Академический Документы

Профессиональный Документы

Культура Документы

India Economy and Trends 170811

Загружено:

Ritika AgrawalИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

India Economy and Trends 170811

Загружено:

Ritika AgrawalАвторское право:

Доступные форматы

INDIA - ECONOMY AND TRENDS

August 2011

INDIA-ECONOMY AND TRENDS

August 2011

Contents

The growth story continues Steady Growth Increasing Market Attractiveness Quarter Update Enablers of Indian growth story Key Developments Growth Enablers Sector update Automotive Energy Pharmaceuticals and Healthcare Retail and Consumer Goods Technology, Media and Telecommunications Transportation and Logistics

Road ahead Future Outlook

2

THE GROWTH STORY CONTINUES India-Economy and Trends August 2011

Steady Growth (1/4)

Current scenario

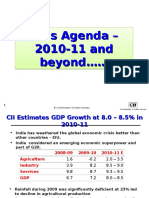

Real GDP grew at 8.6 per cent in 2010-11 compared to 8 per cent in 2009-10. The economy grew by 7.8 per cent in the first quarter of 2011-12. Inflation moderated to 9.1 per cent in April 2011 after peaking at over 16 per cent in January 2010. Service and manufacturing sector grew by 9.4 per cent and 7.9 per cent respectively in 2010-11. Agricultural sector made a significant contribution to the economy with a growth of 6.6 per cent in 2010-11. Industrial production clocked an annual growth of 6.3 per cent for 2010-2011. Consumer durables showed an annual growth of 3.8 per cent in April 2011. Gross fixed investment remains a major driver of economic growth, growing at an average of 11.5 per cent in 2010-11.

The Current Account Deficit (CAD) moderated to 2.6% of the GDP in 2010-11 at $44.3 billion due to fast growth in exports.

Source: Central Statistics Organisation

THE GROWTH STORY CONTINUES India-Economy and Trends August 2011

Steady Growth (2/4)

Economic Indicators

Growth is primarily driven by investment and government expenditure. Inflation is being neutralised with consistent economic growth. Services sector continues to drive GDP growth mainly through trade and finance.

Source: IMF; Economic Intelligence Unit; Estimates

Growth rate (per cent)

200809 5.1 (0.1) 4.4 10.3 6.6 11.8

2009-10 9.1 0.4 8.0 10.1 6.3 16.4

201011 E 8.8 5.4 8.1 9.6 7.3 9.0

Real GDP

Agriculture and allied activities Industry Services

Private final consumption expenditure Government final consumption expenditure Gross fixed capital formation Exports Imports Consumer Prices

2.7

15.8 22.3 10.9

6.6

(4.8) (6.8) 12.0

10.2

13.1 6.1 8.1

Source: International Monetary Fund (IMF)

THE GROWTH STORY CONTINUES India-Economy and Trends August 2011

Steady Growth (3/4)

Fiscal Performance

Public debt is slowly decreasing and is expected to be 50.2 per cent of GDP by 2012-13. Government expenditure is expected to remain at 16.1 per cent of GDP for 2010-11.

Fiscal Indicators (Per cent of GDP) Government Revenue Government Expenditure Government Balance Net Public Debt

200809 10.1 16.6 (6.5) 56.1

200910 11.0 16.1 (5.0) 51.9

201011 E 11.3 16.1 (4.8) 51.5

External Sector

Source: IMF, Economic Intelligence Unit

Export of goods is expected to cross US$ 270 million in 2010-11.

Substantial capital inflows in 2011-12 will ensure that the shortfall on the current account poses little risk to the economy.

Source: IMF; Economic Intelligence Unit; Estimates Economic Intelligence Unit Projections

US$ million Trade Balance Goods: exports Goods: imports Service balance Income balance Current transfer balance Current account balance

200809 (106,982) 168,218 274,566 39,304 (6,851) 49,293 (25,922)

200910 (133,721) 225,423 359,039 42,708 (12,577) 52,157 (51,781)

201011 (164,935) 271,624 436,559 51,365 (13,110) 60,760 (65,919)

Source: IMF, Economic Intelligence Unit

THE GROWTH STORY CONTINUES India-Economy and Trends August 2011

Steady Growth (4/4)

Foreign Exchange

Total International Reserves

3500 3000 2500 2000 1500 1000 500 0 3312 2876 2426

Investment Partners (1991-2011)

US$ billion

Indias total international reserves are estimated to be US$ 603 billion in 2010-11.

275 100 239

439

121

289 287

479 140

340 354

603

2008-09 32% 42% Mauritius Singapore USA UK 4% 5% 7% 10% Source: DIPP Mexico Brazil

2009-10 India Russia

2010-11E China

Foreign Investment in India

80000

60000

US$ million

Netherlands

Others

40000 20000 0 -20000 2008-09 2009-10 FDI FII 2010-11 2011-12(1st Quarter)

Source: DIPP Source: IMF Department of Industrial Policy and Promotion (DIPP), Government of India

Source: DIPP

INDIA-ECONOMY AND TRENDS

August 2011

Contents

The growth story continues Steady Growth Increasing Market Attractiveness Quarter Update Enablers of Indian growth story Key Developments Growth Enablers Sector update Automotive Energy Pharmaceuticals and Healthcare Retail and Consumer Goods Technology, Media and Telecommunications Transportation and Logistics

Road ahead Future Outlook

7

THE GROWTH STORY CONTINUES India-Economy and Trends August 2011

Increasing Market Attractiveness (1/4)

Global Investment Destination

Investment Sectors (1991-2011)

Services

India targets to achieve annual FDI worth US$ 50 billion by 2012 and plans to double the inflows by 2017.

44%

21%

Computer Software and Hardware Telecommunications

Inflow of Foreign Direct Investment (FDI) into India increased to US$ 88.52 billion in 2010-11. Economic growth backed by strong market fundamentals is the core attraction for global investments. Enabling business environment with conducive regulatory regime adds to the investment impetus. Large and growing talent pool along with reaffirmed impetus on infrastructure development is the primary enabler for investment inflow.

5% Source: DIPP

8% 8%

Real Estate and Construction Automobile Others

14%

Investment Intentions

400 350 300 250 200 5218 3991 178.6 327.2 25.8

2003

6371 6338 3818 4085 4456 3475 367.3

7,000

6,000

5,000 4,000 3,000 127.0 223.8 2,000 1,000 0

2007 2008 2009 2010

150

100 50 0 58.1

2004

77.5

2005

2006

Proposed investment

Number of proposals

Source: DIPP

THE GROWTH STORY CONTINUES India-Economy and Trends August 2011

Increasing Market Attractiveness (2/4)

FDI Policy

Sl No Sector/Activity Airports: greenfield projects 1 Airports: existing projects FDI cap/Equity 100 per cent 100 per cent 74 per cent (FDI + FII) 20 per cent 100 per cent Entry route Automatic Investment upto 74 per cent is under the automatic route and beyond 74 per cent under the Government route Upto 49 per cent FDI is under automatic route; Government route beyond 49 per cent and upto 74 per cent Government Automatic (subject to conditions notified vide press note 2 (2005 series) Automatic Automatic Automatic Automatic (subject to licensing by the Insurance Regulatory & Development Authority )

2 3 4

Banking (private sector) Banking (public sector) Construction development projects including housing, commercial premises, hotels, resorts, hospitals, educational institutions, recreational facilities and city and regional level infrastructure Drugs and pharmaceuticals including those involving the use of recombinant technology Health and medical services Hotel and tourism related industry Insurance

5 6 7 8

100 per cent 100 per cent 100 per cent 26 per cent

Source: Department of Industrial Policy and Promotion, Government of India

THE GROWTH STORY CONTINUES India-Economy and Trends August 2011

Increasing Market Attractiveness (3/4)

FDI Policy

Sl No 9 10 11 Sector/Activity Ports and harbours Non Banking Finance Companies (NBFCs) approved activities Exploration activities of oil and natural gas fields, infrastructure related to marketing of petroleum products, actual trading and marketing of petroleum products, petroleum product pipelines, natural gas/LNG pipelines, market study and formulation and Petroleum refining in the private sector Petroleum refining by the Public Sector Undertakings (PSU) a. Generation and transmission of electric energy produced in hydroelectric, coal/lignite based thermal, oil-based thermal and gas-based thermal power plants b. Non-conventional energy generation and distribution c. Distribution of electric energy to households, industrial, commercial and other users d. Power trading FDI cap/Equity 100 per cent 100 per cent 100 per cent Entry route Automatic Automatic Automatic

12

49 per cent

Government

13

100 per cent

Automatic

Source: Department of Industrial Policy and Promotion, Government of India

10

THE GROWTH STORY CONTINUES India-Economy and Trends August 2011

Increasing Market Attractiveness (4/4)

FDI Policy

Sl No Sector/Activity Telecom: basic and cellular, unified access services, national/international long-distance, VSat, Public mobile radio trunked services, Global mobile personal communications services (GMPCS), and other value added telecom services FDI cap/Equity 74 per cent (including FDI, FII, NRI, Foreign Currency Convertible Bonds (FCCBs), American Depositary Receipts (ADRs), Global Depositary Receipts (GDRs), convertible preference shares and proportionate foreign equity in Indian promoters/investing company) Entry route 49 per cent Automatic route; Government route beyond 49 per cent upto 74 per cent

14

Policy changes under review and discussion1

Defense sector: Increase from present cap of 26 per cent to 74 per cent, similar to telecom sector Multi-brand Retail Trading: Increase from present cap of 51 per cent to 100 per cent. Ownership vs Control: Caps on FDI for each sector are placed for limiting control of foreign entities in Indian companies. GoI has identified the difference in ownership and control. Presently discussion are going on to limit foreign control and not ownership in sectors.

