Академический Документы

Профессиональный Документы

Культура Документы

Business & Finance - Dec10

Загружено:

pq646Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Business & Finance - Dec10

Загружено:

pq646Авторское право:

Доступные форматы

BUSINESS&FINANCE

Timeallowed1hours Totalmarks100

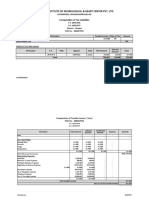

[N.B. The figures in the margin indicate full marks. Questions must be answered in English. Examiner will take account of the quality of language and of the way in which the answers are presented. Different parts, if any, of the same question must be answered in one place in order of sequence.] Marks 1. What is span of control in Management? Narrate the factors influence the span of control in an organization. 2. Following are the financial statements of XYZ Limited: Income Statement of XYZ Limited For the year ended 31 Dec. 2009 2009 Taka 3,095,576 2,402,609 692,967 744 333,466 18,115 342,130 74,200 267,930 1.40 12.76 100 2008 Taka 1,909,051 1,441,950 467,101 2,782 222,872 21,909 225,102 31,272 193,830 1.00 9.23 75 2+4 10

Revenue Cost of sales Gross profit Other income Admin expenses Finance cost Profit before tax Tax Profit for the year Dividend per share Earning per share Market price per share

Balance Sheet of XYZ Limited As at Dec. 2009 Assets: Non-current assets: Tangible assets Current assets: Inventory Receivables Cash in hand Total currents assets Total assets Equity and Liabilities: Equity: Ordinary shares @Tk.10 each Share premium account Retained earnings Non-current liabilities: 10% Loan notes Current liabilities Total equity and liabilities 2009 Taka 802,180 64,422 1,002,701 1,327 1,068,450 1,870,630 210,000 48,178 630,721 100,000 881,731 1,870,630 2008 Taka 656,071 86,550 853,441 68,363 1,008,354 1,664,425 210,000 48,178 393,791 100,000 912,456 1,664,425

From the above please calculate the followings: a) Current Ratio, b) Quick Ratio, c) Asset Turnover Ratio, d) ROCE, e) Debt Equity Ratio, f) Gearing Ratio, g) P/E Ratio, h) Dividend yield, i) Dividend cover and j) Interest cover. 3. a) Explain why SWOT analysis is important for corporate appraisal process. b) What is Gap analysis? How does this help management in setting future strategies? 4. Apollo Drinks and Beverages Ltd. operate many outlets throughout the country. Some of the vending machines in one of its outlets provide very little revenue, so the company is considering removing the machines and installing equipment to dispense soft ice cream. The equipment would cost Taka 80,000 and have an eight-year useful life. Incremental annual revenues and costs associated with the sale of ice cream would be as follows: Please turn over 5 5

2 Sales Less: Cost of ingredients Contribution margin Less: Fixed expenses Salaries Maintenance Depreciation Total fixed expenses Net operating income Taka 150,000 90,000 60,000 27,000 3,000 10,000 40,000 20,000

The vending machines can be sold for Tk.5,000 scrap values. The company will not purchase equipment unless it has a payback of three years or less. Should the equipment be purchased? Required: i. Compute the net annual cash inflow. ii. Compute the payback period. 5. a) What do you understand by Cost Volume Profit (CVP) analysis? b) You are advised to calculate the Break Even Point from the following data: Fixed costs: Monthly Lease Rent Insurance Total Monthly fixed costs Variable Costs: Materials Labor Total Variable costs Selling price Taka 100,000 50,000 150,000 3,000 4,000 7,000 10,000 10 5 5 5 5

6. Following are opening and closing data of Apon Aloy Ltd.s balance sheet and income statement for the year 2009: Calculate approximate length of the cash operating cycle. 1 Jan. Taka 800,000 200,000 600,000 10,000,000 6,000,000 31 Dec Taka 900,000 250,000 700,000

Accounts Receivable Accounts Payable Inventory Credit Sales Cost of Goods Sold

7. Product A currently sells for Tk.5, and demand at this price is 1,700 units. If the price fell to Tk.4.60, demand would increase to 2,000 units. Product B currently sells for Tk.8 and demand at this price is 9,500 units. If the price fell to Tk.7.50, demand would increase to 10,000 units. In each of these cases, calculate: a) The price elasticity of demand (PED) for the price changes given; and b) The effect on total revenue, if demand is met in full at both the old and the new prices, of the change in price. 8. Write short notes on the followings: Management information system (MIS) Balanced scorecard Perpetual inventory methods Basic trade-off: cost of holding vs. cost of running out of cash\ Fiduciary relationship 9. What is corporate governance? What are the objectives of corporate governance? 10. a) Define crisis management and what are the different types of business crisis. b) How business crisis can be addressed. 11. State the economic advantages of International Fare Trade. The End 5 5 10

