Академический Документы

Профессиональный Документы

Культура Документы

Your Eighteen A Bankruptcy Proceeding Inquiries Answered

Загружено:

Ruben687BakerАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

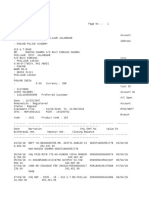

Your Eighteen A Bankruptcy Proceeding Inquiries Answered

Загружено:

Ruben687BakerАвторское право:

Доступные форматы

Your Eighteen A Bankruptcy Proceeding Inquiries Answered

1. What exactly is individual bankruptcy ? Bankruptcy can be a opportinity for good folks throughout negative situations to be able to legally get a fresh start. A number of requirements , however typically , anybody assembly those requirements features a right to file. When a petition is submitted , most collectors are usually not allowed coming from attempting to accumulate in most financial obligations listed in the petition prior to the court docket either discharges you against these types of financial obligations or perhaps can determine that you are not permitted such comfort. 2. Is there a process pertaining to submitting ? First, just about any skilled bankruptcy lawyer will probably need you to complete a customer survey to enable them to evaluation to discover whether individual bankruptcy meets your requirements. If it is determined to get the best choice , the lawyer will need to choose this agreement section you may file. In all probability you'll talk to the lawyer in several situation to resolve concerns , offer papers but for the lawyer to resolve any queries you could have. After the individual bankruptcy petition (legitimate paperwork submitted while using individual bankruptcy court docket in which starts your individual bankruptcy carrying on ) will be submitted , you'll be forced to can be found in court docket in one or more situation , the assembly of collectors , for the section seven submitting , and in all likelihood several appearance should your individual bankruptcy petition is a section 12 submitting (assembly of collectors and confirmation experiencing ). 3. What exactly is section seven ? Chapter seven can be a liquidation carrying on within the united states individual bankruptcy code. In the section seven carrying on , a trustee hired through the individual bankruptcy court docket will need custodianship of and then sell off all of your non-exempt assets. The bucks received out of this selling is going to be employed to pay out creditors. Your financial situation are usually and then released. Which means collectors are usually once and for all not allowed in an attempt to accumulate in these types of released financial obligations in the future. Certain financial obligations , like income tax , alimony, your sons or daughters , so to speak. , and financial obligations who have certainly not been listed in the section seven petition (and also financial obligations which were received due to either a great deliberate tort or the defrauding or perhaps unreliable of the lender ) aren't dischargeable. Which means after the launch , you will preserve to get responsible for these types of financial obligations. 4. What is a section 12 ? A section 12 was created mainly pertaining to residential property owners , and allows a person or perhaps married couple to most , or even a percentage , of these financial obligations within the supervision as well as the protection in the ough.ersus. Individual bankruptcy court docket while staying within their residence. A section 12 plan is mainly employed to repay mortgage arrears , whilst addressing all the financial obligations your debt is to any other collectors. Settlement of your respective mortgage various other financial obligations are likely to be disseminate on the 3-5 yr