Source: Department of Industrial Policy and Promotion, Government of India 1 Discussion papers, Department of Industrial Policy and Promotion, Government of India

11

INDIA-ECONOMY AND TRENDS

August 2011

Contents

The growth story continues Steady Growth Increasing Market Attractiveness Quarter Update Enablers of Indian growth story Key Developments Growth Enablers Sector update Automotive Energy Pharmaceuticals and Healthcare Retail and Consumer Goods Technology, Media and Telecommunications Transportation and Logistics

Road ahead Future Outlook

12

THE GROWTH STORY CONTINUES India-Economy and Trends August 2011

Quarter Update (1/6)

Central Government Finance

Central Government Finance

60.00 40.00 20.00

US$ million

Growth in economy is being driven by government expenditure. Government expenditure is fueled by food inflation, subsidies, focus on social and infrastructure sectors and short term debt servicing. Government revenue is showing a slow but sure positive growth trend.

0.00 -20.00 -40.00 -60.00 -80.00 -100.00 2 Qtr 2009 3 Qtr 2009 4 Qtr 2009 1 Qtr 2010 2 Qtr 2010 3 Qtr 2010 4 Qtr 2010 1 Qtr 2011

Revenue

Expenditure

Balance

Source: Central Statistics Organisation, RBI

13

THE GROWTH STORY CONTINUES India-Economy and Trends August 2011

Quarter Update (2/6)

National Output

National Industrial Production

200.00 180.00 160.00 140.00 120.00 100.00 80.00 60.00 40.00 20.00 0.00 2 Qtr - 3 Qtr - 4 Qtr - 1 Qtr - 2 Qtr - 3 Qtr - 4 Qtr - 1 Qtr 2009 2009 2009 2010 2010 2010 2010 2011 Industrial Production Index % change in industrial production 16.0% 14.0% 12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0% -2.0% -4.0%

The growth in industrial production was 7.7 per cent in the first quarter of 2011-12. Agricultural sector grew by a robust 6.6 per cent in 2010-11 adding to the economic growth. Services sector grew by 9.4 per cent in 201011. It is expected to grow by 9.5 per cent in 2011-12. 2

Source: 1 Central Statistics Organisation 2 Economic Intelligence Unit

IPI ( Base 1993-94)

While the Government had set itself a target of 9 per cent annual growth for 2011-12, it has been revised to a more realistic 8 per cent.1

Source: Central Statistics Organisation, RBI, Department of Economic Affairs, Centre for Monitoring Indian Economy

14

THE GROWTH STORY CONTINUES India-Economy and Trends August 2011

Quarter Update (3/6)

Inflation

Consumer Price Index

160.00 150.00 140.00 130.00 120.00 110.00 100.00 2 Qtr - 3 Qtr - 4 Qtr - 1 Qtr - 2 Qtr - 3 Qtr - 4 Qtr - 1 Qtr 2009 2009 2009 2010 2010 2010 2010 2011 General Index Fuel Index Manufactured Goods Index

After peaking at over 16 per cent in January 2010, the annual rate of consumer price inflation has moderated, to stand at 9.1 per cent in April 2011, compared with 13.7 per cent in April 2010. Food price inflation fell from a peak of 20.9 per cent in first quarter of 2010 to 12.4 per cent in first quarter of 2011.

RBI has announced a tighter monetary policy to check inflation. A calibrated approach is being taken to curb inflation without unduly affecting growth.

Source: Central Statistics Organisation, RBI, Department of Economic Affairs, Centre for Monitoring Indian Economy

15

THE GROWTH STORY CONTINUES India-Economy and Trends August 2011

Quarter Update (4/6)

Exchange Rates

Rs/US$

49 48 47 46 45 44 43

Rupee is showing a robust resilience to fluctuations in global currencies. The rise in the currency is primarily due to strong inflows of foreign investment, attracted by Indias bright economic prospects. The current-account deficit is not expected to pose a threat to the rupee, as it is expected to average modestly at 2 per cent of GDP in 2011-151

Source: 1 Economic Intelligence Unit

2 Qtr - 3 Qtr - 4 Qtr - 1 Qtr - 2 Qtr - 3 Qtr - 4 Qtr - 1 Qtr 2009 2009 2009 2010 2010 2010 2010 2011

Rs/US$

Source: RBI

16

THE GROWTH STORY CONTINUES India-Economy and Trends August 2011

Quarter Update (5/6)

Foreign Trade

Foreign Trade

100,000 80,000 60,000

US$ million

A consistent growth in the exports is a clear contributor to the growth in economy. During April-June, 2011-12, exports grew by 45.7 per cent to US$ 79 billion and imports shot up by 36.2 per cent to US$ 110.6 billion. Trade balance has been fluctuating due to fluctuations in the global crude prices. The exporting sectors that registered strong growth during the quarter include engineering, petroleum products, gems and jewellery, readymade garments and electronics.

40,000 20,000 0 -20,000 -40,000 -60,000 -80,000 -100,000 -120,000 2 Qtr - 3 Qtr - 4 Qtr - 1 Qtr - 2 Qtr - 3 Qtr - 4 Qtr - 1 Qtr 2009 2009 2009 2010 2010 2010 2010 2011 Exports Imports Trade Balance

Source: Center for Monitoring of Indian Economy

17

THE GROWTH STORY CONTINUES India-Economy and Trends August 2011

Quarter Update (6/6)

Financial Markets

Interest Rates

13.0% 12.0% 11.0% 10.0% 9.0% 8.0% 7.0% 6.0% 2 Qtr 2009 Source: RBI 3 Qtr 2009 4 Qtr 2009 1 Qtr 2010 2 Qtr 2010 3 Qtr 2010

At its latest review of monetary policy in June 2011, the Reserve Bank of India (the Central Bank) raised its benchmark interest rate, the repurchase (repo) rate, by 25 basis points to 7.5 per cent. Since March 2010, RBI has increased the repurchase rate 11 times with last update on 26th July 2011. This was done to maintain anti-inflationary stance in a calibrated manner, without affecting economic growth. The effect of tighter funds and likely slowdown in economic growth is reflected in the sentiment of the equity market.

Deposit Rate

Lending Rate

Sensex

25,000 20,000 15,000 100.0% 80.0% 60.0% 40.0% 20.0% 0.0% 2 Qtr - 3 Qtr - 4 Qtr - 1 Qtr - 2 Qtr - 3 Qtr - 4 Qtr - 1 Qtr 2009 2009 2009 2010 2010 2010 2010 2011 Sensex Source: BSE YoY %Change

10,000 5,000 0

18

INDIA-ECONOMY AND TRENDS

2011

Contents

The growth story continues Steady Growth Increasing Market Attractiveness Quarter Update Enablers of Indian growth story Key Developments Growth Enablers Sector update Automotive Energy Pharmaceuticals and Healthcare Retail and Consumer Goods Technology, Media and Telecommunications Transportation and Logistics

Road ahead Future Outlook

19

ENABLERS OF INDIAN GROWTH STORY India-Economy and Trends August 2011

Key Initiatives in Recent Times (1/4)

Policy Proposals Budget 2011-12

Agriculture

Recognition to cold chains, postharvest storage and capital investment in fertiliser production as an infrastructure sub-sector. Proposal for setting up of National Mission for Protein Supplements to promote animal based protein production through livestock development, dairy farming, piggery, goat rearing and fisheries. Promotion of organic farming methods, combining modern technology with traditional farming practices like green manuring, biological pest control and weed management.

Capital investment in the creation of modern storage capacity will be eligible for viability gap funding scheme of the Finance Ministry.

Proposal to review and enforce a reformed Agriculture Produce Marketing Act.

