Академический Документы

Профессиональный Документы

Культура Документы

Publc Notice

Загружено:

piudevaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Publc Notice

Загружено:

piudevaАвторское право:

Доступные форматы

MUNICIPAL CORPORATION OF DELHI

MIXED LAND USE AS PER MPD-2021 AND PAYMENT OF MIXED LAND USE CHARGES. PUBLIC NOTICE As per Master Plan for Delhi-2021 under the Mixed Use Regulations following mixed use/commercial activities are permissible in residential premises (Details as per clause 15 of MPD-2021). 1. MIXED USE STREETS: - Details as per clause 15.3, 15.4, 15.5, 15.6.1, 15.6.2 & 15.9 of MPD-2021. COMMERCIAL STEETS: - Details as per clause 15.12 of MPD-2021. SMALL SHOPS: - Details as per clause 15.6.3 & 15.9 of MPD-2021. OTHER ACTIVITIES: - Details as per clause 15.7 & 15.9 of MPD-2021. PROFESSIONAL ACTIVITES: - Details as per clause 15.8 & 15.9 of MPD2021. GROUP HOUSING: - Details as per clause 15.3.2 (4), 15.6.3 & 15.9 of MPD2021.

2. 3. 4. 5.

6.

NOTIFIED dated 15/09/2006 STREETS (including MIXED USE notifications & 12/04/2007.

(ii)

pedestrian streets) vide GNCTD

(i) Retail shops shall be permitted on plots abutting streets duly notified for mixed use, only on the ground floor up to the maximum permissible ground floor coverage. Shops operating from basement on such streets on 7.2.2007 i.e. date of Notification of MPD-2021 may continue, subject to relevant provisions of building by laws, structural safety and fire safety clearance. However, if such use of basement leads to exceeding the permissible FAR on the plot, such FAR in excess shall be used, subject to payment of appropriate charges prescribed with the approval of Government.

The following activities shall not be allowed under Mixed Use Streets: (a) Retail shops of building materials [timber, timber products (excluding furniture), marble 1, iron and steel, (gravel, cement and sand 2], firewood, coal and any fire hazardous and other bulky materials. (b) Repair shops/workshops of automobiles, tyre resoling and re-treading, and battery charging. Storage, go-down and warehousing. Junk shop (except paper and glass waste) Liquor shop Printing, dyeing and varnishing Any other activity that may be notified from time to time by Government Notes: Will not include: 1. Business of finished marble products where cutting and polishing activity of marble is not undertaken. 2. Retail shops of gravel, sand and cement shall be permissible in residential plots of at least 50sqm. in notified mixed use streets in E, F and G category colonies, provided that the material is kept entirely within the plot premises.

(c) (d) (e) (f) (g)

3. Repair shops and workshops in case of automobiles shall not be prohibited on plots abutting mixed use streets or commercial streets of right of way (ROW) of 30m or more.

NOTIFIED COMMERCIAL STREETS (including pedestrian shopping streets) vide GNCTD notifications dated 15/09/2006 & 12/04/2007.

On notification of a commercial street/area under this clause, such streets/areas shall be considered as local shopping centres as mentioned in Chapter 5.0 of Master Plan for Delhi [MPD] 2021.

Activities permitted under Local Shopping Centre as given below: Retail Shopping, Stockists and dealers of medicines and drugs, Commercial Offices, Clinical Laboratory, Clinic & Poly Clinic, Repair/Services, Bank, ATM, Guest House, Nursing Home, Informal Trade, Coaching Centres/Training Institutes, Restaurant. Shops operating from basement on such streets on date of notification of the MPD 2021 may continue, subject to relevant provisions of building bye laws, structural safety and fire safety clearance. However, if such use of basement leads to exceeding the permissible FAR on the plot, such FAR in excess shall be used subject to payment of appropriate charges prescribed with the approval of Government.

