценок пока нет

- 9 General Structure of An Economic ParagraphДокумент2 страницы9 General Structure of An Economic ParagraphDilip PasariОценок пока нет

- Pros Cons: CapitalismДокумент5 страницPros Cons: CapitalismAlejandro Sanchez ArequipaОценок пока нет

- BS AssignmentДокумент4 страницыBS AssignmentRaufur RahmanОценок пока нет

- Santander - Brazil Fiscal Policy - Fiscal X-RayДокумент9 страницSantander - Brazil Fiscal Policy - Fiscal X-RayIgor EnnesОценок пока нет

- Diskusi 4 Bhs. Inggris Niaga ADBI4201 Chrisdianti 041153205Документ2 страницыDiskusi 4 Bhs. Inggris Niaga ADBI4201 Chrisdianti 041153205Lesley TrialОценок пока нет

- ECON 45- Theories of Economic DevelopmentДокумент9 страницECON 45- Theories of Economic DevelopmentVeronika MartinОценок пока нет

- Trade Policy in Developing CountriesДокумент26 страницTrade Policy in Developing CountriesAlice AungОценок пока нет

- Methodological Guide - Eurostat - OECD Developing Producer Price Indices For ServicesДокумент439 страницMethodological Guide - Eurostat - OECD Developing Producer Price Indices For ServicessandraexplicaОценок пока нет

- Engineering EconomicsДокумент60 страницEngineering EconomicsAbhineet GuptaОценок пока нет

- Vdocument - in - Project Report On Equity Research On Indian Banking SectorДокумент100 страницVdocument - in - Project Report On Equity Research On Indian Banking SectorNarendran BalarajuОценок пока нет

- Measures To Control InflationДокумент6 страницMeasures To Control InflationFeroz PashaОценок пока нет

- The Mundell-Fleming ModelДокумент3 страницыThe Mundell-Fleming ModelM31 Lubna AslamОценок пока нет

- Working Paper No. 792: From The State Theory of Money To Modern Money Theory: An Alternative To Economic OrthodoxyДокумент35 страницWorking Paper No. 792: From The State Theory of Money To Modern Money Theory: An Alternative To Economic OrthodoxyMATICAPEОценок пока нет

- Quiz 1 - SolutionsДокумент4 страницыQuiz 1 - Solutionsabijith taОценок пока нет

- International Monetary Arrangements For MBA, BBA, B.Com StudentsДокумент25 страницInternational Monetary Arrangements For MBA, BBA, B.Com StudentsRavishJiОценок пока нет

- CH 7Документ4 страницыCH 7Aryan RawatОценок пока нет

- UNIT IV - Performance of An Economy - MacroeconomicsДокумент50 страницUNIT IV - Performance of An Economy - MacroeconomicsSaravanan ShanmugamОценок пока нет

- Multinational Financial Management 10th Edition Shapiro Test Bank 1Документ7 страницMultinational Financial Management 10th Edition Shapiro Test Bank 1gerald100% (42)