Source: National Budget, 2011-12

20

ENABLERS OF INDIAN GROWTH STORY India-Economy and Trends August 2011

Key Initiatives in Recent Times (2/4)

Policy Proposals Budget 2011-12

Banking and Financial

Foreign investors are permitted to invest in the equity schemes of SEBI registered Mutual Funds. Amendments in the Reserve Bank of India Act are proposed to be introduced in Parliament. Setting up of Central Electronic Registry under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002. Setting-up a Financial Sector Legislative Reforms Commission to rewrite and streamline the financial sector laws, rules and regulations. Commission will complete its work by 2013.

Source: National Budget, 2011-12

21

ENABLERS OF INDIAN GROWTH STORY India-Economy and Trends August 2011

Key Initiatives in Recent Times (3/4)

Policy Proposals Budget 2011-12

Education

Budget allocation of Rs. 52,057 crore (US$ 11.6 billion) for universalising access to secondary education, increasing the percentage of scholars in higher education and providing skill training. Vocationalisation of Secondary Education Scheme will be implemented to improve the employment of youth. The National Knowledge Network to link 1,500 Institutes of Higher Learning and Research through an optical fibre backbone.

Additional fund of Rs. 500 crore (US$ 111 million) to the National Skill Development Fund.

Environment and Climate Change

Allocate funds from National Clean Energy Fund (NCEF) for Green India Mission and launching environmental remediation programmes.

Source: National Budget, 2011-12

22

ENABLERS OF INDIAN GROWTH STORY India-Economy and Trends August 2011

Key Initiatives in Recent Times (4/4)

Policy Proposals Budget 2011-12

Manufacturing

Proposal to create National Manufacturing and Investment Zones (NMIZs) to increase manufacturing component of economy from 16 to 25 per cent. National Mission for Hybrid and Electric Vehicles will be launched to provide green and clean transportation for the masses. Set-up 7 mega leather clusters during the financial year 2011-12. Jodhpur is included for the development of a handicraft mega cluster.

Microfinance

Creating a dedicated fund India Microfinance Equity Fund of Rs. 100 crore (US$ 22 million) with Small Industries Development Bank of India (SIDBI) for providing equity to smaller Mutual Fund institutions. Creation of a Womens SHGs Development Fund of Rs. 500 crore (US$ 111 million) to empower women and promote their SHG.

Source: National Budget, 2011-12

23

INDIA-ECONOMY AND TRENDS

2011

Contents

The growth story continues Steady Growth Increasing Market Attractiveness Quarter Update Enablers of Indian growth story Key Developments Growth Enablers Sector update Automotive Energy Pharmaceuticals and Healthcare Retail and Consumer Goods Technology, Media and Telecommunications Transportation and Logistics

Road ahead Future Outlook

24

ENABLERS OF INDIAN GROWTH STORY India-Economy and Trends August 2011

Growth enablers (1/6)

Consumer Spending

India Spends on

Clothing and Fashion 17% 10% 4% 6% 3% Electronics Furniture and Fixtures Food and Grocery 60% Others Beauty and Welness

India has approximately 222 million households, with more than 30 per cent of the population living in 5,000 cities and towns. 13 million people enter Indias urban work force each year. Indias population grew at 1.5 per cent during 200510. It is estimated that by about 2025 India will have 25 per cent of the worlds total workforce.

Companies are catering to rural demand - tapping the bottom of the pyramid - for inclusive growth.

The rural consumer market, which grew by 25 per cent in 2008, is expected to reach US$ 425 billion in 2010-11 with 720-790 million customers. This will be double the 2004-05 market size of US$ 220 billion.

Source: CII-Technopak White Paper (2009)

Source: India Retail market, August 2010, Deloitte

25

ENABLERS OF INDIAN GROWTH STORY India-Economy and Trends August 2011

Growth enablers (2/6)

Consumer Spending

Expenditure, 2009-10

43% 63% 57% 37%

85%

15%

Modern

Retail Private Consumption Expenditure Government Expenditure Non Retail

Traditional

Source: India Retail market, August 2010, Deloitte

26

ENABLERS OF INDIAN GROWTH STORY India-Economy and Trends August 2011

Growth enablers (3/6)

Demographics

Projected Population of India (million)

Over 80 65-80 60-64

India is among the worlds youngest nations with a median age of 25 years as compared to 43 in Japan and 36 in the US. In 2025, more than 55 per cent of the population of India would be of working age. With a large working population, India can continue to be competitive globally.

Projected Median Age in 2025

25-60 15-24 5-14 0-4 0 500 2030 1000 2025 1500 2000

50 40 40 30 34 28 39

31

Source: World Population Prospects, 2010, UN

20

10 0 Brazil Russia India Median Age Source: World Population Prospects, 2010, UN China Mexico

27

ENABLERS OF INDIAN GROWTH STORY India-Economy and Trends August 2011

Growth enablers (4/6)

Robust Financial Institutions

30.0%

Growth Rate

25.0% 20.0% 15.0% 10.0% 5.0%

Indias financial markets are robust and backed by strong fundamentals. The Securities Exchange Board of India (SEBI), the strong and independent capital markets regulator is committed to develop and regulate markets in a systematic way. The Bombay Stock Exchange (BSE) is the worlds largest stock exchange in terms of number of listed companies and the National Stock Exchange (NSE) is the world's third-largest stock exchange in terms of number of transactions. The Multi-Commodity Exchange of India (MCX) is among the top three bullion exchanges and top four energy exchanges of the world. National Securities Depository Ltd (NSDL), the first and largest depository for equity market in India manages more than 10 million demat accounts.

0.0%

Q3 2009 Q4 2009 Q1 2010 Q2 2010 Q3 2010 Aggregate Deposits Gross Bank Credit

Source: RBI

Credit Deposit Ratio

78.0% 76.0%

74.0%

72.0% 70.0%

68.0%

Q3 2009

Q4 2009

Q1 2010

Q2 2010

Q3 2010

Credit-Deposit Ratio Source: RBI

28

ENABLERS OF INDIAN GROWTH STORY India-Economy and Trends August 2011

Growth enablers (5/6)

Exports: Indias position is strengthening

Indias exports Goods and services

200 150 100 50 0 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 Goods Source: RBI Services

Exports jumped 46.4 per cent in June 2011 to US$ 29.2 billion continuing the fast paced growth of the previous fiscal. Imports, too, continued to rise at a pace of 42.4 per cent to US$36.9 billion. The trade deficit for June 2011 is estimated at US$ 7.7 billion which was lower than the deficit of US$ 11.02 billion during April 2010. India is a leading exporter of IT services in the world. The US and the UK together account for a dominant share of Indias IT-BPO exports at approximately 61 per cent and 18 per cent, respectively. India is moving from cost competitive exports towards more value based exports both in goods and services. India accounts for approximately 1.64 per cent of global trade in goods and services currently.The government aims to double this share by 2020.

Source: RBI, Government of India

Composition of services exports 20092010 (P)

53%

Travel Transportation Software services

12% 12% 13% 10%

Business Services Others

29

Source: RBI

ENABLERS OF INDIAN GROWTH STORY India-Economy and Trends August 2011

Growth enablers (6/6)

Investment Climate

Presence of large sector backward integration and competitors presents ideal scenario for businesses to grow with a large target market.

Trends in share of gross fixed capital formation (GFCF)

18,000 16,000 14,000 12,000 10,000 8,000 6,000 4,000 2,000 0

33.3 30.3

22.9 23.6 24.7 31.7 28.8

32.2 32.8

35.0 30.0 25.0 20.0 15.0 10.0 5.0 0.0

Indias industrial sector is expected to witness capital expenditure worth INR 22 trillion (US$ 483.5 billion) during 201013.

Electricity sector is expected to witness the highest capacity addition worth INR 4.4 trillion (US$ 96.6 billion) during 201013. Other sectors that are expected to witness significant investments during 201013 include:

FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10

Public sector Household sector

Private corporate sector GFCF as % of GDP

Steel (INR 2,370 billion/US$ 52.1 billion). Roadways (INR 1,606 billion/US$ 35.3 billion). Telecommunications (INR 1,546 billion/US$ 34 billion). Petroleum products (INR 1,411 billion/US$ 31 billion).