THE SMALL SHOPS of maximumground floor only, in residential premises,the following 20 sqm. area, trading in or dealing with items/activities, may be allowed on including in

A and B category colonies: i) Vegetables / fruits / flowers ii) Bakery items/Confectionary items; iii) Kirana/General store; iv) Dairy product; v) Stationery/Books/Gifts/Book binding; vi) Photostat/Fax/STD/PCO; vii) Cyber caf/Call phone booths; viii) LPG booking office/Showroom without LPG cylinders; ix) Atta Chakki; x) Meat/Poultry and Fish shop; xi) Pan shop; xii) Barber shop/Hair dressing saloon/Beauty parlour; xiii) Laundry/Dry cleaning/ironing; xiv) Sweet shop/Tea stall without sitting arrangement; xv) Chemist shop/Clinic/Dispensary/Pathology lab; xvi) Optical shop; xvii) Tailoring shop; xviii) Electrical/Electronic repair shop; and xix) Photo studio; xx) Cable TV/DTH Operation; xxi) Hosiery/Readymade Garments/Cloth shop; xxii) ATM xxiii) Cycle Repair Shop xxiv) Ration shop & Kerosene Shop under PDS. Issue relating to number of small shops to be permitted in one plot is pending before the Honble Supreme Court in the above referred case. The decision of the Honble Courts shall be binding on the plot owner/allottee/residents/user irrespective of the deposition of conversion/ registration charges.

OTHER ACTIVITIES (As per MPD-2021, clause 15.7)

Subject to the general conditions given in para 15.4 of MPD-2021 and additional conditions given in para 15.7.3 of MPD-2021 the following public and semi-public activities shall also be permitted in the residential plots abutting roads of minimum ROW [Right Of Way] prescribed in 15.7.2 of MPD-2021, whether or not the road is notified as mixed use street:

(a) Pre-primary school (including nursery / Montessori school, crche.) (b) i. Nursing home ii. Clinic, Dispensary, Pathology lab and Diagnostic center. (c) Guest house (including lodging houses) irrespective of number of rooms. (d) Bank (e) Fitness Center (including gymnasium, yoga/ meditation center) (f) Coaching center /tuition centres other than those imparting structured course leading directly to the award a degree of diploma or conducting classes such a regular school.

PROFESSIONAL ACTIVITY subject to general terms & conditions specified in para 15.4 & 15.8 of Master Plan of Delhi-2021 following professional activities are permissible in Plotted Development and Group Housing Professional activities shall mean those activities involving services based on professional skills namely Doctor, Lawyer, Architect, and Chartered Accountant, Company secretary, Cost and Works Accountant, Engineer, Town Planner, Media professionals and Documentary Film maker. NB : In view of the stay order passed by the Honble Supreme Court in relation to professional activities, currently registration/mis-use/car parking charges etc,. are not payable at present. i.

GROUP HOUSING in all categories of colonies

Only professional activity, and small shops in terms of para 15.6.3 shall be permissible in group housing. Retail shops specifically provided for in the lay out plan of group housing would be permissible.

i)

SPECIAL AREA

The Registration, Conversion Charges & Parking Charges in special areas shall be governed as follows. Residential areas and streets/stretches earlier declared as commercial areas/streets or where commercial use was allowed in MPD-1962 shall continue such use at least to the extent as permissible in MPD-1962. No charges for conversion and parking would be charged from these areas. Commercial activity to the extent being carried out in Special Area prior to 1962 shall be permissible, subject to documentary proof, without any payment of conversion charges and parking charges. Any commercial activity in special area, at places not covered under (i) and (ii) above, started after 1962 till 7.2.2007 (when the MPD-2021 was notified) shall be permissible subject to registration and payment of conversion and parking charges.

ii)

iii)

PERMISSIBLE AND NON-PERMISSIBLE USES

Any trade or activity involving any kind of obnoxious, hazardous, inflammable, non-compatible and polluting substance or process shall not be permitted. As per clause 15.5 of MPD 2021. All the concerned owners/allottee/resident/user of the premises covered by MixedUse Regulations as described above are required to get their use registered and to pay the registration charges, entire mixed use charges and parking charges as per the provision of MPD 2021 & DDA notification dt. 22/06/2007 as detailed below:

ANNUAL MIXED USE CHARGES

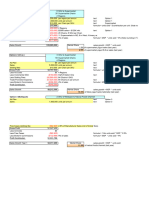

The premises under mixed use shall be subject to levy of Annual Mixed use charges for the period upto which the premises remain / likely to remain under mixed use. The Annual Mixed Use charges for the financial year 2006-07 and 2007-08 for different categories of colonies shall be as under: Rates in Rs per sqm. built up area Type of mixed A & B C&D E,F&G use category of colony Retail Shops 767 511 192 Other Activities 383 256 96

S.No.

