Академический Документы

Профессиональный Документы

Культура Документы

Case Analysis

Загружено:

TATAHHHИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Case Analysis

Загружено:

TATAHHHАвторское право:

Доступные форматы

History analysis In May, 1886, Coca Cola was invented by Doctor John Pemberton apharmacist from Atlanta, Georgia.

John Pemberton concocted the CocaCola formula in a three legged brass kettle in his backyard. Being a bookkeeper, Frank Robinson also had excellent penmanship. Itwas he who first scripted "Coca Cola" into the flowing letters which hasbecome the famous logo of today. The soft drink was first sold to the public at the soda fountain inJacob's Pharmacy in Atlanta on May 8, 1886. Until 1905, the soft drink, marketed as a tonic, contained extracts of cocaine as well as the caffeine-rich kola nut. Until the 1960s, both small town and big city dwellers enjoyedcarbonated beverages at the localsoda fountainor ice cream saloon.Often housed in the drug store, the soda fountain counter served as ameeting place for people of all ages. Often combined with lunchcounters, the soda fountain declined in popularity as commercial icecream, bottled soft drinks, and fast food restaurants became popular. On April 23, 1985, thetrade secret"New Coke" formula was released.Today, products of the Coca Cola Company are consumed at the rate of more than one billion drinks per day. Vision Statement (actual)To maintain our reputation as the leading cola company in the world. Mission Statement (actual)Everything we do is inspired by our enduring mission: ToRefreshtheWorld ... in body, mind, and spirit. To Inspire Moments of Optimism ... through our brands and our actions. To Create Value and Make a Difference ... everywhere we engage.(proposed)At Coca Cola we believe our main responsibility is providing customers (1) withrefreshing beverages including soft drinks, water, energy drinks, juices, and tea (2) to fitany occasion in their day to day lives (6). Our signature product, Coke (7), is a favoritearound the world and a wide variety of our products are sold in over 200 nations (3). Weuse the only the most sophisticated equipment (4) to process and make our products to ensure each glass of Coke product is as good as the last (5). Our employees (9) are fairlycompensated and we practice fair trade in all markets we compete. We value our responsibility to all communities we serve and support many educational and leadership programs (8).1. Customer 2. Products or services3 . M a r k e t s 4 . T e c h n o l o g y 5.Conce rn for survival, profitability, growth6 . P h i l o s o p h y 7 . S e l f c o n c e p t 8.Concern for public image9.Concern for employees The Five Forces Framework Barriers to Entry: The several factors that make it very difficult for the competition to enter the soft drink marketinclude: Bottling Network: Both Coke and PepsiCo have franchisee agreements with their existing bottlers who have rights in a certain geographic area in perpetuity. These agreements prohibit bottlers from taking on new competing brands for similar products. Also withthe recent consolidation among the bottlers and the backward integration with both Cokeand Pepsi buying significant percent of bottling companies, it is very difficult for a firmentering to find bottlers willing to distribute their product.The other approach to try and build their bottling