interval. Section 12 is usually used as an option to credit guidance. Individuals are authorized to repay their own personal credit card debt on the 3-5 yr interval with no extra interest costs. A section 12 submitting is made for those who are at present used and also have continuous earnings , yet are nevertheless overcome using bills , decision , litigation or perhaps various other obligations. 5. What forms of residence are usually exempt? Certain kinds of private rentals are categorized while exempt within the individual bankruptcy code. Which means you're able to save this residence even after your financial situation are usually released. Throughout the big apple , state law offers up particular exceptions including , and others :(a ) income , looking at or perhaps personal savings balances , ough.ersus. Personal savings relationship , stocks , and other valuable investments , and duty refunds up to a optimum full of $2,400.double zero ; (b ) equity in the auto around $2,400.double zero ; (chemical ) simple wearing apparel ; (n ) $50,500.double zero in the equity in your home , co-op or perhaps residence ; (electronic ) cultural safety benefits ; (farrenheit ) home decorating and particular appliances ; (gary ) IRA, 401K and other skilled retirement balances. 6. Can i lose my bank cards immediately after individual bankruptcy ? You must list most outstanding financial obligations that you simply are obligated to pay since the time in the submitting of the individual bankruptcy petition. Just about any balances who have a absolutely no balance need not be listed. For those breaks cards who have account balances , in case you trust the lender to repay any just about any percentage of the credit card's balance at the time of submitting , you could be capable of execute a record known as Reaffirmation contract in which papers your motivation to remain to get to blame for this specific debt after the individual bankruptcy will be released. Generally , the individual bankruptcy court docket should say yes to in the Reaffirmation contract just before the idea becomes powerful. 7. How long will it get ? A standard section seven case takes normally 4-6 several weeks. A section 12 case usually takes anyplace to be able to 3-5 a long time to perform. 8. What is a assembly of collectors ? Section 341 in the united states individual bankruptcy code grants collectors the legal right to talk to the person to discover in case a launch or even a reorganization of debt is suitable based on information and conditions introduced with a person within their individual bankruptcy petition. While collectors carry out officially contain the to attend these types of actions and also to issue the person , collectors rarely look from these types of actions. In section seven carrying on , the assembly of collectors serves a couple of crucial reasons. Initial , a legal court , through examination through the court docket hired Trustee, concurs with that every in the representations within your individual bankruptcy petition are usually genuine and proper to your best of your opinion and information. Second , the individual bankruptcy court docket Trustee also utilizes this specific assembly to ensure with respect to a legal court that you have simply no assets which may be regarded as non-exempt, that may be sold through the Trustee to repay component , or perhaps most , of your respective debt. A standard assembly of collectors in the section seven

carrying on takes about 5-10 minutes to perform. In section 12 carrying on , a person is usually forced to look before the section 12 trustee. In the section 12 case , the assembly of collectors serves a slightly distinct objective. In addition to confirming that every in the representations created by a person are usually genuine and proper , the section 12 trustee will also examine that the person features determined the means check appropriately , which the person contains the monetary capacity using which usually to generate the installments offered inside the offered section 12 program. Verification of the customers ability to help to make payments in the section 12 case is predicated about both the person testimony with the assembly and various documentation , normally taxation statements and/or pay out claims , that must definitely be introduced on the section 12 trustee to ensure the representations produced in your section 12 petition. Such as a section seven case , a standard assembly of collectors throughout section 12 case takes in between 5-10 minutes to perform. 9. The way submitting impact our credit history ? Under the honest credit reporting act , a section seven might remain on your credit report pertaining to 10 years. A section 12 submitting will be legally authorized to get documented pertaining to seven a long time. The submitting of just about any individual bankruptcy petition will significantly impact your credit history soon. By simply start to slowly increase your credit history immediately after your individual bankruptcy will be released , you tell potential loan providers that the problems with credit history are now guiding a person. One way is to have a "secured " credit card from the lender whenever you can. Using a secured minute card , a person applies upwards a great amount of money , as low as $200.double zero , in a account with the lender to guarantee settlement. This specific restrict is often greater as the person shows his / her ability to pay out your debt. Two a long time immediately after your individual bankruptcy will be released , you'll be eligible for home financing mortgage in comparable phrases to folks with similar monetary profiles who have certainly not submitted individual bankruptcy. It is and then that the amount of your advance payment as well as your career and earnings balance are more vital that you a lender than your prior individual bankruptcy submitting. 10. Let's say we submitted just before ? For a person , you could merely register for comfort underneath section seven after each ten a long time. This specific time operates through the time individual bankruptcy is definitely released. Take note nonetheless that the 8-year interval does not manage through the time in the submitting in the initial petition , but instead through the time a legal court issues the individual bankruptcy launch. 11. Can i be able to get beyond trying to repay our so to speak. ? With a couple of conditions , so to speak. Aren't dischargeable in the individual bankruptcy carrying on. nOnetheless , students mortgage could possibly be released if it is neither covered or perhaps assured with a governments system , nor created underneath just about any software financed in whole or perhaps in component with a governments system or perhaps non-profit establishment. Finally , students mortgage possibly released when make payment on mortgage will "impose a great unnecessary trouble for the person and debtor's loved ones." 14 ough.ersus.chemical. Part 523(a )(8