1 2

The owner / allottee / resident / user of the premises shall have option to make one time payment of mixed use charges, which shall be as follows. (a) For MCD areas: (Rates in Rs. Per Sq. Mt. built up area) S.No. Type of mixed A & B C&D E,F&G use Category Category of category of colony colonies 1 Retail Shops 6136 4088 1536 2 Other Activities 3064 2048 768 The annual mixed use charges for mixed land street / commercial streets / areas shall be the same.

ONE TIME CHARGES FOR DEVELOPMENT OF PARKING

The owner / allottee / resident / user of the plot / dwelling unit under the mixed land use shall also be liable to pay one time charges for development of parking and such rate for one ECS per 50 Sq. mtr. of plot area shall be as under :A&B category of colonies Rs. 2,10,500/C&D category of colonies Rs. 1,49,750/E,F&G category of colonies Rs. 66,500/Out of the total one time charges for development of parking, 1/3rd was to be paid on or before 30.6.2007 and the remaining 2/3rd by 31.3.2008. No development charges for parking shall be payable by small shop owners of area upto 20 sqm. dealing with the items/activities as defined in para 15.6.3 of the MPD-2021 in respect of any category of colonies. Development charges for parking shall also not be payable by owner/ allottee / resident/user of the plot / dwelling units falling under notified pedestrian shopping streets both mixed use or commercial pedestrian streets. Procedure for registration and payment of annual mixed use charges ALL THE REGISTRATION OF MIXED USE PREMISES (ON MIXED USE STRETS, COMMERCIAL STREETS, OTHR ACTIVITIES AND SMALL SHOPS) AND PAYMENT OF CHARGES SHALL BE GOVERNED BY THE PROVISIONS OF CLAUSE 15.9 OF MPD-2021, WHICH ARE RE-PRODUCED AS UNDER:i) In respect of a residential premises already under mixed use or intended to be put to mixed use, the owner/ allottee/ resident of the plot/ dwelling unit, in case of plotted development and dwelling unit in the case of group housing, shall be required to declare such mixed-use by filling up a form in this respect and depositing it with the local body concerned any pay one-time registration charges at rates to be notified with the approval of the Central Government. ii) The premises under mixed use shall also be liable for payment of mixed- use

iii)

iv) v)

charges every Year to the local body concerned at the rates notified with the approval of Central Government, for the period during which the property is put to mixed use. Such payment will be made by the property owner/ allottee voluntarily before 30th June of every year in respect of the previous assessment year (April - March). No modification to the building for using residential premises for nonresidential activities, under the mixed use policy, shall be permitted unless the allottee/ owner has obtained sanction of revised building plans and has paid necessary fees or charges. The local body concerned shall be responsible for the conduct of test check of properties under mixed use, whether registered with it or not. In addition to other penal action available under the relevant act, properties found to be under mixed use, without registration or in violation of the terms of this notification shall be liable to pay, to the local body, a penalty amounting to 10 times the annual conversion charges for mixed use.

PENALTY

For the mixed use existing from 2006-07 or before 2006-07

The payment of annual mixed-use charges shall be made by the owner/allottee/resident/user of the premises to the local authority voluntarily before 30th June of every year in respect of the previous assessment year or part thereof, in proportion to that part. For the 2006-07, 1/4th of the annual mixed use charges were to be paid on or before 30.6.2007 and the balance 3/4th were to be paid on or before 30.9.2007. Delay in payment of development charges for parking or mixed use charges of the relevant financial year shall be compoundable on payment of interest at 8% p.a. The property found under mixed use without declaration or registration or in violation of the relevant provisions of the MPD-2021 and these regulations, shall be liable for penal action under the relevant Act by the local body concerned and also a penalty amounting to 10 times the annual conversion charges for mixed use shall be imposed.

For the mixed use started in 2007-08

For the mixed use started in 2007-08 all concerned may take cognizance of this notice and get their premises registered with the concerned zonal office immediately and pay the required conversion/parking charges by the 30th June, 2008.

All concerned with interest/penalty for the year 2006-2007 andthemixed usemixed use may take cognizance of this notice & deposit annual charges along if started in

2007-08, get register themselves with the Zonal Office immediately so as to avoid any punitive action which shall be initiated without any further notice.