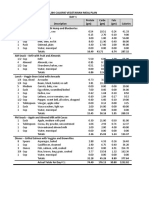

plants would be very capital-intensive effortwith new efficient plant capital requirements in 1998 being $75 million. Advertising Spend: The advertising and marketing spend (Case Exhibit 5 & 6) in theindustry is in 2000 was around $ 2.6 billion (0.40 per case * 6.6 billion cases) mainly byCoke, Pepsi and their bottlers. The average advertisement spending per point of marketshare in 2000 was 8.3 million (Exhibit 2). This makes it extremely difficult for an entrantto compete with the incumbents and gain any visibility. Brand Image / Loyalty: Coke and Pepsi have a long history of heavy advertising and thishas earned them huge amount of brand equity and loyal customers all over the world.This makes it virtually impossible for a new entrant to match this scale in this market place. Retailer Shelf Space (Retail Distribution): Retailers enjoy significant margins of 1520%on these soft drinks for the shelf space they offer. These margins are quite significant for their bottom-line. This makes it tough for the new entrants to c o n v i n c e r e t a i l e r s t o carry/substitute their new products for Coke and Pepsi. Fear of Retaliation: To enter into a market with entrenched rival behemoths like Pepsiand Coke is not easy as it could lead to price wars which affect the new comer. Suppliers: Commodity Ingredients: Most of the raw materials needed to produce concentrate are basic commodities like Color, flavor, caffeine or additives, sugar, packaging. Essentiallythese are basic commodities. The producers of these products have no power over the pricing hence the suppliers in this industry are weak. Buyers: The major channels for the Soft Drink industry (Exhibit 6) are food stores, Fast food fountain,vending, convenience stores and others in the order of market share. The profitability in each of these segments clearly illustrate the buyer power and how different buyers pay different prices based on their power to negotiate. Food Stores: These buyers in this segment are some what consolidated with several chainstores and few local supermarkets, since they offer premium shelf space they commandlower prices, the net operating profit before tax (NOPBT) for concentrate producers inthis segment is $0.23/case Convenience Stores: This segment of buyers is extremely fragmented and hence have to pay higher prices, NOPBT here is $0.69 /case. Fountain: This segment of buyers are the least profitable because of their large amountof purchases hey make, It allows them to have freedom to negotiate. Coke and Pepsi p r i m a r i l y c o n s i d e r t h i s s e g m e n t P a i d S a m p l i n g w i t h l o w m a r g i n s . N O P B T i n t h i s segment is $0.09 /case. Vending: This channel serves the customers directly with absolutely no power with the buyer, hence NOPBT of $0.97/case. Substitutes: Large numbers of substitutes like water, beer, coffee, juices etc are available to theend consumers but this countered by concentrate providers by huge advertising, brand equity,and making their product easily available for consumers, which most substitutes cannot match.A l s o s o f t d r i n k c o m p a n i e s d i v e r s i f y b u s i n e s s b y o f f e r i n g s u b s t i t u t e s t h e m s e l v e s t o s h i e l d themselves from competition. Rivalry:The Concentrate Producer industry can be classified as a Duopoly with Pepsi and Coke as thef i r m s c o m p e t i n g . T h e m a r k e t s h a r e o f t h e r e s t o f t h e c o m p e t i t i o n i s t o o s m a l l t o c a u s e a n y upheaval of pricing or industry structure. Pepsi and Coke mainly over the years competed ondifferentiation and advertising rather than on pricing except for a period in the 1990s.

This p r e v e n t e d a h u g e d e n t i n p r o f i t s . P r i c i n g w a r s a r e h o w e v e r a f e a t u r e i n t h e i r i n t e r n a t i o n a l expansion strategies. PEST Analysis The PEST Analysis is an analysis to examine the macro-environment of Coca-Colas operations (Johnson, Scholes and Whittington, 2008). Political Like most companies, Coca-Cola is monitoring the policies and regulations set bythe government. There are no political issues in this instance. Economic There is low growth in the market for carbonated drinks, especially in Coca-Colasmain market, North America. The market growth recorded at only 1% for NorthAmerica in 2004. Social There are changes in consumers lifestyles. Consumers are more health conscious.This affects the Coca-Colas sales of the carbonated drinks as consumers prefer noncarbonated drinks such as tea, juices and bottled drinks. Demand for carbonated drinks decreases and this leads to a decrease in Coca-Colas revenues. Technological As the technology advances, new products are introduced into the market. Theadvance in technology has led to the creation of cherry coke in 1985 but consumersstill prefers the traditional taste of the original coke.

External Audit u n i t i e s T h r e a t s 1. Bottled water consumption hasincreased 11 percent. 2. According to the S&P Industry Survey , consumers are drawnto new smaller beveragebrands that are not sold on amass scale. 3. Word Economic Forumsannual Davos, Switzerlandgathering grants internationalvoice. 4. Less developed countries arein desperate need to improvecommunity water supplies. 5. Energy drink sales areexpected to increase 7 to 8percent in 2007. 6. Disposable income hasincreased 6.2 percent. 7. Consumers are striving to drinkand eat their way to better health than perviousgenerations. 8. EPS is expected to rise 7 to 8percent in 2007. 1 . C o n s u m p t i o n o f A m e r i c a n beverages is denounced byforeign officials in areas whereconflicting interest exist.2 . M u l t i p l e l a w s u i t s a g a i n s t t h e new Enviga beverage for calorie burning claims inadvertising3 . S m a l l e r , l e s s e r k n o w n b r a n d s are turning to major beer distributors for bottling.4 . O v e r a l l c a r b o n a t e d d r i n k s a l e s have been flat due to links of sugar to obesity and highfructose corn syrup to heartdisease.5 . P e p s i i s m o r e d i v e r s i f i e d offering O p p o r t

beverage and food products.6 . H i g h c o s t o f c o m m o d i t i e s s u c h as sugar, and metals used in production of cans.7 . M a n y s m a l l e r c o m p a n i e s a r e fierce competitors around theworld in their local markets.