) 12. Can i lose our residence ? A section 12 carrying on is designed to aid residential property owners keep their house while helping the crooks to recover their own existence and initiate anew. Section 12 submitting will be authorized pertaining to people in which are obligated to pay below $250,500.double zero throughout personal debt and fewer than $750,500.double zero throughout secured debt. Thus , you are able to file individual bankruptcy and keep the residence. 13. Can i lose our auto ? In the big apple , we have an exemption for the auto highly valued from $2,400 or perhaps much less. For those who have a $20,500 auto and are obligated to pay $10,500 for this car or truck , it's likely that the individual bankruptcy trustee will turn over this kind of car in the section seven carrying on. 14. REally does my partner must file ? New york is a kind of law express. In contrast to group residence states , your husband or wife are not impacted by your individual bankruptcy when they are certainly not to blame for all of your debt. Whether they have a additional credit card these are probably to blame for that debt , however until in addition they signed the contract , these are that's doubtful accountable throughout the big apple. Group residence states are usually : illinois , florida , Idaho, Louisiana, the state of nevada , fresh mexico , arizona , california and Wisconsin. 15. What happens if i don't list my residence ? Failing to list most rentals are a crime. nUmerous assets are safe coming from becoming grabbed through the individual bankruptcy court docket , however only when these are listed. Individual bankruptcy offenses are usually punishable by simply jail time for about 5 years. Criminal conduct contains : submitting a personal bankruptcy petition to be able to defraud creditors ; concealing residence through the court docket or perhaps individual bankruptcy trustee; purposefully and fraudulently create a phony promise or perhaps account ; a great deliberate exchange or perhaps concealment of residence to be able to defraud collectors ; and concealing , transforming , destroying , or perhaps falsifying documents or perhaps papers. 16. Will our workplace discover ? Technically, section seven filings are usually vital records and it's also feasible for one to discover. nOnetheless , until your workplace queries individual bankruptcy filings, it is less likely they'll discover. The credit credit reporting agencies will record your submitting and it'll remain on your personal credit record pertaining to 7-10 a long time. 17. May i lose our work ? No. Companies are usually not allowed coming from discerning towards a person since you submitted individual bankruptcy pursuant to be able to ough.ersus.chemical. Sec. 525. 18. Will be our pension/retirement balances safe and sound ? Employee advantages to be able to ERISA skilled retirement ideas , deferred payment ideas , taxdeferred annuities, and medical health insurance ideas are usually exempt assets. Also , part 522 in the individual bankruptcy code states that the individual can now exempt around tens of thousands of

bucks in a IRA account. Interestingly ample , part 522 especially limits SEP IRA's coming from such exemption , although this form of IRA may perhaps fall under a great ERISA program (anybody selfemployed should talk to their own lawyer and be sure in which their own SEP IRA is definitely exempt just before submitting ). coop car insurance

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Actual Cost of Living On A NarrowboatДокумент6 страницThe Actual Cost of Living On A NarrowboatRuben687BakerОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Actual Living Costs On The NarrowboatДокумент6 страницThe Actual Living Costs On The NarrowboatRuben687BakerОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Actual Cost of Living Over A NarrowboatДокумент6 страницThe Actual Cost of Living Over A NarrowboatRuben687BakerОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Language of Ancient Greece Debts Turmoil and Entrepreneur SДокумент3 страницыLanguage of Ancient Greece Debts Turmoil and Entrepreneur SRuben687BakerОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Pricing Strategy: Presented By:-Madhav Anand Sharma Asst. Professor (FHM) Mriirs, Faridabad, HaryanaДокумент20 страницPricing Strategy: Presented By:-Madhav Anand Sharma Asst. Professor (FHM) Mriirs, Faridabad, Haryanaanurag chaudharyОценок пока нет