Year of Registration starting commercial/ mixed use 2006-07 On start of commercial/mixed use activity Conversion Charges One time Interest/ Penalty mixed use Charges Four quarterly installments, first installment was to be paid on or before 30/06/2007 If registration / declaration has been done or any installment paid as per schedule then delay in payment shall be compoundable on payment of interest @ 8% per annum. One Time Parking Charges 1/3rd was to be paid before 30/06/07.

1/4th was to be paid before 30/06/07

Balance

If

without 2/3rd was to

3/4th was to be paid before 30/09/07

paid registration/declaration/ be payment, Penalty before amounting to 10 times 31/03/08 the annual conversion charges.

2007-08

On start of Before or Before or If registration / Before or commercial/mixed on declaration has been on on use activity done or any installment 30/6/2008 30/06/08 30/6/2008 paid as per schedule then delay in payment shall be compoundable on payment of interest @ 8% per annum. If without registration/declaration, Penalty amounting to 10 times the annual conversion charges.

For any clarification please contact Zonal Nodal Officers whose contact number are given below:-

NAME OF NODAL OFFICER S. NO. 1 NAME OF NODAL OFFICER SH. DINESH KALRA OFFICE TEL NO 29813928

ZONE CENTRAL ZONE

DESIGNATION AE

ADDRESS ZONAL OFFICE, SHIV MANDIR MARG, NEAR JAL SADAN, LAJPAT NAGAR-I ZONAL OFFICE, MULTY LEVEL CAR PARKING, ASAF ALI ROAD ZONAL OFFICE, RAJPUR ROAD ZONAL OFFICE, NEAR KHALSA COLLEGE, ANAND PARVAT ZONAL OFFICE, NEAR WATER TANK, NAJAFGARH ZONAL OFFICE, PRIMARY HEALTH CENTRE, ALIPUR VILLAGE ZONAL OFFICE, NEAR RAJIV GANDHI CANCER HOSPITAL, SECTOR-5, ROHINI ZONAL OFFICE, BEHIND SADAR POLICE STATION, IDGAH-ROAD ZONAL OFFICE, NEAR SHYAM LAL COLLEGE, KESHAV CHOWK ZONAL OFFICE, NEAR KARKARDOOMA COURT, SHAHDARA ZONAL OFFICE, NEAR UPHAR CINEMA, GREEN PARK ZONAL OFFICE, COMMUNITY CENTRE, VISHAL ENCLAVE

MOBILE NO. 9910387879

CITY ZONE

SH. RAM PRAKASH

SE

23261721

9910388075

CIVIL LINE ZONE KAROL BAGH ZONE NAJAFGARH ZONE NARELA ZONE

SH. RAVINDER KUMAR SH. JAGDISH CHANDER SH. P. K. RAJA

AE

23968909

9910388190

AE

25861865

9910388751

EE

25321991

9910388517

SH. NOORUDDIN

AE

27206123

9910387965

ROHINI ZONE

SH. A. K. MITTAL

AE

27052110

9910388171

SADAR PAHARGANJ ZONE SHAHDARA NORTH ZONE

SH. RAJU

AE

23535226

9250140305

SH. R. K. KHARI

AE

22824170

9910388277

10

SHAHDARA SOUTH ZONE SOUTH ZONE

SH. RAJBIR KUNDU SH. ANIL KUMAR

AE

22387084

9910387808

11

AE

26517191

9910387778

12

WEST ZONE

SH. VIPIN KUMAR

AE

25119707

9910387747

ADDITONAL COMMISSONER(ENGG)

The prescribed format for Registration, Conversion Charges and Affidavit are as under:Form for registration of Properties under Mixed Land Use [For Mixed Use Streets (Retail Shops), Commercial Streets, Other Activities and Small Shops]

To The Dy. Commissioner, Municipal Corporation of Delhi, ___________ Zone, Delhi I/We are running a (Retail Shops/Commercial Activities/Other Activities/Small Shop) under name & style of _____________________in premises constructed on Plot in No. _______________ colony Block having

No.________________

situated

_________________

Municipal Ward Number _______________, Delhi.