Source: CMIE, Economic Survey 2010-11

30

INDIA-ECONOMY AND TRENDS

2011

Contents

The growth story continues Steady Growth Increasing Market Attractiveness Quarter Update Enablers of Indian growth story Key Developments Growth Enablers Sector update Automotive Energy Pharmaceuticals and Healthcare Retail and Consumer Goods Technology, Media and Telecommunications Transportation and Logistics

Road ahead Future Outlook

31

SECTOR UPDATE India-Economy and Trends

August 2011

Automotive Industry (1/3)

Fuelling Indias Growth

The automotive sector has been one of India's largest and fastest-growing manufacturing industries, with vehicle production (excluding two- and three-wheelers) increasing by over 130 per cent overall, to 2.9 million units a year, in the last six years leading to 2009-10.The Indian auto sector grew the fastest in the world at over 18 per cent during January-May 20111. India's automotive industry provides direct or indirect employment for over 10m people and accounts for around 5 per cent of industrial output. The automobile sector recorded a 28.2 per cent growth in production, 26.9 per cent in domestic sales and 30.6 per cent in exports during 2010-11 (Apr-Feb). The overall volume growth rate for the sector grew by17.6 per cent yoy and 2.6 per cent qoq during the first quarter of 2011-12. Strong economic growth is expected to support robust passenger-car sales growth in the period 2011-15, with new passenger-car sales forecast to expand at an average rate of 14.5 per cent a year. India is expected to be the seventh-largest automotive market in the world by year 2015. Low penetration levels coupled with a healthy and sustainable economic environment and favourable demographics supported by increasing per capita income levels are expected to drive long-term growth of the industry.

Source: 1 Society of Indian Automobile Manufacturers Economic Intelligence Unit

32

SECTOR UPDATE India-Economy and Trends

August 2011

Automotive Industry (2/3)

Fuelling Indias Growth

Automotive Industry Growth Projections

20.00 15.00 10.00

Foreign carmakers continue to come to India in an attempt to secure a share of the growing domestic market. Super-luxury carmakers are beginning to enter the Indian market. The small-car market, which already accounts for twothirds of domestic sales, offers promising prospects for sales growth as increasing affluence enables more Indians to trade up from motorcycles. Sales of commercial vehicles are forecast to expand strongly rising by an annual average of almost 15 per cent a year in the next five years to around 830,000 units in 2015-16. The automotive components industry in India continues to grow rapidly as a result of lower costs and rising quality of production. The Indian automobile sector is expected to grow faster than US, Japan and Germany in the next 5 years.

Source: Economic Intelligence Unit

5.00 0.00

2011 -5.00 -10.00 -15.00

2012

2013

2014

2015

India

US

Japan

China

Germany

Source: Economic Intelligence Unit

33

SECTOR UPDATE India-Economy and Trends

August 2011

Automotive Industry (3/3)

Union Budget Provisions

National Mission for Hybrid and Electric Vehicles is proposed to be set up in collaboration with all stakeholders to encourage alternative fuel-based vehicles. Full exemption from basic Customs Duty and a concessional rate of Central Excise Duty extended to batteries imported by manufacturers of electrical vehicles. Concessional Excise Duty of 10 per cent to vehicles based on Fuel cell technology. Exemption granted from basic custom duty and special Countervailing Duty (CVD) to critical parts/assemblies needed for Hybrid vehicles. Reduction in Excise Duty on kits used for conversion of fossil fuel vehicles into Hybrid vehicles from 10 per cent to 5 per cent. Excise Duty on LEDs reduced to 5 per cent and special CVD being fully exempted. Concession to factory-built ambulances from Excise Duty. Agricultural credit outlay increased to Rs. 4,75,000 crore (approx. US$ 107054) expected to increase demand for agricultural vehicles. Overall increased emphasis on infrastructure development is expected to boost demand for automobiles.

Source: National Budget, Government of India , 2011-12

34

INDIA-ECONOMY AND TRENDS

2011

Contents

The growth story continues Steady Growth Increasing Market Attractiveness Quarter Update Enablers of Indian growth story Key Developments Growth Enablers Sector update Automotive Energy Pharmaceuticals and Healthcare Retail and Consumer Goods Technology, Media and Telecommunications Transportation and Logistics

Road ahead Future Outlook

35

SECTOR UPDATE India-Economy and Trends

August 2011

Energy

Sector Outlook

The total installed capacity in India is 169,748 MW1. Thermal sector is the largest source of power and contributes 111,034 MW to the total installed capacity. To meet the increase in the total peak power demand and energy requirement, an additional 75,000 MW of capacity is proposed to be added during 2012-17. Additionally, 13,000 MW of captive capacity will also be added to meet the captive demand. There will be a substantial increase in the transmission infrastructure of the country during 2012-17. There will be an increase of 90,000 Circuit Kilometers (Ckm) of transmission lines; 154,000 megavolt amperes (MVA) of substation capacity; and 27,350 MW of inter-regional transmission grid. The power sector in India has experienced significant growth in private investments since the enactment of the Electricity Act, 2003. The private sector currently contributes 35,145 MW to the total installed capacity. Market-based approach to unlock energy efficiency opportunities, estimated to be about Rs. 74,000 crore (approx. US$16,677 million) by 2014-15 with 19,000 MW avoided capacity addition. Excise duty exemption for Ultra Mega Power Projects (UMPP) equipment is expected to aid fast-track creation of new large-scale power generation capacities. Higher FII limit for investment in corporate bonds issued by infrastructure companies is expected to provide additional funding to the power sector.

Source: 1Central Electricity Authority (Data as on Dec. 2010) Ministry of Power, Government of India, Economic Intelligence Unit, National Budget 2011-12

36

SECTOR UPDATE India-Economy and Trends

August 2011

Energy Sector Strengths

Robust legal, regulatory and policy framework The enactment of the Electricity Act 2003 led to a deepening of the reform process through the introduction of a competitive regime in the Indian power sector. The Act also provided framework for franchisee based participation of private sector in Distribution. The Government is continuously working towards promoting a facilitative framework for promotion of renewable energy technologies. Conducive environment to attract private investments Private sector players contribute almost ~32 per cent of total generating capacity addition in 11th Plan and are set to go beyond 60 per cent during 12th Plan. R&D and Training Dedicated institutes for research and development and training such as Central Power Research Institute (CPRI) and the National Power Training Institute (NPTI). Market infrastructure Introduction of open access , expansion of transmission infrastructure, creation of trading licensees , setting up of power exchange and addition of merchant capacity have created a strong base for the power trading market.

37

SECTOR UPDATE India-Economy and Trends

August 2011

Energy Present Capacity

Installed Capacity in India (MW)

Sector State Govt. Private Govt. Union Govt. Total Hydro 27,257 1,425 8,685 37,367 Thermal 52,157 19,755 39,122 111,034 Nuclear 0 0 4,560 4,560 R.E.S. 2,822 13,965 0 16,787 Total 82,236 35,145 52,367 169,748

Hydro 22%

Solar power

18 MW

Bio power* Thermal 54% Gas 10% Small Hydropower Renewable 11 % Nuclear 3% Note: Data as on 31st Dec 2010

2,632 MW

2,939 MW

Wind power

13,066 MW

Source: Ministry of New and Renewable Energy and Ministry of Power, Government of India

38

SECTOR UPDATE India-Economy and Trends

August 2011

Energy

Future Plans Power Sector (2012-2017)

2012-13 Capacity addition (MW) 2013-14 2014-15 2015-16 2016-17 Total

17,500

16,000

15,500

14,000

12,000

75,000

Total Power Sector Fund Requirement (Rs. Crores) Generation Transmission Distribution TOTAL Renewable Energy Sources (MW) Biomass/ Agri waste Bagasse Cogen Urban and Industrial Waste (U&I) Energy Small Hydro Power (SHP) Solar Wind Total

2012-13 1,24,625 35,100 99,375 2,59,100

2013-14 1,12,250 40,250 79,500 2,32,000

2014-15 92,875 42,500 59,625 1,95,000

2015-16 91,375 45,750 59,625 1,96,750

2016-17 90,250 45,900 99,375 2,35,525

Total 5,11,375 2,09,500 3,97,500 11,18,375 Total Target for five years 400 1,350 220 1,610 3,700 11,000

2012-13 80 300 25 300 800 2,200 3,705

2013-14 80 300 35 300 400 2,200 3,315

2014-15 80 250 45 300 400 2,200 3,275

2015-16 80 250 55 350 1,000 2,200 3,935

2016-17 80 250 60 360 1,100 2,200 4,050

Source: Ministry of New and Renewable Energy and Ministry of Power, Government of India

39

INDIA-ECONOMY AND TRENDS

2011

Contents

The growth story continues Steady Growth Increasing Market Attractiveness Quarter Update Enablers of Indian growth story Key Developments Growth Enablers Sector update Automotive Energy Pharmaceuticals and Healthcare Retail and Consumer Goods Technology, Media and Telecommunications Transportation and Logistics

Road ahead Future Outlook

40

SECTOR UPDATE India-Economy and Trends

August 2011

Pharmaceuticals and Healthcare Industry (1/4)

Sector Outlook

Indias pharmaceutical industry production is valued at around Rs. 1 lakh crore (approx. US$ 20 billion) with exports being around 40 per cent. The Indian Pharma Industry globally ranks 3rd in terms of volume. Presently, India contributes around 20 per cent in terms of value in the global generic drugs market. The Indian pharmaceutical sector is expected to witness revenue growth momentum, driven by steady, ~14 per cent growth in domestic brand-named formulations and the continuing expansion of the international business. Domestic formulations are sustaining double-digit growth trajectory, mainly driven by the chronic segments anti-diabetes and cardiovascular which are growing by over 20 per cent and offer strong margins. Export formulations are likely to grow on the back of the continuous launch of products, forays into new areas, supplies under licensing deals and the launch of products with limited competition. Increase in personal income, government healthcare outlays and private domestic investment, combined with longer life expectancy, should allow per-head healthcare spending to rise to US$142 in 2015. While the retail segment is mainstay of the pharmaceuticals market (contributes 85-90 per cent of overall sales), the hospital segment is gaining importance driven by the rise in infrastructure and advent of corporate hospitals.