Вам также может понравиться

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5783)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Chikitsa - Treatment Types, Ayurvedic ClassificationДокумент31 страницаChikitsa - Treatment Types, Ayurvedic ClassificationSN Wijesinhe0% (1)

- Classifying Protein Energy MalnutritionДокумент23 страницыClassifying Protein Energy MalnutritionRanjini Datta0% (1)

- FMCG Lists (Bangalore)Документ4 страницыFMCG Lists (Bangalore)syed8899Оценок пока нет

- MYP 3 - Unit 5Документ3 страницыMYP 3 - Unit 5Matheus XavierОценок пока нет

- Can I Take Your OrderДокумент2 страницыCan I Take Your OrderSarah MahonОценок пока нет

- Enumeration of Microorganisms: Microbiology BIOL 275Документ10 страницEnumeration of Microorganisms: Microbiology BIOL 275Diya GhosalОценок пока нет

- Map Cleveland Central PDFДокумент1 страницаMap Cleveland Central PDFLeena ShafiqОценок пока нет

- Admissions Rules and Regulations General RulesДокумент4 страницыAdmissions Rules and Regulations General RulesShehnaz BaigОценок пока нет

- List of French Expressions in English - Wikipedia, The Free EncyclopediaДокумент43 страницыList of French Expressions in English - Wikipedia, The Free Encyclopediapratik244Оценок пока нет

- 21 Ways To Reduce: A Simple Step-by-Step Guide To Improve Your Health and Eliminate The Pain of in AmmationДокумент57 страниц21 Ways To Reduce: A Simple Step-by-Step Guide To Improve Your Health and Eliminate The Pain of in AmmationCarmen Neacsu100% (1)

- Kitchen Design 350+ Modular Kitchen Design at Best Price in India (2023 Modular Kitchens Ideas)Документ1 страницаKitchen Design 350+ Modular Kitchen Design at Best Price in India (2023 Modular Kitchens Ideas)Mayank OhriОценок пока нет

- ZADANIE 4. (0-4) : Stara Dobra SzkołaДокумент8 страницZADANIE 4. (0-4) : Stara Dobra SzkołaKasia100% (1)

- Travel Tips For Visitors To GreeceДокумент2 страницыTravel Tips For Visitors To GreecelucytenevaОценок пока нет

- LIPIDS BiochemistryДокумент52 страницыLIPIDS BiochemistryMark BagamaspadОценок пока нет

- Drug Discovery StagesДокумент42 страницыDrug Discovery StagesMinh Tuấn100% (1)

- HarpiesДокумент8 страницHarpiesRon Leiper100% (1)

- Getting Ready For Service: Chapter 5 HighlightsДокумент31 страницаGetting Ready For Service: Chapter 5 Highlightschicky_chikОценок пока нет

- Grammar: The Fresh / Fresh Fruit and Vegetables Are Good For YouДокумент6 страницGrammar: The Fresh / Fresh Fruit and Vegetables Are Good For YouViviane ShinzatoОценок пока нет

- Journal of Halal Research Vol.1 No.1 PDFДокумент32 страницыJournal of Halal Research Vol.1 No.1 PDFFatimah Az-ZahraОценок пока нет

- Kids' Web 2: Unit Topic Language Focus VocabularyДокумент1 страницаKids' Web 2: Unit Topic Language Focus VocabularyKatiuska KtskОценок пока нет

- Work ImmersionДокумент4 страницыWork ImmersionZandriana Jane AjeroОценок пока нет

- Albania Pomegranate Market Opportunities 12-19-21 1Документ21 страницаAlbania Pomegranate Market Opportunities 12-19-21 1Ajo2000Оценок пока нет

- Health Assessment QuizДокумент24 страницыHealth Assessment QuizJoyzoey95% (19)

- Randy Ruiz Paz CVДокумент3 страницыRandy Ruiz Paz CVi_randypazmongoliaОценок пока нет

- Two Summers (Excerpt)Документ22 страницыTwo Summers (Excerpt)I Read YAОценок пока нет

- Gariel's Homework - KuminaДокумент3 страницыGariel's Homework - Kuminamatgar0% (1)

- OpenMind 2nded Level 2 SB Unit 3Документ10 страницOpenMind 2nded Level 2 SB Unit 3Fabian Pzv50% (2)

- Hippo 1 Use V1Документ2 страницыHippo 1 Use V1husna mukhzinОценок пока нет

- 1200 Vegetarian Meal PlanДокумент21 страница1200 Vegetarian Meal PlanIl Beneamato100% (1)

- Investigatoy Project On Application of Biotechnology PDFДокумент19 страницInvestigatoy Project On Application of Biotechnology PDFSujit Kumar Mandal86% (14)