The said premises

qualify for use as Retail Shops/Commercial Activity/Other Activity/Small Shop under Mixed Land Use Regulation of M.P.D-2021. I /we hereby

request for registration of the said premises for use as mentioned above. Necessary registration fee of (Rs. 1000 for retail shop/Commercial Activity, Rs. 500 for other activities and small shop) is enclosed.

Signature of the applicant (s) Name in Block Letter

INFORMATION TO BE FURNISHED FOR REGISTRATION OF PROPERTIES under Mixed Land Use [For Mixed Use Streets (Retail Shops), Commercial Streets, Other Activities and Small Shops] 1. Name(s) of the applicant ____________________________________ 2 3. Status of applicant Owner Allottee Resident User

Type of Use Name & style of Commercial Activity Date of start of mix use at the premise Location of Premises

___________________________________ ___________________________________

(i) 4.

____________________________________ ____________________________________

5.

Category of locality

6.

7. 8. 9. 10.

Name of the notified mixed use road on which premises is located (not for Other Activities & Small Shops) ___________________________________ ROW of abutting mixed used Road/Street ____________________________ Area of Plot in Sq.Mtrs. __________________________________ Total Built Up Area of the premises under mixed use. __________________________________ Requirement of Equivalent Car Spaces (ECS) @ one ECS per 50 Sq.mtrs of plot area ______________________________ One time cost of parking

(for A& B Category : Rs. 2,10,500/- per ECS) (for C&D Category : Rs. 1,49,750/- per ECS) (for E,F & G Category : Rs. 66,500/- per ECS)

11.

Rs. _________________________

12.

(Payment of Charges being paid as [Fully] [Installments] (Not for small shops and pedestrian streets) Annual Mixed Use Charges Rs. ________________________

(for A& B Category : Rs.767/-per sqmt built up area (for C&D Category : Rs. 511/-per sqmt built up area (for E,F & G Category : Rs. 192/-per sqmt built up area

13.

(Payment of Charges being paid as [Fully] [Installments] One Time Annual Mixed Use Charges Rs._________________

(for A& B Category : Rs. 6136/-per sqmt built up area (for C&D Category : Rs. 4088/-per sqmt built up area (for E,F & G Category : Rs. 1536/-per sqmt built up area

14. 15.

Amount to be paid on account of delay in payment for INTEREST / PENALTY Whether there is any unauthorized construction in the building. If yes whether applied to the MCD for regularization as per the provisions of Master Plan

Rs.__________________ [Yes] [ No]

16.

[Yes]

[No]

DATE

(Signature of Applicant)

(To be submitted on Non-Judicial Stamp Paper Rs.10/-duly attested by Oath Commissioner/ Notary Public) AFFIDAVIT /UNDERTAKING

I/We_________________________ s/o ______________ aged _______________ years, R/o _______________________ do hereby solemnly affirm and declare as under:1. That deponent is running a (Retail Shops/Commercial Activities/Other activities/Small Shop) of total ________ Sqm. built up area in the name & style of __________________Constructed on Plot No._________________ Block No.__________ situated in _________________ Colony having Municipal Ward number _____________ , Delhi. That the said premises qualify for use as Retail Shops/Commercial Activities /Other activities/Small Shop Under Mixed Use Regulations of Master Plan for Delhi.-2021 (Para 15.6). That deponent hereby undertakes to pay one time cost of parking (not applicable in respect of small shops) and annual mixed use charges. That deponent hereby undertake to pay annual mixed use charges every year as decided by Government of India from time to time before 30th June of each year till the present use continues in the said premises. That deponent hereby undertakes that premise remained under residential use prior to present permission. In case any misrepresentation in this regard is found, I shall be liable for penal action under the relevant Act by the local body concerned and also a penalty amounting to 10 times the annual conversion charges for mixed use. That deponent hereby undertakes to abide all conditions under which the said use has been permitted. That deponent shall get regularized any unauthorized construction existing in the premises, if any, failing which MCD will be at a liberty to take action against the unauthorized construction for which I/we shall not claim any rights or damages. That deponent shall abide by all the orders passed by or to be passed by the Honble Supreme Court in M.C. Mehta Vs Union of India & Ors. That deponent also undertakes that any misrepresentation in this Affidavit would subject him to offence of perjury and contempt on account of the orders of the Honble Supreme Court of India and will also be liable for all legal action against deponent. DEPONENT Verification: I /we the above named deponent do hereby affirm & verify that I / we have voluntarily made the above affidavit and its contents are true to the best to my knowledge. Verified at Delhi on this day _____________ of ____________________ DEPONENT

2.