Source: Department of Pharmaceuticals, Government of India, Economic Intelligence Unit

41

SECTOR UPDATE India-Economy and Trends

August 2011

Pharmaceuticals and Healthcare Industry (2/4)

Sector Outlook

India is one of the lowest cost producers of pharma products with proven track record in high tech manufacturing facilities. India enjoys a high degree of regulatory compliance capabilities of international standards

95 per cent of the domestic requirement being met through domestic production.

Indian Pharma Industry

One of the lowest costs for innovation and clinical trials globally enabled by the low cost scientific pool

India has proven legal skills to evaluate IP and commercial strategies are available in top companies.

Emerging hub for Contract research, Bio-pharma, Clinical trials and Clinical data management.

42

SECTOR UPDATE India-Economy and Trends

August 2011

Pharmaceuticals and Healthcare Industry (3/4)

Growth Drivers

Increasing investment into R&D by Indian pharma companies - around 6 per cent of sales invested in pursuing R&D Rising affordability and increased healthcare insurance

Incremental consumption from tier III-IV towns and rural markets, which constitute 20 per cent of the total market and are currently growing at 2530 per cent

Indian Pharmaceutical industry to reach US$ 20 billion by 2015

International manufactureres pursuing R&D partnerships with Indian firms

Increase in health-awareness and higher prevalence of lifestyle-related diseases

Strong growth in chronic therapies

Source: ASSOCHAM, Thomson Reuters

43

SECTOR UPDATE India-Economy and Trends

August 2011

Pharmaceuticals and Healthcare Industry (4/4)

Union Budget Provisions

Increase in plan allocation for health by 20 per cent in 2011-12 to Rs.26,760 crore (approx. US$ 6,031 million). Scope of the Rashtriya Swasthya Bima Yojana to be expanded to widen coverage. Proposal to increase budgetary allocation for the department of pharmaceuticals to promote the research and development. Plans to allocate total amount of Rs 213 crore (approx. US$ 48 million) to the Department for financial year 2011-12 as compared to the budgetary allocation of Rs 198 crore (approx. US$ 45 million) in FY 2010-11. Proposal for budgetary allocation of Rs.132.31 crore (approx. US$ 30 million) during FY 2011-12 for the National Institute of Pharmaceutical Education and Research (NIPER) and allocation of Rs.8.28 crore (approx. US$ 2 million) for the projects of National Pharmaceutical Pricing Authority (NPPA). Additional health-related budget allocation, encompassing yoga, naturopathy and homeopathy, has been increased by 12.5 per cent year on year in 2011-12.

Source: National Budget, Government of India, 2011-12

44

INDIA-ECONOMY AND TRENDS

2011

Contents

The growth story continues Steady Growth Increasing Market Attractiveness Quarter Update Enablers of Indian growth story Key Developments Growth Enablers Sector update Automotive Energy Pharmaceuticals and Healthcare Retail and Consumer Goods Technology, Media and Telecommunications Transportation and Logistics

Road ahead Future Outlook

45

SECTOR UPDATE India-Economy and Trends

August 2011

Retail and Consumer Goods (1/3)

Sector Outlook

Already a Large Sector

Indias US$ 450 billion retail market is the third-largest in Asia in terms of sales. Second-largest employment provider in India, after the agricultural sector, with approx. 15 per cent employment and expected to continue to account for a significant share of overall employment. The total retail spend is estimated to double in the next five years, of which organised retail is expected to grow at a CAGR of 22 per cent.

High Growth Expected

Consumer expenditure on food, beverages and tobacco is forecast to rise in absolute terms to US$588bn in 2015, from an estimated US$375.3bn in 2010. Growth in market demand for electrical appliances and household goods is forecast to average 13.7 per cent a year in 2011-15.

Multi-Sector Potential

Clothing sales is expected to rise rapidly, driven by a growing youth population.

Source: Reuters, India Retail Report, 2010

46

SECTOR UPDATE India-Economy and Trends

August 2011

Retail and Consumer Goods (2/3)

Growth Drivers

Growing Consumer Class Population

Proposed FDI norms expected to provide strategic investment opportunity for global retailers Increasing momentum of Rural retail

India Retail Sector Growth

Increased spending on R&D wings by FMCG companies Substantial Expansion and Retailer Investment Plans

47

Proposed Setting up of additional 15 Mega Food Parks during 2011-12.

SECTOR UPDATE India-Economy and Trends

August 2011

Retail and Consumer Goods (3/3)

Government Support

Surcharge on domestic companies reduced to 5 per cent from 7.5 per cent. Enhancement of the exemption limit for the general category of individual taxpayers is expected to leave the consumers with a higher disposable income adding to the demand for consumer goods. Proposal to enlarge the scope of exemptions under the package of measures to incentivise food processing by providing full exemption from excise duty to air-conditioning equipment and refrigeration panels for cold chain infrastructure and conveyor belts used in cold storages and warehouses.

FDI up to 100 per cent allowed under the automatic route in Cash and Carry (wholesale)

1991 1997 2006

Government mulled over the idea of allowing 100 per cent FDI in singlebrand retail and 50 per cent in multibrand retail

2008 2011 2006

Liberalisation - Indian economy opened FDI up to 51 per cent allowed under the automatic route in select priority sectors

FDI up to 51 per cent allowed with prior Government approval in 'Single Brand Retail'

48

Government considering to allow FDI in multi-brand retailing

INDIA-ECONOMY AND TRENDS

2011

Contents

The growth story continues Steady Growth Increasing Market Attractiveness Quarter Update Enablers of Indian growth story Key Developments Growth Enablers Sector update Automotive Energy Pharmaceuticals and Healthcare Retail and Consumer Goods Technology, Media and Telecommunications Transportation and Logistics

Road ahead Future Outlook

49

SECTOR UPDATE India-Economy and Trends

August 2011

Technology, Media and Telecommunications (1/4)

Technology

The Indian IT sector has registered robust growth in the last two decades and more particularly in last five years. The industry is expanding beyond US/UK markets into several other emerging markets. The revenues from the sector are estimated to be US$ 74.4 billion in 2010-11, translating into CAGR of 22.5 per cent from 2004-05 to 2010-11. Spending on IT is expected to grow substantially in 2011-15, by an average of 16.9 per cent a year in US dollar terms. This would result in the industry becoming even more prominent in India than it is currently. Deal signings are strong across the tier 1 Indian IT firms. The deal pipeline for the Indian IT firms is stronger as compared to last year. The domestic market for the IT sector is also steadily increasing.

The current deal pipeline also includes many new first-time outsourcers from non-traditional verticals/geographies as well. The Indian IT companies are likely to gain market share in this multi-vendor outsourcing trend.

Source: Gartner Research, April 2011

50

SECTOR UPDATE India-Economy and Trends

August 2011

Technology, Media and Telecommunications (2/4)

Media, Entertainment and Telecom

With a current estimated size of approx US$ 13 billion, the Indian Media and Entertainment industry is one of the fastest growing industries of India and is projected to grow at a CAGR of 13 percent to reach the size of approx. US$ 24 billion by 2014. The Indian animation industry is expected to grow at 20 percent to reach US$ 253 million by 2013 from the current US$ 122 million. The Indian gaming market alone has been estimated at US$ 239 million and is expected to grow at a CAGR of over 50 percent to reach US$ 1.3 billion by 2013. India is the second-largest telecom market in the world with 874.68 million subscribers as on May 31, 2011, which are estimated to reach approximately 1 billion by 2014. The telecom sector is one of the highest FDI-attracting sectors in India, and has recorded FDI inflow worth more than US$ 9 billion between 2000 and 2010. The overall tele-density in India is 73.11 and the total broadband subscriber base is 12.12 million at the end of May 2011. The rural markets are expected to be the next key growth drivers for the Indian telecom sector, given rural Indias growing population and disposable income. The governments push to increase mobile penetration rates is expected to generate increased demand for telecom equipment; domestic demand for telecoms equipment is forecasted to grow by around 10 per cent a year in the next few years.