- 1538139921616Документ6 страниц1538139921616Hena SharmaОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Innovation in Rural MarketingДокумент75 страницInnovation in Rural Marketingm_dattaiasОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Basic Accounting For Non-Accountants (A Bookkeeping Course)Документ49 страницBasic Accounting For Non-Accountants (A Bookkeeping Course)Diana mae agoncilloОценок пока нет

- Commercial LawДокумент144 страницыCommercial LawlegalОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Chapter Eleven SolutionsДокумент60 страницChapter Eleven SolutionsaishaОценок пока нет

- 10 CIR V CitytrustДокумент1 страница10 CIR V CitytrustAnn QuebecОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- MACROECONOMICS For PHD (Dynamic, International, Modern, Public Project)Документ514 страницMACROECONOMICS For PHD (Dynamic, International, Modern, Public Project)the.lord.of.twitter101Оценок пока нет

- iSave-IPruMF FAQsДокумент6 страницiSave-IPruMF FAQsMayur KhichiОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Empirical Methods: Uva - Instructions-Take-Home-Assignment-2018-2019Документ4 страницыEmpirical Methods: Uva - Instructions-Take-Home-Assignment-2018-2019Jason SpanoОценок пока нет

- PDCS Minor Project BBA III Sem Morning Evening Final 1Документ38 страницPDCS Minor Project BBA III Sem Morning Evening Final 1ANKIT MAANОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Intangible Asset Accounting and Accounting Policy Selection in The Football IndustryДокумент347 страницIntangible Asset Accounting and Accounting Policy Selection in The Football IndustryJuan Ruiz-UrquijoОценок пока нет

- DigitalДокумент4 страницыDigitalideal assignment helper 2629Оценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- 5-Vendors Are The King MakerДокумент2 страницы5-Vendors Are The King Makersukumaran3210% (1)

- Case Studies Hotels Nov23Документ3 страницыCase Studies Hotels Nov23Sushmin SahaОценок пока нет

- Compensation Survey 2021Документ14 страницCompensation Survey 2021Oussama NasriОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- L01B Topic 2Документ39 страницL01B Topic 2Emjes GianoОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Most Important Financial Ratios For New InvestorsДокумент12 страницThe Most Important Financial Ratios For New InvestorsFELIX VALERAОценок пока нет

- Capital and Return On CapitalДокумент38 страницCapital and Return On CapitalThái NguyễnОценок пока нет

- Heikin-Ashi Algorithms OptimizeДокумент6 страницHeikin-Ashi Algorithms Optimizerenger20150303Оценок пока нет

- Case StudyДокумент17 страницCase Studysubakarthi0% (1)

- Production Planning & ControlДокумент23 страницыProduction Planning & Controlrupa royОценок пока нет

- Why Public Policies Fail in PakistanДокумент5 страницWhy Public Policies Fail in PakistanbenishОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- IATF by MauryaДокумент91 страницаIATF by MauryaManoj MauryaОценок пока нет

- Opportunity IdentificationДокумент19 страницOpportunity IdentificationAraОценок пока нет

- Form PDF 927448140281220Документ7 страницForm PDF 927448140281220Arvind KumarОценок пока нет

- Essay Dev Econ Kalihputro Fachriansyah 30112016 PDFДокумент7 страницEssay Dev Econ Kalihputro Fachriansyah 30112016 PDFKalihОценок пока нет

- Revisiting Talent Management Practices in A Pandemic Driven Vuca Environment - A Qualitative Investigation in The Indian It IndustryДокумент6 страницRevisiting Talent Management Practices in A Pandemic Driven Vuca Environment - A Qualitative Investigation in The Indian It Industrydevi 2021100% (1)

- Cocktail ReceptionДокумент2 страницыCocktail ReceptionSunlight FoundationОценок пока нет

- Topic 5 Answer Key and SolutionsДокумент6 страницTopic 5 Answer Key and SolutionscykenОценок пока нет