3.

4.

5.

6.

7.

8.

9.

Вам также может понравиться

- Publcnotice PDFДокумент10 страницPublcnotice PDFlalitarani_05Оценок пока нет

- 15 Mix UseДокумент3 страницы15 Mix UseTsheringОценок пока нет

- Mixed Use FinalДокумент30 страницMixed Use Finalikdeep100% (1)

- Bmrda Byelaws For LayoutsДокумент7 страницBmrda Byelaws For Layoutsprashuboy0% (1)

- GHMC taxGHMC TAXДокумент12 страницGHMC taxGHMC TAXpoornima_npОценок пока нет

- CDMUДокумент34 страницыCDMUMichael PraatsОценок пока нет

- Agricultural LandДокумент5 страницAgricultural LandChe CaldeaОценок пока нет

- Ambala Office Space Notice Unpriced Bid 2Документ16 страницAmbala Office Space Notice Unpriced Bid 2shivaОценок пока нет

- CDMU Proposed ChangesДокумент34 страницыCDMU Proposed ChangesJohanna Ferebee StillОценок пока нет

- Government of Punjab Department of Industries & Commerce NotificationДокумент15 страницGovernment of Punjab Department of Industries & Commerce NotificationNikhil ThakraniОценок пока нет

- Article Viii - Rm-2 Medium Density Multiple Family Residential DistrictsДокумент4 страницыArticle Viii - Rm-2 Medium Density Multiple Family Residential DistrictsJorge VillegaОценок пока нет

- Erickson Fairfax ProffersДокумент24 страницыErickson Fairfax ProffersChris AllevaОценок пока нет

- Circular - MCGM For Fungible FSIДокумент4 страницыCircular - MCGM For Fungible FSIMehul ZaveriОценок пока нет

- Hmda Layout Poojitha Tech ParkДокумент3 страницыHmda Layout Poojitha Tech ParkCrazy ProductionsОценок пока нет

- Suggested FAQs V14.0Документ8 страницSuggested FAQs V14.0Gurneet Singh BhurjiОценок пока нет

- Town of Huntington, NY Commercial DistrictsДокумент25 страницTown of Huntington, NY Commercial DistrictsamtavareОценок пока нет

- Asda V Leeds City Council JudgmentДокумент17 страницAsda V Leeds City Council Judgmentmamef24812Оценок пока нет

- Jeddah - Zoning and Building PermitsДокумент5 страницJeddah - Zoning and Building PermitscarlcrowОценок пока нет

- Punjab Local Government Commercialization Rules 2004Документ5 страницPunjab Local Government Commercialization Rules 2004Humayoun Ahmad Farooqi84% (19)

- Oli Zoning Code Limerick TWPДокумент6 страницOli Zoning Code Limerick TWPJoseph LeoneОценок пока нет

- Suggested FAQs V14.0Документ8 страницSuggested FAQs V14.0hamid khanОценок пока нет

- Building Bye Laws, HyderabadДокумент21 страницаBuilding Bye Laws, Hyderabadkritswat100% (3)

- Development of Land in Tuda Application FormДокумент13 страницDevelopment of Land in Tuda Application Formmohan11pavanОценок пока нет

- Amended Composition Policy 30.5.11Документ2 страницыAmended Composition Policy 30.5.11Abhimanyu BhatiaОценок пока нет

- 33.03 Industrial 3 Zone: Use ConditionДокумент6 страниц33.03 Industrial 3 Zone: Use ConditionPuput Handri TrisnantoОценок пока нет

- Chapter 7 - LegalAnalysis REVISEDДокумент7 страницChapter 7 - LegalAnalysis REVISEDStephen Mark Garcellano DalisayОценок пока нет

- Simple Subdivision Approval, PALC and Guidelines On Sec.18 of RA7279.power PointДокумент30 страницSimple Subdivision Approval, PALC and Guidelines On Sec.18 of RA7279.power PointAlmaPascasioTabileОценок пока нет