Source: Telecom Regulatory Authority of India, Gartner Research, April 2011

51

SECTOR UPDATE India-Economy and Trends

August 2011

Technology, Media and Telecommunications (3/4)

Growth Forecasts

Units in US$ Million Computing Hardware (US$ M) Software (US$ M) IT Services (US$ M) Telecommunications (US$ M) Total IT ( US$ M) Rs Billion Films TV Print Radio Music Animation Gaming Internet Outdoor Total Media 2009 2010 2011 2012 2013

6,400

2,215 6,163 43,987 58,765 2009 89 257 175 8 8 20 8 8 14 587

7,412

2,477 7,403 49,767 67,059 2010 96 289 190 9 9 23 10 11 15 652

8,818

2,803 8,636 54,160 74,419 2011 105 337 206 10 10 28 14 15 17 742

10,267

3,186 10,066 57,637 81,155 2012 115 382 225 12 12 33 20 18 19 836

11,679

3,604 11,777 62,295 89,356 2013 125 448 246 14 14 39 26 23 21 956

Source: Gartner Research, April 2011, Deloitte Research

52

SECTOR UPDATE India-Economy and Trends

August 2011

Technology, Media and Telecommunications (4/4)

Union Budget Provisions

The lower rate of 15 per cent tax on dividends received by an Indian company from its foreign subsidiary are expected to boost the margins of large IT companies. Parts and components of mobile handsets are exempted from Special Additional Duty until March 2012. The surcharge in case of domestic companies is proposed to be reduced from 7.5 per cent to 5 per cent and in case of foreign companies from 2.5 per cent to 2 per cent. Also, the dividend distribution tax rate will be reduced from 16.61 per cent to 16.22 per cent. The increase in the plan allocation for School Education by 24 per cent to Rs. 520.57 billion in FY 2011-12 would boost business opportunities for the IT-Education companies. Proposal for connecting 1,500 Institutions of Higher Learning and Research through optical fibres with the assistance of National Knowledge Network (NKN). Plans for set up of Sectoral Innovation Councils and State Innovation Councils in each state in alignment with the National Innovation Council.

Source: National Budget, Government of India, 2011-12

53

INDIA-ECONOMY AND TRENDS

2011

Contents

The growth story continues Steady Growth Increasing Market Attractiveness Quarter Update Enablers of Indian growth story Key Developments Growth Enablers Sector update Automotive Energy Pharmaceuticals and Healthcare Retail and Consumer Goods Technology, Media and Telecommunications Transportation and Logistics

Road ahead Future Outlook

54

SECTOR UPDATE India-Economy and Trends

August 2011

Transport and Logistics

Increased Allocation Allocation of over Rs. 2,14,000 crore (approx. US$ 48230 million) proposed for infrastructure sector in 2011-12 which is 23.3 per cent higher than the allocation in 2010-11. FII Limits Raised FII limit for investment in corporate bonds, with residual maturity of over five years to be raised by US$ 20 bn, resulting in an aggregate limit of US$ 40 bn. Tax Free Bonds Proposal to allow tax free bonds of Rs. 30,000 crore (approx. US$ 6761 million) to be issued by various Government undertakings in the year 2011-12 - Indian Railway Finance Corporation and NHAI Rs.10,000 crore (US$ 2253 million) each and Ports Rs. 5,000 crore (US$1127 million). Increasing PE Confidence Increased activity in transport and logistics sector during the first 5 months of 2011 Overall, about 160 deals in infrastructure sector in last 5 years

Infrastructure Debt Funds Proposal to create Special Vehicles in the form of notified infrastructure debt funds. The Finance Bill, 2011 proposes to provide tax exemption from any income arising to an Infrastructure Debt Fund

FIIs in SPVs Since most of the infrastructure companies are organised in the form of SPVs , it is proposed to permit FIIs to invest in unlisted bonds of such SPVs with a minimum lock-in period of three years.

Source: National Budget, Government of India, 2011-12

55

SECTOR UPDATE India-Economy and Trends

August 2011

Transport and Logistics Roads

Several Opportunities More than 150 projects covering over 30,000 km of roads expected to be awarded by 2014. Standardisation of Processes Concession Agreement framework in place for undertaking projects on BOT Toll, BOT Annuity and Operate, Maintain and Transfer (OMT) basis. Permission for Foreign Equity 100 per cent foreign equity permitted in construction and maintenance of roads, highways, tunnels etc. Duty free import Duty free import of high capacity equipment required for highway construction. Government Financial Support Viability Gap Funding (VGF) Grant upto 40 per cent of project cost to make project viable.

Source: National Highway Authority of India

Tax Exemption 100 per cent tax exemption in any 10 consecutive years within a period of 20 years after completion of the project. Long term Returns Concession period of upto 30 years for enabling long term returns and tolling rights for toll projects. Faster Implementation of Projects Government support for land acquisition, resettlement and rehabilitation - simplified procedures Funding of Projects Provision of funding to select road projects under the Economic Importance and Interstate Connectivity Schemes. Faster Approvals and Clearance Government Support on legal and operational aspects such as obtaining of registration licenses, environmental clearances etc.

56

SECTOR UPDATE India-Economy and Trends

August 2011

Transport and Logistics Ports and Airports

Union Budget Provisions

Aviation Establishment of Civil Aviation Economic Advisory Council - The Council was set up following a surge in airfares of domestic airlines and aims to promote policies to enhance the sustainability of the aviation industry in India in consultation with stakeholders. Ports New Land Policy for Major Ports 2010 - Opens up new opportunities for logistics players wishing to setup logistics facilities in the vicinity of the port. Draft Major Ports Regulatory Authority Act - Proposes to replace Tariff Authority for major ports by MPRA thereby providing more freedom to Major ports in setting tariffs. Seen as the first step in ensuring level playing field for all ports, major and non-major. Draft Indian Ports (Consolidated) Bill 2010 - Seeks to replace and merge the Indian Ports Act 1908 and Major Port Trust Act 1963. Proposes a single regulatory authority to be setup for all ports in India (major and non-major).

Civil Aviation Requirements issued by Directorate General of Civil Aviation (DGCA) for passenger facilitation.

Plan to set up Independent Civil Aviation Authority announced to replace the DGCA.

57

SECTOR UPDATE India-Economy and Trends

2011

Transport and Logistics Railways

Several Policy Developments

Railways Infrastructure for Industry Initiative (R3i) Targeted to attract private sector participation in rail connectivity projects through laying of new lines. Four different models are allowed in this policy all of which essentially provide incentives to the private sector for laying down new lines. Rail Connectivity to Coal and Iron Ore Mines Policy (R2ci) Intended to facilitate and provide incentives to customers to invest in rail connectivity for coal and iron ore blocks. Special Freight Train Operator Policy This policy will allow private sector to move their own rakes for traffic other than containers. A complementary policy on development of automobile and ancillary hubs has also been announced. Private Freight Terminal Policy This policy allows the private sector to set up terminals for handling both container and goods on a revenue sharing basis with the railways.

58

SECTOR UPDATE India-Economy and Trends

2011

Transport and Logistics Logistics

Transport and Logistics sector market size in India is estimated to be over US$ 125 billion employing over 45 million and growing at the rate of 30 to 40 per cent per annum. As per the Ministry of Commerce , over 160 Inland Container Depot (ICD)/Container Freight Stations (CFS) are functional in the country. Half of these are privately owned and the other half by Container Corporation of India Ltd (CONCOR), Central Warehousing Corporation (CWC) and State Governments. Over 70 new ICD/CFS facilities are under development by the private sector. Emerging market survey, 2011 (excluding China) by Transport Intelligence establishes Indias attractiveness:

Found nearly half the respondents agreeing that India would emerge as a major logistics hub in the future. Indias rapid growth and market size is the biggest attraction.

It is proposed to recognise cold chains and post-harvest storage as an infrastructure sub-sector. Key policies governing the sector include: Multimodal Transportation of Goods Act, 2000 (amended), Indian Railways Act, 1989, R3i Policy, Special Freight Train Operator Policy, Warehousing Act, 2007, Procedure for setting up ICD/CFS and Private Freight Terminal Policy.

Source: Emerging market survey, Transport Intelligence and National Budget 2011-12 Ministry of Commerce, Government of India

59

INDIA-ECONOMY AND TRENDS

2011

Contents

The growth story continues Steady Growth Increasing Market Attractiveness Quarter Update Enablers of Indian growth story Key Developments Growth Enablers Sector update Automotive Energy Pharmaceuticals and Healthcare Retail and Consumer Goods Technology, Media and Telecommunications Transportation and Logistics

Road ahead Future Outlook

60

THE ROAD AHEAD India-Economy and Trends

2011

The Road Ahead (1/5)

Future Outlook

Indias strong growth fundamentals, investment rates, fast working population growth and a rapidly expanding middle class are expected to ensure a steady economic performance. The economic growth is expected to be led by private investment and private consumption in the coming years. The concept of inclusive growth remains central to Indias development policy, as does the stabilisation of the public finances. Three dominant themes of the governments spending plan include: support for the farm sector, increased funding for infrastructure, increased focus on manufacturing sector and measures intended to damp down inflationary pressures. Further reforms are expected to open up previously closed sectors and raising limits on foreign ownership in others.