3+3 2+3 5 8

Вам также может понравиться

- Dupont AnalysisДокумент5 страницDupont AnalysisTECH BABAОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Exam 2 SolutionsДокумент5 страницExam 2 Solutions123xxОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Act. 3-9Документ4 страницыAct. 3-9Fernando III PerezОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Report Dairy Milk Management SystemДокумент44 страницыReport Dairy Milk Management SystemSathishОценок пока нет

- Chapter-1 2022Документ36 страницChapter-1 2022Makai CunananОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Jasa Marga TBK - Billingual - 31 - Des - 2018 - JSMR PDFДокумент227 страницJasa Marga TBK - Billingual - 31 - Des - 2018 - JSMR PDFSjamsulHarunОценок пока нет

- New or Revised Interpretations.: Intended Learning Outcomes (Ilos)Документ3 страницыNew or Revised Interpretations.: Intended Learning Outcomes (Ilos)Mon RamОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- JKH DetailedReport February2012Документ56 страницJKH DetailedReport February2012anraidОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Holding Notes 2Документ16 страницHolding Notes 2idealОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeДокумент43 страницыIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeAhmed El KhateebОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- AS - 12 - Accounting For Government GrantsДокумент17 страницAS - 12 - Accounting For Government GrantsSankerps PsОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- NARUC Uniform System of Accounts for Class C Water UtilitiesДокумент59 страницNARUC Uniform System of Accounts for Class C Water UtilitiesRaquion, Jeanalyn R.Оценок пока нет

- GUIDE TO DISCOUNTED CASH FLOW ANALYSIS AND PROJECT EVALUATIONДокумент6 страницGUIDE TO DISCOUNTED CASH FLOW ANALYSIS AND PROJECT EVALUATIONDorianne BorgОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- Managerial Accounting Practice Questions Set 1Документ5 страницManagerial Accounting Practice Questions Set 1BawakОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- CHAPTER 10 - Changes in Accounting EstimateДокумент8 страницCHAPTER 10 - Changes in Accounting EstimateChristian GatchalianОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Kathmandu Hospital UpdatedДокумент7 страницKathmandu Hospital Updatedone twoОценок пока нет

- Accounting Package QUESTION BANKДокумент8 страницAccounting Package QUESTION BANKDivya0% (2)

- Prep COF ASN06 W02.QUIZ.SДокумент3 страницыPrep COF ASN06 W02.QUIZ.SKate B25% (4)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Victory Trading Company March 2019 Journal EntriesДокумент34 страницыVictory Trading Company March 2019 Journal EntriesAnnisa Putri WulansariОценок пока нет

- 201 1ST Ass With AnswersДокумент19 страниц201 1ST Ass With AnswersLyn AbudaОценок пока нет

- Since 1977: Inventory CostsДокумент8 страницSince 1977: Inventory CostsCV CVОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- OM Assignment - Decision Tree Using NPVДокумент5 страницOM Assignment - Decision Tree Using NPVNick SolankiОценок пока нет

- Case 8 - Diamond DCF ModelДокумент2 страницыCase 8 - Diamond DCF ModelAudrey AngОценок пока нет

- Financial Management PDFДокумент111 страницFinancial Management PDFcheri kok100% (1)

- CH 22Документ75 страницCH 22Chika WijayaОценок пока нет

- Accounting ProfessionalДокумент92 страницыAccounting ProfessionalVikasОценок пока нет

- CMA Question August-2013Документ58 страницCMA Question August-2013zafar71Оценок пока нет

- EC1 - Module 2 3Документ6 страницEC1 - Module 2 3Vincent Anthony SandoyОценок пока нет

- GAAP Principles in Financial ReportingДокумент2 страницыGAAP Principles in Financial ReportingAtaur RahmanОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Principles of Capital InvestmentДокумент35 страницPrinciples of Capital InvestmentAnam Jawaid100% (1)