- CDA-Auction Brochure Oct 2023 (1-22 and 112-133)Документ133 страницыCDA-Auction Brochure Oct 2023 (1-22 and 112-133)Adnan MunirОценок пока нет

- Kochi Structural PlanДокумент31 страницаKochi Structural PlanGeorge Michael80% (5)

- Final Bid Document A Re 10 2022 Refurbishment of Buildings and FacilitiesДокумент740 страницFinal Bid Document A Re 10 2022 Refurbishment of Buildings and FacilitiesdawitgggОценок пока нет

- Government of Andhra Pradesh: ND TH TH THДокумент40 страницGovernment of Andhra Pradesh: ND TH TH THamarnathsaiОценок пока нет

- 1200 Vip Toilets For Tshing Extension 10Документ63 страницы1200 Vip Toilets For Tshing Extension 10Ignitious NthaliОценок пока нет

- HMDA Building Application Form Hyderabad IndiaДокумент5 страницHMDA Building Application Form Hyderabad Indiavmandava0720Оценок пока нет

- Caselaw of Balrampur Chini Mills - HCДокумент9 страницCaselaw of Balrampur Chini Mills - HCbmatinvestОценок пока нет

- Residental Cum Commercial ShiftДокумент5 страницResidental Cum Commercial ShiftXplore RealtyОценок пока нет

- BPCL Retail Land Petrol Pump RequirementsДокумент3 страницыBPCL Retail Land Petrol Pump RequirementsNeenuskОценок пока нет

- Industrial Siting/Locational Policy in West Bengal: A. Red Category IndustriesДокумент8 страницIndustrial Siting/Locational Policy in West Bengal: A. Red Category Industriesr_k76Оценок пока нет

- Foreword by Chief Executive OfficerДокумент12 страницForeword by Chief Executive OfficerAnuj RawatОценок пока нет

- GOMs678 2007Документ39 страницGOMs678 2007architectsandeep4uОценок пока нет

- Guidelines For LRS-2020Документ3 страницыGuidelines For LRS-2020Raghu RamОценок пока нет

- Pamohi - Dhalbama Development SchemeДокумент23 страницыPamohi - Dhalbama Development Schemekabir1976Оценок пока нет

- 2020 BBL AmendmentДокумент14 страниц2020 BBL AmendmentsukhdeepОценок пока нет

- Bid-formats-Agar - MalwaДокумент10 страницBid-formats-Agar - MalwaraviОценок пока нет

- Tender Notice Canteen Call 2Документ8 страницTender Notice Canteen Call 2fernandes_j1Оценок пока нет

- Special Economic Zone-1Документ12 страницSpecial Economic Zone-1Garima SinghОценок пока нет

- Government of Andhra PradsehДокумент13 страницGovernment of Andhra PradsehLohitRamakrishnaKotapatiОценок пока нет

- Loksabhaquestions Annex 177 AU729Документ2 страницыLoksabhaquestions Annex 177 AU729ishanshukla20Оценок пока нет

- Circular (Revision of Property Tax in GHMC - Final)Документ20 страницCircular (Revision of Property Tax in GHMC - Final)Dasharath Tallapally62% (13)

- Assam LAND EngДокумент1 страницаAssam LAND EngShivamОценок пока нет

- Saip 2020 Notification1Документ14 страницSaip 2020 Notification1Avinash SikariaОценок пока нет

- Circular No. 151 /2 /2012-STДокумент5 страницCircular No. 151 /2 /2012-STCsDeepakGuptaОценок пока нет

- Image - 2017-07-26-07-15-02 - 5978417638145G.O.Ms - No.86 03.03.2008 Revised Building Rules PDFДокумент31 страницаImage - 2017-07-26-07-15-02 - 5978417638145G.O.Ms - No.86 03.03.2008 Revised Building Rules PDFKrishnan SОценок пока нет

- Zoning Regulation KozhikodeДокумент37 страницZoning Regulation KozhikodeDEVA PRIYA ANIL 1861724Оценок пока нет

- 2 Notifications Cic CD - Conversion ChargesДокумент9 страниц2 Notifications Cic CD - Conversion ChargesSushil TyagiОценок пока нет