Source: RBI, CMIE, Economic Intelligence Unit

Real GDP is expected to grow at 8.6 per cent in 2011-12. Average annual growth rate will be around 8.8 per cent in 201213 to 2015-16. Agriculture, Industry and Services contribution to GDP is expected to grow by approx. 9.5 per cent, 48 per cent and 55 per cent respectively during 2010-15 (at constant 2004-05 prices).

Source: Economic Intelligence Unit

61

THE ROAD AHEAD India-Economy and Trends

2011

The Road Ahead (2/5)

Macroeconomics and Fiscal Policy

India would continue to enjoy relatively rapid GDP growth. The governments stimulus measures are expected to boost short-term growth. The fiscal year budget contains a strong focus on fiscal consolidation. The national budget outlines a schedule of progressive deficit reduction, according to which the budget shortfall is targeted to narrow to 4.8 per cent in 2011-12 and 4.1 per cent in 2012-13. Part of the improvement in the fiscal position is expected to be a function of rapid economic growth.

Source: RBI, CMIE, Economic Intelligence Unit

62

THE ROAD AHEAD India-Economy and Trends

2011

The Road Ahead (3/5)

Competition and Foreign Investment Policy

The government is expected to maintain its focus on stimulus measures. Disinvesting stakes (up to a maximum of 49 per cent) in state-owned firms and moving forward with modest reforms in order to increase competition is likely to be continued. It is expected that the previously closed sectors will open up and limits on foreign ownership in others will be raised. The government is expected to encourage private and foreign participation in areas such as education, healthcare and infrastructure to further its aim of inclusive economic growth. Rapid real GDP growth, overall liberalisation of the economy and a growing need for investment particularly in infrastructure and industry- are expected to lead to a more investor-friendly climate. Foreign investment is expected to be encouraged in the infrastructure sector and in underserved but highpotential areas, such as healthcare.

Source: RBI, CMIE, Economic Intelligence Unit

63

THE ROAD AHEAD India-Economy and Trends

2011

The Road Ahead (4/5)

Trade and Exchange Controls

The free-trade agreement (FTA) with the Association of South-East Asian Nations (ASEAN) that came into effect in January 2010 is expected to lead to the start of a significant reduction in tariffs. India is expected to push for more bilateral FTAs. Restrictions on outward direct and portfolio investment by companies and individuals, and on foreign borrowing, are expected to be relaxed further.

Finance and Taxes

The government plans to introduce a Goods and Services Tax in 2012. It also wants to implement a new Direct Tax Code at the same time, which would reduce exemptions and also reform corporate tax and income tax laws and rates. Significant government control is expected to persist in the banking sector. Competition from private-sector banks is expected to increase. New rules are expected to make banking mergers and acquisitions easier and allow greater foreign investment in private domestic banks.

Source: RBI, CMIE, Economic Intelligence Unit

64

THE ROAD AHEAD India-Economy and Trends

2011

The Road Ahead (5/5)

Infrastructure

Infrastructure is expected to improve most rapidly in sectors such as roads, telecom and ports. Government is expected to push development in core areas including water, sanitation and urban infrastructure. The level of investment in infrastructure is expected to rise and new models of Public-Private Partnership may evolve.

Source: RBI, CMIE, Economic Intelligence Unit

65

INDIA-ECONOMY AND TRENDS

2011

DISCLAIMER

India Brand Equity Foundation (IBEF) engaged Deloitte Touche Tohmatsu India Private Limited to prepare this presentation and the same has been prepared by Deloitte in consultation with IBEF. All rights reserved. All copyright in this presentation and related works is solely and exclusively owned by IBEF. The same may not be reproduced, wholly or in part in any material form (including photocopying or storing it in any medium by electronic means and whether or not transiently or incidentally to some other use of this presentation), modified or in any manner communicated to any third party except with the written approval of IBEF. This presentation is for information purposes only. While due care has been taken during the compilation of this presentation to ensure that the information is accurate to the best of Deloitte and IBEFs knowledge and belief, the content is not to be construed in any manner whatsoever as a substitute for professional advice. Several data sources have been used while preparing this presentation and they have been duly acknowledged at appropriate places. Deloitte and IBEF neither recommend nor endorse any specific products or services that may have been mentioned in this presentation and nor do they assume any liability or responsibility for the outcome of decisions taken as a result of any reliance placed on this presentation. Neither Deloitte nor IBEF shall be liable for any direct or indirect damages that may arise due to any act or omission on the part of the user due to any reliance placed or guidance taken from any portion of this presentation.

66

Вам также может понравиться

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportОт EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportОценок пока нет

- Services 2013 ReportДокумент6 страницServices 2013 Reportnishantjain95Оценок пока нет

- Impact of Globalization On Indian EconomyДокумент33 страницыImpact of Globalization On Indian EconomySrikanth ReddyОценок пока нет

- Compendium of Supply and Use Tables for Selected Economies in Asia and the PacificОт EverandCompendium of Supply and Use Tables for Selected Economies in Asia and the PacificОценок пока нет

- FDI in IndiaДокумент4 страницыFDI in IndiaPratik RambhiaОценок пока нет

- Resurgent Africa: Structural Transformation in Sustainable DevelopmentОт EverandResurgent Africa: Structural Transformation in Sustainable DevelopmentОценок пока нет

- Japan Industry ProducerДокумент7 страницJapan Industry ProducerNancy WilliamsОценок пока нет

- Aid for Trade in Asia and the Pacific: Promoting Connectivity for Inclusive DevelopmentОт EverandAid for Trade in Asia and the Pacific: Promoting Connectivity for Inclusive DevelopmentОценок пока нет

- Indian Economy Opportunities Unlimited: Click To Edit Master Subtitle StyleДокумент15 страницIndian Economy Opportunities Unlimited: Click To Edit Master Subtitle StyleShivang UnadkatОценок пока нет

- Strategic Management: Presented by Shabeer Babu Roshni Suresh.PДокумент25 страницStrategic Management: Presented by Shabeer Babu Roshni Suresh.PShabeer BabuОценок пока нет

- Impact of MNCs On Indian EconomyДокумент37 страницImpact of MNCs On Indian EconomyShrey Sampat0% (1)

- Current Status of FdiДокумент9 страницCurrent Status of FdiGrishma KothariОценок пока нет

- Sectorwise Investment in IndiaДокумент10 страницSectorwise Investment in IndiadinuindiaОценок пока нет

- F.D.I. in India: Suneel GuptaДокумент37 страницF.D.I. in India: Suneel GuptaYash PatelОценок пока нет

- Services Sector: S S: I CДокумент25 страницServices Sector: S S: I CGomathiRachakondaОценок пока нет

- Fdi and FiisДокумент38 страницFdi and Fiisssneha1989Оценок пока нет

- On Indian Economy Features and DevelopmentДокумент36 страницOn Indian Economy Features and DevelopmentSaima Arshad67% (9)

- Dealwatch Monthly Reports - AprДокумент10 страницDealwatch Monthly Reports - AprVaibhav KarthikОценок пока нет

- Services Sector: International ComparisonДокумент12 страницServices Sector: International Comparisonmahesh_khebadeОценок пока нет

- Service Sector in Indian EconomyДокумент5 страницService Sector in Indian EconomyAvik SarkarОценок пока нет

- SWOT AnalysisДокумент38 страницSWOT Analysissukhi9291100% (1)

- HVS - Hotels in India - Trends and OpportunitiesДокумент20 страницHVS - Hotels in India - Trends and OpportunitiesAnkur Sharma100% (1)

- Foreign Direct Investment Prospects For PakistanДокумент30 страницForeign Direct Investment Prospects For PakistanMaliha AhmedОценок пока нет

- Forign Direct Investment in Indian EconomyДокумент19 страницForign Direct Investment in Indian EconomySanal EkОценок пока нет

- EcofinalprezДокумент12 страницEcofinalprezVaishali RadhakrishnanОценок пока нет

- Cristino L. PANLILIO Invest in The Philippines Invest in GrowthДокумент23 страницыCristino L. PANLILIO Invest in The Philippines Invest in GrowthMaharishiPHОценок пока нет

- Foreign Direct Investment (FДокумент27 страницForeign Direct Investment (FPartik BansalОценок пока нет

- Mid Cap Ideas - Value and Growth Investing 250112 - 11 - 0602120242Документ21 страницаMid Cap Ideas - Value and Growth Investing 250112 - 11 - 0602120242Chetan MaheshwariОценок пока нет

- India: Service Sector Service Exports Current Status at WtoДокумент27 страницIndia: Service Sector Service Exports Current Status at WtoManas BhattОценок пока нет

- Foreign Direct Investment: Presenter: Pankaj GaurДокумент15 страницForeign Direct Investment: Presenter: Pankaj GaurNikhil AlwalОценок пока нет

- Industry OutlookДокумент7 страницIndustry OutlookRahul KumarОценок пока нет

- PWC India em Outlook 2011 081211Документ152 страницыPWC India em Outlook 2011 081211Chetan SagarОценок пока нет

- A Project On Business Environment 2Документ41 страницаA Project On Business Environment 2pramit_chhetriОценок пока нет

- Chapter-14 en FDIДокумент22 страницыChapter-14 en FDIS. M. Hasan ZidnyОценок пока нет

- Group4 IVM Project FinalДокумент60 страницGroup4 IVM Project FinalVaibhav GargОценок пока нет

- Trends in Public & Private Sector in India.: BY: Ashutosh Gupta Krishan KumarДокумент29 страницTrends in Public & Private Sector in India.: BY: Ashutosh Gupta Krishan KumarAkashdeep GhummanОценок пока нет

- HDFC AMC - PMS Real Estate Portfolio - I: November 2007Документ39 страницHDFC AMC - PMS Real Estate Portfolio - I: November 2007Sandeep BorseОценок пока нет

- Macro Economic Environment: A Presentation byДокумент44 страницыMacro Economic Environment: A Presentation byAkil DhilawalaОценок пока нет

- Presentation 1Документ4 страницыPresentation 1macpravinОценок пока нет

- KSFC Lending Policy 2013-14Документ57 страницKSFC Lending Policy 2013-14ajayterdalОценок пока нет

- (Approved by AICTE, New Delhi & Affiliated To Rajasthan Technical University, KotaДокумент13 страниц(Approved by AICTE, New Delhi & Affiliated To Rajasthan Technical University, KotaNeelu Tuteja NikhanjОценок пока нет

- Macro Economic EnvironmentДокумент44 страницыMacro Economic EnvironmentDeepak VermaОценок пока нет

- Indian Economy Aviation ReportДокумент29 страницIndian Economy Aviation ReportArindam TiwariОценок пока нет

- Investor Presentation: Bharti Airtel LimitedДокумент27 страницInvestor Presentation: Bharti Airtel LimitedChandrashekhar N ChintalwarОценок пока нет

- HCL Technologies LTD: Key Financial IndicatorsДокумент4 страницыHCL Technologies LTD: Key Financial IndicatorsSankaranand SrinivasanОценок пока нет

- Fdi in Indian Retail - and Its Implications: Policies, Employment, Infrastructure DevelopmentДокумент13 страницFdi in Indian Retail - and Its Implications: Policies, Employment, Infrastructure DevelopmentkushalОценок пока нет

- CII's AgendaДокумент31 страницаCII's AgendaPremkumarJittaОценок пока нет

- Foreign Direct InvestmentДокумент26 страницForeign Direct InvestmentAmanda MurphyОценок пока нет

- Make in India 2014Документ11 страницMake in India 2014vaibhav_choudha791100% (8)

- ICICI SecuritiesДокумент37 страницICICI SecuritiesDipak ChandwaniОценок пока нет

- Executive Summary: Cement IndustryДокумент81 страницаExecutive Summary: Cement IndustrySankaraharan ShanmugamОценок пока нет

- Market Outlook Market Outlook: Dealer's DiaryДокумент13 страницMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingОценок пока нет

- Socio-Economic Planning Secretary DR Emmanuel Esguerra Presentation On Philippine Transport Industry Directions 2016Документ25 страницSocio-Economic Planning Secretary DR Emmanuel Esguerra Presentation On Philippine Transport Industry Directions 2016PortCallsОценок пока нет

- 1 Growing Importance of Services Sector For IndiaДокумент6 страниц1 Growing Importance of Services Sector For IndiaPriya AhujaОценок пока нет

- Foreign Direct Investment Flows To IndiaДокумент21 страницаForeign Direct Investment Flows To IndiaAnurag ThakurОценок пока нет

- Phase 2 1Документ13 страницPhase 2 1Chandra KanthОценок пока нет

- Multinational Corporation-Project ReportДокумент58 страницMultinational Corporation-Project ReportAbhishek Agarwal79% (133)

- Tcs v. InfosysДокумент40 страницTcs v. Infosysneetapai3859Оценок пока нет

- Cement Industry ReportДокумент92 страницыCement Industry ReportAbdulgafoor NellogiОценок пока нет

- Company ProfileДокумент15 страницCompany ProfileMuhammad Syaqil NgОценок пока нет

- DSC User GuidelinesДокумент64 страницыDSC User Guidelineslinus200Оценок пока нет

- F22 RaptorДокумент2 страницыF22 RaptorKakhaОценок пока нет

- VIETTELДокумент20 страницVIETTELSolgrynОценок пока нет

- ReflectionДокумент2 страницыReflectionBảo HàОценок пока нет

- Rob Corry: People's Motion For Hearing To Determine Existence of Conflict-Free RepresentationДокумент4 страницыRob Corry: People's Motion For Hearing To Determine Existence of Conflict-Free RepresentationMichael_Lee_RobertsОценок пока нет

- Reflection PseudoscienceДокумент3 страницыReflection PseudoscienceSuganthi RamasamyОценок пока нет

- Title: Speech of Corazon C. Aquino Before The US Congress: 3 Hours)Документ3 страницыTitle: Speech of Corazon C. Aquino Before The US Congress: 3 Hours)Verna TrillanaОценок пока нет

- EXERCISE 1-Passive FormДокумент5 страницEXERCISE 1-Passive FormMichele LangОценок пока нет

- Admission Sos 2013-14090513 PDFДокумент21 страницаAdmission Sos 2013-14090513 PDFmanoj31285manojОценок пока нет

- Shyla Jennings Ebook FinalДокумент17 страницShyla Jennings Ebook FinalChye Yong HockОценок пока нет

- US of GIT of CattleДокумент13 страницUS of GIT of CattlesangeetsamratОценок пока нет

- Earthquake Lesson Plan 2022Документ5 страницEarthquake Lesson Plan 2022Maylyn Grace Dalumpines-Colon EbonaloОценок пока нет

- STD 12 Accountancy1Документ264 страницыSTD 12 Accountancy1Chetan KhonaОценок пока нет

- 10 Rules of Statcon by Atty Marcus NeelyДокумент4 страницы10 Rules of Statcon by Atty Marcus NeelyMorin OcoОценок пока нет

- A Gandhari Version of The Rhinoceros Sutra - Salomon.thieuДокумент29 страницA Gandhari Version of The Rhinoceros Sutra - Salomon.thieuTRAN NGOCОценок пока нет

- Urban Square Design: Landscape Design Studio III LAR 803Документ44 страницыUrban Square Design: Landscape Design Studio III LAR 803Peter DokpesiОценок пока нет

- Project Proposal Environmental Protection Program-DeNRДокумент57 страницProject Proposal Environmental Protection Program-DeNRLGU PadadaОценок пока нет

- YazdiДокумент7 страницYazditrs1970Оценок пока нет

- The Biography of Hazrat Shah Qamaos Sahib in One PageДокумент3 страницыThe Biography of Hazrat Shah Qamaos Sahib in One PageMohammed Abdul Hafeez, B.Com., Hyderabad, IndiaОценок пока нет

- Talking SwedishДокумент32 страницыTalking Swedishdiana jimenezОценок пока нет

- Coca Cola FSДокумент3 страницыCoca Cola FSManan MunshiОценок пока нет

- This Study Resource WasДокумент2 страницыThis Study Resource Waskaye nicolasОценок пока нет

- Denso HP4Документ87 страницDenso HP4Abraham Janco Janco100% (2)

- CodeДокумент47 страницCodeNadia KhurshidОценок пока нет

- PMAIZMTUSDMДокумент6 страницPMAIZMTUSDMLinh TranОценок пока нет

- Apy1 Kinematics Review - 2015 - KeyДокумент13 страницApy1 Kinematics Review - 2015 - KeyemadОценок пока нет

- Job Board Week WhituДокумент5 страницJob Board Week WhituAnonymous MZh1KUUXОценок пока нет

- Zimbabwe National Code Ccorporate GovernanceДокумент96 страницZimbabwe National Code Ccorporate GovernanceHerbert NgwaraiОценок пока нет

- Nabard Working CapitalДокумент12 страницNabard Working CapitalJaspreet SinghОценок пока нет