- GO Ms No-171Документ5 страницGO Ms No-171Arunachalam NagarajanОценок пока нет

- Presentation On Private Residential Land Development Rule, 2004Документ22 страницыPresentation On Private Residential Land Development Rule, 2004Afroze DilrubaОценок пока нет

- Proposed SSMДокумент24 страницыProposed SSMfrequentlyОценок пока нет

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisОт EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisОценок пока нет

- Wockhardt Distribution ChannelДокумент18 страницWockhardt Distribution ChannelChandan AhireОценок пока нет

- Zara Case Study HarwardДокумент7 страницZara Case Study HarwardNeetika Ghai ManglaniОценок пока нет

- Food and Beverage Market Visit To JamaicaДокумент4 страницыFood and Beverage Market Visit To JamaicaCharlotte BradleyОценок пока нет

- Vat Training ModuleДокумент59 страницVat Training Modulebandajobanda100% (3)

- Food Processing in West BengalДокумент4 страницыFood Processing in West BengalRahul DukaleОценок пока нет

- Porter's Five Forces Model - Analysing Industry StructureДокумент4 страницыPorter's Five Forces Model - Analysing Industry StructureDisha Gardi BavishiОценок пока нет

- Hamley'sДокумент11 страницHamley'sSheldon JuliusОценок пока нет

- Asian PaintsДокумент19 страницAsian PaintsZain MehdiОценок пока нет

- Sampling Methods and Design PracticeДокумент3 страницыSampling Methods and Design Practiceapi-298215585Оценок пока нет

- Iab-Affiliate-Marketing-Handbook 2016Документ29 страницIab-Affiliate-Marketing-Handbook 2016api-380198576Оценок пока нет

- Natureview Farm Case Calculations Pre-Class SpreadsheetДокумент12 страницNatureview Farm Case Calculations Pre-Class Spreadsheet1010478907Оценок пока нет

- Emilio Pucci PDFДокумент15 страницEmilio Pucci PDFapi-280851696Оценок пока нет

- Malting and Brewing in HavantДокумент48 страницMalting and Brewing in HavantRalph CousinsОценок пока нет

- PWC Consumer Intelligence Series Customer ExperienceДокумент18 страницPWC Consumer Intelligence Series Customer ExperienceOona Niall100% (1)

- RUAEA Website RUAEA & Local ChaptersДокумент2 страницыRUAEA Website RUAEA & Local ChaptersTHE THIZZОценок пока нет

- Final OM NestleДокумент32 страницыFinal OM NestleUrkesh Shika33% (3)

- Sales and Effectiveness On Fine Product EnterprisesДокумент72 страницыSales and Effectiveness On Fine Product Enterprisesanand_gsoft3603Оценок пока нет

- Gerardo Chagolla ResumeДокумент2 страницыGerardo Chagolla Resumeapi-242270275Оценок пока нет

- Marketing of MilkДокумент10 страницMarketing of Milkpapai96Оценок пока нет

- Blue Nile Case Analysis EssayДокумент9 страницBlue Nile Case Analysis EssayMohammad Junaid HanifОценок пока нет

- Timetable - 9460 - 400 (Ashford - Tenterden) - 1Документ1 страницаTimetable - 9460 - 400 (Ashford - Tenterden) - 1Giles ThorntonОценок пока нет

- MNC VisionДокумент20 страницMNC VisionRachmat SetiajiОценок пока нет

- Pest Analysis On UnileverДокумент6 страницPest Analysis On UnileverVaibhav TripathiОценок пока нет

- Marketing Strategies of Haldiram by Mohd Aqil FinalДокумент70 страницMarketing Strategies of Haldiram by Mohd Aqil FinalMohd aqil100% (1)

- Godrej Project ReportДокумент75 страницGodrej Project ReportMT RAОценок пока нет

- Baba Transport Company: ConsigneeДокумент1 страницаBaba Transport Company: ConsigneeARSGAОценок пока нет

- Chapter 1 Relationship Selling Opportunities in The Information EconomyДокумент7 страницChapter 1 Relationship Selling Opportunities in The Information EconomykathernОценок пока нет

- Sa20190515 PDFДокумент4 страницыSa20190515 PDFMitess Boñon BrusolaОценок пока нет

- RMДокумент50 страницRMRobin sahaОценок пока нет

- E - Commerce WordДокумент56 страницE - Commerce WordMayukhi DebОценок пока нет